Chinese AI Startup MiniMax Files for Hong Kong IPO, Targeting $4 Billion Valuation

3 Sources

3 Sources

[1]

Chinese AI firm MiniMax files confidentially for Hong Kong IPO, sources say

HONG KONG, July 16 (Reuters) - Chinese AI startup MiniMax has filed confidentially for a Hong Kong initial public offering, targeting a valuation of over $4 billion in the float, which could happen before the end of this year, three people with knowledge of the matter said. MiniMax could raise HK$4 billion to HK$5 billion ($510 million to $637 million) in the IPO, one of the sources said. China International Capital Corp (CICC) (601995.SS), opens new tab and UBS (UBSG.S), opens new tab have been hired as sponsors for the IPO, the sources said. The IPO size and valuation could change, however, subject to market conditions, cautioned the sources, all of whom declined to be named as the information was not public. MiniMax and CICC did not immediately respond to Reuters requests for comment. UBS declined to comment. The Wall Street Journal first reported on MiniMax's Hong Kong IPO filing on Wednesday. ($1 = 7.8496 Hong Kong dollars) Reporting by Kane Wu in Hong Kong and Liam Mo and Che Pan in Beijing; additional reporting by Scott Murdoch in Sydney; Editing by Joe Bavier Our Standards: The Thomson Reuters Trust Principles., opens new tab * Suggested Topics: * Asia Pacific Kane Wu Thomson Reuters Kane Wu covers M&A, private equity, venture capital and investment banks in Asia. She tracks the region's most high-profile deals, fundraisings as well as investment trends amidst geopolitical, macroeconomic and regulatory changes. She was nominated for a SOPA Excellence in Business Reporting award for coverage of China regulatory crackdown in 2021. Prior to Reuters, she worked at the Wall Street Journal and also wrote about Asia's loan market for Thomson Reuters Basis Point. She is based in Hong Kong.

[2]

Chinese AI firm MiniMax targets $4 billion-plus valuation in Hong Kong IPO, sources say - The Economic Times

Chinese AI startup MiniMax has filed confidentially for a Hong Kong initial public offering, targeting a valuation of over $4 billion in the flotation, which could happen before the end of this year, three people with knowledge of the matter said. MiniMax could raise HK$4 billion to HK$5 billion ($510 million to $637 million) in the IPO, one of the sources said. China International Capital Corp and UBS have been hired as sponsors for the IPO, the sources said. The IPO size and valuation could change, subject to market conditions, added the sources, all of whom declined to be named as the information was not public. MiniMax and CICC did not immediately respond to Reuters requests for comment. UBS declined to comment. The Wall Street Journal first reported MiniMax's Hong Kong IPO filing on Wednesday. MiniMax is among the first batch of Chinese artificial intelligence companies to seek a public listing. The rise of DeepSeek, China's answer to ChatGPT, earlier this year has boosted interest in domestic AI products and in the sector from investors. Rival Zhipu AI in April also kicked off onshore IPO plans with CICC as its sponsor, Reuters reported at the time, citing a regulatory filing. Founded in early 2022 by former SenseTime executive Yan Junjie, MiniMax has emerged as one of China's prominent AI companies during the generative AI boom. The company develops multimodal AI models including MiniMax M1, Hailuo-02, Speech-02 and Music-01, which can process text, audio, images, video and music. MiniMax's models and products have served over 157 million individual users across over 200 countries and regions, and more than 50,000 enterprises and developers across over 90 countries and regions, its website says. The company, which has raised over $850 million since 2023, counts Chinese tech giant Alibaba Group and an entity under Tencent Holdings, as well as Hongshan Capital Group, Hillhouse Investment and Yunqi Capital, as investors, according to media reports.

[3]

Chinese AI firm MiniMax targets $4 billion-plus valuation in Hong Kong IPO, sources say

HONG KONG (Reuters) -Chinese AI startup MiniMax has filed confidentially for a Hong Kong initial public offering, targeting a valuation of over $4 billion in the flotation, which could happen before the end of this year, three people with knowledge of the matter said. MiniMax could raise HK$4 billion to HK$5 billion ($510 million to $637 million) in the IPO, one of the sources said. China International Capital Corp and UBS have been hired as sponsors for the IPO, the sources said. The IPO size and valuation could change, subject to market conditions, added the sources, all of whom declined to be named as the information was not public. MiniMax and CICC did not immediately respond to Reuters requests for comment. UBS declined to comment. The Wall Street Journal first reported MiniMax's Hong Kong IPO filing on Wednesday. MiniMax is among the first batch of Chinese artificial intelligence companies to seek a public listing. The rise of DeepSeek, China's answer to ChatGPT, earlier this year has boosted interest in domestic AI products and in the sector from investors. Rival Zhipu AI in April also kicked off onshore IPO plans with CICC as its sponsor, Reuters reported at the time, citing a regulatory filing. Founded in early 2022 by former SenseTime executive Yan Junjie, MiniMax has emerged as one of China's prominent AI companies during the generative AI boom. The company develops multimodal AI models including MiniMax M1, Hailuo-02, Speech-02 and Music-01, which can process text, audio, images, video and music. MiniMax's models and products have served over 157 million individual users across over 200 countries and regions, and more than 50,000 enterprises and developers across over 90 countries and regions, its website says. The company, which has raised over $850 million since 2023, counts Chinese tech giant Alibaba Group and an entity under Tencent Holdings, as well as Hongshan Capital Group, Hillhouse Investment and Yunqi Capital, as investors, according to media reports. ($1 = 7.8496 Hong Kong dollars) (Reporting by Kane Wu in Hong Kong and Liam Mo and Che Pan in Beijing. Additional reporting by Scott Murdoch in Sydney. Editing by Joe Bavier and Mark Potter) By Kane Wu, Liam Mo and Che Pan

Share

Share

Copy Link

MiniMax, a prominent Chinese AI company, has confidentially filed for an IPO in Hong Kong, aiming for a valuation exceeding $4 billion. The company plans to raise up to $637 million in the offering, which could occur before the end of 2023.

MiniMax's IPO Filing and Valuation Target

Chinese AI startup MiniMax has confidentially filed for an initial public offering (IPO) on the Hong Kong Stock Exchange, aiming for a valuation exceeding $4 billion

1

. The company is looking to raise between HK$4 billion to HK$5 billion ($510 million to $637 million) in the offering, which could take place before the end of 20232

.

Source: Reuters

Key Players and Market Conditions

China International Capital Corp (CICC) and UBS have been appointed as sponsors for the IPO

1

. However, sources close to the matter have cautioned that the IPO size and valuation could be subject to change depending on market conditions3

.MiniMax's Position in the AI Landscape

Founded in early 2022 by former SenseTime executive Yan Junjie, MiniMax has quickly established itself as a prominent player in China's AI sector

2

. The company is part of the first wave of Chinese AI firms seeking public listings, riding the wave of increased interest in domestic AI products following the rise of DeepSeek, China's answer to ChatGPT3

.MiniMax's AI Offerings and Market Reach

Source: ET

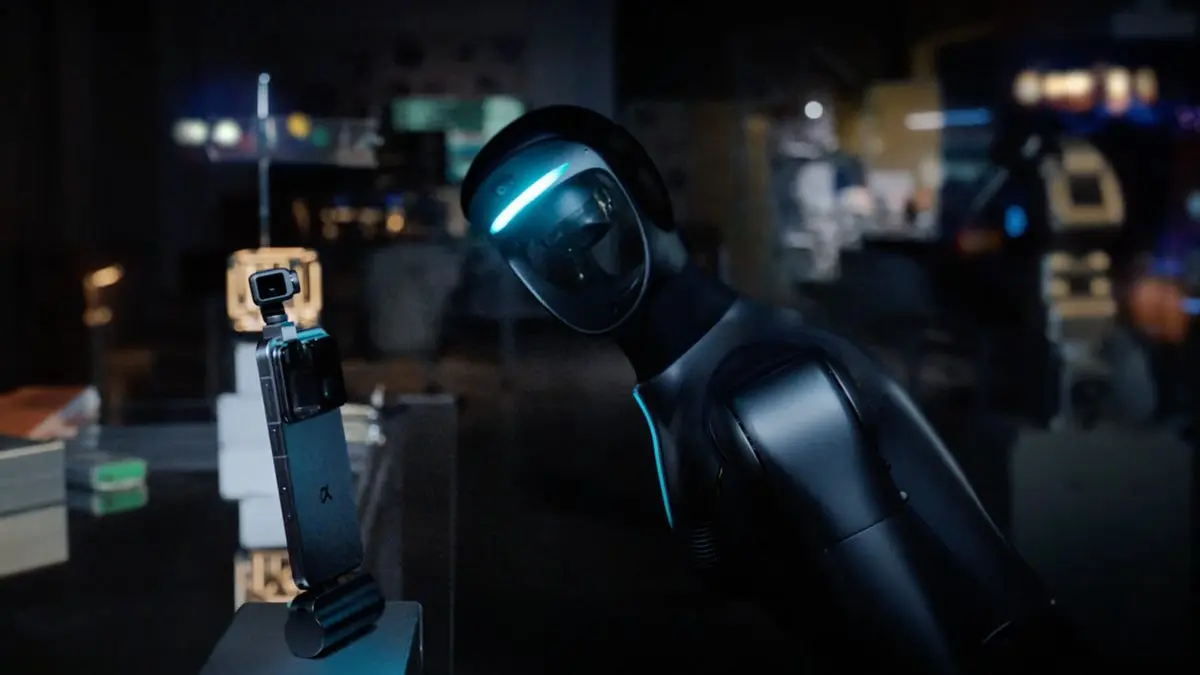

MiniMax specializes in developing multimodal AI models, including MiniMax M1, Hailuo-02, Speech-02, and Music-01. These models are capable of processing various forms of data, including text, audio, images, video, and music

2

. The company's reach is impressive, with its models and products serving over 157 million individual users across more than 200 countries and regions, as well as over 50,000 enterprises and developers in more than 90 countries and regions3

.Related Stories

Funding and Investors

MiniMax has successfully raised over $850 million since 2023, attracting investments from major players in the Chinese tech industry. Notable investors include tech giants Alibaba Group and an entity under Tencent Holdings, as well as Hongshan Capital Group, Hillhouse Investment, and Yunqi Capital

2

.Competitive Landscape

MiniMax's IPO plans come amidst growing competition in China's AI sector. In April, rival company Zhipu AI also initiated onshore IPO plans, with CICC as its sponsor

3

. This trend underscores the increasing interest and investment in AI technologies within China's tech ecosystem.References

Summarized by

Navi

Related Stories

MiniMax prices Hong Kong IPO at top as investor interest in Chinese AI startups surges

30 Dec 2025•Startups

MiniMax surges 90% in Hong Kong debut after $619M IPO, beating rival Zhipu AI

08 Jan 2026•Business and Economy

Zhipu AI becomes first China AI tiger to go public, vows to export brutal price war globally

02 Jan 2026•Business and Economy

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology

3

ChatGPT cracks decades-old gluon amplitude puzzle, marking AI's first major theoretical physics win

Science and Research