How MonkeeMath can help you:

- Tracks and analyzes stock market sentiments.

- Aggregates opinions from Reddit and Stocktwits.

- Monitors sentiment from various news outlets.

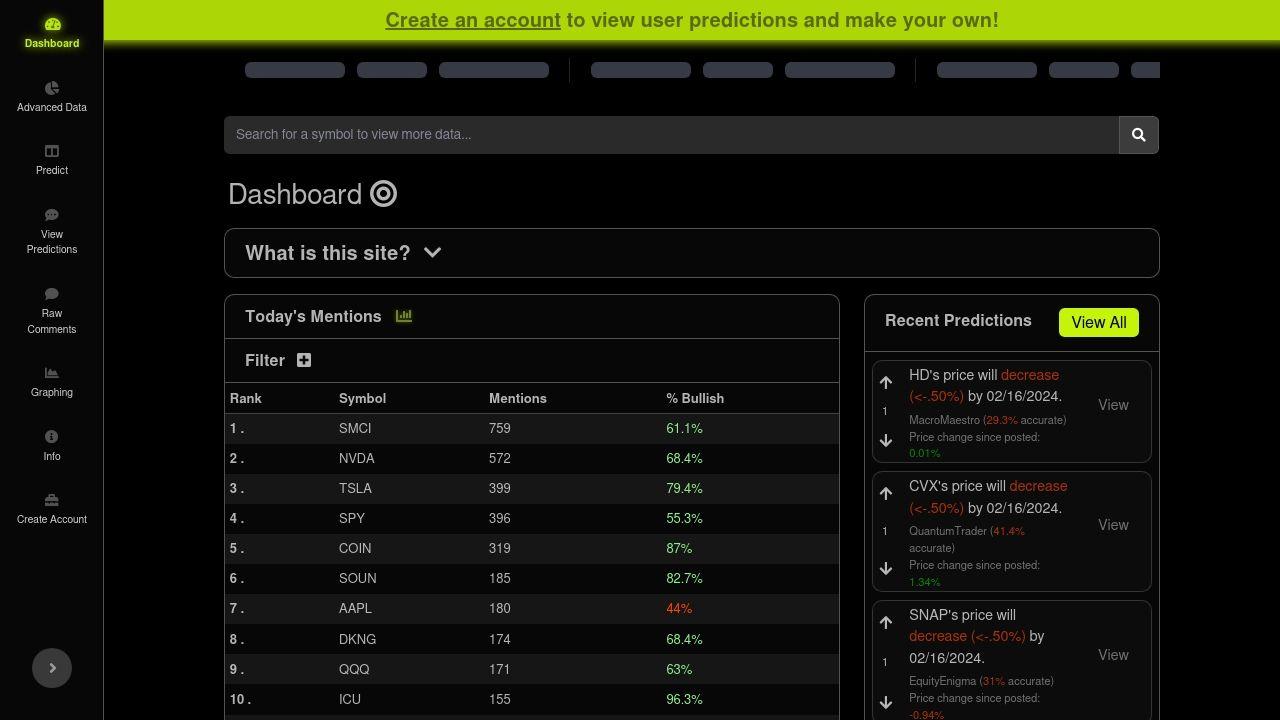

- Provides a dashboard for user predictions and insights.

Why choose MonkeeMath: Key features

- User-friendly dashboard for tracking predictions.

- Uses advanced AI for sentiment analysis.

- Accumulates data from multiple credible sources.

- Offers real-time updates and predictions.

Who should choose MonkeeMath:

- Stock market enthusiasts.

- Investors seeking insights from online sentiments.

- Anyone interested in the impact of social media on stock prices.