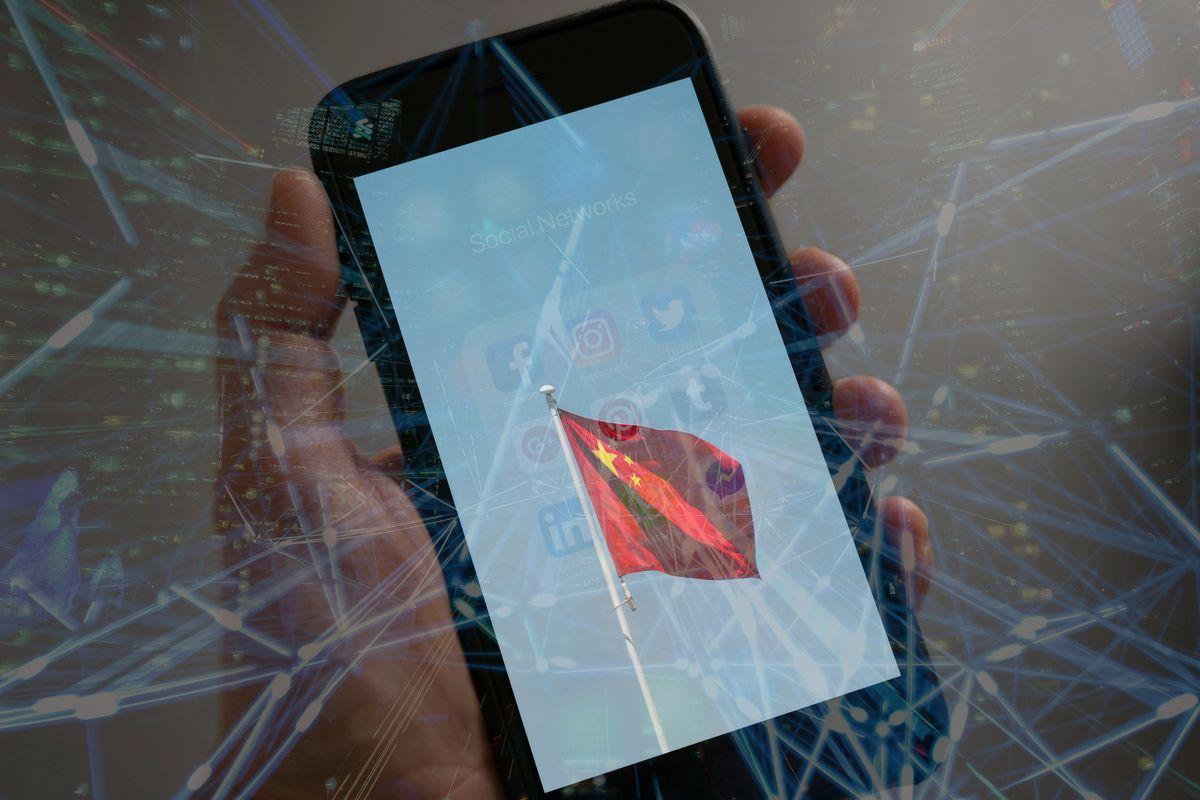

China to Crack Down on AI-Generated Stock Market Misinformation

3 Sources

3 Sources

[1]

China to crack down on stock market fake news as AI spurs misinformation, says state media

SHANGHAI, March 15 ((Reuters)) - China's securities watchdog will step up monitoring fake information in the stock market and work with the police and cyberspace regulators to crack down on those who disseminate false news, which is being made easier by AI, official media reported on Saturday. Regulators will "hit early, hit hard, and hit at the heart" of the issue, the Securities Times said. Artificial intelligence has become a new tool for creating and spreading misleading information to con investors or manipulate stocks, luring investors with the prospect of getting rich quickly, the Shanghai Securities News said in a separate article. The rise of Chinese AI company DeepSeek has driven retail investors and fund managers to embrace AI to help them evaluate companies and invest, but their adoption of the technology also raises risks they will become vulnerable to fake news created by artificial intelligence. The Securities Times said the China Securities Regulatory Commission would be more pro-active in dispelling stock market rumours by issuing clarifications and would strengthen investor education and guidance to "enhance investors' ability to spot" fake information. The reports by the Securities Times and the Shanghai Securities News coincide with the March 15 annual World Consumer Rights Day, which has become a major television and social media event in China to promote consumer protection. Reporting by Shanghai Newsroom; Editing by Susan Fenton Our Standards: The Thomson Reuters Trust Principles., opens new tab Suggested Topics:Artificial Intelligence

[2]

China to crack down on stock market fake news as AI spurs misinformation, says state media

Artificial intelligence has become a new tool for creating and spreading misleading information to con investors or manipulate stocks, luring investors with the prospect of getting rich quickly.China's securities watchdog will step up monitoring fake information in the stock market and work with the police and cyberspace regulators to crack down on those who disseminate false news, which is being made easier by AI, official media reported on Saturday. Regulators will "hit early, hit hard, and hit at the heart" of the issue, the Securities Times said. Artificial intelligence has become a new tool for creating and spreading misleading information to con investors or manipulate stocks, luring investors with the prospect of getting rich quickly, the Shanghai Securities News said in a separate article. The rise of Chinese AI company DeepSeek has driven retail investors and fund managers to embrace AI to help them evaluate companies and invest, but their adoption of the technology also raises risks they will become vulnerable to fake news created by artificial intelligence. The Securities Times said the China Securities Regulatory Commission would be more pro-active in dispelling stock market rumours by issuing clarifications and would strengthen investor education and guidance to "enhance investors' ability to spot" fake information. The reports by the Securities Times and the Shanghai Securities News coincide with the March 15 annual World Consumer Rights Day, which has become a major television and social media event in China to promote consumer protection.

[3]

China to crack down on stock market fake news as AI spurs misinformation, says state media

SHANGHAI, March 15 - China's securities watchdog will step up monitoring fake information in the stock market and work with the police and cyberspace regulators to crack down on those who disseminate false news, which is being made easier by AI, official media reported on Saturday. Regulators will "hit early, hit hard, and hit at the heart" of the issue, the Securities Times said. Artificial intelligence has become a new tool for creating and spreading misleading information to con investors or manipulate stocks, luring investors with the prospect of getting rich quickly, the Shanghai Securities News said in a separate article. The rise of Chinese AI company DeepSeek has driven retail investors and fund managers to embrace AI to help them evaluate companies and invest, but their adoption of the technology also raises risks they will become vulnerable to fake news created by artificial intelligence. The Securities Times said the China Securities Regulatory Commission would be more pro-active in dispelling stock market rumours by issuing clarifications and would strengthen investor education and guidance to "enhance investors' ability to spot" fake information. The reports by the Securities Times and the Shanghai Securities News coincide with the March 15 annual World Consumer Rights Day, which has become a major television and social media event in China to promote consumer protection. (Reporting by Shanghai Newsroom; Editing by Susan Fenton)

Share

Share

Copy Link

China's securities watchdog announces plans to combat fake news in the stock market, particularly focusing on AI-generated misinformation. The move aims to protect investors and maintain market integrity.

China's Regulatory Crackdown on AI-Generated Stock Market Misinformation

In a significant move to protect investors and maintain market integrity, China's securities watchdog has announced plans to intensify its efforts against fake information in the stock market. This initiative comes as artificial intelligence (AI) increasingly becomes a tool for creating and disseminating misleading information that can manipulate stocks and con investors

1

.The AI-Driven Misinformation Challenge

The Shanghai Securities News reports that AI has emerged as a new weapon in the arsenal of those seeking to spread false information in the financial markets. These AI-generated falsehoods often lure investors with promises of quick riches, exploiting the human desire for rapid wealth accumulation

2

.Regulatory Response and Collaboration

The China Securities Regulatory Commission (CSRC) is set to adopt a more proactive stance in combating market rumors. According to the Securities Times, the watchdog will:

- Increase monitoring of fake information

- Collaborate with police and cyberspace regulators

- Issue timely clarifications to dispel rumors

- Strengthen investor education and guidance

3

The regulatory approach is summarized as "hit early, hit hard, and hit at the heart" of the issue, signaling a robust and comprehensive strategy to tackle the problem

1

.The Rise of AI in Chinese Financial Markets

The growing influence of AI in China's financial sector is exemplified by the rise of companies like DeepSeek. This Chinese AI firm has driven both retail investors and fund managers to adopt AI technologies for company evaluation and investment decisions. However, this adoption also increases the risk of vulnerability to AI-generated fake news

1

.Related Stories

Enhancing Investor Protection

A key focus of the regulatory efforts is to "enhance investors' ability to spot" fake information. This initiative aligns with the broader context of consumer protection in China, as evidenced by its coincidence with the annual World Consumer Rights Day on March 15th, a major event promoting consumer rights across Chinese media platforms

3

.Implications for the AI and Financial Sectors

This regulatory crackdown highlights the double-edged nature of AI in financial markets. While AI offers powerful tools for analysis and decision-making, it also presents new challenges in maintaining market integrity. The move by Chinese regulators could set a precedent for how other countries approach the intersection of AI, misinformation, and financial market regulation in the future.

References

Summarized by

Navi

[1]

Related Stories

DeepSeek's AI Breakthrough Sparks Chinese Stock Rally, Shifting Investment from India

18 Feb 2025•Business and Economy

DeepSeek Sparks AI Revolution in Chinese Fund Management Industry

12 Mar 2025•Business and Economy

DeepSeek's AI Breakthrough Sparks Chinese Tech Rally and Global Market Shifts

15 Feb 2025•Technology

Recent Highlights

1

Pentagon threatens Anthropic with Defense Production Act over AI military use restrictions

Policy and Regulation

2

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

3

Anthropic accuses Chinese AI labs of stealing Claude through 24,000 fake accounts

Policy and Regulation