Anthropic Launches Financial Analysis Solution and Analytics Dashboard for Claude Code

13 Sources

13 Sources

[1]

Anthropic's Claude dives into financial analysis. Here's what's new

There have been AI solutions galore for coding, writing, and mathematics, but a technical domain equally as challenging that could use AI assistance, yet is often overlooked, is finance -- until now. On Tuesday, Anthropic launched the Financial Analysis Solution, which instantly pulls financial data from different data providers, both market feeds and internal. The Claude 4 models can then use that information to assist with your financial workloads, including everything from market analysis to research and investment decisions. Also: Anthropic's AI agent can now automate Canva, Asana, Figma and more - here's how it works "The Financial Analysis solution is a comprehensive AI solution that really aims at transforming how finance professionals analyze markets, conduct research, and make investment decisions," said Nicholas Lin, head of product, FSI, at Anthropic, to ZDNET. Partnerships with data providers, such as Box, Daloopa, Databricks, FactSet, Morningstar, S&P Global, Snowflake, and Palantir, allow users to pull information from multiple sources into Claude for analysis without having to context switch manually. Also: Claude might be my new favorite AI tool for Android - here's why Claude can then perform tasks using the information and provide direct hyperlinks to the sources of the financial data, which users can check to verify the responses for themselves -- a practice Lin encouraged. "We really do believe that having humans in the loop to understand where the model is producing its responses and getting its data sources is really important," said Lin. "Especially for high-impact and high-stakes use cases like financial services, it is really important for end users to verify that information." The solution builds on Anthropic's existing AI services, including Claude Code, a powerful feature that lets professionals use the coding assistant directly in their workspace to write or manage code, and Claude for Enterprise, Anthropic's enterprise-level plan that offers higher security, with expanded usage limits. Users can also access pre-built MCP connectors for financial data providers, such as FactSet and Pitchbook, to pull in timely external market data. MCP connectors offer users an open standard for securely connecting AI assistants to data systems. Also: What happened when Anthropic's Claude AI ran a small shop for a month (spoiler: it got weird) As financial data is highly sensitive, Anthropic reassures users that the data is not used to train generative models and adheres to the data protection and regulatory compliance required of financial institutions. "From an enterprise-grade security and compliance perspective, we're SOC 2 Type 2 certified, and we do not train our generative models with any of the data from our motion customers," said Lin. Anthropic shares that the use cases for its Financial Analysis Solution span a wide spectrum of tasks, including market research, competitive benchmarking, portfolio analysis, financial modeling, investment memos, pitch decks, and more. "I'm really excited about the ability for Claude to actually start creating work production and outputs for users, so this includes things like creating PowerPoint documents and Excel from scratch," said Lin. Also: How agentic AI is transforming the very foundations of business strategy Lin added that the target audience for this solution at launch is analysts, portfolio managers at hedge funds, private equity analysts, investment banking analysts, and wealth management advisors. Some financial institutions cited as users include AIG, AIA Labs at Bridgewater, Commonwealth Bank of Australia, and NBIM. If you are interested in using the Financial Analysis Solution, you should contact the Anthropic sales team to learn more or schedule a demo. Anthropic said Claude for Enterprise and the Financial Analysis Solution are now available on AWS Marketplace. Also: Claude for Education just got several new integrations for students While Anthropic has an enterprise and education solution for its chatbot, this is the first time that Anthropic has released a domain-specific version of Claude, and, according to Lin, it won't be the last. "At Anthropic, we're really enterprise-focused at heart, and this is our first foray into a specific domain," said Lin. "What interests us in these domains is, fundamentally, we are a research lab at heart, so everything we do needs to push forward, not only the product functionalities, but also the model intelligence."

[2]

Claude Code's new tool is all about maximizing ROI in your organization - how to try it

Anthropic has distinguished itself from industry competitors for two major reasons: user privacy and coding capabilities. In particular, it's Claude Code's solution -- which allows users to run the coding assistant directly in their workspace to write or manage code -- that has attracted an exponential number of users. It's now a highly requested feature. Also: Anthropic's Claude dives into financial analysis. Here's what's new On Tuesday, Anthropic launched a comprehensive analytics dashboard for Claude Code. This dashboard gives enterprise admins greater insight into how their teams are using the AI coding tools, including a breakdown of user activity and cost tracking per user. The analytics dashboard will be enabled by default for all teams using Claude Code on the Anthropic API. Ultimately, this insight should help admins better understand how the tools are being used and, most importantly, how to better determine ROI. Also: Anthropic's free Claude 4 Sonnet aced my coding tests - but its paid Opus model somehow didn't "Obviously, you don't want to spend too much on this solution, and it can be expensive because the model itself is pretty expensive, but at the same, you don't want to make that number too small, because like in some in a lot of ways, I think every dollar into this system, you know, is like more than one dollar out." Other metrics displayed on the dashboard include lines of code accepted, total spend, user activity over time, and suggestion accept rate. These metrics help admins better understand exactly how the tools are being used and how workflows are changing. "It's not about punishing or even rewarding developers based on their productivity. It's more about sharing knowledge and understanding what's working and what might not be working within your engineering department," said Adam Wolff, manager of the Claude Code team, to ZDNET. Also: The best AI for coding in 2025 (including a new winner - and what not to use) Claude Code has been on an upward trajectory, picking up momentum since the launch of the Claude 4 models. Its user base has grown by 300%, and run-rate revenue has grown by more than 5.5x. Anthropic has also continued to roll out releases, with remote MCP support in Claude Code and the inclusion of Claude Code AI in its $20‑a‑month Pro plan.

[3]

OpenAI Rival Anthropic Courts Finance Industry With New AI Tools

Artificial intelligence startup Anthropic is launching a package of new software services aimed at streamlining work for financial analysts, joining a growing number of AI companies vying to win business from Wall Street professionals. The new offering, called Claude for Financial Services, is designed to help analysts conduct market research, handle due diligence and make investment decisions, Anthropic said on Tuesday. The product pairs Anthropic's core enterprise and coding AI tools with information from third-party financial data providers, including FactSet, PitchBook and Morningstar, for customers with subscriptions to those services. "This is the missing piece between an AI tool that's interesting and cool, and one that's deeply useful," said Mike Krieger, chief product officer at Anthropic and co-founder of Instagram. "Right now, there's a real moment of: If we don't adopt these tools, we'll be left behind by people who are doing it." OpenAI and Perplexity AI have also added features in recent months to attract customers in the financial services sector, with the goal of expanding the business uses of AI and boosting sales. While Anthropic is smaller than OpenAI, its revenue is growing at a fast clip. The startup's annualized revenue increased from $3 billion to $4 billion in the past month, according to a person familiar with the matter who was not authorized to speak publicly on private matters. Anthropic is looking to further its sales momentum with a new hire. The company has recruited Paul Smith, a former executive at ServiceNow Inc., to join as its first chief commercial officer later this year, the person said. Krieger said Anthropic has already picked up traction in the finance sector in part because its AI excels at coding, which is often used in financial analysis. The new tools are meant to expand on that by helping finance professionals with investment memos, portfolio analysis and financial modeling, among other tasks.

[4]

Amazon-backed Anthropic rolls out Claude AI for financial services

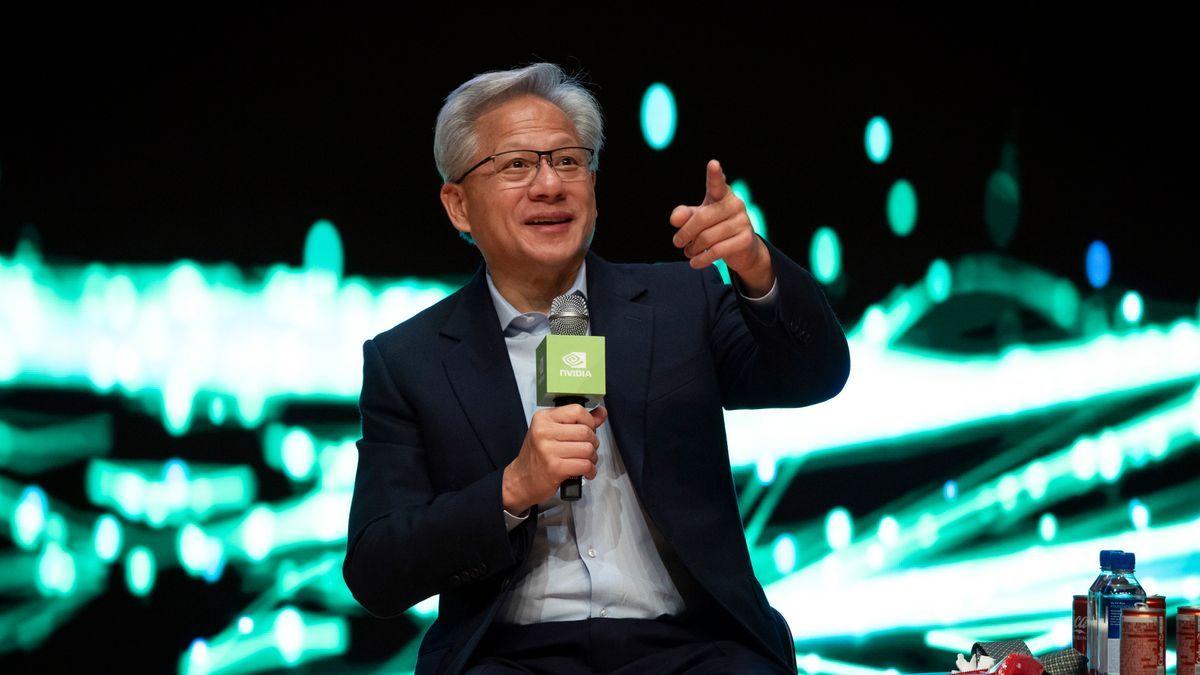

Dario Amodei, Anthropic CEO, speaking on CNBC's Squawk Box outside the World Economic Forum in Davos, Switzerland on Jan. 21st, 2025. Anthropic on Tuesday announced Claude tools for financial services as part of the artificial intelligence startup's latest attempt to court enterprise customers. The so-called Financial Analysis Solution can help financial professionals make investment decisions, analyze markets and conduct research, Anthropic said. It includes the company's Claude 4 models, Claude Code and Claude for Enterprise with expanded usage limits, implementation support and other features. "Claude provides the complete platform for financial AI -- from immediate deployment to custom development," Anthropic said in a release. As part of its new Financial Analysis Solution, Claude will get real-time access to financial information through data providers like Box, PitchBook, Databricks, S&P Global and Snowflake. Anthropic said many of these integrations are available on Tuesday, with more to come. Anthropic's Financial Analysis Solution and Claude for Enterprise are available on AWS Marketplace. The company said Google Cloud Marketplace availability is coming soon.

[5]

Claude Code revenue jumps 5.5x as Anthropic launches analytics dashboard

Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now Anthropic announced today it is rolling out a comprehensive analytics dashboard for its Claude Code AI programming assistant, addressing one of the most pressing concerns for enterprise technology leaders: understanding whether their investments in AI coding tools are actually paying off. The new dashboard will provide engineering managers with detailed metrics on how their teams use Claude Code, including lines of code generated by AI, tool acceptance rates, user activity breakdowns, and cost tracking per developer. The feature comes as companies increasingly demand concrete data to justify their AI spending amid a broader enterprise push to measure artificial intelligence's return on investment. "When you're overseeing a big engineering team, you want to know what everyone's doing, and that can be very difficult," said Adam Wolff, who manages Anthropic's Claude Code team and previously served as head of engineering at Robinhood. "It's hard to measure, and we've seen some startups in this space trying to address this, but it's valuable to gain insights into how people are using the tools that you give them." The dashboard addresses a fundamental challenge facing technology executives: As AI-powered development tools become standard in software engineering, managers lack visibility into which teams and individuals are benefiting most from these expensive premium tools. Claude Code pricing starts at $17 per month for individual developers, with enterprise plans reaching significantly higher price points. Companies demand proof their AI coding investments are working This marks one of Anthropic's most requested features from enterprise customers, signaling broader enterprise appetite for AI accountability tools. The dashboard will track commits, pull requests, and provide detailed breakdowns of activity by user and cost -- data that engineering leaders say is crucial for understanding how AI is changing development workflows. "Different customers actually want to do different things with that cost," Wolff explained. "Some were like, hey, I want to spend as much as I can on these AI enablement tools because they see it as a multiplier. Some obviously are sensibly looking to make sure that they don't blow out their spend." The feature includes role-based access controls, allowing organizations to configure who can view usage data. Wolff emphasized that the system focuses on metadata rather than actual code content, addressing potential privacy concerns about employee surveillance. "This does not contain any of the information about what people are actually doing," he said. "It's more the meta of, like, how much are they using it, you know, like, which tools are working? What kind of tool acceptance rate do you see -- things that you would use to tweak your overall deployment." Claude Code revenue jumps 5.5x as developer adoption surges The dashboard launch comes amid extraordinary growth for Claude Code since Anthropic introduced its Claude 4 models in May. The platform has seen active user base growth of 300% and run-rate revenue expansion of more than 5.5 times, according to company data. "Claude Code is on a roll," Wolff told VentureBeat. "We've seen five and a half times revenue growth since we launched the Claude 4 models in May. That gives you a sense of the deluge in demand we're seeing." The customer roster includes prominent technology companies like Figma, Rakuten, and Intercom, representing a mix of design tools, e-commerce platforms, and customer service technology providers. Wolff noted that many additional enterprise customers are using Claude Code but haven't yet granted permission for public disclosure. The growth trajectory reflects broader industry momentum around AI coding assistants. GitHub's Copilot, Microsoft's AI-powered programming tool, has amassed millions of users, while newer entrants like Cursor and recently acquired Windsurf have gained traction among developers seeking more powerful AI assistance. Premium pricing strategy targets enterprise customers willing to pay more Claude Code positions itself as a premium enterprise solution in an increasingly crowded market of AI coding tools. Unlike some competitors that focus primarily on code completion, Claude Code offers what Anthropic calls "agentic" capabilities -- the ability to understand entire codebases, make coordinated changes across multiple files, and work directly within existing development workflows. "This is not cheap. This is a premium tool," Wolff said. "The buyer has to understand what they're getting for it. When you see these metrics, it's pretty clear that developers are using these tools, and they're making them more productive." The company targets organizations with dedicated AI enablement teams and substantial development operations. Wolff said the most tech-forward companies are leading adoption, particularly those with internal teams focused on AI integration. "Certainly companies that have their own AI enablement teams, they love Claude Code because it's so customizable, it can be deployed with the right set of tools and prompts and permissions that work really well for their organization," he explained. Traditional industries with large developer teams are showing increasing interest, though adoption timelines remain longer as these organizations navigate procurement processes and deployment strategies. AI coding assistant market heats up as tech giants battle for developers The analytics dashboard puts Anthropic in direct competition with enterprise feedback about measuring AI tool effectiveness -- a challenge facing the entire AI coding assistant market. While competitors like GitHub Copilot and newer entrants focus primarily on individual developer productivity, Anthropic is betting that enterprise customers need comprehensive organizational insights. Amazon recently launched Kiro, its own Claude-powered coding environment, highlighting the growing competition in AI development tools. Microsoft continues expanding GitHub Copilot's capabilities, while Google just acquire-hired Windsurf CEO Varun Mohan and key team members in a $2.4 billion deal to bolster its agentic coding efforts. Wolff believes the market has room for multiple solutions, noting that many developers use several AI coding tools depending on specific tasks. "The people who are doing best right now are the ones who are trying everything and using the exactly the right tool for the job," he said. Autonomous AI agents could reshape how software gets built Beyond immediate productivity metrics, Wolff sees Claude Code as part of a broader shift toward "agentic" software development, where AI systems can handle complex, multi-step tasks with minimal human supervision. "One trend that we're starting to see is that the agent is becoming the dominant mode, the way that you want to interact with an LLM," he said. Customers are increasingly building on Claude Code's software development kit to create custom workflows that handle everything from conversation history to tool integration and security settings. The analytics dashboard provides the foundation for organizations to measure this transition. As AI agents become more capable of autonomous software engineering tasks, enterprise leaders will need comprehensive data to understand how these systems impact their development processes. The launch is part of a broader enterprise AI trend, where organizations are moving beyond pilot projects to demand detailed analytics and ROI measurements for their AI investments. As AI coding tools mature from experimental features to core development infrastructure, visibility into their usage and effectiveness becomes increasingly critical for technology leaders. For an industry built on measuring everything from server uptime to code commits, the ability to finally measure AI's impact on developer productivity may prove just as valuable as the AI tools themselves.

[6]

Anthropic launches finance-specific Claude with built-in data connectors, higher limits and prompt libraries

Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now As some regulated enterprises cautiously expand their use of AI, platform and model makers are starting to offer bespoke versions to specific industries. Anthropic is making its first step into that direction with the new Claude for Financial Services, essentially a special version of its Claude for Enterprise tier, that could soothe some of the fears of the sector around interoperability and tool use. Anthropic will also provide pre-built connectors to data providers, opening up discoverability routes for tools on Claude. Jonathan Pelosi, head of industry for financial services at Anthropic, told VentureBeat that Anthropic models "were already particularly well-suited for financial workloads and we've been tailoring them to get better and better." But while the Claude models offer enterprise solutions for financial services firms, Pelosi said the sector was also looking for more features from the Claude chat interface. "Unlike some competitors in the space who built a consumer app that became a sensation, or they built these new video generators and meme generators, that's just never our focus," Pelosi said. "We are enterprise first, so our models are uniquely well-suited to perform best in class against complicated enterprise workloads, which means complicated quantitative analysis, complex data extraction for the financial services industry at scale." Claude for Financial Services would offer users additional rate limits, especially since, Pelosi noted, many analysts often find themselves quickly hitting capacity limitations due to the size of their workloads. Unlike Claude for Enterprise, this financial services-specific platform will also include pre-built MCP connectors to financial data providers like FactSet, PitchBook, S&P Capital IQ and Morningstar, among others, and implementation support from Anthropic. The third big difference between Claude for Enterprise and Claude for Financial Services is the presence of a prompt library. Pelosi said some users had a difficult time translating their analytics workflow or needs into a prompt, so the prompt library can guide them. Pelosi said customers already using Claude for Enterprise are not obligated to move to the financial services version; however, added features like increased limits might prompt them to switch. How Anthropic is approaching the financial services ecosystem Pelosi noted that many financial service institutions have strong engineers who can build AI applications. However, these companies' core focus remains banking or insurance, so a platform that simplifies the process of connecting data to AI is essential. "What we're trying to do is bring all this technology together under one roof," said Pelosi. "Think of it as an out-of-the-box solution that's easily configurable for the Bridgewaters, or the Norwegian Sovereign Wealth Funds of the world, versus the alternative where they cobble this thing together on their own." Financial services companies have been building generative AI tools in various ways, creating AI platforms on their own using off-the-shelf models, or building on top of existing chatbots like Claude, Gemini or ChatGPT. BNY, for example, has been experimenting with AI agents for its AI platform Eliza. Capital One also built an agent that pulls on car dealership inventory and car loan data for auto sales. Startup Metal offers an assistant for financial analysts and private equity that reads and parses through 10-Ks, 10-Qs or 8-Ks. Rogo, another startup, also allows financial institutions to upload documents and set workflows. Allaying concerns Anthropic is not alone in providing bespoke solutions for the financial sector. However, offering a guided setup and vetted access to data providers may go a long way for an industry wary of accidentally exposing itself to more risk. MCP can connect one company or its agent to another company by providing needed identification and tool use permissions. However, regulated industries express concern that it still lacks some important KYC and identity features. Many in the sector see the benefit of MCP servers to access critical financial data or other documents, but are waiting for mass adoption. At the same time, the financial services industry has been criticized for being too cautious in adopting the technology. Pelosi reiterated that Anthropic is focused on safety and responsibility, which is why he feels a solution specific to finance was the natural next step for them. Pelosi said that while Anthropic's intention "is not to build a Claude for every vertical," the company could extend bespoke features to other industries at some point. Anthropic also recently opened up Claude to more tool discoverability with partners like Canva, Notion, Stripe and Figma, providing more context to searches and activities on the app.

[7]

Anthropic launches Claude for Financial Services to help analysts conduct research

The system integrates with internal and external data sources Anthropic has launched a special edition of Claude designed for the highly regulated financial industry, with a focus on market research, due diligence, and investment decision-making. The OpenAI rival hope for financial institutions to use its tool for financial modelling, trading system modernisation, risk modeling, and compliance automation, with pre-built MCP connectors offering seamless access to entperise and market data platforms. The company boasted that Claude for Financial Services offers a unified interface, combining Claude's AI powers with internal and external financial data sources from the likes of Databricks and Snowflake. Anthropic highlighted four of the tool's key benefits: powerful Claude 4 models that outperform other frontier models, access to Claude Code and Claude for Enterprise, pre-built MCP connectors, and expert support for onboarding and training. Testing revealed that Claude Opus 4 passed five of the seven Financial Modeling World Cup competition levels, scoring 83% accuracy on complex excel tasks. "Access your critical data sources with direct hyperlinks to source materials for instant verification, all in one platform with expanded capacity for demanding financial workloads," the company shared in a post. Anthropic also stressed that users' data is not used for training its generative models in the name of intellectual property and client information confidentiality. Besides Snowflake for data and Databricks for analytics, Claude for Financial Services also connects with the likes of Box for document management and S&P Global for market and valuation data, among others. Among the early adopters is the Commonwealth Bank of Australia, whose CTO Rodrigo Castillo praised Claude for its "advanced capabilities" and "commitment to safety." The Australian banking giant envisions using Claude for Financial Services for fraud prevention and customer service enhancement.

[8]

Anthropic announces Claude-based AI tools for finance

Anthropic, the AI startup backed by Amazon and founded by former OpenAI execs, is aiming straight for Wall Street with its newest launch: a suite of AI tools designed specifically for financial pros. Unveiled Tuesday in New York, the new Financial Analysis Solution package is built to help analysts, investors, and dealmakers sift through data, build models, and make decisions faster -- with a big assist from Claude, Anthropic's powerful AI assistant. It's the company's latest play to attract enterprise clients, and a clear signal that it wants a bigger role in how high-stakes financial decisions get made. The product is essentially a finance-savvy version of Claude for Enterprise -- but with features and integrations tailored to the complexity of markets and investment research. It includes access to Anthropic's newest Claude 4 models, Claude Code (for more technical tasks like modeling and compliance automation), and expanded usage limits for demanding workflows. The Financial Analysis Solution is also designed to speed up implementation. It comes with pre-built connectors, onboarding support, and training to get teams up and running quickly. It's now available via AWS Marketplace, and will hit the Google Cloud Marketplace soon. Now, with financial institutions looking for ways to modernize how they handle research, compliance, and investment analysis, Anthropic sees a big opportunity. Instead of building a generic tool and hoping finance teams adapt, it's offering a purpose-built solution for one of the most data-intensive industries out there. Backed by billions in Amazon investment and most recently valued at $61.5 billion, Anthropic is positioning Claude not just as a productivity tool -- but as a full-blown AI co-pilot for the business world.

[9]

Anthropic's Claude to Take on Perplexity with Finance Analysis Abilities | AIM

Claude is making use of the abilities of its AI models to offer more use cases to enterprises. Anthropic has unveiled a dedicated solution for the financial services sector that integrates its Claude models with real-time data and enterprise tooling to accelerate market research, financial modelling, and compliance workflows. Catering to enterprises, this could be a move to rival the financial offerings from Perplexity, whose CEO Aravind Srinivas has frequently described it as a "commoditised version of Bloomberg Terminal." Now, Anthropic's Claude is also entering the same field as the Bloomberg Terminal. The "Financial Analysis Solution" bundles Claude's capabilities with pre-built connectors to platforms such as Snowflake, FactSet, Morningstar, and Databricks, enabling analysts to access verified market data and internal systems through a single interface. The offering also includes Claude Code for quantitative tasks such as Monte Carlo simulations, and expanded usage limits for Claude for Enterprise users. In benchmark tests by Vals AI, the company claims that Claude Opus 4 outperformed peers in finance-specific reasoning. It also passed 5 of 7 levels in the Financial Modeling World Cup when deployed by FundamentalLabs. "We've been developing capabilities powered by Claude since 2023," said Aaron Linsky, CTO of AIA Labs at Bridgewater, which is a premier asset management firm. Nicolai Tangen, CEO of Norges Bank Investment Management, said, "Claude has fundamentally transformed the way we work at NBIM. With Claude, we estimate that we have achieved ~20% productivity gains - equivalent to 213,000 hours." Anthropic's partners include consultancies such as Deloitte, PwC, and KPMG, which are helping financial firms deploy Claude across regulatory analysis, deal diligence, and trading system upgrades. The company claims that the cases span from auto-generating investment memos to modernising legacy underwriting systems. With a strict no-training-on-user-data policy and availability via AWS Marketplace, Anthropic is positioning Claude as a secure and scalable AI layer for financial institutions. Claude's Financial Analysis Solution is available starting today. It will soon be available on Google Cloud Marketplace as well.

[10]

Anthropic upgrades Claude Code with visibility dashboard for software teams - SiliconANGLE

Anthropic upgrades Claude Code with visibility dashboard for software teams Large language model developer Anthropic PBC today rolled out an update for Claude Code, an agentic artificial intelligence software tool for developers that helps turn ideas into code, upgrading it with a metrics dashboard for administrators. Claude Code launched into general availability alongside the launch of Claude 4, the company's flagship frontier AI model family, including Opus 4 and Sonnet 4. Opus is the company's most powerful model yet, designed to sustain the performance of complex, long-running tasks, such as those that might take thousands of steps. Sonnet is a smaller, more generalized instruction-following model designed for speed and cost efficiency across high-volume tasks. Enterprise admins will now have visibility into what developer teams are working on in real-time and how they are using AI tools. This includes lines of code accepted, tool usage rates, user activity breakdowns and cost tracking per user. Claude Code runs in the terminal, which differs from a chat window or a development environment, in that it is where developers go to access the operating system directly. The terminal is a text-based interface that allows users to interact with the computer by typing commands, providing a command-line interface for accessing applications and tools. This is separate from the graphical interface in Windows or macOS, where most interactions take place using icons and drag-and-drop. It's best recognized as the black-and-white screen that people might remember from '90s hacker movies, where people type furiously at keyboards to get computers to perform magical tasks. Anthropic said that since the launch of Claude 4, Clade Code's active user base has grown by over 300% and its run-rate revenue has increased by more than 5.5 times. Public-facing companies using Code include Japanese technology conglomerate Rakuten Group Inc., collaborative web design tool Figma Inc. and communication software company Intercom Inc. This news comes a month after the company announced model context protocol support for Code, which builds in the ability to connect external tools and services. MCP is an open standard pioneered by Anthropic that defines how AI models can securely access and use context from external tools, data sources and other resources. This allows Code to connect to tools such as a Figma server, OpenAI's ChatGPT or image generation services, an external database from Oracle Corp. or numerous other sources. On Monday, the company also announced that Claude Code is now natively available for Windows operating systems. Claude Code follows a trend of new AI coding tools that work in the terminal, including from Google LLC and OpenAI, with releases of Gemini CLI and Codex CLI, respectively. According to a report from TechCrunch, these terminal-based AI products are already among the most popular among developers. "Our big bet is that there's a future in which 95% of LLM-computer interaction is through a terminal-like interface," said Mike Merrill, co-creator of the leading terminal-focused benchmark Terminal-Bench.

[11]

Anthropic Just Made It Easier to Track How Your Company Is Using AI

Anthropic, the rapidly-growing company behind popular AI model Claude, has announced new updates to coding assistant Claude Code, giving administrators more detailed insights into how their teams are using AI. Claude has developed a reputation for being one of the best AI models for coding and software engineering. While popular vibe coding platforms, such as Replit and Lovable, use Claude to help people with no technical experience create digital applications, Claude's own coding solution is aimed more at experienced engineers. Unlike those platforms, Claude Code is integrated directly into the user's computer terminal, which makes it faster and also able to easily analyze locally-hosted codebases. Since Anthropic launched its newest Claude models in late May 2025, the company says Claude Code's user base has grown by 300 percent, and run-rate revenue has grown by more than 5.5x. Now, Anthropic is launching an analytics dashboard to give administrators and engineering leads more visibility regarding their teams' AI use. The dashboard will inform admins of how many AI-generated lines of code have been accepted by developers, how many times developers save or request changes to a codebase, and how much each developer's AI usage costs in API fees.

[12]

Claude for Financial Services : Could Slash Financial Workloads by 80%

What if the future of finance wasn't just about human expertise but a seamless collaboration between people and innovative artificial intelligence? With the unveiling of Claude for Financial Services, Anthropic has introduced a innovative AI platform tailored specifically for the financial sector. This isn't just another tech release -- it's a bold step toward redefining how financial professionals approach analysis, decision-making, and strategy. Imagine reducing underwriting timelines by 80% or boosting accuracy rates to 90% -- these aren't hypothetical scenarios but real-world outcomes reported by early adopters of Claude. In an industry where precision and efficiency are paramount, this innovation could be the fantastic option for a new era of financial excellence. Anthropic explain how Claude is reshaping the financial landscape with its enterprise-grade AI infrastructure and specialized tools for data integration, financial modeling, and reporting. From automating tedious workflows to delivering actionable insights, the platform is designed to free up time for what truly matters: strategic decision-making and innovation. But it's not just about the technology -- successful adoption also hinges on fostering a culture of collaboration between humans and AI. Whether you're curious about its core features, real-world applications, or strategies for seamless integration, this deep dive will illuminate how Claude is empowering financial professionals to stay ahead in an increasingly competitive market. Could this be the future your organization has been waiting for? Claude for Financial Services offers a comprehensive suite of features tailored to meet the demands of modern financial workflows. These capabilities are designed to streamline processes and improve outcomes: These features collectively enable financial professionals to reduce manual workloads, improve the precision of their analyses, and focus on strategic initiatives that drive growth. Claude's capabilities have already delivered tangible benefits across a range of financial applications. Organizations using this platform have reported significant improvements in efficiency and accuracy: By automating repetitive tasks and providing data-driven insights, Claude allows financial professionals to dedicate more time to strategic decision-making. This shift not only boosts productivity but also fosters innovation, allowing organizations to remain competitive in a rapidly evolving financial landscape. Expand your understanding of Anthropic's Claude AI with additional resources from our extensive library of articles. Adopting AI in financial services requires a strategic approach that goes beyond simply implementing new technology. Anthropic emphasizes the importance of fostering a culture that supports innovation and collaboration between humans and AI. Key strategies for successful integration include: Additionally, iterative learning systems allow organizations to continuously refine their use of AI, making sure that the technology evolves alongside their needs. By adopting these strategies, you can maximize the benefits of AI while minimizing potential disruptions to existing workflows. One of the critical decisions financial firms face when adopting AI is whether to build in-house solutions or purchase external platforms. Claude for Financial Services offers a compelling case for the latter. Partnering with an established AI provider like Anthropic grants you access to innovative technology and industry-specific expertise without the significant investment of time and resources required to develop tools internally. This approach allows your organization to focus on using AI's capabilities to achieve business objectives, rather than navigating the complexities of building and maintaining AI systems. By choosing a proven platform like Claude, you can accelerate your AI adoption and realize its benefits more quickly and effectively. AI is poised to play an increasingly pivotal role in the financial sector, driving advancements in areas such as investment management, risk assessment, and operational efficiency. By allowing faster, data-driven decision-making, AI helps uncover new revenue opportunities and equips organizations to navigate complex market dynamics with greater precision. However, AI is not a replacement for human expertise. Instead, it serves as a collaborative tool that enhances your capabilities, allowing you to make more informed and strategic decisions. This partnership between technology and human insight underscores the fantastic potential of AI to empower financial professionals and foster long-term growth. Claude for Financial Services exemplifies this potential by combining advanced technology with a focus on security, trust, and accuracy. As AI continues to reshape the financial landscape, adopting solutions like Claude can position your organization at the forefront of innovation, allowing you to thrive in an increasingly competitive market.

[13]

Anthropic Launches Claude for Financial Services to Power Data-Driven Decisions | PYMNTS.com

"Where we saw a lot of traction early on was with these high-trust industries," Pelosi told PYMNTS in an interview. "Our models, our solutions, are just very well positioned to help these firms." The platform enables financial professionals to conduct research, generate investment reports, and perform financial modeling with audit trails and verified source data. It can be used to modernize trading, automate compliance and run complex analyses including Monte Carlo simulations and risk modeling using Claude Code. The service comes with six weeks of hands-on training, Pelosi said. Anthropic also partnered with consulting firms such as Deloitte and KPMG to provide implementation help. The product expands Claude's context window as well as usage limits to support large document analysis, a necessity for hedge funds, banks and insurers conducting due diligence or modeling transactions. Users can "look at hundreds of pages of financial documents," without running into rate limits or losing continuity, Pelosi said. Anthropic said client data is not used for AI model training. However, the AI industry has a lot to prove before chief financial officers become comfortable with the technology. The PYMNTS Intelligence report "The Agentic Trust Gap: Enterprise CFOs Push Pause on Agentic AI" found that a nagging concern is hallucinations, where an AI agent can go off script and expose firms to cascading payment errors and other inaccuracies. Even as financial services companies know that AI brings a speed advantage at a time of tighter spreads and market volatility, they are hesitating. "For finance leaders, the message is stark: Harness AI's momentum now, but build the guardrails before the next quarterly call -- or risk owning the fallout," the report said. For highly regulated industries like financial services, the accurate responses of generative AI models are important, and Pelosi said the solution delivers on that front. The concern over hallucinations has "significantly stymied meaningful adoption in the financial industry," Pelosi said. "If you and I are in the business of making very large investments or analysis on very high-stakes transactions, we don't have the luxury of saying, 'Hopefully that [calculation is] right." The solution's integration with data and service providers should enable users to verify the data against original sources, Pelosi said. Moreover, it can handle not only text, but also audio and images -- for slides, graphs and the like. But Pelosi stopped short of saying Anthropic has solved hallucinations completely. Anthropic isn't claiming that "Claude would never hallucinate again," he said. However, "it's making it easier and easier to validate the numbers that you're making very big decisions on." To that end, Claude not only can cite sources, but it also expresses uncertainty and responds with "humility," according to Pelosi. Giving a large language model this avenue when it can't find the answer is one way to prevent hallucinations, which occur when a model doesn't know the answer but wants to fulfill the user's request. So, it makes things up. The product also includes Claude Code for analysts who need to go beyond standard capabilities, enabling users to "write and debug code" for custom modeling, and it can also tap deep research, which can pull data from external and internal data libraries, Pelosi said.

Share

Share

Copy Link

Anthropic introduces a new Financial Analysis Solution powered by Claude AI, targeting financial professionals. The company also rolls out an analytics dashboard for Claude Code to help enterprises track AI tool usage and ROI.

Anthropic's New Financial Analysis Solution

Anthropic, the AI startup known for its Claude chatbot, has launched a new Financial Analysis Solution aimed at transforming how finance professionals analyze markets, conduct research, and make investment decisions

1

. This comprehensive AI solution integrates Claude 4 models with financial data from various providers, including Box, Daloopa, FactSet, Morningstar, and S&P Global1

3

.

Source: VentureBeat

The Financial Analysis Solution offers a wide range of capabilities, including:

- Market research and analysis

- Competitive benchmarking

- Portfolio analysis

- Financial modeling

- Creation of investment memos and pitch decks

1

Nicholas Lin, head of product for FSI at Anthropic, emphasized the importance of human verification in high-stakes financial use cases, encouraging users to check the provided hyperlinks to data sources

1

.Claude Code Analytics Dashboard

Source: Inc.

In addition to the Financial Analysis Solution, Anthropic has introduced a comprehensive analytics dashboard for Claude Code, its AI-powered coding assistant

2

. This new feature provides enterprise administrators with detailed insights into how their teams are utilizing AI coding tools, including:- Breakdown of user activity

- Cost tracking per user

- Lines of code accepted

- Total spend

- User activity over time

- Suggestion accept rate

2

Adam Wolff, manager of the Claude Code team, stated that the dashboard's purpose is to share knowledge and understand what's working within engineering departments, rather than to punish or reward developers based on productivity

2

.Rapid Growth and Market Position

Claude Code has experienced significant growth since the launch of Claude 4 models:

- 300% increase in user base

- 5.5x growth in run-rate revenue

2

5

Anthropic's overall annualized revenue has reportedly increased from $3 billion to $4 billion in just the past month

3

. The company is positioning itself as a premium enterprise solution in the AI coding assistant market, with pricing starting at $17 per month for individual developers and higher for enterprise plans5

.Related Stories

Enterprise Focus and Partnerships

Anthropic is targeting organizations with dedicated AI enablement teams and substantial development operations

5

. The company has formed partnerships with various data providers to enhance its offerings, including FactSet, PitchBook, Morningstar, Databricks, and Snowflake3

4

.To further its enterprise strategy, Anthropic has recruited Paul Smith, a former executive at ServiceNow Inc., to join as its first chief commercial officer later this year

3

.

Source: CNBC

Market Competition and Future Outlook

Anthropic's new offerings place it in direct competition with other AI companies vying for business from Wall Street professionals, including OpenAI and Perplexity AI

3

. The company's focus on coding capabilities and user privacy has helped distinguish it in the market2

.Mike Krieger, chief product officer at Anthropic and co-founder of Instagram, emphasized the critical nature of adopting these AI tools, stating, "If we don't adopt these tools, we'll be left behind by people who are doing it"

3

.As the AI coding assistant market heats up, Anthropic's latest innovations in financial analysis and usage tracking demonstrate its commitment to addressing enterprise needs and solidifying its position in the competitive landscape of AI-powered business solutions.

References

Summarized by

Navi

Related Stories

Anthropic Embeds Claude AI Directly Into Microsoft Excel, Targeting Financial Services Market

27 Oct 2025•Business and Economy

Anthropic's Claude 4: A Leap Forward in AI Coding and Extended Reasoning

23 May 2025•Technology

Anthropic Launches Claude Enterprise: A New AI Service for Businesses

05 Sept 2024

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

Anthropic takes Pentagon to court over unprecedented supply chain risk designation

Policy and Regulation

3

Meta smart glasses face lawsuit and UK probe after workers watched intimate user footage

Policy and Regulation