Generative AI Reshapes Workplace Dynamics and Productivity

2 Sources

2 Sources

[1]

S&P's tilt at record high held back by US tech giants

US tech giants are holding back the S&P 500 from hitting a record high, reversing the role the industry has occupied for the last 18 months as the main pillar supporting the US blue-chip benchmark. After a weak US jobs report jolted global markets at the start of the month, the S&P has quickly clawed back the bulk of its losses. It was up 1 per cent on Friday, closing just 21 points short of the record high set in mid-July. But it has struggled to make the final push over that line, even as the majority of stocks in the index have advanced since coming within touching distance of a new high more than week ago. The inability to get over the hurdle is largely down to the lowly performance of the Silicon Valley tech groups that were in highest demand in the first half of the year. "It's the reverse of what was happening earlier," said Kevin Gordon, senior investment strategist at Schwab. "You're being weighed down by some of the mega-caps . . . [and] it wouldn't surprise me to see that dynamic continue." Almost 70 per cent of companies in the S&P 500 have risen since the index peaked on July 16, according to Bloomberg data. If every company in the S&P were weighted equally, the index would have been back at a record by August 23. But tech and communication services have an outsized weighting on the S&P, accounting for around 40 per cent of the total, even with Amazon and Tesla categorised as consumer groups. Instead, their sluggish returns since July are turning into an anchor. Sixteen of the 20 biggest drags on the S&P 500 since its last record were tech groups, led lower by six of the so-called "Magnificent Seven" -- Microsoft, Amazon, Alphabet, Tesla, Apple and Nvidia. The exception is Meta, which has risen since mid-July but is still down 4 per cent from its peak. Chipmakers and their suppliers like Broadcom, Qualcomm, AMD and Applied Materials were among the other major drags. Their leaden returns since July stand in sharp contrast to 2023 and the first half of this year, when enthusiasm over the potential of artificial intelligence fuelled a massive rally in semiconductor stocks and other large tech groups predicted to be early AI beneficiaries. For most of them, there has been no sudden downturn in corporate performance, but the extent of the rally had prompted widespread debate over whether stock prices were simply too high. Bloomberg's Magnificent Seven index has fallen 10 per cent from its early July peak, but the decline has been even steeper on a price to earnings basis. It was this week trading at around 33 times expected earnings over the next 12 months, still higher than the broader S&P 500 but down 13 per cent since the peak. Investors have been holding big tech groups to a high standard during the latest quarterly earnings season, with many of them punished even after publishing strong results. Nvidia, which single-handedly drove more than a quarter of the S&P's advance in the first half, fell 6 per cent on Thursday despite reporting stronger than forecast results. Alphabet and Microsoft had similarly negative responses to solid results. In contrast, the equal-weighted S&P 500 is trading at its most expensive level since February on a price-to-earnings basis. Smaller companies and more cyclical sectors have been boosted by reassuring economic data, positive earnings reports and encouraging comments from Federal Reserve chair Jay Powell, who declared at the annual Jackson Hole economic symposium that "the time has come" for the US central bank to begin cutting interest rates. "One of the bigger themes over the next year is going to be a broadening of the market," said Francis Gannon, co-chief investment officer at Royce Investment Partners, which specialises in small-cap investing. "It usually begins in fits and starts . . . but I think we're on our way." The Russell 2000 index of smaller companies is up 8 per cent so far this quarter, compared with a 3 per cent increase in the S&P 500. Within the S&P 500, the best-performing areas have been rate-sensitive sectors like real estate, utilities and financials. The debate over tech is still far from settled, however. Schwab's Gordon said many investors had become "exhausted" by the AI trade, but stressed that even after a "necessary and understandable catch-up" for other sectors, tech was still by far the best-performing sector of the year to date. And despite the recent resilient data, US economic growth is still slowing, which could put pressure on the rest of the market later in the year. "There is more downside risk," said Drew Matus, chief market strategist at MetLife Investment Management, highlighting falling consumer savings and rising unemployment. "And if the Fed cuts as aggressively as the market is currently pricing in, [it would mean] nothing good is happening in the economy." Sebastien Page, head of global multi-asset and chief investment officer at T Rowe Price, said "we're having more debates between the bulls and bears than we usually do in our committee. "Rates are coming down and earnings are powering through this slower economic environment . . . [but] we're back to fairly expensive markets." Page said that in the short term his division's funds were positioned for a further outperformance in value stocks, but said "we still like a lot of the big tech companies" and could switch if tech becomes oversold. "Expectations are very high for technology, but it is not the tech bubble," he added. For many active investors, a broadening out of gains away from the largest names would be a welcome change, even if it made it less likely to see big rises at the level of the headline index. For true believers in the potential of AI, however, a slight pullback has not shaken their faith. "We have all this discussion about 'bubble bubble bubble', [but] valuations are nothing like they were in 2000 or even 2021," said Tony Kim, head of technology investing in BlackRock's fundamental equities division. "We're in the second year of a complete replatforming of the whole tech industry to this new thing called AI, and I think we've barely started."

[2]

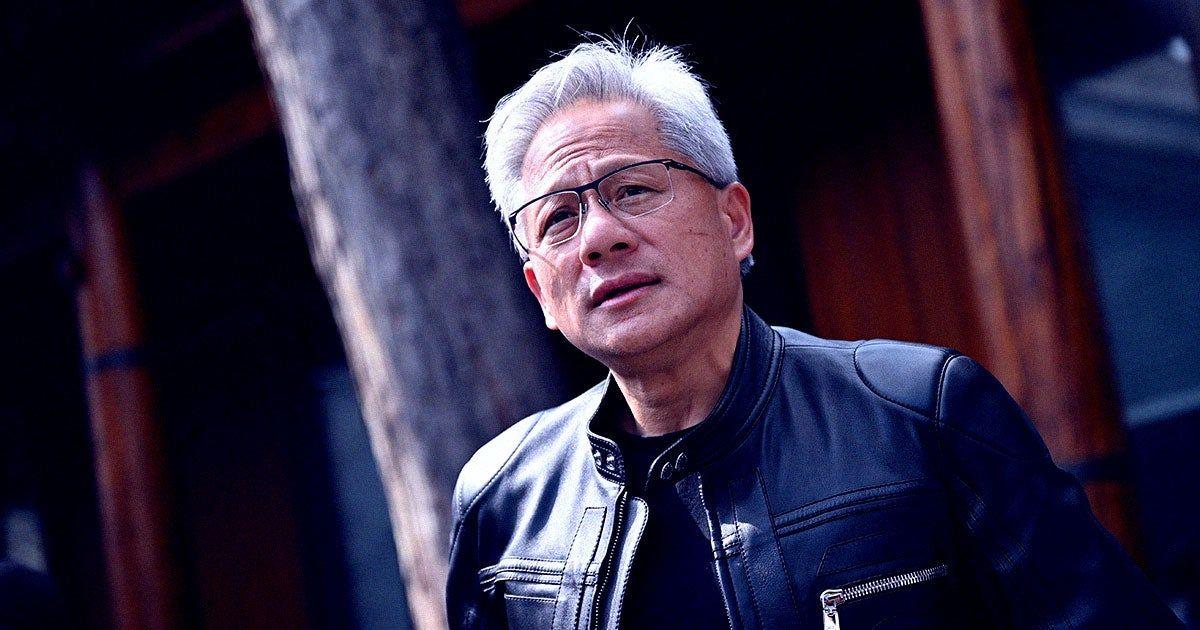

Why a cooling of the Nvidia party might be no bad thing for US stocks

If you were wondering whether markets were still in summertime silly season, allow me to settle the matter for you: they definitely are. August is traditionally a month when markets go bump in the night thanks to slimmed-down trading desks in the northern hemisphere summer, and 2024 is a particularly fine example. Remember the yen carry trade? No, nor does anyone else, but only around three weeks ago it was one of several factors thrown into the mix to help understand an ugly and swiftly reversed stock market sell-off. Bond and currency markets continue to exaggerate the likely scale of the impending US economic slowdown. But the real evidence of summertime flights of fancy stems from the scale of focus this week on the earnings of one company, Nvidia. Hype and general overexcitement are pretty standard fare in markets, and Nvidia is, after all, one of the most valuable companies on the planet, but the breathless lead-up to this week's results from the Silicon Valley-based chipmaker was intense, even by those standards. Several analysts compared the importance of the results to the most heavy-hitting of all US economic data releases, such as inflation or non-farm payrolls -- the only regular data reports for which fund managers will ever rearrange a lunch. Nvidia's numbers are, as Deutsche Bank pointed out, "an important macro event in their own right", up there with those key inputs into US monetary policy. This is curious but perfectly rational, given the outsized role that Nvidia plays in driving US and global stocks. But the real excess exposed by this "macro event" is the weight of investor expectations. Nvidia managed to more than double its revenues in the three months to the end of July, compared with the previous quarter, reaching a stonking $30bn. The company said that in the third quarter, it expects that tally to stretch up to $32.5bn. This is serious money. And what did the shares do? They fell in after-market trading, of course, by some 6 per cent, largely because some investors had been looking for a slightly higher forecast for the third quarter. Analysts at UBS, among others, suggested this was silly. "This is . . . missing the forest for the trees," wrote Timothy Arcuri, an analyst at the bank, and reflected, he said, "somewhat frothy expectations". He advised clients to buy the dip in the stocks, for which he is still expecting a 20 per cent ascent from here. This is something that is always worth remembering about markets: they tell you very little about what is going on today, and much more about what investors think will happen tomorrow. In this case, these are great expectations indeed. The explosion higher in Nvidia stocks -- some 800 per cent or so since the start of 2023 -- is already a reflection of the so-far largely unproven potential of artificial intelligence. The task now is for AI-related companies to demonstrate they can live up to the hype. In this show-me phase, markets will punish any little crack or wobble, even if only briefly. Reasons to accentuate the positive fall into two areas. The first is that, finally, barring some kind of inflationary disaster, interest rates are poised to fall, as US Federal Reserve chair Jay Powell underlined at the Jackson Hole monetary policy symposium earlier this month. Another is that, backing out a little from the myopic market obsession with Nvidia, the broader US stock market is in fine fettle. French bank Société Générale points out that 80 per cent of US companies beat earnings-per-share expectations over the quarter and, importantly, the proportion of companies delivering positive surprises is growing. Stripping tech-focused Nasdaq 100 companies out of the bigger S&P 500 index delivers encouraging news, analyst Manish Kabra at the bank said. Profit growth for non-tech companies is outstripping the shiny tech sector that has grabbed so much attention of late. "The biggest theme we find is of rotation -- the rotation from the narrow 'bubble' trade to the broader 'breadth' trade should continue," Kabra wrote. It is striking that despite the significant blow to Nvidia stocks this week, the S&P 500 kept on motoring higher. Perhaps from now on, the intense focus on this one company will fade, just a little. Charlotte Daughtrey, an equity investment specialist at Federated Hermes, is among those who expect a slice of the profits extracted from mega-tech stocks this year to be churned into the rest of the market from here. She notes that the gap in valuations between the tech giants and the rest of the market is abnormally large, at more than 25 per cent. Monster tech stocks could be "vulnerable" for the rest of this year, she said, while small and mid-cap stocks finally find their time to shine. This wholesome dynamic lacks the fireworks of the spectacular rally in AI-related stocks. Let's be honest, it's pretty dull. But broad-based market gains and a Federal Reserve that is about to start cutting rates are unambiguously positive news for stock market investors. Ignore the short-termist tech obsessives -- they are an overly tough crowd.

Share

Share

Copy Link

Generative AI tools like ChatGPT are transforming workplace dynamics, boosting productivity, and raising concerns about job displacement. Companies are exploring ways to integrate AI while addressing ethical and practical challenges.

The Rise of Generative AI in the Workplace

The rapid advancement of generative artificial intelligence (AI) tools, such as ChatGPT, is revolutionizing workplace dynamics and productivity across various industries. As these technologies become more sophisticated, companies are scrambling to integrate them into their operations, while employees are both embracing the potential benefits and grappling with concerns about job security

1

.Boosting Productivity and Efficiency

Generative AI has demonstrated its ability to significantly enhance workplace productivity. Tasks that once took hours can now be completed in minutes, allowing employees to focus on higher-value work. For instance, consultants at Bain & Company have reported time savings of up to 30% when using AI tools for research and analysis

1

.Changing Job Roles and Skill Requirements

As AI tools become more prevalent, job roles are evolving. Employees are finding that their positions now require a mix of traditional skills and the ability to effectively utilize AI technologies. This shift is creating new opportunities for those who can adapt quickly and leverage AI to enhance their work

2

.Ethical Concerns and Challenges

The integration of generative AI in the workplace is not without its challenges. Companies are grappling with ethical considerations, such as data privacy and the potential for AI-generated content to contain biases or inaccuracies. There are also concerns about the impact on creative industries, where AI-generated content could potentially replace human-created work

1

.Job Displacement and Workforce Adaptation

While AI tools are enhancing productivity, they are also raising concerns about job displacement. Some experts predict that certain roles may become obsolete as AI takes over routine tasks. However, others argue that AI will create new job opportunities and allow workers to focus on more complex, creative aspects of their roles

2

.Related Stories

Company Strategies for AI Integration

Forward-thinking companies are developing strategies to effectively integrate AI into their operations. This includes providing training for employees on how to use AI tools, establishing guidelines for appropriate use, and exploring ways to leverage AI to create new products and services

1

.The Future of Work with AI

As generative AI continues to evolve, it is clear that the future of work will be shaped by human-AI collaboration. Companies and employees that can successfully navigate this new landscape, balancing the benefits of AI with ethical considerations and human expertise, are likely to thrive in the AI-augmented workplace of tomorrow

2

.References

Summarized by

Navi

Related Stories

Tech Stocks Stumble as AI Enthusiasm Cools and Investors Await Fed Signals

21 Aug 2025•Technology

Nvidia Stock Stumble Sparks AI Industry Concerns and Market Volatility

21 Aug 2025•Business and Economy

Tech Sector Faces Uncertainty Amid Q3 Earnings and AI Growth Prospects

18 Oct 2024•Business and Economy

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

Anthropic takes Pentagon to court over unprecedented supply chain risk designation

Policy and Regulation

3

Meta smart glasses face lawsuit and UK probe after workers watched intimate user footage

Policy and Regulation