AI Stocks Showing Resilience in Economic Uncertainty

2 Sources

2 Sources

[1]

Opinion: This Artificial Intelligence (AI) Stock Is Recession Proof

Ties to national defense and productivity gains in the business world support this stock in any economic environment. The increased investor interest in all things related to artificial intelligence (AI) helped drive massive returns for several associated stocks and contributed greatly to the performance of the current bull market. The investment spark that AI advancement set off also likely contributed to an improvement in the overall economy. The U.S. economy is showing signs of strength as well as some signs of weakness these days, leading some to wonder if a recession is possible. If a recession does come, plenty of stocks are likely to take a hit, including the tech sector and the AI stocks that are currently dominating the sector. Economic downturns tend to send investors scrambling to find recession-proof stocks they can hold as they wait for better times. Investors interested in AI stocks will have a difficult task finding recession-proof options. And yet, they do exist. Palantir got its start offering software and analytical services to the national security sector. Regardless of the broader economy, the need for national security and related services doesn't tend to change. The military and the intelligence branches rely on analytical insights at all times, not just when things are going well. As Palantir grew its operations, it began to offer its AI-related analytics services to the commercial sector as well. On the surface, this might not appear recession-proof. After all, companies can fail or face struggles that might require them to cut non-essential services. Palantir's saving grace is that what it offers is becoming essential for many businesses who will look to cut expenses elsewhere first. Palantir's Artificial Intelligence Platform (AIP), for instance, can be used to help analyze a business's operations to determine where it can save money. This generative AI platform can arguably be put to use at any stage of the business cycle. However, that need is especially acute when a recession occurs and companies need its insights on how to be more efficient. Palantir has been hosting boot camps for prospective clients to better showcase how its software can be put to use. The productivity gains companies are discovering are eye-popping. One insurance brokerage reported using it to automate policy review cases, while a convenience store chain applied it to inventory management and pricing optimization. The boot camps are effectively demonstrating why AIP is indispensable regardless of economic conditions. How Palantir fares financially Between its various segments, Palantir generated more than $1.3 billion in revenue during the first six months of 2024, up 24% year over year. Gross margins are enormous in this business, coming in at 81%. Operating expenses are leveling off (up by only 6% in the first half of the year), allowing Palantir to report $240 million in net income attributable to shareholders (up from $45 million over the same time frame last year). Palantir's growth rate continues apace, with forecasted revenue of $2.75 billion representing a 23% increase. That optimism has led to the stock approximately doubling in value over the last year. Considering the productivity gains offered by AIP, one has to wonder whether that revenue growth rate will not rise over time. Unfortunately, that optimism also took the price-to-sales (P/S) ratio on the stock to 32. In the near term, such a valuation admittedly makes Palantir stock vulnerable to a sell-off should market sentiment or company challenges spook shareholders. However, in the long run, the strength of the business should support the stock regardless of the state of the economy. Palantir as a recession-proof AI stock Palantir is one of the few AI stocks that will likely be minimally affected by economic cycles. Admittedly, its stock is not invulnerable to an economic downturn, and shareholders could take a short-term hit if traders turn on the market generally and hit highly valued stocks. That suggests investors might want to wait for a pullback or signs of accelerated growth before buying in or buying more Palantir shares. However, Palantir's recession-proof nature likely means demand for its services will remain constant or perhaps even increase in an economic downturn. Regarding the commercial side of the business, AI has brought its clients massive productivity gains and financial savings, making its services and capabilities attractive regardless of the state of the economy. Even though the stock's near-term outlook is more uncertain, Palantir's growth as a business should bring long-term increases in the stock regardless of economic headwinds.

[2]

Opinion: These 2 Artificial Intelligence (AI) Stocks Are Recession-Proof | The Motley Fool

Technology stocks may be seen as too risky to own during a recession, but I see these companies as exceptions. The very idea of investing during a recession might seem counterintuitive, but believe it or not, recessions can end up being incredibly lucrative opportunities. Why? Well, not all businesses are as sensitive to recessions as you might think. For example, I see these two artificial intelligence (AI) stocks as essentially recession-proof businesses thanks to their high levels of resiliency. The chart below highlights Microsoft's (MSFT 2.34%) revenue and net income trends between January 2007 and December 2009. I deliberately chose this period because it shows the picture before, during, and after the Great Recession, which ran from December 2007 to June 2009 (the grey-shaded area of the chart). Do you notice anything a little peculiar about Microsoft's business trends during the Great Recession? Although its revenue experienced some noticeable volatility throughout the Great Recession, Microsoft's sales actually remained higher during most quarters of that downturn than they were just prior to it. More importantly, its profitability did not take an overly pronounced hit either. The only real blemish on Microsoft's business during that period came in the form of a sharp downturn in the quarter that ended June 30, 2009 -- right around the conclusion of the Great Recession. But it rebounded spectacularly just six months later when it generated $19 billion in sales and $6.7 billion of profit in its fiscal 2010's second quarter. That was thanks in part to its successful launch of Windows 7. Microsoft's ability to generate growth even during times of widespread economic crisis and come out the other side stronger underscores the company's success in its relentless pursuit of innovation. Over the last several decades, Microsoft has evolved from a PC software powerhouse into a much more diversified business with segments spanning hardware devices, workplace productivity software, cloud computing, gaming, social media, and AI. To me, Microsoft is one of the best stock picks in the tech sector, and would still be a prudent choice for investors to buy even during a recessionary period. I'd understand if you're scratching your head at the notion that a volatile growth stock such as CrowdStrike (CRWD 1.40%) could be considered recession-proof. But one way to help identify recession-proof businesses is to look at what a company actually sells. For example, does it sell things people actually need or are its wares merely nice to have? I'd argue that CrowdStrike's services fit squarely into the "something people need" category. Businesses can't really afford to disengage from data and identity protection or network security just because there is an economic downturn. This makes cybersecurity platforms such as CrowdStrike more resistant to economic downturns than other areas of the software market. Need some proof? The narrow grey-shaded column in the graph below illustrates the COVID-19 recession -- which lasted from February 2020 to April 2020. Right around the onset of the pandemic, CrowdStrike began a period of accelerating sales growth. Of course, a big influence was that organizations had a heightened need for stronger cybersecurity as employees around the world traded office cubicles for work-from-home situations. Yet even several years after the crisis phase of the pandemic ended and social distancing efforts faded, CrowdStrike's revenue continued to soar, and the company is now consistently profitable. Consider as well CrowdStrike's recent software update glitch, which caused major IT outages for many of its customers globally. For weeks, the company featured in media headlines, and the storylines weren't pretty. But last week, investors learned just how much of a toll the IT outage took on CrowdStrike. As it turns out, CrowdStrike swiftly implemented strategies including flexible payment packages to encourage customer retention. All told, management is forecasting a $60 million impact to revenue as a result of these retention packages. Considering that CrowdStrike boasts $3.9 billion in annual recurring revenue (ARR), I wouldn't be too worried about a $60 million headwind. I think this speaks volumes about both the need for cybersecurity services generally and CrowdStrike's capabilities specifically. Given that CrowdStrike has managed to navigate two Black Swan-style events in recent years and maintain healthy levels of revenue and profit, I see the stock as a solid opportunity even during times of economic uncertainty.

Share

Share

Copy Link

As economic concerns loom, certain AI stocks are demonstrating strong potential for growth and stability. This article explores the resilience of key players in the AI sector and their strategies for navigating potential market downturns.

The Rise of AI in Uncertain Economic Times

In the face of potential economic headwinds, artificial intelligence (AI) has emerged as a beacon of hope for investors. As traditional sectors brace for impact, AI-focused companies are demonstrating remarkable resilience and growth potential. This trend is particularly evident in the stock market, where select AI-driven enterprises are outperforming expectations

1

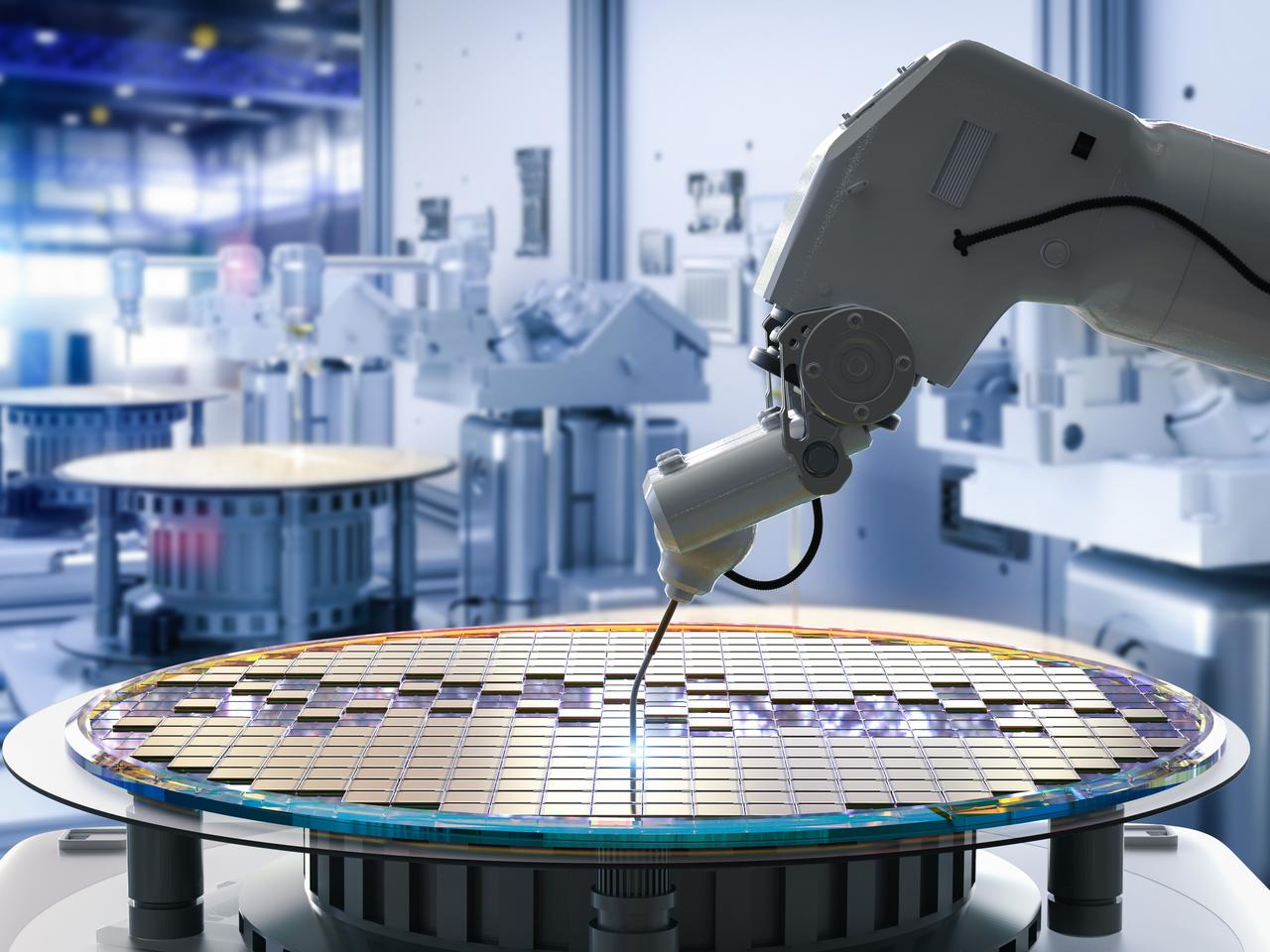

.Nvidia: A Standout Performer

Among the AI stocks garnering attention, Nvidia (NASDAQ: NVDA) stands out as a formidable player. The company's dominance in the GPU market, coupled with its strategic pivot towards AI-specific hardware, has positioned it as a potential "recession-proof" investment. Nvidia's chips are integral to the AI infrastructure, powering everything from data centers to autonomous vehicles

1

.Diversification and Market Adaptation

While Nvidia leads the pack, other AI-focused companies are also showing promise. Palantir Technologies (NYSE: PLTR) and C3.ai (NYSE: AI) are carving out their niches in the AI landscape. Palantir's data analytics platforms are finding applications across various sectors, while C3.ai's enterprise AI solutions are gaining traction in industries ranging from oil and gas to financial services

2

.AI's Role in Economic Resilience

The robustness of AI stocks in the face of economic uncertainty can be attributed to several factors:

- Increasing adoption: As businesses seek efficiency and cost-cutting measures, AI solutions become more attractive.

- Scalability: AI technologies can be scaled up or down based on demand, allowing companies to adapt to market conditions.

- Innovation potential: The AI sector continues to evolve, opening new markets and applications.

Related Stories

Investor Considerations

While the AI sector shows promise, investors should approach with caution. The high valuations of some AI stocks may present risks, and market volatility can affect even the most promising sectors. Diversification within the AI space and beyond remains a prudent strategy for long-term investors

2

.Future Outlook

As AI continues to permeate various aspects of business and daily life, the sector's growth trajectory appears strong. Companies that can innovate and adapt to changing market conditions are likely to weather economic storms more effectively. The AI revolution is not just changing how businesses operate; it's reshaping the investment landscape, offering new opportunities for those willing to navigate this dynamic field

1

2

.References

Summarized by

Navi

Related Stories

AI Stock Showdown: Nvidia vs Palantir - Billionaires' Shifting Bets and Market Outlook

09 Jul 2025•Business and Economy

AI Stock Market Volatility: Insider Activity and Investment Opportunities Amid Tech Sector Pullback

02 Mar 2025•Business and Economy

AI Stocks Surge: Investors Eye Opportunities Amid Market Shifts

20 Aug 2024

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology

3

ChatGPT cracks decades-old gluon amplitude puzzle, marking AI's first major theoretical physics win

Science and Research