SoftBank Vision Fund Cuts 20% of Staff, Pivots to Bold AI Investments

4 Sources

4 Sources

[1]

SoftBank Vision Fund to lay off 20% of employees in shift to bold AI bets, source and memo say

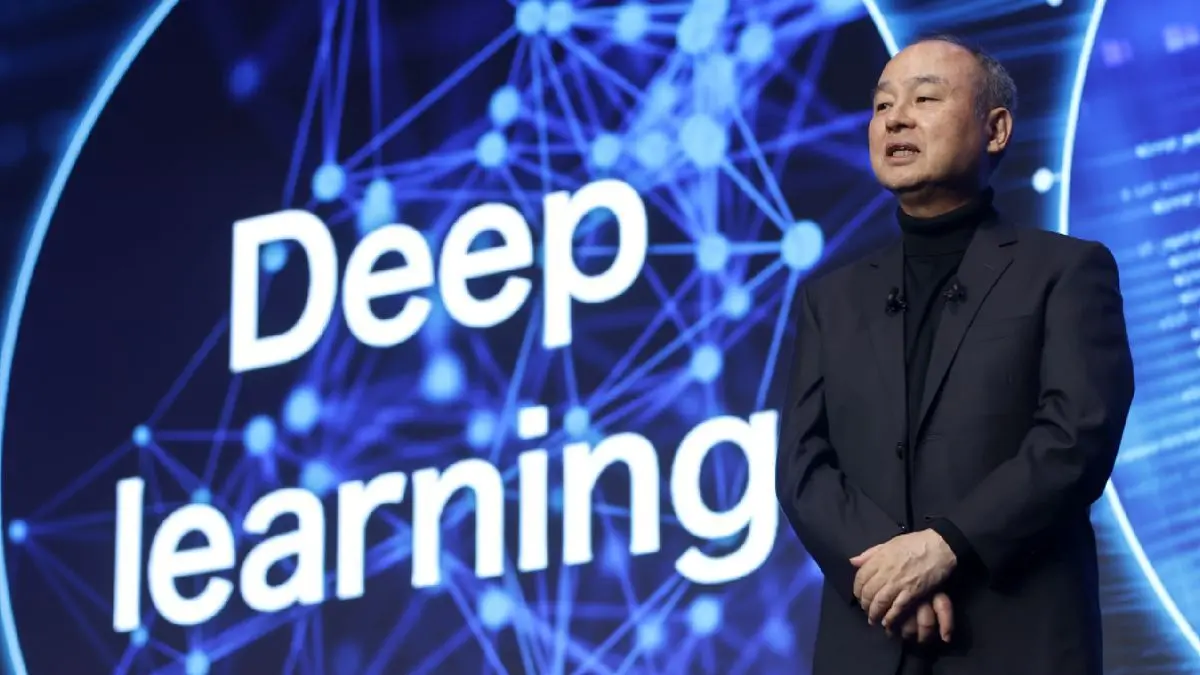

Sept 18 (Reuters) - SoftBank Group (9984.T), opens new tab will lay off nearly 20% of its Vision Fund team globally as it shifts resources to founder Masayoshi Son's large-scale artificial intelligence bets in the United States, according to a memo seen by Reuters and a source familiar with the plan. The cuts mark the third round of layoffs at the Japanese investment conglomerate's flagship fund since 2022. Vision Fund currently employs 44 people, according to its website. Unlike previous rounds, when the group was saddled with major losses, the latest reductions come after the fund last month reported its strongest quarterly performance since June 2021, driven by gains in public holdings such as Nvidia (NVDA.O), opens new tab and South Korean e-commerce firm Coupang (CPNG.N), opens new tab. The move signals a pivot away from a broad portfolio of startup investments. While the fund will continue to make new bets, remaining staff will dedicate more resources to Son's ambitious AI initiatives, such as the proposed $500 billion Stargate project - an initiative to build a vast network of U.S. data centers in partnership with OpenAI, the source added. A Vision Fund spokesperson confirmed the layoffs without commenting on the details, and said in a statement: "We continually adjust the organization to best execute our long-term strategy - making bold, high-conviction investments in AI and breakthrough technologies, and creating long-term value for our stakeholders." The restructuring marks a return to Son's classic high-risk, high-reward approach of making massive, concentrated wagers, moving on from the sprawling venture capital model that defined the last era of the Vision Fund, and a period in which the group was forced to de-risk, sell assets and rebuild credibility after incurring billions in losses on its once high-flying bet on the office-sharing startup WeWork. This shift toward capital‑intensive AI infrastructure reflects where Son - who made his name with outsized bets and was an early champion of AI - sees the path back to the top. He is now aggressively pursuing new investments in foundation models and the infrastructure layer, sometimes at premium valuations. In the past 12 months, Son has invested $9.7 billion in OpenAI through Vision Fund 2, which manages about $65.8 billion in total. SoftBank is also plotting a capital-intensive infrastructure strategy centered on its crown jewel, chip designer Arm . It has acquired chip firms Graphcore and Ampere Computing and taken stakes in Intel (INTC.O), opens new tab and Nvidia. These moves aim to build an ecosystem spanning chips, data centers, and models to support future AI adoptions. The capital-intensive strategy carries execution risk, underscored by recent delays in both the U.S. Stargate project and a similar joint venture with OpenAI in Japan, Reuters reported this week. SoftBank CFO Yoshimitsu Goto said the company held a "very safe level" of cash of 4 trillion yen ($27 billion) on the company's most recent earnings call in August. Reporting by Krystal Hu in San Francisco; Editing by Matthew Lewis Our Standards: The Thomson Reuters Trust Principles., opens new tab * Suggested Topics: * World at Work Krystal Hu Thomson Reuters Krystal reports on venture capital and startups for Reuters. She covers Silicon Valley and beyond through the lens of money and characters, with a focus on growth-stage startups, tech investments and AI. She has previously covered M&A for Reuters, breaking stories on Trump's SPAC and Elon Musk's Twitter financing. Previously, she reported on Amazon for Yahoo Finance, and her investigation of the company's retail practice was cited by lawmakers in Congress. Krystal started a career in journalism by writing about tech and politics in China. She has a master's degree from New York University, and enjoys a scoop of Matcha ice cream as much as getting a scoop at work.

[2]

SoftBank Vision Fund lays off 20% of staff to make room for AI ambitions

This content has been selected, created and edited by the Finextra editorial team based upon its relevance and interest to our community. According to Reuters, SoftBank Vision Fund founder Masayoshi Son is restructuring funding and resources into AI growth. The Fund employs over 300 people worldwide. This marks the third round of layoffs in the firm since 2022. The shift indicates Son's ambitions to excel in the AI race, as global investment in AI initiatives skyrockets. In the last year, Son has invested $9.7 billion in OpenAI, and has invested in chip firms Graphcore and Ampere Computing, along with leading tech companies Intel and Nvidia. These investments indicate a move to build AI infrastructure in chips, datacentres, and models. A SoftBank spokesperson commented: "We continually adjust the organisation to best execute our long-term strategy - making bold, high-conviction investments in AI and breakthrough technologies, and creating long-term value for our stakeholders."

[3]

Even after strongest quarterly performance since June 2021, SoftBank to layoff 20% of its Vision Fund team

SoftBank Vision Fund layoffs 2025: Even after delivering its best quarterly results in over three years, SoftBank Group is cutting nearly 20% of its global Vision Fund workforce, a move that underscores a dramatic shift in strategy under founder Masayoshi Son, as per a report. The layoffs, affecting about 60 of the Vision Fund's 300 employees globally, were announced internally this week, as per a memo seen by Reuters and a source familiar with the matter. It marks the third round of job cuts since 2022, but unlike earlier reductions driven by mounting losses, this wave comes just a month after strong results. In its most recent earnings report last month, the Vision Fund posted its strongest performance since June 2021, buoyed by sharp gains in public holdings like Nvidia and South Korea's Coupang, as per a Reuters report. Still, that hasn't spared staff from Son's evolving focus, one that is now leaning heavily into large-scale artificial intelligence bets, according to the report. ALSO READ: iOS 26 vs iOS 18: How your iPhone's home screen, lock screen, control center & features have changed "We continually adjust the organization to best execute our long-term strategy - making bold, high-conviction investments in AI and breakthrough technologies, and creating long-term value for our stakeholders," a Vision Fund spokesperson said, confirming the layoffs but declining to provide specifics, as reported by Reuters. The shift marks a clear departure from the fund's earlier venture capital approach that backed a sprawling portfolio of startups, an era that included its investment in WeWork, which later incurred billions in losses. Since then, Son has been forced to trim operations and rebuild investor confidence. Now, he's going back to his roots: high-risk, high-reward plays, particularly in AI, as per the Reuters report. A source told Reuters that while the fund will continue to make new bets, the remaining staff will dedicate more resources to Son's ambitious AI initiatives, like the proposed $500 billion Stargate project, an initiative to build a vast network of US data centers in partnership with OpenAI, as reported by Reuters. Over the past year, SoftBank has poured nearly $10 billion into OpenAI through Vision Fund 2, which manages assets worth about $65.8 billion, according to the report. ALSO READ: Samsung smart fridges may soon show ads you can't escape, but users found a sneaky fix Reuters reported that SoftBank is also plotting a capital-intensive infrastructure strategy centered on its crown jewel, chip designer Arm. The investment holding company has acquired chip firms Graphcore and Ampere Computing and taken stakes in Intel and Nvidia as it aims to build an ecosystem spanning chips, data centers, and models to support future AI adoptions, as per the report. Is SoftBank stopping all other investments? No, but new investments will focus more narrowly on AI and breakthrough technologies. Why is SoftBank laying off 20% of its Vision Fund team? SoftBank is refocusing its Vision Fund team to prioritize large-scale AI projects.

[4]

SoftBank's Vision Fund mulls 20% job cuts after Son's pivot to AI

SoftBank Group's Vision Fund is considering cutting as much as 20% of its staff, a person familiar with the matter said, underscoring a shift in CEO Masayoshi Son's focus to ambitious bets on artificial intelligence. The unit, which employed about 282 people as of the end of March, may shed more than 50 roles, the person said, asking not to be identified discussing private deliberations. The reduction extends years of cutbacks as the Vision Fund unit shrank in importance next to Son's growing appetite for big AI bets. Those include a plan to invest about $30 billion in OpenAI and a $6.5 billion deal to acquire chip designer Ampere Computing, which faces regulatory scrutiny. SoftBank has so far invested roughly $10 billion in OpenAI.

Share

Share

Copy Link

SoftBank Group's Vision Fund is laying off 20% of its global workforce as it shifts focus to large-scale artificial intelligence investments. This move comes despite the fund's strongest quarterly performance since June 2021, signaling a strategic pivot under founder Masayoshi Son's leadership.

SoftBank Vision Fund Announces Major Layoffs

SoftBank Group's Vision Fund is set to lay off nearly 20% of its global workforce, marking a significant shift in strategy under founder Masayoshi Son's leadership

1

. This move, affecting approximately 60 of the fund's 300 employees, comes as a surprise given the fund's recent strong performance3

.Pivot to AI Investments

The layoffs signal a dramatic pivot towards large-scale artificial intelligence investments. SoftBank is reallocating resources to support Son's ambitious AI initiatives, such as the proposed $500 billion Stargate project - a vast network of U.S. data centers in partnership with OpenAI

1

. This shift represents a return to Son's classic high-risk, high-reward approach of making massive, concentrated wagers.Recent AI Investments

In the past year, SoftBank has made significant strides in the AI sector:

- Invested $9.7 billion in OpenAI through Vision Fund 2

1

- Acquired chip firms Graphcore and Ampere Computing

1

- Taken stakes in Intel and Nvidia

1

These moves aim to build an ecosystem spanning chips, data centers, and models to support future AI adoptions.

Related Stories

Strategic Shift and Risks

This strategic shift marks a departure from the fund's earlier venture capital approach that backed a sprawling portfolio of startups. The new focus on capital-intensive AI infrastructure reflects Son's vision for the future, but it also carries execution risks

1

. Recent delays in both the U.S. Stargate project and a similar joint venture with OpenAI in Japan highlight these challenges1

.Financial Position and Future Outlook

Despite the layoffs, SoftBank's financial position remains strong. CFO Yoshimitsu Goto reported a "very safe level" of cash at 4 trillion yen ($27 billion) in August

1

. The Vision Fund recently posted its strongest performance since June 2021, driven by gains in public holdings such as Nvidia and Coupang1

.As SoftBank refocuses its Vision Fund team to prioritize large-scale AI projects, the company continues to adjust its organization to execute its long-term strategy of making bold, high-conviction investments in AI and breakthrough technologies

2

. This move underscores the growing importance of AI in the global investment landscape and SoftBank's determination to lead in this rapidly evolving sector.References

Summarized by

Navi

[1]

[2]

Related Stories

SoftBank Reports $2.4 Billion Loss Amid Major AI Investment Plans

12 Feb 2025•Business and Economy

SoftBank's AI investments deliver $1.62 billion profit as OpenAI stake drives turnaround

12 Feb 2026•Business and Economy

Microsoft Plans Massive Layoffs Amid $80 Billion AI Investment Push

19 Jun 2025•Business and Economy

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology