Anthropic Embeds Claude AI Directly Into Microsoft Excel, Targeting Financial Services Market

7 Sources

7 Sources

[1]

Claude can integrate with Excel now - plus 7 other new connectors

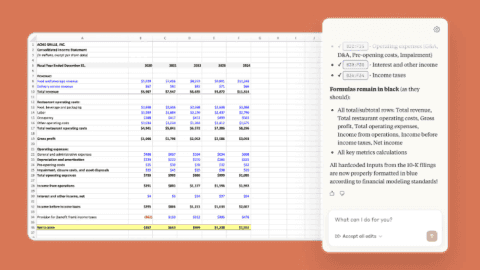

AI is playing an increasingly central role in the financial sector. Anthropic is ramping up its efforts to court new customers in the finance sector with a suite of upgrades for Claude, including an integration with Microsoft Excel, seven new market data connectors, and six new Agent Skills. The upgrades arrive at a time when Anthropic is leaning more heavily into its partnership with Microsoft, and when the finance sector is being reshaped by the ongoing rise of generative AI tools. Here's what's new, and what each upgrade can do. Anthropic announced Monday that Claude can now be integrated directly with Microsoft Excel, allowing users to interact with it via a sidebar that appears on an open spreadsheet (like Clippy -- RIP -- just a little smarter). For example, users can prompt the chatbot to answer questions about spreadsheet data, modify them while preserving the overall structure, or create entirely new spreadsheets. Also: AI will boost the value of human creativity in financial services, says AWS The Excel integration builds on a partnership between Anthropic and Microsoft that was first reported last month. Microsoft has since embedded Anthropic's AI models across its Microsoft 365 suite and into its Copilot AI assistant. Claude for Excel is available now as a preview to paid users of Anthropic's Max, Enterprise, and Teams subscription tiers. Each of Claude's seven new connectors directly links the chatbot with a financial services platform, allowing the chatbot to pull data from them in real time. Also: AI just passed a brutal finance exam most humans fail - should analysts be worried? A new connector with the financial research platform Aiera, for example, gives Claude access to transcripts of company earnings calls, summaries of investor meetings, and other breaking financial documents. Another one with financial news website MT Newswires keeps the chatbot up to date on the latest market news. Google announced a similar update in August, fusing a chatbot and live market updates into its Finance platform. The other connectors link to credit reporting agency Moody's, the London Stock Exchange Group (LSEG), cloud security platform Egnyte, portfolio monitoring software company Chronograph, and global investment research firm Third Bridge (via the Aiera connector). In addition to being able to pull real-time data via the seven new connectors, Claude also now has six new finance Skills. The company debuted Agent Skills for Claude -- or simply "Skills" -- earlier this month. These are customizable folders of preset instructions that shape Claude's performance on a given task, such as drafting a document that aligns with a company's brand voice. They're designed to make the chatbot more personalizable and useful: less of a general assistant, more of a digital employee that understands a particular business's policies and procedures. Also: How AI can help you manage your finances (and what to watch out for) The six new Skills share that goal, with a focus on financial research. The new earnings analysis Skill, for example, takes a company's quarterly transcripts and financial data and turns them into digestible reports, including statements from executives and strategic recommendations. The other Skills include analyzing comparable companies, modeling discounted cash flow, processing data room documents, generating company profiles for pitchbooks and buyer lists, and initiating reports covering companies' financial performance. Want more stories about AI? Sign up for AI Leaderboard, our weekly newsletter. Like the Excel integration, Skills are available now as a research preview to paid users of Anthropic's Max, Enterprise, and Teams subscription tiers. Algorithms have long been used on Wall Street and throughout the financial sector to analyze and predict convoluted market trends. But the use of AI has been growing over recent years with the rise of chatbots like ChatGPT, Gemini, and Claude, which are trained to detect subtle mathematical patterns across enormous troves of data. A study published last month found that some industry-leading AI models were able to pass the Chartered Financial Analyst Level III exam, widely viewed as the finance sector's most difficult aptitude test, suggesting that such tools could soon take over some of the more routine aspects of roles like financial planning and portfolio management. Also: Fighting AI with AI, finance firms prevented $5 million in fraud - but at what cost? Meanwhile, generative AI deepfakes and other forms of scamartistry have led to new opportunities for financial fraudsters -- along with new possibilities for financial firms to protect themselves from such attacks.

[2]

Anthropic's Claude is learning Excel so you don't have to

Good luck to the 1,000 enterprise guinea pigs on the initial preview Anthropic has opened a waitlist for Claude for Excel, promising spreadsheet devotees that its LLM will be able to understand their entire workbook. Forty years since its launch, Excel is the productivity app that keeps the world ticking over, or the office cockroach that just won't die, depending on your point of view. According to research by Acuity Training, two-thirds of all office workers use Excel at least once an hour, while over a third of total office worker time is spent on Excel. Many of the "models" that financial whizzes rely on - and blithely refer to during earnings calls or presentations - are really nothing more than sophisticated spreadsheets. So what better way for Anthropic to embed AI into corporate workflows than to take them over cell-by-cell? Though that won't happen overnight. Anthropic's initial preview will be limited to a waitlist of 1,000 Max, Team, and Enterprise customers. This will be gradually expanded as "we build confidence through this limited preview." In a statement, Anthropic said that Claude for Excel will allow users to "work directly with Claude in a sidebar in Microsoft Excel, where Claude can read, analyze, modify, and create new Excel workbooks." It promised that "Claude listens carefully, follows instructions precisely, and thinks through complex problems." More practically, it said Excel users will be able to ask the LLM about specific formulas or worksheets, with "cell-level citations so you can verify the logic." Users will be able to "debug and fix errors" and create draft models from scratch or "populate existing templates with fresh data while maintaining all formulas and structure." The preview version won't have "advanced Excel capabilities" such as pivot tables and data validation, or macros and VBA. But Anthropic said "we're working on those features." Meanwhile, the model maker announced a slew of new "connectors" to financial information to give Claude access to real-time data. These include access to live market data via LSEG, as well as Moody's, and MT Newswires. Earlier this month, it released half a dozen Agent Skills targeted at financial tasks, including company comparisons, discounted cash flow models, and earnings analyses. When it comes to Claude for Excel, the LLM vendor's FAQs promise that it is trained to "recognize common financial modelling patterns, formula structures, and industry-standard calculations." Nevertheless, it warns users to "verify outputs match your specific methodologies." They also caution that Claude for Excel will work within an enterprise's existing security frameworks, before warning: "Claude can make mistakes, so you should always review changes before finalizing, especially for client-facing deliverables." Case studies for analytics and automation vendors alike trumpet managers' efforts to get users off Excel and onto something that allows them to standardize models, processes, and data. That's understandable given some of the screw-ups that over-reliance on unwieldy and/or badly managed spreadsheets has caused. Earlier this year, it emerged that New Zealand was managing its entire public health system via a single spreadsheet. This contributed to concerns about the organization's ability to track its true financial position. A review noted, among other things, that the system was "highly prone to human error, such as accidental typing of a number or omission of a zero." Back in 2023, recruitment of trainee anesthetists across England and Wales was plunged into confusion thanks to a complex and muddled approach to using spreadsheets. Meanwhile, the ease with which spreadsheets can be shared - and the potentially disastrous consequences - were highlighted by the UK's Afghan data breach scandal. And there's no shortage of multimillion or even billion-dollar losses in the finance world thanks to fat thumbs, copy and paste errors, and worse in Excel. If Claude was able to spot the outline of a misplaced finger with the potential to tip the world economy into meltdown, that really would be an advance. ®

[3]

Claude joins Excel and suddenly your formulas, errors, and reports change

The AI assistant can fix formulas and generate new sheets in seconds Anthropic has introduced Claude for Excel, a new service allowing users to work with the AI assistant directly within Microsoft's popular spreadsheet software. The new tool lets Claude read and modify workbooks, fix formulas, and create new spreadsheets from within a sidebar. Every action is tracked and explained, enabling users to see the exact cells or formulas referenced in its process. Anthropic says about 1,000 testers will provide feedback before a wider release, and the rollout is a beta research preview for its Max, Enterprise, and Teams users. The tool extends Anthropic's earlier financial services initiatives, which already include connectors to market data providers such as Moody's, LSEG, Egnyte, and Aiera. These connections allow Claude to access live pricing data, earnings transcripts, and credit reports, offering real-time financial context during spreadsheet analysis. The integration brings Claude into the same environment used daily by analysts and accountants, signaling a move toward deeper embedding within existing professional workflows. Several major financial institutions already use Claude in their operations, including AIG, whose early deployment reportedly cut business review timelines by more than 5x while improving data accuracy to over 90%, and Norway's sovereign wealth fund, managed by Norges Bank Investment Management, which recorded roughly 20% productivity gains, equal to 213,000 hours of work saved. These are not pilot projects but large-scale implementations across risk and portfolio departments. Although the figures come from company statements, they point to strong productivity claims in an industry often cautious about adopting new technology. By linking Claude to Excel, Anthropic is entering territory already occupied by Microsoft Copilot. Both systems use AI tools to help users handle complex spreadsheets, but Anthropic's version adds links to specialized financial datasets and workflows. These integrations could make Claude valuable to analysts who depend on precise, up-to-date data. Yet questions remain about how well the assistant will perform in production environments and whether it can earn the same trust as Microsoft's established productivity tools. For now, Claude's arrival shows growing competition over who will shape the next generation of AI-driven finance.

[4]

Anthropic rolls out Claude AI for finance, integrates with Excel to rival Microsoft Copilot

Anthropic is making its most aggressive push yet into the trillion-dollar financial services industry, unveiling a suite of tools that embed its Claude AI assistant directly into Microsoft Excel and connect it to real-time market data from some of the world's most influential financial information providers. The San Francisco-based AI startup announced Monday it is releasing Claude for Excel, allowing financial analysts to interact with the AI system directly within their spreadsheets -- the quintessential tool of modern finance. Beyond Excel, select Claude models are also being made available in Microsoft Copilot Studio and Researcher agent, expanding the integration across Microsoft's enterprise AI ecosystem. The integration marks a significant escalation in Anthropic's campaign to position itself as the AI platform of choice for banks, asset managers, and insurance companies, markets where precision and regulatory compliance matter far more than creative flair. The expansion comes just three months after Anthropic launched its Financial Analysis Solution in July, and it signals the company's determination to capture market share in an industry projected to spend $97 billion on AI by 2027, up from $35 billion in 2023. More importantly, it positions Anthropic to compete directly with Microsoft -- ironically, its partner in this Excel integration -- which has its own Copilot AI assistant embedded across its Office suite, and with OpenAI, which counts Microsoft as its largest investor. Why Excel has become the new battleground for AI in finance The decision to build directly into Excel is hardly accidental. Excel remains the lingua franca of finance, the digital workspace where analysts spend countless hours constructing financial models, running valuations, and stress-testing assumptions. By embedding Claude into this environment, Anthropic is meeting financial professionals exactly where they work rather than asking them to toggle between applications. Claude for Excel allows users to work with the AI in a sidebar where it can read, analyze, modify, and create new Excel workbooks while providing full transparency about the actions it takes by tracking and explaining changes and letting users navigate directly to referenced cells. This transparency feature addresses one of the most persistent anxieties around AI in finance: the "black box" problem. When billions of dollars ride on a financial model's output, analysts need to understand not just the answer but how the AI arrived at it. By showing its work at the cell level, Anthropic is attempting to build the trust necessary for widespread adoption in an industry where careers and fortunes can turn on a misplaced decimal point. The technical implementation is sophisticated. Claude can discuss how spreadsheets work, modify them while preserving formula dependencies -- a notoriously complex task -- debug cell formulas, populate templates with new data, or build entirely new spreadsheets from scratch. This isn't merely a chatbot that answers questions about your data; it's a collaborative tool that can actively manipulate the models that drive investment decisions worth trillions of dollars. How Anthropic is building data moats around its financial AI platform Perhaps more significant than the Excel integration is Anthropic's expansion of its connector ecosystem, which now links Claude to live market data and proprietary research from financial information giants. The company added six major new data partnerships spanning the entire spectrum of financial information that professional investors rely upon. Aiera now provides Claude with real-time earnings call transcripts and summaries of investor events like shareholder meetings, presentations, and conferences. The Aiera connector also enables a data feed from Third Bridge, which gives Claude access to a library of insights interviews, company intelligence, and industry analysis from experts and former executives. Chronograph gives private equity investors operational and financial information for portfolio monitoring and conducting due diligence, including performance metrics, valuations, and fund-level data. Egnyte enables Claude to securely search permitted data for internal data rooms, investment documents, and approved financial models while maintaining governed access controls. LSEG, the London Stock Exchange Group, connects Claude to live market data including fixed income pricing, equities, foreign exchange rates, macroeconomic indicators, and analysts' estimates of other important financial metrics. Moody's provides access to proprietary credit ratings, research, and company data covering ownership, financials, and news on more than 600 million public and private companies, supporting work and research in compliance, credit analysis, and business development. MT Newswires provides Claude with access to the latest global multi-asset class news on financial markets and economies. These partnerships amount to a land grab for the informational infrastructure that powers modern finance. Previously announced in July, Anthropic had already secured integrations with S&P Capital IQ, Daloopa, Morningstar, FactSet, PitchBook, Snowflake, and Databricks. Together, these connectors give Claude access to virtually every category of financial data an analyst might need: fundamental company data, market prices, credit assessments, private company intelligence, alternative data, and breaking news. This matters because the quality of AI outputs depends entirely on the quality of inputs. Generic large language models trained on public internet data simply cannot compete with systems that have direct pipelines to Bloomberg-quality financial information. By securing these partnerships, Anthropic is building moats around its financial services offering that competitors will find difficult to replicate. The strategic calculus here is clear: Anthropic is betting that domain-specific AI systems with privileged access to proprietary data will outcompete general-purpose AI assistants. It's a direct challenge to the "one AI to rule them all" approach favored by some competitors. Pre-configured workflows target the daily grind of Wall Street analysts The third pillar of Anthropic's announcement involves six new "Agent Skills" -- pre-configured workflows for common financial tasks. These skills are Anthropic's attempt to productize the workflows of entry-level and mid-level financial analysts, professionals who spend their days building models, processing due diligence documents, and writing research reports. Anthropic has designed skills specifically to automate these time-consuming tasks. The new skills include building discounted cash flow models complete with full free cash flow projections, weighted average cost of capital calculations, scenario toggles, and sensitivity tables. There's comparable company analysis featuring valuation multiples and operating metrics that can be easily refreshed with updated data. Claude can now process data room documents into Excel spreadsheets populated with financial information, customer lists, and contract terms. It can create company teasers and profiles for pitch books and buyer lists, perform earnings analyses that use quarterly transcripts and financials to extract important metrics, guidance changes, and management commentary, and produce initiating coverage reports with industry analysis, company deep dives, and valuation frameworks. It's worth noting that Anthropic's Sonnet 4.5 model now tops the Finance Agent benchmark from Vals AI at 55.3% accuracy, a metric designed to test AI systems on tasks expected of entry-level financial analysts. A 55% accuracy rate might sound underwhelming, but it is state-of-the-art performance and highlights both the promise and limitations of AI in finance. The technology can clearly handle sophisticated analytical tasks, but it's not yet reliable enough to operate autonomously without human oversight -- a reality that may actually reassure both regulators and the analysts whose jobs might otherwise be at risk. The Agent Skills approach is particularly clever because it packages AI capabilities in terms that financial institutions already understand. Rather than selling generic "AI assistance," Anthropic is offering solutions to specific, well-defined problems: "You need a DCF model? We have a skill for that. You need to analyze earnings calls? We have a skill for that too." Trillion-dollar clients are already seeing massive productivity gains Anthropic's financial services strategy appears to be gaining traction with exactly the kind of marquee clients that matter in enterprise sales. The company counts among its clients AIA Labs at Bridgewater, Commonwealth Bank of Australia, American International Group, and Norges Bank Investment Management -- Norway's $1.6 trillion sovereign wealth fund, one of the world's largest institutional investors. NBIM CEO Nicolai Tangen reported achieving approximately 20% productivity gains, equivalent to 213,000 hours, with portfolio managers and risk departments now able to "seamlessly query our Snowflake data warehouse and analyze earnings calls with unprecedented efficiency." At AIG, CEO Peter Zaffino said the partnership has "compressed the timeline to review business by more than 5x in our early rollouts while simultaneously improving our data accuracy from 75% to over 90%." If these numbers hold across broader deployments, the productivity implications for the financial services industry are staggering. These aren't pilot programs or proof-of-concept deployments; they're production implementations at institutions managing trillions of dollars in assets and making underwriting decisions that affect millions of customers. Their public endorsements provide the social proof that typically drives enterprise adoption in conservative industries. Regulatory uncertainty creates both opportunity and risk for AI deployment Yet Anthropic's financial services ambitions unfold against a backdrop of heightened regulatory scrutiny and shifting enforcement priorities. In 2023, the Consumer Financial Protection Bureau released guidance requiring lenders to "use specific and accurate reasons when taking adverse actions against consumers" involving AI, and issued additional guidance requiring regulated entities to "evaluate their underwriting models for bias" and "evaluate automated collateral-valuation and appraisal processes in ways that minimize bias." However, according to a Brookings Institution analysis, these measures have since been revoked with work stopped or eliminated at the current downsized CFPB under the current administration, creating regulatory uncertainty. The pendulum has swung from the Biden administration's cautious approach, exemplified by an executive order on safe AI development, toward the Trump administration's "America's AI Action Plan," which seeks to "cement U.S. dominance in artificial intelligence" through deregulation. This regulatory flux creates both opportunities and risks. Financial institutions eager to deploy AI now face less prescriptive federal oversight, potentially accelerating adoption. But the absence of clear guardrails also exposes them to potential liability if AI systems produce discriminatory outcomes, particularly in lending and underwriting. The Massachusetts Attorney General recently reached a $2.5 million settlement with student loan company Earnest Operations, alleging that its use of AI models resulted in "disparate impact in approval rates and loan terms, specifically disadvantaging Black and Hispanic applicants." Such cases will likely multiply as AI deployment grows, creating a patchwork of state-level enforcement even as federal oversight recedes. Anthropic appears acutely aware of these risks. In an interview with Banking Dive, Jonathan Pelosi, Anthropic's global head of industry for financial services, emphasized that Claude requires a "human in the loop." The platform, he said, is not intended for autonomous financial decision-making or to provide stock recommendations that users follow blindly. During client onboarding, Pelosi told the publication, Anthropic focuses on training and understanding model limitations, putting guardrails in place so people treat Claude as a helpful technology rather than a replacement for human judgment. Competition heats up as every major tech company targets finance AI Anthropic's financial services push comes as AI competition intensifies across the enterprise. OpenAI, Microsoft, Google, and numerous startups are all vying for position in what may become one of AI's most lucrative verticals. Goldman Sachs introduced a generative AI assistant to its bankers, traders, and asset managers in January, signaling that major banks may build their own capabilities rather than rely exclusively on third-party providers. The emergence of domain-specific AI models like BloombergGPT -- trained specifically on financial data -- suggests the market may fragment between generalized AI assistants and specialized tools. Anthropic's strategy appears to stake out a middle ground: general-purpose models, since Claude was not trained exclusively on financial data, enhanced with financial-specific tooling, data access, and workflows. The company's partnership strategy with implementation consultancies including Deloitte, KPMG, PwC, Slalom, TribeAI, and Turing is equally critical. These firms serve as force multipliers, embedding Anthropic's technology into their own service offerings and providing the change management expertise that financial institutions need to successfully adopt AI at scale. CFOs worry about AI hallucinations and cascading errors The broader question is whether AI tools like Claude will genuinely transform financial services productivity or merely shift work around. The PYMNTS Intelligence report "The Agentic Trust Gap" found that chief financial officers remain hesitant about AI agents, with "nagging concern" about hallucinations where "an AI agent can go off script and expose firms to cascading payment errors and other inaccuracies." "For finance leaders, the message is stark: Harness AI's momentum now, but build the guardrails before the next quarterly call -- or risk owning the fallout," the report warned. A 2025 KPMG report found that 70% of board members have developed responsible use policies for employees, with other popular initiatives including implementing a recognized AI risk and governance framework, developing ethical guidelines and training programs for AI developers, and conducting regular AI use audits. The financial services industry faces a delicate balancing act: move too slowly and risk competitive disadvantage as rivals achieve productivity gains; move too quickly and risk operational failures, regulatory penalties, or reputational damage. Speaking at the Evident AI Symposium in New York last week, Ian Glasner, HSBC's group head of emerging technology, innovation and ventures, struck an optimistic tone about the sector's readiness for AI adoption. "As an industry, we are very well prepared to manage risk," he said, according to CIO Dive. "Let's not overcomplicate this. We just need to be focused on the business use case and the value associated." Anthropic's latest moves suggest the company sees financial services as a beachhead market where AI's value proposition is clear, customers have deep pockets, and the technical requirements play to Claude's strengths in reasoning and accuracy. By building Excel integration, securing data partnerships, and pre-packaging common workflows, Anthropic is reducing the friction that typically slows enterprise AI adoption. The $61.5 billion valuation the company commanded in its March fundraising round -- up from roughly $16 billion a year earlier -- suggests investors believe this strategy will work. But the real test will come as these tools move from pilot programs to production deployments across thousands of analysts and billions of dollars in transactions. Financial services may prove to be AI's most demanding proving ground: an industry where mistakes are costly, regulation is stringent, and trust is everything. If Claude can successfully navigate the spreadsheet cells and data feeds of Wall Street without hallucinating a decimal point in the wrong direction, Anthropic will have accomplished something far more valuable than winning another benchmark test. It will have proven that AI can be trusted with the money.

[5]

Anthropic Brings Claude Inside Excel | AIM

Users of financial services can now also use Microsoft Excel with Claude for easier analysis. Anthropic is deepening its focus on financial services with the launch of Claude for Excel and new real-time data integrations, aiming to streamline financial analysis and modelling. The update expands Claude's role as an AI assistant for financial professionals, particularly those using Microsoft's tools. Currently in beta as a research preview, Claude for Excel lets users interact directly with Claude via a sidebar in Microsoft Excel. The model can read, analyse, and modify workbooks while maintaining transparency by tracking and explaining each change. It also helps with debugging formulas, generating financial models, and building new spreadsheets from scratch, tasks that typically consume hours of analyst time. The Excel integration adds to Anthropic's existing suite of Microsoft collaborations. Within Claude apps, users can already create and edit Excel and PowerPoint files, and search across Microsoft 365, including emails and Teams conversations. Select Claude models are also embedded in Microsoft Copilot Studio and Researcher Agent. Anthropic is inviting 1,000 initial users from Max, Enterprise, and Teams tiers to test the Excel add-in before a wider rollout. Alongside the Excel release, the company is introducing new connectors that allow Claude to access live financial data. These include integrations with Aiera for earnings calls, LSEG for market data, Moody's for credit ratings, and Egnyte for secure document access. Additional sources such as Chronograph, Third Bridge, and MT Newswires enhance Claude's capabilities in portfolio monitoring, valuation, and research. Anthropic has also released six new pre-built Agent Skills designed for finance professionals. These skills help generate discounted cash flow models, conduct due diligence, produce company profiles, and compile initiating coverage reports. The company said these updates build on Sonnet 4.5's state-of-the-art performance in finance benchmarks, scoring 55.3% on the Finance Agent benchmark from Vals AI. With these additions, Claude is positioned to become a more embedded tool for banks, asset managers, and investment firms, assisting across front, middle, and back-office functions.

[6]

Anthropic beefs up Claude for Financial Services

This content has been selected, created and edited by the Finextra editorial team based upon its relevance and interest to our community. Launched over the summer, Claude for Financial Services gives analysts access to the latest Claude 4 models, as well as Claude Code and Claude for Enterprise with expanded usage limits, and implementation support. The technology promises to unify users' financial data -- from market feeds to internal data stored in platforms like Databricks and Snowflake -- into a single interface so that Claude can be used to analyse it. Now it has added more sources of live information, including Aiera, Chronograph, Moody's, Egnyte and MT Newswires. London Stock Exchange operator LSEG connects Claude to live market data, including fixed income pricing, equities, foreign exchange rates, macroeconomic indicators, and analysts' estimates of other important financial metrics. Ron Lefferts, co-head, data and analytics, LSEG, says: "With Claude for Financial Services, our customers can now access LSEG's unmatched financial data and insights to power and scale agentic AI directly within their workflows." Meanwhile, Claude for Excel has been launched in beta as a research preview, allowing users to work directly with Claude in a sidebar in Microsoft Excel, where the AI can read, analyse, modify, and create new workbooks. This means that Claude can discuss how a spreadsheet works, modify it while preserving its structure and formula dependencies, debug and fix cell formulas, populate templates with new data and assumptions, or build new spreadsheets entirely from scratch, says Anthropic. The platform has added new agent skills, including comparable company analysis, discounted cash flow models, due diligence data packs, company teasers and profiles, earnings analyses, and initiating coverage reports.

[7]

Anthropic Debuts Updates to Claude for Financial Services | PYMNTS.com

This update includes an Excel add-in and new connectors to real-time market data and portfolio analytics, as well as new "pre-built Agent Skills" such as building discounted cash flow models and initiating coverage reports, the company wrote in a Monday (Oct. 27) blog post. "Claude is already widely used by leading banking, asset management, insurance and financial technology companies," the post read. "It supports front-office tasks like client experience, middle-office tasks in underwriting, risk and compliance and back-office tasks like code modernization and legacy processes. With ongoing updates to our models and products specific to financial services, we expect Claude to become even better in roles like these." With Claude for Excel, the blog post adds, users can work directly with the artificial intelligence (AI) model in a sidebar in Microsoft Excel, letting Claude read, analyze, modify and create new Excel workbooks. The connectors give Claude direct access to external tools and platforms such as Chronograph for private equity investors, joining existing connections to the likes of S&P Capital IQ, Daloopa, Morningstar and Pitchbook. The new agent skills -- folders featuring instructions, scripts and resources that Claude can use to complete given tasks -- include things like comparable company analysis and discounted cash flow models. Claude for Financial Services is the first industry-specific service that Anthropic has formally introduced, Jonathan "JP" Pelosi, head of FSI at Anthropic, told PYMNTS when the product was unveiled in July. "Where we saw a lot of traction early on was with these high-trust industries," Pelosi said. "Our models, our solutions, are just very well positioned to help these firms." And as PYMNTS noted at the time, the AI industry still has much to provide before chief financial officers (CFOs) grow comfortable with the technology. Research from the PYMNTS Intelligence report "The Agentic Trust Gap: Enterprise CFOs Push Pause on Agentic AI" shows that a persistent concern among CFOs is hallucinations, where an AI agent can go off script and subject firms to cascading payment errors and other inaccuracies. Even as financial services companies recognize that AI offers a speed advantage at a time of tighter spreads and market volatility, they are nonetheless reluctant. "For finance leaders, the message is stark: Harness AI's momentum now, but build the guardrails before the next quarterly call -- or risk owning the fallout," the report said.

Share

Share

Copy Link

Anthropic launches Claude for Excel integration with real-time financial data connectors and specialized Agent Skills, positioning itself to compete directly with Microsoft Copilot in the trillion-dollar financial services sector.

Claude AI Enters the Excel Arena

Anthropic has launched Claude for Excel, embedding its AI assistant directly into Microsoft's ubiquitous spreadsheet software through a sidebar interface that allows users to interact with their data without leaving the familiar Excel environment

1

. The integration represents Anthropic's most aggressive push into the financial services sector, where Excel remains the primary tool for analysts, accountants, and financial professionals worldwide2

.

Source: Finextra Research

The Claude for Excel integration allows users to ask questions about spreadsheet data, modify existing workbooks while preserving formulas and structure, debug errors, and create entirely new spreadsheets from scratch

3

. What sets this apart from typical AI chatbots is its transparency feature - Claude provides cell-level citations, allowing users to verify the logic behind every action and navigate directly to referenced cells4

.Real-Time Financial Data Access

Beyond Excel integration, Anthropic has introduced seven new financial data connectors that provide Claude with real-time access to market information from major financial service providers

1

. The Aiera connector gives Claude access to earnings call transcripts, investor meeting summaries, and insights from Third Bridge's expert interviews5

. The LSEG partnership provides live market data including fixed income pricing, equities, foreign exchange rates, and macroeconomic indicators4

.Additional connectors include Moody's for credit ratings and company data covering over 600 million public and private companies, Egnyte for secure document access in data rooms, Chronograph for portfolio monitoring, and MT Newswires for global financial market news

1

. These integrations transform Claude from a general-purpose AI assistant into a specialized financial research tool with access to the same premium data sources that professional investors rely upon.Specialized Financial Agent Skills

Anthropic has also released six new Agent Skills specifically designed for financial professionals, building on the company's earlier Skills framework that allows for customizable preset instructions

1

. These include earnings analysis capabilities that convert quarterly transcripts and financial data into digestible reports, discounted cash flow modeling, comparable company analysis, data room document processing, company profile generation for pitchbooks, and initiating coverage reports5

.

Source: ZDNet

The Skills are designed to make Claude function less like a general assistant and more like a digital employee that understands specific business policies and procedures

1

. This approach addresses the financial industry's need for AI tools that can handle specialized tasks while maintaining the precision and regulatory compliance standards required in professional finance.Related Stories

Market Competition and Early Results

The Excel integration positions Anthropic in direct competition with Microsoft's own Copilot AI assistant, creating an interesting dynamic where partners become competitors within the same software environment

3

. This competition is playing out in a financial services AI market projected to grow from $35 billion in 2023 to $97 billion by 20274

.Early adopters are already reporting significant productivity gains. AIG has implemented Claude across its operations, reportedly cutting business review timelines by more than 5x while improving data accuracy to over 90%

3

. Norway's sovereign wealth fund, managed by Norges Bank Investment Management, recorded approximately 20% productivity gains, equivalent to 213,000 hours of work saved3

.Limited Preview and Future Expansion

The Claude for Excel integration is currently available as a research preview to a waitlist of 1,000 users from Anthropic's Max, Enterprise, and Teams subscription tiers

2

. The initial version lacks advanced Excel capabilities such as pivot tables, data validation, and VBA macros, though Anthropic indicates these features are in development2

.The company emphasizes that while Claude is trained to recognize common financial modeling patterns and industry-standard calculations, users should always verify outputs match their specific methodologies, particularly for client-facing deliverables

2

. This cautious approach reflects the high-stakes nature of financial modeling, where errors can have significant consequences, as demonstrated by various spreadsheet-related mishaps in finance and government organizations2

.

Source: The Register

References

Summarized by

Navi

[2]

[4]

Related Stories

Claude gains shared context across Excel and PowerPoint with automated one-click skills

11 Mar 2026•Technology

Anthropic Launches Financial Analysis Solution and Analytics Dashboard for Claude Code

15 Jul 2025•Technology

Anthropic's New Claude Feature: Powerful File Creation with Security Concerns

09 Sept 2025•Technology

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

Anthropic sues Pentagon over supply chain risk label after refusing autonomous weapons use

Policy and Regulation

3

OpenAI secures $110 billion funding round as questions swirl around AI bubble and profitability

Business and Economy