Wall Street Bullish on AI Stocks: Potential for Significant Growth

2 Sources

2 Sources

[1]

An Artificial Intelligence (AI) Stock Some Investors See as the "Next Nvidia" Could Surge 130%, According to a Wall Street Analyst | The Motley Fool

Semiconductor company Arm went public in September 2023, and shares have already doubled amid enthusiasm about artificial intelligence. Nvidia has been one of the biggest beneficiaries of the artificial intelligence (AI) boom, due to its dominance in data center accelerators. The company's shares have surged 750% since ChatGPT launched in November 2022, and it remains a foundational AI stock in many portfolios. But Nvidia has a market capitalization just shy of $3 trillion, so the odds of similar returns in the future are slim. Accordingly, some investors have shifted focus to Arm Holdings (ARM -15.72%) in the hopes of finding the "next Nvidia." Arm stock has more than doubled since the company went public in September 2023, but Lee Simpson at Morgan Stanley believes the momentum could continue. His bull-case price target of $300 per share implies a 130% upside from its current share price of $129. Here's what investors should know about Arm. Arm designs central processing unit (CPU) architectures and licenses the intellectual property (IP) to other companies, which use the IP to build custom chips. The company further supports its clients with development tools and services that streamline product engineering across hardware and software. It earns revenue via licensing fees and pre-chip royalty fees, so it benefits when popular products (like iPhones) are built with its IP. Every CPU has an instruction set architecture that defines how the hardware interacts with software. Arm architecture has historically been associated with power efficiency, whereas the x86 architecture from Intel and AMD has been associated with computational performance. As a result, Arm chips are widely used in battery-powered devices. For instance, the company holds 99% market share in smartphones and 67% market share in other mobile devices. Meanwhile, Intel and AMD processors have historically been the industry standard in consumer electronics and cloud computing. But Arm has been taking share in both end markets with more powerful chips. In the last two years, its market share in cloud computing CPUs has increased 6 percentage points to 15%. Its market share in consumer electronics CPUs has increased 6 percentage points to 30%. Moreover, Arm IP has found its way into many popular products. Apple and Microsoft have introduced personal computers (PCs) outfitted with Arm-based processors, and Amazon Web Services, Alphabet's Google Cloud, and Meta Platforms have developed Arm-based CPUs for their data center servers. Nvidia has also introduced an Arm-based data center CPU purpose-built for artificial intelligence (AI). In summary, Arm has an attractive business model. It gives customers the flexibility to build custom chips but still reduces time to market and research and development (R&D expenses), compared to semiconductors designed from scratch. Accordingly, Arm CPUs are ubiquitous in smartphones and other mobile devices, and the company is gaining share across key end markets like cloud computing and consumer electronics. Morgan Stanley believes Arm is particularly well-positioned to monetize edge AI, meaning AI workloads that run on end-user devices like PCs and smartphones. The opposite of edge computing is cloud computing, where information is sent back to centralized data centers for processing. The upside of cloud computing is more powerful chips, but the downside is application lag time. Edge computing reduces lag time by processing data at the device level, rather than sending it through the internet to and from data centers. Arm-based processors are already the industry standard in smartphones and other mobile devices, and the company's chips are becoming more popular in PCs, so Morgan Stanley makes a very compelling argument. In fact, there's already evidence of Arm benefiting from edge AI. Arm-based CPUs will power Apple Intelligence on iPhones and MacBooks and some Copilot+ PCs recently introduced by Microsoft and other OEMs like Dell Technologies and Hewlett Packard. Copilot+ PCs are a category of laptops designed for AI. CEO Rene Haas recently told Reuters that Arm could capture more than 50% market share in Windows PCs within five years. That would represent a significant shake-up for the PC industry, given that Arm-based processors accounted for less than 15% of PC CPU shipments last year, according to Counterpoint Research. Wall Street expects Arm to grow adjusted earnings at 29% annually through fiscal 2027 (ends March 2027). But Morgan Stanley has outlined base-case and bull-case scenarios in which earnings grow at 46% annually and 69% annually, respectively. The base-case scenario corresponds to a fair value of $190 per share, while the bull case corresponds to a fair value of $300 per share. Importantly, Morgan Stanley's price targets are the highest on Wall Street, so other analysts are more pessimistic. Arm carries a median price target of $125 per share, which implies a 3% downside from its current share price of $129. I doubt Arm's earnings will increase much faster than the Wall Street consensus in the coming years. Company guidance implies 22% earnings growth in fiscal 2025 (ends March 2025), which actually falls short of the consensus. Moreover, that projection makes the current valuation of 94 times adjusted earnings look expensive. Arm has an attractive business model, and its strong presence in mobile devices leaves the company with substantial growth prospects, but I doubt the stock will deliver triple-digit returns over the next year.

[2]

2 Powerhouse Artificial Intelligence (AI) Stocks That Could Soar as Much as 115%, According to Select Wall Street Analysts | The Motley Fool

After an epic run, some AI stocks are taking a breather, representing a compelling opportunity for savvy investors. One of the biggest drivers of the market rebound over the past year or so has been the rapid and ongoing adoption of artificial intelligence (AI). Recent developments have marked a giant leap forward in the technology, promising to automate a great number of mundane tasks, thereby increasing productivity and saving money. In recent weeks, however, the AI rally has been taking a breather, with some of the most high-profile names in the space losing ground. That isn't surprising, given the relentless run that started early last year. The news isn't all bad. Most experts agree that we're still in the early stages of AI adoption, so the rally likely still has much further to climb, despite the recent retrenchment. This gives savvy investors the opportunity to invest in companies that still have room to run. Here are two AI-related stocks that with up to 111% additional upside, according to select Wall Street analysts. One of the bottlenecks in generative AI adoption is the fact that many enterprises lack the expertise to implement the technology while still getting the most bang for their buck. Given the complexity of the systems at issue, that's not surprising. However, Palantir Technologies (PLTR -3.01%) has bridged the gap between knowledge and execution. The company has a long history of developing AI tools for the U.S. government and its allies and expanded its mandate to help businesses discover actionable intelligence from reams of corporate data. This expertise allowed Palantir to pivot quickly to develop generative AI tools that businesses could actually use. The fruit of these efforts is the company's Artificial Intelligence Platform (AIP), which helps provide common sense solutions to everyday business problems. Furthermore, to address the resulting knowledge gap, management developed hands-on sessions, which it calls boot camps, that pair users with Palantir engineers to create solutions to company-specific problems. This unmet need has attracted companies in droves, with 1,300 bootcamps held since Palantir began hosting them late last year, with 500 over the past three months alone. This is fueling robust results. In the first quarter, Palantir's U.S. commercial revenue jumped 40% year over year, even as the segment's customer count soared 69%. More importantly, the remaining deal value -- which provides insight into its future trajectory -- grew 74%, which suggests its growth will continue. Wedbush analyst Dan Ives is the most bullish among his Wall Street peers, suggesting Palantir stock will soar to $50 by 2025, representing upside potential of 85% compared to Monday's closing price. Ives believes these bootcamps will continue to attract converts, increasing Palantir's fortunes. At 227 times earnings and 27 times sales, Palantir seems frightfully expensive. However, its forward price/earnings-to-growth (PEG) ratio, which takes into account its accelerating growth, comes in at 0.3, when any number less than 1 suggests an undervalued stock. While Palantir helps companies harness the potential of AI, Super Micro Computer (SMCI -4.19%), also known as Supermicro, creates high-end servers packed with the computational horsepower needed to bring AI to life. As AI adoption has accelerated, many users are now looking to curb the massive energy consumption that is the result of AI processing, and Supermicro's focus on energy-efficient solutions is well-documented. Furthermore, the company boasts a building block architecture, which helps users create a system that best suits their needs. Supermicro offers a broad cross-section of free-air, liquid-cooling, and traditional air-cooling technology, ensuring there's a system that fits every budget. During Supermicro's fiscal 2024 third quarter, revenue surged 200% year over year to roughly $3.8 billion, while its diluted earnings per share soared 329% to $6.56. The company is scrambling to expand its production capabilities to meet the accelerating demand. Supermicro stock has soared a massive 750% since the dawn of 2023, but some believe there's much more upside ahead. Loop Capital analyst Ananda Baruah has a Street high price target of $1,500 and a buy rating on the shares. That represents potential upside of 115% compared to Monday's closing price. The analyst is bullish on Supermicro's "posture" in the AI server industry and cites the company as a leader in terms of both complexity and scale. Perhaps more importantly, Baruah believes Supermicro can generate a revenue run rate of $40 billion to close out its fiscal 2026. For context, Supermicro delivered revenue of $7.1 billion in fiscal 2023 (ended June 30, 2023) and is on track to generate revenue of $14.5 billion for fiscal 2024. This suggests there's still plenty of upside ahead. The analyst isn't alone in his bullish take. Of the 17 analysts who offered an opinion in June, 12 rated the stock a buy or strong buy, and none recommended selling. Finally, Supermicro stock is a bargain given the opportunity, currently selling for 1.4 times forward sales.

Share

Share

Copy Link

Wall Street analysts are optimistic about AI stocks, with predictions of substantial growth for companies like Super Micro Computer and C3.ai. These firms are positioned to benefit from the expanding AI market.

AI Stock Market Outlook

The artificial intelligence (AI) sector continues to captivate investors and analysts alike, with Wall Street projecting significant growth potential for select companies in this space. As the AI revolution unfolds, certain stocks are emerging as potential frontrunners, drawing comparisons to industry giant Nvidia.

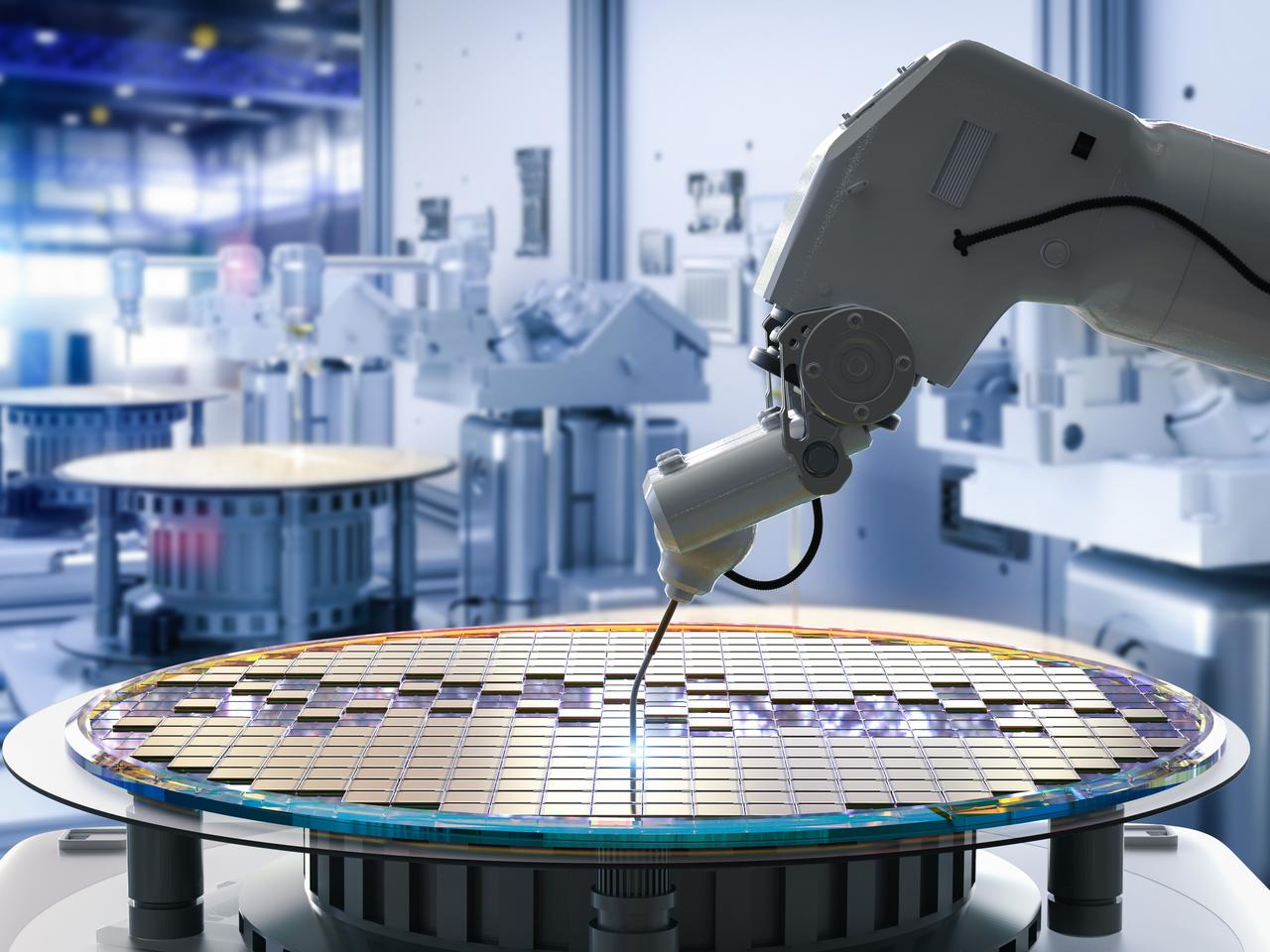

Super Micro Computer: The Next Nvidia?

Super Micro Computer (NASDAQ: SMCI) has caught the attention of Wall Street, with some analysts drawing parallels to Nvidia's success story. The company, which specializes in high-performance server technology optimized for AI applications, has seen its stock price soar by 246% year to date as of August 2023

1

.Analysts at Rosenblatt Securities are particularly bullish on Super Micro Computer, setting a price target that suggests a potential 130% upside from its current trading levels. This optimism is fueled by the company's strong position in the AI server market and its ability to capitalize on the growing demand for AI infrastructure.

C3.ai: A Pure-Play AI Investment

Another stock garnering attention in the AI space is C3.ai (NYSE: AI). As a pure-play AI software provider, C3.ai offers investors direct exposure to the burgeoning AI market. The company's stock has experienced significant volatility, reflecting both the excitement and uncertainty surrounding AI investments

2

.C3.ai's focus on enterprise AI solutions and its partnerships with major tech players have positioned it as a potentially lucrative investment opportunity. However, investors should be aware of the risks associated with the company's current lack of profitability and the intense competition in the AI software market.

Related Stories

Market Dynamics and Growth Drivers

The enthusiasm for AI stocks is driven by several factors:

- Expanding AI applications across industries

- Increased enterprise adoption of AI technologies

- Advancements in generative AI and machine learning

- Growing demand for AI-optimized hardware and infrastructure

As companies across various sectors seek to integrate AI into their operations, the demand for specialized AI hardware and software solutions is expected to surge. This trend is likely to benefit companies like Super Micro Computer and C3.ai, which are well-positioned to meet this growing demand.

Investor Considerations

While the potential for growth in AI stocks is significant, investors should approach these opportunities with caution. The AI market is rapidly evolving, and competition is intense. Factors to consider include:

- Company fundamentals and financial health

- Market position and competitive advantages

- Potential for sustained growth in the AI sector

- Regulatory landscape and potential challenges

As with any investment, thorough research and a balanced portfolio approach are essential when considering AI stocks. The sector's volatility and the speculative nature of some AI investments underscore the importance of careful consideration and risk management.

References

Summarized by

Navi

Related Stories

AI Giants Dominate Tech Landscape: Nvidia, AMD, and Others Poised for Growth in 2025

14 Dec 2024•Technology

Beyond Nvidia: Exploring Alternative AI Investment Opportunities in 2024

30 Jul 2024

AI Stock Market Volatility: Insider Activity and Investment Opportunities Amid Tech Sector Pullback

02 Mar 2025•Business and Economy

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology