Tesla Plans $20 Billion AI Push as Elon Musk Abandons Traditional Car Business

23 Sources

23 Sources

[1]

Musk Is Fueling Tesla by Torching Piles of Cash

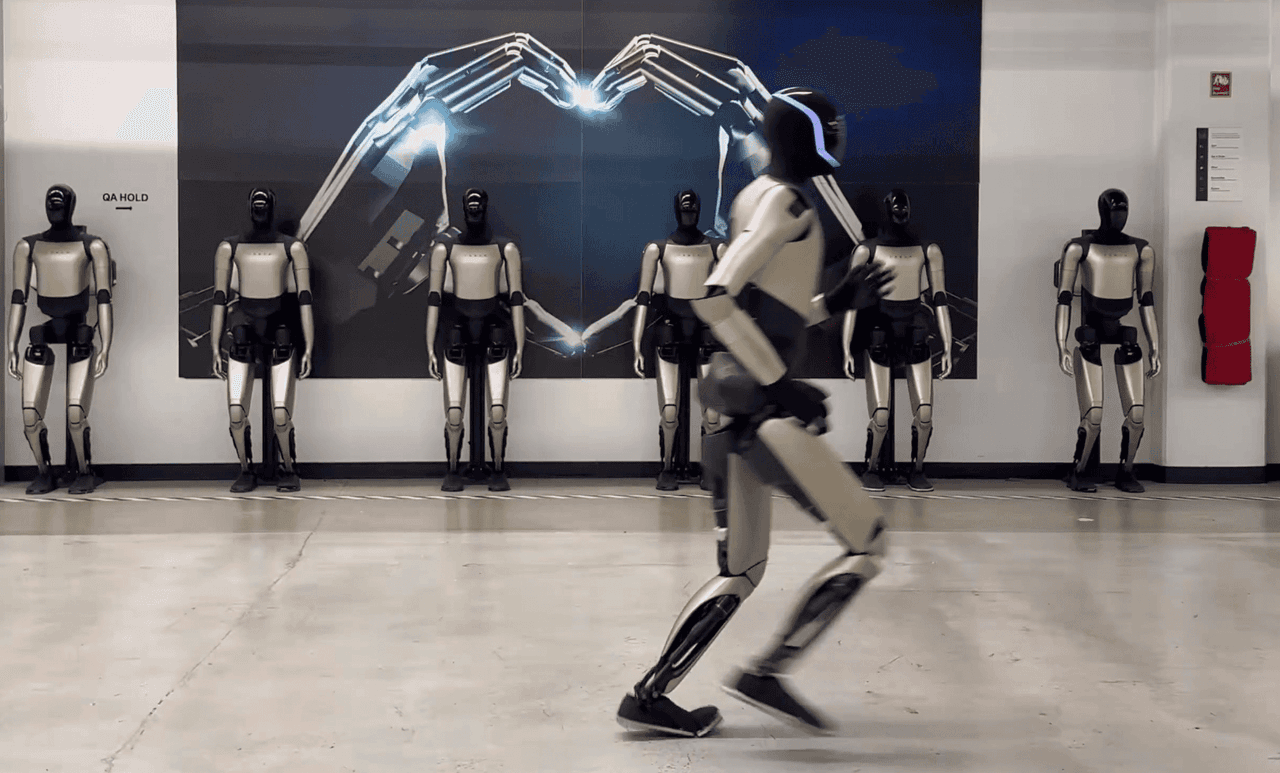

Tesla plans to invest about $2 billion in xAI, Musk's own artificial intelligence venture, and will burn a lot of cash this year, with a capex budget of $20 billion-plus. Elon Musk, ever attuned to the political zeitgeist, has updated Tesla Inc.'s mission to "amazing abundance." It is the kind of hyperbole beloved of investors in the company he runs. Before the amazing variety arrives, however, another type of abundance was announced on Wednesday evening's earnings call: Tesla's investment budget will more than double. For the bulls, Tesla is finally unleashing its financial firepower to own the future of autonomous vehicles, robots and artificial intelligence. Yet the news came alongside weak fourth-quarter results and the bombshell announcement that Tesla is investing about $2 billion in xAI, Musk's own artificial intelligence venture. Amid all the plans and targets thrown out on the call, the one certainty is that Tesla will burn a lot of cash this year. The financial results themselves were messy and underwhelming. The closely watched metric of auto gross profit margin, adjusted for regulatory credits, came in at 17.9% -- surprisingly high given a collapse in vehicle deliveries, even factoring in foreign exchange gains. Tesla's energy business performed well, although gross profit was essentially flat with the third quarter. In any case, none of this seeming strength trickled down. Tesla's overall operating margin fell to just 5.7%. "Other" costs, possibly reflecting swings in crypto values, soared. Fourth-quarter GAAP earnings slumped by 60%, year over year. None of which matters, of course. Tesla's stock is determined less by reported numbers, more by a complex, if nebulous, function that multiplies planned initiatives with the level of faith in Musk. Both factors are high. Musk announced that Tesla will retire two of its premium priced, and oldest, models, the S and X, next quarter -- an acknowledgement of sliding sales, perhaps, but cast as symbolizing the company's shift toward fully autonomous vehicles such as Cybercabs. Production of those is planned to begin by the end of June. Tesla also plans to unveil its third-generation version of the Optimus humanoid robot soon, with mass production "planned" to begin by year-end. Big things are also planned in solar power, batteries, chargers and chips. This narrative setting is all par for the course with Tesla, and Musk's targets should be treated with skepticism. When asked for specifics on how many Optimus robots are working today at Tesla factories, and what they are doing, Musk demurred. He said the technology was still in the research and development stage, which sits rather oddly with the idea that mass production will begin in less than 12 months (and that the S and X are being scrapped to switch over their production lines to making robots). Musk's expectation of having fully autonomous vehicles operating in a quarter-to-half of the US by year-end should be put in the context of his expectation of reaching half the US by year-end -- last year. What can't be doubted is the money Tesla is spending to do all this. The mooted capex figure of $20 billion-plus for 2026 is not only more than the prior two years combined, it is substantially higher than Tesla's best ever annual cash flow from operations, $14.9 billion in 2024. That declined slightly in 2025 and the consensus is for it to fall again this year. Unsurprising, since Tesla is essentially de-emphasizing its main source of profits, EV manufacturing, and plowing billions into nascent businesses that won't earn a profit for a while, even assuming success. Remarkably, that $20 billion is equivalent to half of the entire value of the property, plant and equipment assets carried on Tesla's balance sheet. It signals a radical expansion in a very short space of time. Based on consensus forecasts, the capex budget implies Tesla burning around $6 billion of cash this year. With $44 billion on its balance sheet, Tesla can afford it. But this would make 2026 Tesla's first year of negative free cash flow since 2018, before a ramp-up of sales of then-new models and the pricing tailwind delivered by the pandemic's disruption flipped free cash flow positive. This echo of the 2010s, for much of which Tesla was a kind of publicly listed start-up, dovetails with the xAI investment. Recall that Tesla shareholders were given a non-binding vote on this at November's meeting. While there were more 'yeas' than 'nays', a high number of abstentions meant that it technically counted as a no. Tesla, however, appears to have focused more on the yeas and Musk said offhandedly on Wednesday's earnings call that "we're just doing what shareholders asked us to do, pretty much." Sign up for the Bloomberg Opinion bundle Sign up for the Bloomberg Opinion bundle Sign up for the Bloomberg Opinion bundle Get Matt Levine's Money Stuff, John Authers' Points of Return and Jessica Karl's Opinion Today. Get Matt Levine's Money Stuff, John Authers' Points of Return and Jessica Karl's Opinion Today. Get Matt Levine's Money Stuff, John Authers' Points of Return and Jessica Karl's Opinion Today. Bloomberg may send me offers and promotions. Plus Signed UpPlus Sign UpPlus Sign Up By submitting my information, I agree to the Privacy Policy and Terms of Service. The "pretty much" does a ton of work there but, in a sense, he's correct. After that vote, I wrote that, while the abstentions were noted, "the signal here is green." How could it not be when set in the context of Musk's trillion-dollar pay package, approved overwhelmingly, and shares that trade at 200 times earnings despite faltering sales and profits? The fact that the pay package was justified on the grounds that it would persuade Musk to keep his best ideas in-house, even as shareholders voted on putting money into a strategic AI business that clearly hadn't stayed in-house, got a bit lost. The latest results and plans reaffirm the idea that Tesla investors now own something more like a blank-check company. One that promises amazing abundance on any number of fronts even as its main existing business succumbs to the banalities of competitive pressure. One that feels free to intertwine its strategy and assets with the CEO's own ventures. And, to complete the picture, one that is ready to burn billions in pursuit of that. More From Bloomberg Opinion: * Tesla's Greatest Threat Is Being Boring: Liam Denning * Musk Finally Meets His Match Over Sexual Images: Rosa Prince * Matt Levine's Money Stuff: Moonshot Pay Kind of Works Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter.

[2]

Tesla plans $20 billion capital spending spree in push beyond human-driven cars

This video file cannot be played.(Error Code: 102630) LOS ANGELES, Jan 28 (Reuters) - Tesla (TSLA.O), opens new tab plans to more than double capital spending to a record high of more than $20 billion this year - but little of it will go to its traditional business of selling electric vehicles to human drivers. The company, which last year lost its global EV sales crown to China's BYD (002594.SZ), opens new tab, is instead shifting investment to yet-unproven business lines such as fully autonomous vehicles and humanoid robots, based on executive comments on Wednesday's earnings call. Highlighting the change, CEO Elon Musk said Tesla would end production of its Model X SUV and Model S sedans and instead use the space in its California factory to make humanoid robots. "This is going to be a very big capex year," he said. "We're making big investments for an epic future." Most of the record investment will be spent on production lines for the Cybercab, a fully autonomous vehicle without a steering wheel and pedals, the long-promised Tesla semi-truck, Optimus robots and plants for battery and lithium production, Chief Financial Officer Vaibhav Taneja said. Tesla is still reliant on human-driven EVs for most of its sales, but its valuation far exceeds any other automaker, putting it more in league with major tech companies. Much of that value hangs on investors' beliefs that Musk will deliver on lofty promises of delivering robotaxis and humanoid robots backed by the company's investment in artificial intelligence. It joins Facebook-parent Meta Platforms (META.O), opens new tab, Microsoft (MSFT.O), opens new tab and Alphabet (GOOGL.O), opens new tab in planning sharp increases in capital spending this year, as those companies invest heavily in hardware and data centers to support AI model training and customer demand. Scott Acheychek, chief operating officer of REX Financial, which manages ETFs with exposure to Tesla stock, argued that Tesla's car business was no longer the main focus. "The bigger story," he said, "is the business model transition now underway" as Tesla focuses on autonomous driving. Item 1 of 2 People take images of Tesla Cybercab at the company's booth at the 8th China International Import Expo (CIIE) in Shanghai, China, November 6, 2025.REUTERS/Maxim Shemetov/File Photo [1/2]People take images of Tesla Cybercab at the company's booth at the 8th China International Import Expo (CIIE) in Shanghai, China, November 6, 2025.REUTERS/Maxim Shemetov/File Photo Purchase Licensing Rights, opens new tab 'NECESSARY SPENDING' Andrew Rocco, stock strategist at Zacks Investment Research, said he viewed the $20 billion as "necessary spending." "If Optimus is going to be a best-selling product, the AI must be trained as well as possible," he said, adding the planned spending gives him confidence that Musk's "sometimes loose timelines will actually be honored." The $20 billion is more than double the $8.5 billion in capital spending last year, and significantly above the prior record of $11.3 billion in 2024. Taneja said on the call that Tesla has more than $44 billion in cash and investments on the books that it can use to fund the investments. He signaled this year was not likely to be the end of increased spending, adding the company could look to pay for the investments "through more debt or other means." Musk said Tesla was embarking on some of the spending projects not for fun, but rather "out of desperation". "Can other people, please, for the love of God, in the name of all that is holy, can others please build this stuff?" Musk said, referring to spending on cathode and lithium refining. "It's very hard to build these things." Reporting by Chris Kirkham in Los Angeles and Akash Sriram in Bengaluru; Editing by Jamie Freed Our Standards: The Thomson Reuters Trust Principles., opens new tab * Suggested Topics: * Artificial Intelligence * ADAS, AV & Safety * Software-Defined Vehicle * Sustainable & EV Supply Chain Chris Kirkham Thomson Reuters Chris Kirkham is a business reporter in Los Angeles who writes about Tesla, electric vehicles and the wider automotive industry. He previously worked at The Wall Street Journal and the Los Angeles Times, and has covered topics including tobacco, worker safety, gambling, and the economy over a two-decade career. Contact him at [email protected] or on Signal at chris_kirkham.51 Akash Sriram Thomson Reuters Akash reports on technology companies in the United States, electric vehicle companies, and the space industry. His reporting usually appears in the Autos & Transportation and Technology sections. He has a postgraduate degree in Conflict, Development, and Security from the University of Leeds. Akash's interests include music, football (soccer), and Formula 1.

[3]

Davos-Musk expects Europe, China to approve Tesla's FSD system next month

Jan 22 (Reuters) - Tesla (TSLA.O), opens new tab is likely to win regulatory approval in Europe and China for its Full Self-Driving system as early as next month, CEO Elon Musk said on Thursday, as the electric automaker looks to boost software revenue amid slowing vehicle sales. The approvals would be crucial for Tesla, which is under pressure to generate revenue from software and services and is looking to monetize FSD outside the U.S. "We hope to get Supervised Full Self-Driving approval in Europe, hopefully next month, and then maybe a similar timing, timing for China," Musk said at his first appearance at the World Economic Forum in Davos. Shares of the automaker rose about 1.5% after the comment. Tesla has been seeking approval for the FSD system in Europe, where tougher vehicle safety rules and a fragmented regulatory framework have slowed deployment compared with the U.S. Musk has been pitching Tesla as a company whose growth lies in humanoid robots and self-driving vehicles, even though it makes a big share of its money from the electric-vehicle business, which faces intense competition and brand hit in some markets. Registration of Tesla's vehicles fell 11.4% in California last year, with its market share in the U.S. state slipping below 50%, according to a report by the California New Car Dealers Association. The company reported a second consecutive drop in vehicle deliveries in 2025, ceding its position as the largest electric vehicle maker in the world to China's BYD (002594.SZ), opens new tab after several years in the pole position. The system, which Tesla markets as Full Self-Driving, is classified as an advanced driver assistance feature that requires drivers to remain attentive, and regulators have scrutinized it amid concerns over the safety and oversight of automated driving technologies. Musk has repeatedly said much of the artificial intelligence developed for autonomous vehicles will also underpin Tesla's planned humanoid robots. Musk said on Thursday that he expects robots to outnumber humans. "We do have some Tesla Optimus robots doing simple tasks in the factory," he said, adding that Tesla expects to sell humanoid robots to the public by the end of next year, later than the timeline he had previously outlined. Industry experts and executives have said scaling humanoid robots for real-world use is technically complex, in part because of a lack of data needed to train the AI models that underpin robot behavior. "For Optimus, what they (the market) need is credible evidence of scalable manufacturing, a regulatory path, and unit economics if possible," said Ken Mahoney, CEO of Tesla shareholder Mahoney Asset Management Reporting by Akash Sriram in Bengaluru; Editing by Arun Koyyur Our Standards: The Thomson Reuters Trust Principles., opens new tab * Suggested Topics: * Davos * ADAS, AV & Safety * Software-Defined Vehicle * Sustainable & EV Supply Chain * EV Battery Akash Sriram Thomson Reuters Akash reports on technology companies in the United States, electric vehicle companies, and the space industry. His reporting usually appears in the Autos & Transportation and Technology sections. He has a postgraduate degree in Conflict, Development, and Security from the University of Leeds. Akash's interests include music, football (soccer), and Formula 1.

[4]

Tesla profit plunges as AI expenses pile up and sales fall

Why it matters: Tesla has ambitions to become an AI powerhouse, but meanwhile it needs EV revenue to pay the bills. Driving the news: The automaker's net income fell 61% to $840 million in the fourth quarter, compared with a year earlier. * Revenue declined 3%, to $24.9 billion. * Operating expenses soared 39%, to $3.6 billion, sending operating margins down to 5.7% from 6.2% a year earlier. Yes, but: The market is largely focused on Tesla's future, not its current finances. * The company also said Wednesday that it was investing $2 billion in the preferred shares of xAI, Musk's AI startup. * Tesla shares were up more than 3% in after-hours trading. * Musk told the World Economic Forum in Davos last week that Tesla would begin selling humanoids by the end of 2027: "I think everyone on earth is going to have one and want one." * And the company has already launched self-driving car services in Austin, Texas, with plans to expand throughout the country. Zoom in: For the quarter, Tesla's vehicle deliveries fell 8.6% in 2025 to 1.64 million. * The company faced a consumer backlash in early 2025 to Musk's involvement with the Trump administration. He eventually withdrew from leadership of the Department of Government Efficiency. * Tesla later reaped an influx of sales from buyers seeking to cash in on the federal EV tax credit before it expired at the end of September. What to watch: Tesla is barreling forward with a production expansion to make the Cybercab driverless vehicle and the Optimus humanoid robot.

[5]

Elon Musk pivots Tesla to robotics and AI as car business flails

Musk's optimism for Optimus robot demand help EV maker beat quarterly expectations despite first-ever yearly revenue decline Tesla's most recent quarterly earnings report showed slumping vehicle sales and declining revenue, as the company's CEO, Elon Musk, pins the company's futures on AI and robotics. The earnings report described Tesla's chaotic year as a "transition from a hardware-centric business to a physical AI company". The high hopes and grand possibilities Musk has outlined helped Tesla beat Wall Street expectations, even as the company reported its first-ever decline in total revenue - losing 3% year-over-year. Tesla reported fourth quarter earnings per share of $0.50 after the market close on Wednesday, exceeding the $0.45 that Wall Street expected. Its reported revenue was $24.9bn, beating analyst estimates of $24.79bn. The company's total automotive revenues dropped 11% year-over-year in 2025. Earlier this month, Tesla reported its fourth quarter vehicle delivery numbers, which measure buyers' receipt of their cars rather than dealership sales, revealing a 16% decline year-over-year, hurt especially by cratering interest in Europe. The company's stock rose by about 4% in after-hours trading. As Tesla's vehicle sales have fallen over the past year, Musk and the company have emphasized a shift towards AI-driven projects such as Optimus consumer robots and self-driving Robotaxis. All of these technologies remain unproven and not widely available to the public, let alone profitable, but they have allowed Musk to claim the company will see unparalleled future growth without much to show for it today. Musk has stated that Optimus would be the "biggest product of all time" and said that the robots, along with autonomous vehicles, would usher in "a world where there is no poverty". Tesla plans to start production of Optimus before the end of 2026, according to the earnings report. Musk has said the company will sell the robot to the public in 2027. Tesla also revealed that earlier this month it agreed to invest $2bn into xAI, Musk's artificial intelligence company. Although Tesla's stock price plummeted during Musk's tumultuous time in government last year, it rebounded to its highest price ever in December amid ongoing market frenzy for AI investments and Musk's promise of building a "robot army". The previous month, Tesla shareholders also approved a pay package for Musk that could award him up to a trillion dollars in compensation if the company meets a series of financial milestones. While Tesla has touted its upcoming projects as evidence of upcoming success, some of its formerly futuristic products have struggled. The company's Cybertruck, which Musk said earlier this month was "the best vehicle Tesla has ever made", saw a drastic 48% decline in sales last year, according to Kelley Blue Book reports. Tesla has faced increasing competition from other electric vehicles companies, primarily China's BYD, which overtook Tesla last year as the world's largest electric carmaker. BYD's sales grew by 28% in 2025, as it offered consumers in a number of markets less expensive alternatives to Tesla's models.

[6]

You might actually be able to buy a Tesla robot in 2027

Elon Musk promises Optimus humanoid robots will go on sale by year's end, if reliability and safety checks out Tesla CEO Elon Musk has once again laid out an ambitious timeline for the company's long-awaited humanoid robot, Optimus. Speaking at the World Economic Forum in Davos, Musk said Tesla plans to begin selling Optimus robots to the public by the end of 2027, assuming the machines reach the levels of reliability, safety, and functionality the company is targeting. The comments follow a series of years-long development milestones. Optimus, which was originally unveiled as the Tesla Bot in 2021, has undergone multiple prototype iterations and has already been pressed into service handling simple tasks in Tesla factories. According to Musk, those internal deployments will expand in complexity later this year, helping prepare the robotics platform for broader use. Ambition Meets Reality in Robotics Musk's timeline is bold by any industry standard. Humanoid robotics has long struggled with major challenges across hardware design, artificial intelligence, and large-scale manufacturing. Speaking at Davos, Musk stressed that Optimus won't go on sale simply to meet a deadline. Instead, he said consumer availability will depend on the robots proving themselves reliable and safe, adding that sales would only begin once reliability and functionality are "very high." Tesla's long-term vision for Optimus goes far beyond factory work. Musk has described a future where humanoid robots handle everyday tasks such as household chores and elder care, eventually becoming as common and useful as personal computers or smartphones. He has even suggested that one day there could be "more robots than people," underscoring how central he believes robotics will be to everyday life. That optimism comes with real skepticism, though. The last public demonstrations of Optimus revealed that the robots were being remotely piloted by human operators, not acting autonomously. Combined with Musk's history of aggressive timelines, many experts remain cautious, noting that true general-purpose humanoid robots are still an unsolved problem. For now, Musk says commercial deployments could begin in 2026, with public sales following in 2027, but only if Tesla is confident the robots meet strict standards for reliability, safety, and functionality. Whether that's a realistic caution or a built-in hedge against delays remains to be seen.

[7]

Elon Musk Predicts AI Will Outpace Human Intelligence as Early as This Year

Musk said electricity generation, not chips or models, is the main bottleneck slowing AI deployment. Elon Musk said Thursday that artificial intelligence could surpass human intelligence as soon as this year, arguing that progress toward artificial general intelligence is accelerating faster than humanity is prepared for. The comments by the Tesla, SpaceX, and xAI CEO came during a wide-ranging conversation with BlackRock CEO Larry Fink at the World Economic Forum in Davos on Thursday. "I think we might have AI that is smarter than any human by the end of this year," Musk said. "No later than next year." He added that by around 2030 or 2031, AI could become "smarter than all of humanity collectively." Musk's comments place him among a growing group of tech CEOs who say AGI will arrive within years, not decades, raising concerns about labor disruption, governance, and economic concentration. He said the economic impact of AI will depend less on software alone, and more on the deployment of humanoid robots capable of performing physical work at scale. "If you have ubiquitous AI that is essentially free or close to it, and ubiquitous robotics, then you will have an explosion in the global economy," he said. Musk also repeated his view that humanoid robots will eventually outnumber humans. "My prediction, in the benign scenario of the future, is that we will make so many robots and AI that they will saturate all human needs," Musk said. Tesla, Musk added, has already begun using early versions of its Optimus humanoid robot in factories, where they are performing simple tasks, with more complex tasks planned by the end of 2026. The company also plans to sell humanoid robots to the public by the end of next year, Musk said, once safety and reliability targets are met. Some researchers have previously questioned Musk's timelines, citing unresolved safety, cost, and engineering challenges. "Elon has a track record of overoptimistic predictions about AI," Gary Marcus, a cognitive scientist and professor emeritus of psychology and neural science at New York University, previously told Decrypt. "It's just fantasy to imagine selling 200 times as many humanoid robots in the nearish term when nobody knows how to build a single safe, reliable, generally useful humanoid right now, at any price." Musk acknowledged the risks posed by a proliferation of humanoid robots, but said progress in AI and robotics is compounding. The main constraint in deployment is power, he explained, highlighting the need to shift to solar power. "Solar is by far the biggest source of energy. When you look beyond Earth, the sun rounds up to 100% of all energy. The sun is 99.8% of the mass of the solar system. Jupiter is about 0.1%, and everything else is miscellaneous," he said. "Even if you were to burn Jupiter in a thermonuclear reactor, the amount of energy produced by the sun would still round up to 100%." He argued that large-scale solar deployment will determine how quickly AI systems can expand; however, Musk said advanced AI and robotics must be developed carefully. "We need to be very careful with AI. We need to be very careful with robotics," he said. "We don't want to find ourselves in a James Cameron movie...'Terminator.'" Despite these concerns, Musk closed by encouraging optimism about the future of AI and humanoid robotics. "For quality of life, it is actually better to err on the side of being an optimist and wrong," he said, "rather than a pessimist and right."

[8]

Tesla earnings top estimates as Musk pivots company from cars to robots

Tesla earnings top estimates as Musk pivots company from cars to robots Shares in Tesla Inc. were up slightly in after-hours trading today after the company beat expectations in its fiscal fourth quarter and Chief Executive Officer Elon Musk announced major changes that will shift Tesla's identity beyond car manufacturing. For the quarter that ended on Dec. 31, Tesla reported adjusted earnings per share of 50 cents, down from 73 cents per share in the same quarter of 2024, on revenue of $24.9 billion, down 3% year-over-year. Both figures came in ahead of the 45 cents per share and revenue of $24.78 billion expected by analysts. Non-adjusted net income for the quarter came in at $840 million, driven in part by stronger-than-expected margins and a record in energy storage deployments. Vehicle deliveries in the quarter passed 418,000 units but were lower than the same quarter of 2024 and below investor forecasts. For the full year, Tesla reported $94.8 billion in revenue, marking the first annual decline in the company's history. Profits also fell compared to 2024 due to weaker vehicle sales in markets such as Europe and China, where competitive pressures have intensified. But car sales numbers were not the main area investors were interested in, with Elon Musk laying out on Tesla's investor call the company's strategic roadmap and it is one that is focused on robots. Musk and Tesla executives said on the call that Tesla was accelerating the company's transformation from a traditional electric car maker into a "physical AI company." The shift towards robotics is starting with a restructuring of the company's product lineup, with Musk announcing that Tesla is ending production of its long-running Model S and Model X vehicles. Tesla plans to use freed-up capacity at its Fremont factory to build Optimus humanoid robots and future autonomous vehicles, effectively repositioning Fremont as a robotics and autonomous vehicle hub. The third-generation Optimus robot is expected to be showcased in the coming months, with Tesla targeting the start of production before the end of 2026 and mass-market sales projected for 2027. Alongside its shift to robots, it was also announced that Tesla would invest $2 billion into xAI Inc., Musk's artificial intelligence company and tighten integration between Tesla's AI systems and its physical products. On the call, Musk did not shy away from acknowledging near-term headwinds, including margin pressures, supply chain risks, and softer EV demand in some regions. Tesla also forecasts significant capital expenditures in 2026 - more than $20 billion - to build out manufacturing capacity, AI compute infrastructure, and robotics facilities. While Tesla may be shifting much of its focus to robots, it is not abandoning vehicles altogether, with the company still moving forward with both the Tesla Semi and Cybercab, which are both expected to go into production in the first half of this year, along with the production of a next-generation Roadster.

[9]

Tesla to sell Optimus robots to public next year, Musk says

Tesla will probably sell its Optimus robots to the public by the end of next year, according to CEO Elon Musk, who's said the carmaker's fortunes will be increasingly dependent on humanoid machines. The company is already using some of the robots to do simple tasks in its factory, Musk said Thursday at the World Economic Forum in Davos, Switzerland. He predicted Optimus would be "doing more complex tasks" by the end of 2026. Sales to the public will begin when Tesla is "confident that it's very high reliability, very high safety, and the range of functionality is also very high," Musk said. The comments offer a more concrete timeline for the future business line, which Musk sees as a key focus for Tesla going forward, alongside artificial intelligence and autonomous vehicles. The automaker's core business of selling cars has suffered from a stale product lineup and the loss of EV incentives in the U.S., leading to two consecutive years of declining deliveries. While Musk regularly talks up the potential of Optimus, he's been relatively vague about production timelines and targets. During a January 2025 earnings call, he said his "very rough guess" was that Tesla would start delivering Optimus robots to other companies in the second half of 2026. Musk has cautioned that initial production of Optimus and Tesla's newest vehicle, the Cybercab, will be "agonizingly slow." Musk's appearance in Davos came as a surprise after the world's richest man was confirmed as a last-minute addition to Thursday's schedule. He'd previously criticized the forum, calling the annual gathering of the world's elite "boring" and slammed the WEF as a body that's "increasingly becoming an unelected world government that the people never asked for and don't want." "How is WEF/Davos even a thing? Are they trying to be the boss of Earth!?" he posted on social media in 2022. Musk touched on a variety of topics in his conversation with BlackRock CEO Larry Fink, including data centers in space, robotaxis and power-generation bottlenecks.

[10]

Tesla Investors Are Eager to Hear Elon Musk Talk About Everything But EVs

Tesla shareholders want answers on Musk's growing empire, from SpaceX's IPO plans to Optimus robots and Robotaxi in Austin. Tesla is scheduled to report earnings tomorrow (Jan. 28). But the electric carmaker's shareholders are less interested in quarterly margins than in hearing Elon Musk talk about everything else. On Say.com, a third-party platform Tesla uses to collect questions for its earnings calls, the most up-voted submissions from both retail and institutional investors aren't about vehicle sales; they're about robotaxis, humanoid robots and SpaceX. Sign Up For Our Daily Newsletter Sign Up Thank you for signing up! By clicking submit, you agree to our <a href="http://observermedia.com/terms">terms of service</a> and acknowledge we may use your information to send you emails, product samples, and promotions on this website and other properties. You can opt out anytime. See all of our newsletters Here are the top investor questions, and why they matter. "You once said: Loyalty deserves loyalty. Will long-term Tesla shareholders still be prioritized if SpaceX does an IPO?" Musk runs six companies, but Tesla is the only one that's publicly traded. As a result, its earnings calls have become the one venue where investors and Wall Street analysts can directly ask Musk about his other privately-held ventures. SpaceX has been top of mind for many Musk observers because of its highly anticipated blockbuster IPO. The rocket and satellite company is reportedly taking steps to go public as soon as this year, targeting a valuation of $1.5 trillion -- nearly double its current valuation of $800 billion. That would instantly make SpaceX Musk's most valuable company. Tesla, for now, remains the largest Musk-led firm with a $1.36 trillion market cap, but its momentum is fading as EV sales slow and new products struggle to scale. Meanwhile, SpaceX is thriving out of the spotlight, pulling in 11-figure annual revenue from government contracts and consumer Starlink subscriptions. Musk's stake there now represents more than half of his net worth. If SpaceX goes public, Musk would suddenly have a second set of public shareholders to answer to -- along with earnings calls, regulatory scrutiny and even more media obligations. Tesla investors already bristled last year when Musk took on another high-profile time sink as head of DOGE, a political side project that distracted from the carmaker. "When is FSD going to be 100% unsupervised?" and "What is the current bottleneck to increased Robotaxi deployment & personal use of unsupervised FSD? The safety/performance of the most recent models or people to monitor robotaxis in-car or remotely? Or something else?" When it comes to Tesla itself, investors are eager for updates on FSD and Robotaxi. FSD, short for "Full Self-Driving," is Tesla's driver-assistance software, though the name is misleading: it still requires a human driver to remain alert and ready to intervene at all times. Musk has been promising true autonomy for more than a decade, but it's not quite there yet. Regulators classify FSD as Level 2 autonomy, meaning the human is still in charge. Fully unsupervised driving would be Level 5. So far, the biggest step Tesla has taken toward that vision is Robotaxi, its autonomous ride-hailing service now operating in Austin. The company launched it in June 2025, using modified Model Y vehicles equipped with FSD. Initially, human safety monitors sat in the passenger seat. As of January, a small number of vehicles without supervisors have joined the fleet, marking a major milestone. Expansion to more cities hinges on regulatory approval. With global EV demand leveling off, the success or failure of Robotaxi plays a large role in Tesla's future. "Regarding Optimus, could you share the current number of units deployed in Tesla factories and actively performing production tasks? What specific roles or operations are they handling, and how has their integration impacted factory efficiency or output?" Another key product that will determine Tesla's fate is Optimus, a humanoid robot designed to take over tasks that are boring or unsafe -- from household chores to factory work. Naturally, Tesla's EV factories would be a perfect proving ground for these robots. The company plans to begin training Optimus at its Austin Gigafactory in early 2026, teaching robots to perform human factory tasks. Tesla announced the Optimus project in 2021 and unveiled a prototype in 2022. It's powered by Tesla's in-house machine learning and A.I. technology. Musk has described the project as one of Tesla's most important long-term endeavors, even saying it could eventually be more significant than the company's vehicle business. According to Musk, initial production of Optimus is expected later this year, but at an "agonizingly slow" pace due to the complexity of humanoid robotics. Musk has targeted selling Optimus to the public as soon as next year. But given Musk's track record of sticking to ambitious timelines, investors may want to take that with a grain of salt.

[11]

Elon Musk is fueling Tesla by torching piles of cash

Tesla plans a massive investment boost, doubling its budget for autonomous vehicles, robots and AI. This comes despite recent weak financial results. The company is also investing heavily in Elon Musk's AI venture, xAI. Tesla aims for future abundance, but significant cash burn is expected this year as it shifts focus from car manufacturing to new technologies. Elon Musk, ever attuned to the political zeitgeist, has updated Tesla Inc.'s mission to "amazing abundance." It is the kind of hyperbole beloved of investors in the company he runs. Before the amazing variety arrives, however, another type of abundance was announced on Wednesday evening's earnings call: Tesla's investment budget will more than double. For the bulls, Tesla is finally unleashing its financial firepower to own the future of autonomous vehicles, robots and artificial intelligence. Yet the news came alongside weak fourth-quarter results and the bombshell announcement that Tesla is investing about $2 billion in xAI, Musk's own artificial intelligence venture. Amid all the plans and targets thrown out on the call, the one certainty is that Tesla will burn a lot of cash this year. The financial results themselves were messy and underwhelming. The closely watched metric of auto gross profit margin, adjusted for regulatory credits, came in at 17.9% -- surprisingly high given a collapse in vehicle deliveries, even factoring in foreign exchange gains. Tesla's energy business performed well, although gross profit was essentially flat with the third quarter. In any case, none of this seeming strength trickled down. Tesla's overall operating margin fell to just 5.7%. "Other" costs, possibly reflecting swings in crypto values, soared. Fourth-quarter GAAP earnings slumped by 60%, year over year. None of which matters, of course. Tesla's stock is determined less by reported numbers, more by a complex, if nebulous, function that multiplies planned initiatives with the level of faith in Musk. Both factors are high. Musk announced that Tesla will retire two of its premium priced, and oldest, models, the S and X, next quarter -- an acknowledgement of sliding sales, perhaps, but cast as symbolizing the company's shift toward fully autonomous vehicles such as Cybercabs. Production of those is planned to begin by the end of June. Tesla also plans to unveil its third-generation version of the Optimus humanoid robot soon, with mass production "planned" to begin by year-end. Big things are also planned in solar power, batteries, chargers and chips. This narrative setting is all par for the course with Tesla, and Musk's targets should be treated with skepticism. When asked for specifics on how many Optimus robots are working today at Tesla factories, and what they are doing, Musk demurred. He said the technology was still in the research and development stage, which sits rather oddly with the idea that mass production will begin in less than 12 months (and that the S and X are being scrapped to switch over their production lines to making robots). Musk's expectation of having fully autonomous vehicles operating in a quarter-to-half of the US by year-end should be put in the context of his expectation of reaching half the US by year-end -- last year. What can't be doubted is the money Tesla is spending to do all this. The mooted capex figure of $20 billion-plus for 2026 is not only more than the prior two years combined, it is substantially higher than Tesla's best ever annual cash flow from operations, $14.9 billion in 2024. That declined slightly in 2025 and the consensus is for it to fall again this year. Unsurprising, since Tesla is essentially de-emphasizing its main source of profits, EV manufacturing, and plowing billions into nascent businesses that won't earn a profit for a while, even assuming success. Remarkably, that $20 billion is equivalent to half of the entire value of the property, plant and equipment assets carried on Tesla's balance sheet. It signals a radical expansion in a very short space of time. Based on consensus forecasts, the capex budget implies Tesla burning around $6 billion of cash this year. With $44 billion on its balance sheet, Tesla can afford it. But this would make 2026 Tesla's first year of negative free cash flow since 2018, before a ramp-up of sales of then-new models and the pricing tailwind delivered by the pandemic's disruption flipped free cash flow positive. This echo of the 2010s, for much of which Tesla was a kind of publicly listed start-up, dovetails with the xAI investment. Recall that Tesla shareholders were given a non-binding vote on this at November's meeting. While there were more 'yeas' than 'nays', a high number of abstentions meant that it technically counted as a no. Tesla, however, appears to have focused more on the yeas and Musk said offhandedly on Wednesday's earnings call that "we're just doing what shareholders asked us to do, pretty much." The "pretty much" does a ton of work there but, in a sense, he's correct. After that vote, I wrote that, while the abstentions were noted, "the signal here is green." How could it not be when set in the context of Musk's trillion-dollar pay package, approved overwhelmingly, and shares that trade at 200 times earnings despite faltering sales and profits? The fact that the pay package was justified on the grounds that it would persuade Musk to keep his best ideas in-house, even as shareholders voted on putting money into a strategic AI business that clearly hadn't stayed in-house, got a bit lost. The latest results and plans reaffirm the idea that Tesla investors now own something more like a blank-check company. One that promises amazing abundance on any number of fronts even as its main existing business succumbs to the banalities of competitive pressure. One that feels free to intertwine its strategy and assets with the CEO's own ventures. And, to complete the picture, one that is ready to burn billions in pursuit of that. (You can now subscribe to our Economic Times WhatsApp channel)

[12]

Elon Musk Says Tesla Could Start Selling Humanoid Robots Next Year, Gene Munster Calls It A 'Slight Positive' For This Reason - Reddit (NYSE:RDDT), Tesla (NASDAQ:TSLA)

On Thursday, Elon Musk gave wide-ranging remarks that included new timelines for Tesla Inc. (NASDAQ:TSLA) humanoid robot and Full Self-Driving software. Musk Teases Optimus Sales Timeline At Davos Making a surprise debut at the World Economic Forum in Davos, Musk said Tesla could begin selling its humanoid robot, Optimus, "probably sometime next year." Musk has been talking about Optimus since 2021 and has repeatedly framed the robot as a product that could eventually reshape the global economy. Despite the bold claims, reports suggest Tesla is still working through technical hurdles, including challenges related to Optimus' hands. On the other hand, China's Unitree Robotics shipped over 5,500 full-body humanoid robots in 2025, far surpassing U.S. competitors like Tesla, Figure AI and Agility Robotics, which each shipped about 150 units, reported South China Morning Post earlier this week. According to Counterpoint Research, in 2025, approximately 16,000 more humanoid robots were deployed globally, with China responsible for over 80% of these installations. FSD Approval Hints Lift Near-Term Optimism Musk also said Tesla hopes to receive regulatory approval as early as next month to deploy its driver-supervised Full Self-Driving system in Europe, with China potentially following on a similar timeline. "We hope to get supervised Full Self-Driving approval in Europe, hopefully next month, and then maybe a similar timing for China," Musk said. How Investors And Tech Leaders Reacted Deepwater Asset Management's managing partner Gene Munster said the market reaction reflected cautious optimism rather than exuberance. In a post on X, Munster called Musk's comments "slightly positive," noting that even limited Optimus sales would represent meaningful progress. Tesla shares rose more than 4% during Thursday's regular session, outpacing the Nasdaq's gains, according to Benzinga Pro. In after-hours trading, Tesla shares are up 0.25%. However, not all reactions were serious. When Musk suggested it would be a "no-brainer" to build solar-powered AI data centers in space, Reddit Inc. (NYSE:RDDT) co-founder Alexis Ohanian responded on X with a quip: "Data centers in space, you say?" Tesla is scheduled to report fourth-quarter results and host its earnings call on Wednesday, Jan. 28, at 5:30 p.m. ET, covering the company's financial performance for the quarter ended in December. Tesla maintains a stronger price trend over medium and long terms, but negative in short term with a poor value ranking. Additional performance details, as per Benzinga's Edge Stock Rankings. Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Photo Courtesy: Iv-olga on Shutterstock.com RDDTReddit Inc $214.54-% Overview TSLATesla Inc $450.480.25% Market News and Data brought to you by Benzinga APIs

[13]

Tesla Stock Investors Just Got Good News From CEO Elon Musk About Robotaxis and Robots

CEO Elon Musk recently provided encouraging updates on Tesla's autonomous driving and humanoid robotics technology. Tesla (TSLA 0.99%) lost substantial market share in electric cars during the past year due to increased competition, brand backlash, and the discontinuation of federal tax credits. The company said deliveries fell 9% in 2025 despite global electric car sales increasing 25%. However, Tesla is more focused on robotaxis and robots, a transition that has been years in the making, and CEO Elon Musk recently shared some good news about those products. Here's what you need to know. Tesla's robotaxis are operating without safety monitors in Austin Tesla launched its autonomous ride-sharing service in Austin to a limited group of people in June 2025. The company has since opened the service to everyone and expanded the service area rapidly, validating its camera-only strategy to some extent. Last week, Musk posted on social media: "Just started Tesla robotaxi drives in Austin with no safety monitor in the car. Congrats to the Tesla AI team!" Whereas rivals like Waymo equip robotaxis with lidar sensors that use detailed maps to navigate, Tesla relies solely on cameras. That strategy is not only cheaper, but also less time-consuming because the company doesn't need to map cities before putting robotaxis on the road. In other words, Tesla should be able to scale its autonomous ride-sharing service faster than its competitors. Beyond Austin, Tesla also offers its autonomous ride-sharing service in the San Francisco Bay Area, though a safety monitor still sits in the car. In addition to Texas and California, Tesla has also received a permit to operate a ride-sharing service in Arizona and to test robotaxis in Nevada. This year, the company hopes to launch autonomous ride-sharing in five new markets: Las Vegas, Phoenix, Dallas, Houston, and Miami. Tesla still trails Waymo, which has commercial robotaxi services in five U.S. cities, but the company is making progress with its autonomous driving technology. That bodes well for shareholders because the robotaxi market is projected to grow at 99% annually through 2033, according to Grand View Research. Tesla's full self-driving (FSD) service could soon be available in Europe (and maybe China) Tesla introduced its full self-driving (FSD) technology in the United States in 2020. The service, officially called FSD (Supervised) because it does not yet provide full autonomy, is currently available as a subscription at $99 per month. But the company plans to raise the price as its capabilities improve. Musk recently said Tesla's FSD service could win approval in Europe as early as February 2026. Specifically, the Netherlands Vehicle Authority is expected make a decision on the technology next month, and approval in one country would allow other members of the European Union to fast-track adoption. Musk also said approval in China was possible around the same time, but Chinese state media has since rejected that claim. Either way, the announcement is good news for Tesla because launching FSD in Europe will expand its addressable market. Currently, FSD is a negligible source of revenue, but Morgan Stanley says autonomous car sales will hit $3.3 trillion annually by 2040. Tesla could start selling its humanoid robot Optimus at the end of 2027 Last week, Musk said Tesla's autonomous humanoid robot, Optimus, should be available to the public by late 2027. Since the company prototyped the technology in 2022, Musk has made several bold predictions about Optimus, the most striking being that it could add $20 trillion to Tesla's future market value. Musk has also said the humanoid robot could account for 80% of the company's valuation, implying a total market value of $25 trillion. Of course, he has frequently overpromised and underdelivered where artificial intelligence (AI) products are concerned. But there is no question Optimus could be a major source of revenue in the future. Morgan Stanley estimates the humanoid robot market will increase at 50% annually to reach $1.2 trillion by 2040. Here's the big picture: Tesla is losing market share in electric vehicles, but the company is building momentum in physical AI. The stock is quite risky, with shares trading at 290 times earnings. But the valuation could moderate quickly if robotaxis and robots become a material source of revenue in the future.

[14]

Tesla plots $20 billion spending spree to build Elon Musk's AI future

The capital expenditure plans laid out Wednesday - roughly twice as much as Wall Street was expecting - will support production expansion at multiple factories, scaling up the nascent robotaxi business and building out AI infrastructure. Tesla also revealed plans to discontinue the Model S and X vehicles and devote that plant capacity to building Optimus humanoid robots. Tesla Inc. plans $20 billion of spending this year to streamline its electric-vehicle lineup and shift resources toward robotics and AI, part of a sweeping set of changes pushing the company further from its roots as an automobile manufacturer. The capital expenditure plans laid out Wednesday - roughly twice as much as Wall Street was expecting - will support production expansion at multiple factories, scaling up the nascent robotaxi business and building out AI infrastructure. Tesla also revealed plans to discontinue the Model S and X vehicles and devote that plant capacity to building Optimus humanoid robots. "We're making very, very big investments," Chief Executive Officer Elon Musk said on a conference call after Tesla released fourth-quarter results. The dramatic moves also include a new agreement to invest $2 billion in Musk's xAI startup and discussions to potentially build a semiconductor manufacturing facility. They underscore Tesla's ambitions to reorient around artificial intelligence, driverless technology and robots at the expense of its car-selling business, which has endured two years of decline and faces more challenges in 2026. Investors have broadly supported the reinvention, even as many of the new business lines remain far-off and uncertain prospects. Neither the EV sales slump nor Tesla's earnings beat received much attention on Wednesday's call. "This quarter officially marks the fundamental shift from EV company to an all-in bet on robotaxi, energy and Optimus," said Andrew Rocco, an analyst with Zacks Investment Research. "It looks like they're almost ready to tear off the Band-Aid on the EV business and go full in on autonomy." The shares climbed 1.2% at 7:03 p.m. in extended trading in New York. The stock rallied to new highs last year despite underperforming the broader market. AI agreement Tesla reached an agreement this month to acquire preferred shares as part of xAI's latest funding round, according to the company's fourth-quarter earnings statement. The companies also entered into a "framework agreement" to strengthen their relationship and "enhance Tesla's ability to develop and deploy AI products and services into the physical world." The investment highlights the deepening ties between Musk's business interests and reinforces the growing focus on AI. The xAI agreement will likely be welcomed by many investors and overshadow the earnings results, said Matt Maley, chief market strategist for Miller Tabak + Co. "If Tesla is going to do as well as the bulls are thinking, it's going to be with the robotaxi and robotics," Maley said. "So, this investment is exactly what the bulls wanted to hear." While Musk has previously expressed support for Tesla to invest in xAI, the decision comes as a surprise after an unsuccessful shareholder vote at the carmaker's November annual meeting seemed to cloud the prospects. More of Tesla's shareholders voted for a nonbinding measure encouraging such an investment, but a heavy number of abstentions meant the measure didn't pass. Still, Tesla said then that it would continue to explore the possibility. The two companies, both of which are led by Musk, already work together. Tesla sells its Megapack energy storage system to xAI and xAI's Grok chatbot is integrated into some Tesla vehicles. Bloomberg also reported that xAI told investors that its aims to build AI will eventually power humanoid robots such as Optimus. Quarterly profit Adjusted earnings per share were 50 cents in the quarter, Tesla said Wednesday, five cents higher than the average of analyst estimates. The results snap a string of four quarters in which profit was weaker than expected. Tesla is navigating lower EV demand and rising competition. Musk has previously warned the company faces a rough patch while it works on these new priority areas. As part of the overhaul, Tesla is axing the Model S, a luxury sedan that costs about $95,000 and the Model X, an SUV with a pricetag of nearly $100,000. The two are low-volume vehicles compared to Tesla's more-affordable 3 and Y models. The profit beat helps offset disappointment stemming from a steady decline in vehicle sales: Tesla earlier this month reported a 9% decline in 2025 deliveries from the previous year. That slump sharpened in the fourth quarter, when deliveries dropped 16% from a year earlier. Last year was marked by a crowded EV market, the end of US regulator credits and a backlash against Musk's polarizing politics and his role in the Trump administration. Sales from regulatory credits fell 22% in the fourth quarter from a year earlier, showing how a lucrative revenue stream is drying up. The company receives the payments from competitors who exceed federal fuel economy standards. That income has dropped after the Trump administration eliminated penalties for automakers that failed to meet the standards. Due to the lower regulatory credit revenue and a drop in vehicle deliveries, Tesla's 2025 revenue declined for the first time. Separately, the company reported 1.1 million active subscribers for its Full Self Driving driver assistance software -- up nearly 40% from a year earlier. The software, which currently is not considered autonomous and requires constant human supervision, is becoming subscription-only starting after Feb. 14. Tesla on Wednesday said it aims to expand its budding robotaxi business to Dallas, Houston, Phoenix, Miami, Orlando, Tampa and Las Vegas in the first half of this year. The business has been slowly expanding but has also missed a number of predicted timelines. Tesla launched its automated rideshare operations in Austin in June. This month, Tesla started rolling out "a few" robotaxis without human driver supervision in Austin. It plans to scale this to its entire Austin fleet over time. The vehicles have previously operated with human safety supervisors in the front seats. The milestone has been long-anticipated, and Musk promised it would come late last year. The company also operates a rideshare service on the same app in the San Francisco Bay Area that is not considered autonomous and has drivers in the front seat. It also has permits to test the service in Nevada and Arizona.

[15]

Tesla Bets Future Growth on Optimus Robots and Autonomous Vehicles | PYMNTS.com

The company said it will convert the Fremont, California, factory space used for Model S and Model X into a dedicated Optimus facility, targeting long-term capacity of 1 million robots per year. Elon Musk said the move reflects a broader transition toward autonomy and robotics as Tesla's next growth engines. "It is time to bring the S and X programs to an end and shift to an autonomous future," he said. Tesla did not provide a detailed timeline for reaching meaningful Optimus volumes, beyond indicating that material production is unlikely before the end of the year. Optimus: Growth Driver With Long Timelines Optimus featured prominently throughout the call, positioned as a general-purpose humanoid robot designed to perform physical tasks across factories, logistics and service environments. Tesla expects to unveil Optimus Gen 3 in the coming months, which Musk described as a significant leap in capability. At the same time, the company acknowledged that Optimus remains in the research and development phase. Limited deployments inside Tesla factories are used to test basic tasks, with older versions retired as designs evolve. "We wouldn't expect to have any kind of significant Optimus production volume until probably the end of this year," Musk said. Musk framed Optimus as a product with macroeconomic implications, saying it could "move the needle on U.S. GDP significantly." Tesla, however, did not outline expected unit economics, pricing, or margins, leaving open questions around how quickly technical progress can translate into financial returns. The company also cautioned that Optimus faces a slower manufacturing ramp than vehicle programs because its supply chain is largely new. Musk said production will follow a "stretched-out" curve, constrained by the weakest links in a complex, first-principles manufacturing process. Focus on Autonomy Expands Tesla said unsupervised autonomous driving is operating in Austin, Texas, where vehicles are completing paid rides without a safety driver, chase vehicle or human inside the car. Musk emphasized that expansion is proceeding cautiously, with safety prioritized over speed. Tesla expects unsupervised autonomy to reach dozens of major U.S. cities by year-end, pending regulatory approval. Musk said coverage could extend to between one-quarter and one-half of the U.S., though the lack of federal preemption continues to require a city-by-city and state-by-state rollout. The company reiterated plans to allow vehicle owners to add their cars to an autonomous fleet and earn income when not in personal use. Tesla did not provide updated assumptions around utilization, pricing or revenue sharing, making the near-term financial impact difficult to quantify. What Else Stood Out on the Call * Automotive margins excluding regulatory credits improved sequentially to 17.9% from 15.4%, despite lower deliveries, supported by a regional mix shift toward APAC and EMEA. The improvement comes as Tesla transitions to a subscription-based full self-driving model, which is expected to pressure margins in the near term. * Full self-driving adoption reached nearly 1.1 million paid customers globally, with about 70% opting for upfront purchases. Future net additions will primarily come via subscriptions. * Energy revenue reached $12.8 billion for the year, up 26.6% year over year. Tesla warned of potential margin pressure from tariffs, policy uncertainty, and rising low-cost competition. * Chip supply was identified as a medium-term constraint, particularly for Optimus. Musk said Tesla may pursue a large-scale U.S. semiconductor fabrication facility, adding further capital intensity and execution risk. Topline Results Tesla ended the quarter with total gross margin of 20.1%, its highest level in more than two years, despite lower fixed-cost absorption and more than $500 million in tariff impacts. Free cash flow totaled $1.4 billion. Capital expenditures came in slightly below prior guidance at $9 billion for 2025, before rising sharply in 2026 as spending accelerates across robotics, autonomy, AI compute, and manufacturing infrastructure. The scale of planned investment points to a multiyear period of elevated spending before newer initiatives materially contribute to cash flow. Musk closed the call by underscoring Tesla's willingness to take on long-term risk. "I don't know how you create value by solving easy problems," he said.

[16]

This "Magnificent Seven" Stock Has a Secret Weapon for 2026: Meet Optimus

The stuff of science fiction is quickly becoming reality. Iconic electric vehicle maker Tesla (TSLA 0.99%) is now making AI-controlled humanoid robots that will be available for purchase by the public before the end of 2027. That's what Tesla CEO Elon Musk said at this year's World Economic Forum, anyway. Just bear in mind the larger-than-life founder has significantly understated developmental timelines before. On the other hand, he's also got a penchant for eventually delivering. So, what's this new robot -- called Optimus -- all about? The time is (more or less) right for this tech With two arms, two legs, and one head all attached to a torso, Optimus is clearly intended to do everything a human can do in the space that a human can occupy. Musk isn't envisioning them to serve as full-blown replacements, though, or provide replacement bodies (at least not yet). Rather, his vision is to instruct these robots to autonomously handle tasks that are boring, dangerous, or both to humans. Anticipated retail price? Between $20,000 and $30,000. We'll see. Still, it's not an outrageous expectation. Carmaker Hyundai recently confirmed plans to deploy humanoid robots at its factory in Georgia by 2028, following November's news from Agility Robotics that its humanoid package-handling automatons (called Digit) have now collectively moved 100,000 totes. Indeed, Amazon reported last year that it has already deployed over 1 million self-driving package-moving robotic carts within its warehouses. Tweaking these technological tools into something suitable for the home, office, or in situations where a limited judgment call needs to be made isn't exactly a big leap from here. But is there enough money to be made by Tesla in this market to merit an investment that wasn't merited before? It certainly doesn't hurt the near-term bullish argument As is so often the case, this technology will likely be ready for the mainstream before most consumers and corporations are ready for it. That was certainly the case for solar power, AT&T's videophone back in the 1960s, and arguably, even Tesla's electric vehicles. There's little doubt it will take some time for the world to become comfortable with a relatively expensive assistant that is human-like, but clearly not human. Time and proof should slowly but surely convince them, though, so much so that analysts with Morgan Stanley predict the global humanoid robot industry will be worth $5 trillion by 2050. The firm adds that there could be more than 1 billion of these autonomous machines in use by that point. Musk is even more optimistic about their utilization, though. He's said more than once that there may come a time when there's at least one artificial intelligence-controlled humanoid robot for every person on the planet, creating what he's also referred to as "infinite money glitch" for Tesla. That degree of fiscal success is obviously still years down the road, if it ever materializes as suggested at all. The hope is enough to fan the bullish flames in 2026, however, particularly if investors see regular developmental progress with Optimus along the way.

[17]

Musk to sell humanoid robots to public by end of next year - The Korea Times

SpaceX and xAI CEO Elon Musk speaks during a panel discussion during the 56th annual meeting of the World Economic Forum (WEF), in Davos, Switzerland, Thursday. EPA-Yonhap DAVOS, Switzerland -- Elon Musk sees his humanoid robots hitting the market next year, one of several "optimistic" forecasts by the U.S. tech mogul at his first-ever Davos appearance on Thursday. In front of a packed conference hall, Musk had a chance to tear into a World Economic Forum he has long derided as a "boring" confab of out-of-touch elites. But in a remarkably subdued "conversation" with WEF interim chair Larry Fink -- also the CEO of investment behemoth BlackRock -- Musk stuck to his script of optimistic enthusiasm for AI, robotics and space travel. He was not pressed for example on the scandal caused by sexualised deepfakes of his Grok AI tool, or claims of persistent fake news spread by his X social network. "Who wouldn't want a robot to watch over your kids, take care of your pet... If you had a robot that could take care and protect an elderly parent, that'd be great," he told the audience. His Optimus robots will be doing more complex tasks later this year, he said, and "by the end of next year I think we'll be selling humanoid robots to the public." Musk also predicted the artificial intelligence boom will have models that are "smarter than any human by the end of this year, and I would say no later than next year." "And then probably by 2030 or 2031, so five years from now, AI will be smarter than all of humanity collectively." But he ended his talk with a caveat: "Generally, I think that for quality of life, it is actually better to err on the side of being an optimist and wrong, rather than being a pessimist and right."

[18]

Elon Musk Says Tesla Will Sell Humanoid Robots to Public by Late 2027 | PYMNTS.com

"That's when we are confident that it's very high reliability, very high safety, and the range of functionality is also very high -- you can basically ask it to do anything you'd like," Musk said while speaking at the World Economic Forum in Davos, Switzerland. Tesla already has Optimus humanoid robots performing simple tasks in its factories, and the company expects those robots to be doing more complex tasks within that industrial environment by the end of this year, Musk said. Musk had predicted in June 2024 that Tesla would have "genuinely useful humanoid robots" in low production for use in its facilities by 2025. PYMNTS reported in November that physical artificial intelligence is emerging as the next stage of robotics and will provide a new workforce layer. In February, PYMNTS reported that Tesla is one of several companies that are working to produce AI-powered robots that will perform general tasks such as household chores. Looking further in the future, Musk said Thursday that he predicts that at some point, robots will outnumber people. "My prediction is, in the benign scenario of the future, that we will actually make so many robots and AI that they will actually saturate all human needs, meaning you won't be able to even think of something to ask the robot for at a certain point," Musk said. "There will be such an abundance of goods and services... My prediction is there will be more robots than people." Musk also said during Thursday's conversation at the World Economic Forum that there might be AI that is smarter than any human by the end of the year, and no later than 2027, and that AI will be smarter than all of humanity collectively by 2030 or 2031. To provide the power that is needed by AI, Tesla and SpaceX teams are working separately to build 100 gigawatts a year of manufactured solar power in the United States, Musk said. They expect to achieve that capacity in about three years. For all PYMNTS AI coverage, subscribe to the daily AI Newsletter.

[19]

Davos 2026: Humanoid robots a must for Musk by next year as Tesla CEO eyes Europe, China nod for self-driving system

Tesla plans to offer its Optimus robots to consumers by the end of next year. Elon Musk also anticipates regulatory approval for the company's Full Self-Driving system in Europe and China within the next month. These developments come as Tesla seeks to diversify revenue streams beyond its electric vehicle sales. Tesla is looking to sell sell its Optimus robots to the public by the end of next year, according to chief executive officer Elon Musk, who's said the carmaker's fortunes will be increasingly dependent on humanoid machines. The company is already using some of the robots to do simple tasks in its factory, Musk said Thursday at the WEF. He predicted Optimus would be "doing more complex tasks" by the end of 2026. Check all latest developments related to Davos 2026 here Sales to the public will begin when Tesla is "confident that it's very high reliability, very high safety, and the range of functionality is also very high," Musk said. The comments offer a more concrete timeline for the future business line, which Musk sees as a key focus for Tesla going forward, alongside artificial intelligence and autonomous vehicles. The automaker's core business of selling cars has suffered from a stale product lineup and the loss of EV incentives in the US, leading to two consecutive years of declining deliveries. While Musk regularly talks up the potential of Optimus, he's been relatively vague about production timelines and targets. During a January 2025 earnings call, he said his "very rough guess" was that Tesla would start delivering Optimus robots to other companies in the second half of 2026. Meanwhile, Tesla is likely to win regulatory approval in Europe and China for its Full Self-Driving (FSD) system as early as next month, said Musk as the electric automaker looks to boost software revenue amid slowing vehicle sales. Musk also expects to sell humanoid robots to the public by the end of next year. The approvals would be crucial for Tesla, which is under pressure to generate revenue from software and services and is looking to monetise FSD outside the US. "We hope to get Supervised Full Self-Driving approval in Europe, hopefully next month, and then may be a similar timing for China," Musk said. Shares of the automaker rose about 1.5% after the comment. Tesla has been seeking approval for the FSD system in Europe, where tougher vehicle safety rules and a fragmented regulatory framework have slowed deployment compared with the US The Dutch vehicle authority RDW said in November it expects to decide on FSD software in February. Tesla had said once it secures approval in the Netherlands, other EU countries can recognize the exemption and allow a rollout ahead of a formal EU approval. Musk has been positioning Tesla as a self-driving and humanoid robotics company, even as most of its revenue still comes from its EV business, which faces stiff competition. Registration of Tesla's vehicles fell 11.4% in California last year, with its market share in the US state slipping below 50%, according to a report by the California New Car Dealers Association. The company reported a second consecutive drop in vehicle deliveries in 2025, ceding its position as the largest electric vehicle maker in the world to China's BYD. (You can now subscribe to our Economic Times WhatsApp channel)

[20]

Elon Musk says AI will outsmart humans by the end of this year By Investing.com

Investing.com -- Tesla CEO Elon Musk outlined his vision for AI, robotics, and space exploration during a conversation with BlackRock CEO Larry Fink at the World Economic Forum in Davos. Musk revealed that Tesla plans to begin selling humanoid robots to the public by the end of next year, once the company is confident in their reliability and safety. Some Tesla Optimus robots are already performing simple tasks in factories, with more complex capabilities expected by the end of this year. On autonomous driving, Musk claimed self-driving cars are "essentially a solved problem," with Tesla's Full Self-Driving software sometimes updated weekly. He noted some insurance companies are offering half-price insurance to customers using Tesla's Full Self-Driving technology due to its safety record. Tesla has rolled out robotaxi service in several cities and expects widespread deployment in the US by the end of this year, with supervised full self-driving approval in Europe potentially coming next month. Regarding space exploration, Musk said SpaceX hopes to achieve full rocket reusability this year with Starship, which he described as "the largest flying machine ever made." This breakthrough would reduce the cost of access to space by a factor of 100, bringing it below $100 per pound. Musk also discussed plans to launch solar-powered AI satellites within a few years, noting that solar panels in space are five times more effective than on Earth due to constant sunlight and no atmospheric interference. He predicted that "the lowest cost place to put AI will be space" within two to three years. On energy production, Musk stated that a 100-mile by 100-mile area of solar panels could power the entire United States, and that SpaceX and Tesla teams are separately working to build manufacturing capacity for 100 gigawatts of solar power per year in the US within about three years. Looking ahead, Musk predicted AI could become "smarter than any human by the end of this year" or "no later than next year." He described his companies' overall goal as maximizing "the probability that civilization has a great future" and extending "consciousness beyond Earth."

[21]

AI could be smarter than all of humanity in five years, says Elon Musk

Elon Musk believes artificial intelligence will soon be smarter than all humans combined. This advancement will reshape jobs and life's purpose. Musk also noted energy shortages could limit AI growth. He suggested space could become the cheapest location for AI systems. Tesla's humanoid robots and self-driving technology are also progressing rapidly. Tesla CEO Elon Musk said artificial intelligence (AI) is on track to become smarter than all of humanity combined within the next five years -- a shift he believes will change how people work, move and even find purpose. Speaking at the World Economic Forum in a conversation with BlackRock CEO Larry Fink, Musk said AI is advancing faster than many expect. He predicted that AI could be "smarter than any individual human this year," and become "smarter than all of humanity combined" within the decade. Also Read: Davos 2026: AI is changing who becomes an entrepreneur, experts say Musk linked that trajectory to the rise of humanoid robots, which he said could dramatically expand economic output. Tesla's Optimus robots, he said, are already performing simple tasks in factories, with more advanced capabilities expected soon. "If things go well, we expect to sell humanoid robots to the public by the end of next year," Musk said, adding that safety would be critical before any wider rollout. On autonomous driving, Musk said Tesla's Full Self-Driving software has reached a level where insurers are offering significant discounts to customers using it. He said Tesla is seeking regulatory approval to expand supervised self-driving in Europe, potentially as early as next month, followed by China. "If regulated and supervised, it will be widespread," Musk said. Also Read: AI poised to disrupt jobs, top executives warn at Davos 2026 While much of the discussion focused on AI's potential, Musk warned that energy -- not computing power -- could become the biggest constraint on progress. He said electricity generation is not scaling fast enough to keep pace with AI infrastructure, particularly in the United States. "AI chips are being produced faster than we can power them," Musk said, pointing to solar energy as the most viable solution at scale. He noted that China is deploying solar capacity far more rapidly, while tariffs and policy barriers are slowing adoption elsewhere. Looking further ahead, Musk said space could ultimately be the cheapest place to run large-scale AI systems. Solar panels in orbit, he said, generate more energy than those on Earth, while the cold vacuum of space offers natural cooling for data centres. "The lowest-cost place to put AI will be space," Musk said, predicting that solar-powered AI infrastructure in orbit could emerge within the next few years. Also Read: Davos 2026: India is emerging as a manufacturing hub for electronics, Qualcomm CEO says Musk also spoke about SpaceX's efforts to achieve full rocket reusability with its Starship vehicle, which he said could reduce the cost of access to space by a factor of 100 if successful. Asked what continues to motivate him, Musk pointed to curiosity and a desire to understand reality. When asked whether he would personally go to Mars, he replied: "Yes, but just not on impact." (You can now subscribe to our Economic Times WhatsApp channel)

[22]

Tesla plans $20 billion capital spending spree in push beyond human-driven cars