Tower Semiconductor Forecasts Strong Q3 Revenue Amid Rising Demand for AI and Data Center Chips

3 Sources

3 Sources

[1]

Tower Semiconductor forecasts quarterly revenue above estimates on steady chip demand

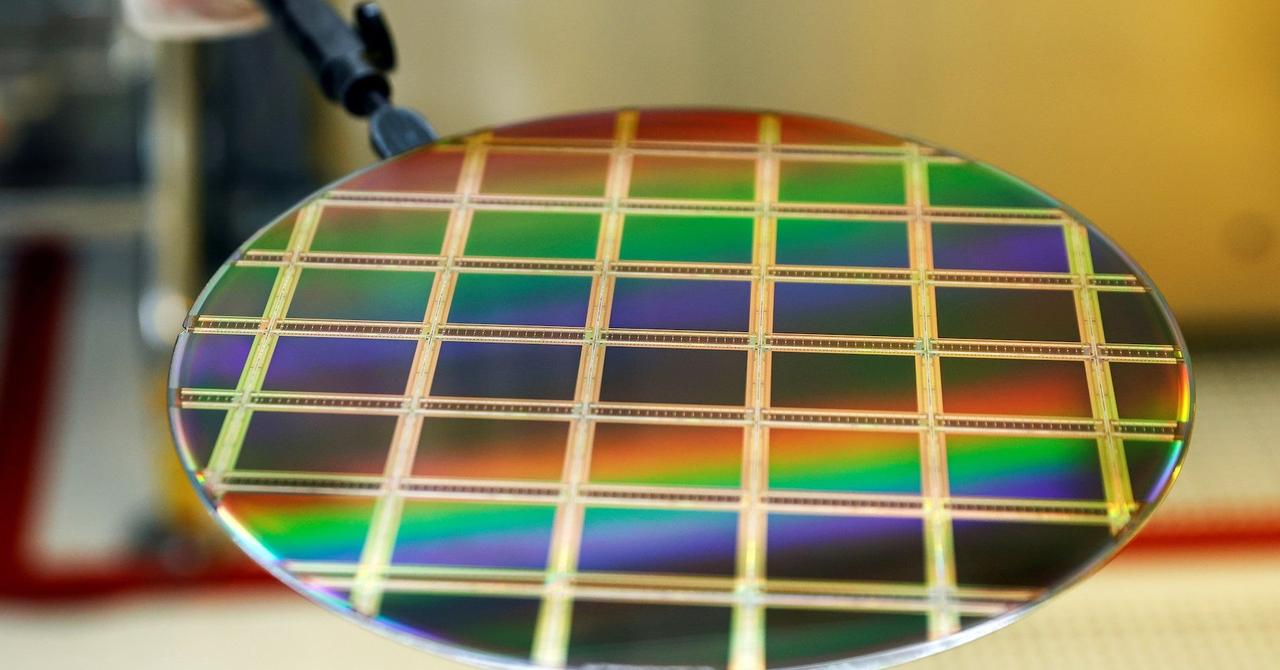

Aug 4 (Reuters) - Israeli contract chipmaker Tower Semiconductor (TSEM.TA), opens new tab forecast third-quarter revenue above Wall Street expectations on Monday, driven by steady demand for its chips used in the automotive and industrial markets. The company's U.S.-listed shares were up 5% in early trading. Tower Semiconductor has also seen higher demand for its advanced chip technologies used in optical fiber communications from companies building data centers and AI infrastructure. These chips help move large amounts of data quickly and efficiently, making them essential components in the modern data centers and networks powering today's digital world. The company specializes in manufacturing analog and mixed-signal integrated circuits for a wide range of applications, including automotive, industrial, consumer electronics and optical communications. "The momentum we have gained in our RF infrastructure business, driven by data centers and AI expansions, is particularly noteworthy, with customer forecasts continuing to increase," CEO Russell Ellwanger said. Tower Semiconductor forecast third-quarter revenue of $395 million, plus or minus 5%, while analysts expect revenue of $392.5 million, according to data compiled by LSEG. It reported 6% growth in revenue to $372.1 million in the second quarter, compared with an expectation of $371.6 million. Reporting by Harshita Mary Varghese in Bengaluru; Editing by Pooja Desai Our Standards: The Thomson Reuters Trust Principles., opens new tab

[2]

Why Is Tower Semiconductor Stock Gaining Monday? - Tower Semiconductor (NASDAQ:TSEM)

Tower Semiconductor (NASDAQ: TSEM) stock gained after it reported fiscal second-quarter results on Monday. The company reported a quarterly revenue growth of 6% year-on-year (Y/Y) to $372.06 million, compared to the analyst consensus estimate of $370.23 million. The Israel-based contract chipmaker's adjusted EPS of 50 cents beat the analyst consensus estimate of 45 cents. Also Read: Tower Semiconductor Adapts To Nvidia's Architectural Shift, Analyst Sees Growth In AI Optical Networks Gross profit was $80 million, down 7.9% Y/Y. The margin declined to 21.5% from 24.8% Y/Y. Operating profit of $39.9 million decreased 27.7% Y/Y. During the quarter, the company generated $123 million in operating cash flow and held $1.21 billion in cash and equivalents. Tower Semiconductor CEO Russell Ellwanger credited the company's ongoing strategic initiatives, particularly the repurposing of multiple factories to expand RF (Radio Frequency) infrastructure capacity, with supporting recent gains and setting the stage for continued growth in the coming quarters. He noted that driven by rising demand from data centers and AI expansion, Tower has built strong momentum in its RF infrastructure business, backed by growing customer forecasts and reinforced by its leading market share. The company expects to maintain this trajectory, with third-quarter revenue guidance set at $395 million and a targeted $40 million increase in the fourth quarter. Trending Investment OpportunitiesAdvertisementArrivedBuy shares of homes and vacation rentals for as little as $100. Get StartedWiserAdvisorGet matched with a trusted, local financial advisor for free.Get StartedPoint.comTap into your home's equity to consolidate debt or fund a renovation.Get StartedRobinhoodMove your 401k to Robinhood and get a 3% match on deposits.Get StartedOutlook Tower Semiconductor expects third-quarter revenue of $375.25 million-$414.75 million compared to the $394.54 million analyst consensus estimate. TSEM Price Action: TSEM stock is trading higher by 7.95% to $48.22 at last check Monday. Read Next: Rising Competition In China Threatens Nvidia's Comeback Photo via Shutterstock TSEMTower Semiconductor Ltd$48.919.50%Stock Score Locked: Edge Members Only Benzinga Rankings give you vital metrics on any stock - anytime. Unlock RankingsEdge RankingsMomentum56.29Growth87.80Quality55.93Value65.09Price TrendShortMediumLongOverviewMarket News and Data brought to you by Benzinga APIs

[3]

Tower Semiconductor forecasts quarterly revenue above estimates on steady chip demand

(Reuters) -Israeli contract chipmaker Tower Semiconductor forecast third-quarter revenue above Wall Street expectations on Monday, driven by steady demand for its chips used in the automotive and industrial markets. The company's U.S.-listed shares were up 5% in early trading. Tower Semiconductor has also seen higher demand for its advanced chip technologies used in optical fiber communications from companies building data centers and AI infrastructure. These chips help move large amounts of data quickly and efficiently, making them essential components in the modern data centers and networks powering today's digital world. The company specializes in manufacturing analog and mixed-signal integrated circuits for a wide range of applications, including automotive, industrial, consumer electronics and optical communications. "The momentum we have gained in our RF infrastructure business, driven by data centers and AI expansions, is particularly noteworthy, with customer forecasts continuing to increase," CEO Russell Ellwanger said. Tower Semiconductor forecast third-quarter revenue of $395 million, plus or minus 5%, while analysts expect revenue of $392.5 million, according to data compiled by LSEG.It reported 6% growth in revenue to $372.1 million in the second quarter, compared with an expectation of $371.6 million. (Reporting by Harshita Mary Varghese in Bengaluru; Editing by Pooja Desai)

Share

Share

Copy Link

Tower Semiconductor, an Israeli contract chipmaker, predicts higher-than-expected Q3 revenue, driven by steady demand in automotive and industrial markets, as well as increased demand for advanced chip technologies used in AI infrastructure and data centers.

Tower Semiconductor's Strong Q3 Forecast

Tower Semiconductor, an Israeli contract chipmaker, has forecast third-quarter revenue above Wall Street expectations, signaling robust growth in the semiconductor industry. The company's U.S.-listed shares rose 5% in early trading following the announcement

1

2

.

Source: Reuters

Revenue Growth and Market Performance

Tower Semiconductor reported a 6% year-on-year revenue growth to $372.1 million in the second quarter, slightly surpassing analyst expectations of $371.6 million

1

. For the third quarter, the company projects revenue of $395 million, plus or minus 5%, exceeding the analyst consensus of $392.5 million1

3

.Driving Factors Behind Growth

The company's growth is primarily attributed to two key factors:

-

Steady Demand in Traditional Markets: Tower Semiconductor continues to see strong demand for its chips used in automotive and industrial applications

1

2

. -

Increased Demand for Advanced Technologies: The company has experienced higher demand for its advanced chip technologies, particularly those used in optical fiber communications. This surge is driven by companies building data centers and AI infrastructure

1

3

.

Specialization and Market Position

Tower Semiconductor specializes in manufacturing analog and mixed-signal integrated circuits for a wide range of applications, including:

- Automotive

- Industrial

- Consumer electronics

- Optical communications

1

These chips play a crucial role in moving large amounts of data quickly and efficiently, making them essential components in modern data centers and networks powering today's digital world

1

.RF Infrastructure Business Momentum

Source: Benzinga

CEO Russell Ellwanger highlighted the company's strong performance in the RF (Radio Frequency) infrastructure business. He stated, "The momentum we have gained in our RF infrastructure business, driven by data centers and AI expansions, is particularly noteworthy, with customer forecasts continuing to increase"

1

2

.Related Stories

Financial Performance and Outlook

While revenue growth has been strong, the company did experience some pressure on profitability:

- Gross profit decreased 7.9% year-on-year to $80 million

- Gross margin declined to 21.5% from 24.8% year-on-year

- Operating profit fell 27.7% year-on-year to $39.9 million

2

Despite these challenges, Tower Semiconductor maintains a strong financial position with $1.21 billion in cash and equivalents. The company generated $123 million in operating cash flow during the quarter

2

.Strategic Initiatives and Future Growth

Tower Semiconductor's CEO credited ongoing strategic initiatives for supporting recent gains and setting the stage for continued growth. These initiatives include repurposing multiple factories to expand RF infrastructure capacity

2

.The company expects to maintain its growth trajectory, with third-quarter revenue guidance set at $395 million and a targeted $40 million increase in the fourth quarter

2

.As Tower Semiconductor continues to adapt to market demands, particularly in AI and data center technologies, it appears well-positioned to capitalize on the growing need for advanced semiconductor solutions in these rapidly expanding sectors.

References

Summarized by

Navi

Related Stories

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

ChatGPT cracks decades-old gluon amplitude puzzle, marking AI's first major theoretical physics win

Science and Research