Chinese AI chipmakers Biren and Iluvatar race to Hong Kong IPO amid chip funding frenzy

2 Sources

2 Sources

[1]

China's premier GPU maker Biren kicks off Hong Kong IPO -- GPU startups vying for Nvidia's crown race to fund AI chip development

Shanghai-based Biren is targeting up to US$624 million in what would be the first Hong Kong listing by a mainland GPU developer. Shanghai Biren Intelligent Technology Co has begun bookbuilding for a Hong Kong initial public offering aimed at raising as much as HK$4.85 billion (US$624 million), as Chinese AI chipmakers accelerate listings to fund expansion amid strong investor demand. The company plans to start trading on January 2, becoming the first new Hong Kong listing of 2026. According to its exchange filing, Biren is offering approximately 247.7 million shares at a price range of HK$17 to HK$19.60 per share. The company would be the first mainland GPU developer to list in Hong Kong, joining a growing pipeline of Chinese AI firms that are tapping into offshore capital markets. The offering comes as domestic GPU startups attract intense market attention following recent product debuts by Moore Threads Technology, with its "Huagang" architecture, and MetaX Integrated Circuits. Shares in Moore Threads rose roughly 425% on their first day of trading, while MetaX climbed about 693% by the close of its debut session. Alongside Biren and Enflame Technology, the companies are often grouped as China's "four little dragons" in the GPU sector, each seeking to challenge the dominance of Nvidia in AI accelerators. Biren's IPO has secured commitments from 23 cornerstone investors, who have agreed to subscribe to roughly US$372.5 million worth of shares with a six-month lock-up period. The group includes Qiming Venture Partners, Ping An Group, UBS, Digital China, and asset managers such as Lion Global Investors and Eastspring Investments. Founded in 2019, Biren began generating revenue from its intelligent computing solutions in 2023. The company reported revenue of 336.8 million yuan (US$47.8 million) last year, followed by 58.9 million yuan in the first half of 2025. It also disclosed pending and contracted orders totaling about 2.1 billion yuan, which it says will support near-term growth as deployments scale. Losses, however, have continued to widen. Biren said its total loss for the first half of 2025 rose 32.3% year over year to nearly 9 billion yuan, reflecting heavy spending on research, software development, and commercialization. In its prospectus, the company cited global political and economic factors as ongoing risks to its financial position and path to profitability, including U.S. trade restrictions. Biren was added to Washington's Entity List in October 2023, a move that limited its access to certain foreign technologies and suppliers and contributed to a 108.7 million yuan loss that year. The company has since emphasized greater reliance on domestic supply chains while continuing to develop data center-class AI accelerators. Biren's listing adds to a broader wave of mainland technology firms pursuing Hong Kong floats. AI startup MiniMax recently cleared its IPO hearing and is also due to launch in January, while "AI tiger" Zhipu has completed the same process. Backed by Alibaba Group Holding and Tencent Holdings, MiniMax is also expected to direct IPO proceeds toward research and development as competition in China's AI hardware and software markets intensifies.

[2]

Hong Kong Chip Frenzy Enters AI Lane With This IPO

Enter your email to get Benzinga's ultimate morning update: The PreMarket Activity Newsletter The maker of general purpose GPUs used in AI computing has made its first public filing and passed its listing hearing for a Hong Kong IPO that could raise around $300 million Key Takeaways: Iluvatar CoreX has filed for a Hong Kong IPO and passed its listing hearing, following a similar filing by rival Biren, seizing on strong investor appetite for GPU listings The AI chipmaker's sales increased by 64% in the first half of this year, but its loss for the period was nearly double its revenue. Call it microchip mania or a silicon feeding frenzy. Whatever you name it, China's AI chip sector is having its moment, feeding on the glory of global superstar Nvidia, which lived in obscurity for years before breaking out to become the world's most valuable company. Two homegrown AI chipmakers captivated investors this month with spectacular stock debuts that made them some of the hottest properties on China's domestic stock markets. Moore Threads (688795.SS) saw its shares surge over 400% when it debuted in Shanghai this month. Two weeks later, rival MetaX (688802.SS) soared by an even bigger 700% in its Shanghai debut. But the story doesn't end there, as envious competitors clamor for their own piece of the investor pie. Into that mix comes Shanghai Iluvatar CoreX Semiconductor Co. Ltd., which last Friday made its first public filing for aHong Kong IPO, the same day it also passed its listing hearing. Iluvatar's move came just two days after rival Biren Semiconductor made its own first public filing for a Hong Kong IPO. Those two filings follow an announcement by search leader and autonomous driving specialist Baidu this month that it was evaluating a potential spinoff and listing of its AI chip unit, Kunlunxin, also in Hong Kong. Reports of Iluvatar's Hong Kong IPO plans first surfaced in August, saying the company planned to raise about $300 million. The success of Moore Threads and MetaX suggests there's strong appetite in China for general purpose graphic processing unit (GPU) stocks - a dynamic that Iluvatar and Biren hope will translate to similar demand from Hong Kong's more internationally focused investor base. The Shanghai rallies were driven by investors wagering on Beijing's push for technological self-sufficiency in AI chips, at a time when Nvidia and other international leaders face growing restrictions on what products they can sell to companies in China. However, investors will need to weigh a series of risks before piling in. Those include not only challenges posed by U.S. sanctions but also a major technology gap that will limit these upstarts, most with less than a decade of history, in their ability to capture market share. We'll explore these issues in more detail shortly. But first, we'll take a closer look at Iluvatar, which is quite typical of this group of AI chipmakers whose actual experience and sales are far smaller than their big dreams. The company was founded in 2015 by Li Yunpeng, a previous R&D director at U.S. database giant Oracle. Its management team also includes Zheng Jinshan, a former researcher at leading chipmaker AMD. Such leadership teams, featuring executives with experience at major U.S. tech firms, is common among Chinese AI chip startups. MetaX, for instance, was founded by AMD veterans, while Moore Threads was established by a former Nvidia executive. Like its peers, Iluvatar designs GPU products for AI workloads, including chips for training new AI models as well as inference chips used for deploying those models. And like others in the sector, it is a "fabless" company that outsources chip manufacturing to third-party foundries while focusing its efforts on chip design and marketing. Tiny scale Iluvatar's listing document reveals the company is still quite small in terms of sales, though the figure is growing rapidly. Its revenue reached 539.5 million yuan ($76.6 million) in 2024, nearly double the 289 million yuan it recorded in 2023. Its revenue jumped another 64% year-on-year to 324 million yuan in the first half of this year. While that growth appears impressive, the absolute numbers are still quite small. In terms of actual chips shipped, Iluvatar delivered just 52,000 units as of June - a tiny fraction of the nearly 2 million chips Nvidia moved in China in 2024 alone, according to IDC. Most of Iluvatar's Chinese rivals are also just blips on the global AI chip radar. MetaX posted revenue of 743 million yuan in 2024, while Moore Threads recorded an even smaller 438 million yuan, and Biren clocked in at just 337 million yuan. The group faces a series of difficulties, led by their lack of access to advanced chip manufacturing technology. U.S. sanctions implemented in late 2024 effectively cut off Chinese AI chip companies from working with contract chip foundry TSMC, which dominates the global market for advanced chip manufacturing. Lacking such access, many have shifted their production back to Mainland China, turning to domestic foundries like industry leader SMIC. But that approach presents significant challenges. First, U.S. sanctions have capped SMIC's capabilities at around 7 nm technology - several generations behind TSMC, which has already begun producing 2 nm chips. This means companies like Iluvatar will lack the ability to produce upgraded products even as their design capabilities catch up with U.S. peers. SMIC also has limited capacity to make 7 nm chips due to inability to buy additional advanced manufacturing equipment, forcing Chinese chipmakers to compete fiercely for the foundry's scarce manufacturing slots. Those slots typically go to larger players like Huawei, leaving smaller firms struggling for access and often forced to look elsewhere. Given their relatively small revenue base and the high costs associated with designing and producing chips, it's no surprise that Iluvatar and its peers have yet to turn profits. In the first half of this year, Iluvatar posted a net loss of 609 million yuan, nearly double its revenue for the period. The potential upside for investors betting on Chinese GPU stocks is clear: Chinese demand for AI chips is massive and growing. Iluvatar cites third-party research in its prospectus forecasting the market will reach 898.1 billion yuan by 2029, quadruple the 217.5 billion yuan in 2024. Domestically made general purpose GPU products are expected to capture over 50% of that market by 2029, up from 17.4% last year and just 8.3% in 2022. Beijing will almost certainly continue supporting domestic GPU makers through various means, including financial subsidies and policy measures that carve out protected areas of the market. However, as investors weigh the massive upside, they should also consider the intensely fierce competition building in the market. Beyond the names we've already mentioned, Iluvatar and its peers face more formidable rivals in the likes of Huawei, along with mid-tier players like Cambricon (688256.SH) and Hygon (688041.SH). These larger competitors not only command priority access to SMIC's limited capacity, but also lead in technology and product development, and possess far deeper financial resources. But all signs of a building chip bubble, which seems destined to burst in the next five to 10 years, are beside the point. For now, at least, shares of all the new names like Iluvatar seem destined to do well in the beginning, snapped up by investors looking for big short-term gains. Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy. Market News and Data brought to you by Benzinga APIs

Share

Share

Copy Link

Shanghai-based Biren has kicked off bookbuilding for a Hong Kong IPO targeting up to $624 million, becoming the first mainland GPU developer to list in the city. Rival Iluvatar CoreX followed days later with its own filing, riding a wave of investor enthusiasm after Moore Threads and MetaX saw their shares surge over 400% and 693% respectively on debut. But widening losses and U.S. trade restrictions cast shadows over the sector's path to profitability.

Chinese AI Chipmakers Launch Dual Hong Kong IPO Push

Shanghai Biren Intelligent Technology Co has begun bookbuilding for a Hong Kong IPO aimed at raising as much as HK$4.85 billion ($624 million), marking a watershed moment as the first mainland GPU developer to list in the city

1

. The company is offering approximately 247.7 million shares at a price range of HK$17 to HK$19.60 per share, with trading set to commence on January 2, 20261

. Just days after Biren's filing, rival Shanghai Iluvatar CoreX Semiconductor Co also passed its listing hearing and made its first public filing for a Hong Kong IPO targeting around $300 million2

. This dual push by GPU developers signals an accelerating race among Chinese AI chipmakers to secure offshore capital as they attempt to fund AI chip development and challenge Nvidia's dominance.

Source: Tom's Hardware

GPU Startups Ride Investor Frenzy After Spectacular Debuts

The timing of these Hong Kong IPO plans capitalizes on extraordinary investor appetite following recent mainland listings. Moore Threads Technology saw its shares surge roughly 425% on its first day of trading in Shanghai, while MetaX Integrated Circuits climbed about 693% by the close of its debut session

1

2

. This Hong Kong chip frenzy reflects strong investor belief in China's drive for technological independence in AI hardware, particularly as U.S. trade restrictions limit what Nvidia and other international leaders can sell to Chinese companies2

. Biren has secured commitments from 23 cornerstone investors who agreed to subscribe to roughly $372.5 million worth of shares with a six-month lock-up period, including Qiming Venture Partners, Ping An Group, UBS, Digital China, Lion Global Investors, and Eastspring Investments1

.Revenue Growth Masks Widening Losses and Scale Challenges

While these GPU startups show rapid revenue expansion, the absolute numbers reveal companies still in early commercialization stages. Founded in 2019, Biren began generating revenue from its intelligent computing solutions only in 2023, reporting revenue of 336.8 million yuan ($47.8 million) last year, followed by 58.9 million yuan in the first half of 2025

1

. The company disclosed pending and contracted orders totaling about 2.1 billion yuan to support near-term growth1

. Iluvatar CoreX showed stronger momentum with revenue reaching 539.5 million yuan ($76.6 million) in 2024, nearly double the 289 million yuan in 2023, and jumping another 64% year-over-year to 324 million yuan in the first half of this year2

.However, widening losses paint a sobering picture. Biren's total loss for the first half of 2025 rose 32.3% year-over-year to nearly 9 billion yuan, reflecting heavy spending on research, software development, and commercialization

1

. Iluvatar's loss for the same period was nearly double its revenue2

. The scale gap remains vast—Iluvatar delivered just 52,000 chips as of June, a tiny fraction of the nearly 2 million chips Nvidia moved in China in 2024 alone, according to IDC2

.

Source: Benzinga

Related Stories

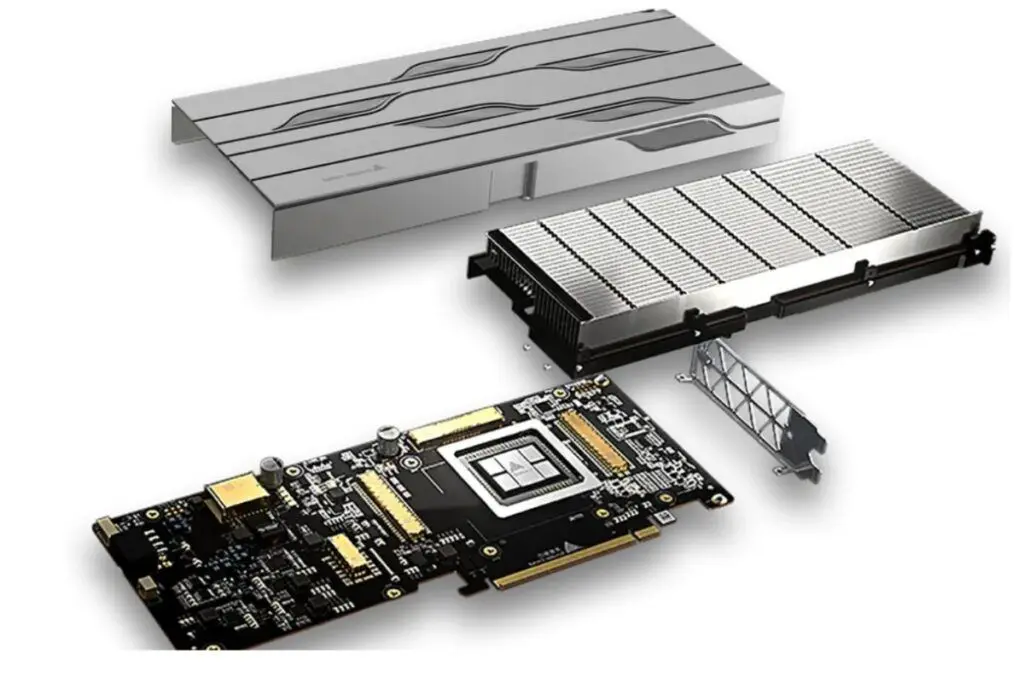

U.S. Trade Restrictions Force Domestic Supply Chain Pivot

Biren was added to Washington's Entity List in October 2023, limiting its access to certain foreign technologies and suppliers and contributing to a 108.7 million yuan loss that year

1

. The company has since emphasized greater reliance on domestic supply chains while continuing to develop data center-class AI accelerators1

. U.S. trade restrictions implemented in late 2024 effectively cut off Chinese AI chipmakers from working with contract chip foundry TSMC, which dominates the global market for advanced chip manufacturing2

. In its prospectus, Biren cited global political and economic factors as ongoing risks to its financial position and path to profitability1

. These general purpose GPUs face a major technology gap that will limit their ability to capture market share from established players.Broader Wave of AI Firms Tap Hong Kong Markets

Biren's listing adds to a broader wave of mainland technology firms pursuing Hong Kong floats to fund AI chip development. AI startup MiniMax recently cleared its IPO hearing and is also due to launch in January, while "AI tiger" Zhipu has completed the same process

1

. Backed by Alibaba Group Holding and Tencent Holdings, MiniMax is expected to direct IPO proceeds toward research and development as competition intensifies1

. Search leader and autonomous driving specialist Baidu announced this month it was evaluating a potential spinoff and listing of its AI chip unit, Kunlunxin, also in Hong Kong2

. Alongside Biren and Enflame Technology, companies like Moore Threads and MetaX are often grouped as China's "four little dragons" in the GPU sector, each seeking to challenge Nvidia's dominance in AI accelerators . Investors will watch whether Hong Kong's more internationally focused investor base shows the same enthusiasm as mainland markets, and whether these firms can achieve self-sufficiency while navigating geopolitical headwinds.References

Summarized by

Navi

[1]

Related Stories

Chinese AI Chip Startup Biren Technology Secures $207 Million Funding, Plans Hong Kong IPO Amid US-China Tech Tensions

26 Jun 2025•Business and Economy

Chinese AI Chipmakers Challenge Nvidia's Dominance with IPO Plans

12 Sept 2024

Zhipu AI becomes first China AI tiger to go public, vows to export brutal price war globally

02 Jan 2026•Business and Economy

Recent Highlights

1

Pentagon threatens Anthropic with Defense Production Act over AI military use restrictions

Policy and Regulation

2

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

3

Anthropic accuses Chinese AI labs of stealing Claude through 24,000 fake accounts

Policy and Regulation