Chinese Robotaxi Firm Pony AI Files for US IPO, Signaling Renewed Interest in Chinese Listings

2 Sources

2 Sources

[1]

Chinese robotaxi firm Pony AI files for US IPO

Oct 17 (Reuters) - China-based autonomous driving firm Pony AI filed for an initial public offering in the U.S. on Thursday, in another sign of growing investor interest in new listings and easing regulatory pressures. Activity in the IPO market has picked up pace in recent weeks, buoyed by the U.S. Federal Reserve kicking off its highly anticipated policy-easing cycle and benchmark indexes tracking equities trading near record high levels. Advertisement · Scroll to continue The number of Chinese companies that pursued stock market flotations in the United States had dropped in the past few years, after Beijing clamped down on offshore capital-raising in 2021. Pony AI has applied to list on the Nasdaq stock exchange under the ticker symbol 'PONY'. The company did not reveal the size of its offering. Goldman Sachs, BofA Securities, Deutsche Bank, Huatai Securities and Tiger Brokers are the lead underwriters of the offering. Reporting by Manya Saini in Bengaluru; Editing by Shilpi Majumdar Our Standards: The Thomson Reuters Trust Principles., opens new tab

[2]

Chinese robotaxi firm Pony AI files for U.S IPO

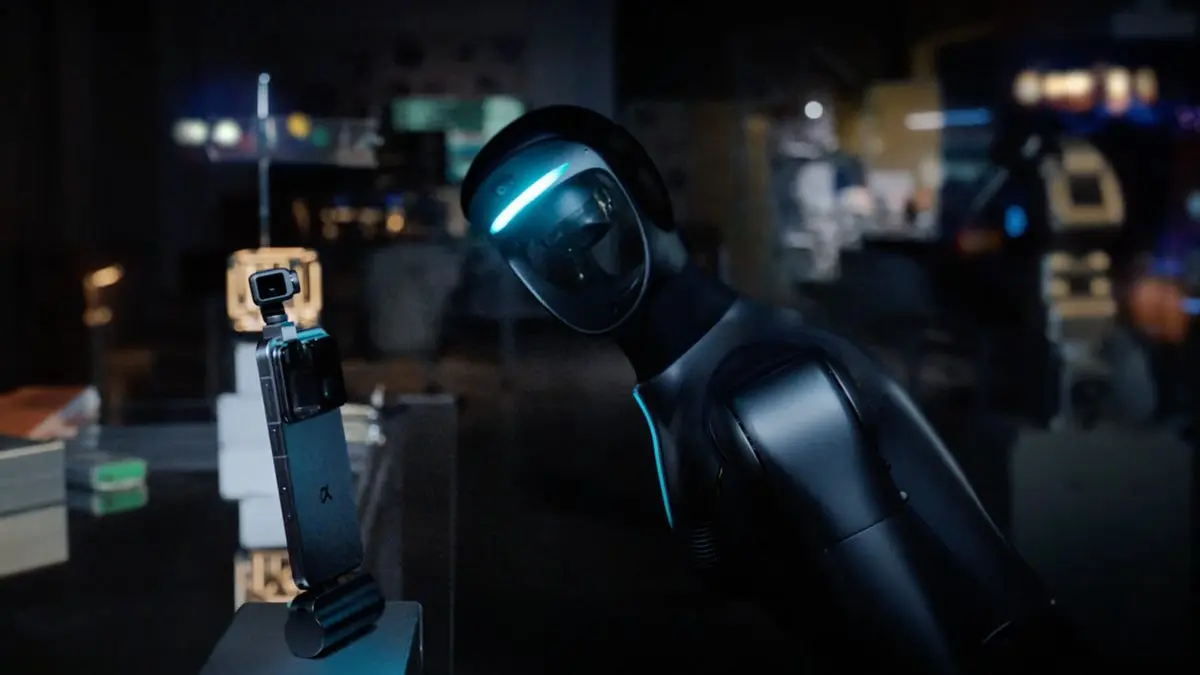

Chinese tech giant Baidu's robotaxis have grabbed about 10% of the ride-hailing market in a Beijing suburb, the company said Tuesday China-based autonomous driving firm Pony AI, backed by automaker Toyota, filed for an initial public offering in the U.S. on Thursday, in another sign of growing investor interest in new listings and easing regulatory pressures. Activity in the IPO market has picked up pace in recent weeks, buoyed by the U.S. Federal Reserve kicking off its highly anticipated policy-easing cycle and benchmark indexes trading near record high levels. Pony AI, in which Japan's Toyota owns a 13.4% stake, revealed that its revenue nearly doubled to $24.7 million in the first half of 2024. Net loss attributable to the company was $51.3 million in the same period, compared with $69.4 million last year. The company said it operates a fleet of over 250 robotaxis, which have accumulated over 33.5 million kilometers of autonomous driving mileage, including over 3.9 million kilometers of driver-less mileage. The company was valued at $8.5 billion when it raised funds in 2022. It also secured $100 million from Saudi Arabia's NEOM last year. Even so, analysts and industry experts note that establishing robotaxis may still take years, primarily due to the challenges of ensuring safety and reliability. They cite accidents and the technology's struggles to respond to situations such as inclement weather, complex intersections and unpredictable pedestrian behavior. The number of Chinese companies that pursued stock market flotations in the U.S. dropped in the past few years after Beijing clamped down on offshore capital-raising in 2021. EV maker Zeekr's debut in May was the first big listing by a Chinese company in the U.S. since then. Earlier this month, courier delivery firm BingEx also listed on the Nasdaq. Pony AI has applied to list on the Nasdaq stock exchange under the ticker symbol "PONY." The company did not reveal the size of its offering. Goldman Sachs, BofA Securities, Deutsche Bank, Huatai Securities and Tiger Brokers are the underwriters of the offering.

Share

Share

Copy Link

Pony AI, a China-based autonomous driving company backed by Toyota, has filed for an IPO in the US. This move indicates growing investor interest in new listings and easing regulatory pressures on Chinese companies in US markets.

Chinese Robotaxi Firm Pony AI Seeks US IPO

Pony AI, a China-based autonomous driving company, has filed for an initial public offering (IPO) in the United States, marking a significant development in the autonomous vehicle industry and US-China business relations

1

2

. This move comes as a sign of growing investor interest in new listings and easing regulatory pressures on Chinese companies in US markets.Company Profile and Performance

Pony AI, backed by Japanese automaker Toyota with a 13.4% stake, has shown promising growth in recent times. The company reported that its revenue nearly doubled to $24.7 million in the first half of 2024, while its net loss attributable to the company decreased to $51.3 million from $69.4 million in the same period last year

2

.The firm operates a fleet of over 250 robotaxis, which have accumulated an impressive 33.5 million kilometers of autonomous driving mileage, including over 3.9 million kilometers of driverless mileage

2

. This extensive experience positions Pony AI as a significant player in the autonomous driving sector.Market Valuation and Funding

Pony AI was valued at $8.5 billion during its last funding round in 2022. The company has also secured additional funding, including a $100 million investment from Saudi Arabia's NEOM last year

2

. However, the size of the IPO offering has not been disclosed in the filing.Challenges in the Robotaxi Industry

Despite the progress, industry experts caution that widespread adoption of robotaxis may still be years away. The technology faces challenges in ensuring safety and reliability, particularly in complex scenarios such as inclement weather, intricate intersections, and unpredictable pedestrian behavior

2

.Related Stories

Revival of Chinese Listings in the US

Pony AI's IPO filing is part of a broader trend of renewed interest in US listings by Chinese companies. This comes after a period of reduced activity following Beijing's clampdown on offshore capital-raising in 2021

1

. Recent successful listings, such as EV maker Zeekr's debut in May and courier delivery firm BingEx's listing on Nasdaq, have paved the way for this resurgence2

.IPO Details and Market Conditions

Pony AI has applied to list on the Nasdaq stock exchange under the ticker symbol 'PONY'. The IPO is being underwritten by a consortium of financial institutions, including Goldman Sachs, BofA Securities, Deutsche Bank, Huatai Securities, and Tiger Brokers

1

2

.The timing of the IPO aligns with favorable market conditions, including the U.S. Federal Reserve's anticipated policy-easing cycle and benchmark equity indexes trading near record high levels

1

. This environment has contributed to increased activity in the IPO market in recent weeks.References

Summarized by

Navi

Related Stories

Pony AI Targets $4.5 Billion Valuation in US IPO, Highlighting Growth in Autonomous Vehicle Sector

15 Nov 2024•Business and Economy

Pony AI's Nasdaq Debut: A Mixed Start for the Autonomous Driving Startup

27 Nov 2024•Business and Economy

Pony AI Leads Autonomous Vehicle Revolution with Robotruck Platooning Approval and Robotaxi Expansion in China

15 Jan 2025•Technology

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology

3

ChatGPT cracks decades-old gluon amplitude puzzle, marking AI's first major theoretical physics win

Science and Research