Alibaba Reports 6% Annual Revenue Growth, Highlighting AI-Driven Strategy Amid Economic Uncertainties

3 Sources

3 Sources

[1]

China's Alibaba posts annual revenue increase despite spending slump

Beijing (AFP) - Internet giant Alibaba posted on Thursday a six percent increase in annual revenue, the latest positive sign for China's tech sector despite persisting economic uncertainties that include sluggish spending and threatened trade. The Hangzhou-based company is one of the biggest players in China's tech industry, with operations spanning retail, digital payment, artificial intelligence and entertainment. This year has seen its share price rollercoaster on a wave of investor enthusiasm about Chinese AI capabilities that began in January, followed by a steep drop last month triggered by US President Donald Trump's global tariff blitz. The firm's revenue during the fiscal year ended March 31 totalled 996.3 billion yuan ($138.2 billion), according to results posted to the Hong Kong Stock Exchange, up six percent from the previous 12-month period. Net income attributable to ordinary shareholders rose to 129.5 billion yuan, the statement showed, a jump of 62 percent year-on-year according to AFP calculations. In the final quarter alone, Alibaba saw revenue of 236.5 billion yuan, narrowly coming up short of a Bloomberg forecast. Net income attributable to ordinary shareholders during the quarter reached 12.4 billion yuan, surging 279 percent from the low base of 3.3 billion yuan recorded during the same period last year. "Our results this quarter and for the full fiscal year demonstrate the ongoing effectiveness of our 'user first, AI-driven' strategy, with core business growth continuing to accelerate," CEO Eddie Wu said in a statement. The growth is another positive sign for China's tech sector, which has garnered revamped interest from investors since the shock release in January of advanced AI chatbot DeepSeek -- apparently developed at a fraction of the cost thought necessary. Alibaba and fellow tech giants Tencent and Baidu are now funnelling large sums into a new race to develop and integrate the most cutting-edge AI applications. Spending slump As the Chinese economy strains under sluggish spending and a tumultuous trade relationship with the United States, Beijing is increasingly looking to platforms operated by domestic internet giants as a cushion for employment and consumption. Prospects improved Monday when Beijing and Washington announced plans to significantly scale back sky-high tariffs that had severely threatened trade between the two nations. However, economists say that the Chinese economy may still struggle to achieve the official growth target set by leaders of around five percent this year. Alibaba's announcement on Thursday came after Tencent and e-commerce giant JD.com posted moderate increases in first-quarter revenue earlier this week, indicating a possible rebound in spending. But official figures released on Saturday showed that consumer prices remained mired in a slump last month, reflecting continued deflationary pressure. Alibaba was once a key subject of the aggressive regulatory crackdown launched in late 2020 on the domestic tech sector, attributed to worries in Beijing that top firms had become too powerful. Jack Ma, the firm's charismatic co-founder who had spoken boldly about the shortcomings of China's financial and regulatory system, kept a low profile during the lengthy campaign. He reappeared in February during a meeting with President Xi Jinping and other business luminaries -- a shock development that suggested a warmer stance from Beijing and sent Alibaba stocks soaring. Ma is no longer an executive at Alibaba but is believed to retain a significant shareholding in the company.

[2]

China's Alibaba says annual revenue up six percent year-on-year

Beijing (AFP) - Internet giant Alibaba posted on Thursday a six percent increase in annual revenue, the latest positive sign for China's tech sector despite persisting economic uncertainties. The Hangzhou-based company is one of the biggest players in China's tech industry, with operations spanning retail, digital payment, artificial intelligence and entertainment. This year has seen its share price rollercoaster on a wave of investor enthusiasm about Chinese AI capabilities that began in January, followed by a steep drop last month triggered by US President Donald Trump's global trade blitz. The firm's revenue during the fiscal year ended March 31 totalled 996.3 billion yuan ($138.2 billion), according to results posted to the Hong Kong Stock Exchange, up six percent from the previous twelve-month period. Net income attributable to ordinary shareholders rose to 129.5 billion yuan, the statement showed, a jump of 62 percent year-on-year according to AFP calculations. In the final quarter alone, Alibaba saw revenue of 236.5 billion yuan, narrowly coming up short of a Bloomberg forecast. Net income attributable to ordinary shareholders during the quarter reached 12.4 billion yuan, surging 279 percent from the low base of 3.3 billion yuan recorded during the same period last year. "Our results this quarter and for the full fiscal year demonstrate the ongoing effectiveness of our 'user first, AI-driven' strategy, with core business growth continuing to accelerate," said CEO Eddie Wu in a statement. The growth is another positive sign for China's tech sector, which has garnered revamped interest from investors since the shock release in January of advanced AI chatbot DeepSeek -- apparently developed for a fraction of the cost thought necessary. Alibaba and fellow tech giants Tencent and Baidu are now funnelling large sums in a new race to develop and integrate the most cutting-edge AI applications.

[3]

China's Alibaba says annual revenue up 6% year-on-year

Alibaba reported a 6% rise in annual revenue to 996.3 billion yuan ($138.2 billion), with net income surging 62%. The results signal renewed strength in China's tech sector, driven by AI. Despite market volatility, Alibaba's "user first, AI-driven" strategy shows momentum as it joins rivals in the race for AI innovation.Internet giant Alibaba posted on Thursday a 6% increase in annual revenue, the latest positive sign for China's tech sector despite persisting economic uncertainties. The Hangzhou-based company is one of the biggest players in China's tech industry, with operations spanning retail, digital payment, artificial intelligence and entertainment. This year has seen its share price rollercoaster on a wave of investor enthusiasm about Chinese AI capabilities that began in January, followed by a steep drop last month triggered by US President Donald Trump's global trade blitz. The firm's revenue during the fiscal year ended March 31 totalled 996.3 billion yuan ($138.2 billion), according to results posted to the Hong Kong Stock Exchange, up 6% from the previous twelve-month period. Net income attributable to ordinary shareholders rose to 129.5 billion yuan, the statement showed, a jump of 62% year-on-year according to AFP calculations. In the final quarter alone, Alibaba saw revenue of 236.5 billion yuan, narrowly coming up short of a Bloomberg forecast. Net income attributable to ordinary shareholders during the quarter reached 12.4 billion yuan, surging 279% from the low base of 3.3 billion yuan recorded during the same period last year. "Our results this quarter and for the full fiscal year demonstrate the ongoing effectiveness of our 'user first, AI-driven' strategy, with core business growth continuing to accelerate," said CEO Eddie Wu in a statement. The growth is another positive sign for China's tech sector, which has garnered revamped interest from investors since the shock release in January of advanced AI chatbot DeepSeek -- apparently developed for a fraction of the cost thought necessary. Alibaba and fellow tech giants Tencent and Baidu are now funnelling large sums in a new race to develop and integrate the most cutting-edge AI applications.

Share

Share

Copy Link

Alibaba's latest financial results show a 6% increase in annual revenue and a 62% surge in net income, demonstrating the effectiveness of its AI-driven strategy and signaling renewed strength in China's tech sector despite economic challenges.

Alibaba's Financial Performance

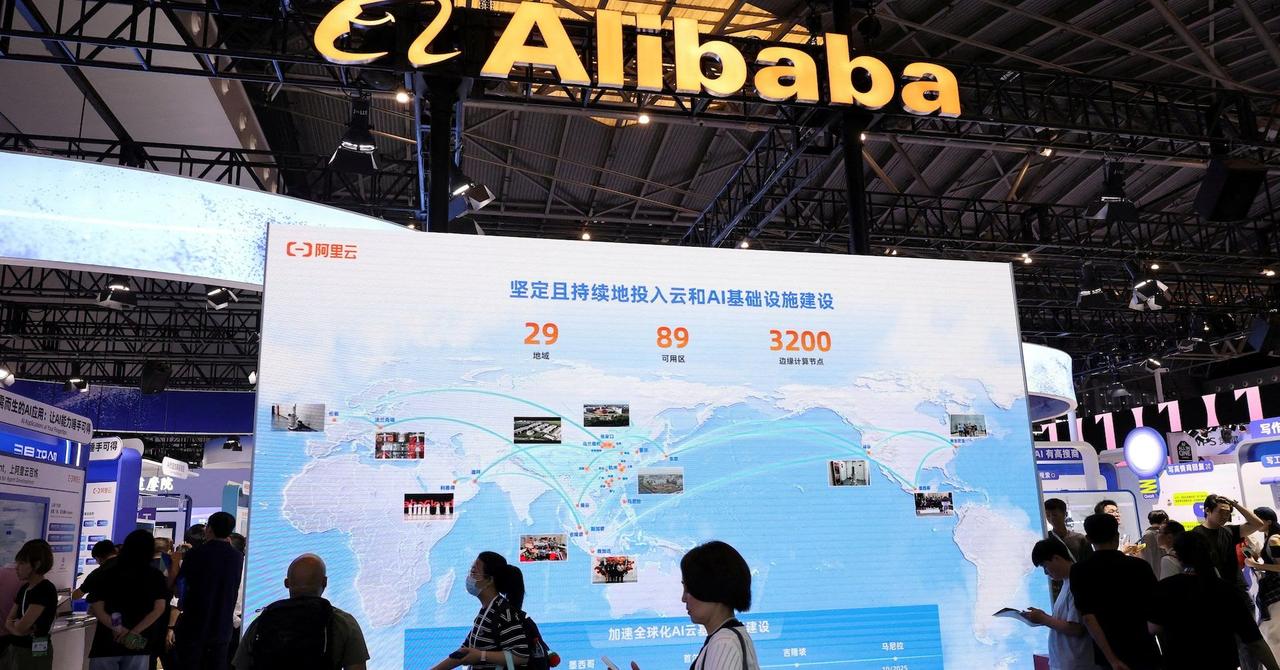

Chinese tech giant Alibaba has reported a 6% increase in annual revenue, reaching 996.3 billion yuan ($138.2 billion) for the fiscal year ended March 31, 2025

1

2

3

. This growth comes despite ongoing economic uncertainties and sluggish consumer spending in China. The company's net income attributable to ordinary shareholders rose significantly by 62% year-on-year, totaling 129.5 billion yuan1

2

.In the final quarter of the fiscal year, Alibaba saw revenue of 236.5 billion yuan, slightly below Bloomberg forecasts

1

. However, the quarter's net income surged by an impressive 279% to 12.4 billion yuan, compared to the same period last year1

2

.AI-Driven Strategy and Tech Sector Momentum

CEO Eddie Wu attributed the company's performance to its "user first, AI-driven" strategy, stating that core business growth continues to accelerate

1

2

3

. This approach aligns with the renewed interest in China's tech sector, particularly in artificial intelligence capabilities.The tech industry received a significant boost in January 2025 with the release of the advanced AI chatbot DeepSeek, which was reportedly developed at a fraction of the expected cost

1

2

. This breakthrough has sparked a race among Chinese tech giants, including Alibaba, Tencent, and Baidu, to develop and integrate cutting-edge AI applications1

2

3

.Market Volatility and Economic Challenges

Alibaba's share price has experienced significant fluctuations throughout the year. Initial enthusiasm about Chinese AI capabilities in January was followed by a steep drop in April, triggered by US President Donald Trump's global trade policies

1

2

. Despite these challenges, the company's financial results signal resilience in China's tech sector.The broader Chinese economy continues to face headwinds, with sluggish consumer spending and deflationary pressures

1

. Official figures released recently showed that consumer prices remained in a slump last month1

. However, there are signs of potential improvement, as evidenced by moderate increases in first-quarter revenue reported by other tech companies like Tencent and JD.com1

.Related Stories

Regulatory Environment and Future Outlook

Alibaba's positive results come after a period of regulatory scrutiny in China's tech sector. The company was once a key subject of the regulatory crackdown launched in late 2020

1

. However, recent developments suggest a potentially warmer stance from Beijing towards the tech industry. In February, Alibaba's co-founder Jack Ma reappeared in a meeting with President Xi Jinping and other business leaders, which was seen as a positive sign for the company and the sector as a whole1

.As China looks to its internet giants to support employment and consumption, Alibaba's performance and AI-driven strategy may play a crucial role in the country's economic landscape. The company, along with its peers, is now at the forefront of AI development and integration, which could shape the future of China's tech industry and its global competitiveness in the field of artificial intelligence

1

2

3

.References

Summarized by

Navi

Related Stories

Alibaba's AI Investments Boost Cloud Revenue Amid Overall Revenue Miss

27 Aug 2025•Technology

Alibaba's AI-Driven Cloud Revenue Surge Signals Chinese Tech Giant's Strategic Pivot

18 Nov 2025•Business and Economy

Alibaba's Profit Dips Amid Food Delivery War, but AI Boom Offers Hope

29 Aug 2025•Business and Economy

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy