Cerebras Systems raises $1B at $23B valuation as Benchmark doubles down with $225M investment

7 Sources

7 Sources

[1]

Benchmark raises $225M in special funds to double down on Cerebras

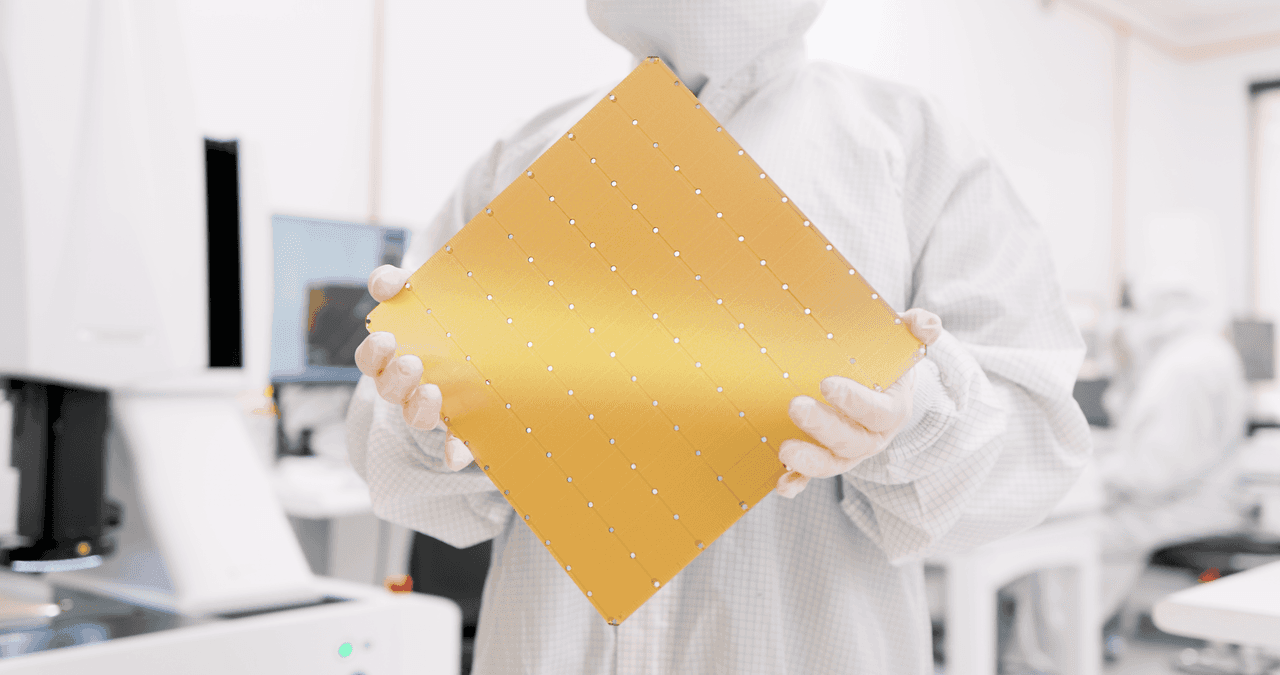

This week, AI chipmaker Cerebras Systems announced that it raised $1 billion in fresh capital at a valuation of $23 billion -- a nearly threefold increase from the $8.1 billion valuation the Nvidia rival had reached just six months earlier. While the round was led by Tiger Global, a huge part of the new capital came from one of the company's earliest backers: Benchmark Capital. The prominent Silicon Valley firm invested at least $225 million in Cerebras' latest round, according to a person familiar with the deal. Benchmark first bet on 10-year-old Cerebras when it led the startup's $27 million Series A in 2016. Since Benchmark deliberately keeps its funds under $450 million, the firm raised two separate vehicles, both called 'Benchmark Infrastructure,' according to regulatory filings. According to the person familiar with the deal, these vehicles were created specifically to fund the Cerebras investment. Benchmark declined to comment. What sets Cerebras apart is the sheer physical scale of its processors. The company's Wafer Scale Engine, its flagship chip announced in 2024, measures approximately 8.5 inches on each side and packs 4 trillion transistors into a single piece of silicon. To put that in perspective, the chip is manufactured from nearly an entire 300-millimeter silicon wafer, the circular discs that serve as the foundation for all semiconductor production. Traditional chips are thumbnail-sized fragments cut from these wafers; Cerebras instead uses almost the whole circle. This architecture delivers 900,000 specialized cores working in parallel, allowing the system to process AI calculations without shuffling data between multiple separate chips (a major bottleneck in conventional GPU clusters). The company says the design enables AI inference tasks to run more than 20 times faster than competing systems. The funding comes as Cerebras, based in Sunnyvale, Calif., gains momentum in the AI infrastructure race. Last month, Cerebras signed a multi-year agreement worth more than $10 billion to provide 750 megawatts of computing power to OpenAI. The partnership, which extends through 2028, aims to help OpenAI deliver faster response times for complex AI queries. (OpenAI CEO Sam Altman is also an investor in Cerebras.) Cerebras claims its systems, built with its proprietary chips designed for AI use, are faster than Nvidia's chips. The company's path to going public has been complicated by its relationship with G42, a UAE-based AI firm that accounted for 87% of Cerebras' revenue as of the first half of 2024. G42's historical ties to Chinese technology companies triggered a national security review by the Committee on Foreign Investment in the United States, bumping back Cerebras' initial IPO plans and even prompting the outfit to withdraw an earlier filing in early 2025. By late last year, G42 had been removed from Cerebras' investor list, clearing the way for a fresh IPO attempt. Cerebras is now preparing for a public debut in the second quarter of 2026, according to Reuters.

[2]

Nvidia-rival Cerebras Systems valued at $23.1 billion in latest financing

Feb 4 (Reuters) - AI chipmaker Cerebras Systems said on Wednesday it raised $1 billion in a late-stage funding round that valued it at $23 billion, nearly tripling its valuation just over four months after its previous financing. The round was led by Tiger Global. Other investors included Benchmark, Coatue and Donald Trump Jr.-backed 1789 Capital. AI-linked companies have continued to draw billions in private financing as corporations and governments race to develop data centers for supporting the still-nascent technology. The race has made the chips required for computing power in these data centers a prized commodity, fueling rival Nvidia's (NVDA.O), opens new tab meteoric rise to the most valuable company in the world. The fundraising marks Cerebras' second billion-dollar round since September, when it was valued at $8.1 billion, reflecting the investor allure for a company that could grow to become a key player in the AI-chip supply chain alongside Nvidia and AMD, which also participated in the round. It comes at a time when key AI players are looking to diversify their chip supplies. Reuters reported on Monday that OpenAI was seeking alternatives to Nvidia for AI inference chips, including Cerebras, AMD, and Groq. Amid OpenAI's reservations, Nvidia approached companies working on SRAM-heavy chips, including Cerebras and Groq, about a potential acquisition. Cerebras declined and struck a commercial deal with OpenAI, which was announced last month. The round is also Cerebras' first since it withdrew its U.S. IPO filing in October, underscoring a broader trend of companies staying private for longer with abundant capital available outside of public markets. Sunnyvale, California-based Cerebras is known for its wafer-scale engine chips, designed to speed up the training and inference of large AI models and compete with products from Nvidia and other AI chipmakers. Reporting by Ateev Bhandari and Manya Saini in Bengaluru; Editing by Tasim Zahid and Alan Barona Our Standards: The Thomson Reuters Trust Principles., opens new tab

[3]

Nvidia rival Cerebras raises $1bn at $23bn valuation

Cerebras raised $1.1bn in a previous round last September at an $8.1bn post-money valuation. Cerebras Systems, the AI chipmaker rivalling Nvidia, has raised $1bn in a Series H round led by Tiger Global with participation from AMD. The raise values the company at around $23bn - nearly tripling in price in just more than four months. Other backers in this round include Benchmark; Fidelity Management and Research Company; Atreides Management; Alpha Wave Global; Altimeter; Coatue; and 1789 Capital, among others. The Series H comes after Cerebras raised $1.1bn in a previous round last September at an $8.1bn post-money valuation backed by several of the same investors. Meanwhile, around the time, the company withdrew from a planned Initial Public Offering (IPO) without providing an official reason. Although, the withdrawal came shortly after criticism around its heavy reliance on a single United Arab Emirates-based customer, the Microsoft-backed G42. Cerebras still intends to go IPO as soon as possible, it said. The recent raise better positions the company to compete with global AI chip leader Nvidia. Cerebras claims that it builds the "fastest AI infrastructure in the world" and company CEO Andrew Feldman has also come on record to say that his hardware runs AI models multiple times faster than that of Nvidia's. Cerebras is behind WSE-3, touted to be the "largest" AI chip ever built, with 19-times more transistors and 28-times more compute that the Nvidia B200, according to the company. The company has a close connection with OpenAI, according to statements made by both Feldman and OpenAI chief Sam Altman - who happens to be an early investor in the chipmaker. Last month, the two announced a partnership to deploy 750MW of Cerebras' wafer-scale systems to make the OpenAI's chatbots faster. OpenAI - a voracious user of Nvidia's AI technology - has been in search for alternatives. Though that's not to say that OpenAI is backing down from using Nvidia technology anymore. Last year, the company drew a 6GW agreement with AMD to power its AI infrastructure. The first 1GW deployment of AMD Instinct MI450 GPUs set to begin in the second half of 2026. At the time of the announcement, Altman said that the deal was "incremental" to their work with Nvidia. "We plan to increase our Nvidia purchasing over time", he added. Don't miss out on the knowledge you need to succeed. Sign up for the Daily Brief, Silicon Republic's digest of need-to-know sci-tech news.

[4]

Cerebras raises another $1B for its wafer-size AI chip - SiliconANGLE

Four months after closing a $1.1 billion funding round, chip startup Cerebras Systems Inc. today announced that it has raised another $1 billion from many of the same investors. Tiger Global led the Series H deal. It was joined by Advanced Micro Devices Inc., Fidelity Management, Atreides Management, Alpha Wave Global, Altimeter, Coatue, 1789 Capital and several others. Cerebras is now valued at $23 billion. The raise comes a few weeks after the company reportedly inked a more than $10 billion deal to supply OpenAI Group PBC with artificial intelligence hardware. Cerebras makes an AI chip called the WSE-3 that contains 4 trillion transistors, 19 times more than Nvidia Corp.'s Blackwell B200 graphics card. About half the processor's surface area is dedicated to hosting a 44-gigabyte pool of SRAM memory. Cerebras says that using one big chip instead of multiple smaller graphics cards boosts efficiency. WSE-3's large memory pool enables it to run many AI models without moving their data to off-chip HBM memory. That avoids the processing delays associated with streaming data to and from a separate memory module, which speeds up processing. The reason chipmakers historically didn't make wafer-size processors is that they're difficult to manufacture. The larger the chip, the greater the likelihood that some of its transistors will contain defects. In theory, even a single defect can render a processor inoperable. Cerebras addressed the challenge by splitting the WSE-3 into 900,000 cores. If a transistor contains a manufacturing defect, only the host core is affected and the other circuits can route data around it. That architecture prevents localized manufacturing flaws from short-circuiting the entire processor. The company ships the WSE-3 as part of a water-cooled system called the CS-3 that provides 125 petaflops of performance. According to Cerebras, customers can link together 2,048 CS-3 appliances into a cluster with 256 exaflops of aggregate computing capacity. That's enough to train a large language model with 24 trillion parameters. Cerebras filed for an initial public offering in September 2024. The company disclosed at the time that it generated $136.4 million in revenue during the first six months of 2024, a more than tenfold increase from the same time a year earlier. Cerebras' losses narrowed to $66.6 million from $77.8 million.

[5]

AI chip maker Cerebras Systems raises $1 billion in late-stage funding

AI chipmaker Cerebras Systems said on Wednesday it raised $1 billion in a late-stage funding round that valued it at $23 billion. The round was led by Tiger Global. Other investors included Benchmark, AMD, Coatue and Donald Trump Jr.-backed 1789 Capital. AI chipmaker Cerebras Systems said on Wednesday it raised $1 billion in a late-stage funding round that valued it at $23 billion. The round was led by Tiger Global. Other investors included Benchmark, AMD, Coatue and Donald Trump Jr.-backed 1789 Capital. AI-linked companies have continued to draw billions in private financing as corporations and governments race to scale the still-nascent technology. (Reporting by Ateev Bhandari and Manya Saini in Bengaluru; Editing by Tasim Zahid)

[6]

AI Infrastructure Builder Cerebras Valued at $23 Billion in Latest Funding Round | PYMNTS.com

By completing this form, you agree to receive marketing communications from PYMNTS and to the sharing of your information with our sponsor, if applicable, in accordance with our Privacy Policy and Terms and Conditions. The company raised $1 billion in a Series H funding round that valued it at $23 billion, Cerebras said in a Tuesday press release. The round was led by Tiger Global, according to the release. Cerebras said in the release that its AI infrastructure makes AI "blisteringly fast," is used by corporations, research institutes and governments on four continents, and is available on-site or in the cloud. The company's Series H came just over four months after a Series G funding round that was announced Sept. 30, 2025, and raised $1.1 billion at an $8.1 billion valuation. Cerebras said at the time in a press release that it would use the funds from the Series G to continue developing innovations in AI processor design, packaging, system design and AI supercomputers, as well as expanding its U.S. manufacturing capacity and U.S. data center capacity to keep up with demand for its products and services. "From our inception we have been backed by the most knowledgeable investors in the industry," Cerebras Co-Founder and CEO Andrew Feldman said in a September press release. "They have seen the historic opportunity that is AI and have chosen to invest in Cerebras." In January, OpenAI said it will integrate 750 megawatts of ultra-low latency compute from Cerebras to accelerate the response time of its AI models. "Cerebras adds a dedicated low-latency inference solution to our platform," Sachin Katti, compute infrastructure at OpenAI, said when announcing the deal. "That means faster responses, more natural interactions, and a stronger foundation to scale real-time AI to many more people." Cerebras said in January that the rollout of the compute will add up to the world's largest deployment of high-speed AI inference. The company added that large language models running on its AI processor deliver responses as much as 15 times faster than those using GPU-based systems. "Just as broadband transformed the internet, real-time inference will transform AI, enabling entirely new ways to build and interact with AI models," Feldman said in a January press release.

[7]

Cerebras Systems: valuation reaches a $23.1bn after $1bn funding round

Cerebras Systems, an artificial intelligence chip specialist, raised $1bn in a funding round announced Wednesday, taking its valuation to $23.1bn. The deal marks a near tripling of its value in just over four months, following a similarly sized raise in September, when the company was valued at $8.1bn. The financing was led by Tiger Global, with participation from Benchmark, Coatue, AMD and 1789 Capital, a fund backed amongst others by Donald Trump Jr. The fresh influx of capital underscores investors' sustained appetite for key players in AI infrastructure, as the global race for computing capacity accelerates. Cerebras' technology, built around "wafer-scale" chips designed for training and inference of large AI models, is drawing growing interest from strategic customers such as OpenAI, with which it recently signed a commercial agreement. The California start-up is now seen as a credible alternative to Nvidia, whose dominance is prompting many companies to diversify their suppliers. While Nvidia reportedly approached Cerebras about a potential acquisition, the company declined discussions. That decision strengthens its positioning as an independent player in an increasingly concentrated market. The funding round is also the first since Cerebras shelved its initial public offering plans in October. In an environment where private capital remains plentiful, the company plans to keep growing while staying off public markets, in line with many AI-sector start-ups.

Share

Share

Copy Link

AI chipmaker Cerebras Systems secured $1 billion in fresh capital at a $23 billion valuation, nearly tripling its worth in just four months. The funding round, led by Tiger Global, included a massive $225 million commitment from early backer Benchmark Capital, which created special infrastructure funds specifically for the investment. The raise positions Cerebras to compete more aggressively with Nvidia following its recent $10 billion OpenAI partnership.

Cerebras Systems Secures Massive Funding Round

Cerebras Systems announced it raised $1 billion in a Series H funding round that valued the AI chipmaker at $23 billion, representing a nearly threefold increase from the $8.1 billion Cerebras Systems valuation reached just four months earlier in September

1

2

. The late-stage funding was led by Tiger Global, with participation from AMD, Benchmark Capital, Fidelity Management and Research Company, Atreides Management, Alpha Wave Global, Altimeter, Coatue, and 1789 Capital3

. This marks the AI chipmaker's second billion-dollar raise since September, underscoring the intense investor interest in companies positioned to challenge established players in the AI chip supply chain.

Source: PYMNTS

Benchmark Capital Creates Special Funds for Investment

A significant portion of the new capital came from Benchmark Capital, one of Cerebras' earliest backers that led the startup's $27 million Series A in 2016

1

. The prominent Silicon Valley firm invested at least $225 million in this latest funding round, according to sources familiar with the deal. Because Benchmark deliberately keeps its funds under $450 million, the firm raised two separate vehicles, both called 'Benchmark Infrastructure,' specifically to fund the Cerebras investment1

. This unusual move demonstrates the firm's conviction in Cerebras' potential to disrupt the AI hardware market dominated by Nvidia.Wafer-Scale Engine Technology Sets Cerebras Apart

What distinguishes this Nvidia rival is the physical scale of its processors. The company's Wafer Scale Engine, with its flagship WSE-3 AI chip announced in 2024, measures approximately 8.5 inches on each side and packs 4 trillion transistors into a single piece of silicon—19 times more than Nvidia's Blackwell B200 graphics card

1

4

. The chip is manufactured from nearly an entire 300-millimeter silicon wafer, whereas traditional chips are thumbnail-sized fragments cut from these wafers. This architecture delivers 900,000 specialized cores working in parallel, allowing the system to process AI calculations without shuffling data between multiple separate chips—a major bottleneck in conventional GPU clusters1

4

.

Source: SiliconANGLE

OpenAI Partnership Validates AI Infrastructure Approach

The funding comes as Cerebras gains momentum in the AI infrastructure race. Last month, the Sunnyvale, California-based company signed a multi-year agreement worth more than $10 billion to provide 750 megawatts of computing power to OpenAI through 2028

1

3

. The partnership aims to help OpenAI deliver faster response times for complex AI queries. OpenAI CEO Sam Altman, who is also an early investor in Cerebras, has been seeking alternatives to Nvidia for AI inference chips as the company looks to diversify its chip supplies2

. About half of the WSE-3 processor's surface area is dedicated to hosting a 44-gigabyte pool of SRAM memory, enabling it to run many AI models without moving data to off-chip HBM memory, which speeds up AI model training and inference tasks by more than 20 times compared to competing systems1

4

.Related Stories

Path to IPO Complicated by G42 Relationship

Cerebras' journey to going public has faced obstacles related to its relationship with G42, a UAE-based AI firm that accounted for 87% of Cerebras' revenue as of the first half of 2024

1

. G42's historical ties to Chinese technology companies triggered a national security review by the Committee on Foreign Investment in the United States, delaying Cerebras' initial IPO plans and prompting the company to withdraw an earlier filing in early 2025. By late last year, G42 had been removed from Cerebras' investor list, clearing the way for a fresh IPO attempt1

. The company filed for an IPO in September 2024, disclosing that it generated $136.4 million in revenue during the first six months of 2024, a more than tenfold increase from the same period a year earlier, while losses narrowed to $66.6 million from $77.8 million4

. Cerebras is now preparing for a public debut in the second quarter of 2026, according to Reuters1

.Competition Intensifies in Data Centers Market

The race to develop data centers for supporting AI technology has made the chips required for computing power a prized commodity, fueling Nvidia's rise to become the most valuable company in the world

2

. AI-linked companies have continued to draw billions in private financing as corporations and governments race to scale the technology5

. The fundraising underscores a broader trend of companies staying private for longer with abundant capital available outside of public markets2

. According to Cerebras, customers can link together 2,048 CS-3 appliances—water-cooled systems that ship the WSE-3 chip—into a cluster with 256 exaflops of aggregate computing capacity, enough to train a large language model with 24 trillion parameters4

. This capability positions Cerebras as a key player alongside Nvidia and AMD in the evolving AI chip supply chain, particularly as major AI players seek to diversify their hardware suppliers.

Source: Reuters

References

Summarized by

Navi

[3]

Related Stories

Cerebras Systems Raises $1.1 Billion in Pre-IPO Funding Round, Challenging Nvidia in AI Chip Market

30 Sept 2025•Business and Economy

Cerebras Systems Files for IPO, Showcasing Strong Revenue Growth in AI Chip Market

02 Oct 2024

Cerebras Files for IPO, Challenging Nvidia's AI Chip Dominance

01 Oct 2024•Technology

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

Meta strikes up to $100 billion AI chips deal with AMD, could acquire 10% stake in chipmaker

Technology

3

Pentagon threatens Anthropic with supply chain risk label over AI safeguards for military use

Policy and Regulation