SoundHound AI Faces Investor Lawsuit Over Financial Reporting Issues

2 Sources

2 Sources

[1]

INVESTOR DEADLINE APPROACHING: Faruqi & Faruqi, LLP Investigates Claims on Behalf of Investors of SoundHound AI - SoundHound AI (NASDAQ:SOUN)

Faruqi & Faruqi, LLP Securities Litigation Partner James (Josh) Wilson Encourages Investors Who Suffered Losses In SoundHound AI To Contact Him Directly To Discuss Their Options If you purchased or acquired securities in SoundHound AI between May 10, 2024 and March 3, 2025 and would like to discuss your legal rights, call Faruqi & Faruqi partner Josh Wilson directly at 877-247-4292 or 212-983-9330 (Ext. 1310). [You may also click here for additional information] NEW YORK, April 09, 2025 (GLOBE NEWSWIRE) -- Faruqi & Faruqi, LLP, a leading national securities law firm, is investigating potential claims against SoundHound AI, Inc. ("SoundHound" or the "Company") SOUN and reminds investors of the May 27, 2025 deadline to seek the role of lead plaintiff in a federal securities class action that has been filed against the Company. Faruqi & Faruqi is a leading national securities law firm with offices in New York, Pennsylvania, California and Georgia. The firm has recovered hundreds of millions of dollars for investors since its founding in 1995. See www.faruqilaw.com. As detailed below, the complaint alleges that the Company and its executives violated federal securities laws by making false and/or misleading statements and/or failing to disclose that: (1) the material weaknesses in SoundHound's internal controls over financial reporting impaired the Company's ability to effectively account for corporate acquisitions; (2) in addition, the Company overstated the extent to which it had remediated, and/or its ability to remediate, the material weaknesses in its internal controls over financial reporting; (3) as a result of the foregoing material weaknesses, SoundHound's reported goodwill following the Amelia Acquisition was inflated and would need to be corrected; (4) further, SoundHound would likely require extra time and expense to effectively account for the SYNQ3 and Amelia Acquisitions; (5) the foregoing increased the risk that the Company would be unable to timely file certain financial reports with the United States Securities and Exchange Commission ("SEC"); and (6) as a result, the Company's public statements were materially false and misleading at all relevant times. On March 4, 2025, SoundHound disclosed in a filing with the SEC that it would be unable to timely file its Annual Report for 2024 (the "2024 10-K"). SoundHound stated that "[d]ue to the complexity of accounting for [the SYNQ3 and Amelia Acquisitions], the Company require[d] additional time to prepare financial statements and accompanying notes" and that it "ha[d] identified material weaknesses in its internal control over financial reporting." On this news, SoundHound's stock price fell $0.60 per share, or 5.81%, to close at $9.72 per share on March 4, 2025. The court-appointed lead plaintiff is the investor with the largest financial interest in the relief sought by the class who is adequate and typical of class members who directs and oversees the litigation on behalf of the putative class. Any member of the putative class may move the Court to serve as lead plaintiff through counsel of their choice, or may choose to do nothing and remain an absent class member. Your ability to share in any recovery is not affected by the decision to serve as a lead plaintiff or not. Faruqi & Faruqi, LLP also encourages anyone with information regarding SoundHound's conduct to contact the firm, including whistleblowers, former employees, shareholders and others. To learn more about the SoundHound AI class action, go to www.faruqilaw.com/SOUN or call Faruqi & Faruqi partner Josh Wilson directly at 877-247-4292 or 212-983-9330 (Ext. 1310). Follow us for updates on LinkedIn, on X, or on Facebook. Attorney Advertising. The law firm responsible for this advertisement is Faruqi & Faruqi, LLP (www.faruqilaw.com). Prior results do not guarantee or predict a similar outcome with respect to any future matter. We welcome the opportunity to discuss your particular case. All communications will be treated in a confidential manner. A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/165045a2-81c1-4076-820a-38057608bc81 SOUNSoundHound AI Inc$7.04-2.02%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum96.89Growth83.03Quality-Value7.77Price TrendShortMediumLongOverviewMarket News and Data brought to you by Benzinga APIs

[2]

SOUN INVESTOR DEADLINE: Robbins Geller Rudman & Dowd LLP Announces that SoundHound AI, Inc. Investors with Substantial Losses Have Opportunity to Lead Class Action Lawsuit

The law firm of Robbins Geller Rudman & Dowd LLP announces that purchasers or acquirers of SoundHound AI, Inc. (NASDAQ: SOUN) securities between May 10, 2024 and March 3, 2025, both dates inclusive (the "Class Period"), have until May 27, 2025 to seek appointment as lead plaintiff of the SoundHound class action lawsuit. Captioned Liles v. SoundHound AI, Inc., No. 25-cv-02915 (N.D. Cal.), the SoundHound class action lawsuit charges SoundHound as well as certain of SoundHound's top executives with violations of the Securities Exchange Act of 1934. If you suffered substantial losses and wish to serve as lead plaintiff of the SoundHound class action lawsuit, please provide your information here: https://www.rgrdlaw.com/cases-soundhound-ai-inc-class-action-lawsuit.html You can also contact attorneys J.C. Sanchez or Jennifer N. Caringal of Robbins Geller by calling 800/449-4900 or via e-mail at [email protected]. CASE ALLEGATIONS: SoundHound provides an independent voice AI platform that purportedly enables businesses across industries to deliver high-quality conversational experiences to their customers. The SoundHound class action lawsuit alleges that defendants throughout the Class Period made false and/or misleading statements and/or failed to disclose that: (i) material weaknesses in SoundHound's internal controls over financial reporting impaired SoundHound's ability to effectively account for corporate acquisitions; (ii) in addition, SoundHound overstated the extent to which it had remediated, and/or its ability to remediate, the material weaknesses in its internal controls over financial reporting; (iii) as a result of the foregoing material weaknesses, SoundHound's reported goodwill following its acquisition of Amelia Holdings, Inc. was inflated and would need to be corrected; (iv) further, SoundHound would likely require extra time and expense to effectively account for its SYNQ3 and Amelia acquisitions; and (v) the above increased the risk that SoundHound would be unable to timely file certain financial reports with the U.S. Securities and Exchange Commission. The SoundHound class action lawsuit further alleges that on March 4, 2025, SoundHound disclosed that it would be unable to timely file its annual report for 2024, stating that "[d]ue to the complexity of accounting for [the SYNQ3 and Amelia acquisitions], the Company require[d] additional time to prepare financial statements and the accompanying notes" and that SoundHound "ha[d] identified material weaknesses in its internal control over financial reporting." On this news, the price of SoundHound stock fell nearly 6%, according to the complaint. THE LEAD PLAINTIFF PROCESS: The Private Securities Litigation Reform Act of 1995 permits any investor who purchased or acquired SoundHound securities during the Class Period to seek appointment as lead plaintiff in the SoundHound class action lawsuit. A lead plaintiff is generally the movant with the greatest financial interest in the relief sought by the putative class who is also typical and adequate of the putative class. A lead plaintiff acts on behalf of all other class members in directing the SoundHound class action lawsuit. The lead plaintiff can select a law firm of its choice to litigate the SoundHound class action lawsuit. An investor's ability to share in any potential future recovery is not dependent upon serving as lead plaintiff of the SoundHound class action lawsuit. ABOUT ROBBINS GELLER: Robbins Geller Rudman & Dowd LLP is one of the world's leading law firms representing investors in securities fraud and shareholder litigation. Our Firm has been ranked #1 in the ISS Securities Class Action Services rankings for four out of the last five years for securing the most monetary relief for investors. In 2024, we recovered over $2.5 billion for investors in securities-related class action cases - more than the next five law firms combined, according to ISS. With 200 lawyers in 10 offices, Robbins Geller is one of the largest plaintiffs' firms in the world, and the Firm's attorneys have obtained many of the largest securities class action recoveries in history, including the largest ever - $7.2 billion - in In re Enron Corp. Sec. Litig. Please visit the following page for more information: https://www.rgrdlaw.com/services-litigation-securities-fraud.html Past results do not guarantee future outcomes. Services may be performed by attorneys in any of our offices. View source version on businesswire.com: https://www.businesswire.com/news/home/20250408846231/en/

Share

Copy Link

SoundHound AI, a voice AI platform provider, is under investigation for potential securities law violations related to its financial reporting and corporate acquisitions.

Legal Troubles for SoundHound AI

SoundHound AI, Inc. (NASDAQ: SOUN), a company that provides an independent voice AI platform for businesses, is facing potential legal action from investors. Two prominent law firms, Faruqi & Faruqi, LLP and Robbins Geller Rudman & Dowd LLP, have announced investigations into claims on behalf of investors who purchased SoundHound AI securities between May 10, 2024, and March 3, 2025 12.

Allegations of Securities Law Violations

The class action lawsuits allege that SoundHound AI and its executives violated federal securities laws by making false and/or misleading statements and failing to disclose critical information. The key allegations include:

- Material weaknesses in SoundHound's internal controls over financial reporting, particularly in relation to corporate acquisitions 1.

- Overstating the extent to which the company had remediated or could remediate these internal control weaknesses 2.

- Inflated reporting of goodwill following the acquisition of Amelia Holdings, Inc. 2.

- Underestimating the time and expense required to effectively account for the SYNQ3 and Amelia acquisitions 12.

Impact on Investors

On March 4, 2025, SoundHound AI disclosed in an SEC filing that it would be unable to timely file its Annual Report for 2024. The company cited the complexity of accounting for the SYNQ3 and Amelia acquisitions and identified material weaknesses in its internal control over financial reporting 1.

Following this announcement, SoundHound's stock price reportedly fell $0.60 per share, or 5.81%, closing at $9.72 per share on March 4, 2025 1. This decline in stock value has prompted the current legal actions on behalf of affected investors.

Legal Proceedings and Investor Options

Both law firms are encouraging investors who suffered losses in SoundHound AI to contact them to discuss their legal options. Key points for potential claimants include:

- The deadline for investors to seek appointment as lead plaintiff is May 27, 2025 12.

- The lead plaintiff will be responsible for directing and overseeing the litigation on behalf of the putative class 1.

- Investors' ability to share in any potential recovery is not affected by the decision to serve as a lead plaintiff 1.

Broader Implications

This case highlights the importance of robust internal controls and accurate financial reporting for publicly traded companies, especially those in the rapidly evolving AI sector. It also underscores the challenges companies may face when integrating acquisitions and managing complex accounting processes.

As the legal proceedings unfold, this situation may have broader implications for investor confidence in AI startups and could potentially lead to increased scrutiny of financial practices within the tech industry.

Summarized by

Navi

OpenAI's £2 Billion Proposal: ChatGPT Plus for All UK Citizens

OpenAI CEO Sam Altman proposed a multibillion-pound deal to provide ChatGPT Plus access to all UK citizens, sparking discussions on AI accessibility and government collaboration.

3 Sources

Technology

11 hrs ago

3 Sources

Technology

11 hrs ago

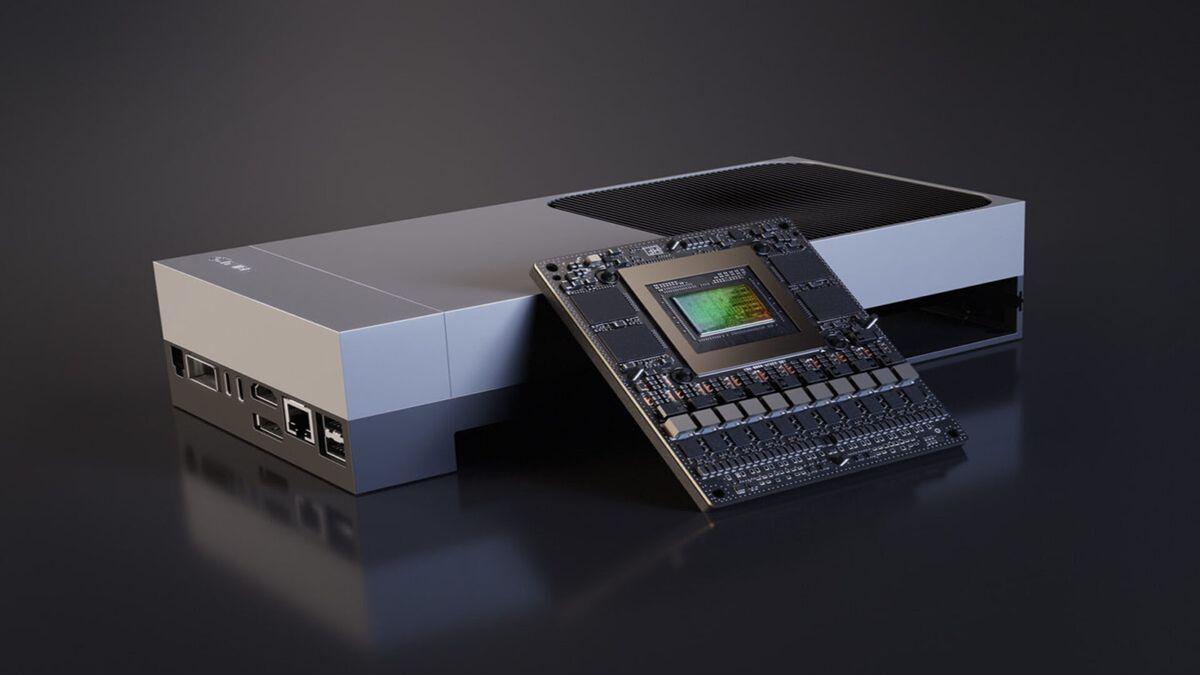

NVIDIA Unveils Jetson AGX Thor: A Powerful Mini PC for AI and Edge Computing

NVIDIA has introduced the Jetson AGX Thor Developer Kit, a compact yet powerful mini PC designed for AI, robotics, and edge computing applications, featuring the new Jetson T5000 system-on-module based on the Blackwell architecture.

2 Sources

Technology

3 hrs ago

2 Sources

Technology

3 hrs ago

Ethereum Gaming Network Xai Sues Elon Musk's xAI for Trademark Infringement

Ex Populus, the company behind Ethereum-based gaming network Xai, has filed a lawsuit against Elon Musk's AI company xAI for trademark infringement and unfair competition, citing market confusion and reputational damage.

2 Sources

Technology

3 hrs ago

2 Sources

Technology

3 hrs ago

AI-Generated Articles Slip Through Editorial Filters at Major Publications

Multiple news outlets, including Wired and Business Insider, have been duped by AI-generated articles submitted under a fake freelancer's name, raising concerns about the future of journalism in the age of artificial intelligence.

4 Sources

Technology

2 days ago

4 Sources

Technology

2 days ago

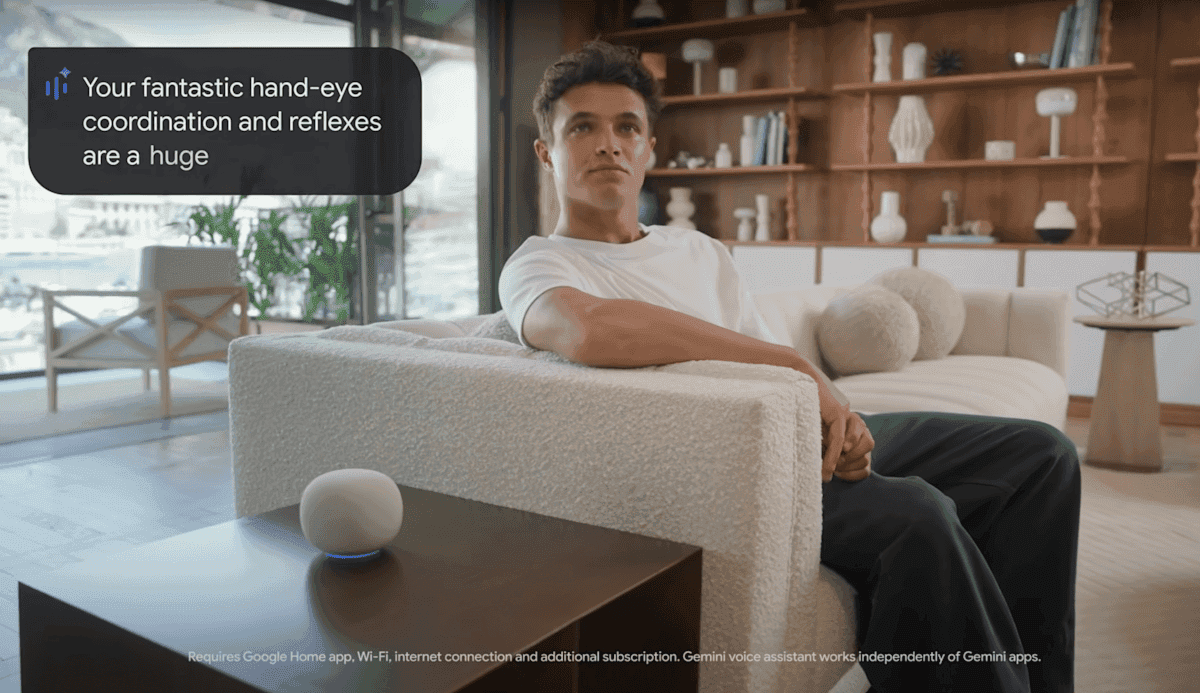

Google's New Gemini-Powered Smart Speaker: A Glimpse into the Future of AI Home Assistants

Google inadvertently revealed a new smart speaker during its Pixel event, sparking speculation about its features and capabilities. The device is expected to be powered by Gemini AI and could mark a significant upgrade in Google's smart home offerings.

5 Sources

Technology

1 day ago

5 Sources

Technology

1 day ago