Utility Stocks Surge on AI-Driven Energy Demand: Vistra and Constellation Energy Lead the Charge

4 Sources

4 Sources

[1]

Unlikely S&P 500 Stock Leaves Nvidia Behind With 241% Gain In 2024 - Vistra (NYSE:VST)

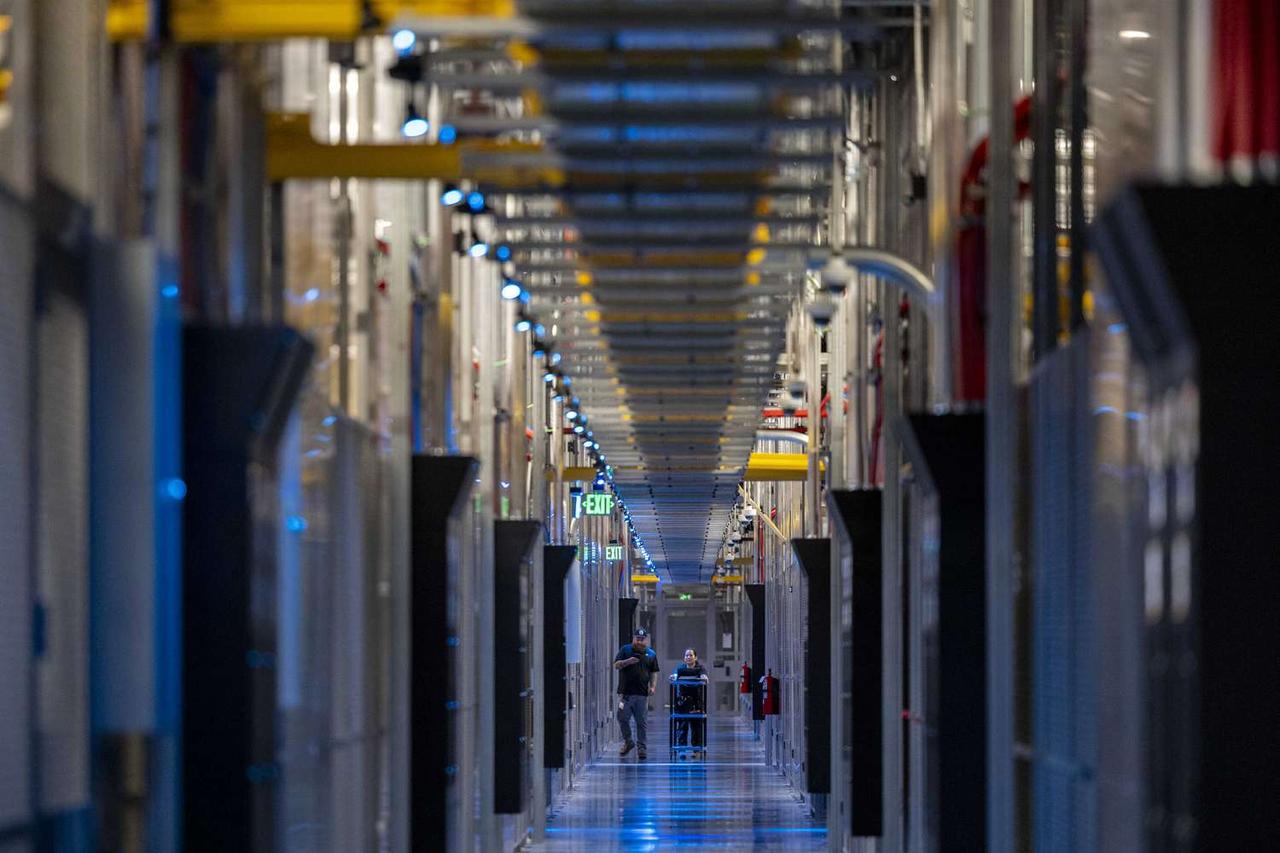

The Texas-based utility is capitalizing on AI-driven demand for clean energy, especially from data centers requiring vast power supplies. While Nvidia Corp NVDA continues to ride the AI wave, it's not the only S&P 500 stock cashing in on artificial intelligence. Meet Vistra Corp VST -- a Texas-based utility powerhouse that has quietly surged by 45.69% over the past month, leaving Nvidia's modest 12.43% monthly gain in the dust. The real kicker? Vistra is leveraging AI in a whole new way. Powering Up: How Vistra Is Tapping Into AI's Energy Demand You might not immediately associate a utility company with AI, but Vistra is a different breed. The company accounts for nearly one-fifth of Texas' electricity generation, and with its recent expansion into nuclear power, it's now well-positioned to supply the massive energy needs of AI data centers. These centers require enormous amounts of clean, reliable power, and Vistra's strategic nuclear acquisitions in 2023 and 2024 have put it at the forefront of this emerging energy market. Nuclear Moves: Vistra's Big Bet Pays Off When Vistra finalized the purchase of the remaining assets of its newly created nuclear entity earlier this year, the market responded enthusiastically. It's no wonder -- nuclear power is set to play a critical role in AI infrastructure, and Vistra has positioned itself as a key player. Read Also: Utilities Outpace S&P 500, Fueled By AI: These 2 Stocks Lead The Charge Vistra Stock Still Bullish Despite The Surge Technically speaking, Vistra's stock remains on a bullish tear. Chart created using Benzinga Pro At $129.60, the stock is well above its key moving averages, with the eight-day SMA at $129.13 and the 50-day SMA at $96.33, signaling continued buying pressure. Even after its rapid rise, Vistra's technicals suggest there's still room for upside. The AI Utility Play You Didn't See Coming With a year-to-date gain of 241.48%, Vistra has not only outpaced Nvidia but has also shattered expectations in the utility sector. Vistra's rise indicates that AI is lifting not just tech stocks but utilities as well, riding high on the demand for power-hungry data centers. Read Next: CEG Stock Is Up 60% In A Month: Is Constellation Energy The New Power Play? Photo: Shutterstock Market News and Data brought to you by Benzinga APIs

[2]

AI's Thirst for Power Turns Utility Stocks Into Big Tech Proxies

The tech world's obsession with artificial intelligence is continuing to spur a huge demand for power -- supercharging returns in the utilities sector and shaking up the S&P 500 index. Wall Street sees more to come. While utilities have been market leaders all year thanks to AI, shares in independent power producers Vistra Corp. and Constellation Energy Corp. have really taken off in the past month, helped by a landmark deal for Constellation to supply nuclear power to Microsoft Corp. Vistra -- a top pick of Third Point LLC's Daniel Loeb because of its AI-related potential -- is the top S&P 500 performer year-to-date, with a more than 230% gain eclipsing Nvidia Corp.'s 168% rally.

[3]

Utility Stocks Come Down From AI-Driven Highs

Despite Wednesday's declines, all three stocks remained solidly in positive territory for 2024. Shares of power generators Constellation Energy (CEG), NRG Energy (NRG), and Vistra (VST) posted some of the steepest losses in the S&P 500 on Wednesday. The declines came after all three stocks ended last week with record highs on enthusiasm about opportunities to benefit from growing energy demand for data centers to support artificial intelligence (AI). The retreat for the red-hot electric utility stocks came as several analysts expressed concerns about the sustainability of their valuations following massive AI-driven gains this year. Although many analysts remain bullish about the upside potential for companies like Constellation, NRG, and Vistra as they could help meet the large energy demand needed to power AI, BTIG analysts suggested utilities could be set for a correction of around 7% to 10%. According to BTIG's analysis, the sector's valuation appears "stretched" relative to its historical levels, and utilities tend to drop off following periods of outperformance versus the broader markets. SentimenTrader's Jason Goepfert echoed that utility stocks have a history of reversing their momentum after strong runs, and added any cracks in the "new narrative about AI" could hit confidence in returns. Constellation Energy was the weakest performer of any S&P 500 stock Wednesday, plunging 6.1%. NRG Energy shares dropped 5.3%, while Vistra stock slipped almost 3%. Despite the declines, all three stocks remained solidly in positive territory for 2024. Constellation shares have more than doubled in value since the start of the year, while NRG stock is up more than 70%. Vistra, meanwhile, remains the S&P 500's top-performing stock this year, having more than tripled in value over the period.

[4]

These Are the 4 Hottest Stocks in the S&P 500 This Year -- and Only One Is In the "Magnificent Seven." Are They Still Buys?

All four of these stocks in the S&P 500 have more than doubled. Some of the names might surprise you. The broader benchmark S&P 500 has ripped all year and is now up nearly 22%. The index is a bellwether for the entire market and includes 500 larger companies in many industries. Technically, the S&P 500 has more than 500 stocks because some companies have multiple classes of shares. With such a wide sample size, many stocks in the S&P 500 have performed worse than the broader index and many have performed better. Here are the four hottest stocks in the S&P 500 so far this year, and believe it or not, only one is in the "Magnificent Seven." Can you still buy these stocks after such a good run? 1. Vistra Corp -- 224% Utility stocks have had a bang-up year, as lower interest rates have led investors to gravitate toward dividend-paying stocks. However, something else has been fueling Vistra (VST -2.45%), the largest competitive power generator in the U.S. That, of course, is artificial intelligence. Interestingly, Vistra looks to be a potential "picks and shovels" trade for the AI sector, but in a very different way than semiconductors. AI is powered by data and data centers, which are very energy-intensive. Tech companies believe a good alternative could be to connect data centers to nuclear plants. Vistra owns four nuclear reactors after acquiring Energy Harbor in 2023. 2. Nvidia -- 172% Investors shouldn't be surprised to see this name on the list, considering it's been arguably the most talked about ticker in the investing world. Nvidia (NVDA -1.38%) is the classic "picks and shovels" play on AI, designing chips that make AI possible. Nvidia's chips are used by some of the world's largest and most innovative tech companies, including OpenAI, Amazon, Google, and Microsoft. Some analysts estimate that Nvidia's market share for the AI semiconductors that helped make ChatGPT technology possible is between 70% and 95%. Since the start of 2023, Nvidia's revenue and profits have grown like a weed. Palantir Technologies (PLTR -1.34%) went public during the pandemic in 2020, and it's been quite the ride ever since, with the stock up almost 370%. What does Palantir do? You guessed it: AI. Palantir uses AI to help people and organizations analyze vast quantities of data in a user-friendly way that doesn't require them to learn some of the more complex languages and techniques at the core of AI. Palantir has constructed platforms that use AI to manipulate and manage data. The company then builds applications atop these platforms so humans with no AI expertise can analyze this data. The company's largest client is the U.S. government, and it has gotten large contracts with the U.S. State Department and the U.S. Army. Constellation Energy -- 127% Constellation Energy (CEG -2.79%) is the largest carbon-free energy producer in the U.S. It's based in Baltimore and owns sustainable energy assets, including wind and solar farms and hydropower plants. Roughly 90% of the energy from Constellation is carbon-free, and the company is responsible for 10% of all carbon-free energy in the U.S. Constellation also owns 21 nuclear reactors at 12 sites across the country, making it the largest operator of nuclear reactors in the U.S. Investors believe it could be a critical asset in the future powering of data centers and AI. Earlier this year, Constellation's CEO Joe Dominguez cited AI as one of the industries it is seeing demand from in terms of nuclear energy. Constellation is projecting that major tech companies will invest $1 trillion in data centers over the next five years. Are these AI stocks buys? AI has driven stocks to meteoric valuations, and this sentiment can be seen in the current price-to-earnings ratios of these four stocks. NVDA PE Ratio data by YCharts. All these companies are compelling given what they do and the potential for AI to fundamentally shift almost every aspect of our lives. I've never been a huge growth investor who buys companies at massive valuations. That's because the margin for error gets slim, and a simple miss on earnings or disappointing guidance can send the stock tumbling. But for long-term investors who can handle some volatility, I think all of these stocks offer promise. Of these four, I like the utility names like Constellation and Vistra better right now. They've gotten expensive as a group, but pay dividends and are not entirely dependent on AI. So they can benefit from the AI boom, but also have other sources of business to fall back on if AI stumbles.

Share

Share

Copy Link

Utility companies like Vistra and Constellation Energy are experiencing unprecedented stock growth, outpacing even tech giants like Nvidia, as the AI boom drives demand for clean, reliable power for data centers.

Utility Stocks Soar on AI-Driven Energy Demand

In an unexpected turn of events, utility companies are emerging as major beneficiaries of the artificial intelligence (AI) boom, with their stocks outperforming even tech giants like Nvidia. This surge is primarily driven by the growing energy demands of AI-powered data centers, which require vast amounts of clean and reliable power

1

2

.Vistra Corp: The Unlikely S&P 500 Leader

Vistra Corp (VST), a Texas-based utility powerhouse, has become the top performer in the S&P 500 this year, with a staggering 241% gain year-to-date, surpassing Nvidia's 168% rally

1

2

. Vistra's strategic expansion into nuclear power has positioned it to meet the massive energy needs of AI data centers, accounting for nearly one-fifth of Texas' electricity generation1

.Constellation Energy: Nuclear Power for AI

Constellation Energy (CEG), the largest carbon-free energy producer in the U.S., has also seen its stock more than double this year

4

. The company's ownership of 21 nuclear reactors across 12 sites makes it a critical asset for powering AI infrastructure. Constellation recently secured a landmark deal to supply nuclear power to Microsoft, further solidifying its position in the AI-driven energy market2

4

.The AI-Utility Connection

The surge in utility stocks is directly linked to the tech world's growing appetite for power to support AI operations. Companies like Vistra and Constellation are capitalizing on this demand by offering clean, reliable energy sources, particularly nuclear power, which is seen as an ideal solution for energy-intensive AI data centers

1

2

4

.Market Performance and Investor Sentiment

Despite recent pullbacks due to concerns about stretched valuations, utility stocks remain solidly in positive territory for 2024

3

. Wall Street analysts see more potential for growth, with some viewing these utilities as "picks and shovels" plays for the AI sector, similar to semiconductor companies but in the energy domain1

4

.Related Stories

Challenges and Considerations

While the AI-driven surge has been impressive, some analysts warn of potential corrections. BTIG analysts suggest utilities could face a 7% to 10% correction due to stretched valuations relative to historical levels

3

. Additionally, the sustainability of these high valuations and the sector's ability to maintain momentum are points of concern for some market observers3

4

.Future Outlook

Despite potential short-term corrections, the long-term outlook for AI-focused utility companies remains positive. Constellation Energy projects that major tech companies will invest $1 trillion in data centers over the next five years, indicating sustained demand for power

4

. This trend suggests that utilities with significant clean energy assets, particularly nuclear power, may continue to benefit from the ongoing AI revolution.References

Summarized by

Navi

[3]

Related Stories

Nuclear Power Emerges as Key Player in AI Infrastructure, Attracting Tech Giants and Investors

01 Nov 2024•Business and Economy

Vistra Stock Plummets Amid AI Efficiency Concerns: DeepSeek's Innovation Sparks Market Reassessment

28 Jan 2025•Business and Economy

AI Stocks Poised for Further Growth in 2025 Amid Evolving Tech Landscape

26 Dec 2024•Business and Economy

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology