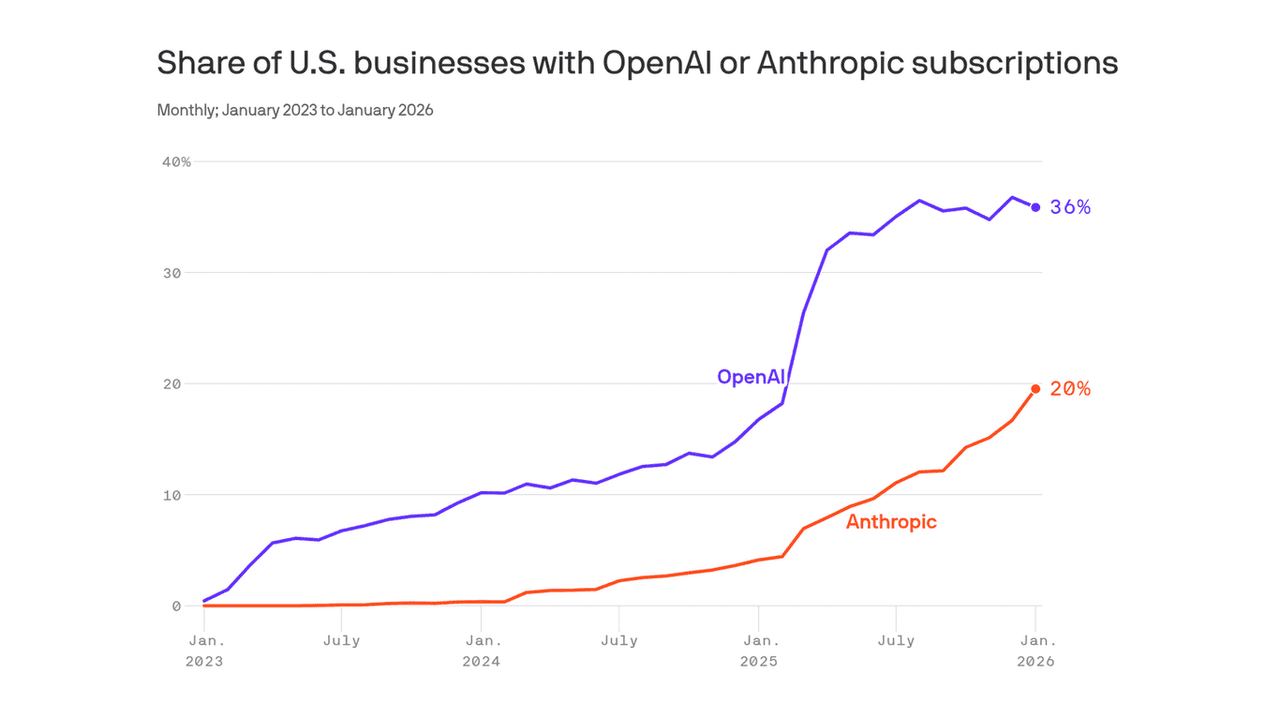

Anthropic captures 20% of business market as AI adoption accelerates to new highs

2 Sources

2 Sources

[1]

Here's why Anthropic just had a breakout month

Why it matters: It was Anthropic's breakthrough month, writes Ara Kharazian, an economist at Ramp, which has been tracking business spending on AI. By the numbers: The share of companies paying for Anthropic increased to 20% from 17%, per Ramp, a company that offers corporate credit cards and expense-management tools to roughly 50,000 companies nationwide. * OpenAI dropped slightly from 37% to 36%. * One in five businesses that use Ramp now pay for Anthropic, up from one in 25 last year. The big picture: The competition between Anthropic and OpenAI is shaping up to be the Kendrick vs. Drake tech battle of our time. * It's not a zero-sum game in either realm. You can enjoy listening to "Not Like Us" and "God's Plan." Similarly, companies appear willing to pay for both companies' tools. * Anthropic isn't gaining users at OpenAI's expense -- at least so far, per the report. According to Ramp, about 79% of OpenAI users also pay for Anthropic. Between the lines: Anthropic's new software coding product, which went viral earlier this year, helped drive adoption. Yes, but: The Ramp data doesn't take into account workers inside companies who are using free AI tools -- which would skew the numbers more in OpenAI's favor, as ChatGPT remains the leader for consumers overall. * And Ramp's data skews toward more tech-forward early adopter type companies; not the full breadth of the business sector. * A December 2025 report from Menlo Ventures found that Anthropic captures 40% of enterprise LLM spend -- up from 24%, while OpenAI's share fell to 27%, down from 50%. But the data looked only at API usage (not chatbot sessions or consumer subscriptions). * Zoom out: Adoption is happening crazy fast: Nearly 47% of businesses paid for AI in January, a new high. In 2023, that number was less than 7%. The bottom line: "The race isn't zero-sum," says Ramp economist Ara Kharazian in a release Wednesday. "At least not yet."

[2]

This Major OpenAI Rival Is Surging, and There's a Surprising Reason Why

According to a monthly update to Ramp's AI Index, which measures data from over 50,000 of the company's U.S.-based business customers, 46.8 percent of businesses are currently paying for access to AI tools, and Anthropic's Claude is the fastest-growing tool of all. The company says that one in five U.S. businesses on Ramp now pays for Anthropic, up from one in 25 just a year ago. In the month of January alone, Ramp reported, Anthropic use rose from 16.7 to 19.5 percent of measured businesses. Over that same period, OpenAI's market share actually decreased slightly, from 36.8 to 35.9 percent. The natural takeaway might be that Anthropic is growing at the expense of OpenAI, but "so far," according to Ramp economist Ara Kharazian, "we're not seeing that." Kharazian says that OpenAI and Anthropic have nearly identical churn rates, with roughly 4 percent of users at both companies cancelling subscriptions each month. "If businesses were switching from OpenAI to Anthropic, you'd see that in OpenAI's churn," he wrote. "You don't."

Share

Share

Copy Link

Anthropic reached a milestone in January, with one in five U.S. businesses now paying for its AI tools—up from one in 25 last year. The surge positions Anthropic as the fastest-growing AI tool while OpenAI maintains its lead at 36%. But this isn't a zero-sum game: 79% of OpenAI users also pay for Anthropic, suggesting businesses are willing to invest in multiple AI platforms as overall adoption reaches 47%.

Anthropic Achieves Breakthrough Month with Rapid Business Growth

Anthropic marked January as its breakthrough month, with the share of companies paying for its AI tools climbing to 20% from 17%, according to data from the Ramp AI Index

1

. The report, which tracks business spending across roughly 50,000 U.S. companies using Ramp's corporate credit cards and expense-management tools, reveals that one in five businesses on the platform now pays for Anthropic—a dramatic increase from one in 25 just a year ago2

. This surge establishes Anthropic as the fastest-growing AI tool in the enterprise market, even as OpenAI rival dynamics intensify.

Source: Axios

OpenAI Maintains Lead Despite Slight Dip in Market Share

While Anthropic business adoption accelerated, OpenAI experienced a modest decline, dropping from 37% to 36% of businesses adopting AI tools

1

. However, OpenAI maintains its position as the market leader. The competition between these two companies is shaping up to be one of the defining tech rivalries of this era, yet the data suggests this isn't a zero-sum game. According to Ramp economist Ara Kharazian, roughly 79% of OpenAI users also pay for Anthropic1

, indicating that businesses adopting AI tools are willing to invest in multiple platforms simultaneously rather than choosing one over the other.

Source: Inc.

User Churn Rates Reveal Non-Competitive Growth Pattern

The relationship between Anthropic and OpenAI appears more complementary than competitive when examining user churn rates. Both companies maintain nearly identical churn rates, with roughly 4% of users at each platform cancelling subscriptions each month

2

. "If businesses were switching from OpenAI to Anthropic, you'd see that in OpenAI's churn," Kharazian explained. "You don't"2

. This pattern suggests Anthropic is expanding the overall market rather than cannibalizing OpenAI's customer base, though Kharazian cautions that "the race isn't zero-sum—at least not yet"1

.Related Stories

AI Adoption Reaches Historic Levels Across Business Sector

The broader picture shows AI adoption accelerating at unprecedented rates. Nearly 47% of businesses paid for AI in January, representing a new high and a dramatic increase from less than 7% in 2023

1

. This explosive growth in businesses adopting AI tools reflects how quickly artificial intelligence has moved from experimental technology to essential business infrastructure. Anthropic's viral software coding product Claude, which gained significant traction earlier this year, helped drive this adoption surge1

.Enterprise LLM Spend Shows Different Distribution Pattern

While the Ramp data provides valuable insights into AI market share, other measurements paint a slightly different picture of enterprise LLM spend. A December 2025 report from Menlo Ventures found that Anthropic captures 40% of enterprise LLM spend—up from 24%—while OpenAI's share fell to 27%, down from 50%

1

. However, that data focused exclusively on API usage rather than chatbot sessions or consumer subscriptions, highlighting how different metrics can yield varying perspectives on market dynamics. Additionally, Ramp's data doesn't account for workers using free AI tools, which would likely skew numbers more favorably toward OpenAI, as ChatGPT remains the consumer leader1

. The Ramp dataset also tends toward tech-forward early adopter companies rather than representing the full breadth of the business sector1

.References

Summarized by

Navi

Related Stories

OpenAI vs Anthropic: Diverging Strategies in the AI Race

28 Oct 2025•Technology

Anthropic doubles funding target to $20B as enterprise AI revenue surges toward $18B in 2026

27 Jan 2026•Business and Economy

OpenAI and Anthropic intensify enterprise AI push as business customers become primary revenue focus

21 Jan 2026•Business and Economy

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Microsoft AI chief predicts artificial intelligence will automate most white-collar jobs in 18 months

Business and Economy

3

Anthropic and Pentagon clash over AI safeguards as $200 million contract hangs in balance

Policy and Regulation