Tech Stocks Surge as ECB Signals Potential Rate Cut

3 Sources

3 Sources

[1]

Tech takes stocks higher as ECB prepares rate cut

The central bank's second quarter-point rate cut of the cycle is almost certain, but how hard and fast it moves for the rest of the year still seems up in the air and this meeting will throw new ECB staff forecasts into the mix. Chief European Economist at BNP Paribas Paul Hollingsworth said the crucial inflation projections might actually come in higher than the last set in June, although they will have been finalised before this month's dive in oil prices. "We think that this will translate into a message of gradualism," he said, adding that even if Lagarde does not completely rule out a third cut in October, it does not look likely for now at least. Traders currently expect rates to drop to around 2% over the next 12-18 months, "but if we are right on the base case", Hollingsworth said, "the market is probably pricing in too many cuts". European shares, which have not enjoyed the same strength of rebound this week as other parts of the world, were up a solid 1%, with tech stocks jumping 2.5% after Magnificent 7 powerhouse Nvidia had surged on Wall Street on Wednesday. [.EU][.N] Excitement that Italy's UniCredit might be about to make a bid for Germany's Commerzbank also sparked a near 2% rise in banking stocks. JPMorgan's analysts said that now Commerzbank was "in play", its shares could leap by a fifth. "We assume CBK (Commerzbank's) valuation at 20.9 billion euros in our sensitivity which is based on 20% premium vs. current share price," JPMorgan said in a research note. The pre-ECB lull meanwhile kept the euro and sterling hovering at just above $1.10 and $1.30 respectively, while rate-sensitive 2-year German government bond yields bobbed at 2.18% having just dropped to their lowest level since December 2022. Overnight, MSCI's broadest index of Asia-Pacific shares outside Japan had rallied 1.6%. The Nikkei jumped 3.4%, helped by a weaker yen, which pulled back from its 2024 high of 140.71 per dollar. The dollar was last up almost 0.2% to 142.57 yen, having been pressured earlier by hawkish comments from a senior Bank of Japan official who called for raising rates at least to 1%. U.S. data on Wednesday meanwhile showed core consumer price index rose 0.28% in August, compared with forecasts for a rise of 0.2%. It was enough of a steer for markets to almost abandon the chance of a half-point rate cut from the Federal Reserve next week, with probability for such a move at just 15%. "We wanted answers to help settle the 25bp vs 50bp Fed rate cut debate on Friday, but now it seems the market has made its own mind up," said Chris Weston, head of research at Pepperstone, "We are now comfortable with calling a 25bp cut for September, but also open-minded to the idea that a weak U.S. payrolls report on 4 October would fully open up a 50bp cut in the November FOMC meeting." Wall Street futures pointed to U.S. markets reopening fractionally higher with weekly jobless claims coming up. [.N] Wednesday's core inflation figures had initially pressured the main S&P 500, Nasdaq and Dow Jones indexes, but tech stocks had again came to the rescue, with AI darling Nvidia jumping 8% on talk the U.S. government is considering letting it export advanced chips to Saudi Arabia. [.N] Regional tech-heavy share markets in Asia followed suit, with Taiwan adding 2.8% and South Korea gaining 1.7%. Back in the rates markets, 2-year Treasury yields edged up 1 basis point to 3.66%, having risen 4 basis points overnight, while 10-year yields were at 3.6665%. That left the 2-10-year yield curve flattening slightly and barely remaining positive at less than 1 bp. Oil extended gains on fears that Hurricane Francine could lead to lengthy production shutdowns in the U.S. [O/R] Brent crude futures, which hit their lowest in almost three years earlier this week, rose over 1% to $71.40 a barrel, after gaining 2% overnight. Industrial bellwether metal copper was having its best day since July thanks to a 2% rally while gold was 0.2% stronger at $2,517 an ounce, just a touch below its record high of $2,531.60. (Additional reporting by Stella Qiu in Sydney; Editing by Alison Williams)

[2]

Tech takes stocks higher as ECB prepares for rate cut

The central bank's second quarter-point rate cut of the cycle is almost certain, but how hard and fast it moves for the rest of the year still seems up in the air and this meeting will throw new ECB staff forecasts into the mix. Chief European Economist at BNP Paribas Paul Hollingsworth said new inflation projections might actually come in higher than the last set in June, although they will have been finalised before this month's dive in oil prices. "We think that this will translate into a message of gradualism," he said, adding that even if Lagarde does not completely rule out a follow-up cut in October, it does not look likely for now. Markets currently expect rates to drop to around 2% over the next 12-18 months. "But if we are right on the base case, the market is probably pricing in too many cuts." European shares, which have not enjoyed the same strength of rebound this week as other parts of the world, were up a solid 1% with tech stocks jumping 2.5% after Magnificent 7 powerhouse Nvidia had surged on Wall Street on Wednesday.[.EU][.N] The euro and sterling were hovering at just above $1.10 and $1.30 respectively, while ECB-sensitive 2-year German government bond yields bobbed at 2.18% having just dropped to their lowest level since December 2022. Overnight, MSCI's broadest index of Asia-Pacific shares outside Japan had rallied 1.5%. The Nikkei jumped 3.3%, helped by a weaker yen, which pulled back from its 2024 high of 140.71 per dollar. The dollar was last up another 0.2% to 142.57 yen, having been pressured earlier by hawkish comments from a senior Bank of Japan official who called for raising rates at least to 1%. U.S. data on Wednesday meanwhile showed core consumer price index (CPI) rose 0.28% in August, compared with forecasts for a rise of 0.2%. It was enough of a steer for markets to almost abandon the chance of a half-point rate cut from the Federal Reserve next week, with probability for such a move at just 15%. "We wanted answers to help settle the 25bp vs 50bp Fed rate cut debate on Friday, but now it seems the market has made its own mind up," said Chris Weston, head of research at Pepperstone, referring to the mixed August payrolls report last Friday. "We are now comfortable with calling a 25bp cut for September, but also open-minded to the idea that a weak U.S. payrolls report on 4 October would fully open up a 50bp cut in the November FOMC meeting." TECH REBOOT The disappointment over core inflation figures had pressured Wall Street but again tech stocks came to the rescue, with AI darling Nvidia jumping 8%, helped by a media report that the U.S. government is considering letting the company export advanced chips to Saudi Arabia. [.N] Regional tech-heavy share markets in Asia followed suit, with Taiwan adding 2.8% and South Korea gaining 1.7%. Back in the rates markets, 2-year Treasury yields edged up 1 basis point to 3.66%, having risen 4 basis points overnight, while 10-year yields were at 3.6665%. That left the 2-10-year yield curve flattening slightly and barely remaining positive at less than 1 bp. Oil extended gains on fears that Hurricane Francine could lead to lengthy production shutdowns in the U.S. [O/R] Brent crude futures, which hit their lowest in almost three years earlier this week, rose over 1% to $71.40 a barrel, after gaining 2% overnight. Industrial bellwether metal copper was having its best day since July thanks to a 2% rally while gold was 0.2% stronger at $2,517 an ounce, just a touch below its record high of $2,531.60. (Reporting by Marc Jones, Editing by William Maclean)

[3]

Tech takes stocks higher as ECB prepares rate cut

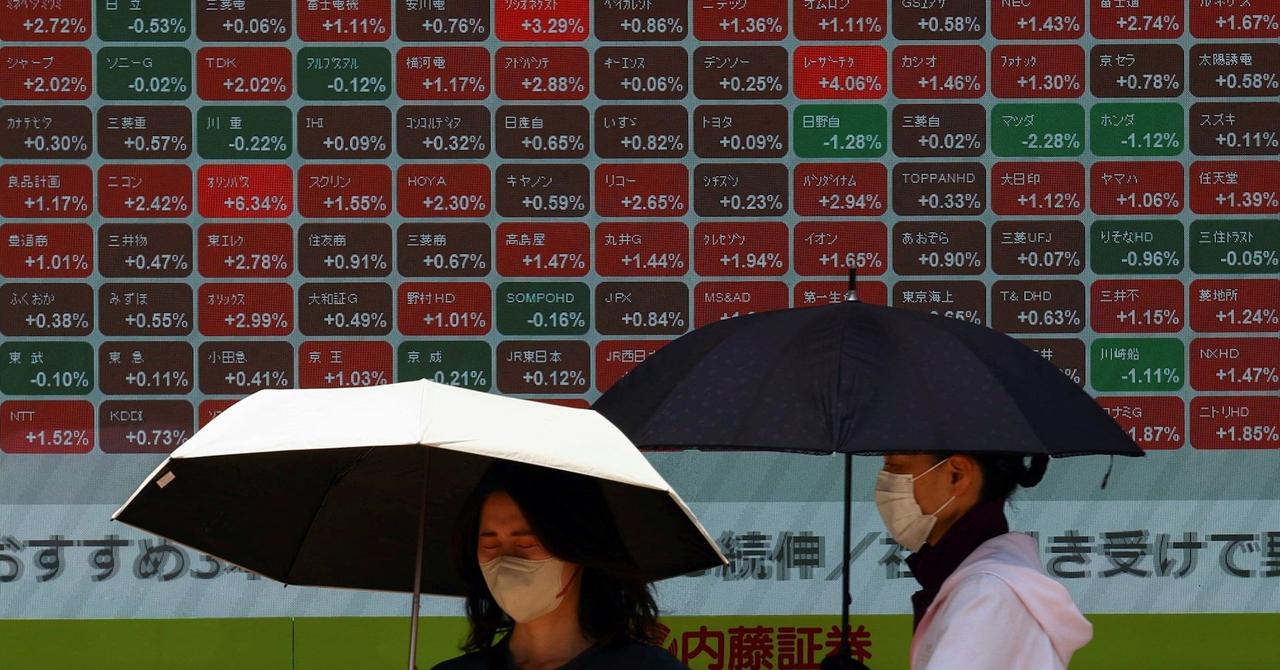

Share markets enjoyed a fourth straight day of gains on Thursday as the prospect of another ECB rate cut pinned shorter-term euro zone borrowing costs near to their lowest level since the end of 2022, and the euro to a 4-month nadir. An overnight rally in supersized U.S. tech stocks and a rebound in commodity markets was also helping the mood, but focus was rapidly gravitating towards what message ECB chief Christine Lagarde sends from Frankfurt shortly. The central bank's second quarter-point rate cut of the cycle is almost certain, but how hard and fast it moves for the rest of the year still seems up in the air and this meeting will throw new ECB staff forecasts into the mix. Chief European Economist at BNP Paribas Paul Hollingsworth said the crucial inflation projections might actually come in higher than the last set in June, although they will have been finalised before this month's dive in oil prices. "We think that this will translate into a message of gradualism," he said, adding that even if Lagarde does not completely rule out a third cut in October, it does not look likely for now at least. Traders currently expect rates to drop to around 2% over the next 12-18 months, "but if we are right on the base case", Hollingsworth said, "the market is probably pricing in too many cuts". European shares, which have not enjoyed the same strength of rebound this week as other parts of the world, were up a solid 1%, with tech stocks jumping 2.5% after Magnificent 7 powerhouse Nvidia had surged on Wall Street on Wednesday. Excitement that Italy's UniCredit might be about to make a bid for Germany's Commerzbank also sparked a near 2% rise in banking stocks. JPMorgan's analysts said that now Commerzbank was "in play", its shares could leap by a fifth. "We assume CBK (Commerzbank's) valuation at 20.9 billion euros in our sensitivity which is based on 20% premium vs. current share price," JPMorgan said in a research note. The pre-ECB lull meanwhile kept the euro and sterling hovering at just above $1.10 and $1.30 respectively, while rate-sensitive 2-year German government bond yields bobbed at 2.18% having just dropped to their lowest level since December 2022. Overnight, MSCI's broadest index of Asia-Pacific shares outside Japan had rallied 1.6%. The Nikkei jumped 3.4%, helped by a weaker yen, which pulled back from its 2024 high of 140.71 per dollar. TECH REBOOT The dollar was last up almost 0.2% to 142.57 yen, having been pressured earlier by hawkish comments from a senior Bank of Japan official who called for raising rates at least to 1%. U.S. data on Wednesday meanwhile showed core consumer price index rose 0.28% in August, compared with forecasts for a rise of 0.2%. It was enough of a steer for markets to almost abandon the chance of a half-point rate cut from the Federal Reserve next week, with probability for such a move at just 15%. "We wanted answers to help settle the 25bp vs 50bp Fed rate cut debate on Friday, but now it seems the market has made its own mind up," said Chris Weston, head of research at Pepperstone, "We are now comfortable with calling a 25bp cut for September, but also open-minded to the idea that a weak U.S. payrolls report on 4 October would fully open up a 50bp cut in the November FOMC meeting." Wall Street futures pointed to U.S. markets reopening fractionally higher with weekly jobless claims coming up. Wednesday's core inflation figures had initially pressured the main S&P 500, Nasdaq and Dow Jones indexes, but tech stocks had again came to the rescue, with AI darling Nvidia jumping 8% on talk the U.S. government is considering letting it export advanced chips to Saudi Arabia. Regional tech-heavy share markets in Asia followed suit, with Taiwan adding 2.8% and South Korea gaining 1.7%. Back in the rates markets, 2-year Treasury yields edged up 1 basis point to 3.66%, having risen 4 basis points overnight, while 10-year yields were at 3.6665%. That left the 2-10-year yield curve flattening slightly and barely remaining positive at less than 1 bp. Oil extended gains on fears that Hurricane Francine could lead to lengthy production shutdowns in the U.S. Brent crude futures, which hit their lowest in almost three years earlier this week, rose over 1% to $71.40 a barrel, after gaining 2% overnight. Industrial bellwether metal copper was having its best day since July thanks to a 2% rally while gold was 0.2% stronger at $2,517 an ounce, just a touch below its record high of $2,531.60. (Additional reporting by Stella Qiu in Sydney; Editing by Alison Williams)

Share

Share

Copy Link

Global stock markets rally, led by technology sector gains, as the European Central Bank hints at possible interest rate cuts. Investors anticipate shifts in monetary policy amid changing economic conditions.

Tech Sector Leads Market Rally

The global stock market experienced a significant upturn, with technology stocks at the forefront of the surge. This positive momentum was largely fueled by anticipation of potential interest rate cuts by the European Central Bank (ECB)

1

. The STOXX 600 index, a key indicator of European stock performance, saw a 0.5% increase, while the technology sector specifically enjoyed a robust 1.5% gain2

.ECB's Monetary Policy Shift

The ECB's President, Christine Lagarde, hinted at the possibility of interest rate cuts in the coming months, marking a potential shift in the central bank's monetary policy. This indication came as inflation in the euro zone showed signs of easing, prompting discussions about adjusting the current tight monetary stance

3

. The ECB's openness to rate cuts contrasts with the more cautious approach of the U.S. Federal Reserve, which has maintained a restrictive policy outlook.Global Market Response

The positive sentiment wasn't limited to European markets. Wall Street also saw gains, with the S&P 500 and Nasdaq Composite both rising. The dollar index, which measures the greenback against a basket of currencies, experienced a slight dip

1

. This global market response underscores the interconnected nature of financial markets and the widespread impact of major central bank decisions.Related Stories

Technology Sector Performance

Technology stocks were particularly buoyant, with companies like ASML Holding NV, Europe's largest tech company by market value, seeing significant gains. The tech sector's strong performance was attributed to optimism surrounding artificial intelligence and the potential for more favorable financing conditions in a lower interest rate environment

2

.Economic Indicators and Future Outlook

While stock markets rallied, other economic indicators presented a mixed picture. The euro remained steady against the dollar, and government bond yields saw little change. Oil prices, however, experienced an uptick due to rising tensions in the Middle East

3

. These varied indicators suggest that while investor sentiment is positive, there are still complex factors at play in the global economy.As markets digest the ECB's signals and await concrete policy changes, investors and analysts will be closely monitoring economic data and central bank communications for further clues about the direction of monetary policy and its potential impact on various sectors and asset classes.

References

Summarized by

Navi

Related Stories

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

Pentagon Summons Anthropic CEO as $200M Contract Faces Supply Chain Risk Over AI Restrictions

Policy and Regulation

3

Canada Summons OpenAI Executives After ChatGPT User Became Mass Shooting Suspect

Policy and Regulation