AMD Stock Surges on AI Chip Advancements and Potential AWS Partnership

8 Sources

8 Sources

[1]

AMD shares rise 10% after analysts say they expect a 'snapback' for chipmaker

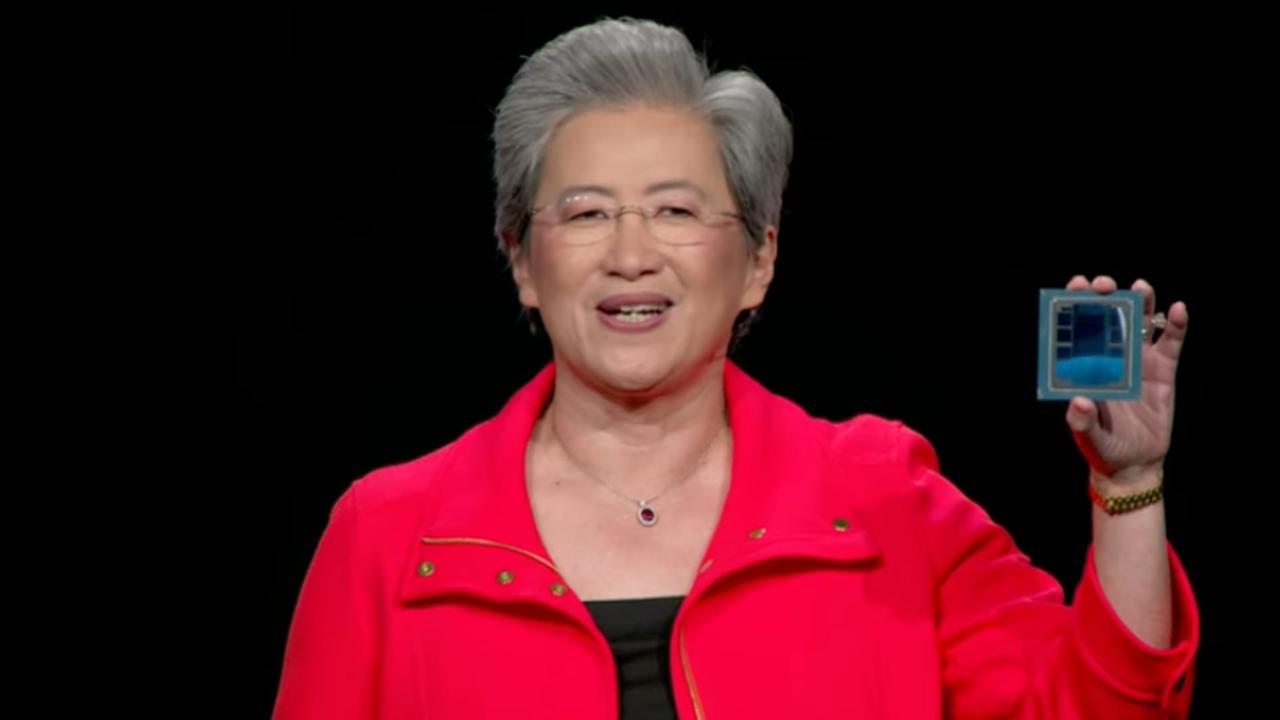

CEO Dr. Lisa Su, AMD executives, and industry luminaries unveil the AMD vision for Advancing Al. Shares of Advanced Micro Devices rose nearly 10% on Monday after analysts at Piper Sandler lifted their price target on the stock on optimism about the chipmaker's latest product announcement. The analysts said they see a snapback for AMD's graphics-processing units (GPUs) in the fourth quarter. That's when they expect the chipmaker to be through the bulk of the $800 million in charges that AMD said it would incur as a result of a new U.S. license requirement that applies to exports of semiconductors to China and other countries. Last week, AMD revealed its next-generation AI chips, the Instinct MI400 series. Notably, the company unveiled a full-server rack called Helios that enables thousands of the chips to be tied together. That chip system is expected to be important for artificial intelligence customers like cloud companies and developers of large language models. AMD CEO Lisa Su showed the products on stage at an event in San Jose, California, alongside OpenAI CEO Sam Altman, who said they sounded "totally crazy." "Overall, we are enthused with the product launches at the AMD event this week, specifically the Helios rack, which we think is pivotal for AMD Instinct growth," the analysts wrote in their note. Piper Sandler raised its price target for AMD's share price from $125 to $140. The stock jumped past $127 on Monday and is at its highest since Jan. 6, before President Donald Trump announced sweeping new tariffs or AMD warned of the chip control charges.

[2]

AMD Stock Soars as Piper Sandler Raises Price Target After 'Advancing AI' Event

Bank of America analysts expect a partnership to be announced between AMD and Amazon Web Services. Advanced Micro Devices (AMD) shares popped nearly 10% to lead S&P 500 gainers Monday as Piper Sandler analysts raised their price target for the stock coming out of the chipmaker's "Advancing AI" event. Piper raised its target to $140 from $125 and maintained an "overweight" rating for AMD stock. Shares of AMD were at about $127 in recent trading, making Piper's target a roughly 10% premium. The analysts came away "enthused" by the firm's newly unveiled Helios server rack architecture, which it called "pivotal" for the growth of AMD Instinct GPUs. Helios will combine next-generation AMD MI400 chips into one larger system, the company said, and is expected in 2026. AMD highlighted its partnerships with ChatGPT maker OpenAI, Meta Platforms (META), Oracle (ORCL), Microsoft (MSFT), and others at the event. Bank of America analysts believe there's another high-profile partner announcement to come: Amazon (AMZN). Amazon Web Services (AWS) was "a key sponsor for the event," BofA said. However, AWS typically uses its own events to announce new engagements, making a future reveal likely, the bank added. BofA maintained a "buy" rating and price target of $130 following the event. For comparison, the analyst consensus price target from Visible Alpha is about $124.

[3]

AMD stock up over 9% after new AI chips reveal: Is AMD the breakout investors have been waiting for?

AMD stock jumped over 9% after the company unveiled its latest AI chips, including the Instinct MI325X, sparking fresh investor excitement. The news came during AMD's "Advancing AI" event, where it laid out its future AI roadmap and new hardware plans. With major analysts raising price targets and AMD doubling down on AI tech, many now wonder if this is the breakout moment investors have been waiting for. Backed by rising volume, upbeat forecasts, and bullish momentum, AMD stock is once again in the spotlight -- and the story is far from over.AMD stock is once again catching Wall Street's attention -- and for good reason. On Monday, June 16, AMD shares soared over 8%, closing at $126.72. The jump came right after the company's highly anticipated Advancing AI event in San Jose, where AMD introduced its new generation of AI chips and laid out a detailed roadmap for future growth. This isn't just another short-term rally. With fresh product announcements, big price target hikes from analysts, and a wave of investor excitement, AMD stock seems to be entering a new phase. Let's break down what's really happening. At the center of this price surge is AMD's unveiling of the Instinct MI325X AI chip, expected later this year, and its plans for the MI350 series in 2025. The company also teased its upcoming MI400 chips that are set to launch in 2026 and will use a new "Next" architecture designed for high-performance AI computing. AMD also introduced Helios, a rack-scale AI platform that will house its future MI400 accelerators. While this sounds technical, the takeaway is simple: AMD is doubling down on AI, and investors liked what they heard. Analysts responded quickly. Piper Sandler raised its price target from $125 to $140, saying the announcements were "impressive" and could give AMD a serious boost in the competitive AI chip space. There are a few reasons for the surge in AMD stock price: That's the big question. AMD stock has climbed about 60% since bottoming out near $78 in April, but it's still down about 30% from its 2023 high of $184.92. This suggests there could be more room to grow, especially if its AI chips gain traction. Many analysts are still bullish: But there are risks. U.S. chip export rules could cut up to $800 million from future revenue. That's not a small amount, and it could affect margins in Q2 and Q3. Still, most analysts see this as a manageable headwind rather than a deal-breaker. Let's be honest -- Nvidia is still the leader in AI chips. But AMD isn't just sitting on the sidelines. Its newer products are starting to show up in major server systems, and its focus on open-source AI platforms makes it a serious player. What AMD lacks in current AI market share, it hopes to make up for in scalability and cost efficiency. If its MI325X and MI350 chips can compete on performance and price, then AMD could carve out a significant share of the AI market in 2025 and beyond. Absolutely. Whether you're a long-term investor or just tracking short-term gains, AMD stock deserves a spot on your radar right now. Between its product roadmap, analyst upgrades, and strong investor interest, this isn't just a hype-driven bump -- it's a shift toward long-term AI growth. That said, keep an eye on chip export regulations and future earnings. The next few quarters will tell us how well AMD can execute on these bold AI plans. For now, it's clear: AMD is stepping up, and the market is watching.

[4]

AMD Stock Surges On Citigroup Upgrade Ahead Of 'Advancing AI' Event - Advanced Micro Devices (NASDAQ:AMD)

Advanced Micro Devices Inc AMD saw its stock price climb over 4.5% on Monday, trading at $121.70 by mid-afternoon. The surge followed a positive revision from Citigroup, which maintained its Buy rating and increased its price target for the semiconductor giant from $100 to $120 per share. What To Know: The analyst price increase comes just days before AMD's highly anticipated "Advancing AI" event on Thursday. At the event, CEO Lisa Su and other industry leaders are expected to unveil AMD's vision for the future of artificial intelligence, including updates on its end-to-end AI solutions and product ecosystem. The full-day event will feature sessions for developers, customers and business leaders, with major sponsors including Dell, Lenovo and Oracle. Read Also: Robinhood Stock Is Falling Monday: What's Going On? Investor optimism is also buoyed by AMD's recent strategic moves. Last week, the company announced the acquisition of Brium, a team specializing in AI software and compilers, to bolster its software capabilities. The move followed the purchase of Enosemi to advance co-packaged optics innovation. These acquisitions are part of a broader strategy to enhance AMD's AI platform. The company recently reported strong first-quarter earnings and provided an optimistic revenue forecast for the second quarter. Read Also: Rocket Lab, AST SpaceMobile Shares Are Surging Monday: What's Fueling The Move? How To Buy AMD Stock Besides going to a brokerage platform to purchase a share - or fractional share - of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument. For example, in Advanced Micro Devices' case, it is in the Information Technology sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment. According to data from Benzinga Pro, AMD has a 52-week high of $187.28 and a 52-week low of $76.48. AMDAdvanced Micro Devices Inc$121.704.74%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum20.15Growth97.07Quality76.61Value16.71Price TrendShortMediumLongOverviewMarket News and Data brought to you by Benzinga APIs

[5]

AMD Stock Is Soaring Monday: What's Going On? - Advanced Micro Devices (NASDAQ:AMD)

Advanced Micro Devices Inc AMD shares are trading higher Monday following a positive update from Piper Sandler. There are also unconfirmed rumors that the company scored a "GPU win" with Amazon Web Services. What's Going On: Piper Sandler analyst Harsh Kumar maintained AMD with an Overweight rating and raised its price target from $125 to $140 following the chipmaker's pre-quarter close call. Kumar highlighted product launches at AMD's "Advancing AI" event last week, noting that the Helios rack announcement is "pivotal" for AMD Instinct growth moving forward. The Piper Sandler analyst is also optimistic that the company's GPU business is trending in the right direction and should see a "snapback" in the fourth quarter after it gets past China-related charges. "We know that AMD's AI business is expected to inflect upward starting 3Q25 and that should offset some of these charges. We are showing growth in our model for the AI business starting Sept 25 quarter," the analyst said in a new note to clients. Kumar also noted that AMD and Amazon.com Inc AMZN appear to be engaged in a strong relationship, with Amazon being a customer at multiple levels. "The relationship spans CPUs + GPUs and Amazon is likely to announce the relationship at its own discretion. There was some speculation about this in the investor community," the Piper Sandler analyst said. The potential expanded relationship with Amazon appears to be the main driver of the strong surge in AMD shares on Monday. CNBC's David Faber reported on "Squawk On The Street" that the unusual momentum in shares appears to be fueled by an unconfirmed rumor about a GPU deal between the two companies. "I am hearing some talk though that involves perhaps a GPU win for AMD from AWS," Faber said Monday morning on the show. Amazon disclosed in a regulatory filing last month that it acquired an $84.4 million stake in AMD after the chipmaker acquired server manufacturer ZT Group International, which Amazon held a stake in. In connection with the takeover deal, AMD issued shares to ZT Group shareholders, including Amazon. AMD Price Action: AMD shares were up 9.44% at $127.04 at the time of publication Monday, according to Benzinga Pro. Read Next: Wall Street Roars Back As Iran Signals De-Escalation: Nasdaq 100 Nears All-Time High Taiwan Semiconductor Eyes Rollout Of 2nm Advanced Tech Chips This Year Photo: courtesy of AMD. AMDAdvanced Micro Devices Inc$126.929.26%Stock Score Locked: Edge Members Only Benzinga Rankings give you vital metrics on any stock - anytime. Unlock RankingsEdge RankingsMomentum23.00Growth97.05Quality76.08Value16.13Price TrendShortMediumLongOverviewAMZNAmazon.com Inc$215.571.64%Market News and Data brought to you by Benzinga APIs

[6]

Why Advanced Micro Devices Rallied Today | The Motley Fool

AMD made some big product announcements last week, especially around AI. Today, a Wall Street analyst wrote his positive conclusion on the event, and revealed some positive industry data in the PC space, too. Last week's big event centered on AMD's new Instinct MI350 accelerators, and upcoming MI400 "Helios" racks, which will be available next year. But one sell-side analyst also sees some optimistic signs in AMD's client business, which led to a price target bump today. On Monday, Piper Sandler semiconductor analyst Harsh Kumar noted he is seeing some "pull-ins" in the client space, which used to be AMD's largest, but is now its second largest after data centers. The PC has been mired in somewhat of a downturn for a few years now, but a combination of aging pandemic-era PCs, new AI PC capabilities, pull-ins ahead of potential further tariffs, and the coming phaseout of the Windows 10 operating system may be spurring a nice refresh cycle. In addition, some investors were worried about the sequential decrease in AMD's data center and GPU revenue last quarter, where AMD hopes to compete more effectively against Nvidia. However, in the note today, Kumar also noted he sees a "snap-back" in that area, in the second half of the year, based on the new Instinct MI350 chips, which will be available in the second half of 2025, and "Helios" rack-scale systems, which will become available in the latter part of 2025. As a result, Kumar raised his price target on AMD to $140, up from $125. There are a lot of questions surrounding AMD at this moment, namely whether there is a place for its Instinct AI accelerators in the AI world where Nvidia currently dominates, and large cloud companies are all now building more custom AI silicon themselves. However, it appears as though last week's product even was encouraging on that front, and that AMD's AI design progress and acquisitions are beginning to garner enthusiasm among the analyst community.

[7]

AMD: Is the Stock Ready for Repricing as AI Revenue Forecasts Climb? | Investing.com UK

AMD (NASDAQ:AMD) shares surged 5.08% to $122.09 following Cantor Fitzgerald's analyst C.J. Muse raising the price target to $140 from $120 while maintaining an Overweight rating. The upgrade comes ahead of AMD's pivotal "Advancing AI 2025" event featuring CEO Dr. Lisa Su, where the company is expected to showcase its latest AI chip developments and strategic roadmap. Cantor Fitzgerald's price target increase to $140 reflects growing confidence in AMD's AI strategy, particularly around the anticipated MI350 production acceleration to mid-2025 and updates on the MI400 series roadmap. The firm suggests their current 2026 EPS estimate of $5.30 may be conservative, with a more reasonable range of $5.50-$5.75 supporting the $140 fair value based on a 25x multiple. The upgrade comes as AMD trades at $122.20 with a market cap of $198.135B, showing strong momentum after impressive 21.71% revenue growth over the last twelve months and 23% forecasted growth for the upcoming fiscal year. The upcoming "Advancing AI 2025" event represents a critical inflection point, with AMD expected to announce new design wins for 2026 and provide commentary on its comprehensive AI solution framework. The company's AI Total Addressable Market (TAM) projections could extend to 2029-2030 with estimates approaching $600 billion, positioning AMD to capture significant market share from NVIDIA's dominant position. Cantor Fitzgerald sees potential for $25-50 billion in GPU Accelerator revenues, which could translate to annual EPS exceeding $10, assuming a 5-10% market share of the $500 billion TAM. The analyst maintains that 2025 may be transitional, with attention shifting to AMD's market share gains during the MI400 product cycle. AMD's financial metrics support the bullish outlook, with the company maintaining a strong balance sheet including $7.31B in cash, a healthy current ratio of 2.8, and gross profit margins of 53.58%. Despite trading at a premium P/E ratio of 89.20, the company's forward P/E of 29.15 and PEG ratio of 0.59 suggest reasonable valuation given growth prospects. With analyst price targets ranging from $95-$200 and an average of $128.29, AMD appears positioned to benefit from the expanding AI infrastructure market while competing against NVIDIA's 92% GPU market share dominance. The stock's YTD return of 1.17% trails the broader semiconductor rally, but recent analyst upgrades from multiple firms, including Wells Fargo (NYSE:WFC) and Stifel, indicate growing institutional confidence. *** Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult our website policy prior to making financial decisions.

[8]

<article> By Investing.com

On Monday, Citi analysts raised their price target for Advanced Micro Devices (NASDAQ:AMD) to $120.00, an increase from the previous target of $100.00. The firm maintained its Neutral rating on the company's shares. Currently trading at $116.19 with a market capitalization of $188.39 billion, AMD shows strong momentum with notable returns over recent months, according to InvestingPro data. The stock is currently trading near its Fair Value. The adjustment comes ahead of AMD's "Advancing AI" day, which is scheduled for June 12th. Citi analysts expect AMD to launch its latest AI product, MI355X, and discuss its upcoming MI400 product at the event. The firm also anticipates that AMD could highlight new customers, potentially including AWS or OpenAI. With impressive revenue growth of 21.71% and a P/E ratio of 85.14, AMD continues to demonstrate strong market positioning. InvestingPro subscribers have access to 15+ additional exclusive insights about AMD's financial health and growth prospects. In their commentary, Citi analysts noted a factor influencing their model. "We are adjusting our model for a one-time charge of $800.0 million due to China export controls and reiterate our Neutral rating," the firm stated. Despite this adjustment, AMD maintains strong fundamentals with a healthy current ratio of 2.8 and operates with moderate debt levels. In other recent news, AMD announced the sale of ZT Systems' manufacturing operations to Sanmina for approximately $3.0 billion, comprising $2.4 billion in cash, $150 million in stock, and a $450 million contingent payment. This transaction is part of AMD's strategy to focus on AI infrastructure, retaining the 1,200-strong engineering team from ZT Systems to enhance its competitive edge in this sector. The sale aligns with AMD's broader goals, including a strategic partnership with Sanmina to introduce new products related to AMD's cloud rack and cluster-scale AI solutions. Analysts have responded to these developments with varied perspectives. Wells Fargo (NYSE:WFC) maintains an Overweight rating with a $120 price target, while Citi holds a Neutral stance with a $100 target, reflecting differing views on AMD's valuation and strategy. Stifel, on the other hand, reiterated a Buy rating with a $132 target, emphasizing AMD's potential in the AI infrastructure market. Mizuho also raised its price target to $135, citing AMD's AI growth prospects and strategic partnerships as key factors. These recent moves and analyst ratings underscore AMD's focus on innovation and strategic positioning in the evolving tech landscape.

Share

Share

Copy Link

AMD's stock price soars following the unveiling of new AI chips and rumors of a partnership with Amazon Web Services, signaling the company's growing presence in the AI market.

AMD Unveils Next-Generation AI Chips

Advanced Micro Devices (AMD) has made a significant splash in the AI chip market with the announcement of its next-generation AI chips, the Instinct MI400 series. The company also revealed a full-server rack called Helios, designed to connect thousands of these chips for high-performance AI computing

1

. This move positions AMD as a serious contender in the AI hardware space, challenging industry leader Nvidia.

Source: CNBC

Stock Market Reaction and Analyst Optimism

Following the announcement, AMD's stock price surged by nearly 10%, reaching its highest level since January

1

. The positive market reaction was further bolstered by analysts' optimistic outlook:- Piper Sandler raised its price target for AMD from $125 to $140, maintaining an "overweight" rating

2

. - Citigroup maintained its "Buy" rating and increased its price target from $100 to $120

4

. - Bank of America maintained a "buy" rating with a price target of $130

2

.

Analysts are particularly enthused about the Helios rack architecture, which they believe is pivotal for the growth of AMD's Instinct GPUs

2

.Potential Partnership with Amazon Web Services

Adding to the excitement, there are unconfirmed rumors of a potential partnership between AMD and Amazon Web Services (AWS). CNBC's David Faber reported on speculation about a possible "GPU win" for AMD from AWS

5

. This rumor gained traction after it was noted that AWS was a key sponsor for AMD's recent "Advancing AI" event2

.Related Stories

AMD's AI Strategy and Market Position

AMD CEO Lisa Su presented the company's AI vision alongside industry luminaries, including OpenAI CEO Sam Altman

1

. The company's strategy includes:- Focusing on scalability and cost efficiency in AI computing

3

. - Developing open-source AI platforms to compete with established players

3

. - Strategic acquisitions to enhance software capabilities, such as the recent purchase of Brium, an AI software and compiler team

4

.

While AMD still trails Nvidia in AI chip market share, its newer products are gaining traction in major server systems

3

.

Source: Motley Fool

Challenges and Future Outlook

Despite the positive momentum, AMD faces some challenges:

- U.S. chip export rules could potentially cut up to $800 million from future revenue, affecting margins in Q2 and Q3

3

. - The company needs to prove it can execute on its ambitious AI plans in the coming quarters

3

.

However, with its product roadmap, analyst upgrades, and strong investor interest, AMD appears well-positioned for long-term AI growth

3

. The market will be closely watching AMD's performance in the highly competitive AI chip sector, especially as it aims to launch its MI350 series in 2025 and the advanced MI400 chips in 20263

5

.

Source: Investopedia

As the AI hardware race intensifies, AMD's recent announcements and potential partnerships signal its commitment to becoming a major player in the AI chip market, offering investors and industry watchers an exciting alternative in the rapidly evolving landscape of AI technology.

References

Summarized by

Navi

[3]

[4]

Related Stories

AMD's AI Chip Momentum Drives Stock to New Heights Amid Market Optimism

23 Jul 2025•Business and Economy

AMD Targets $100 Billion Data Center Revenue by 2030 as AI Demand Surges

12 Nov 2025•Business and Economy

AMD Reports Strong Q2 Revenue Despite AI Chip Export Restrictions to China

06 Aug 2025•Technology

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

Anthropic takes Pentagon to court over unprecedented supply chain risk designation

Policy and Regulation

3

Meta smart glasses face lawsuit and UK probe after workers watched intimate user footage

Policy and Regulation