Google's TPUs Challenge NVIDIA's AI Chip Dominance as Demand Surges

2 Sources

2 Sources

[1]

Omdia: Demand for Google's TPU chips accelerates challenging NVIDIA's dominance By Investing.com

, /PRNewswire/ -- Omdia's latest research highlights the rapid growth in demand for Google (NASDAQ:GOOGL)'s Tensor Processing Unit (TPU) AI chips, a trend that may be strong enough to start chipping away at NVIDIA (NASDAQ:NVDA)'s market dominance in GPUs. 3Q results from Broadcom (NASDAQ:AVGO), whose Semiconductor Solutions division acts as a custom chip outsourcing partner for Google, Meta (NASDAQ:META), and several other AI players, give our analysts some insight into purchasing trends and information that is typically kept under wraps " how many custom processors is Google buying? Broadcom's CEO has repeatedly revised up his target for AI semiconductor revenue, aiming for for this year. Based on this, it is estimated that Google's TPUs could account for somewhere between " close to Omdia's existing estimates - and , depending on the breakdown between compute and networking devices. This figure includes a substantial number of Meta's MTIA chips, with a project for a mysterious third client expected to ramp up in 2025. Alexander Harrowell, Principal Analyst at Omdia noted: "Even though there is some uncertainty in the exact ratio between compute and networking devices, shipments of TPUs, even at the lower estimate, are growing at a pace fast enough to take share from NVIDIA for the first time. It's worth noting that Google's Cloud Platform business continues to grow as a share of Google's revenue while improving profitability. This could indicate that TPU-accelerated instance types or AI products running on TPUs are driving the growth at Google Cloud, especially as accelerator instance types are high-margin products."

[2]

Omdia Research: Google's Tensor Processing Units (TPUs) Are Eating NVIDIA's Lunch

This is not investment advice. The author has no position in any of the stocks mentioned. Wccftech.com has a disclosure and ethics policy. NVIDIA has reigned uncontested over the AI chip sphere for far too long. However, now it seems that some much-needed competition is finally putting up a challenge to the GPU manufacturer's full-spectrum dominance over this critical arena. To wit, Omdia Research has now published its fresh take on the dynamics within the AI chip sphere, noting that Goggle's Tensor Processing Units (TPUs) could account for between $6 billion and $9 billion in AI-related sales for Broadcom this year. As a refresher, Broadcom is currently developing custom AI chips (ASICs) for three major customers: Google, Meta, and ByteDance. The company is also developing next-gen AIXPUs with two other clients. For the benefit of those who might not be aware, many cloud providers have begun preferring custom chips or ASICs over NVIDIA's GPUs due to the former's cost advantage over the latter, which enables cost-effective optimization of internal workloads. As per Morgan Stanley's estimates, the custom AI chip market - driven primarily by cloud providers - will grow from $120 billion in 2024 to $300 billion by 2027, outpacing the growth rate for the GPU market. Coming back, Omdia believes that even if Broadcom's TPU shipments for 2024 ultimately clock-in at $6 billion, which constitutes the low-end of the research firm's estimated range, they would still be significant enough to dent NVIDIA's AI chip market share! Looking ahead, Omdia continues to see TPU-powered AI products driving broad-based growth for Google Cloud. Of course, this does not mean that NVIDIA is about to cede its market dominance anytime soon. As an illustration, Omdia notes elsewhere that Microsoft bought a whopping 485,000 units of NVIDIA's Hopper GPUs in 2024, while Meta bought another 224,000 units of these last-gen chips. Meanwhile, NVIDIA continues to prepare the ground for its next-gen Blackwell GPUs to take volume leadership from the older Hopper chips. Meanwhile, Citi expects the AI chip sphere to grow to a TAM of $380 billion by 2028, where AI GPUs (read NVIDIA) control 75 percent of the market while ASICs account for the residual 25 percent.

Share

Share

Copy Link

Omdia research reveals Google's Tensor Processing Units (TPUs) are gaining significant market share in the AI chip industry, potentially challenging NVIDIA's long-standing dominance.

Google's TPUs Gain Ground in AI Chip Market

Recent research by Omdia has highlighted a significant shift in the AI chip market, with Google's Tensor Processing Units (TPUs) experiencing rapid growth and potentially challenging NVIDIA's long-standing dominance in the field

1

. This development marks a crucial turning point in the AI hardware landscape, as it represents the first time NVIDIA's market share might be notably impacted by a competitor.Broadcom's Role and Revenue Projections

Broadcom, acting as a custom chip outsourcing partner for major tech giants including Google and Meta, has provided insights into the growing demand for AI chips. The company's CEO has repeatedly revised upward the target for AI semiconductor revenue, now aiming for between $6 billion and $9 billion this year

1

. A substantial portion of this revenue is attributed to Google's TPUs, with estimates ranging from $6 billion to $9 billion, depending on the mix between compute and networking devices2

.Impact on Google Cloud and Market Dynamics

The surge in TPU demand appears to be driving growth in Google's Cloud Platform business. Alexander Harrowell, Principal Analyst at Omdia, noted that Google Cloud's increasing share of Google's revenue and improving profitability could indicate that TPU-accelerated instance types or AI products running on TPUs are fueling this growth

1

. This trend suggests that Google's custom AI chips are not only gaining market share but also enhancing the company's cloud services offerings.The Broader AI Chip Landscape

While Google's TPUs are making significant strides, the AI chip market remains dynamic and competitive. Microsoft and Meta continue to be major customers for NVIDIA's GPUs, with Microsoft reportedly purchasing 485,000 units of NVIDIA's Hopper GPUs in 2024, and Meta acquiring 224,000 units

2

. NVIDIA is also preparing to launch its next-generation Blackwell GPUs, aiming to maintain its market leadership.Related Stories

Future Market Projections

The AI chip market is poised for substantial growth in the coming years. Morgan Stanley estimates that the custom AI chip market, primarily driven by cloud providers, will grow from $120 billion in 2024 to $300 billion by 2027, outpacing the growth rate of the GPU market

2

. Citi projects an even larger total addressable market of $380 billion by 2028, with AI GPUs (primarily NVIDIA) controlling 75% of the market and ASICs accounting for the remaining 25%2

.Implications for the AI Industry

The rise of Google's TPUs and other custom AI chips represents a significant shift in the AI hardware landscape. This trend towards custom chips or ASICs is driven by cloud providers seeking cost-effective solutions for optimizing internal workloads

2

. As competition intensifies, it may lead to increased innovation, potentially benefiting the broader AI industry through improved performance, efficiency, and cost-effectiveness of AI computations.References

Summarized by

Navi

[1]

Related Stories

Google's custom AI chips draw billions from Meta and Anthropic, challenging Nvidia's dominance

28 Nov 2025•Technology

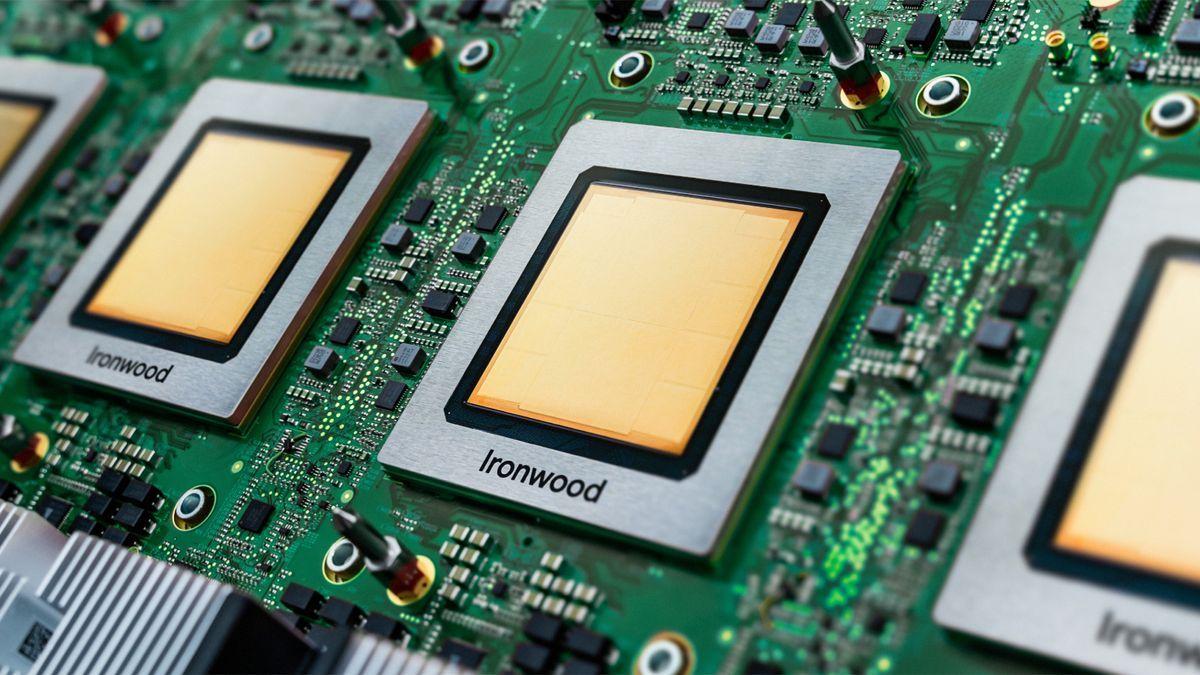

Google Unleashes Ironwood TPU v7: Seventh-Generation AI Chips Challenge Nvidia's Dominance

06 Nov 2025•Technology

Google TPUs Challenge Nvidia's AI Chip Dominance as Meta Explores Billion-Dollar Switch

25 Nov 2025•Business and Economy

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

Anthropic takes Pentagon to court over unprecedented supply chain risk designation

Policy and Regulation

3

Meta smart glasses face lawsuit and UK probe after workers watched intimate user footage

Policy and Regulation