Synthesia AI Startup Nearly Doubles Valuation to $4 Billion with $200M Series E Funding

10 Sources

10 Sources

[1]

Synthesia hits $4B valuation, lets employees cash out

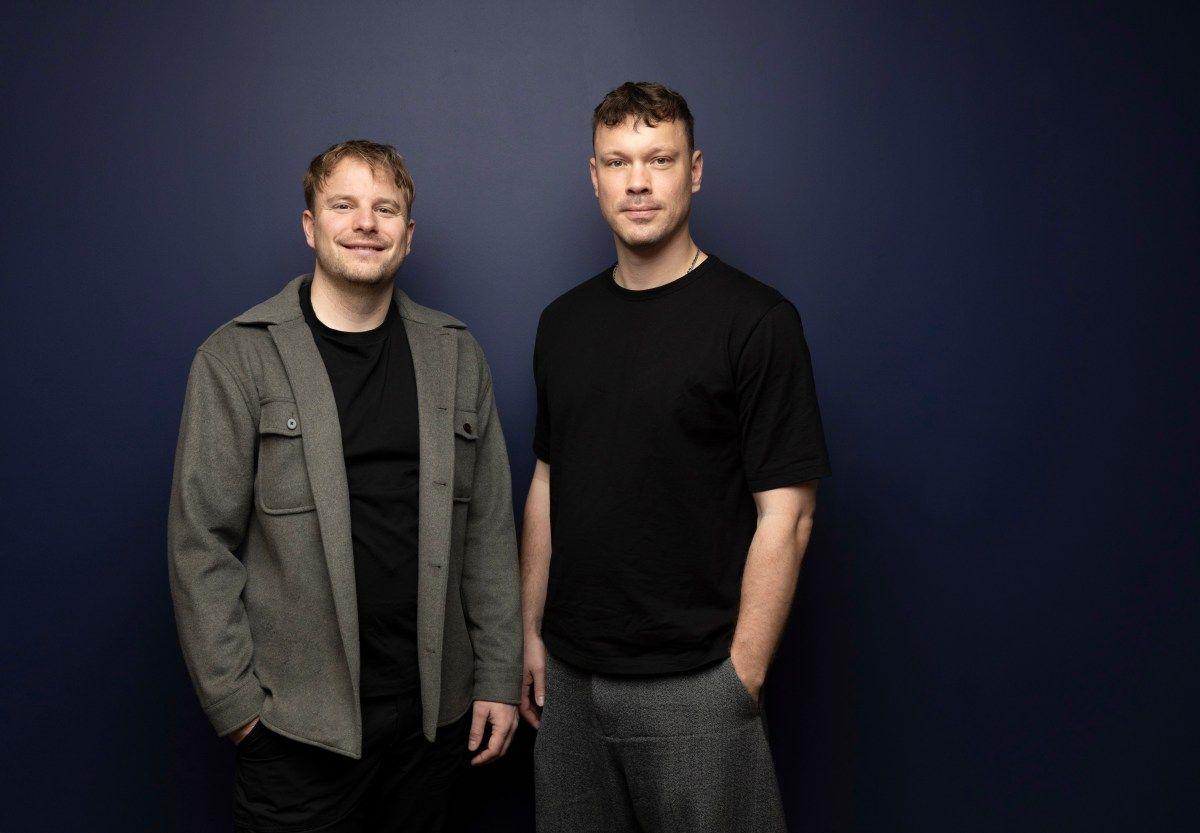

British startup Synthesia, whose AI platform helps companies create interactive training videos, has raised a $200 million Series E round of funding that brings its valuation to $4 billion -- up from $2.1 billion just a year ago. Unlike some other AI startups that are still a long way from turning a profit, Synthesia has found a lucrative business in transforming corporate training thanks to AI-generated avatars. With enterprise clients including Bosch, Merck, and SAP, the London-based company crossed $100 million in annual recurring revenue (ARR) in April 2025. This milestone explains why Synthesia's venture backers are literally doubling down. The Series E that nearly doubled its valuation was led by existing investor GV (Google Ventures), with participation from several other previous backers -- including Series B lead Kleiner Perkins, Series C lead Accel, Series D lead New Enterprise Associates (NEA), NVIDIA's venture capital arm NVentures, Air Street Capital, and PSP Growth. Aside from ongoing support, this round will bring both new and departing investors. On one hand, Matt Miller's VC firm Evantic and the secretive VC firm Hedosophia are joining the cap table as new entrants. On the other hand, Synthesia will facilitate an employee secondary sale in partnership with Nasdaq, TechCrunch has learned. To be clear, Synthesia isn't going public just yet -- Nasdaq isn't acting as a public exchange in this operation, but as a private markets facilitator that will help early team members turn their shares into cash. These employee stock sales often happen outside of this framework, but usually at prices either below or above the company's official valuation, and are sometimes frowned upon by other shareholders. With this process, all sales will be tied to the same $4 billion valuation as Synthesia's Series E, while the company keeps an element of control. "This secondary is first and foremost about our employees," Synthesia CFO Daniel Kim told TechCrunch. "It gives employees a meaningful opportunity to access liquidity and share in the value they've helped create, while we continue to operate as a private company focused on long-term growth." For Synthesia, this long-term growth involves going beyond expressive videos and embracing the AI agents trend. According to a press release, the company is developing AI agents that will let its clients' employees "interact with company knowledge in a more intuitive, human-like way by asking questions, exploring scenarios through role-play, and receiving tailored explanations." The company said early pilots have received positive feedback from customers, who reported higher engagement and faster knowledge transfer compared to traditional formats. This positive response explains why Synthesia now plans to make agents a "core strategic focus" to invest in, alongside further product improvements to its existing platform. While it didn't disclose revenue forecasts, the company hopes its platform will offer a welcome answer to the struggles of enterprises in keeping their workforce adequately trained despite rapid changes. "We see a rare convergence of two major shifts: a technology shift with AI agents becoming more capable, and a market shift where upskilling and internal knowledge sharing have become board-level priorities," Synthesia's co-founder and CEO Victor Riparbelli said in a statement. Seeing boards care more about employees as a result of AI wasn't on anyone's bingo card, except perhaps Riparbelli. Together with his cofounder, Synthesia COO Steffen Tjerrild, Riparbelli took the initiative of conducting a secondary sale so that employees could share in the success of the unicorn company. Founded in 2017, Synthesia now has more than 500 team members, a 20,000-square-foot HQ in London, and additional offices in Amsterdam, Copenhagen, Munich, New York City, and Zurich. While unusual for a British startup, this coordinated secondary sale isn't a first and likely not a last, Synthesia's head of corporate affairs and policy, Alexandru Voica told TechCrunch. "My guess is that as [U.K.-based] private companies stay private longer, this type of structured, cross-border employee liquidity may become increasingly common, so I wouldn't be surprised to see others do it, either with Nasdaq or others," he predicted.

[2]

Nvidia and Alphabet VC arms back AI startup Synthesia at $4 billion valuation

Nvidia and Alphabet's VC arms have backed British AI startup Synthesia in a $200 million funding round, amid a surge of private investment in promising young tech companies seeking to capitalize on the AI boom. The round sees Synthesia hit a $4 billion valuation and was led by Alphabet's GV, with participation from Evantic, Hedosophia, Nvidia's NVentures, Accel, New Enterprise Associates (NEA) and Air Street Capital. It nearly doubles the price tag the startup hit a year ago, when it picked up $180 million in funding, and a valuation of $2.1 billion. Synthesia develops video generation tools for enterprises to be used for internal and external communications. Victor Riparbelli, Synthesia's cofounder and CEO, in a statement, that the funding round was "about scaling" its vision of AI reducing the cost of content creation, and AI video providing "a better, more engaging way for organizations to communicate and learn." "We see a rare convergence of two major shifts: a technology shift with AI Agents becoming more capable, and a market shift where upskilling and internal knowledge sharing have become board-level priorities," he added.

[3]

Synthesia's valuation jumps to $4B after $200M raise

London-based AI video startup secures fresh backing as enterprise demand for generative video tools grows. London-based AI video startup Synthesia has raised $200 million in a Series E round, nearly doubling its valuation to around $4 billion and cementing its position as one of Europe's most valuable AI companies. The round was led by Google Ventures, with participation from existing investors, underscoring continued appetite for applied AI products that have already found a clear commercial use. Synthesia builds generative AI tools that let companies create videos using AI-generated avatars instead of cameras, studios, or presenters. The technology has found a strong foothold in corporate training, internal communications, and product explainers, areas where speed, scale, and consistency often matter more than production gloss. "Synthesia was founded on two core beliefs: first, that AI will bring the cost of content creation down to zero. And secondly, that AI video provides a better, more engaging way for organizations to communicate and learn," said Victor Riparbelli, Synthesia's co-founder and CEO. That focus appears to be paying off. Synthesia says a significant share of Fortune 100 companies now use its platform, a rare level of enterprise penetration for a European AI startup at this stage. Rather than chasing consumer virality, the company has built its business around predictable, high-value enterprise use cases, a strategy investors have increasingly rewarded over the past year. The funding comes at a moment when enthusiasm around generative AI has shifted from experimentation to execution. Enterprises are no longer asking whether AI video works, but how reliably it can plug into existing workflows. Synthesia's pitch is that AI-generated video should be as routine as slides or documents, created quickly, updated easily, and deployed globally without production bottlenecks. At a $4 billion valuation, Synthesia joins a small group of European AI companies that have managed to scale beyond regional relevance. Its rise also highlights a broader pattern: applied AI startups, focused on specific business functions rather than general-purpose models, are attracting some of the largest growth rounds in the market. For the UK tech ecosystem, the deal is another signal that London remains a serious hub for commercial AI, even as regulatory debates continue around model safety, copyright, and synthetic media. Synthesia has previously positioned itself as cautious about misuse, building safeguards around consent and disclosure for its avatars, a stance that may become more important as scrutiny of AI-generated content increases. The challenge ahead is less about proving demand and more about maintaining trust and differentiation as competitors multiply. But with deep enterprise adoption, a clear product focus, and backing from one of Silicon Valley's most influential investors, Synthesia is entering its next phase with momentum firmly on its side.

[4]

UK maker of AI avatars nearly doubles valuation to $4bn after funding round

Synthesia makes digital presenters for clients to use in corporate videos and counts 70% of FTSE 100 as customers A British AI startup that makes realistic video avatars has almost doubled its valuation to $4bn (£3bn), in a boost for the UK technology sector. Synthesia was valued at $2.1bn last year and moved into new offices in central London, marking the moment with a ceremony attended by the Sadiq Khan, the city's mayor, and Peter Kyle, then technology secretary. On Monday, it announced its latest funding round, led by an existing investor, Google Ventures, had raised $200m and valued the British company at $4bn. Google Ventures is the search firm's venture capital arm. Synthesia uses human actors to generate digital avatars of people and also offers employers the ability to create replicas of their staff. Those avatars are then deployed by organisations in corporate videos in a range of scenarios such as health and safety in the workplace, advising on cybersecurity and how to communicate better at work. The company counts 70% of the FTSE 100 as clients, including NatWest, Lloyds Bank and British Gas. It is also used by non-corporate bodies including the NHS, the European Commission and the United Nations. The startup is also developing new avatars that will help train employees and give them new skills, through scenarios such as role-playing and giving tailored explanations. Synthesia's co-founder, Steffen Tjerrild, said the increased valuation reflected the commitment of the company's longstanding backers rather than the investment hype surrounding the AI sector. "Existing investors have seen the progress, have seen the numbers, have seen them compound year over year," he said. "That is also telling a story that this is less [a case of] external investors trying to kind of hype it up, but more about validation from existing investors as well." Last year, a leading British tech investor, James Anderson, said he found sharp increases in valuations of AI startups such as OpenAI and Anthropic "disconcerting". Tjerrild said Synthesia was focusing on executing its business plan, which, he added, was backed by investors who were long-term supporters. "This round is led by insiders, or predominantly existing investors that deeply understand the business, have seen the execution and the improvement of the business over many years," he said. Synthesia generated revenues of $58.3m in 2024 but made a pre-tax loss of $59.2m, according to its latest published accounts, which the company said reflected its investment in headcount, its technology and new offices. Synthesia said it was on track to make $200m in revenues this year. The $4bn valuation puts the company on a par with UK broadcaster ITV, which is worth £3.1bn. Tjerrild's shareholding in Synthesia is now worth $160m, the same as its chief executive and fellow co-founder, Victor Riparbelli. Synthesia was founded in 2017 by the two Danish nationals, as well as the computer scientists Matthias Niessner and Lourdes Agapito. Last year, the London mayor said Synthesia was doing "incredibly well" as he opened its new offices. However, in a speech this month Khan said AI would "usher in a new era of mass unemployment" if used recklessly, as intelligent, autonomous systems proved cheap replacements for humans. Tjerrild said he believed AI would enable businesses to hire more staff. "We're an AI-first company, we have 600 employees and we hired 40% more people last year," he said. "As a business owner myself, if my employees become more productive that means I can invest and hire more people.

[5]

Synthesia raises $200M at $4B valuation to build worker skills using AI avatars

Synthesia raises $200M at $4B valuation to build worker skills using AI avatars London-based Synthesia Ltd., an artificial intelligence video avatar platform, today announced that it has raised $200 million in a late-stage funding, bringing the company's valuation to $4 billion. Founded in 2017, Synthesia offers a platform that generates photorealistic lifelike video avatars of people using generative AI. The company said it will use the new Series E round to redefine how employees learn, using its specialized video-AI product. Synthesia's tool lets users create a personalized avatar from a webcam or smartphone capture, then pair it with a clone of their own voice. The avatar looks like them, sounds like them, and can speak on their behalf in more than 30 languages -- now with a full-body mode, complete with moving arms and hands that gesture as it talks. A library of fully AI generated people for purposes of marketing and communication is also available. It's possible to select from more than 230 prebuilt lifelike avatars that can speak more than 140 languages. Existing investor Google Ventures Co. led the funding round, with participation from Evantic and Hedosophia. Other current investors, including NVentures, Accel, Kleiner Perkins, New Enterprise Associates, PSP Growth, Air Street Capital and MMC Ventures, also joined in the round. The announcement confirms reports from October that the company sought and raised $200 million, led by Google Ventures. "Synthesia was founded on two core beliefs: first, that AI will bring the cost of content creation down to zero. And secondly, that AI video provides a better, more engaging way for organizations to communicate and learn," said co-founder and Chief Executive Victor Riparbelli. "This funding round is about scaling that vision." The company said the next decade will usher in a transition from static, one-way content into interactive, conversational experiences powered by AI agents. For example, kiosks, video, cellphones and more can power AI avatars that can converse and react to humans, similar to a video call. At the same time, enterprises are currently struggling to keep up with keeping employees informed and skilled amid rapid changes in products, regulations and other opportunities. To assist with this, Synthesia has focused on conversational agents designed around education and upskilling. "Market opportunities like this do not come along often," Riparbelli added. "We are at a unique point in time where technology enables agents that can truly understand and respond." The company said early feedback from customers piloting the new agent-based products was positive. Organizations reported higher engagement compared to traditional formats. In response, Synthesia said it will make the educational agents its core strategic focus, alongside investing in further product features for its existing platform.

[6]

UK A.I. Rising Star Synthesia Hits $4B Valuation With $200M Round

Backed by Nvidia and Alphabet, Synthesia is using fresh funding to create interactive A.I. agents that can speak, train and explain. Synthesia, a U.K.-based startup making lifelike digital avatars for enterprise communications, just raised a $200 million series E at a $4 billion valuation, making it one of the most valuable A.I. startups in Britain. The round was led by Alphabet's venture capital arm. Other participants included Nvidia's venture capital arm, Evantic, Accel, Kleiner Perkins and NEA. The new valuation nearly doubled the $2.1 billion figure Synthesia claimed last year after a $180 million funding round. Sign Up For Our Daily Newsletter Sign Up Thank you for signing up! By clicking submit, you agree to our <a href="http://observermedia.com/terms">terms of service</a> and acknowledge we may use your information to send you emails, product samples, and promotions on this website and other properties. You can opt out anytime. See all of our newsletters "Synthesia was founded on two core beliefs: first, that A.I. will bring the cost of content creation down to zero. And secondly, that A.I. video provides a better, more engaging way for organizations to communicate and learn," said Victor Riparbelli, Synthesia's CEO, in a statement. Riparbelli co-founded Synthesia in 2017 with Steffen Tjerrild -- his former partner at crypto exchange Coincall -- and computer scientists Lourdes Agapito and Matthias Niessner. The company is headquartered in London, with additional offices in Amsterdam, Copenhagen, Munich, Zurich and New York City. The startup specializes in text-to-video generation, producing digital avatars that corporations use for training, internal communications and marketing. Its realistic avatars -- created using paid human actors who license their likenesses -- can speak more than 160 languages and be customized by outfit, setting and action. The startup specializes in text-to-video generation, producing digital avatars that corporations use for training, internal communications and marketing. Its realistic avatars, which are created using paid human actors licensing their likeness, can speak more than 160 languages and be customized by outfits, settings and actions. Synthesia's clients include Microsoft, UBS, Ford, Lloyds Bank, among more than 90 percent of Fortune 100 companies. In April, the company said it had surpassed $100 million in annualized recurring revenue (ARR), a measure of predictable subscription income, and confirmed to Observer that it is on track to reach $200 million ARR in 2026. It also boasts a 140 percent net retention rate, reflecting revenue retained from existing customers. The new funding will help Synthesia expand into a new class of agents designed to interact with employees in a more conversational way. Rather than simply delivering training content, these avatars will allow users to role-play scenarios and receive explanations interactively. "We are at a unique point in time where technology enables agents that can truly understand and respond, and where enterprises are under unprecedented pressure to reskill and upskill their workforce," said Riparbelli. Synthesia's valuation still pales in comparison to the sky-high figures attached to U.S. A.I. startups like OpenAI and Anthropic. But the latest funding round makes it one of the U.K.'s most valuable A.I. companies as funding surges across Europe. The continent's A.I. companies raised $17.5 billion in venture capital last year, up 75 percent year-over-year. The trend was led by Paris-based Mistral AI's nearly $2 billion round, according to Crunchbase, representing a roughly 75 percent year-over-year increase and making A.I. the region's leading sector in venture investment for the first time.

[7]

Nvidia's Synthesia wants its talking AI avatars to recruit and train

London-based AI firm Synthesia is developing digital humans for businesses. These avatars will soon engage in conversations for sales training and recruitment. The company secured $200 million in funding, valuing it at $4 billion. Next time you apply for a job, your initial interview and training sessions might be with a talking bot. That's the vision of Synthesia, an artificial intelligence startup in London that creates digital humans for businesses. Synthesia's software lets clients turn written scripts into presentations that feature realistic-looking video avatars. Now the company plans to offer interactive audio-visual "agents" - avatars that can go beyond a script to carry on conversations in specific topics, starting with sales training before expanding into recruiting and other corporate communication. To fund that technology, Synthesia has raised $200 million in financing at a $4 billion valuation, the company said on Monday. Earlier backer GV, Alphabet Inc.'s fund, led the round, which includes a tender offer for employees and participation from existing investors Nvidia Corp. and Accel. New investors Hedosophia and Evantic Capital also joined the round. The funding nearly doubles Synthesia's valuation from a year ago. Victor Riparbelli, Synthesia's chief executive, described the new product as a way to meet the demand from companies to "upskill" employees using automation. "We're providing one part of the solution today," he said in an interview. "The problem is that the other part - the role-playing, the coaching, the feedback - has to be done by humans." Synthesia is one of the leading startups that will serve as a test case of whether generative AI can successfully sell into enterprises, something public investors are watching closely as they judge the financial prospects of the sector. While the tech has captivated the corporate world, few AI firms have shown profits or significant traction in business sales. Video AI, in particular, is a costly, competitive field that's drawing increasing interest from larger tech companies. In October, The Information reported that Adobe Inc. held talks with Synthesia about a $3 billion acquisition. Riparbelli declined to comment on those discussions. The publication also reported earlier on parts of Synthesia's fundraising plans. Formed in 2017 by Riparbelli and three researchers, Synthesia searched for a steady business model until the arrival of ChatGPT. The startup has since used that product and other chatbots to develop avatars that can speak in multiple languages for human resources training, marketing pitches or other workplace programs. (You can now subscribe to our Economic Times WhatsApp channel)

[8]

AI startup Synthesia raises $200M in funding from Nvidia, Google, others (NVDA:NASDAQ)

Artificial intelligence startup Synthesia has raised $200M in a new Series E funding round, the company said on Monday. Nvidia's (NVDA) venture capital arm, Google's (GOOG) (GOOGL) venture arm, and venture firm Kleiner Perkins are among It enables Synthesia to scale, strengthen its market presence, and further innovation in AI video for enterprise needs. Synthesia will invest in building category-defining products for enterprise learning, development, and organizational communications using AI video technologies. They are investing due to Synthesia's position at the intersection of AI-driven content creation and growing enterprise demand for scalable, engaging communication tools.

[9]

Synthesia Raises $400 Million for AI Avatar Platform | PYMNTS.com

The company, which makes artificial intelligence avatars for businesses to use for in-house and external communication, announced its Series E funding round Monday (Jan. 26), with the venture capital arms of Google and Nvidia among the investors. Synthesia says it plans to use the new capital to build on its AI video platform, enhancing its virtual communication offering and creating new enterprise products. "Why? Because we believe the winning companies of the future will be the ones who can teach employees how to leverage the power of AI at work," Victor Riparbelli, Synthesia's co-founder and CEO, said in the announcement. "Automation is a very important value driver, but upskilling your workforce to build their own automations is going to be even more important." The round came a little over a year after Synthesia raised $180 million in a funding round that valued the company at $2.1 billion. PYMNTS wrote last year about the implications of AI-generated avatar use in the B2B world, arguing that the "economics may turn out to be compelling" for enterprise sales teams. An account executive can only handle so many client conversations each week before running into cognitive fatigue and scheduling bottlenecks, the report argued. "An AI avatar, by contrast, scales elastically. In theory, a firm could 'staff' hundreds of simultaneous discovery calls, nurturing prospects across time zones and languages at negligible marginal cost," PYMNTS added. "At the same time, B2B teams risk the threat of agentic avatars turning out to be merely artificial polish. And nothing is more deadly to a sales target than one-size-fits-all inauthenticity." For this system to work, the report continues, artificial intelligence avatars need to master a precise blend of natural language understanding, real-time rendering and context-sensitive reasoning. "The stakes are higher than casual chatbots; sales conversations are nuanced, with subtle cues, objections and relationship dynamics," PYMNTS wrote. "An avatar that fumbles a key industry acronym or mishandles a skeptical prospect could undermine a company's reputation." There's also greater risk of fraud. AI has made it tougher to combat fraud, according to research from the PYMNTS Intelligence report "Rising Risk: Confronting Modern AP Fraud Threats," with account payable teams dealing with issues such as AI-generated deepfakes and impersonations.

[10]

Synthesia raises $200M at $4B valuation with Nvidia, Alphabet among backers By Invezz

Invezz.com - British artificial intelligence company Synthesia has raised $200 million in a Series E funding round, valuing the business at $4 billion and underscoring continued investor appetite for niche AI companies with clear commercial use cases. The valuation nearly doubles the $2.1 billion level the London-based startup achieved last year. The latest round was led by Google Ventures and included participation from new investors Hedosophia and Evantic, the venture fund founded by former Sequoia Capital investor Matt Miller. Existing backers NVentures, Nvidia's venture capital arm, Accel, Kleiner Perkins, New Enterprise Associates, PSP Growth and Air Street Capital also took part. Growing focus on corporate training softwareFounded in 2017 by AI researchers and entrepreneurs from institutions including Stanford and Cambridge, Synthesia specialises in text-to-video generation software. The company has built a business around helping enterprises create training and internal communications videos using AI-generated avatars, reducing the need for traditional video production. Synthesia offers a freemium model with capped video usage, alongside subscription plans and bespoke enterprise packages. Unlike many AI startups still focused on experimentation, the company has found traction in corporate learning and development, with clients including Bosch, Merck, SAP and, more recently, Microsoft. The company said it crossed $100 million in annual recurring revenue in April 2025 and is on track to reach $200 million this year. It also reported a sharp increase in large contracts, quadrupling agreements worth more than $100,000 over the past 12 months. Capital to fuel AI agents and interactivitySynthesia plans to use the new funding to develop more advanced interactive video tools, moving beyond one-way training content. The company is working on AI agents embedded in video avatars that can answer questions, simulate role-play scenarios and provide tailored explanations to employees during training sessions. Chief executive and co-founder Victor Riparbelli said enterprises are under growing pressure to reskill and upskill their workforce, creating a timely opportunity for more interactive and responsive training tools. He described the convergence of enterprise demand and AI capability as a rare market moment. The shift aligns with a broader trend toward AI agents that can interact dynamically with users, rather than simply generating static content. Employee liquidity through structured secondary saleAlongside the funding round, Synthesia is facilitating an employee secondary share sale in partnership with The process allows employees to sell shares at the same $4 billion valuation as the Series E, while giving the company more control over the transaction. Chief financial officer Daniel Kim said the secondary sale is designed to give employees access to liquidity while allowing Synthesia to remain focused on long-term growth as a private company. Secondary sales are often conducted informally and at varying valuations, sometimes creating tension among shareholders. Investor confidence amid AI valuation debateThe funding comes amid ongoing debate over whether heavy spending in artificial intelligence is inflating a market bubble. While some investors have grown cautious, the Synthesia round suggests capital continues to flow toward companies with defined revenue streams and enterprise adoption. The deal also follows other large AI-related raises in the UK, including a $1.1 billion round by data centre operator Nscale Global Holdings earlier this year. Despite this activity, European AI startups still trail US peers in valuation scale. Anthropic and OpenAI are both seeking massive funding rounds at valuations far exceeding those typically seen in Europe, highlighting the transatlantic gap in AI capital markets.

Share

Share

Copy Link

British AI startup Synthesia has raised $200 million in Series E funding, nearly doubling its valuation to $4 billion from $2.1 billion a year ago. The London-based company, which creates AI-generated avatars for corporate training videos, crossed $100 million in annual recurring revenue in April 2025. Led by Google Ventures, the funding round includes participation from NVentures, Accel, and other existing investors, while Synthesia facilitates an employee secondary sale through Nasdaq.

Synthesia Valuation Soars as AI Video Generation Gains Enterprise Traction

British AI startup Synthesia has secured $200 million funding in a Series E funding round that pushes its valuation to $4 billion, nearly doubling the $2.1 billion price tag it achieved just one year ago

1

2

. The London-based company, which specializes in AI video generation using AI avatars for corporate training videos, has found a lucrative niche in transforming how enterprises handle employee upskilling and internal communications. Unlike many AI startups still struggling toward profitability, Synthesia crossed $100 million in annual recurring revenue in April 2025, with enterprise clients including Bosch, Merck, and SAP1

.

Source: PYMNTS

Google Ventures Leads Investment as Enterprise Demand Accelerates

The Series E funding round was led by existing investor Google Ventures, with participation from NVentures (Nvidia's venture capital arm), Evantic, Hedosophia, Accel, New Enterprise Associates (NEA), Kleiner Perkins, PSP Growth, and Air Street Capital

1

2

. The company counts 70% of the FTSE 100 as clients, including NatWest, Lloyds Bank, and British Gas, alongside non-corporate bodies like the NHS, the European Commission, and the United Nations4

. A significant share of Fortune 100 companies now use its platform, demonstrating rare enterprise penetration for a European AI company at this stage3

.Co-founder Steffen Tjerrild emphasized that the increased valuation reflects validation from longstanding backers who have witnessed consistent execution rather than investment hype. "Existing investors have seen the progress, have seen the numbers, have seen them compound year over year," he told The Guardian

4

. Synthesia generated revenues of $58.3 million in 2024 but is now on track to make $200 million in revenues this year4

.Generative AI Video Tools Enable New Training Paradigms

Synthesia's platform lets users create personalized digital presenters from a webcam or smartphone capture, paired with voice cloning technology that can speak in more than 140 languages

5

. The company offers over 230 prebuilt lifelike avatars, now with full-body mode complete with moving arms and hands that gesture as they talk5

. These generative AI video tools have found strong footholds in corporate training, internal communications, and product explainers, where speed, scale, and consistency often matter more than production gloss3

.

Source: SiliconANGLE

Victor Riparbelli, Synthesia's co-founder and CEO, articulated the company's founding vision: "Synthesia was founded on two core beliefs: first, that AI will bring the cost of content creation down to zero. And secondly, that AI video provides a better, more engaging way for organizations to communicate and learn"

3

5

.Related Stories

AI Agents Become Core Strategic Focus for Knowledge Sharing

Beyond expressive videos, Synthesia is developing AI agents that will enable employees to interact with company knowledge in more intuitive, human-like ways through role-play scenarios, tailored explanations, and conversational experiences

1

5

. Early pilots have received positive feedback from customers, who reported higher engagement and faster knowledge transfer compared to traditional formats1

. This positive response has prompted Synthesia to make agents a "core strategic focus" alongside further product improvements to its existing platform.Riparbelli sees a convergence of technological and market shifts: "We see a rare convergence of two major shifts: a technology shift with AI Agents becoming more capable, and a market shift where upskilling and internal knowledge sharing have become board-level priorities"

1

2

. The company anticipates that the next decade will transition from static, one-way content into interactive, conversational experiences powered by AI agents deployed through kiosks, video, and mobile devices5

.Employee Secondary Sale Provides Liquidity Through Nasdaq Partnership

In a move that could set precedent for UK tech companies, Synthesia is facilitating an employee secondary sale in partnership with Nasdaq

1

. While the company isn't going public, Nasdaq will act as a private markets facilitator helping early team members convert shares into cash at the same $4 billion valuation as the Series E round. "This secondary is first and foremost about our employees," Synthesia CFO Daniel Kim explained. "It gives employees a meaningful opportunity to access liquidity and share in the value they've helped create, while we continue to operate as a private company focused on long-term growth"1

.

Source: TechCrunch

Founded in 2017 by Victor Riparbelli, Steffen Tjerrild, Matthias Niessner, and Lourdes Agapito, Synthesia now has more than 500 team members, with offices in London, Amsterdam, Copenhagen, Munich, New York City, and Zurich

1

4

. Alexandru Voica, Synthesia's head of corporate affairs and policy, predicts that as UK-based private companies stay private longer, structured cross-border employee liquidity may become increasingly common1

. At the $4 billion valuation, Riparbelli's and Tjerrild's shareholdings are each now worth $160 million4

.References

Summarized by

Navi

[1]

[3]

Related Stories

Synthesia Raises $180M, Doubling Valuation to $2.1B in AI Video Avatar Boom

15 Jan 2025•Business and Economy

Adobe Invests in AI Video Startup Synthesia, Betting on the Future of Corporate Communication

15 Apr 2025•Business and Economy

Anthropic Raises $3.5 Billion at $61.5 Billion Valuation, Minting New AI Billionaires

04 Mar 2025•Business and Economy

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

Anthropic takes Pentagon to court over unprecedented supply chain risk designation

Policy and Regulation

3

Meta smart glasses face lawsuit and UK probe after workers watched intimate user footage

Policy and Regulation