Fermi's AI-Powered Data Center IPO Surges Amidst Soaring AI Demand

5 Sources

5 Sources

[1]

Rick Perry feeds IPO ducks with data center dream

NEW YORK, Oct 1 (Reuters Breakingviews) - When the ducks quack, feed them. The old Wall Street saying states that, when investors are hungry for initial public offerings, it's time to stuff them with whatever is handy. Today, their appetite for anything that smells of artificial intelligence data centers and the associated electricity seems nearly limitless. So UBS, Evercore and other banks have teamed up with Rick Perry, the former head of the U.S. Department of Energy, to deliver Fermi, a company with no revenue, opens new tab but over 15,000 acres of land in Texas and dreams of building nuclear-powered facilities. By around noon on Wednesday, the newly listed firm was worth over $15 billion. Fermi, which was only founded in January, has a few things going for its plan to eventually build 11 gigawatts of capacity - five times the maximum power generated by the Hoover Dam. Total AI power demand is set to grow from 55 gigawatts in 2023 to 219 gigawatts by 2030, according to McKinsey, implying some $5 trillion of infrastructure investment. Only a fraction of this is currently being built. Even the big five U.S. tech giants, which are cranking up their combined capital expenditure to around $400 billion this year, cannot hit that target without help. Moreover, Fermi's site in Amarillo, Texas, has access to plentiful gas, and Perry's connections in the state where he was once governor might help secure both backlogged generators and permission to eventually build nuclear power plants. Naming the site "Project Matador: The President Donald J. Trump Advanced Energy and Intelligence Campus" will only boost its appeal. If everything goes right, the project could mint money. The company provides some illustrative math, which it stresses is not a corporate projection, spelling out how things may go assuming both finished projects and eager clients. A lease might generate $1.5 billion annually for each gigawatt of gross capacity and power purchase agreements. Operating expenses might be $500 million, implying a cool $1 billion of net operating income per gigawatt. Rival operator Digital Realty Trust is valued at 12 times expected revenue for the next 12 months. So if Fermi actually produces 11 gigawatts of capacity and rents it out, the whole firm, including debt, might eventually be worth some $200 billion. This speculative approach carries some huge risks. Most data center builders have a far more cautious style, locking customers into long-term agreements before breaking ground. The current data center frenzy has a strong whiff of overinvestment. And nuclear facilities are prone to spectacular cost overruns and multi-year delays. If demand is less than expected, or clients don't show up, today's ducks might end up starving. Follow Robert Cyran on Bluesky, opens new tab. Context News Editing by Peter Thal Larsen; Production by Maya Nandhini * Suggested Topics: * Breakingviews Breakingviews Reuters Breakingviews is the world's leading source of agenda-setting financial insight. As the Reuters brand for financial commentary, we dissect the big business and economic stories as they break around the world every day. A global team of about 30 correspondents in New York, London, Hong Kong and other major cities provides expert analysis in real time. Sign up for a free trial of our full service at https://www.breakingviews.com/trial and follow us on Twitter @Breakingviews and at www.breakingviews.com. All opinions expressed are those of the authors. Robert Cyran Thomson Reuters Robert Cyran, U.S. tech columnist, joined Breakingviews in London in 2003 and moved four years later to New York, where he continues to cover global technology, pharmaceuticals and special situations. Robert began his career at Forbes magazine, where he assisted in the startup of the international version of the magazine. Before working at Breakingviews he worked as a market researcher and reporter covering the pharmaceutical industry. Robert has a Masters degree in economics from Birmingham University and an undergraduate degree from George Washington University.

[2]

IPO of data centre developer touting Trump ties surges on market debut

A data centre real estate start-up co-founded by former US energy secretary Rick Perry jumped 28 per cent in its Wall Street debut as investors flocked to the latest stock offering tied to artificial intelligence. Fermi's shares opened at $25, above the $21 initially marketed to investors, and rallied as high as $27.37 on Wednesday -- giving the group a fully diluted market capitalisation of more than $16bn -- as the Texas-based power group began trading on Nasdaq. The offering raised more than $682mn for the company. Fermi is also set to trade on the London Stock Exchange on Thursday, marking a coup for the UK's beleaguered equity markets -- where the five listings in the first six months of the year raised just $160mn, the lowest half-year figure since 1995. It is the first Nasdaq-LSE dual listing in decades. The London listing is intended to attract capital from foreign investors. Fermi is tapping into surging demand for electricity from data centres to power the AI boom with plans to build the world's largest energy and data campus in Amarillo, Texas. It aims to build nuclear, natural gas and renewable energy assets capable of delivering up to 11 gigawatts of electricity, which is more than the peak power demand of Portugal. The build-out of the energy assets is expected to cost more than $50bn and includes plans to construct four Westinghouse AP1000 nuclear reactors. The company's IPO comes a week after Nvidia, the world's biggest public company, pledged to invest up to $100bn in OpenAI, the start-up behind ChatGPT, and as other big data companies, including Google and Microsoft, have committed to building out vast data centre facilities to develop and power advanced AI. Shares in companies supplying energy hungry data centres have seen record gains this year, with nuclear developer Oklo quadrupling in value. Constellation Energy, turbine manufacturer GE Vernova and power group NRG Energy have surged 53 per cent, 76 per cent and 80 per cent, respectively, since January, ranking them among the best performing stocks on the blue-chip S&P 500. Some commentators, including UK tech investor James Anderson, have warned about an AI stock market bubble. In an interview with the Financial Times, co-founder and chief executive Toby Neugebauer said he was not concerned the company would be derailed by over-optimistic forecasts of surging power demand. "I think it is delusional to think we're going to live in a world that doesn't need dramatically more power," he said. "There's not enough electrons to fuel it." Fermi, which was founded in January, has still not announced the identity of its first customer. Neugebauer said it had clinched a deal with "one of the most valuable and respected technology companies on the planet" and is in talks with four other potential customers. The company has close ties with the Trump administration, as Perry, a Republican and former Texas governor, served as energy secretary during the president's first term in office. Fermi has provisionally named its energy centre the "President Donald J Trump Advanced Energy and Intelligence Campus". Perry, who is a director, twice sought the Republican nomination for the US presidency, famously promising he would eliminate the energy department if elected, though he forgot its name during a televised debate. He was later a contestant on the television show Dancing with the Stars. The company is in the business of powering "the world's most expensive sheds", said Nick Davis, a London partner at Haynes Boone, which advised Fermi on its IPO. The listing process in London had been streamlined by co-operative regulators, he added. "The [Financial Conduct Authority] and LSE have been incredibly pragmatic and helpful," Davis said. "London is showing it is able to move at scale." Tapping global investors, particularly in the Middle East, drove Fermi's decision to dual list in London, according to Davis. "People in the Far East and the Middle East who want time zones and want familiarity, are more comfortable trading through London than they are through New York," he said. Fermi is named after Italian-born scientist Enrico Fermi, who led the team that built the first nuclear reactor in the US in 1942. The company is structured as a real estate investment trust, which has secured a long-term lease on a 5,263 acre site next to Texas Tech University. It has not yet generated any revenues and does not expect to within the next 12 months.

[3]

Former Energy Secretary Rick Perry's Fermi aims to raise $715 million in US IPO

Sept 29 (Reuters) - Fermi is aiming to raise $715 million in its upsized U.S. initial public offering, the data center real estate investment trust said on Monday, as it aims to leverage burgeoning demand for energy infrastructure required to support AI buildouts. Co-founded by former U.S. Energy Secretary Rick Perry, the company is aiming to sell 32.5 million shares priced between $18 and $22 apiece, compared with its previous target of 25 million shares. UBS, Evercore, Cantor and Mizuho are the joint lead book-running managers. Fermi will list on the Nasdaq and the London Stock Exchange under the symbol "FRMI". Reporting by Ateev Bhandari in Bengaluru; Editing by Krishna Chandra Eluri Our Standards: The Thomson Reuters Trust Principles., opens new tab

[4]

Fermi AI energy start-up soars on Nasdaq, plans massive nuclear and renewable power campus

A start-up called Fermi, co-founded by former US energy secretary Rick Perry, jumped 28% in its Wall Street debut as investors rushed toward AI-linked stocks. Fermi's shares opened at $25, above the $21 originally marketed, and climbed to $27.37, giving it a fully diluted market value of over $16 billion. The company raised more than $682 million from its initial public offering (IPO) on Nasdaq Fermi is also set to trade on the London Stock Exchange (LSE) on Thursday, making it the first Nasdaq-LSE dual listing in decades. The London listing is aimed at attracting foreign investors and boosting the UK's struggling equity market, which raised only $160 million from five listings in the first half of this year -- the lowest since 1995, as reported by Financial Times. Fermi plans to build the world's largest energy and data campus in Amarillo, Texas, to power AI data centres. The company aims to produce up to 11 gigawatts of electricity, more than the peak power demand of Portugal, using nuclear, natural gas, and renewable energy assets. The energy build-out is expected to cost over $50 billion and includes plans for four Westinghouse AP1000 nuclear reactors. Fermi's IPO comes after Nvidia pledged up to $100 billion to OpenAI, and other tech giants like Google and Microsoft are expanding AI data centres. Companies supplying power to AI data centres have seen record stock gains in 2025:Some experts, including UK tech investor James Anderson, warn about a possible AI stock market bubble Fermi CEO Toby Neugebauer said he is not worried about over-optimistic forecasts of power demand, "I think it is delusional to think we're going to live in a world that doesn't need dramatically more power. There's not enough electrons to fuel it", according to the report by Financial Times. Fermi has not announced its first customer yet but claims a deal with "one of the most valuable and respected technology companies on the planet", plus talks with four other potential customers. The company has close ties to the Trump administration; Perry served as energy secretary under Trump. Fermi has provisionally named its energy centre the "President Donald J Trump Advanced Energy and Intelligence Campus". Perry, a director, twice ran for US president, once saying he would eliminate the energy department, though he forgot its name during a debate, and later appeared on Dancing with the Stars. Perry and his son Griffin, co-founder of Fermi, now hold stakes worth a combined $2.2 billion after Wednesday's rally. Fermi powers what Nick Davis, a London partner at Haynes Boone, called "the world's most expensive sheds", as mentioned in the report by Financial Times. The London listing was supported by cooperative regulators, making the process smoother. Davis said, "The [Financial Conduct Authority] and LSE have been incredibly pragmatic and helpful. London is showing it is able to move at scale." Fermi's dual listing strategy targets global investors, especially in the Middle East and Far East, who prefer London trading hours and familiarity over New York. The company is named after Enrico Fermi, who led the first US nuclear reactor in 1942. Fermi is structured as a real estate investment trust (REIT) and leased a 5,263-acre site next to Texas Tech University. The company has not generated any revenue yet and does not expect to make money in the next 12 months, as stated by Financial Times. Q1. What is Fermi and why is it in the news? Fermi is a start-up co-founded by Rick Perry that builds energy and AI data centres, and it jumped 28% in its Wall Street debut. Q2. Where will Fermi trade and how much money did it raise? Fermi will trade on Nasdaq and the London Stock Exchange, raising over $682 million from its IPO.

[5]

Former Energy Secretary Rick Perry's Fermi upsizes US IPO, aims to raise US$715 million

Fermi is aiming to raise $715 million in its upsized U.S. initial public offering, the data center real estate investment trust said on Monday, as it aims to leverage burgeoning demand for energy infrastructure required to support AI buildouts. Co-founded by former U.S. Energy Secretary Rick Perry, the company is aiming to sell 32.5 million shares priced between US$18 and US$22 apiece, compared with its previous target of 25 million shares. The outsized demand for energy supply stems from efforts to scale large language models by companies such as Anthropic and ChatGPT-parent OpenAI, which has been signing deals worth hundreds of billions of dollars with Oracle ORCL.N, SoftBank and CoreWeave CRWV.O. Fermi's upsized offering also indicates pent-up investor appetite for companies at the heart of the AI race, as the vast majority of leaders in the space continue to stay private. Nvidia-backed NVDA.O AI cloud provider CoreWeave's shares have more than tripled their IPO price since their debut in March. Fermi is aiming to build the world's largest energy and data complex, powered by nuclear, natural gas and solar. It has incurred a US$6.4 million loss since its inception through June 30 and does not expect to generate revenue within the next 12 months. UBS, Evercore, Cantor and Mizuho are the joint lead book-running managers. Fermi will list on the Nasdaq and the London Stock Exchange under the symbol "FRMI." ---

Share

Share

Copy Link

Fermi, an AI data center real estate startup co-founded by former US Energy Secretary Rick Perry, saw its shares surge 28% in its Wall Street debut. The company plans to build the world's largest energy and data campus in Texas to power the expanding AI industry.

Fermi's Explosive Wall Street Debut

Fermi, a data center real estate start-up co-founded by former US Energy Secretary Rick Perry, made a spectacular entrance on Wall Street, with its shares surging 28% on their first day of trading . The company's stock opened at $25, well above the initial $21 price, and climbed as high as $27.37, giving Fermi a fully diluted market capitalization of over $16 billion . This impressive debut underscores the growing investor appetite for companies positioned at the forefront of the AI infrastructure race.

Source: Reuters

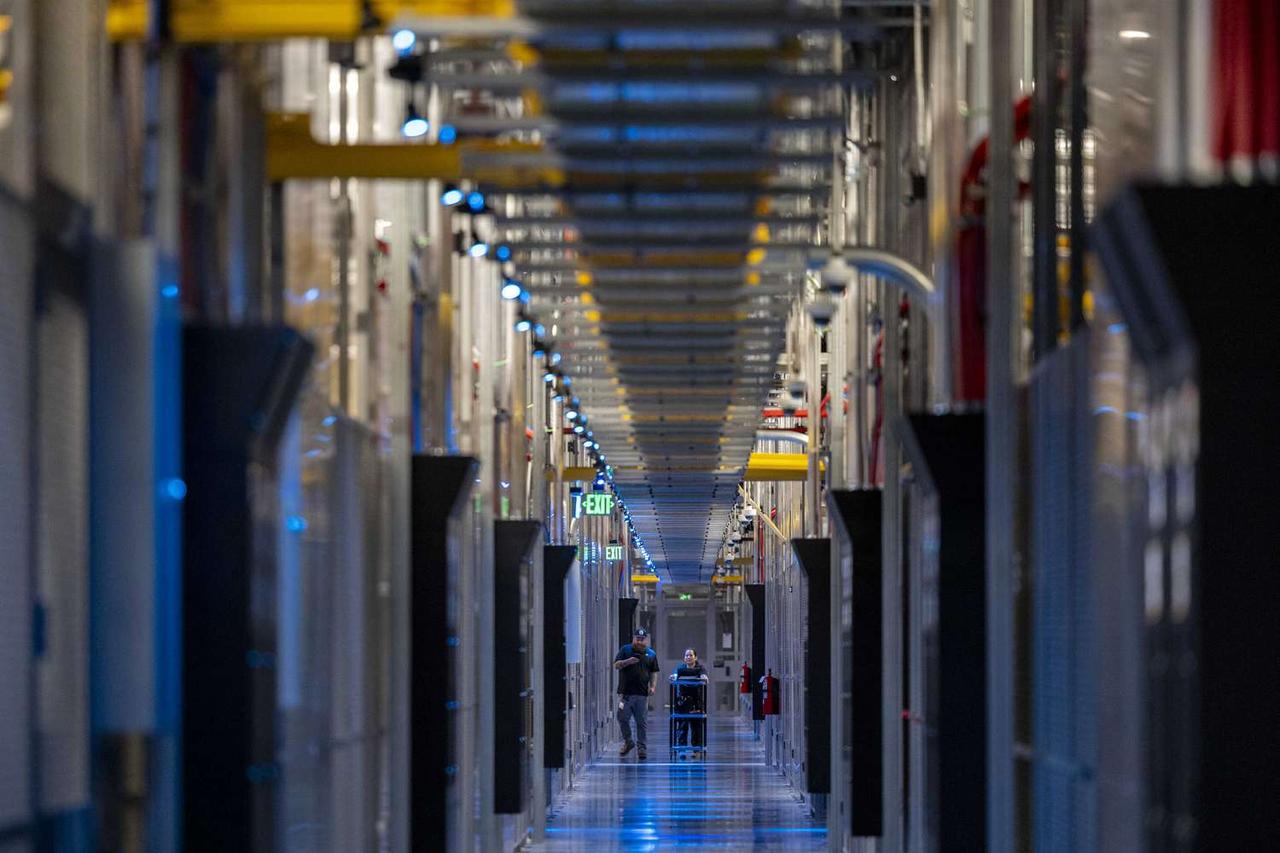

Ambitious Plans for AI-Powered Data Centers

At the heart of Fermi's appeal is its ambitious plan to construct the world's largest energy and data campus in Amarillo, Texas . The company aims to build nuclear, natural gas, and renewable energy assets capable of delivering up to 11 gigawatts of electricity – more than the peak power demand of Portugal . This massive undertaking is expected to cost over $50 billion and includes plans for four Westinghouse AP1000 nuclear reactors .

Tapping into the AI Boom

Fermi's IPO comes at a time of surging demand for electricity to power the AI boom. The company is positioning itself to capitalize on the growing need for data center infrastructure, as tech giants like Nvidia, Google, and Microsoft commit to building vast facilities for AI development . According to McKinsey, total AI power demand is projected to grow from 55 gigawatts in 2023 to 219 gigawatts by 2030, implying some $5 trillion of infrastructure investment .

Dual Listing and Global Ambitions

In a notable move, Fermi is set to trade on both the Nasdaq and the London Stock Exchange, marking the first Nasdaq-LSE dual listing in decades . This strategy aims to attract global investors, particularly from the Middle East and Far East, who may prefer London's trading hours and familiarity . The London listing is also seen as a coup for the UK's struggling equity markets .

Political Connections and Branding

Fermi's close ties to the Trump administration, through Rick Perry's involvement, have influenced its branding strategy. The company has provisionally named its energy center the "President Donald J Trump Advanced Energy and Intelligence Campus" . This connection, along with Perry's political background and media presence, adds an intriguing dimension to Fermi's public image.

Source: BNN

Related Stories

Risks and Challenges

Despite the enthusiasm surrounding Fermi's debut, the company faces significant challenges. It has yet to generate any revenue and does not expect to do so within the next 12 months . The speculative nature of its approach, which involves building infrastructure before securing long-term customer agreements, carries substantial risks . Additionally, the potential for overinvestment in the data center sector and the notorious cost overruns and delays associated with nuclear facilities could pose threats to Fermi's ambitious plans .

Market Impact and Future Outlook

Fermi's successful IPO reflects a broader trend of investor enthusiasm for AI-related stocks. Companies supplying energy-hungry data centers have seen record gains in 2025, with nuclear developer Oklo quadrupling in value and power groups like Constellation Energy and NRG Energy experiencing significant surges . However, some experts warn of a potential AI stock market bubble .

As Fermi embarks on its journey as a public company, its ability to execute its grand vision while navigating the complex landscape of energy infrastructure and AI development will be closely watched by investors and industry observers alike.

References

Summarized by

Navi

Related Stories

Fermi, AI-Focused Data Center Builder, Files for US IPO Amid Market Enthusiasm

09 Sept 2025•Business and Economy

Fermi America's Ambitious Plan: World's Largest AI-Powered Energy Complex in Texas

27 Jun 2025•Business and Economy

Fermi America's 'HyperGrid': Nuclear-Powered AI Data Center Planned for Texas

05 Aug 2025•Business and Economy

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology