AMD confirms it will pay 15% tax to resume AI chip shipments to China under Trump deal

3 Sources

3 Sources

[1]

AMD chief says company ready to pay 15% tax on AI chip shipments to China

AMD CEO Lisa Su confirmed the company has licenses to ship certain MI 308 chips to China and is prepared to pay a 15% U.S. tax on these exports. This follows a reported deal between the Trump administration, Nvidia, and AMD to resume chip shipments to China in exchange for the fee. Advanced Micro Devices CEO Lisa Su on Thursday said the company has licenses to ship some of its MI 308 chips to China and is prepared to pay a 15% tax to the U.S. government if it ships them. Su made the remarks at a conference held by technology publication Wired in San Francisco. U.S. President Donald Trump in August said his administration had reached a deal with Nvidia and AMD under which they could resume shipping some chips to China in exchange for paying a 15% fee, a move some legal experts argued could violate the U.S. Constitution's ban on taxing exports.

[2]

Lisa Su Says AMD Will Pay Trump's 15% Fee To Resume China AI Chip Sales Despite Beijing's Partial Block On Foreign Silicon - NVIDIA (NASDAQ:NVDA), Advanced Micro Devices (NASDAQ:AMD)

On Thursday, Advanced Micro Devices, Inc. (NASDAQ:AMD) CEO Lisa Su said that the company is prepared to restart shipments of its MI308 artificial intelligence chips to China after securing U.S. export licenses. AMD Says It Will Pay 15% Fee To Resume China Shipments Speaking at a Wired conference with senior writer Lauren Goode, Su was pressed on whether AMD would resume selling chips to China. In response, Su said the company will comply with the Trump administration's 15% fee on MI308 exports. The U.S. previously halted MI308 sales to China and later began reviewing applications again over the summer. AMD earlier warned that losing access to China for the export-compliant chip could reduce its revenue by roughly $800 million. In August, President Trump said his administration struck an agreement with Nvidia Corp (NASDAQ:NVDA) and AMD, allowing them to restart limited chip exports to China if they paid a 15% fee. See Also: Jensen Huang Was Mistakenly Sent To A Kentucky Reform School, Where He Cleaned Bathrooms While His Brother Worked On Tobacco Farms China Tightens AI Chip Restrictions Amid US Controls Su's comments come as China moves to reduce reliance on American technology. Last month, Beijing reportedly ordered state-funded data centers to stop using foreign AI chips in new projects, requiring them to adopt domestic alternatives. During the company's second-quarter earnings call, Su said, "China is an important market for us." Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox. Strong Earnings And A $100 Billion AI Opportunity The remarks follow AMD's stronger-than-expected third-quarter results. The company reported $9.25 billion in revenue and forecasted fourth-quarter sales of about $9.6 billion, excluding any China sales. AMD is also leaning on long-term growth from its multiyear partnership with OpenAI, which could generate more than $100 billion in revenue over the next several years as AMD begins supplying next-generation Instinct GPUs starting in 2026. Price Action: AMD shares are up 79.04% year-to-date. During Thursday's regular session, the stock was down 0.74% but in the after-hours trading, it gained slightly and reached $216.20, according to Benzinga Pro. Benzinga's Edge Stock Rankings indicate that AMD maintains a strong medium and long-term trend, though its short-term performance remains under pressure. Click here to see how it compares with its peers. Check out more of Benzinga's Consumer Tech coverage by following this link. Read Next: Meta's Ray-Ban Smart Glasses Might Never Have Happened If Not For One Cold Email -- EssilorLuxottica's Rocco Basilico Reveals How It All Started Photo Courtesy: jamesonwu1972 on Shutterstock.com Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. AMDAdvanced Micro Devices Inc$216.200.10%OverviewNVDANVIDIA Corp$183.470.05%Market News and Data brought to you by Benzinga APIs

[3]

AMD chief says company ready to pay 15 per cent tax on AI chip shipments to China

SAN FRANCISCO -- Advanced Micro Devices CEO Lisa Su on Thursday said the company has licenses to ship some of its MI 308 chips to China and is prepared to pay a 15 per cent tax to the U.S. government if it ships them. Su made the remarks at a conference held by technology publication Wired in San Francisco. U.S. President Donald Trump in August said his administration had reached a deal with Nvidia and AMD under which they could resume shipping some chips to China in exchange for paying a 15 per cent fee, a move some legal experts argued could violate the U.S. Constitution's ban on taxing exports. In response to the latest U.S. move, China's foreign ministry on Friday urged the American side to take concrete actions to maintain the stability and smooth operation of the world's supply chains. AMD's MI308 AI accelerator is a downgraded version of its Instinct MI300X series, designed to comply with U.S. export controls for sale to China. The chip was placed under export restrictions alongside Nvidia's H20 in April. The Chinese government has issued guidance requiring new data center projects that have received state funds to only use homemade artificial intelligence chips, a move that is likely to affect U.S. firms Nvidia, AMD and Intel.

Share

Share

Copy Link

AMD CEO Lisa Su announced the company has secured U.S. export licenses to ship MI308 AI chips to China and is prepared to pay a 15% tax on these exports. The move follows a Trump administration deal with AMD and Nvidia, though China is simultaneously pushing state-funded data centers to adopt domestically produced AI chips instead of foreign silicon.

AMD Secures Export Licenses for MI308 AI Chips

AMD CEO Lisa Su confirmed at a Wired conference in San Francisco that the company has obtained U.S. export licenses to ship its MI308 AI chips to China and is prepared to pay a 15% U.S. tax on these exports

1

2

. The announcement marks a significant development in the ongoing tech trade relationship between the United States and China, as AMD moves to restart AI chip shipments to China after months of regulatory uncertainty. Speaking with senior writer Lauren Goode, Lisa Su stated that AMD will comply with the Trump administration's fee structure to resume selling these export-compliant chips to the Chinese market2

.

Source: ET

Trump Administration Deal Faces Constitutional Questions

In August, Donald Trump announced his administration had reached an agreement with Nvidia and AMD that would allow them to resume shipping certain chips to China in exchange for paying a 15% fee . Some legal experts have argued this arrangement could violate the U.S. Constitution's ban on taxing exports, raising questions about the long-term viability of this approach

3

. The U.S. had previously halted MI308 sales to China before beginning to review applications again over the summer. AMD earlier warned that losing access to China for this export-compliant chip could reduce its revenue by roughly $800 million2

.China Pushes for Domestically Produced AI Chips

Su's comments arrive as China intensifies efforts to reduce reliance on American technology and foreign silicon. Last month, Beijing reportedly ordered state-funded data centers to stop using foreign AI chips in new projects, requiring them to adopt domestic alternatives instead

2

. This guidance is likely to affect U.S. firms including AMD, Nvidia, and Intel3

. China's foreign ministry responded to the latest U.S. move by urging the American side to take concrete actions to maintain stability and smooth operation of global supply chains3

.Related Stories

Understanding the MI308 AI Accelerator

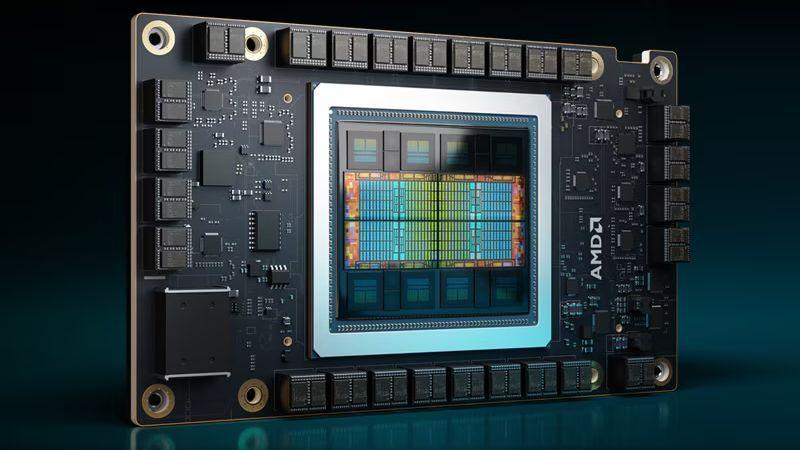

The MI308 AI accelerator represents a downgraded version of AMD's Instinct MI300X series, specifically designed to comply with export controls for sale to China

3

. The chip was placed under export restrictions alongside Nvidia's H20 in April. During AMD's second-quarter earnings call, Su emphasized that "China is an important market for us," underscoring the strategic significance of maintaining access to Chinese customers2

.

Source: Benzinga

AMD's Strong Performance and Future Growth

The remarks follow AMD's stronger-than-expected third-quarter results, with the company reporting $9.25 billion in revenue and forecasting fourth-quarter sales of about $9.6 billion, excluding any China sales

2

. AMD is also positioning itself for long-term growth through its multiyear partnership with OpenAI, which could generate more than $100 billion in revenue over the next several years as AMD begins supplying next-generation Instinct GPUs starting in 20262

. AMD shares are up 79.04% year-to-date, demonstrating strong investor confidence despite ongoing geopolitical tensions affecting the semiconductor industry2

. The company's willingness to navigate complex export controls while maintaining compliance signals its commitment to balancing regulatory requirements with market opportunities in data centers and AI applications.References

Summarized by

Navi

Related Stories

Nvidia and AMD to Pay 15% of China AI Chip Sales Revenue to US Government

04 Aug 2025•Business and Economy

AMD and Nvidia Set to Resume AI Chip Sales to China as US Eases Export Restrictions

15 Jul 2025•Business and Economy

AMD Faces $800 Million Charge as US Tightens AI Chip Export Controls to China

17 Apr 2025•Business and Economy

Recent Highlights

1

Pentagon threatens Anthropic with Defense Production Act over AI military use restrictions

Policy and Regulation

2

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

3

Anthropic accuses Chinese AI labs of stealing Claude through 24,000 fake accounts

Policy and Regulation