Databricks closes $7 billion financing round at $134 billion valuation, bets on AI agents

4 Sources

4 Sources

[1]

Databricks closes $7B+ financing round at $134B valuation - SiliconANGLE

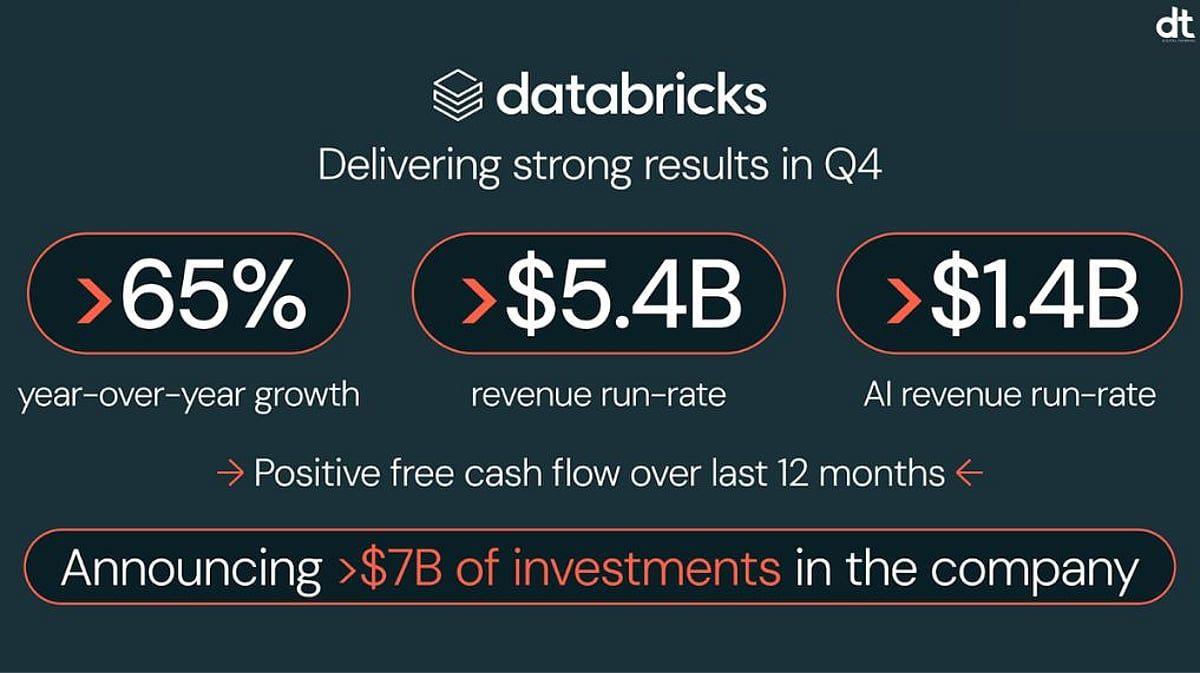

Databricks Inc. today announced that it has raised more than $7 billion in equity and debt financing to accelerate its growth efforts. The company first disclosed the investment late last year when it was still in the process of finalizing the financial terms. At the time, Databricks stated that it was raising more than $4 billion in equity funding. The equity component of the investment has since grown to more than $5 billion. The deal size increased because JPMorgan Chase, one of the four lead investors in the round, boosted its contribution. In addition, Microsoft Corp. and several large financial institutions joined the raise. Databricks says that the transaction also included $2 billion in debt funding led by JPMorgan Chase, Barclays, Citi, Goldman Sachs and Morgan Stanley. The company will use the funds to enhance its Genie and Lakebase products. Both offerings are important components of Databricks' artificial intelligence strategy. Genie is an AI assistant that enables workers to query data in Databricks' platform using natural language prompts. A supply chain analyst, for example, could ask the tool to show how merchandise processing times vary across warehouses. Developers, meanwhile, can integrate Genie into external services using an application programming interface. The AI assistant interacts with data in Databricks' platform by generating SQL queries. To reduce the risk of errors, customers can provide Genie with pre-packaged SQL code for common requests. Queries tested ahead of time for bugs are less likely to return inaccurate results than code generated on an ad hoc basis. Lakebase, the other focus of Databricks' engineering push, became part of its product portfolio last year through a $1 billion startup acquisition. It's a managed PostgreSQL database that doesn't require developers to maintain the underlying infrastructure. According to Databricks, AI agents can use Lakebase to store configuration data and the information they incorporate into prompt responses. The company disclosed in December that the service has thousands of customers. The same month, Databricks released a feature that enables Lakebase to scale to zero. That means instances can shut down completely when they're not used, which avoids unnecessary hardware costs. Scale-to-zero features are technically difficult to implement, which is why many workloads consume limited infrastructure resources even when they're idle. "With this new capital, we'll double down on Lakebase so developers can create operational databases built for AI agents," said Databricks co-founder and Chief Executive Officer Ali Ghodsi. "At the same time, we're investing in Genie to let every employee chat with their data, driving accurate and actionable insights." The company disclosed today that its AI products' annualized recurring revenue has increased from $1 billion in early December to $1.4 billion. Databricks' overall run rate stands at $5.4 billion, a more than 65% increase from last year. The software maker says that its sales momentum is partly driven by demand from its largest customers. More than 800 organizations spend at least $1 million on Databricks' product per year. According to the company, 70 of those customers spend over $10 million.

[2]

Databricks Reports $5.4 Billion Revenue Run Rate As It Closes A $7B Investment Round

The data and AI giant will use its latest capital infusion to accelerate development of its Lakebase database for AI agents and Genie conversational AI assistant. Databricks' astronomical growth trajectory shows little sign of slowing after the data and AI platform developer disclosed Monday that it surpassed an annual revenue run rate of $5.4 billion after recording 65 percent year-over-year growth during its fourth quarter ended Jan. 31. The company also announced the completion of a $7 billion Series L funding round, initially announced Dec. 16, that boosts the company's market capitalization to a $134 billion valuation. Databricks said it will use the additional financing to accelerate development of Lakebase, the company's serverless Postgres database designed for AI agents, and its Genie conversational AI assistant for interacting with data. [Related: Databricks Bolsters Lakebase Database 'Vision' With Latest Acquisition] "We're seeing overwhelming investor interest in our next chapter as we go after two new markets," said Ali Ghodsi, Databricks co-founder and CEO, in a statement. "With this new capital, we'll double down on Lakebase so developers can create operational databases built for AI agents. At the same time, we're investing in Genie to let every employee chat with their data, driving accurate and actionable insights." The company also will use the additional funding to advance AI research, pursue strategic acquisitions, and provide employee liquidity. In addition to surpassing the $5.4 billion revenue run rate threshold in its fiscal 2026 fourth quarter and recording better that 65 percent year-over-year growth, Databricks also disclosed that it delivered positive cash flow over the previous 12 months and sustained a net retention rate of greater than 140 percent. Databricks also said the revenue run rate for its AI products exceeded $1.4 billion during the fourth quarter. In December the company said its data warehousing business had a revenue run rate of greater than $1 billion in the third fiscal quarter. The company currently has 800 customers consuming its services at an annual run rate of $1 million and 70 customers doing so at an annual run rate of $10 million. Privately held Databricks doesn't disclose detailed financial results. But industry watchers have long anticipated an initial public offering from Databricks and since last year the company has been issuing statements about its quarterly revenue and growth rates. Ghodsi told CNBC in December that he would not rule out a Databricks IPO this year. Databricks said the latest funding round totaled more than $7 billion including approximately $5 billion of equity financing at the $134 billion valuation and approximately $2 billion of additional debt capacity. The Series L funding round included participation from both new and existing investors. In December the company said the round was led by Insight Partners, Fidelity Management & Research Company, and J.P. Morgan Asset Management with additional participation from Andreessen Horowitz, Coatue, GIC, MGX, NEA, Ontario Teachers Pension Plan, Robinhood Ventures, Temasek, Thrive Capital, Winslow Capital, accounts advised by T. Rowe Price Associates, funds and accounts managed by BlackRock, and funds managed by Blackstone. In addition to those, Databricks said Monday that JPMorganChase expanded its investment in the company through its Security and Resiliency Initiative's newly formed Strategic Investment Group. And in addition to the investors named in December, investors in the round included Glade Brook Capital, Growth Equity at Goldman Sachs Alternatives, Microsoft, Morgan Stanley, Qatar Investment Authority (QIA), funds affiliated with Neuberger, funds associated with UBS, and others. The credit facilities were provided by JP Morgan Chase Bank, N.A., along with Barclays, Citi, Goldman Sachs and Morgan Stanley. "Databricks is a generational company that has become a backbone for enterprise data and AI, helping organizations across critical sectors seize opportunities and overcome challenges," said Todd Combs, head of the Strategic Investment Group for JPMorganChase's Security and Resiliency Initiative, in a statement. "This initial investment reflects the strength of Databricks' secure platform and continues to support their innovative, production‑scale applications that serve customers around the world."

[3]

Databricks Surpasses $5.4B Revenue Run Rate, Bets Big on Lakebase, Genie

This financing drew strong participation from both new and returning investors. JPMorganChase expanded its investment in the company through its Security and Resiliency Initiative's newly-formed Strategic Investment Group. Databricks announced it crossed a $5.4 billion revenue run-rate, delivering >65% year-over-year growth during its Q4. Building on this momentum, Databricks is completing investments in the company in excess of $7 billion, including ~$5B of equity financing at a $134 billion valuation and ~$2B of additional debt capacity. With this new funding, the company will accelerate Lakebase, its serverless Postgres database built for AI agents, and Genie, its conversational AI assistant that lets any employee chat with their data.

[4]

Databricks Raises $7 Billion for AI Agent Database | PYMNTS.com

By completing this form, you agree to receive marketing communications from PYMNTS and to the sharing of your information with our sponsor, if applicable, in accordance with our Privacy Policy and Terms and Conditions. The data analytics/artificial intelligence (AI) company announced that valuation Monday (Feb. 7) along with $7 billion in new investments: $5 billion of equity financing and roughly $2 billion of additional debt capacity. Databricks says it will use the new capital to bolster Lakebase, its serverless Postgres database for AI agents, and Genie, a conversational AI assistant. "We're seeing overwhelming investor interest in our next chapter as we go after two new markets," said Ali Ghodsi, co-founder and CEO of Databricks. "With this new capital, we'll double down on Lakebase so developers can create operational databases built for AI agents. At the same time, we're investing in Genie to let every employee chat with their data, driving accurate and actionable insights." In addition to the new valuation and financing, Databricks announced a few quarterly business milestones, including a revenue run-rate of more than $5.4 billion, up more than 65% year over year. The company also reached a $1.4 billion revenue run-rate for its AI offerings. The announcement comes nearly two months after a report that Databricks was hoping to reach a $134 billion valuation with new fundraising. That figure is up 34% from the company's funding round in September. In January of last year, the company was valued at $62 billion. The new funding is also happening as tech companies grow increasingly familiar with AI agents, as shown by PYMNTS Intelligence research. The same research also shows a gap between tech firms and goods/services businesses. Tech companies "have greater exposure to AI development, deeper engineering talent and longer investment horizons than most goods-producing or services companies," PYMNTS wrote last week. "As a result, they are both more knowledgeable about agentic AI and more willing to explore its use in real operations. Other sectors are watching closely but moving more slowly, constrained by regulatory uncertainty, skills gaps and concerns about control." The research shows that 75% of tech firms say they are extremely familiar with agentic AI, compared with around a third of goods-producing companies and 38% of services firms. The data also shows an "exploration gap," with 42% of technology companies actively exploring how to integrate agentic AI into their operations. Under 4% of goods firms say they are doing the same, and no services firms are looking to add agentic AI.

Share

Share

Copy Link

Databricks announced completion of a $7 billion investment round at a $134 billion valuation, marking a 34% jump from its September funding. The data and AI platform company reported surpassing a $5.4 billion revenue run rate with over 65% year-over-year growth, driven by surging demand for its AI products which now generate $1.4 billion in annualized recurring revenue.

Databricks Secures Massive Funding at Record Valuation

Databricks has closed a financing round exceeding $7 billion, cementing its position as one of the most valuable private technology companies at a $134 billion valuation

1

. The investment includes approximately $5 billion in equity financing and roughly $2 billion in additional debt capacity2

. This represents a 34% increase from the company's September funding round and a dramatic leap from its $62 billion valuation in January of last year4

.

Source: PYMNTS

The deal size expanded significantly from initial projections. When Databricks first disclosed the investment in December, the company stated it was raising more than $4 billion in equity funding

1

. JPMorgan Chase, one of four lead investors, boosted its contribution through its Security and Resiliency Initiative's newly-formed Strategic Investment Group3

. Microsoft Corp. and several large financial institutions also joined the raise. The debt component was led by JPMorgan Chase Bank, along with Barclays, Citi, Goldman Sachs and Morgan Stanley1

.Revenue Run Rate Accelerates Past $5.4 Billion

Databricks disclosed it surpassed a revenue run rate of $5.4 billion during its fourth quarter ended January 31, recording more than 65% year-over-year growth

2

. The company also delivered positive cash flow over the previous 12 months and sustained a net retention rate greater than 140 percent2

.

Source: DT

The data and AI platform's momentum is particularly evident in its AI product portfolio. The company revealed that its AI products' annualized recurring revenue jumped from $1 billion in early December to $1.4 billion

1

. This rapid acceleration underscores growing enterprise adoption of AI-powered data analytics tools across critical sectors.Databricks' sales momentum is driven substantially by demand from its largest customers. More than 800 organizations now spend at least $1 million on Databricks products annually, with 70 of those customers spending over $10 million per year

1

. The company currently serves customers at an annual run rate of $1 million for 800 clients and $10 million for 70 customers2

.Strategic Focus on Lakebase and Genie

Databricks will channel the new capital into accelerating development of two key products: Lakebase and Genie. Ali Ghodsi, co-founder and CEO of Databricks, stated the company is seeing "overwhelming investor interest in our next chapter as we go after two new markets"

4

. He emphasized the company will "double down on Lakebase so developers can create operational databases built for AI agents" while simultaneously "investing in Genie to let every employee chat with their data, driving accurate and actionable insights"1

.Lakebase, described as a serverless Postgres database built for AI agents, joined Databricks' product portfolio through a $1 billion startup acquisition last year

1

. The managed PostgreSQL database eliminates the need for developers to maintain underlying infrastructure. According to Databricks, AI agents can leverage Lakebase to store configuration data and information they incorporate into prompt responses . The service already has thousands of customers and recently introduced a scale-to-zero feature that allows instances to shut down completely when not in use, avoiding unnecessary hardware costs1

.Genie functions as a conversational AI assistant that enables workers to query data using natural language prompts

1

. A supply chain analyst could ask Genie to show how merchandise processing times vary across warehouses, while developers can integrate the tool into external services through an application programming interface. The AI assistant generates SQL queries to interact with data, and customers can provide pre-packaged SQL code for common requests to reduce error risk1

.

Source: CRN

Related Stories

Market Implications and Future Outlook

The funding will also support AI research initiatives, pursue strategic acquisitions, and provide employee liquidity

2

. Todd Combs, head of the Strategic Investment Group for JPMorganChase's Security and Resiliency Initiative, described Databricks as "a generational company that has become a backbone for enterprise data and AI, helping organizations across critical sectors seize opportunities and overcome challenges"2

.While privately held Databricks doesn't disclose detailed financial results, industry watchers have long anticipated an initial public offering. Ghodsi told CNBC in December he would not rule out a Databricks IPO this year

2

. The company's recent practice of issuing quarterly revenue and growth statements suggests preparation for increased public scrutiny.The investment arrives as tech companies grow increasingly familiar with AI agents. PYMNTS Intelligence research shows 75% of tech firms report being extremely familiar with agentic AI, compared with around a third of goods-producing companies and 38% of services firms

4

. This familiarity gap reflects tech companies' greater exposure to AI development, deeper engineering talent, and longer investment horizons. The data also reveals an exploration gap, with 42% of technology companies actively exploring how to integrate agentic AI into their operations, while under 4% of goods firms and no services firms are doing the same4

. This disparity suggests substantial growth potential as adoption spreads beyond the technology sector into broader enterprise markets where Databricks is positioning itself with Lakebase and Genie.References

Summarized by

Navi

Related Stories

Databricks Secures $1B Funding at $100B Valuation, Projecting $4B Annual Revenue Amid AI Surge

09 Sept 2025•Business and Economy

Databricks Secures $1 Billion Funding at $100 Billion Valuation, Targets AI Database Market

19 Aug 2025•Business and Economy

Databricks raises $4B at $134B valuation as AI business drives 55% revenue growth

16 Dec 2025•Business and Economy

Recent Highlights

1

OpenAI secures $110 billion funding round from Amazon, Nvidia, and SoftBank at $730B valuation

Business and Economy

2

Trump bans Anthropic from government as AI companies clash with Pentagon over weapons and surveillance

Policy and Regulation

3

ChatGPT Health fails to recognize half of medical emergencies in first independent safety test

Health