Arm launches Physical AI division to expand presence in robotics and automotive markets

5 Sources

5 Sources

[1]

Exclusive: Arm launches 'Physical AI' division to expand in robotics market

Jan 7 (Reuters) - Chip technology company Arm Holdings has reorganized the company and formed a Physical AI unit to expand its presence in the robotics market, company executives told Reuters at CES. The decision to create a unit that specializes in robotics arrives amid a flurry of announcements and activity at CES around humanoid robots. At the sprawling Las Vegas trade show, large and small companies demonstrated robots that could help build cars, clean toilets and deal games of poker - at a glacial pace. Reuters is reporting the creation of the Physical AI unit and reorganization for the first time. Overall, Arm will now operate three main lines of business: its Cloud and AI, Edge - which includes its mobile devices and PC products - and Physical AI, which also folds in its automotive business. The UK-based company does not make chips itself but supplies the underlying technology that powers most of the world's smartphones and a growing number of other devices such as laptops and data center chips. The company makes money by charging licensing fees and collecting royalties when its designs are used. The company's expanded focus on Physical AI is part of a larger effort to increase the business. Since CEO Rene Haas took over the company roughly four years ago, Arm has developed ways to hike prices for its latest technology and is considering its own full chip design. Arm executives see robotics as a market with immense potential for growth in the long run. The head of the newly formed unit, Drew Henry, told Reuters that physical AI solutions could "fundamentally enhance labor, free up extra time" and may have a considerable impact on gross domestic product as a result. The potential for growth in robotics spurred discussions inside Arm for months about how best to tackle the market. The company formally reorganized recently and created the Physical AI division. That division plans to add staff dedicated to robotics, Arm Chief Marketing Officer Ami Badani said. The company combined automotive and robotics into a single unit because the customer requirements for things such as power constraints, safety and reliability are similar, Badani said. Several automakers are moving into humanoid robotics, as well. When asked about customers, Henry said, "We work with everyone." Arm-based chips are used by dozens of automakers around the world, and by robotics companies such as Boston Dynamics, which showed off several robots at CES. "We're already demonstrating that we could put thousands of quadruped robots out in the market and actually make money," Boston Dynamics CEO Robert Playter told Reuters. He acknowledged there was "a bit of a hype cycle around (robotic) humanoids at this point in time." Reporting by Max A. Cherney; additional reporting by Abhirup Roy in Las Vegas Editing by Matthew Lewis Our Standards: The Thomson Reuters Trust Principles., opens new tab * Suggested Topics: * Artificial Intelligence Max A. Cherney Thomson Reuters Max A. Cherney is a correspondent for Reuters based in San Francisco, where he reports on the semiconductor industry and artificial intelligence. He joined Reuters in 2023 and has previously worked for Barron's magazine and its sister publication, MarketWatch. Cherney graduated from Trent University with a degree in history.

[2]

Chip designer Arm targets robotics with new Physical AI business - SiliconANGLE

Chip designer Arm targets robotics with new Physical AI business Chip design company Arm Holdings Plc has created a new Physical AI business unit that's going to be focused on developing semiconductors for robotics and intelligent cars. The announcement was made at CES 2026 this week, where robots have been a major theme. The sprawling Las Vegas trade show saw dozens of companies, large and small, demonstrate new robots that can work in warehouses and build cars, clean toilets and even deal cards at a poker table. Reuters reported that Arm is splitting off its new Physical AI business from its Edge division, which is primarily focused on chips for mobile devices. The chipmaker also operates a Cloud and AI unit. The Physical AI unit will also develop chips for vehicles, the report said. Arm has decided to bundle its robotics and automotive chip design business together because they share many similarities in terms of the kinds of sensors and technology they rely on, as well as power constraints and safety considerations. Arm does not manufacture chips itself, but instead provides the underlying architectural designs and intellectual property that's used by other companies to develop chips for the vast majority of the world's smartphones and other devices, such as laptops and data center processors. It makes money through licensing fees and royalties. The U.K.-based company has been looking to expand its business, however. Under Chief Executive Rene Haas, who took over about four years ago, the company has started developing more complete chip designs for some customers, charging more money for them. It's also considering developing its own, complete chips for the first time. The Physical AI business is another effort by the company to grow its revenues. The division will be led by Executive Vice President of Physical AI Drew Henry, who told Reuters that robotics has the potential to "fundamentally enhance labor" and "free up extra time". He believes robotics can significantly boost the gross domestic product of nations that adopt them. Henry declined to name any specific customers when asked about this, but said the company is happy to "work with everyone". That said, it's known that Boston Dynamics Inc., the robotics company that was previously owned by Google LLC before being sold to SoftBank Group Corp. and later, Hyundai Motor Group, uses Arm's chip designs in its machines. Boston Dynamics was one of the stars of the show at CES this week, where it unveiled a new humanoid robot called Atlas that's capable of working autonomously in industrial settings. It stands at a towering six-feet, three-inches tall and weighs around 200 pounds, and is already in production. One of the first customers is Hyundai itself, which will use Atlas robots in its vehicle manufacturing facility in Savannah, Georgia, to help build cars. Many technology companies believe that advances in artificial intelligence automation can take robots to the next level, giving them the smarts they need to operate alongside humans in various industries. Tesla Inc. CEO Elon Musk has previously said that the company's Optimus humanoid robots are key to its future, and has predicted that it could eventually generate revenue that dwarfs that of its electric cars. This week, the autonomous driving company Mobileye Global Inc., which is part owned by Intel Corp., revealed that it's going to acquire a robotics firm called Mentee Robotics Ltd. for $900 million. Meanwhile, AI chip leader Nvidia Corp. announced a new open-source AI model at CES called Alpamayo 1, which it hopes will be used to train the navigation systems of autonomous vehicles.

[3]

Arm launches 'Physical AI' unit, joining rush to robotics by tech and automakers

Robots and autos are the core of Physical AI and share a wide range of existing sensor tech and other hardware. Automakers including Tesla are creating robots to automate warehouse and factory tasks. The head of the newly formed unit, Drew Henry, said that physical AI solutions could "fundamentally enhance labour, free up extra time" and may have a considerable impact on gross domestic product as a result. Chip technology company Arm Holdings has reorganized the company to create a Physical AI unit to expand its presence in the robotics market, company executives told Reuters at CES, where robots are a theme of the year. The decision to create a unit that specialises in robotics arrives amid a flurry of announcements and activity at CES around humanoid robots. At the sprawling Las Vegas trade show, large and small companies demonstrated robots that could help build cars, clean toilets and deal games of poker - at a glacial pace. Reuters is reporting the creation of Arm's Physical AI unit and reorganization for the first time. Arm will now operate three main lines of business: its Cloud and AI, Edge - which includes its mobile devices and PC products - and Physical AI, which will house its automotive business. Robots and autos are the core of physical AI and share a wide range of existing sensor tech and other hardware. Automakers including Tesla are creating robots to automate warehouse and factory tasks. UK-based Arm does not make chips itself but supplies the underlying technology that powers most of the world's smartphones and a growing number of other devices such as laptops and data centre chips. The company makes money by charging licensing fees and collecting royalties when its designs are used. The company's expanded focus on Physical AI is part of a larger effort to increase the business. Since CEO Rene Haas took over the company roughly four years ago, Arm has developed ways to hike prices for its latest technology and is considering its own full chip design. Arm executives see robotics as a market with immense potential for growth in the long run. The head of the newly formed unit, Drew Henry, told Reuters that physical AI solutions could "fundamentally enhance labour, free up extra time" and may have a considerable impact on gross domestic product as a result. That division plans to add staff dedicated to robotics, Arm Chief Marketing Officer Ami Badani said. The company combined automotive and robotics into a single unit because the customer requirements for things such as power constraints, safety and reliability are similar, Badani said. Several automakers are moving into humanoid robotics, as well. When asked about customers, Henry said, "We work with everyone." Arm-based chips are used by dozens of automakers around the world, and by robotics companies such as Boston Dynamics, which is owned by Hyundai. The two companies unveiled a production-ready Atlas humanoid robot that the Korean automaker said it will begin deploying in U.S. factories by 2028. Year of robots at CES Interest in humanoid robots has boomed as companies across the tech and auto industries see human-form machines as the next frontier in AI and automation. Tesla CEO Elon Musk has described the company's humanoid robot project, Optimus, as key to the company's future. Musk has said the robots could eventually dwarf its vehicle business and unlock vast new economic value by performing a wide range of tasks that humans do not wish to perform. This year, CES has been dominated by robotics. Reuters observed dozens of companies exhibiting humanoid robots at the cavernous convention centre halls. They performed dances, played ping-pong and conducted repetitive sorting tasks. Many such machines at CES include forms of artificial intelligence, which further enhance their capabilities. "(But) the real spend and where things are really moving forward is when they combine the machining with the level of AI to increase the precision, increase the productivity, or change how something's able to produce," C.J. Finn, U.S. automotive industry leader for PwC, told Reuters. Boston Dynamics CEO Robert Playter told Reuters there was "a bit of a hype cycle around (robotic) humanoids at this point in time." But he said his company has already "put thousands of quadruped robots out in the market and actually (made) money." Driving technology company Mobileye, owned in part by Intel , announced that it planned to acquire robotics company Mentee for $900 million in order to bring its product under its roof. World AI leader Nvidia unveiled a tool called Alpamayo and other physical AI products that it hopes will power the next generation of autonomous vehicles.

[4]

Arm Launches 'Physical AI' Division To Target Robotics As Humanoid Robots Take Center Stage At CES - ARM Holdings (NASDAQ:ARM)

Arm Holdings (NASDAQ:ARM) is reorganizing its business to create a new "Physical AI" division, signaling a deeper push into robotics and automotive technology as humanoid robots dominate the spotlight at CES 2026. Arm Reorganizes To Focus On Robots And Cars Chip design firm Arm Holdings has launched a new business unit called Physical AI, aimed at expanding its footprint in robotics and automotive markets, company executives told Reuters. The move reflects growing industry interest in AI systems that interact with the physical world rather than operating solely in software or the cloud. As part of the reorganization, Arm will now operate three core divisions: Cloud and AI, Edge -- which includes mobile devices and PCs -- and Physical AI, which will house both its automotive and robotics efforts, the report noted. Why Robotics And Automotive Are A Natural Fit Arm executives said robots and vehicles share many of the same technical requirements, including power efficiency, safety, reliability and advanced sensor integration. Those similarities prompted the company to combine automotive and robotics under a single umbrella. Several automakers, including Tesla Inc. (NASDAQ:TSLA), are increasingly exploring humanoid robots for factory and warehouse automation. CES 2026 Highlights A Surging Robotics Race This year's CES has been dominated by humanoid robots, with dozens of companies showcasing machines that can sort items, perform factory tasks or interact with people -- albeit often at slow speeds. Industry leaders such as Nvidia Corp (NASDAQ:NVDA), Tesla, Boston Dynamics and Mobileye are all investing heavily in physical AI. Price Action: Arm shares closed Wednesday at $115.68, up 0.13% and edged higher in after-hours trading to $115.75, according to Benzinga Pro. According to Benzinga Edge Rankings, Arm's price trend is negative across short, medium and long term. Click here to see how it compares to companies like Tesla and Nvidia. Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Photo courtesy: Shutterstock ARMARM Holdings PLC$115.75-%OverviewNVDANVIDIA Corp$189.37-%TSLATesla Inc$431.88-%Market News and Data brought to you by Benzinga APIs

[5]

Arm reorganizes to launch Physical AI unit amid robotics rush

British chip architecture designer Arm (ARM) has reorganized the company to create a Physical AI unit to expand its presence in the robotics market, Reuters reported. The company will now operate three main lines of business: its Cloud and AI, Edge -- which includes Arm's new Physical AI unit aims to expand the company's presence in robotics by focusing on solutions that can enhance productivity, potentially affecting GDP, and by dedicating staff to support robotics growth. Arm combined these businesses because automotive and robotics customers share similar requirements, such as power constraints, safety, and reliability. Arm plans to collaborate broadly, with its chips used by global automakers and robotics firms like Boston Dynamics, supporting diverse robotics applications.

Share

Share

Copy Link

Chip design company Arm Holdings reorganized its business at CES 2026 to create a new Physical AI division focused on robotics and automotive technology. The UK-based firm now operates three core units, combining automotive and robotics under one umbrella due to shared requirements for power efficiency, safety and reliability.

Arm Restructures to Focus on Physical AI and Robotics

Chip design company Arm Holdings has completed a major reorganization to launch a dedicated Physical AI division, marking a strategic push to expand presence in robotics and automotive markets

1

. The announcement came at CES 2026 in Las Vegas, where humanoid robots dominated the trade show floor with demonstrations ranging from factory automation to poker dealing3

.

Source: Seeking Alpha

The UK-based company now operates three main lines of business: Cloud and AI, Edge—which includes mobile devices and PC products—and the newly formed Physical AI division that houses both robotics and automotive operations

2

. This reorganization represents Arm's most significant structural shift since CEO Rene Haas took over roughly four years ago, during which time the company has developed strategies to increase pricing for its latest technology and is considering designing its own complete chips1

.Why Robotics and Automotive Share a Single Unit

Arm combined robotics and automotive markets into the Physical AI division because customer requirements for power constraints, safety and reliability are remarkably similar, according to Chief Marketing Officer Ami Badani

1

. Both sectors rely on advanced sensor technology and other hardware, making the integration a natural fit3

. Several automakers, including Tesla, are already moving into humanoid robotics to automate warehouse and factory tasks, further blurring the lines between these industries4

.

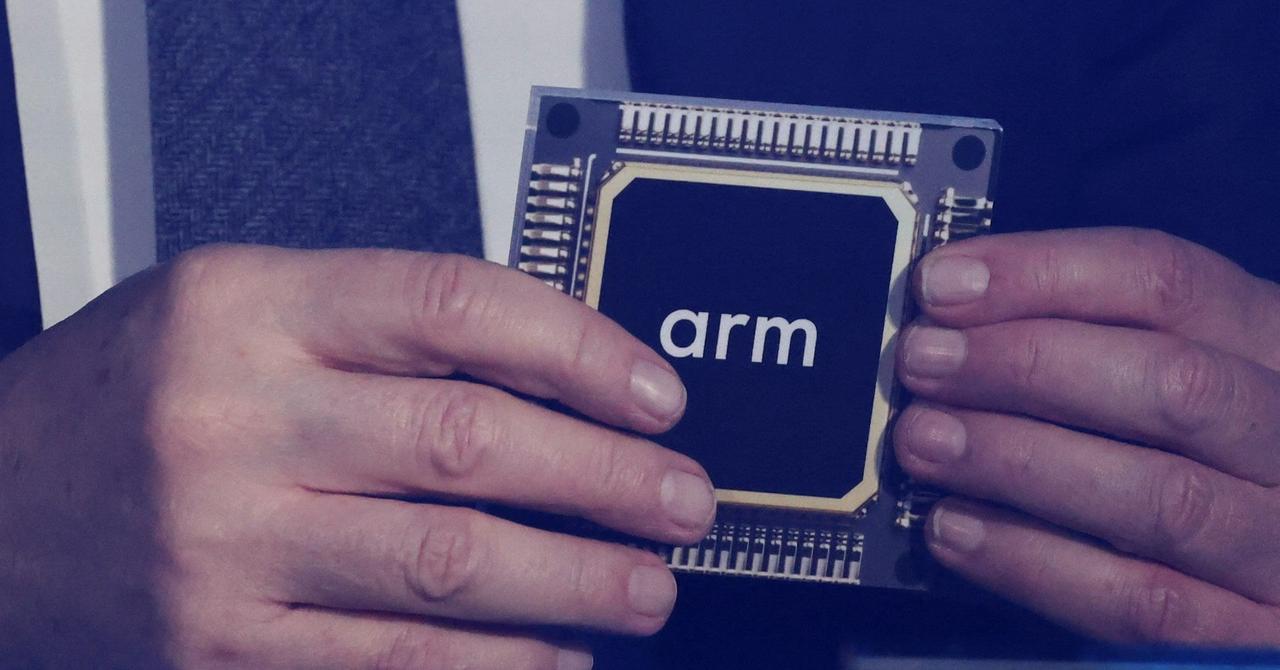

Source: ET

The division will be led by Drew Henry, Executive Vice President of Physical AI, who told Reuters that physical AI solutions could "fundamentally enhance labor, free up extra time" and may have considerable impact on gross domestic product as a result

1

. The unit plans to add staff dedicated to robotics as it scales operations .Arm's Business Model and Market Position

Arm does not manufacture semiconductors itself but supplies the underlying chip design technology that powers most of the world's smartphones and a growing number of AI-powered devices such as laptops and data center chips

1

. The company generates revenue by charging licensing fees and collecting royalties when its designs are used by manufacturers2

.

Source: Reuters

When asked about customers, Henry said "We work with everyone"

5

. Arm-based chips are currently used by dozens of automakers worldwide and by robotics companies such as Boston Dynamics, which showcased several robots at CES1

. Boston Dynamics CEO Robert Playter acknowledged "a bit of a hype cycle around humanoids at this point in time" but noted the company has already "put thousands of quadruped robots out in the market and actually make money"1

.Related Stories

Industry Momentum at CES 2026

This year's CES has been dominated by robotics, with dozens of companies exhibiting humanoid robots that performed dances, played ping-pong and conducted repetitive sorting tasks

3

. The surge in activity reflects growing industry interest in AI systems that interact with the physical world rather than operating solely in software or the Cloud4

.Mobileye, partly owned by Intel, announced plans to acquire robotics firm Mentee Robotics for $900 million

2

. Meanwhile, Nvidia unveiled a new open-source AI model called Alpamayo 1 designed to train navigation systems for autonomous vehicles2

. Boston Dynamics and Hyundai unveiled a production-ready Atlas humanoid robot that the Korean automaker plans to deploy in U.S. factories by 2028 . Tesla CEO Elon Musk has described the company's Optimus humanoid robot project as key to its future, predicting it could eventually generate revenue that dwarfs its electric vehicle business2

.References

Summarized by

Navi

[5]

Related Stories

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy