China's Ambitious Plan to Create a National Computing Power Network Faces Challenges

3 Sources

3 Sources

[1]

China is developing nation-spanning network to sell surplus data center compute power -- latency, disparate hardware are key hurdles

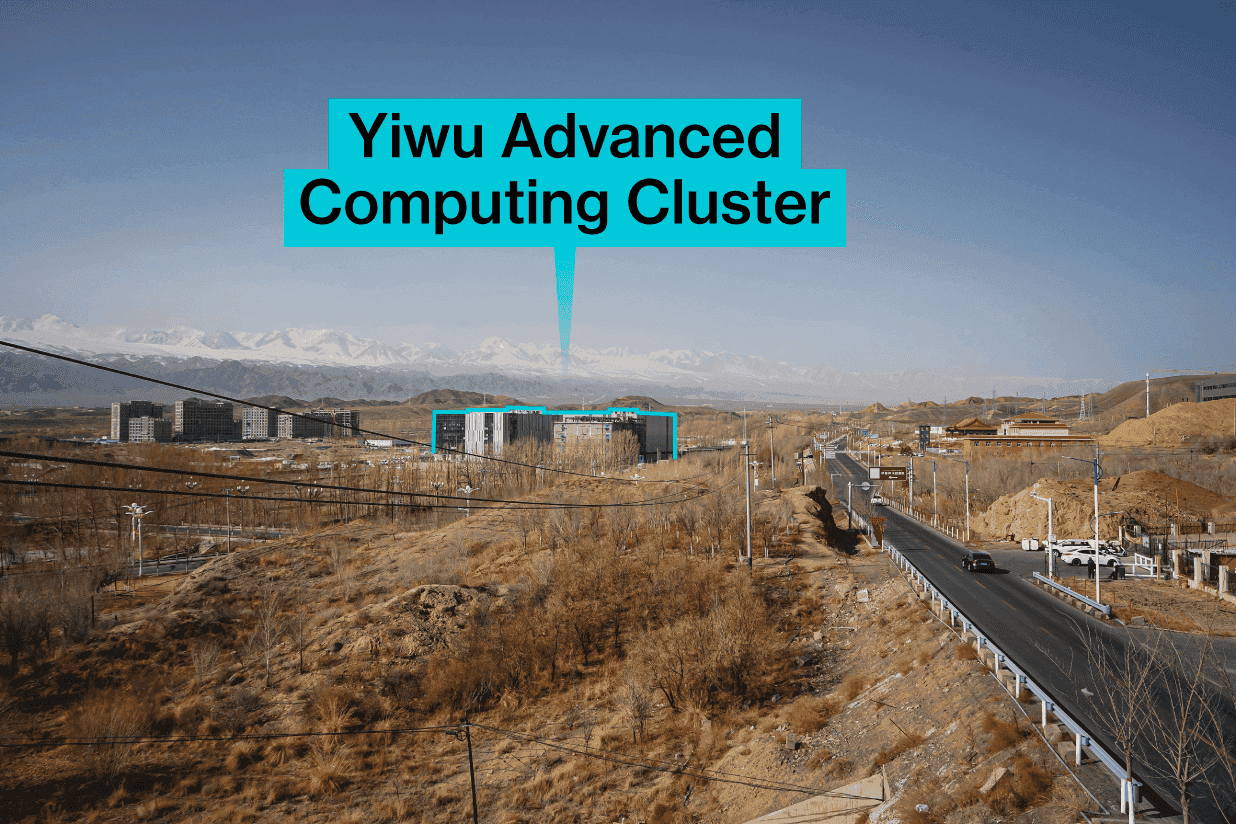

Wedding Nvidia CUDA and Huawei CANN in a single cloud service? After a rapid expansion left China with excess capacity of compute power in underused data centers, the country is reevaluating its approach to data center development. Authorities are now working on a national plan to regulate growth, optimize existing resources, and link facilities into a unified computing network that can sell unused compute power to those who need it, reports Reuters. Driven by the 'Eastern Data, Western Computing' strategy, various startups built hundreds of large-scale data centers for AI and cloud computing in the People's Republic. This initiative encouraged local governments to build data centers in the country's western regions, where electricity is cheaper, to serve demand from the eastern economic zones. Analysts argued that while building in remote provinces lowers energy costs, it often compromises latencies, which in turn lowers demand for their services, as many applications are latency sensitive. Many data centers were built on the assumption that state-owned companies and government agencies would purchase computing power. However, demand has fallen short of expectations, leaving many data centers idle or operating at a 20% - 30% load, way below their capacity. And despite the weak outlook, investments continued and state spending on data centers totaled $3.4 billion in 2024, which was even more than in 2023. This year, around $1.73 billion has been spent on data center infrastructure, according to government procurement data reviewed by Reuters. Now, concerns are growing among local governments about the long-term viability of their investments. Over the past 18 months, more than 100 data center projects have been scrapped, a sharp increase from just 11 cancellations in all of 2023. As a result, the National Development and Reform Commission (NDRC) is conducting a comprehensive review of the sector, imposing new restrictions to prevent overbuilding. For example, reviews of projects are now more thorough, and there is a ban on small-scale computing infrastructure funded by local authorities. The goal is to filter out projects lacking economic justification and ensure that new facilities meet basic efficiency criteria, such as minimum utilization thresholds and purchase contracts. In parallel, the Ministry of Industry and Information Technology (MIIT) is exploring the creation of a centralized cloud platform to aggregate unused computing power across the country and offer computing capacity as a service to users around China through a centralized national network. The plan is developed in cooperation with three state-owned telecom providers, China Mobile, China Telecom, and China Unicom. However, there are technical challenges with such a platform. When the 'Eastern Data, Western Computing' initiative was launched, Beijing set a goal of achieving a network latency of 20 milliseconds, which is necessary for real-time applications like financial services or high-frequency trading. However, many western-region centers fail to meet this performance standard due to infrastructure limitations. Another obstacle is the diversity of computing hardware used across different facilities. Some data centers use Nvidia GPUs and the CUDA software stack, while others rely on Huawei's Ascend accelerators and the CANN software stack. As a result, it is impossible to integrate them into a single, seamless cloud environment, which poses a major hurdle to the success of the proposed unified platform. The MIIT may have to offer a choice of hardware to clients, which might not help to improve utilization of Huawei-based facilities, but will at least boost utilization of Nvidia-powered clusters. Despite these issues, Beijing remains committed to its national computing network. Officials believe that centralized scheduling and orchestration of computing power will support China's ambitions in AI and cloud services and facilitate better return-on-investment for at least some projects. However, analysts say that the integration of diverse hardware is an extremely complex endeavor, which will take time and may not deliver on its full promise.

[2]

China plans network to sell surplus computing power in crackdown on data centre glut

July 24 (Reuters) - China is taking steps to build a network to sell computing power and curb the unwieldy growth of data centres after thousands of local government-backed centres that sprouted in the country caused a capacity glut and threatened their viability. The state planner is conducting a nationwide assessment of the sector after a three-year data centre building boom, according to two sources familiar with the matter and a document seen by Reuters. Beijing is also seeking to set up a national, state-run cloud service for harnessing surplus computing power, according to Chinese government policy advisers. The Ministry of Industry and Information Technology (MIIT) is collaborating with China's three state telecoms companies on ways to connect the data centres in a network to create a platform that can sell the computing power, they said. Computing power is a crucial element in the race for technological supremacy between China and the U.S. Besides being an embarrassment for Beijing, unused computing power and financially shaky data centres could hinder China's ambitions in the development of artificial intelligence capabilities. "Everything will be handed over to our cloud to perform unified organisation, orchestration, and scheduling capabilities," Chen Yili, deputy chief engineer at the China Academy of Information and Communications Technology, a think tank affiliated to the industry ministry, told an industry conference in Beijing last month. Chen did not specify details of the cloud service proposal, but his presentation materials showed China was targeting standardised interconnection of public computing power nationwide by 2028, even as some analysts were skeptical about the plan given the technological challenges it posed. China Mobile (600941.SS), opens new tab, China Unicom (0762.HK), opens new tab and China Telecom (601728.SS), opens new tab, the state-run telecoms companies, and MIIT did not respond to requests for comment. The sources did not want to be identified because of the sensitivities of the issue. NATIONWIDE NETWORK China's data centre building boom kickstarted in 2022 after Beijing launched an ambitious infrastructure project called "Eastern Data, Western Computing", aimed at coordinating data centre construction by concentrating facilities in western regions - where energy costs are cheaper - to meet demand from the eastern economic hubs. Chen said at the June event that the industry ministry has so far licensed at least 7,000 computing centres. A Reuters review of government procurement documents for data centres used in computing shows a surge last year in state investment, totalling 24.7 billion yuan ($3.4 billion), compared to over 2.4 billion yuan in 2023. This year, already 12.4 billion yuan has been invested in these centres, most of it in the far-west region of Xinjiang. But while only 11 such data centre-related projects were cancelled in 2023, over 100 cancellations occurred over the past 18 months, pointing to growing concerns among local governments about returns on their investments. And utilisation rates are estimated to be low, with four sources putting them at around 20%-30%. Driven by expectations that government and state-owned firms will act as buyers, investors and local governments tend to build without considering real market needs, said a project manager who works for a server company that provides products for such data centers. "The idea of building data centers in remote western provinces lacks economic justification in the first place," said Charlie Chai, an analyst with 86Research, adding lower operating costs had to be viewed against degradation in performance and accessibility. To regulate the sector's growth, China's state planner National Development and Reform Commission (NDRC) initiated a nationwide assessment earlier this year that has already tightened scrutiny of new data center projects planned after March 20, and banned local governments from participating in small-sized computing infrastructure projects. The NDRC aims to prevent resource wastage by setting specific thresholds - such as requiring a computing power purchase agreement and a minimum utilisation ratio - to filter out unqualified projects, according to a person familiar with the matter, who did not provide details on the thresholds. NDRC did not respond to a request for comment. CHALLENGES Industry sources and Chinese policy advisers said the formation of a computing power network will not be easy, given that the technology for data centers to efficiently transfer the power to users in real-time remains underdeveloped. When the Chinese government rolled out the Eastern Data, Western Computing project, it targeted a maximum latency of 20 milliseconds by 2025, a threshold necessary for real-time applications such as high-frequency trading and financial services. However, many facilities, especially those built in the remote western regions, still have not achieved this standard, the project manager said. Many of the centres also use different chips from Nvidia (NVDA.O), opens new tab and local alternatives such as Huawei's (HWT.UL) Ascend chips, making it difficult to integrate various AI chips with different hardware and software architectures to create a unified cloud service. Chen, however, was optimistic, describing a vision of the cloud bridging the differences in underlying computing power and the physical infrastructure. "Users do not need to worry about what chips are at the bottom layer; they just need to specify their requirements, such as the amount of computing power and network capacity needed," he said. ($1 = 7.1715 Chinese yuan renminbi) Reporting by Reuters staff; Editing by Muralikumar Anantharaman Our Standards: The Thomson Reuters Trust Principles., opens new tab

[3]

China plans network to sell surplus computing power in crackdown on data centre glut

China is actively developing a national network to distribute computing power and address the oversupply of data centers. The initiative follows a period of rapid expansion and aims to consolidate resources, improve efficiency, and support the country's AI ambitions. Challenges remain in achieving seamless data transfer and integrating diverse chip technologies. China is taking steps to build a network to sell computing power and curb the unwieldy growth of data centres after thousands of local government-backed centres that sprouted in the country caused a capacity glut and threatened their viability. The state planner is conducting a nationwide assessment of the sector after a three-year data centre building boom, according to two sources familiar with the matter and a document seen by Reuters. Beijing is also seeking to set up a national, state-run cloud service for harnessing surplus computing power, according to Chinese government policy advisers. The Ministry of Industry and Information Technology (MIIT) is collaborating with China's three state telecoms companies on ways to connect the data centres in a network to create a platform that can sell the computing power, they said. Computing power is a crucial element in the race for technological supremacy between China and the U.S. Besides being an embarrassment for Beijing, unused computing power and financially shaky data centres could hinder China's ambitions in the development of artificial intelligence capabilities. "Everything will be handed over to our cloud to perform unified organisation, orchestration, and scheduling capabilities," Chen Yili, deputy chief engineer at the China Academy of Information and Communications Technology, a think tank affiliated to the industry ministry, told an industry conference in Beijing last month. Chen did not specify details of the cloud service proposal, but his presentation materials showed China was targeting standardised interconnection of public computing power nationwide by 2028, even as some analysts were skeptical about the plan given the technological challenges it posed. China Mobile, China Unicom and China Telecom, the state-run telecoms companies, and MIIT did not respond to requests for comment. The sources did not want to be identified because of the sensitivities of the issue. NATIONWIDE NETWORK China's data centre building boom kickstarted in 2022 after Beijing launched an ambitious infrastructure project called "Eastern Data, Western Computing", aimed at coordinating data centre construction by concentrating facilities in western regions - where energy costs are cheaper - to meet demand from the eastern economic hubs. Chen said at the June event that the industry ministry has so far licensed at least 7,000 computing centres. A Reuters review of government procurement documents for data centres used in computing shows a surge last year in state investment, totalling 24.7 billion yuan ($3.4 billion), compared to over 2.4 billion yuan in 2023. This year, already 12.4 billion yuan has been invested in these centres, most of it in the far-west region of Xinjiang. But while only 11 such data centre-related projects were cancelled in 2023, over 100 cancellations occurred over the past 18 months, pointing to growing concerns among local governments about returns on their investments. And utilisation rates are estimated to be low, with four sources putting them at around 20%-30%. Driven by expectations that government and state-owned firms will act as buyers, investors and local governments tend to build without considering real market needs, said a project manager who works for a server company that provides products for such data centers. "The idea of building data centers in remote western provinces lacks economic justification in the first place," said Charlie Chai, an analyst with 86Research, adding lower operating costs had to be viewed against degradation in performance and accessibility. To regulate the sector's growth, China's state planner National Development and Reform Commission (NDRC) initiated a nationwide assessment earlier this year that has already tightened scrutiny of new data center projects planned after March 20, and banned local governments from participating in small-sized computing infrastructure projects. The NDRC aims to prevent resource wastage by setting specific thresholds - such as requiring a computing power purchase agreement and a minimum utilisation ratio - to filter out unqualified projects, according to a person familiar with the matter, who did not provide details on the thresholds. NDRC did not respond to a request for comment. CHALLENGES Industry sources and Chinese policy advisers said the formation of a computing power network will not be easy, given that the technology for data centers to efficiently transfer the power to users in real-time remains underdeveloped. When the Chinese government rolled out the Eastern Data, Western Computing project, it targeted a maximum latency of 20 milliseconds by 2025, a threshold necessary for real-time applications such as high-frequency trading and financial services. However, many facilities, especially those built in the remote western regions, still have not achieved this standard, the project manager said. Many of the centres also use different chips from Nvidia and local alternatives such as Huawei's Ascend chips, making it difficult to integrate various AI chips with different hardware and software architectures to create a unified cloud service. Chen, however, was optimistic, describing a vision of the cloud bridging the differences in underlying computing power and the physical infrastructure. "Users do not need to worry about what chips are at the bottom layer; they just need to specify their requirements, such as the amount of computing power and network capacity needed," he said.

Share

Share

Copy Link

China is developing a nationwide network to sell surplus data center computing power, aiming to address overcapacity issues and boost AI capabilities. However, the project faces significant technical hurdles.

China's Ambitious Data Center Initiative

China is embarking on an ambitious project to create a nationwide network for selling surplus computing power from its data centers. This initiative comes in response to a significant overcapacity issue that has emerged following a rapid expansion of data center construction across the country

1

2

3

.The 'Eastern Data, Western Computing' Strategy

The surge in data center development was initially driven by China's 'Eastern Data, Western Computing' strategy, launched in 2022. This plan aimed to concentrate data center facilities in western regions, where energy costs are lower, to meet the computing demands of the eastern economic zones

1

2

. The Ministry of Industry and Information Technology (MIIT) has licensed at least 7,000 computing centers as part of this initiative2

.Overcapacity and Underutilization

Despite the ambitious plans, many of these data centers are now operating well below capacity:

- Utilization rates are estimated to be around 20-30%

2

- Over 100 data center projects have been cancelled in the past 18 months

1

2

- State investment in data centers surged to 24.7 billion yuan ($3.4 billion) in 2024, up from 2.4 billion yuan in 2023

2

The National Computing Power Network

To address these issues, Chinese authorities are now working on a plan to create a centralized cloud platform. This platform aims to:

- Aggregate unused computing power across the country

- Offer computing capacity as a service to users throughout China

- Optimize existing resources and regulate future growth

1

2

Source: Tom's Hardware

The Ministry of Industry and Information Technology is collaborating with state-owned telecom providers China Mobile, China Telecom, and China Unicom to develop this platform

1

2

.Technical Challenges

The implementation of this national computing network faces several significant hurdles:

-

Latency Issues: Many western-region centers fail to meet the 20-millisecond latency standard set by the government, which is crucial for real-time applications

1

2

. -

Hardware Diversity: Data centers use a variety of computing hardware, including Nvidia GPUs with CUDA software and Huawei's Ascend accelerators with CANN software, making integration challenging

1

3

. -

Real-time Power Transfer: The technology for efficiently transferring computing power to users in real-time is still underdeveloped

2

.

Related Stories

Regulatory Measures

To address these challenges and prevent further resource wastage, China's National Development and Reform Commission (NDRC) is taking several steps:

- Conducting a comprehensive review of the sector

- Imposing new restrictions to prevent overbuilding

- Banning small-scale computing infrastructure funded by local authorities

- Setting specific thresholds for new projects, including minimum utilization requirements

1

2

Future Outlook

Despite the challenges, Chinese officials remain committed to the national computing network. They believe that centralized scheduling and orchestration of computing power will support China's ambitions in AI and cloud services

1

. However, analysts caution that integrating diverse hardware is a complex endeavor that will take time and may not fully deliver on its promise1

3

.As China targets standardized interconnection of public computing power nationwide by 2028, the success of this initiative could have significant implications for the country's technological competitiveness and its race for AI supremacy with the United States

2

3

.References

Summarized by

Navi

[1]

Related Stories

China's Ambitious AI Data Center Plans Raise Questions About Chip Acquisition

10 Jul 2025•Technology

China's AI Data Center Boom Turns Bust: Billions in Idle Infrastructure as Market Shifts

28 Mar 2025•Business and Economy

Power Crisis Becomes Critical Bottleneck in Global AI Infrastructure Race

02 Nov 2025•Technology

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology