AMD Forecasts Strong Q1 Revenue, Riding the AI Chip Demand Wave

2 Sources

2 Sources

[1]

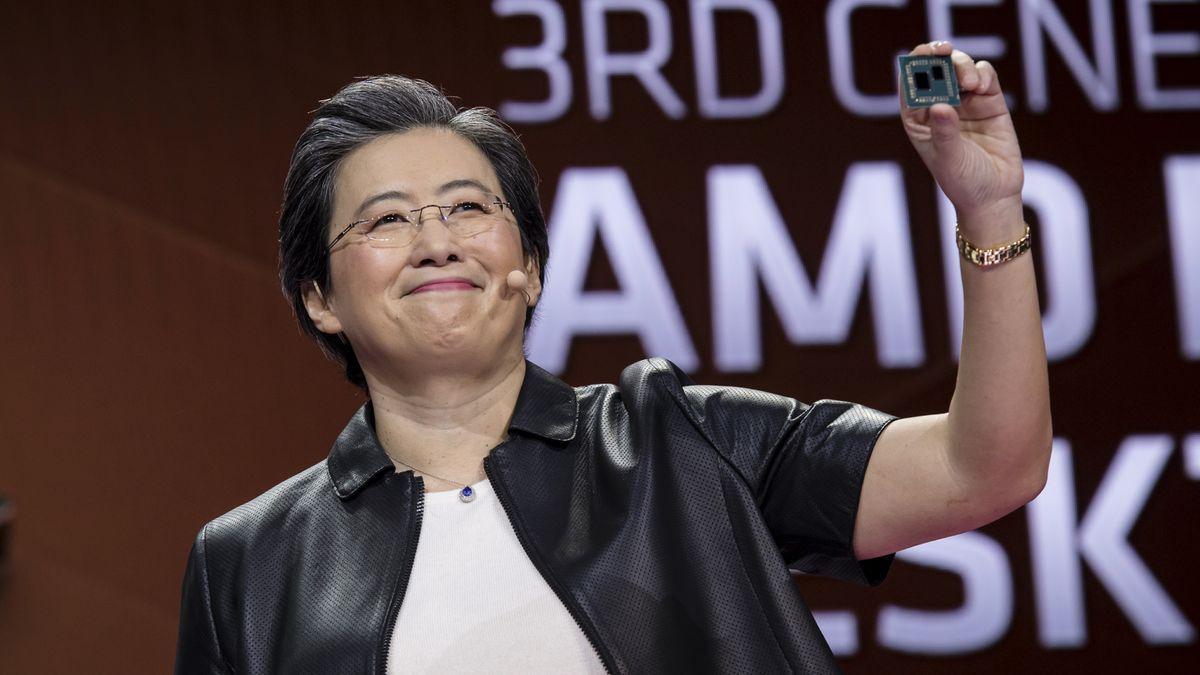

AMD forecasts first-quarter revenue above estimates

(Reuters) - Advanced Micro Devices forecast first-quarter revenue above Wall Street estimates on Tuesday, betting on strong demand for its AI chips as Wall Street's technology heavyweights build infrastructure to dominate the emerging technology. The company expects revenue of about $7.1 billion, plus or minus $300 million in the first quarter, compared with analysts' average estimate of $6.99 billion according to data compiled by LSEG. (Reporting by Arsheeya Bajwa in Bengaluru; Editing by Maju Samuel)

[2]

AMD's Strong Forecast Eases Concerns About AI Chip Slowdown

Advanced Micro Devices Inc. gave an upbeat revenue forecast for the current quarter, signaling that it continues to win market share from Intel Corp. and benefit from demand for artificial intelligence gear. Sales will roughly $7.1 billion in the first quarter, the company said in a statement Tuesday. Analysts estimated $7.04 billion on average.

Share

Share

Copy Link

Advanced Micro Devices (AMD) projects first-quarter revenue above Wall Street estimates, signaling continued growth in AI chip demand and market share gains from competitors.

AMD's Optimistic Q1 Revenue Forecast

Advanced Micro Devices (AMD) has released a bullish first-quarter revenue forecast, surpassing Wall Street expectations and alleviating concerns about a potential slowdown in the AI chip market. The company projects revenue of approximately $7.1 billion, plus or minus $300 million, for the first quarter of the year

1

. This forecast exceeds the average analyst estimate of $6.99 billion, according to data compiled by LSEG1

.Driving Forces Behind AMD's Growth

The strong forecast is attributed to two primary factors:

-

AI Chip Demand: AMD is capitalizing on the robust demand for its artificial intelligence chips. As major technology companies continue to build infrastructure to dominate the emerging AI landscape, the demand for specialized AI processors remains high

1

. -

Market Share Gains: The company's performance suggests that it is successfully winning market share from its main competitor, Intel Corporation. This shift in the competitive landscape is contributing to AMD's growth trajectory

2

.

Implications for the AI and Semiconductor Industries

AMD's positive outlook provides valuable insights into the current state of the AI and semiconductor industries:

-

Continued AI Momentum: The forecast indicates that the AI boom is far from over, with major tech players still investing heavily in AI infrastructure and capabilities.

-

Competitive Dynamics: AMD's ability to gain market share from Intel highlights the intense competition in the semiconductor industry, particularly in the AI chip segment.

-

Industry Health: The strong demand for AI chips suggests that the broader semiconductor industry remains robust, despite concerns about potential slowdowns in other tech sectors.

Related Stories

Market Response and Future Outlook

While the immediate market response to AMD's forecast was not detailed in the provided sources, such positive projections typically lead to favorable reactions from investors. The company's ability to exceed analyst expectations in a highly competitive market environment bodes well for its future prospects.

As the AI industry continues to evolve rapidly, AMD's position as a key supplier of essential components for AI infrastructure could lead to further growth opportunities. However, the company will need to maintain its technological edge and manufacturing capabilities to capitalize on the ongoing AI boom and continue its market share gains.

References

Summarized by

Navi

[1]

Related Stories

AMD Reports Record Q3 Revenue of $9.25 Billion Driven by AI Chip Demand, But Faces Growing Competition

04 Nov 2025•Business and Economy

AMD Targets $100 Billion Data Center Revenue by 2030 as AI Demand Surges

12 Nov 2025•Business and Economy

AMD's Q2 Earnings: AI Chip Sector Gains and Data Center Growth Boost Optimism

31 Jul 2024

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology