Alibaba's AI-Driven Cloud Revenue Surge Signals Chinese Tech Giant's Strategic Pivot

13 Sources

13 Sources

[1]

Alibaba's cloud business revenue soars 34% driven by AI boom

HONG KONG (AP) -- China's Alibaba Group posted a 34% jump in revenue from its cloud business in its most recent quarter, buoyed by the boom in artificial intelligence. But overall revenue at the Chinese tech group for the July-September quarter increased by just 5% year-on-year to 247.8 billion yuan ($35 billion), and profit fell 52% from last year, as a fierce price war in China's e-commerce landscape -- including in the food delivery segment -- eroded into short-term profitability. JD.com, its e-commerce rival, reported a 55% net profit drop in the same quarter. Alibaba started out in e-commerce and later turned its focus to cloud and AI technologies. Earlier this year, it pledged to invest at least 380 billion yuan ($53 billion) in three years in advancing its cloud computing and AI infrastructure. CEO Eddie Wu said in prepared remarks Tuesday that the group's "significant" investments in AI had helped its revenue growth. The 34% cloud revenue growth was faster than the 26% increase in the April-June quarter. The company added that demand for AI was "accelerating" and its "conviction in future AI demand growth is strong." It also will probably end up investing more than the planned 380 billion yuan in AI to meet surging demand, Alibaba said Tuesday. On Monday, Alibaba announced that its upgraded AI chatbot Qwen -- which aims to rival OpenAI's ChatGPT -- recorded 10 million downloads in the first week after its public launch. The company's Hong Kong shares gained 2% Tuesday and just before the opening bell on the New York Stock Exchange, shares rose 2.4%. Shares have gained more than 90% so far this year, fueled by optimism over its progress in AI. Chinese companies have been gaining ground in AI since tech startup DeepSeek upended the industry, raising doubts over the dominance in the sector of its U.S. rivals. Recent earnings reports by other Chinese tech giants have been mixed. Tencent, which rivals Alibaba in AI, this month reported a strong 15% year-on-year gain in its revenue for the July-September quarter. But Baidu, which also competes with Alibaba in AI development, recorded a 7% drop in revenue in the same quarter compared to last year. Concerns among investors and analysts over an overblown AI bubble have also been growing, although strong earnings at Nvidia last week slightly eased worries.

[2]

Alibaba's cloud business revenue soars 34% driven by AI boom

HONG KONG (AP) -- China's Alibaba Group posted a 34% jump in revenue from its cloud business in its most recent quarter, buoyed by the boom in artificial intelligence. But overall revenue at the Chinese tech group for the July-September quarter increased by just 5% year-on-year to 247.8 billion yuan ($35 billion), and profit fell 52% from last year, as a fierce price war in China's e-commerce landscape -- including in the food delivery segment -- eroded into short-term profitability. JD.com, its e-commerce rival, reported a 55% net profit drop in the same quarter. Alibaba started out in e-commerce and later turned its focus to cloud and AI technologies. Earlier this year, it pledged to invest at least 380 billion yuan ($53 billion) in three years in advancing its cloud computing and AI infrastructure. CEO Eddie Wu said in prepared remarks Tuesday that the group's "significant" investments in AI had helped its revenue growth. The 34% cloud revenue growth was faster than the 26% increase in the April-June quarter. The company added that demand for AI was "accelerating" and its "conviction in future AI demand growth is strong." It also will probably end up investing more than the planned 380 billion yuan in AI to meet surging demand, Alibaba said Tuesday. On Monday, Alibaba announced that its upgraded AI chatbot Qwen -- which aims to rival OpenAI's ChatGPT -- recorded 10 million downloads in the first week after its public launch. The company's Hong Kong shares gained 2% Tuesday and just before the opening bell on the New York Stock Exchange, shares rose 2.4%. Shares have gained more than 90% so far this year, fueled by optimism over its progress in AI. Chinese companies have been gaining ground in AI since tech startup DeepSeek upended the industry, raising doubts over the dominance in the sector of its U.S. rivals. Recent earnings reports by other Chinese tech giants have been mixed. Tencent, which rivals Alibaba in AI, this month reported a strong 15% year-on-year gain in its revenue for the July-September quarter. But Baidu, which also competes with Alibaba in AI development, recorded a 7% drop in revenue in the same quarter compared to last year. Concerns among investors and analysts over an overblown AI bubble have also been growing, although strong earnings at Nvidia last week slightly eased worries.

[3]

Alibaba's Cloud Business Revenue Soars 34% Driven by AI Boom

HONG KONG (AP) -- China's Alibaba Group posted a 34% jump in revenue from its cloud business in its most recent quarter, buoyed by the boom in artificial intelligence. But overall revenue at the Chinese tech group for the July-September quarter increased by just 5% year-on-year to 247.8 billion yuan ($35 billion), and profit fell 52% from last year, as a fierce price war in China's e-commerce landscape -- including in the food delivery segment -- eroded into short-term profitability. JD.com, its e-commerce rival, reported a 55% net profit drop in the same quarter. Alibaba started out in e-commerce and later turned its focus to cloud and AI technologies. Earlier this year, it pledged to invest at least 380 billion yuan ($53 billion) in three years in advancing its cloud computing and AI infrastructure. CEO Eddie Wu said in prepared remarks Tuesday that the group's "significant" investments in AI had helped its revenue growth. The 34% cloud revenue growth was faster than the 26% increase in the April-June quarter. The company added that demand for AI was "accelerating" and its "conviction in future AI demand growth is strong." It also will probably end up investing more than the planned 380 billion yuan in AI to meet surging demand, Alibaba said Tuesday. On Monday, Alibaba announced that its upgraded AI chatbot Qwen -- which aims to rival OpenAI's ChatGPT -- recorded 10 million downloads in the first week after its public launch. The company's Hong Kong shares gained 2% Tuesday and just before the opening bell on the New York Stock Exchange, shares rose 2.4%. Shares have gained more than 90% so far this year, fueled by optimism over its progress in AI. Chinese companies have been gaining ground in AI since tech startup DeepSeek upended the industry, raising doubts over the dominance in the sector of its U.S. rivals. Recent earnings reports by other Chinese tech giants have been mixed. Tencent, which rivals Alibaba in AI, this month reported a strong 15% year-on-year gain in its revenue for the July-September quarter. But Baidu, which also competes with Alibaba in AI development, recorded a 7% drop in revenue in the same quarter compared to last year. Concerns among investors and analysts over an overblown AI bubble have also been growing, although strong earnings at Nvidia last week slightly eased worries.

[4]

Alibaba's cloud business revenue soars 34% driven by AI boom

China's Alibaba Group posted a 34% jump in revenue from its cloud business in its most recent quarter, buoyed by the boom in artificial intelligence. Earlier this year, it pledged to invest at least $53 billion in three years in advancing its cloud computing and AI infrastructure. China's Alibaba Group posted a 34% jump in revenue from its cloud business in its most recent quarter, buoyed by the boom in artificial intelligence. But overall revenue at the Chinese tech group for the July-September quarter increased by just 5% year-on-year to 247.8 billion yuan ($35 billion), and profit fell 52% from last year, as a fierce price war in China's ecommerce landscape -- including in the food delivery segment -- eroded into short-term profitability. JD.com, its ecommerce rival, reported a 55% net profit drop in the same quarter. Alibaba started out in ecommerce and later turned its focus to cloud and AI technologies. Earlier this year, it pledged to invest at least 380 billion yuan ($53 billion) in three years in advancing its cloud computing and AI infrastructure. CEO Eddie Wu said in prepared remarks Tuesday that the group's "significant" investments in AI had helped its revenue growth. The 34% cloud revenue growth was faster than the 26% increase in the April-June quarter. The company added that demand for AI was "accelerating" and its "conviction in future AI demand growth is strong." It also will probably end up investing more than the planned 380 billion yuan in AI to meet surging demand, Alibaba said Tuesday. On Monday, Alibaba announced that its upgraded AI chatbot Qwen -- which aims to rival OpenAI's ChatGPT -- recorded 10 million downloads in the first week after its public launch. The company's Hong Kong shares gained 2% Tuesday and just before the opening bell on the New York Stock Exchange, shares rose 2.4%. Shares have gained more than 90% so far this year, fueled by optimism over its progress in AI. Chinese companies have been gaining ground in AI since tech startup DeepSeek upended the industry, raising doubts over the dominance in the sector of its US rivals. Recent earnings reports by other Chinese tech giants have been mixed. Tencent, which rivals Alibaba in AI, this month reported a strong 15% year-on-year gain in its revenue for the July-September quarter. But Baidu, which also competes with Alibaba in AI development, recorded a 7% drop in revenue in the same quarter compared to last year. Concerns among investors and analysts over an overblown AI bubble have also been growing, although strong earnings at Nvidia last week slightly eased worries.

[5]

Alibaba's AI Boom Doubles David Tepper's Bet Into A Billion‑Dollar Fortune - Alibaba Gr Hldgs (NYSE:BABA)

Alibaba Group Holding Ltd's (NYSE:BABA) (NYSE:BABAF) AI breakout isn't just powering an 80% year-to-date rally -- it's rewriting one billionaire's P&L in real time. As Qwen stormed past 10 million downloads in its first week, igniting a sharp rerating in China tech, billionaire David Tepper's long-held Alibaba position suddenly flipped into one of the biggest mark-to-market wins of the quarter. Track BABA stock here. His 6.45 million-share stake, built at an average cost of $81 per share, carried a cost basis of roughly $522 million. At current levels, that stake is worth about $987 million, handing the Appaloosa founder a gain of more than $465 million -- a swing that lands squarely on the back of Alibaba's AI momentum. Qwen's Viral Surge Rewires The Alibaba Narrative The catalyst is clear. Alibaba didn't just rebrand its AI products -- it consolidated them into a single consumer-facing push under the Qwen banner, and the market is treating it like a long-overdue reset. The app shot into the top ranks of China's App Store, analysts began calling it a credible contender for an "AI-era WeChat," and investor confidence snapped back almost overnight. What makes the run more potent is that Qwen's momentum is arriving alongside Alibaba Cloud's renewed AI push, tightening the link between product traction and stock rerating. Jack Ma's Return Adds Fuel To The Story There's also a narrative tailwind powerful enough to pull in sidelined investors: Jack Ma quietly stepped back into a hands-on role at Ant Group just as the company launched its new multimodal AI assistant, LingGuang. The reappearance matters -- Ma's involvement historically coincides with strategic pivots, and the timing suggests a coordinated push across the Alibaba ecosystem to reclaim ground in China's AI race. Why Tepper's Win Matters To Investors Tepper didn't hold Alibaba flawlessly -- he trimmed repeatedly through 2024 and 2025 -- but he never walked away. That decision now anchors one of the sharpest performance reversals tied to China tech's rebirth. For investors, the takeaway is simple: Qwen's blistering start isn't just a product win -- it's a reminder that AI execution can rewrite the math on legacy tech giants, and fast. Read Next: Alibaba Q2 Preview: Qwen's 10 Million Milestone Highlights 'Historic Opportunities' In AI, Cloud Photo: Shutterstock BABAAlibaba Group Holding Ltd$159.254.13%OverviewBABAFAlibaba Group Holding Ltd$20.44-0.83% This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Market News and Data brought to you by Benzinga APIs

[6]

Alibaba's Q3 report underscored by 'robust AI demand' in cloud unit (BABA:NYSE)

Chinese e-commerce giant Alibaba (BABA) reported a strong revenue beat for the third quarter driven by double-digit percentage gains in its core operating segments, most notably in the cloud intelligence group. Shares of the company were up as much as Alibaba's revenue growth is supported by a 34% boost in cloud intelligence, mainly due to public cloud and strong AI-related product demand. AI is improving core e-commerce efficiency, leading to better logistics, increased customer retention, higher average order value, and enhanced unit economics. A more than 100% surge in sales and marketing expenses caused Alibaba's net income to fall, despite strong revenue growth.

[7]

Alibaba's main AI app debuts strongly in effort to rival ChatGPT - The Economic Times

Alibaba's Qwen app has seen a massive surge, crossing 10 million downloads post-relaunch, signaling a strong contender against OpenAI's ChatGPT. This rapid adoption highlights AI's growing influence, with Qwen poised to integrate deeply into Alibaba's e-commerce and lifestyle services, aiming to become a comprehensive AI agent. The move is seen as a key step in benchmarking against AI giants. Alibaba Group Holding Ltd.'s Qwen app drew more than 10 million downloads in the week after its relaunch, boding well for a longer-term effort to build a rival to OpenAI's ChatGPT. The Chinese e-commerce leader's shares climbed more than 5% Monday in Hong Kong after Alibaba disclosed the number in a WeChat blog post. That rapid ramp follows the move this month to rename and freshen up Alibaba's pre-existing apps on iOS and Android, unifying the services under the Qwen banner. Qwen's debut underscores how artificial intelligence apps have set new highs for rapid adoption in recent times, starting with OpenAI's ChatGPT being fastest to 100 million users three years ago. Setting aside Meta Platforms Inc.'s Threads, which got the benefit of its parent company's vast social networks, Alibaba's Qwen is among the faster risers, particularly in China, where ChatGPT is unavailable. "Whether or not they can leverage the Qwen app to drive their to-consumer business will be an important factor influencing the company's future valuation," said Kenny Ng, a strategist at China Everbright Securities International Co. "The market also views this move as a crucial step for benchmarking it against the valuation of OpenAI." The early user figures for Qwen followed a similar statement over the weekend from Alibaba fintech affiliate Ant Group Co., which introduced its own multimodal AI assistant LingGuang last week. LingGuang has been downloaded more than a million times in the four days since its launch. Alibaba will gradually add agentic AI features to support online shopping -- spanning platforms including its marquee Taobao marketplace -- in the coming months, en route to making Qwen a fully functioning AI agent. Under Chief Executive Officer Eddie Wu, the company has rebranded itself as an AI-first business, a strategy that will be freshly assessed when Alibaba fields questions from investors after it discloses quarterly results on Tuesday. "Alibaba plans to deeply integrate core lifestyle and productivity services -- including digital maps, food delivery, travel booking, office tools, e-commerce, education, and health guidance -- directly into the Qwen App," the company said in a statement.

[8]

Alibaba Q2 Preview: Qwen's 10 Million Milestone Highlights 'Historic Opportunities' In AI, Cloud - Alibaba Gr Hldgs (NYSE:BABA)

Chinese e-commerce giant Alibaba Group Holding (NYSE:BABA) could highlight the growth of its AI products and new initiatives when it reports second-quarter financial results on Tuesday before the market opens. Here are the earnings estimates, what analysts are saying and key items to watch. Earnings Estimates: Analysts expect Alibaba to report second-quarter revenue of $34.43 billion, up from $33.70 billion in last year's second quarter, according to data from Benzinga Pro. The company has beaten analyst estimates for revenue in seven of the last 10 quarters, including the most recent first quarter. Analysts expect Alibaba to report second-quarter earnings per share of 81 cents, down from $2.15 in last year's second quarter. The company has beaten analyst estimates for earnings per share in seven of the last 10 quarters, including in three straight quarters. Read Also: David Tepper's Hedge Funds Bets On AMD, Nvidia In Q3, Takes Profits On Intel What Analysts Are Saying: Strong cloud revenue growth led Goldman Sachs to raise its price target on Alibaba stock. The Goldman Sachs analyst maintained a Buy rating and raised the price target to $205 from $179. Cloud revenue is expected to grow by more than 30% year over year in each of the coming three fiscal years, according to analysts' new estimates. The analyst also highlighted breakthroughs in AI models for Alibaba and a diversified chip supply, leading to a more bullish tone on the stock. Benchmark analyst Fawne Jiang recently reiterated a Buy rating on Alibaba and raised the price target to $195 from $176. The analyst highlighted Alibaba's focus on enhancing its cloud business segment alongside expanding its e-commerce business. Jiang said the company is focused on strengthening its position in cloud and GenAI, two growth sectors. Key Items to Watch: Alibaba's earnings report comes as shares are rallying on Monday, thanks to new data for the company's Qwen app. The company said the app had over 10 million downloads in its first week. Qwen is the company's unified app for its AI features, like the Tongyi app and Quark browser. The impressive milestone comes in a tough AI sector, where DeepSeek and other Chinese companies compete. With a strong market position in e-commerce, strong brand awareness, and early strength in downloads, Alibaba's focus on new AI-related products could pay off. Alibaba's Qwen could become a super app for the AI era in China, given the tools and services it offers. Alibaba has been marketing Qwen as "the best personal AI assistant." The app is built on Alibaba Cloud's open-source Qwen model. Alibaba is adopting a "free-for-all" strategy that could help drive mass adoption and put it ahead of rivals that charge subscription fees. Within the model, Alibaba aims to monetize the app and users through products like cloud services and data. Ant Group, which is partially owned by Alibaba Group, has also been working on boosting its AI products. The company recently rolled out an AI assistant, LingGuang, that can help create apps in about 30 seconds. Alibaba founder Jack Ma recently toured Ant Group's Hangzhou campus and highlighted the company's LingGuang launch. While Ma is no longer in charge of Alibaba, he is one of the key figures in the company's history and his appearance with Ant Group could provide a boost to the spotlight on the company's new products. The company's Cloud Intelligence Group reported 26% year-over-year revenue growth in the first quarter, driven by rising demand for cloud services and AI products. AI-related product revenue has grown by 100% or more in eight consecutive quarters. "Looking ahead, we remain committed to investing in our two strategic pillars of consumption and AI + Cloud to capture historic opportunities and drive long-term growth," Alibaba CEO Eddie Wu said after first-quarter results. While e-commerce will lead the way in overall revenue for the company, the data points and commentary on cloud and AI will likely determine if shares keep trading higher in 2025. BABA Price Action: Alibaba stock is up 5.3% to $161.00 on Monday versus a 52-week trading range of $80.06 to $192.67. Alibaba shares are up 89.3% year-to-date in 2025. Read Next: These Analysts Boost Their Forecasts On Alibaba Following Q1 Results Photo: Shutterstock BABAAlibaba Group Holding Ltd$160.564.99%OverviewMarket News and Data brought to you by Benzinga APIs

[9]

Alibaba unveils major consumer AI upgrade with new Qwen chatbot

The new free app, based on its Qwen large language model, is available as a mobile application and website. It has entered public beta testing and is being billed as "the best personal AI assistant with the most powerful model," the company said in a statement on Monday. China's Alibaba has launched a major upgrade to its AI chatbot, marking an aggressive push into the consumer artificial intelligence market where it has lagged rivals. The new free app, based on its Qwen large language model, is available as a mobile application and website. It has entered public beta testing and is being billed as "the best personal AI assistant with the most powerful model," the company said in a statement on Monday. The move represents a strategic shift for Alibaba, which has not ploughed significant resources into developing its ChatGPT-style consumer app, instead focusing largely on enterprise customers as part of its cloud services offering. China's brutal AI price war It also comes amid a brutal price war in China's domestic AI sector triggered by DeepSeek, which has prioritized low-cost compute costs, forcing its competitors to follow suit. Alibaba has had some consumer-facing AI apps, including the Tongyi app, which Qwen is rebranded from, as well as AI assistant services embedded in its Quark browser. But this marks the first time Alibaba has made such a serious push into the consumer market. Despite being among the first Chinese companies to release a consumer AI assistant app to the public in late 2023, Tongyi has failed to achieve widespread adoption. The app had 6.96 million monthly active users in September, according to AI product tracker Aicpb.com. Market leader ByteDance's Doubao had 150 million monthly active users, while DeepSeek had 73.4 million and Tencent followed with 64.2 million.

[10]

Alibaba Launches Free 'Qwen' AI Assistant, Aiming To Be The 'Everything App' For Work And Life - Alibaba Gr Hldgs (NYSE:BABA)

Alibaba Group Holding Limited (NYSE:BABA) is making a stronger push into consumer artificial intelligence by launching a significant upgrade to its chatbot, aiming to catch up with rivals after falling behind in the fast-growing market. The company, which released a free mobile and web app in China based on its most advanced Qwen language model, said an international version is coming soon. Now users can ask the chatbot to create complete research reports and multi-slide PowerPoint presentations instantly. The Qwen App is promoting itself as a powerful personal AI assistant in public beta, Reuters reported on Tuesday. Also Read: Alibaba Unlocks New Value With Qwen AI Push, Singles' Day Sales Surge And Shares Climb The $376 billion Alibaba AI endeavor helped it gain 87% in stock value year to date. However, Alibaba also grappled with intense rivalry and steep price cuts in China's AI industry, especially after low-cost rival DeepSeek sparked a price war. Alibaba has offered consumer AI tools before, including the older Tongyi app and AI features in its Quark browser, but they made limited traction. Tongyi had just under 7 million monthly active users in September, far behind leaders like ByteDance's Doubao and DeepSeek, each with tens of millions more users. Analysts say Alibaba's new AI app, Qwen, could become China's version of a "super-app" for the AI era -- much like Tencent Holding Ltd's (OTC:TCEHY) WeChat transformed the smartphone era. Boosted by Alibaba Cloud's homegrown Qwen AI models, the consumer app quickly jumped into the top five free apps on Apple Inc.'s (NASDAQ:AAPL) store in both Hong Kong and mainland China during its second day of beta testing. Alibaba pitches Qwen as an all-in-one personal AI assistant that can handle work and everyday tasks, from in-depth research to creating images and slides. The company wants Qwen to evolve beyond a chatbot into an "everything app" that changes how people interact with digital services, Beijing-based tech analyst Poe Zhao told SCMP. Alibaba has a significant advantage: its massive ecosystem already spans shopping, payments, food delivery, mapping, and entertainment. Alibaba plans to roll out Qwen globally and directly compete with ChatGPT to define the future "everything app." "If Alibaba executes well, Qwen could set the standard for AI-powered apps -- not just in China, but worldwide," Zhao said. BABA Price Action: Alibaba Group Holding shares were up 0.12% at $157.91 at the time of publication on Tuesday. BABAAlibaba Group Holding Ltd $159.190.94% Overview AAPLApple Inc $267.740.10% TCEHYTencent Holdings Ltd $79.84-1.35% Market News and Data brought to you by Benzinga APIs

[11]

Alibaba shares jump as Qwen AI app logs strong debut By Investing.com

Investing.com-- Alibaba Group (HK:9988) shares jumped on Monday after its revamped consumer AI app, Qwen, registered a very strong start in public beta, sparking fresh investor optimism about its push into the generative-AI market. The app logged more than 10 million downloads in the week following its relaunch, according to the company's WeChat blog post. Hong Kong-listed shares of the company climbed as much as 6% to HK$156.3 as of 06:45 GMT. In a statement published last week, Alibaba said the Qwen chatbot -- powered by its advanced Qwen large language model -- is now available via mobile and web, with international rollout planned later. The app, which can generate complex research reports and multi-slide PowerPoint presentations from a single prompt, was described by the company as "the best personal AI assistant with the most powerful model."

[12]

Alibaba boosts its cloud growth thanks to artificial intelligence

Chinese group Alibaba has reported better-than-expected Q2 results, driven by the expansion of its cloud business supported by strong demand for artificial intelligence. Overall revenue rose by 5% y-o-y to 247.8bn yuan (about €30.3bn), above expectations of 242.65bn yuan. The cloud division was the main engine of this performance, with revenue up 34% to 39.8bn yuan, boosted by surging sales of AI-related products. Eddie Wu, the group's chief executive officer, said demand was outstripping current server deployment capacity. Alibaba has already invested 120bn yuan in its AI infrastructure in a year and could revise upwards its initial three-year budget of 380bn yuan. The Qwen app, based on the group's proprietary models, surpassed 10 million downloads in its first week after public launch, consolidating Alibaba's position as a major AI player in China.

[13]

Alibaba's Profit Slumps but AI Business Shines -- Update

Alibaba Group's profit halved in its fiscal second quarter amid fierce competition in the food-delivery sector, but revenue growth was steady as its artificial-intelligence business gained momentum, with the consumer AI space the latest target in its sights. The Hangzhou, China-based company said Tuesday that its net profit fell 53% to 20.99 billion yuan, equivalent to $2.96 billion. Adjusted net profit declined by even sharper 72% to 10.35 billion yuan, a tad below market expectations. Revenue rose about 5% to 247.795 billion yuan for the three months ended September, slightly higher than the consensus in a FactSet poll of analysts. China's e-commerce players have invested heavily in the food-delivery sector in recent quarters, resorting to aggressive promotions to capture more market share. New entrant JD.com earlier this month reported a 55% drop in net profit for the latest quarter, while sector leader Meituan is expected to post continued operating losses in its food-delivery segment when it reports results later this week. Despite the sharply lower net profit, Alibaba's American depositary receipts rose almost 5% in premarket trading as investors turned their focus on its AI progress. For the second quarter, its cloud business revenue climbed 34%, accelerating from the 26% increase in the previous quarter, driven by surging demand for AI services. "We have entered into an investment phase to build long-term strategic value in AI technologies and infrastructure and a consumption platform integrating daily life services and e-commerce," Chief Executive Eddie Wu said. On Monday, Alibaba said its Qwen app, a relaunched AI assistant, positioned as a competitor to OpenAI's ChatGPT, reached 10 million downloads within a week of its public beta launch, emerging as a popular consumer AI tool in China. Alibaba aims to integrate the app with other consumer services in its ecosystem and grow it into a fully functioning AI agent. The development is the latest sign that Alibaba, whose AI strategy has long focused on cloud computing, is also making headway in the consumer AI market, coming as capital spending on AI and cloud infrastructure reached around 120 billion yuan over the past four quarters. Alibaba's overseas e-commerce unit posted a 10% increase in revenue. Total revenue from its China e-commerce division, which includes Taobao and Tmall as well as on-demand delivery platform Ele.me, rose 16%. Behind the intense competition in food delivery and instant shopping among the e-commerce players is the fight to become China's everyday app for transactions across goods and services, according to Goldman Sachs analysts. "We are reinvesting our profits and free cash flow for the future while near-term profitability is expected to fluctuate," Chief Financial Officer Toby Xu said. While the competition will continue to eat into earnings, analysts said Alibaba stands to benefit in the long term. Morningstar sees the company as the biggest winner of China's on-demand delivery price battle this year, even though Meituan is expected to continue holding a dominant share of the pie, analysts Chelsey Tam and Junhao Yang wrote in a note, adding that the price war could conclude by the end of 2027. Write to Sherry Qin at [email protected] and Tracy Qu at [email protected]

Share

Share

Copy Link

Alibaba reports 34% cloud revenue growth driven by AI demand, with its Qwen chatbot achieving 10 million downloads in its first week. Despite overall profit declines due to e-commerce price wars, the company's AI investments are paying off.

Alibaba's Cloud Business Powers AI-Driven Growth

China's Alibaba Group has reported a remarkable 34% surge in cloud business revenue for the July-September quarter, marking a significant acceleration from the 26% growth recorded in the previous quarter

1

. This impressive performance comes as the company capitalizes on the artificial intelligence boom sweeping through the tech industry.

Source: Benzinga

The cloud revenue growth represents a bright spot in an otherwise mixed earnings report. While Alibaba's overall revenue increased by just 5% year-on-year to 247.8 billion yuan ($35 billion), the company's profit fell 52% compared to the same period last year

2

. This decline stems from intense price competition in China's e-commerce landscape, particularly in the food delivery segment, which has eroded short-term profitability.Strategic AI Investment Commitment

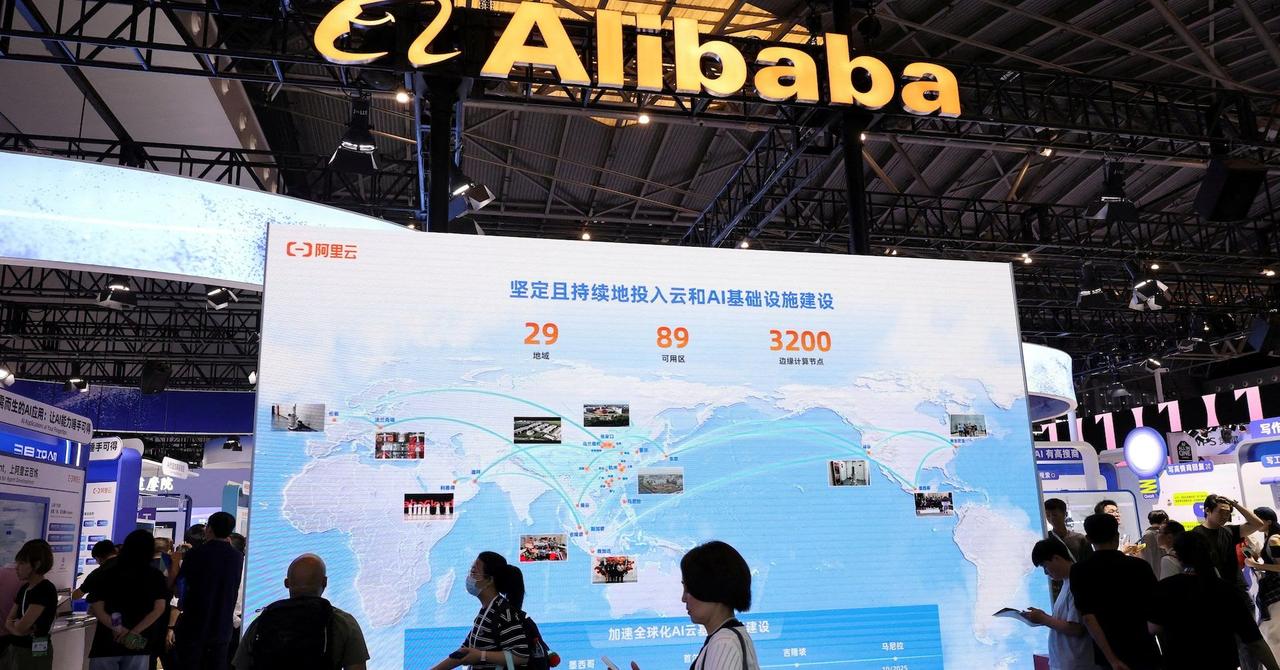

Alibaba's transformation from an e-commerce giant to an AI-focused technology company continues to gain momentum. Earlier this year, the company pledged to invest at least 380 billion yuan ($53 billion) over three years in advancing its cloud computing and AI infrastructure

3

. CEO Eddie Wu emphasized that the group's "significant" investments in AI have been instrumental in driving revenue growth.The company's confidence in AI demand appears unwavering, with executives stating that demand for AI is "accelerating" and expressing "strong conviction in future AI demand growth." Alibaba indicated it will likely exceed its planned 380 billion yuan investment to meet the surging demand for AI services

4

.Qwen Chatbot Achieves Milestone Success

A key highlight of Alibaba's AI strategy materialized with the launch of its upgraded AI chatbot, Qwen, which aims to rival OpenAI's ChatGPT. The platform achieved a remarkable milestone by recording 10 million downloads within its first week of public availability

1

. This rapid adoption demonstrates the strong market appetite for Chinese-developed AI solutions.

Source: ET

The success of Qwen has contributed significantly to investor confidence, with some analysts describing it as a potential "AI-era WeChat"

5

. The app quickly climbed to the top ranks of China's App Store, signaling strong consumer acceptance of the platform.Related Stories

Market Response and Investor Sentiment

Investor enthusiasm for Alibaba's AI progress has translated into substantial stock gains. The company's Hong Kong shares rose 2% following the earnings announcement, while New York Stock Exchange shares climbed 2.4% before the opening bell

2

. More impressively, Alibaba's shares have gained over 90% year-to-date, driven primarily by optimism surrounding its AI initiatives.The stock performance has created significant value for major investors, including billionaire David Tepper, whose 6.45 million-share stake has generated gains exceeding $465 million

5

. Tepper's position, built at an average cost of $81 per share, now carries a market value of approximately $987 million.Competitive Landscape in Chinese AI Market

Alibaba's AI success comes amid a broader shift in the global AI landscape, with Chinese companies gaining ground since tech startup DeepSeek disrupted the industry and challenged the dominance of U.S. rivals

3

. However, earnings results among Chinese tech giants have been mixed, highlighting the competitive nature of the market.Tencent, a key rival in the AI space, reported strong performance with a 15% year-on-year revenue increase for the July-September quarter. In contrast, Baidu, another AI competitor, experienced a 7% revenue decline during the same period

4

. These varied results underscore the importance of execution and strategic positioning in the rapidly evolving AI market.References

Summarized by

Navi

[2]

Related Stories

Alibaba's AI Investments Boost Cloud Revenue Amid Overall Revenue Miss

27 Aug 2025•Technology

Alibaba Links Taobao Shopping to Qwen AI App, Advancing Push Into Consumer AI Services

14 Jan 2026•Technology

Alibaba's Profit Dips Amid Food Delivery War, but AI Boom Offers Hope

29 Aug 2025•Business and Economy

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy