AMD stock surges on AI partnerships, data center momentum, and mass-market AI PC push

2 Sources

2 Sources

[1]

What's Going On With Advanced Micro Devices Stock Friday? - Advanced Micro Devices (NASDAQ:AMD)

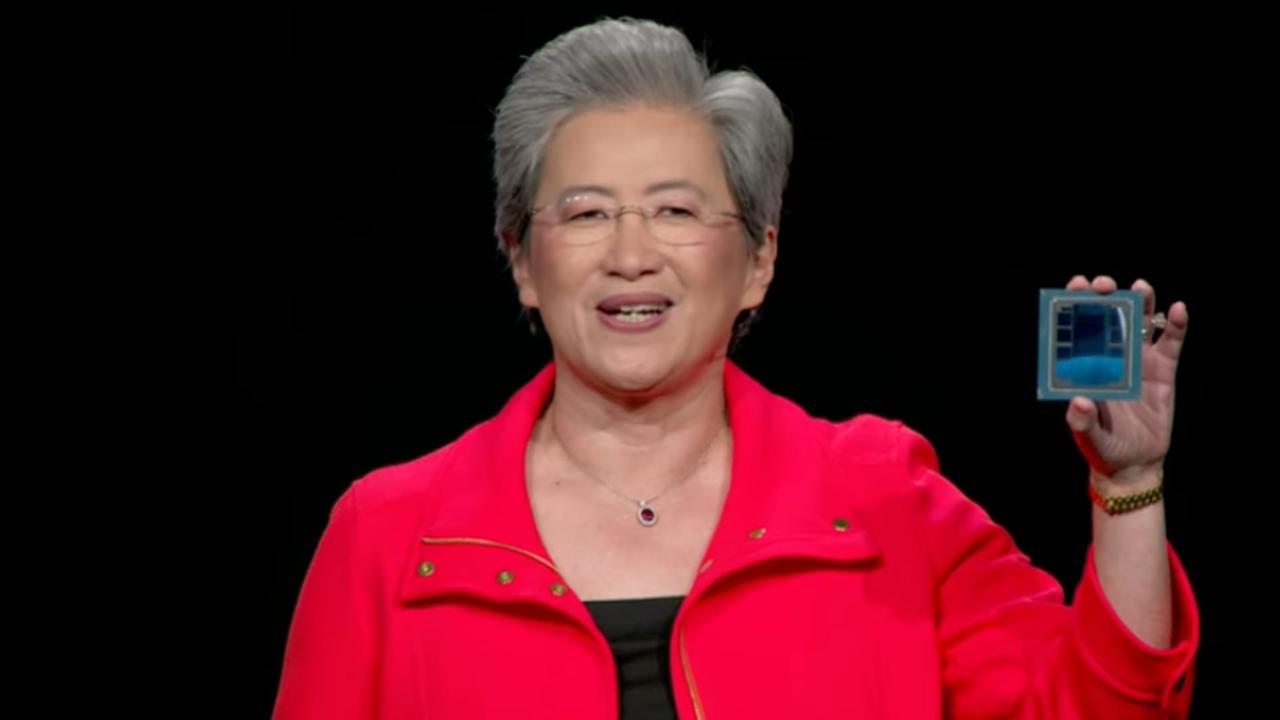

Advanced Micro Devices, Inc. (NASDAQ:AMD) stock rose on Friday as investors assessed the company's artificial intelligence prospects in both data centers and personal computers, even as Nvidia Corp. (NASDAQ:NVDA) continues to dominate next-generation AI infrastructure. TrendForce analyst Frank Kung said Nvidia's GB300 platform is on track to anchor most global AI data centers in 2026, accounting for an estimated 70% to 80% of worldwide AI server rack shipments. AMD continues to feature prominently in the competitive landscape with its MI400 accelerators, which analysts expect to be shipped alongside Nvidia systems as aggregate AI server volumes increase. AMD Targets Mass-Market AI PCs After CES 2026 AMD is positioning itself for the next phase of AI-driven growth by pushing artificial intelligence into mainstream PCs, while relying on its data center business for longer-term momentum, according to Counterpoint Research. The company used CES 2026 to pivot from proof-of-concept demos to mass-market execution, aiming to scale AI features across affordable consumer and commercial PCs, as per the firm. Major manufacturers, including Dell Technologies Inc. (NYSE:DELL) and HP Inc. (NYSE:HPQ), plan to launch AMD-powered AI PCs in early 2026, with entry-level pricing starting at around $499. Counterpoint noted that AMD is emphasizing practical use cases such as productivity, gaming, and creative workloads, a strategy that could help spark a new PC upgrade cycle, particularly in desktops. Data Centers Remain Core Growth Driver Counterpoint also highlighted AMD's data center segment as its primary growth engine. Strong hyperscaler demand, tight supply conditions, and rising server CPU adoption are expected to support earnings. At the same time, platform initiatives like Helios could further strengthen AMD's role in AI infrastructure without directly displacing Nvidia. AMD shares were largely unaffected by Intel Corp.'s (NASDAQ:INTC) quarterly results, which sent Intel stock lower. Intel reported fourth-quarter revenue of $13.67 billion, beating estimates of $13.37 billion, while adjusted earnings of 15 cents per share exceeded expectations. However, revenue declined 4% year over year, and the company guided to breakeven earnings in the first quarter. AMD Price Action: Advanced Micro Devices shares were up 3.73% at $263.20 at the time of publication on Friday. The stock is trading near its 52-week high of $267.07, according to Benzinga Pro data. Image via Shutterstock AMDAdvanced Micro Devices Inc $264.404.21% Overview DELLDell Technologies Inc $114.96-1.89% HPQHP Inc $19.41-2.09% INTCIntel Corp $45.77-15.7% NVDANVIDIA Corp $187.821.61% Market News and Data brought to you by Benzinga APIs

[2]

AMD Leads Chip Stock Rally as AI Partnerships and Server Demand Accelerate

Data Center CPUs, AI Accelerators, and CES 2026 Products Broaden Catalysts Investors also focused on AMD's core server central processing unit (CPU) business, where analysts cited momentum for EPYC 'Turin' processors. The commentary linked among cloud providers and enterprise customers to ongoing manufacturing and execution challenges at Intel (INTC). KeyBanc's Vinh said robust demand for Turin data center CPUs could support an earnings beat when AMD reports fourth-quarter results on February 3. He also said AMD may be nearly sold out of server CPUs for 2026, a dynamic that could enable price increases of as much as 15%. Meanwhile, AI infrastructure demand helped lift sentiment across after comments from NVIDIA (NVDA) Chief Executive Officer Jensen Huang at the World Economic Forum (WEF) in Davos. Huang told BlackRock (BLK) Chief Executive Officer Larry Fink that the AI boom has driven the "largest infrastructure buildout in history," and he said trillions of dollars still need to be built. Meanwhile, the rally also followed a new focus on AMD's large AI partnerships. OpenAI plans to deploy AMD graphics processing units (GPUs) to support up to 6 gigawatts of computing capacity for ChatGPT and future models announced later in 2025. Oracle (ORCL) disclosed plans to build AI 'superclusters' using about 50,000 Instinct MI450 GPUs. Furthermore, AMD added a PC Catalyst at , where it unveiled the Ryzen AI 400 Series for 'AI PC' designs. Major original equipment manufacturers (OEMs), including Acer, ASUS, and Dell, plan to ship systems in the first quarter of 2026, supporting an AI PC upgrade cycle narrative even as broader PC demand moderates. Looking ahead, attention now turns to AMD's Feb. 3 earnings report for fourth-quarter 2025 results.

Share

Share

Copy Link

Advanced Micro Devices shares climbed 3.73% to $263.20 as investors responded to expanding AI partnerships and accelerating data center demand. OpenAI plans to deploy AMD GPUs for up to 6 gigawatts of computing capacity, while Oracle will build AI superclusters using 50,000 Instinct MI450 GPUs. The company is also targeting mass-market AI PCs with Dell and HP launching systems starting at $499 in early 2026.

Advanced Micro Devices Stock Rally Reflects Broadening AI Strategy

Advanced Micro Devices shares rose 3.73% to $263.20 on Friday, trading near its 52-week high of $267.07, as investor confidence strengthened around the company's expanding role in artificial intelligence across multiple fronts

1

. The stock rally came as analysts highlighted momentum in both data centers and consumer markets, positioning AMD to capture growth across the AI value chain even as Nvidia continues to dominate next-generation AI infrastructure2

.

Source: Analytics Insight

Major AI Partnerships Drive Computing Capacity Expansion

The surge in investor confidence followed revelations of significant AI partnerships that underscore AMD's growing presence in large-scale artificial intelligence deployments. OpenAI announced plans to deploy AMD graphics processing units (GPUs) to support up to 6 gigawatts of computing capacity for ChatGPT and future models expected later in 2025

2

. Oracle disclosed plans to build AI superclusters using approximately 50,000 Instinct MI450 GPUs, representing one of the largest single commitments to AMD's AI accelerators2

. These partnerships validate AMD's MI400 accelerators, which analysts expect to be shipped alongside Nvidia systems as aggregate AI server volumes increase1

.Data Center Business Anchors Growth with Strong Server Demand

Counterpoint Research identified AMD's data center business as its primary growth driver, supported by strong hyperscaler demand, tight supply conditions, and rising server CPU adoption

1

. KeyBanc analyst Vinh noted robust demand for EPYC 'Turin' processors among cloud providers and enterprise customers, momentum linked to ongoing manufacturing and execution challenges at Intel2

. Vinh suggested AMD may be nearly sold out of server CPUs for 2026, a dynamic that could enable price increases of as much as 15%2

. Platform initiatives like Helios could further strengthen AMD's role in AI infrastructure without directly displacing Nvidia1

.Related Stories

AI PCs Target Mass Market with $499 Entry Point

AMD used CES 2026 to pivot from proof-of-concept demonstrations to mass-market execution, unveiling the Ryzen AI 400 Series for AI PC designs

1

. Major OEMs including Dell, HP, Acer, and ASUS plan to launch AMD-powered AI PCs in early 2026, with entry-level pricing starting at around $4991

2

. AMD is emphasizing practical use cases such as productivity, gaming, and creative workloads, a strategy that could help spark a PC upgrade cycle, particularly in desktops, according to Counterpoint1

. This approach aims to scale artificial intelligence features across affordable consumer and commercial PCs, supporting an AI PC upgrade cycle narrative even as broader PC demand moderates2

.Earnings Expectations Build Ahead of February 3 Report

Attention now turns to AMD's February 3 earnings report for fourth-quarter 2025 results, with KeyBanc suggesting robust demand for Turin data center CPUs could support an earnings beat

2

. The optimistic outlook comes as broader AI infrastructure demand lifted sentiment across the sector following comments from Nvidia Chief Executive Officer Jensen Huang at the World Economic Forum in Davos, where he described the AI boom as driving the "largest infrastructure buildout in history" with trillions of dollars still needing to be invested2

. TrendForce analyst Frank Kung noted that while Nvidia's GB300 platform is on track to anchor most global AI data centers in 2026, accounting for an estimated 70% to 80% of worldwide AI server rack shipments, AMD continues to feature prominently in the competitive landscape1

.References

Summarized by

Navi

[1]

[2]

Related Stories

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology