AI Investment Bubble Concerns Intensify as Industry Leaders Warn of 'Irrationality' Despite Nvidia's Strong Earnings

50 Sources

50 Sources

[1]

Google's Sundar Pichai warns of "irrationality" in trillion-dollar AI investment boom

On Tuesday, Alphabet CEO Sundar Pichai warned of "irrationality" in the AI market, telling the BBC in an interview, "I think no company is going to be immune, including us." His comments arrive as scrutiny over the state of the AI market has reached new heights, with Alphabet shares doubling in value over seven months to reach a $3.5 trillion market capitalization. Speaking exclusively to the BBC at Google's California headquarters, Pichai acknowledged that while AI investment growth is at an "extraordinary moment," the industry can "overshoot" in investment cycles, as we're seeing now. He drew comparisons to the late 1990s Internet boom, which saw early Internet company valuations surge before collapsing in 2000, leading to bankruptcies and job losses. "We can look back at the Internet right now. There was clearly a lot of excess investment, but none of us would question whether the Internet was profound," Pichai said. "I expect AI to be the same. So I think it's both rational and there are elements of irrationality through a moment like this." Over the past year, some analysts and tech industry critics have expressed increasing skepticism about a web of $1.4 trillion in deals surrounding Google competitor OpenAI in particular. The company has committed to spending $1.4 trillion on infrastructure over eight years, while it expects to generate around $13 billion in revenue this year. OpenAI CEO Sam Altman told reporters at a private dinner in August that investors are "overexcited" about AI models and that "someone" will lose a "phenomenal amount of money." Reacting to the Pichai comments, prominent AI industry critic Ed Zitron told Ars Technica, "I think that this is the first moment where a magnificent 7 feels it's necessary to be on the right side of history, leaning on the shaky talking point of 'there was a lot of over investment in the Internet too' because there really isn't a defense for the -- to use his own terminology -- 'excess investment' in AI." He added, "I imagine others will follow."

[2]

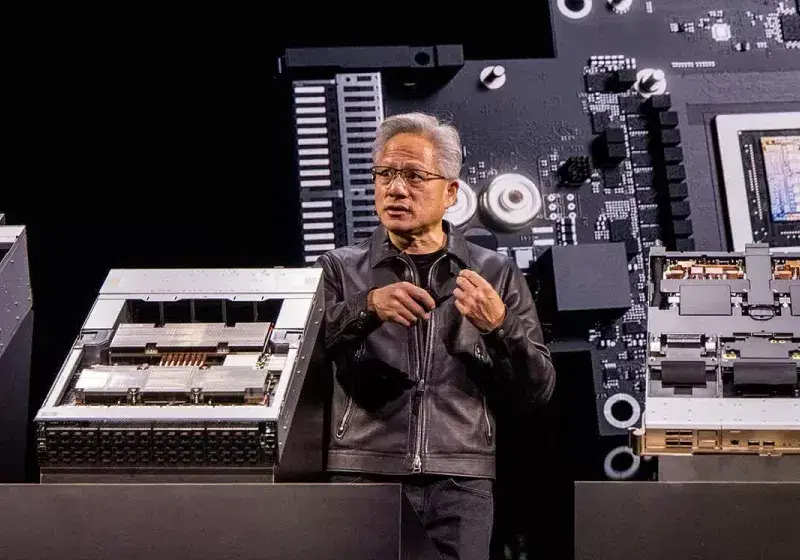

AI mania is making Nvidia a lot of money

AI companies are spending so much on infrastructure that Nvidia's data center business now brings in nearly $50 billion. But is this sustainable growth or just the latest tech mania? And should we even be calling it a "bubble" when the belief in AI's future is what's holding the whole ecosystem together? This week on Equity, Kirsten Korosec, Anthony Ha, and Sean O'Kane dig into Nvidia's massive earnings beat, the circular economy of AI infrastructure spending, and whether CEO Jensen Huang's optimistic vision of AI agents handling everything in our daily lives can justify the investment.

[3]

Bubble Trouble: AI rally shows cracks as investors question risks

NEW YORK, Nov 21 (Reuters) - The biggest bout of volatility in U.S. stocks in months has revealed cracks in the artificial intelligence-related rally, raising questions about whether the market has been in the grips of a speculative bubble that may be popping. Soaring valuations in AI stocks this year have stoked worries that Wall Street may be inflating another speculative bubble, with some of these fears coming to the fore after a stellar earnings report from AI bellwether Nvidia failed to rally the stock and broader market. Sign up here. In recent days investors have been watchful of emerging signs of cracks in the AI investment narrative. Several high-flying AI stocks have experienced sharp pullbacks, questions are mounting about when AI investments will translate into actual profits, and concerns are growing that enthusiasm may be outpacing the technology's near-term capabilities. Investor sentiment has been rattled recently by several developments, including a noticeable dip in retail traders' enthusiasm for "buying the dip." This caution comes alongside a hit to Oracle bonds on news the company plans to increase its substantial debt to finance artificial intelligence infrastructure, and as lenders seek greater protection on loans to major tech companies, citing concerns over debt-financed AI investments. The boom and recent retreat in AI and AI-adjacent stocks has drawn comparisons to some of history's most notorious market manias, from the dot-com frenzy of the late 1990s to the more recent cryptocurrency boom. At the heart of investors' concerns about a market bubble are lofty valuations. Despite the recent pullback, valuations remain elevated and investors are wary of risks around customer capital spending and financing, plus challenges in expanding data center capacity amid energy constraints and memory chip shortages. Alphabet Chief Executive Sundar Pichai recently said no company would be unscathed if the artificial intelligence boom collapses, but Nvidia CEO Jensen Huang on Wednesday shrugged off concerns. Not all bubbles are created equal, and the warning signs that signal the buildup of excess in one bubble can differ significantly from those in another. Historical data shows dramatic variations in how asset manias unfold - from the speed of their collapse to the years required for recovery. The Japanese stock market crash of the early 1990s took decades to recover, while the 2021-2022 crypto crash played out in a matter of months. Understanding these patterns matters for investors trying to gauge whether today's AI enthusiasm represents rational exuberance over a transformative technology or the kind of speculative excess that ends in tears. Some charts here help assess how the AI mania compares with historic bubbles and what stage it is in, if indeed this is a bubble. Its recent wobble notwithstanding, the U.S. stock market's valuation has surged into territory that historically preceded major downturns, with the Buffett Indicator -- a gauge favored by billionaire investor Warren Buffett -- flashing warning signs. The indicator, which compares total U.S. stock market capitalization to gross domestic product, recently rose above 200%, surpassing levels last seen at the pandemic-era market peak in 2021. The metric currently stands near its highest level on record, surpassing even the dot-com bubble of 2000. Named after the Berkshire Hathaway chairman, the ratio shows elevated readings before major market corrections since 1975. Other stock valuation gauges also show elevated readings, though not at historical highs. The S&P 500's price-to-earnings ratio has climbed to about 23 times, based on 12-month earnings estimates for its constituents, around its highest level in five years and well above its 10-year average of 18.7, according to LSEG Datastream. A separate valuation measure - the CAPE ratio, or Shiller P/E ratio - which measures earnings averaged over 10 years to adjust for economic cycles, also shows elevated readings, though not yet at the heights touched during past bubbles. The Nasdaq's current trajectory during the artificial intelligence boom bears a striking resemblance to its dot-com era path, albeit with less exuberance, backing the view that if this is a bubble it may still be early stage. The tech-heavy index climbed roughly 100% in the three years following ChatGPT's November 2022 launch, mirroring the early stages of excitement that followed Netscape's August 1995 IPO. A key ingredient in past stock market bubbles has been runaway investor optimism, which appears to be absent now. The American Association of Individual Investors survey, a weekly poll that measures investor sentiment among individual retail investors in the U.S. stock market, shows bullish sentiment at 38%, in line with its long-term average. That's a far cry from the 75% high hit in January 2000 or even the 57% high scaled during the meme-stock mania in 2021. While elevated bullishness is not a necessary precondition for a market reversal, heightened bullishness would have backed the view that investors have grown too complacent. Historical data shows that prolonged periods of above-average optimism often precede market turbulence, as crowded trades and stretched valuations leave little room for disappointment. Reporting by Saqib Iqbal Ahmed; Additional reporting by Lewis Krauskopf and Matt Tracy; editing by Megan Davies and Deepa Babington Our Standards: The Thomson Reuters Trust Principles., opens new tab

[4]

Bubble fears ease but investors still waiting for AI to live up to its promise

Fears about the artificial intelligence boom turning into an overblown bubble have evaporated for now, thanks to a stellar earnings report from Nvidia that illustrated why its indispensable chips transformed it into the world's most valuable company. But that doesn't mean the specter of an AI bubble won't return in the months and years ahead as Big Tech gears up to spend trillions of dollars more on a technology the industry's leaders believe will determine the winners and losers during the next wave of innovation. For now, at least, Nvidia has eased worries that the AI craze propelling the stock market and much of the economy for the past year is on the verge of a massive collapse. If anything, Nvidia's quarterly report indicated that AI spending is picking up even more momentum. The highlights, released late Wednesday, included quarterly revenue of $57 billion, a 62% increase from the same time last year. That sales growth was an acceleration from the 56% increase in year-over-year revenue from the May-July quarter. What's more, Nvidia forecast revenue of $65 billion for the current quarter covering November-January, which would be a 65% year-over-year increase. Given Nvidia's forecasts, "it is very hard to see how this stock does not keep moving higher from here," according to analysts at UBS led by Timothy Arcuri. The UBS analyst also said the "AI infrastructure tide is still rising so fast that all boats will be lifted." Nvidia's numbers are viewed through a window that extends far beyond the Santa Clara, California, company's headquarters because its products are needed by a wide range of companies -- including Big Tech peers like Microsoft, Amazon, Alphabet and Meta Platforms -- to build data centers that are becoming known as AI factories. "AI spending isn't just holding up, it's accelerating. That's exactly what the market needed to see," said Jake Behan, head of capital markets for investment firm Direxion. The numbers initially lifted Nvidia's stock price by as much as 5% in Thursday's trading, while other tech stocks tied to the AI spending frenzy also got a boost. But Nvidia's shares and other tech stocks backtracked later in the session as investors found other issues besides AI, such as the government's latest jobs report and the future direction of interest rates. Even with a slight downturn in its stock price amid the broader market decline, Nvidia remains valued at $4.5 trillion, more than 10 times its valuation three years ago when OpenAI released its ChatGPT chatbot, triggering the biggest technological shift since Apple released the iPhone in 2007. Nvidia's rapid rise has turned its CEO Jensen Huang into the chief evangelist for the AI revolution and he sought to use his bully pulpit during a late Wednesday conference call with industry analysts to make a case that the spending to make technology with humanlike intelligence is just beginning. "There's been a lot of talk about an AI bubble. From our vantage point, we see something very different," Huang insisted while celebrating "depth and breadth" of Nvidia's growth. Huang is hardly a lone voice in the wilderness. A recent report from Gartner Inc. estimates that worldwide spending on AI will rise to more than $2 trillion next year, a 37% increase from the nearly $1.5 trillion that the research firm expects to be spent this year. But it remains to be seen if all that money pouring into AI will actually produce all the profits and productivity that proponents have been promising. That leaves the question unanswered if all the real spending that's happening will be worth it. The most recent survey of global fund managers by Bank of America showed a record percentage of investors saying companies are "overinvesting." Big Tech is already so profitable that many of the most successful finance their spending sprees with their ongoing stream of revenue and cash hoards in their bank accounts. But some companies, such as Meta Platforms and Oracle, are relying more heavily on debt to fund their AI ambitions -- a strategy that has raised enough alarms among investors that their stock prices have plunged more dramatically than their peers in recent weeks. Both Meta and Oracle have suffered more than 20% declines in their stock prices since late October. But other Big Tech powerhouses leading the way in AI remain just behind Nvidia and iPhone maker Apple in the rankings of the most valuable companies. Alphabet, Microsoft and Amazon boast market values currently ranging from $2.3 trillion to $3.6 trillion. "It is true that valuations are high and that there is some froth in the market, however, the spending on AI is real," said Chris Zaccarelli, chief investment officer for money manager Northlight Asset Management. "Whether or not the spending turns out to be overdone won't be known for many years." -- AP Business Writer Stan Choe in New York contributed to this story.

[5]

Nvidia sent a strong signal on AI infrastructure -- but is it a bubble barometer?

Analysts say long-term AI growth still looks solid, with hyperscalers betting on surging computing needs.Nvidia reported strong earnings and forecasts Wednesday, in what analysts saw as a clear signal for continued spending on AI infrastructure. Less clear, however, is whether the results can dispel fears of an AI bubble in markets. Fears have grown in recent months that massive investment in AI by major tech companies could outpace realistic returns, leading some industry insiders and analysts to predict an AI bubble. While Nvidia 's earnings are widely viewed as an important gauge of the AI industry's health, some analysts warn that its performance doesn't tell the whole story. "I think a lot of people will be relieved, but they really didn't need to worry about Nvidia heading [into earnings] anyway," Gil Luria, head of technology research at D.A. Davidson, told CNBC on Thursday. Concern about [an AI bubble] actually isn't an Nvidia problem. The concern is about companies raising a lot of debt to build data centers. Head of technology research at D.A. Davidson Gil Luria The analyst noted that Nvidia's customers, including Microsoft , Amazon , Google and Meta , had already telegraphed plans to accelerate spending on Nvidia chips, and that was reflected in Nvidia's results. This strong demand has also been a boon for Nvidia-related chip stocks, with its key suppliers in Asia trading higher on Thursday. However, Luria said, "concern about [an AI bubble] actually isn't an Nvidia problem. The concern is about companies raising a lot of debt to build data centers." Nvidia's AI chips, also known as Graphics Processing Units, are used in data centers to provide the computing power needed to train and run AI services. These data centers are often owned by specialized operators and major tech companies like Microsoft and Google, known as hyperscalers. As these companies prepare to meet growing AI demand, they've been financing data center roll-out with debt. "Any concerns about Nvidia were certainly laid to rest [with Nvidia's earnings], but that doesn't mean that we don't need to keep an eye on companies lending or borrowing to build data centers," Luria said. The analyst described data centers as inherently speculative investments that could face a reckoning two or three years from now when the world reaches full capacity and the cycle rolls over. Even so, he added, "Nvidia will keep selling chips one way or another." AI chips vs. AI promise Other analysts who spoke to CNCB drew a clear line in the sand between AI chip companies like Nvidia and downstream players, including hyperscalers and firms actually building AI models like Chat-GPT maker OpenAI. "Nvidia's earnings are a strong signal of AI infrastructure spending, but they're not a reliable gauge of whether AI economics are truly maturing across the industry," said Billy Toh, regional head of retail research at CGS International Securities Singapore. "To understand the broader industry's stability, it's more meaningful to look at actual adoption and monetization of AI services at companies like Microsoft, Adobe , and other enterprise platforms, where real customer demand and recurring revenue ultimately confirm whether the AI boom is sustainable," he added. In addition to concerns about hyperscalers taking on debt, AI developers such as OpenAI posting weak revenue relative to their heavy spending have been a source of unease for some investors. That lack of revenue for AI companies has not been felt by Nvidia, which dominates advanced chips and chip software and has deep integration across the AI ecosystem, giving it pricing power and profitable demand. "Even if many AI startups struggle, Nvidia still sells to hyperscalers, sovereign AI initiatives, and enterprises building core infrastructure," Toh said. "This dynamic helps justify its trillion-dollar market cap and why investors view it as the safest way to gain exposure to AI," he said, though that protection will fade as the AI build-out phase slows. Bulls on parade Rolf Bulk, equity research analyst at New Street Research, agreed with the distinction between Nvidia's earnings and the broader AI market. However, he still saw Nvidia's results as a factor that could calm AI bubble fears in the near term. "It's an indicator that hyperscalers and AI companies expect demand for compute to continue to grow strongly in 2026 and beyond," he told CNBC. "Of course, these GPUs need to continue to be well utilized to generate a return for the hyperscalers. That is the bet they're making," he added. While Nvidia may not be a perfect barometer of the AI bubble, analysts like Bulk still see long-term growth ahead for the AI market. "AI infrastructure demand consistently exceeds available capacity, with OpenAI, Anthropic, Amazon, Google, and others all noting that customer demand exceeds their ability to provide the necessary compute," he said. Meanwhile, strong believers in AI, who already discard fears of a bubble, were likely to see Nvidia's earnings as yet another bullish sign for the broader industry. "This is not a bubble. It's just the beginning," said Ray Wang, Constellation Research chairman and AI Forum co-founder, citing Nvidia's $500 billion in bookings for its advanced chips through 2026. Dan Ives of Wedbush Securities echoed that sentiment in an email to CNBC, calling Nvidia's results "a validation moment of no AI bubble and instead early days of the AI Revolution." "There is one chip in the world fueling the AI Revolution and that is Nvidia," Ives added. Nvidia CEO Jensen Huang himself dispelled fears regarding AI in an earnings call on Wednesday. "There's been a lot of talk about an AI bubble," he said. "From our vantage point, we see something very different." -- CNBC's Martin Soong contributed to this report

[6]

The A.I. Boom Has Found Another Gear. Why Can't People Shake Their Worries?

It would not be a stretch to describe this period of hyperactive growth in the tech industry as a historic moment. Nvidia, which makes computer chips that are essential to building artificial intelligence, said on Wednesday that its quarterly profit jumped to nearly $32 billion, up 65 percent from a year ago and 245 percent from the year before that. Just three weeks ago, Nvidia became the first publicly traded company to be worth $5 trillion. Microsoft, Google, Apple and Amazon are also now valued in the trillions. In their most recent quarters, the four companies reported more than $110 billion in combined profits. "There's been a lot of talk about an A.I. bubble," said Jensen Huang, Nvidia's chief executive, after his company's blowout quarterly report. "From our vantage point, we see something very different." But some industry insiders say there is something ominous lurking behind all this bubbly news. They look at the same eye-popping growth and the same stunning wealth creation as Mr. Huang and see a house of cards. And they say it is hard to know what the damage will be if it collapses. Even Nvidia's growth can be explained away. Demand for the company's chips doesn't mean people want to use A.I. It merely means that companies are building giant A.I. systems in hopes someone will pay to use them. The Nvidia-led rally on Wall Street lasted only a few hours, after all, and the company's share price was down about 3 percent at the end of trading on Thursday. A sharp reversal in tech stocks pulled the whole market lower, with the S&P 500 dropping 1.6 percent for the day. The heart of the pessimist's case against the A.I. boom, however, is the money pouring into the start-up world and the billions upon billions those companies are spending on data centers. OpenAI, the company that kicked off the boom three years ago, is now worth an estimated $500 billion, making it the most valuable start-up in the world. Anthropic, OpenAI's archrival, is now worth an estimated $183 billion. And Thinking Machines Labs, which was started in February, is already believed to be valued in the tens of billions of dollars. OpenAI is not profitable and doesn't expect to be until 2030. Anthropic is also in the red. Thinking Machines just put out its first product. That hasn't stopped them from spending. Anthropic recently said it would invest $50 billion in new data centers. Sam Altman, OpenAI's celebrity chief executive, said his company was committed to spending $1.4 trillion on computing power for its A.I. pursuits. "What OpenAI is engaged in is the most dramatic case of 'Fake It Until You Make It' that we have ever seen," said Gil Luria, head of technology research at D.A. Davidson. "They are making huge commitments that they literally can't afford." OpenAI and its partners are pumping $500 billion into new data centers in the United States as part of what they call Project Stargate. In today's dollars, that is enough to fund the Manhattan Project 15 times over. It could pay for the entire Apollo moon project. Twice. "Stargate alone -- if it does actually reach $500 billion -- would be the largest infrastructure project in the world, several time over," said Evan Conrad, chief executive of San Francisco Compute, a start-up that specializes in hardware for A.I. An OpenAI spokesman said in a statement that the company believed its trajectory was heading in the right direction, with 800 million weekly users and more than a million business users. "Progress in generational advancements -- like railroads, electricity and the internet -- comes from bold investment and long-term conviction," said the spokesman, Steve Sharpe. "In under three years we've built the fastest-growing consumer and enterprise platform in history." Tech companies, governments and their partners around the world will spend nearly $3 trillion on data centers by 2028, according to analysts at Morgan Stanley. To make that happen, they will borrow nearly a trillion dollars from banks and other financial institutions. Over the last 12 months, Google, Microsoft, Amazon and Meta spent about $360 billion on new data centers. With their huge profits, they can afford it. Other companies have to take on debt. That includes established companies like the software maker Oracle and smaller outfits with names like CoreWeave and Nebius. Because that debt is held by a wide array of financial institutions -- including private credit lenders as well as traditional banks -- experts are struggling to understand how much risk is in the system. Adding to worries, critics say some of the deals OpenAI has made with chipmakers, cloud computing companies and others are oddly circular. OpenAI is set to receive billions from tech companies but also sends billions back to the same companies to pay for computing power and other services. Some financial analysts worry that these deals make the market look stronger than it really is. Ultimately, the health of the market will depend on whether companies like OpenAI can turn a profit before debt overwhelms them. (The New York Times has sued OpenAI and Microsoft, claiming copyright infringement of news content related to A.I. systems. The two companies have denied the suit's claims.) Nvidia has also made some deals that have raised questions about whether the company is paying itself. It announced that it would invest $100 billion in OpenAI. The start-up receives that money as it buys or leases Nvidia's chips. On Tuesday, Nvidia announced a similar $10 billion deal with Anthropic, which will buy $30 billion in A.I. computing backed by Nvidia chips. That money will actually go to buy computing power from Microsoft, which also invested $5 billion in Anthropic. Goldman Sachs has estimated that Nvidia will make 15 percent of its sales next year from what critics also call circular deals. Many companies justify their spending because they're not just building a product, they're creating something that will change the world: artificial general intelligence, or A.G.I., a machine that can do anything the human brain can do. The rub is that none of them quite know how to do it. But Anton Korinek, an economist at the University of Virginia, said the spending will all be justified if Silicon Valley reaches its goal. He is optimistic it can be done. "It's a bet on A.G.I. or bust," Dr. Korinek said. A.I. company's chatbots and image generators are already being used by hundreds of millions of people. Many of them pay monthly fees that can top $100. But it's not so clear that business customers -- the real cash cow for the tech industry -- are as keen to use A.I. Nearly eight in 10 businesses have said they have not yet used A.I. technologies. Just as many have said these technologies had "no significant bottom-line impact," according to recent research from McKinsey & Company. Nonetheless, tech companies say business interest is starting to congeal. Microsoft, Google and Amazon all said they have more customer demand than available supply and they expect to be constrained into next year. Even among some executives of Silicon Valley's wealthiest companies, however, the money sloshing around is worrying. Sundar Pichai, the chief executive of Alphabet, Google's parent company, said in an interview with the BBC this week that the spending and skyrocketing valuations were driven at least in part by "irrationality." If the market crashes, he said, the damage will be widespread. "I think no company is going to be immune, including us," he said. Tech industry veterans often compare the A.I. boom to the dot-com bubble of the 1990s. When that bubble burst, hundreds of start-ups disappeared and established companies that were selling technology to those young outfits experienced huge losses. But other start-ups found lasting success and did, in fact, change the world -- most notably Amazon and Google. "When bubbles happen, smart people get over-excited about a kernel of truth," Mr. Altman told reporters earlier this year. "Are we in a phase where investors as a whole are over-excited about A.I.? My opinion is yes. Is A.I. the most important thing to happen in a very long time? My opinion is also yes."

[7]

Sundar Pichai says AI boom shows irrational investment, but Google can weather the coming storm

Serving tech enthusiasts for over 25 years. TechSpot means tech analysis and advice you can trust. Editor's take: Another Big Tech executive has admitted the AI market is in a bubble fueled by "irrational" investment. Overhype and the belief that unproven technology can solve all the world's problems are creating a situation where no company - not even Google - will be immune when it all comes crashing down. Alphabet CEO Sundar Pichai says the AI market is experiencing clear signs of overexuberance, with some investment driven more by hype than fundamentals. Speaking exclusively to the BBC, he called the surge in funding an "extraordinary moment" while acknowledging elements of investor irrationality - a view echoed by OpenAI CEO Sam Altman back in August. Pichai said the tech industry can "overshoot" in cycles of enthusiasm, with investments sometimes running ahead of underlying fundamentals. Despite the froth, he stressed that the technology itself remains transformative, reshaping how people work and interact digitally, equating it to the dot-com boom. "We can look back at the internet right now. There was clearly a lot of excess investment, but none of us would question whether the internet was profound. It's fundamentally changed how we work digitally as a society. I expect AI to be the same. So I think it's both rational, and there are elements of irrationality through a moment like this." The CEO admits that a crash will affect every company in the industry, including Google. However, the search giant's integrated approach - spanning custom AI chips, data platforms like YouTube, and proprietary models - acts as a buffer against market turbulence. Like Altman, Pichai believes Google will weather an AI crash that analysts say is inevitable. This full-stack model positions Alphabet to absorb volatility better than companies that rely on external technologies or partnerships. Pichai also outlined the company's significant UK expansion, committing £5 billion over two years to research and infrastructure, including work at DeepMind in London. For the first time, Google plans to train AI models within the UK, a step that aligns with the government's ambitions to establish the country as a top-tier AI hub. Artificial intelligence's impact on workforces is equally profound, Pichai said. Just as the internet changed how we work, AI will transform the industry, eliminating some jobs while creating others. Success will favor those who adopt and integrate AI tools into their professions. "It doesn't matter whether you want to be a teacher or a doctor," Pichai said. "All those professions will be around, but the people who will do well in each of those professions are people who learn how to use these tools." The rapid growth of AI also carries an environmental cost. Pichai noted that AI consumed one and a half percent of global electricity last year, straining energy systems. He warned that failing to scale energy infrastructure could constrain economic growth. Alphabet remains committed to reaching net zero by 2030 through investment in new energy technologies, even though progress toward the company's climate targets has slowed.

[8]

Google boss Sundar Pichai warns 'no company immune' if AI bubble bursts

Every company would be affected if the AI bubble were to burst, the head of Google's parent firm Alphabet has told the BBC. Speaking exclusively to BBC News, Sundar Pichai said while the growth of artificial intelligence (AI) investment had been an "extraordinary moment", there was some "irrationality" in the current AI boom. It comes amid fears in Silicon Valley and beyond of a bubble as the value of AI tech companies has soared in recent months and companies spend big on the burgeoning industry. Asked whether Google would be immune to the impact of the AI bubble bursting, Mr Pichai said the tech giant could weather that potential storm, but also issued a warning. "I think no company is going to be immune, including us," he said.

[9]

'AI industry is in a bubble' warns Google DeepMind co-founder

Google DeepMind co-founder Demis Hassabis considers the future of AI This week, talk of the AI industry bubble has heated up, with Google's top executive Demis Hassabis throwing some fuel on this fire while discussing the release of the company's much-anticipated Gemini 3 model. Speaking to podcast Hard Fork hosts Kevin Roose and Casey Newton, the chief executive officer and co-founder of Google DeepMind and Isomorphic Labs echoed what colleague Sundar Pichai - CEO of Google parent Alphabet - also said of the seemingly unsustainable AI industry. "Are we in an AI bubble?" host Kevin asked candidly, to which Hassabis chuckles and pauses to consider his response. "It's too binary a question, I would say," Hassabis replied. "My view on this - this is just strictly just my own opinion - is that there are some parts of the AI industry that are probably in a bubble. If you look at seed investment rounds being multi-ten-billion-dollar rounds with basically nothing, it seems ... there are talented teams, but it seems like that might be the first signs of some kind of bubble." In a similarly timed interview, Pichai warned that even the biggest players, like Alphabet and all its subsidiaries like Google DeepMind, will feel it. "I think no company is going to be immune, including us," he told the BBC. And while the AI bubble is a hot topic as the end of 2025 nears - a year that's seen unprecedented investment and valuations of companies like Alphabet, Nvidia and OpenAI - it's not all doom and gloom. "I think there's a lot of amazing work value to - at least from our perspective that we see - not only all the new product areas, like Gemini app, NotebookLM, and thinking more forward, robotics, gaming," Hassabis pivoted. "And drug discovery we're doing with Isomorphic, and Weymo. So there are all these new 'greenfield' areas. They're going to take a while to mature into massive multi-hundred-billion-dollar businesses, but I think there's actually potential for half a dozen to a dozen there, that I think Alphabet will be involved with, which I'm really excited about." It's no secret that many companies in the field are operating at a loss right now - OpenAI has reportedly hemhoraged US$14 billion in this quarter alone - but the DeepMind boss remains optimistic. "Immediate returns - this is the engine room part of Google, where we're pushing this into all of these incredible multi-billion-user products that people use every day. We have so many ideas, it's just about execution," he added. "I think a lot of that will also bring in near-term revenue and direct returns, while we're also investing in the future. "I feel really good were we are, as Alphabet, whether there's a bubble or not," he continued. "Our job is to be winning in both cases, right? If there's no bubble and things carry on, then we're going to take advantage of that opportunity. But if there is is some sort of bubble and there's a retrenchment, I think we'll also be best-placed to take advantage of that scenario." An easy comparison of where we're at is the dot-com era, during which countless startups were valued on good vibes alone, with just the promise of financial returns on investments in the future. Then everything unraveled in 2000, wiping out many of these companies and tech sector jobs, and contributing to a US recession in 2001 - a brief one, but still one. Now, there are valid concerns that the AI industry - one built on unprecedented investment without adequate financial returns - may follow a similar trajectory. This year has seen some of the market leaders greatly increase in value: Alphabet has reached a valuation of $3.5 trillion, OpenAI has reportedly hit a $500-billion valuation, and NVIDIA has become the first company to ever surpass the $5-trillion mark. This month, however, some big investors are seemingly getting nervous. Nvidia lost big investments from serious players like Peter Thiel's hedge fund, which took back the $94 million it had put on the line, and money manager Michael Burry is now betting against the semiconductor company as well as Thiel's data-mining firm Palantir, predicting the stocks will continue to fall. Burry made a reported $100 million by predicting the 2007 subprime mortgage crisis which led to the great recession the following year (and inspired the book and then the film The Big Short). Pichai told the BBC that current AI spending was experiencing an "extraordinary moment" but conceded there are now "elements of irrationality" in the market that are reminiscent of the "irrational exuberance" that investors had during the dot-com hype. Right now, it seems Hassabis' position is a reasonable one: there's most likely bubble, and if a burst does come, it's most likely going to thin out the crowded AI industry and hit the tech employment sector immediately. And former International Monetary Fund chief economist Gita Gopinath believes such a crash - like the dot-com implosion - would wipe out $20 trillion from US households and $15 trillion from worldwide investors. However, on the other side of the pain - like in 2001 - the AI industry should emerge as a more sensible and less speculative business. And like the internet, AI is here to stay - as are the huge companies like Alphabet, which continues to focus on diverse areas of product development. Hassabis made history in 2024, when he, along with creative partner and DeepMind director Dr. John Jumper, shared the Nobel Prize in Chemistry for their work developing AlphaFold, the AI system that predicts the 3D structure of proteins from their amino acid sequences. This week, Nature detailed the future of DeepMind and the company's focus on science-based development, which is certainly worth a read. As for Gemini 3 - yes, it's a big deal, but many of its tools are yet to be rolled out, and access to the launch model is staggered across platforms in the US. So check out the video below for more.

[10]

Google CEO Admits 'Elements of Irrationality' Have Led to an AI Bubble

A growing list of experts, from the Bank of England to investor Michael Burry of 'The Big Short' fame, have indicated belief in an overvaluation of AI stocks to varying degrees. Over the past few months, tech executives leading companies with record valuations thanks to the AI hype have also joined their ranks. Sam Altman said in August that he thinks investors are currently "over-excited" about AI. Just last month, Bezos called AI an "industrial bubble." The latest name to add to that list is Google CEO Sundar Pichai. "Given the potential of this technology, the excitement is very rational. It's also true, when we go through these investment cycles, there are moments we overshoot collectively as an industry," Pichai told the BBC in an interview published on Tuesday. "So, I think its both rational and there are elements of irrationality in moments like these." The Google chief essentially likened the current AI trade to the dot-com bubble, which wiped out around $5 trillion in market value when it burst. "We can look back at the internet right now, there was clearly a lot of excess investment but none of us would question whether the internet was profound or that it drives a lot of impact, it fundamentally changed how we work digitally as a society," Pichai said. "I expect AI to be the same." What's been worrying AI enthusiasts more than the spectre of a bubble ballooning is one bursting. Those worries were raised by some after Meta downsized its AI department last month, following a massive hiring spree over the summer. And then again this past week, when both SoftBank and Peter Thiel's hedge fund Thiel Macro reportedly dumped their stakes in AI darling Nvidia, which is reporting a much anticipated earnings report on Wednesday afternoon. When asked what would happen if this hypothetical AI bubble burst, Pichai said that "no company is going to be immune." That includes Google themselves, even though Pichai said he thinks they are "better positioned." Google is one of several companies that have made big bucks on AI hype. Google-parent Alphabet became the fourth company to pass $3 trillion market cap in September. Meanwhile it continues to pour billions into scaling its AI offerings, including the company's top AI product Gemini. It's not just Google that's shelling out a fortune. Tech giants across the industry are spending exorbitant amounts of money on AI. Pichai told the BBC that the tech industry overall has "well over a trillion dollars of investment" dedicated to building AI infrastructure, a number that is only exponentially increasing with no end in sight. Deutsche Bank said in September that current AI spend is so massive that it could be propping up the entire American economy right now. Meanwhile, an MIT report from August claims that only 5% of businesses that have adopted AI were generating real revenue gains. Nevertheless, Pichai believes AI is still the future of society. In the BBC interview, he had some advice to share on how to navigate this AI-integrated future he and the rest of Silicon Valley are envisioning. Pichai said that people had to "adapt" as he predicted that widespread adoption of AI will cause certain jobs to "evolve and transition." To do so, he claimed, everyone in every occupation should embrace using AI in their work. But just moments after this endorsement of AI-integrated work, he admitted that the technology is prone to errors, unlike the company's other products, like Google Search, which are "more grounded in providing accurate information."

[11]

Don't blindly trust what AI tells you, Google boss tells BBC

People should not "blindly trust" everything AI tools tell them, the boss of Google's parent company Alphabet told the BBC. In an exclusive interview, chief executive Sundar Pichai said that AI models are "prone to errors" and urged people to use them alongside other tools. Mr Pichai said it highlighted the importance of having a rich information ecosystem, rather than solely relying on AI technology. "This is why people also use Google search, and we have other products that are more grounded in providing accurate information." While AI tools were helpful "if you want to creatively write something", Mr Pichai said people "have to learn to use these tools for what they're good at, and not blindly trust everything they say". He told the BBC: "We take pride in the amount of work we put in to give us as accurate information as possible, but the current state-of-the-art AI technology is prone to some errors."

[12]

Here's why concerns about an AI bubble are bigger than ever

Nvidia CEO Jensen Huang delivers a keynote address at the Consumer Electronics Show (CES) in Las Vegas in January. Patrick T. Fallon/AFP via Getty Images hide caption Perhaps nobody embodies artificial intelligence mania quite like Jensen Huang, the chief executive of chip behemoth Nvidia, which has seen its value spike 300% in the last two years. A frothy time for Huang, to be sure, which makes it all the more understandable why his first statement to investors on a recent earnings call was an attempt to deflate bubble fears. "There's been a lot of talk about an AI bubble," he told shareholders. "From our vantage point, we see something very different." Take in the AI bubble discourse and something becomes clear: Those who have the most to gain from artificial intelligence spending never slowing are proclaiming that critics who fret about an over-hyped investment frenzy have it all wrong. "I don't think this is the beginning of a bust cycle," White House AI czar and venture capitalist David Sacks said on his podcast All-In. "I think that we're in a boom. We're in an investment super-cycle." "The idea that we're going to have a demand problem five years from now, to me, seems quite absurd," said prominent Silicon Valley investor Ben Horowitz, adding: "if you look at demand and supply and what's going on and multiples against growth, it doesn't look like a bubble at all to me." Appearing on CNBC, JPMorgan Chase executive Mary Callahan Erdoes said calling the amount of money rushing into AI right now a bubble is "a crazy concept," declaring that "we are on the precipice of a major, major revolution in a way that companies operate." Yet a look under the hood of what's really going on right now in the AI industry is enough to deliver serious doubt, said Paul Kedrosky, a venture capitalist who is now a research fellow at MIT's Institute for the Digital Economy. He said there is a startling amount of capital pouring into a "revolution" that remains mostly speculative. "The technology is very useful, but the pace at which it is improving has more or less ground to a halt," Kedrosky said. "So the notion that the revolution continues with the same drum beat playing for the next five years is sadly mistaken." The gusher of money is rushing in at a rate that is stunning to financial experts. Take OpenAI, the ChatGPT maker that set off the AI race in late 2022. Its CEO Sam Altman has said the company is making $20 billion in revenue a year, and it plans to spend $1.4 trillion on data centers over the next eight years. That growth, of course, would rely on ever-ballooning sales from more and more people and businesses purchasing its AI services. There is reason to be skeptical. A growing body of research indicates most firms are not seeing chatbots affect their bottom lines, and just 3% of people pay for AI, according to one analysis. "These models are being hyped up, and we're investing more than we should," said Daron Acemoglu, an economist at MIT, who was awarded the 2024 Nobel Memorial Prize in Economic Sciences. "I have no doubt that there will be AI technologies that will come out in the next ten years that will add real value and add to productivity, but much of what we hear from the industry now is exaggeration," he said. Nonetheless, Amazon, Google, Meta and Microsoft are set to collectively sink around $400 billion on AI this year, mostly for funding data centers. Some of the companies are set to devote about 50% of their current cash flow to data center construction. Or to put it another way: every iPhone user on earth would have to pay more than $250 to pay for that amount of spending. "That's not going to happen," Kedrosky said. To avoid burning up too much of its cash on hand, big Silicon Valley companies, like Meta and Oracle, are tapping private equity and debt to finance the industry's data center building spree. One assessment, from Goldman Sachs analysts, found that hyperscaler companies -- tech firms that have massive cloud and computing capacities -- have taken on $121 billion in debt over the past year, a more than 300% uptick from the industry's typical debt load. Analyst Gil Luria of the D.A. Davidson investment firm, who has been tracking Big Tech's data center boom, said some of the financial maneuvers Silicon Valley is making are structured to keep the appearance of debt off of balance sheets, using what's known as "special purpose vehicles." The tech firm makes an investment in the data center, outside investors put up most of the cash, then the special purpose vehicle borrows money to buy the chips that are inside the data centers. The tech company gets the benefit of the increased computing capacity but it doesn't weigh down the company's balance sheet with debt. For example, a special purpose vehicle was recently funded by Wall Street firm Blue Owl Capital and Meta for a data center in Louisiana. The design of the deal is complicated but it goes something like this: Blue Owl took out a loan for $27 billion for the data center. That debt is backed up by Meta's payments for leasing the facility. Meta essentially has a mortgage on the data center. Meta owns 20% of the entity but gets all of the computing power the data center generates. Because of the financial structure of the deal, the $27 billion loan never shows up on Meta's balance sheet. If the AI bubble bursts and the data center goes dark, Meta will be on the hook to make a multi-billion-dollar payment to Blue Owl for the value of the data center. Such financial arrangements, according to Luria, have something of a checkered past. "The term special purpose vehicle came to consciousness about 25 years ago with a little company called Enron," said Luria, referring to the energy company that collapsed in 2001. "What's different now is companies are not hiding it. But having said that, it's not something we should be leaning on to build our future." Silicon Valley is taking on all this new debt with the assumption that massive new revenues from AI will cover the tab. But again, there is reason for doubt. Morgan Stanley analysts estimate that Big Tech companies will dish out about $3 trillion on AI infrastructure through 2028, with their own cash flows covering only half of that. "If the market for artificial intelligence were even to steady in its growth, pretty quickly we will have over-built capacity, and the debt will be worthless, and the financial institutions will lose money," Luria said. Twenty-five years ago, the original dot-com bubble burst after, among other factors, debt financing built out fiber-optic cables for a future that had not yet arrived, said Luria, a lesson, it appears, tech companies are not worried about repeating. "If we get to the point after spending hundreds of billions of dollars on data centers that we don't need a few years from now, then we're talking about another financial crisis," he said. Another aspect of the over-heated AI landscape that is raising eyebrows is the circular nature of investments. Take a recent $100 billion deal between Nvidia and OpenAI. Nvidia will pump that amount into OpenAI to bankroll data centers. OpenAI will then fill those facilities with Nvidia's chips. Some analysts say this structure, where Nvidia is essentially subsidizing one of its biggest customers, artificially inflates actual demand for AI. "The idea is I'm Nvidia and I want OpenAI to buy more of my chips, so I give them money to do it," Kedrosky said. "It's fairly common at a small scale, but it's unusual to see it in the tens and hundreds of billions of dollars," noting that the last time it was prevalent was during the dot-com bubble. Lesser-known companies are getting in on the action, too. CoreWeave, once a crypto mining startup, pivoted to data center building to ride the AI boom. Major AI companies are turning to CoreWeave to train and run their AI models. OpenAI has entered deals with CoreWeave worth tens of billions of dollars in which CoreWeave's chip capacity in data centers is rented out to OpenAI in exchange for stock in CoreWeave, and OpenAI, in turn, could use that stock to pay its CoreWeave renting fees. Nvidia, meanwhile, which also owns part of CoreWeave, has a deal guaranteeing that Nvidia will gobble up any unused data center capacity through 2032. "The danger," said the MIT economist Acemoglu,"is that these kinds of deals eventually reveal a house of cards." Some influential investors are showing signs of bubble jitters. Tech billionaire Peter Thiel sold off his entire stake in Nvidia worth around $100 million earlier this month. That came after SoftBank sold a nearly $6 billion stake in Nvidia. And in recent weeks, AI bubble pessimists have rallied around Michael Burry, the hedge-fund investor who made hundreds of millions of dollars betting against the housing market in 2008. He was the subject of the 2015 film The Big Short. Since then, though, he's had a mixed reputation for market predictions, having warned about imminent collapses that never came to pass. For what it's worth, Burry is now betting against Nvidia, accusing the AI industry of hiding behind a bunch of fancy accounting tricks. He's homed in the circular deals between companies. "True end demand is ridiculously small. Almost all customers are funded by their dealers," Burry wrote on X. He later wrote: "OpenAI is the linchpin here. Can anyone name their auditor?" As tech companies sink billions into data centers, some executives themselves are freely admitting there looks to be some over exuberance. OpenAI CEO Sam Altman told reporters in August: "Are we in a phase where investors as a whole are overexcited about AI? My opinion is yes. Is AI the most important thing to happen in a very long time? My opinion is also yes." And Google chief executive Sundar Pichai told the BBC recently that "there are elements of irrationality" in the AI market right now. Asked how Google would fare if the bubble burst, Pichai responded: "I think no company is going to be immune, including us."

[13]

Huang contrasts Gelsinger's AI bubble warnings

Agentic AI emergence will demand far greater computing resources globally Nvidia CEO Jensen Huang has dismissed suggestions the global AI market is currently in an economic bubble, arguing instead that current trends point to fundamental changes in computing infrastructure. On the company's recent earnings call, Huang outlined a three-pronged rationale explaining why AI is driving long-term investment in new systems rather than speculative hype. He noted that industries handling data processing, ad recommendations, search systems, and engineering are increasingly turning to GPUs because traditional CPU-based infrastructure cannot meet the demands of AI workloads. Huang's assertions are in stark contrast to those of Pat Gelsinger, former CEO of Intel, who believes the AI sector is in bubble territory, though this could happen gradually rather than suddenly. Huang emphasized AI is not only being integrated into existing applications but will also enable entirely new software capabilities. He said the emergence of "agentic AI," which can operate with minimal user input, reason autonomously, and plan complex tasks. Such developments will require substantially greater computing resources, reinforcing the need for high-performance GPUs. Huang stated that Nvidia is uniquely positioned to address all three categories of AI adoption, encompassing data-intensive workloads, new applications, and autonomous AI operations. "There's been a lot of talk about an AI bubble," Huang said. "From our vantage point we see something very different." "As you consider infrastructure investments, consider these three fundamental dynamics," Huang said. "Each will contribute to infrastructure growth in the coming years." Nvidia reported revenue and profits exceeding analysts' expectations, with guidance also surpassing forecasts. Huang recently projected that AI chip sales could reach $500 billion by 2025 and 2026. The company noted its order backlog does not yet include deals with organizations such as Anthropic or the expanded agreement with Saudi Arabia. CFO Colette Kress confirmed Nvidia remains on track to meet revenue targets, highlighting robust demand for AI-driven systems. Investors have raised concerns about reliance on a small number of hyperscalers, but Huang stressed that Nvidia chips continue to boost cloud provider revenue through AI-enhanced recommendation engines. Huang believes the AI boom will increase traffic across enterprise systems, requiring greater inspection and monitoring capabilities. AI tools and expanding datasets are driving this trend, and Nvidia expects infrastructure growth to continue as AI applications scale. The CEO stressed that what appears as high capital expenditure today reflects foundational shifts rather than speculative investment. Huang concluded by asserting that investors and operators must consider these dynamics when evaluating the AI sector. Nvidia views AI-driven GPU adoption as a structural transformation in computing, signaling long-term growth potential beyond short-term market fluctuations. Via CNBC

[14]

Google boss sounds the alarm over trillion-dollar AI bubble

If fears of an AI bubble bursting were already keeping people up at night, recent comments from Alphabet CEO Sundar Pichai certainly won't help. The Google chief sat down with the BBC for an exclusive interview to talk all things AI -- from energy demands to UK investment to the future of jobs. But the most striking moment came when Pichai admitted that if the AI bubble does burst, no one is safe. "I think no company is going to be immune, including us," he told the BBC. In the interview, Pichai said that while the AI sector has seen tremendous growth, there's also a lot of "irrationality" fueling the boom as valuations and investments rocket upward. He warned that the industry can "overshoot" during hype cycles like this, drawing a direct parallel to the dot-com boom and bust of the late 90s and early 2000s. The dot-com era saw early internet companies skyrocket in value on pure optimism, only for the bubble to burst in 2000, wiping out hundreds of companies and countless jobs. The concern now is that AI may follow a similar trajectory. Big Tech valuations have surged in recent months: Alphabet has reached a valuation of $3.5 trillion, OpenAI has reportedly hit a $500 billion valuation, and NVIDIA has become the first company to ever surpass the $5 trillion mark. But cracks are beginning to show. In the past few weeks, several major investors have started offloading NVIDIA stock. On Monday, it was reported that Peter Thiel's hedge fund exited its entire $94 million position. Even more eyebrow-raising, Michael Burry -- famous for predicting the 2007-08 mortgage crisis -- is reportedly betting against NVIDIA and Palantir. Despite all this, Pichai himself appears largely unfazed. "We can look back at the internet right now. There was clearly a lot of excess investment, but none of us would question whether the internet was profound," he told the BBC. "I expect AI to be the same. So I think it's both rational and there are elements of irrationality through a moment like this."

[15]

Google CEO: "No company is going to be immune" if AI bubble bursts

Why it matters: Investors are increasingly nervous about the health of the AI frenzy, and the sustainability of the trillions in pledged spending in the coming years. What they're saying: If the bubble bursts, "I think no company is going to be immune, including us," Pichai said in what was billed as an exclusive interview. * "We can look back at the internet right now. There was clearly a lot of excess investment, but none of us would question whether the internet was profound," he told the British broadcaster. "I expect AI to be the same." * "So I think it's both rational and there are elements of irrationality through a moment like this." By the numbers: Shares in Google parent Alphabet closed at an all-time high Monday, having risen 51% this year alone. * Despite Pichai's warning, the stock was up another 0.5% in premarket trading early Tuesday. * The company is benefitting from surging demand for AI infrastructure, as well as growing consumer adoption of its own platform Gemini. The bottom line: Investors continue to aggressively buy stocks linked to the AI boom -- but they're also asking more questions about how long it can last. Go deeper: Why the AI economy might not be 1990s redux

[16]

Don't blindly trust everything AI tools say, warns Alphabet boss

Sundar Pichai says artificial intelligence models are 'prone to some errors' and warns of impact if AI bubble bursts The head of Google's parent company has said people should not "blindly trust" everything artificial intelligence tools tell them. In an interview with the BBC, Sundar Pichai, the chief executive of Alphabet, said AI models were "prone to errors" and urged people to use them alongside other tools. In the same interview, Pichai warned that no company would be immune if the AI bubble bursts. Since May, Google has introduced an "AI Mode" into its search using its Gemini chatbot, which aims to give users the experience of talking to an expert. Google's consumer AI model, Gemini 3.0, is expected to launch imminently but the company has yet to name a date. Pichai said that while AI tools were helpful "if you want to creatively write something", people "have to learn to use these tools for what they're good at, and not blindly trust everything they say". He told the BBC: "We take pride in the amount of work we put in to give us as accurate information as possible, but the current state-of-the-art AI technology is prone to some errors." There are concerns in Silicon Valley and beyond of a bubble as the value of AI tech companies has increased recently and companies are spending large amounts on the booming industry. Asked whether Google would be immune to the impact of an AI bubble bursting, Pichai said: "I think no company is going to be immune, including us." He added: "We can look back at the internet right now. There was clearly a lot of excess investment, but none of us would question whether the internet was profound. I expect AI to be the same. So I think it's both rational and there are elements of irrationality through a moment like this." Last month the head of America's largest bank said the chance of the US stock market crashing was far greater than many financiers believed. Jamie Dimon, the chair and chief executive of the Wall Street bank JPMorgan Chase, said he was "far more worried than others" about a serious market correction, which he predicted could come in the next six months to two years. Dimon said there were a "lot of things out there" creating an atmosphere of uncertainty, pointing to risks including the geopolitical environment, fiscal spending and the remilitarisation of the world.

[17]

'The Big Short' investor Michael Burry on AI bubble: 'There is a Cisco at the center of it all...Its name is Nvidia' | Fortune

Michael Burry has doubled down on his concerns of an AI bubble, drawing similarities between Cisco during the late '90's dot-com crash and one key tech company today. In his first Substack post entitled "The Cardinal Sign of a Bubble: Supply-Side Gluttony" published on Sunday, Burry, who was made famous for his prescience on the 2008 housing market collapse made famous in the 2015 film The Big Short, called the AI boom a "glorious folly," singling out Nvidia as a harbinger for when he expects the industry's bubble to burst. "Folly makes money. Creative destruction and manic folly are exactly why the U.S. is the center of innovation in the world," Burry said. "Companies are allowed to innovate themselves to death. And ever more spring up to do the same. Sometimes the new company is the same company on a pivot." During the dot-com boom, Burry said the tech industry was defined by "highly profitable large caps, among which were the so-called 'Four Horsemen' of the era -- Microsoft, Intel, Dell, and Cisco." Similarly, there are five publicly traded horsemen of the current AI boom, according to Burry: Microsoft, Google, Meta, Amazon and Oracle. Notably, Burry singled out Cisco as the company at the forefront of the dot-com bubble burst. The tech company's stock surged 3,800% between 1995 and 2000, becoming the most valuable company in the world with a market capitalization of about $560 billion. The tech firm's stock collapsed at the turn of the millennium, plummeting more than 80%. Today, Burry argued, history is repeating itself with today's AI boom: "And once again there is a Cisco at the center of it all, with the picks and shovels for all and the expansive vision to go with it," Burry said. "Its name is Nvidia." Burry has published a flurry of X posts casting doubt on the ballooning valuations of AI companies, in particular Nvidia, which he has criticized over the actual longevity of its chips, as well as the chipmakers' ability to sustain demand for its products. Earlier this month, Burry's hedge fund Scion Asset Management bought more than $1 billion in put options -- a contract that allows you to profit from an asset sold at a later date -- on Nvidia and Palantir, according to regulatory filings. That's before the investor quietly deregistered Scion just weeks later, effectively resigning from managing others' money. Similar to Cisco's record-breaking market cap 25 years ago, Nvidia has established itself as the world's most valuable company today, worth roughly $5 trillion. The company's swelling value has also concerned Lisa Shalett, Morgan Stanley Wealth Management's chief investment officer, who told Fortune in September she's worried about the industry's "Cisco moment" in the next 24 months. She said the tech companies surrounding Nvidia are "starting to become interwoven," with firms creating a circular financing loop. For example, Nvidia pledged to invest $100 million in OpenAI in September, and announced last week it will invest $10 billion into Anthropic. In return, Anthropic will invest $30 billion to scale its Claude AI model on Microsoft's Nvidia-powered Azure cloud platform. The continuous investments have, in effect, created one giant blob of AI companies passing the same billions of dollars back and forth. Nvidia, for its part, has pushed back against its skeptics. It reported another quarter of blockbuster earnings last week, including a 62% surge in revenue. Chief Financial Officer Colette Kress rebutted Burry's claim about the life of Nvidia's chips, saying in the earnings presentation that the company's hardware is long-lasting and efficient because of its CUDA software system. CEO Jensen Huang dismissed concerns of a bubble and circular funding in a Fox Business Network interview on "The Claman Countdown," saying the company has not doled out any money yet, and that the investments they plan to make are a "tiny percentage" of its revenues. "We reinvented computing for the first time in 60, 70 years," Huang said. "And so all of the computers that have been installed around the world is being modernized to accelerated computing and video GPUs and to artificial intelligence. And so this build-out is going to last us many years to come."

[18]

Top Economist Warns That AI Data Center Investments Are "Digital Lettuce" That's Already Starting to Wilt

AI chipmaker Nvidia beat Wall Street expectations this week, announcing soaring revenues while downplaying growing fears of an AI bubble. The company's chips have been at the center of the ongoing AI boom, with AI companies' valuations soaring to astronomical levels while their revenues continue to lag far behind. Despite plenty of shakiness in the market, investors still firmly believe that the trillions of dollars companies like OpenAI, Microsoft, and Oracle are planning to spend on AI infrastructure buildouts will one day deliver a return. But at the same time, economists are warning that those investors are overlooking some glaring problems with their plans to pile graphics processing units into enormous data centers to train and run immensely power-hungry AI models. For one, all of that hardware is degrading fast while running around the clock. "You're investing in something that is a perishable good," economist and author David McWilliams told Fortune, calling AI hardware "digital lettuce" that's "going to go off now." Worse yet, GPUs could also become obsolete as the technology improves. "Technological change suggests that if you buy a GPU today, the chip is going to be outdated next year," McWilliams added. To McWilliams, it's a recipe for disaster. He argues that the AI trade is "undoubtedly going to crash" -- and points out that the tech isn't creating any jobs, either. McWilliams isn't the first to point out some eyebrow-raising accounting in the sector. Michael Burry, who famously shorted the US housing market before its collapse in 2008, similarly argued earlier this month that AI companies' projected growth could be massively exaggerated, accusing them in a November 10 tweet of assuming it will take far longer for AI hardware to depreciate to boost the numbers. "By 2028, Oracle will overstate earnings 26.9 percent, Meta by 20.8 percent, etc.," he wrote. "But it gets worse," he added cryptically. "Companies are always upgrading their servers and networking gear and chips, so it isn't a new factor, but we haven't seen it at this kind of scale before," Ameriprise Financial Services chief market strategist Anthony Saglimbene told Bloomberg. "That's what is making investors nervous." While aging computer chips may feel inconsequential at first blush, they represent the beating heart at the core of the current AI hype. Firms have bet that scaling up these data centers will result in more capable AI models, a major assumption that experts are starting to challenge. But even if the AI bubble were to crash, McWilliams is optimistic about the US economy surviving it largely unscathed and remaining the center of innovation. Others, however, have a far more grim outlook, warning of a potential collapse that could send ripples through the financial market.

[19]

Nvidia says there's no AI bubble. Investors agree -- for now

On Wednesday afternoon, Jensen Huang looked straight at the market's favorite anxiety and waved it off. "There's been a lot of talk about an AI bubble. From our vantage point, we see something very different," the Nvidia CEO told analysts on the quarter's earnings call as he walked through $57 billion in quarterly revenue, a $65 billion forecast, and sold-out cloud GPUs. By the time he hung up, the stock was up over 6% in after-hours trading, analyst blasts were landing in inboxes with subject lines such as "AI Bubble Who?" with notes that they'd raised their earnings forecast (again), and even the people paid to worry about excess for a living sounded oddly relieved to let Huang win the argument -- at least for one more quarter.

[20]

Nvidia's Stellar Quarter Fails to Quell Bears as AI Valuation Fears Deepen on Wall Street - Decrypt

Pure-play AI software firms such as C3.ai were hit hardest, underscoring doubts about business models without established cash flows. Wall Street's conviction in the long-term potential of artificial intelligence faced its sternest test this week, and the markets delivered a complex, yet clear, message: high valuation anxieties trump fundamental strength. Despite Nvidia Corp. reporting blockbuster fiscal third-quarter earnings that easily surpassed consensus estimates, the market's reaction demonstrated that valuation concerns and uncertainty about the sustainability of the AI boom continue to hold investor sentiment firmly in bearish territory. The chipmaker, whose graphics processing units are the essential bedrock of the current AI revolution, reported revenue of $57 billion late Wednesday, exceeding expectations and issuing similarly robust guidance for the current period, projecting fourth-quarter sales of $65 billion. The results, fueled by seemingly insatiable demand from hyperscalers like Google parent Alphabet and Microsoft, should have ignited a sector-wide rally. Instead, the surge proved short-lived. Nvidia's stock, which initially jumped in after-hours trading and opened sharply higher on Thursday, rapidly reversed course, closing the session down approximately 3.15%. The dramatic reversal in the market's AI bellwether dragged the entire technology sector down with it, contributing to a 2.2% plunge for the tech-heavy Nasdaq Composite Index that day. The week's action was a stark manifestation of a broader debate raging among institutional investors: whether the multi-year AI rally has inflated into a speculative bubble. This skepticism is evidenced by a noticeable market rotation into defensive sectors. Throughout November, professional fund managers have been moving capital out of high-growth technology and AI-adjacent stocks and into sectors like healthcare, which have substantially outperformed the broader market. Tech, meanwhile, has been the S&P 500's worst-performing sector this month. Other key AI infrastructure plays followed Nvidia's slide. Rival Advanced Micro Devices (AMD) slumped nearly 8%, and other chipmakers contributed to the sell-off, with the PHLX Semiconductor Index declining nearly 5% on Thursday. The bearish sentiment was particularly painful for pure-play AI software vendors, many of which lack the established cash flows and diverse revenue streams of the Big Tech titans. C3.ai Inc. (AI), a prominent enterprise AI application provider, saw its stock price decline over the five-day period, underscoring the vulnerability of companies whose entire valuation rests on the promise of rapidly scaling AI revenue. The stock began the week trading around $13.44 per share but retreated steadily and was down 5% over the past five days, according to Yahoo Finance. This decline means C3.ai's shares are down more than 26% in the past month, a sign that investors are reassessing the risk associated with its current business model ahead of its December earnings report. The company faces stiff competition from major cloud providers now aggressively pushing their own AI platforms, and concerns remain regarding the long path to profitability for enterprise AI solutions. The divergence between Nvidia's underlying business strength and the stock market's lukewarm reception illustrates that while the AI revolution is undoubtedly real, investors are no longer willing to underwrite the sector's current valuations without clearer signs of sustained, broad-based commercialization -- outside of the largest cloud and chip companies.

[21]

Google CEO's warning about the AI bubble bursting: 'No company is going to be immune, including us'

With one of the world's top bankers, ex-Intel CEO Pat Gelsinger, and even OpenAI chief Sam Altman suggesting AI is in a bubble, Google's CEO has chimed in with thoughts of his own. When asked how the AI bubble bursting would affect Google Pichai tells the BBC the company would survive, but also that "no company is going to be immune, including us." In an interview with the British news organisation Google's Sundar Pichai talks at length about this technology as we enter "clearly the era of AI." Pichai has been the CEO of Google for over a decade now, and as such, he is one of the most influential voices in favour of the rise of generative AI tools. Google, alongside all its competitors, is committing a lot of time, money, and effort into the growth of AI. Pichai says, "AI is dramatically increasing demand for energy", adding that "maybe four years ago, Google was spending less than 30 billion dollars per year. This year, that number is going to be over 90 billion dollars." With exponential growth comes the potential of that growth stopping suddenly, and the industries built around it collapsing in response. Nvidia has become a company worth over $5 trillion, and that's partially due to the rise of AI and the costs of capable hardware. This knock-on effect has pumped up the worth of major AI companies, such as OpenAI, and would explain the AI commitments made by Google, Microsoft, Meta, and more. "No one company should own a technology as powerful as AI," says Pichai. "We can look back at the internet right now. There was clearly a lot of excess investment, but none of us would question whether the internet was profound or did it drive a lot of impacts. It fundamentally changed how we work digitally, as a society. I expect AI to be the same." But even successful industry bubbles can pop. For instance, the infamous dot-com bubble of the late '90s could be attributed to a broad trend of overvaluations of many internet companies and market saturation (among other things), but that doesn't mean that the invention of the internet isn't influential on the world around us today. Pichai also talks about the role of generative AI tools in the wider world going forward. 'Agentic' is the current buzzword around AI, and the notion of one AI that can autonomously complete assignments with little oversight is certainly intriguing. "Down the line, that means there are moments it can help you make a decision... ' should I invest in this stock?'... or 'my doctor is recommending a treatment. How should I think about the pros and cons of that treatment?" But Pichai doesn't envision AI as a one-stop solution for all queries. He urges people not to "blindly trust" AI as it is currently prone to errors. AI is known to have hallucinations, where it effectively makes things up. If you ask a chatbot a question it doesn't have an answer for, or it has scraped its answer from inaccurate sources, it can feed you misinformation unintentionally. As we trust these tools more, the effects of that misinformation can become more pronounced. "This is why people also use Google search, and we have other products that are more grounded in providing accurate information." When asked, "Could an AI agent do your job at some point?", Pichai says, "I think what a CEO does is maybe one of the easier things for an AI to do one day." So, at least if AI does take all our jobs, we'll all be job hunting together. Or not, I suppose, if Pichai's estimated net worth is accurate.

[22]

And...breathe out! The global economy survived NVIDIA's Q3 numbers and the AI bubble didn't burst (yet)