Elon Musk's xAI Seeks $113 Billion Valuation Amid Ambitious Growth Projections and Political Turmoil

14 Sources

14 Sources

[1]

Elon Musk's xAI reportedly looks to raise $300M in tender offer | TechCrunch

Billionaire Elon Musk's AI startup, xAI, is reportedly launching a $300 million share sale that values the company at $113 billion. According to The Financial Times, the secondary stock offering, which comes after xAI acquired Musk's social media platform, X, for $33 billion, will allow staff to sell shares to new investors. The tender offer will likely precede a larger investment round in which xAI will offer new equity to outside backers. As The Financial Times notes, xAI is looking to raise additional cash while Musk works to shift his attention from politics to his various companies, which have suffered during the tech mogul's time in Washington. Shares of Tesla hit a six-month low in early March, while X has experienced numerous lengthy outages. Meanwhile, xAI has repeatedly missed its own deadlines to ship an upgrade to its flagship AI model, Grok.

[2]

Musk's xAI seeks $113 billion valuation in $300 million share sale, FT reports

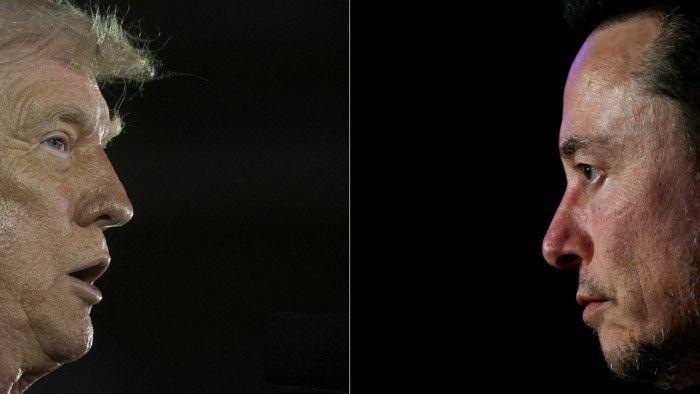

June 2 (Reuters) - Elon Musk's xAI is seeking a valuation of $113 billion in a share sale worth $300 million, the Financial Times reported on Monday, citing people close to the situation. The deal would allow employees to sell shares to investors and a larger investment round is expected to follow the secondary stock offer, in which xAI will offer new equity to outside investors, the FT report said. The artificial-intelligence startup acquired X, Musk's social media business, in March. The deal valued xAI at $80 billion and social media platform X - formerly known as Twitter - at $33 billion, Musk had said then. XAI did not immediately respond to a Reuters request for comment on the FT report. Musk recently stepped back from the Trump administration after the Tesla CEO ended a chaotic four-month stint leading the administration's sweeping cost-cutting campaign. U.S. President Donald Trump, however, said Musk would remain a close adviser. During an earnings call in April, Musk had said he would refocus his attention on the EV maker. XAI was launched less than two years ago and was in talks with investors to raise roughly $20 billion in funding for the combined AI startup and social media business, Bloomberg News reported in April. Reporting by Juby Babu in Mexico City; Editing by Pooja Desai Our Standards: The Thomson Reuters Trust Principles., opens new tab Suggested Topics:Artificial Intelligence

[3]

Elon Musk's xAI seeks $113bn valuation in $300mn share sale

Elon Musk's xAI is launching a $300mn share sale that values the group at $113bn, as the world's richest man returns to his business empire and the race to develop artificial intelligence. The deal will allow staff to sell shares to new investors, according to people close to the situation, validating the pricetag struck when Musk's xAI start-up acquired his social media service X in March. The secondary stock offering, known as a tender offer, is expected to be followed by a larger investment round in which the company will offer new equity to outside investors, one of the people said. The March takeover valued the overall group at $113bn: pricing xAI at $80bn with X at $33bn. Musk bought X, formerly Twitter, for $44bn in October 2022. xAI declined to comment. The new share sale comes after Musk, who helped bankroll Donald Trump's presidential campaign, stepped back last week from his role heading the administration's cost-cutting initiative. His time at the so-called Department of Government Efficiency (Doge) came to an end after he clashed with cabinet secretaries and criticised central parts of the Trump administration's policy agenda. The Tesla and SpaceX chief said he is refocusing on his business holdings after his companies suffered what he called "blowback" over his ties to the president. "Back to spending 24/7 at work and sleeping in conference/server/factory rooms," Musk wrote on X late last month. "I must be super focused on X/xAI and Tesla . . . as we have critical technologies rolling out." Musk has said the combined group will allow his two companies to benefit from combining models, computing power, distribution and talent. For instance, AI developers can better train their models on the social media group's data and tap its audience. However, he did not disclose further specifics on how the March deal was structured. The opaque transaction allowed X, which had alienated some advertisers after adopting Musk's hands-off approach to content moderation, to leverage the rising value of xAI. The AI start-up obtained a $45bn valuation in a $5bn private funding round late last year. Musk last year granted investors that backed his Twitter acquisition 25 per cent of the shares in xAI. Musk launched xAI in 2023 to take on Sam Altman's OpenAI and other Big Tech rivals. It quickly unveiled the Grok chatbot and built a supercomputer cluster dubbed Colossus, one of the biggest AI data centre projects in the US. As well as competing with Big Tech and the sometimes rough-and-ready image of Grok, Musk has also agreed partnerships. Last month, Microsoft announced it was making xAI models available to its cloud computing customers, while messaging app Telegram agreed to distribute Grok to its 1bn users.

[4]

Musk's xAI expects annual earnings over $13 billion by 2029, Bloomberg reports

June 6 (Reuters) - Billionaire Elon Musk's xAI expects to generate more than $13 billion in annual earnings by 2029, according to numbers revealed by the artificial intelligence startup's banker Morgan Stanley (MS.N), opens new tab, Bloomberg News reported. Morgan Stanley, which is seeking investors for a $5 billion debt sale of xAI, opened the AI startup's books to those willing to commit at least $50 million, Bloomberg reported late Thursday, citing people with knowledge of the situation. The development comes as Musk and U.S. President Donald Trump have been involved in a huge public spat that saw threats fly over government contracts and ended with Musk suggesting Trump should be impeached. The impact of their hostilities on the bank's sale of xAI's debt is uncertain, according to Bloomberg News. Morgan Stanley allowed investors to view limited statistics about xAI, including revenue, earnings, cash flow and projections, the report showed. xAI expects $1 billion in gross revenue by the end of this year, and $14 billion by 2029, the report added. Gross revenue during the first quarter stood at $52 million while xAI lost $341 million before interest, taxes, depreciation and amortization (EBITDA), the report stated. The company projects that EBITDA will be $2.7 billion in 2027 and $13.1 billion in 2029, the report added. Startups in the AI space typically burn through huge amounts of cash, with billions poured into acquiring pricey, advanced data center hardware and attracting top generative AI researchers. XAI plans to spend $18 billion on investments in data centers going forward after spending $2.6 billion on capital expenditures, according to the report. Morgan Stanley and xAI did not immediately respond to Reuters requests for comment. Besides Morgan Stanley's $5 billion debt sale, xAI is also seeking a valuation of $113 billion in a share sale worth $300 million, according to media reports earlier this week. Reporting by Arsheeya Bajwa in Bengaluru; Editing by Leroy Leo Our Standards: The Thomson Reuters Trust Principles., opens new tab Suggested Topics:Artificial Intelligence

[5]

Elon Musk's feud with Donald Trump muddies xAI debt raising for Morgan Stanley

Elon Musk's artificial intelligence company xAI was closing in on a $5bn debt financing package to fund new data centres and chips to power its business. Then on Thursday the world's wealthiest man torpedoed his relationship with US President Donald Trump. Musk's bankers at Morgan Stanley must now contend with this new complication as would-be investors try to assess the fallout from the dramatic unravelling of Musk's ties to the president, according to people briefed on the matter. The debt could be more expensive too, they added. Before the two men launched into a war of words -- which included Trump's threat to rip up Musk's government contracts -- investors had placed more than $4bn of orders for the deal. Lending money to an AI venture belonging to the president's "first buddy", as Musk referred to himself, also looked like a solid bet. The enthusiasm was drawing Morgan Stanley close to the finish line on the debt raising, with big name investors such as TPG in tow. The interest was so high that Morgan Stanley had floated the prospect that xAI might lock in cheaper financing than they had initially pitched. But that pricing is now up in the air, with some investors wagering xAI may have to pay up to lock in the financing. The multibillion-dollar borrowing package is still expected to be split between fixed- and floating-interest rate loans as well as a corporate bond, and a person briefed on the matter said the $5bn capital raising was still on track. Bankers had earlier in the week debated reducing the coupon on the bonds and fixed-rate loans from 12 per cent to 11.5 per cent, while the floating-rate loan was expected to price with an interest rate 7 percentage points above the benchmark floating interest rate. "This makes it even harder," one person conducting due diligence on the deal said of Musk's fallout with Trump. "You need government support for that whole ecosystem, not just for this. It has to have some impact on . . . people's comfort level with supporting it." xAI management met investors on Thursday as the two men locked heads on social media, sharing projections for the company's business and its growth prospects. Morgan Stanley had pitched the debt to large credit shops who could place orders of at least $100mn and had targeted many of the same investors who had agreed to buy loans from xAI's sister company, social media site X, earlier this year, several people said. In a sign of the effect the kerfuffle was having on Musk's businesses, prices on X's debt slid to about 96 cents on the dollar from more than 99 cents a day earlier. Even before the spat, Morgan Stanley had faced some investor pushback. Lenders had raised concerns with the documents that underpin the deal, requesting that xAI buttress a number of traditional safeguards that are offered to investors. Those include the amount of incremental debt xAI can take on as well how much cash it can pay out to its investors. Others had raised questions about the intellectual property that secures the loan package and the value of the collateral. The debt is also secured by data centres xAI is building. Some investors had signalled they would walk away from the deal if their concerns were not met, which could diminish how much money xAI is able to raise or increase its interest burden. Morgan Stanley is working towards a deadline of June 17 to hammer out these terms. xAI did not immediately respond to a request for comment. Morgan Stanley and TPG declined to comment. Investors who have been conducting due diligence on the debt said xAI was lossmaking and revenues were small. But their investment thesis is in part underpinned by the company's equity valuation and their belief xAI will begin to sell lucrative corporate contracts to use its technology. "It's a product that will probably be one of the winners of commercial AI," one lender said. "On the consumer side OpenAI has a big lead but on the commercial side they can be a material player and that will be worth a lot more than $15bn to $20bn." The Financial Times reported on Monday that xAI was launching a $300mn share sale that would value the group at $113bn. Nonetheless, some creditors have complained about the limited data that has been shared so far. People familiar with the deal said that Morgan Stanley was keeping a tight yoke on access to the data room and on calls with management. One person added that a slide deck xAI provided ahead of a management presentation to investors on Thursday had roughly 10 or fewer slides. "It was really pretty fugazi and I say that as a lover of the xAI data room," the person said, using a slang term for phoney. "It's all fantasy, it's an idea," a second person said of the presentation. "They are spending money, not making money yet."

[6]

Elon Musk's xAI launches $5B debt sale to fuel AI infrastructure investments - SiliconANGLE

Elon Musk's xAI launches $5B debt sale to fuel AI infrastructure investments xAI Corp., the artificial intelligence startup founded by Elon Musk, is arranging a $5 billion debt sale that will help the company to keep up its lavish spending on data center infrastructure as it strives to keep pace with rivals such as OpenAI and Google LLC. The debt sale was first reported today by Bloomberg, which cited anonymous sources as saying that Morgan Stanley is marketing the deal. It came as the Financial Times separately reported today that Musk is looking to sell $300 million of xAI's shares in a secondary stock sale. That deal will enable xAI employees to sell their shares, ahead of a more substantial investment round targeting external investors. The latest financial maneuver comes just weeks after Musk controversially merged xAI with his social media platform X Corp. The two companies are now owned by the same parent entity, called xAI Holdings Corp., which was valued at around $113 billion, excluding debt. It also signals Musk is serious about his commitment to double-down on his technology ventures, after previously stepping back to focus on helping out new U.S. President Donald Trump at the White House, where he led the government cost-cutting team known as the Department of Government Efficiency. Musk said last week he is now "super-focused" on his companies, X, xAI and Tesla Inc. at a time when "critical technologies" are being rolled out. He also cited "blowback" from the controversial nature of his work at DOGE as a reason for returning to the tech firms. The value of xAI Holdings was determined in March at the time of the merger, with xAI priced at $80 billion and X said to be worth $33 billion. Musk acquired X, then known as Twitter, in October 2022, and the consolidation between the two firms was notable for bypassing Wall Street's oversight mechanisms, such as third-party valuations, due to the novel structure of its ownership. It's believed that X's precarious finances were one of the main motivations for the merger. The social media platform was said to have debts of around $13 billion, and its advertising business has struggled after Musk alienated many advertisers after changing the platform's content moderation policy. By merging the two companies, X can leverage xAI's soaring value, with the AI startup racking up a valuation of $45 billion following its most recent private funding round in late 2024. xAI was launched in 2023 as a rival to industry leader OpenAI, and it launched its flagship AI chatbot Grok shortly afterwards. It has since announced plans to build an enormous supercomputer known as "Colussus" that's expected to cost billions of dollars. The funds from today's debt sale will likely help to pay for that investment. At present, it's already operating with more than 200,000 graphics processing units for AI training and inference, and Musk said last month he wants to expand it with more than a million new chips. Besides the debt sale, xAI is also trying to raise around $20 billion from venture capitalists, according to an earlier Bloomberg report. Ultimately, Musk believes the futures of xAI and X are "intertwined", and he believes there's enormous potential to be had by blending advanced AI models with the social media platform's vast amounts of data. xAI has been racing to keep pace with OpenAI's GPT large language models, and earlier this year rolled out a new "Memory" feature for Grok that enables better conversational context. Other new features include the "Grok Studio" workspace for collaborating on AI-applications powered by Grok. The AI startup has also cemented a number of key partnerships, with Microsoft Corp. recently adding Grok 3 to the Azure AI Foundry platform, and Telegram agreeing a deal that will see Grok integrated with the popular messaging app. xAI also invested $300 million into Telegram. However, it hasn't been all plain sailing for xAI and Grok. Last month, it was reported that Grok couldn't stop talking about supposed "white genocide" in South Africa, and it has previously generated some controversy due to its erratic voice mode outputs and allegations of politcially-biased content filtering. In addition, xAI is currently involved in a trademark dispute with an AI startup called Bizly AI Inc., which claims it registered a patent for the name "Grok" several years ago, and believes that Musk is trying to "steal" it.

[7]

Musk taps investors for billions, days after leaving Trump's side

Elon Musk is selling $5 billion in debt for his artificial intelligence startup, xAI, the latest in a series of fundraising efforts across his business empire as the billionaire pivots away from politics and returns to running his various companies. Morgan Stanley is shopping the xAI debt, according to a person familiar with the matter, which could help Musk continue to spend aggressively on AI infrastructure as he builds out a massive data center in Memphis, Tenn. Musk appears eager to refocus on his array of businesses after announcing last week that he would be stepping back from politics. He had spent months as a senior adviser and regular companion to President Donald Trump, for whom he campaigned in the 2024 election and was a top financial supporter. Musk's presence in Washington -- where he oversaw a broad government cost-cutting initiative known as the Department of Government Efficiency -- led to widespread criticism of him personally, but also concern about the performance of his companies. Shares at Tesla, where Musk is CEO, are down 20% since the inauguration. In addition to xAI's debt offering on Monday, Musk also raised $650 million for his neurotechnology company, Neuralink, and is selling $300 million in xAI stock through a secondary offering, according to the Financial Times. The debt package includes a term loan B, a fixed-rate term loan and senior secured notes, said the person, who was not authorized to share the information publicly. The proceeds will go toward general corporate purposes, with commitments due June 17. A representative for xAI declined to comment. Morgan Stanley did not immediately provide a comment. Musk recently merged xAI with his social-networking platform X into a combined company called XAI Holdings. He has been investing heavily in its Memphis data center, called Colossus, which the debt sale could help finance. That operation already has 200,000 graphics processing units training its AI systems, and Musk aims to add 1 million in another location nearby, he said in a May 20 interview on CNBC. Bloomberg previously reported that the company was in talks with investors to raise roughly $20 billion in funding, underscoring the market's enthusiasm for AI as well as Musk's standing as a business titan and political player. Morgan Stanley has a long history of working with Musk. The bank advised him on his takeover of X -- then called Twitter -- in 2022 and led a group of lenders that provided debt financing for the $44 billion acquisition. They intended to immediately sell the loans to investors, but concerns about the underlying business and some of Musk's erratic decisions left banks stuck with $13 billion of risky debt on their balance sheets for more than two years. Morgan Stanley successfully relaunched the sale process this year, getting rid of the last bits of debt in April, as Musk's standing in Washington bolstered optimism about his business prospects. The early relationship between X and xAI was also marketed as a perk for investing in the platform's bonds. Between the debt sales at or near face value, the interest payments and the advisory fees, Morgan Stanley ended up profiting handsomely from the transaction.

[8]

Musk taps investors for billions days after Washington exit

Elon Musk's xAI Corp. is seeking $5 billion in debt financing, with Morgan Stanley managing the offering, to fuel its AI infrastructure expansion, including a massive data center in Memphis. This move comes as Musk shifts focus back to his businesses after a period of political involvement. The debt package has already seen strong investor demand, exceeding $3.5 billion.Elon Musk is selling $5 billion in debt for his artificial intelligence startup, xAI Corp., the latest in a series of fundraising efforts across his business empire as the billionaire pivots away from politics and returns to running his various companies. Morgan Stanley is shopping the debt for xAI with a double-digit interest rate, according to people familiar with early pricing discussions. The financing could help Musk continue to spend aggressively on AI infrastructure as he builds out a massive data center in Memphis. Musk appears eager to refocus on his array of businesses after announcing last week that he would be stepping back from politics. He had spent months as a senior adviser and regular companion to President Donald Trump, for whom he campaigned in the 2024 election and was a top financial supporter. The debt package includes a floating-rate term loan, a fixed-rate term loan and senior secured notes, said the people, who are not authorized to share the information publicly. The proceeds will go toward general corporate purposes, with commitments due June 17. Early pricing discussions are 7 percentage points over the benchmark rate for the floating-rate term loan and a roughly 12% yield on the senior notes, different people with knowledge of the matter said. The debt sale has already garnered demand in excess of $3.5 billion, they added. A representative for xAI declined to comment. Morgan Stanley did not immediately provide a comment. Musk's presence in Washington -- where he oversaw a broad government cost-cutting initiative known as the Department of Government Efficiency -- led to widespread criticism of him personally, but also concern about the performance of his companies. Shares at Tesla Inc., where Musk is chief executive officer, are down 20% since the inauguration. In addition to xAI's debt offering, Musk also raised $650 million for his neurotechnology company, Neuralink Corp., and is selling $300 million in xAI stock through a secondary offering, according to the Financial Times. Investor enthusiasm Musk recently merged xAI with his social-networking platform X into a combined company called XAI Holdings. He has been investing heavily in its Memphis data center, called Colossus, which the debt sale could help finance. That operation already has 200,000 graphics processing units (GPUs) training its AI systems, and Musk aims to add 1 million in another location nearby, he said in a May 20 interview on CNBC. Bloomberg previously reported that the company was in talks with investors to raise roughly $20 billion in funding, underscoring the market's enthusiasm for AI as well as Musk's standing as a business titan and political player. Morgan Stanley has a long history of working with Musk. The bank advised him on his takeover of X -- then called Twitter Inc. -- in 2022 and led a group of lenders that provided debt financing for the $44 billion acquisition. They intended to immediately sell the loans to investors, but concerns about the underlying business and some of Musk's erratic decisions left banks stuck with $13 billion of risky debt on their balance sheets for more than two years. Morgan Stanley successfully re-launched the sale process this year, getting rid of the last bits of debt in April, as Musk's standing in Washington bolstered optimism about his business prospects. The early relationship between X and xAI was also marketed as a perk for investing in the platform's bonds. Between the debt sales at or near face value, the interest payments and the advisory fees, Morgan Stanley ended up profiting handsomely from the transaction.

[9]

Musk's xAI seeks $113 billion valuation in $300 million share sale: Report

The deal would allow employees to sell shares to investors and a larger investment round is expected to follow the secondary stock offer, in which xAI will offer new equity to outside investors, the FT report said.Elon Musk's xAI is seeking a valuation of $113 billion in a share sale worth $300 million, the Financial Times reported on Monday, citing people close to the situation. The deal would allow employees to sell shares to investors and a larger investment round is expected to follow the secondary stock offer, in which xAI will offer new equity to outside investors, the FT report said. The artificial-intelligence startup acquired X, Musk's social media business, in March. The deal valued xAI at $80 billion and social media platform X - formerly known as Twitter - at $33 billion, Musk had said then. XAI did not immediately respond to a Reuters request for comment on the FT report. Musk recently stepped back from the Trump administration after the Tesla CEO ended a chaotic four-month stint leading the administration's sweeping cost-cutting campaign. U.S. President Donald Trump, however, said Musk would remain a close adviser. During an earnings call in April, Musk had said he would refocus his attention on the EV maker. XAI was launched less than two years ago and was in talks with investors to raise roughly $20 billion in funding for the combined AI startup and social media business, Bloomberg News reported in April.

[10]

Morgan Stanley opens xAI books with Musk in Trump crosshairs

Morgan Stanley faces challenges in selling debt for xAI Corp. due to the public feud between Elon Musk and Donald Trump, despite xAI's projections of significant earnings growth. Internal numbers presented to investors reveal xAI anticipates generating over $13 billion in annual earnings by 2029. However, Trump's willingness to punish those who challenge him complicates the debt sale effort.Even before Elon Musk and President Donald Trump's public falling out, selling debt for the tech mogul's companies has always been tricky for Morgan Stanley. But xAI Corp. was supposed to be different. Beyond the frenzy around artificial intelligence in markets of late, internal numbers, which the bank revealed to a select group of investors Thursday, show a company that anticipates generating more than $13 billion of annual earnings by 2029, according to a person with knowledge of the figures. Yet the Musk-Trump feud, which has exploded into public view and degenerated into an ugly tit-for-tat for all to see, will now almost certainly make the bankers' task more complicated. Trump, as he's proven with Harvard and Columbia Universities, is willing to use unconventional tactics to punish those who challenge him, and all companies in Musk's empire, including xAI, could wind up in the crosshairs. It wasn't immediately clear how the debt sale effort had been affected by the clash. The price of a loan for social-media-platform X, another of Musk's companies that is attached to xAI in a broader enterprise, was down roughly 1.25 points on Thursday, as their arguments became more ferocious online. By late Thursday, Musk signaled he would move to cool tensions with Trump, while White House aides ahd scheduled a call between the two to avoid further escalation, Politico reported. A representative for Morgan Stanley declined to comment, while xAI didn't respond to a request for comment made after normal business hours. In meetings Thursday, investors who were willing to write checks of at least $50 million were allowed to view limited statistics about xAI, including revenue, earnings, cash flow and projections, said multiple people with knowledge of the situation, who asked not to be identified because they were not authorized to speak publicly. The figures showed xAI losing money and burning cash, which is typical for a startup in the AI industry. The company had $52 million in gross revenue during the first quarter and lost $341 million before interest, taxes, depreciation and amortization, according to material shared with investors. The company projects that figure -- known as Ebitda in Wall Street parlance -- will be $2.7 billion in 2027 and $13.1 billion in 2029, one of the people said. xAI anticipates $1 billion in gross revenue by the end of this year, which it predicts will grow to $14 billion by 2029, the person added. Its cash flow from operations was negative $220 million after spending $2.6 billion on capital expenditures, that person added. The company plans to spend $18 billion on investments in data centers going forward. The figures were not audited nor were they subject to the same accounting standards publicly traded companies follow, the people said.

[11]

Elon Musk's xAI Targets $113 Billion Valuation With $300 Million Share Sale: Report - Tesla (NASDAQ:TSLA)

Elon Musk's artificial intelligence startup xAI is pursuing a $300 million share sale that would value the combined entity at $113 billion. The secondary offering allows existing staff to sell shares to new investors while validating the price tag established during xAI's March acquisition of social media platform X. What Happened: The tender offer represents the latest capital-raising effort for the AI company as competition intensifies in the generative artificial intelligence sector. The secondary sale will likely precede a larger primary funding round where xAI would issue new equity to external investors, the Financial Times reported, citing sources. The March transaction structured xAI's valuation at $80 billion while pricing X at $33 billion, creating the $113 billion combined enterprise value. Musk originally acquired Twitter for $44 billion in October 2022 before rebranding it as X and integrating it with his AI operations. X Corp. did not immediately respond to Benzinga's request for comment. See Also: Elizabeth Warren Says Trump 'Approved' The Largest Meat Company In World To Be Listed On NYSE Ignoring Corruption And Bribery History, Demands Answers Why It Matters: The share sale timing coincides with Musk's recent withdrawal from the Department of Government Efficiency role. "Back to spending 24/7 at work and sleeping in conference/server/factory rooms," Musk posted on X, signaling renewed focus on his core business holdings, including Tesla Inc. TSLA and SpaceX. The combined entity leverages synergies between xAI's Grok chatbot technology and X's data distribution network. Recent partnerships include Microsoft's cloud integration and Telegram's agreement to distribute Grok to one billion users. The strategy positions xAI to compete directly with OpenAI and other Big Tech AI rivals while monetizing X's user base and data assets. Read Next: Bitcoin, Ethereum, Dogecoin Rise As China Counters Trump's Trade Deal Breach Claim: Analyst Says BTC Success Riding On Health Of US Economy Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Photo courtesy: JRdes / Shutterstock.com TSLATesla Inc$341.70-1.37%Stock Score Locked: Edge Members Only Benzinga Rankings give you vital metrics on any stock - anytime. Unlock RankingsEdge RankingsMomentum94.46Growth91.89Quality88.56Value8.35Price TrendShortMediumLongOverviewMarket News and Data brought to you by Benzinga APIs

[12]

Reports: xAI Launches $5 Billion Debt Sale and $300 Million Share Sale | PYMNTS.com

Elon Musk's artificial intelligence company, xAI, reportedly launched a $5 billion debt sale and a $300 million share sale. The $5 billion debt sale was launched Monday (June 2) through Morgan Stanley, with commitments due June 17, and its proceeds will be used for general corporate purposes, Bloomberg reported Monday, citing an unnamed source. The $300 million share sale will allow staffers to sell their shares to new investors, the Financial Times (FT) reported Monday, citing unnamed sources. It values xAI at $113 billion, equal to the valuation it achieved in March when it acquired Musk's social media platform, X, according to the report. XAI did not immediately reply to PYMNTS' request for comment on the two reports. Musk announced xAI's acquisition of X March 28, saying the deal valued xAI at $80 billion and X at $33 billion ($45 billion minus $12 billion in debt). "XAI and X's futures are intertwined," Musk wrote in a March 28 post on X. "Today, we officially take the step to combine the data, models, compute, distribution and talent. This combination will unlock immense potential by blending xAI's advanced AI capability and expertise with X's massive reach." It was reported in November that xAI raised $5 billion in a funding round that valued it at $50 billion. That financing brought the total amount raised by xAI at that point in 2024 to $11 billion, while the funding round more than doubled the company's valuation from the $24 billion at which it was valued in spring 2024. XAI said at the time that it planned to use that funding to add another 100,000 Nvidia chips for training its AI models.

[13]

Musk's xAI eyes $13 billion annual earnings by 2029 By Investing.com

Investing.com -- Elon Musk's artificial intelligence startup, xAI, is projected to generate more than $13 billion in annual earnings by 2029, according to figures disclosed by the company's banker, Morgan Stanley (NYSE:MS), as reported by Bloomberg News. The bank is currently courting investors for a $5 billion debt sale of xAI and has opened the startup's financials to those ready to invest a minimum of $50 million. The move comes amidst a high-profile dispute between Musk and U.S. President Donald Trump over government contracts, which concluded with Musk suggesting Trump should be impeached. The effect of this conflict on Morgan Stanley's debt sale for xAI remains unclear. The bank provided potential investors with access to select financial details about xAI, including information about its earnings, revenue, cash flow, and financial projections. xAI anticipates gross revenue of $1 billion by the end of this year, and $14 billion by 2029. The company's gross revenue in the first quarter was $52 million, while it reported a loss of $341 million before interest, taxes, depreciation, and amortization (EBITDA). xAI projects that its EBITDA will reach $2.7 billion in 2027 and $13.1 billion in 2029. AI startups like xAI typically consume large amounts of cash, investing billions in advanced data center hardware and recruiting top generative AI researchers. xAI has plans to invest $18 billion in data centers in the future, after already spending $2.6 billion on capital expenditures. In addition to Morgan Stanley's $5 billion debt sale, xAI is also pursuing a valuation of $113 billion in a share sale worth $300 million, according to media reports from earlier this week.

[14]

Musk's xAI expects annual earnings over $13 billion by 2029, Bloomberg reports

(Reuters) -Billionaire Elon Musk's xAI expects to generate more than $13 billion in annual earnings by 2029, according to numbers revealed by the artificial intelligence startup's banker Morgan Stanley, Bloomberg News reported. Morgan Stanley, which is seeking investors for a $5 billion debt sale of xAI, opened the AI startup's books to those willing to commit at least $50 million, Bloomberg reported late Thursday, citing people with knowledge of the situation. The development comes as Musk and U.S. President Donald Trump have been involved in a huge public spat that saw threats fly over government contracts and ended with Musk suggesting Trump should be impeached. The impact of their hostilities on the bank's sale of xAI's debt is uncertain, according to Bloomberg News. Morgan Stanley allowed investors to view limited statistics about xAI, including revenue, earnings, cash flow and projections, the report showed. xAI expects $1 billion in gross revenue by the end of this year, and $14 billion by 2029, the report added. Gross revenue during the first quarter stood at $52 million while xAI lost $341 million before interest, taxes, depreciation and amortization (EBITDA), the report stated. The company projects that EBITDA will be $2.7 billion in 2027 and $13.1 billion in 2029, the report added. Startups in the AI space typically burn through huge amounts of cash, with billions poured into acquiring pricey, advanced data center hardware and attracting top generative AI researchers. XAI plans to spend $18 billion on investments in data centers going forward after spending $2.6 billion on capital expenditures, according to the report. Morgan Stanley and xAI did not immediately respond to Reuters requests for comment. Besides Morgan Stanley's $5 billion debt sale, xAI is also seeking a valuation of $113 billion in a share sale worth $300 million, according to media reports earlier this week. (Reporting by Arsheeya Bajwa in Bengaluru; Editing by Leroy Leo)

Share

Share

Copy Link

Elon Musk's AI startup xAI is launching a $300 million share sale, valuing the company at $113 billion. The company is also seeking a $5 billion debt financing package, projecting over $13 billion in annual earnings by 2029. However, Musk's recent political fallout with President Trump has complicated the fundraising efforts.

xAI's Ambitious Valuation and Share Sale

Elon Musk's artificial intelligence startup, xAI, is making waves in the tech industry with its latest financial moves. The company is launching a $300 million share sale that values the group at a staggering $113 billion

1

3

. This secondary stock offering, known as a tender offer, will allow xAI employees to sell shares to new investors, validating the price tag struck when xAI acquired Musk's social media service X (formerly Twitter) in March3

.

Source: ET

The deal structure values xAI at $80 billion and X at $33 billion, following Musk's $44 billion acquisition of Twitter in October 2022

3

. This move comes after xAI obtained a $45 billion valuation in a $5 billion private funding round late last year3

.Ambitious Growth Projections and Debt Financing

xAI's financial ambitions extend beyond the share sale. The company is also seeking a $5 billion debt financing package to fund new data centers and chips

5

. According to projections revealed by xAI's banker Morgan Stanley, the company expects to generate more than $13 billion in annual earnings by 20294

.The company's financial roadmap includes:

- $1 billion in gross revenue by the end of 2025

- $14 billion in gross revenue by 2029

- $2.7 billion in EBITDA by 2027

- $13.1 billion in EBITDA by 2029

4

However, like many AI startups, xAI is currently operating at a loss. In the first quarter of 2025, the company reported $52 million in gross revenue but lost $341 million before interest, taxes, depreciation, and amortization (EBITDA)

4

.Political Complications and Investor Concerns

Source: FT

The fundraising efforts have been complicated by Musk's recent political fallout with U.S. President Donald Trump. The public spat between the two has raised concerns among potential investors and could potentially impact the pricing of the debt

5

. Some investors are now speculating that xAI may have to offer higher interest rates to secure the financing5

.Investors have also raised questions about the intellectual property securing the loan package and the value of the collateral. The debt is partially secured by the data centers xAI is building

5

.Related Stories

xAI's Market Position and Strategy

xAI was launched in 2023 to compete with established players like OpenAI and other Big Tech rivals in the AI space

3

. The company has already unveiled its Grok chatbot and built a supercomputer cluster called Colossus, one of the largest AI data center projects in the U.S.3

Source: FT

To strengthen its market position, xAI has formed strategic partnerships. Microsoft recently announced it would make xAI models available to its cloud computing customers, while messaging app Telegram agreed to distribute Grok to its 1 billion users

3

.Investor Due Diligence and Market Outlook

Despite the ambitious projections, some investors have expressed concerns about the limited data shared during the due diligence process. Morgan Stanley has maintained tight control over access to the data room and management calls

5

.However, many investors remain optimistic about xAI's potential in the commercial AI market. One lender stated, "It's a product that will probably be one of the winners of commercial AI. On the consumer side OpenAI has a big lead, but on the commercial side they can be a material player and that will be worth a lot more than $15bn to $20bn."

5

As xAI continues its fundraising efforts and market expansion, the tech industry watches closely to see how this ambitious AI startup will navigate the challenges of rapid growth, political complications, and fierce competition in the evolving AI landscape.

References

Summarized by

Navi

Related Stories

Morgan Stanley Markets $5 Billion Debt Package for Elon Musk's xAI Amid Political Tensions

10 Jun 2025•Business and Economy

xAI Secures $10 Billion in Funding to Boost AI Infrastructure and Challenge Competitors

01 Jul 2025•Business and Economy

Elon Musk's xAI Seeks $15 Billion Funding Round at $230 Billion Valuation

13 Nov 2025•Business and Economy

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology