Intuit Introduces Agentic AI to Enterprise Suite, Revolutionizing Mid-Market Business Operations

3 Sources

3 Sources

[1]

Intuit brings agentic AI to the mid-market saving organizations 17 to 20 hours a month

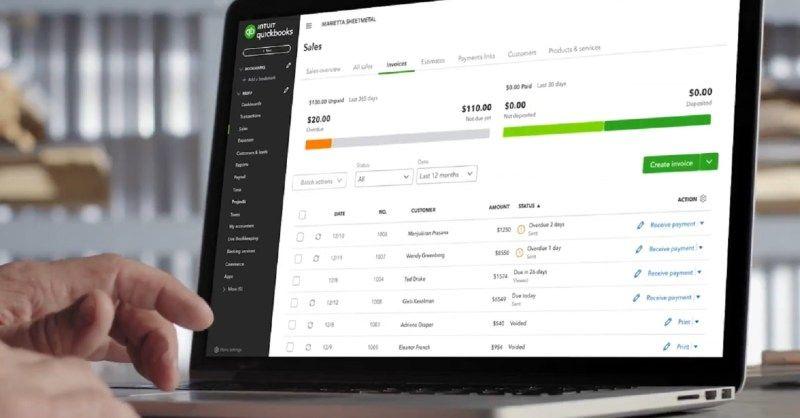

Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now One of the fastest-growing segments of the business market faces a technology paradox. They've outgrown small business tools but sometimes remain too small for many types of traditional enterprise solutions. That's the domain of the mid-market, which Intuit defines as companies that generate anywhere from $2.5 million to $100 million in annual revenue. Mid-market organizations tend to operate differently from both small businesses and large enterprises. Small businesses might run on seven applications. Mid-market companies typically juggle 25 or more disconnected software tools as they scale. Unlike enterprises with dedicated IT teams and consolidated platforms, mid-market organizations often lack resources for complex system integration projects. This creates a unique AI deployment challenge. How do you deliver intelligent automation across fragmented, multi-entity business structures without requiring expensive platform consolidation? It's a challenge that Intuit, the company behind popular small business services including QuickBooks, Credit Karma, Turbotax and Mailchimp, is aiming to solve. In June, Intuit announced the debut of a series of AI agents designed to help small businesses get paid faster and operate more efficiently. An expanded set of AI agents is now being introduced to the Intuit Enterprise Suite, which is designed to help meet the needs of mid-market organizations. The enterprise suite introduces four key AI agents - finance, payments, accounting and project management - each designed to streamline specific business processes. The finance agent, for instance, can generate monthly performance summaries, potentially saving finance teams up to 17-20 hours per month. The deployment provides a case study in addressing the needs of the mid-market segment. It reveals why mid-market AI requires fundamentally different technical approaches than those for either small businesses or enterprise solutions. "These agents are really about AI combined with human intelligence," Ashley Still, executive vice president and general manager, mid-market at Intuit told VentureBeat. "It's not about replacing humans, but making them more productive and enabling better decision-making." Mid-market multi-entity AI requirements build on existing AI foundation Intuit's AI platform has been in development over the last several years at the company under the platform name GenOS. The core foundation includes large language models (LLMs), prompt optimization and a data cognition layer that understands different data types. The company has been building out agentic AI to automate complex business processes since 2024. The mid-market agents build on this foundation to address the specific needs of mid-market organizations. As opposed to small businesses, which might only have one line of operations, a mid-market organization could have several lines of business. Rather than requiring platform consolidation or operating as disconnected point solutions, these agents function across multi-entity business structures while integrating deeply with existing workflows. The Finance Agent exemplifies this approach. It doesn't just automate financial reporting. It creates consolidated monthly summaries that understand entity relationships, learns business-specific metrics and identifies performance variances across different parts of the organization. The Project Management Agent addresses another mid-market-specific need: real-time profitability analysis for project-based businesses operating across multiple entities. Still explained that, for example, construction companies need to understand the profitability on a project basis and see that as early in the project life cycle as possible. This requires AI that correlates project data with entity-specific cost structures and revenue recognition patterns. Implementation without disruption accelerates AI adoption The reality for many mid-market companies is that they want to utilize AI, but they don't want to deal with the complexity. "As businesses grow, they're adding more applications, fragmenting data and increasing complexity," Still said. "Our goal is to simplify that journey." What's critical to success and adoption is the experience. Still explained that the AI capabilities of the mid-market are not part of an external tool, but rather an integrated experience. It's not about using AI just because it's a hot technology; it's about making complex processes faster and easier to complete. While the agentic AI experiences are the exciting new capabilities, the AI-powered ease of use starts at the beginning, when users set up Intuit Enterprise Suite, migrating from QuickBooks or even just spreadsheets. "When you've been managing everything in spreadsheets or different versions of QuickBooks, the first time, where you actually create your multi-entity structure, can be a lot of work, because you've been managing things all over the place," Still said. "We have a done-for-you experience, it basically does that for you, and creates the chart of accounts" Still emphasized that the onboarding experience is a great example of something where it's not even necessarily important that people know that it's AI-powered. For the user, the only thing that really matters is that it's a simple experience that works. What it means for enterprise IT Technology decision-makers evaluating AI strategies in complex business environments can use Intuit's approach as a framework for thinking beyond traditional enterprise AI deployment: The mid-market segment's unique needs suggest the most successful AI deployments will deliver enterprise-grade intelligence through small-business-grade implementation complexity. For enterprises looking to lead in AI adoption, this development means recognizing that operational complexity is a feature, not a bug. Seek AI solutions that work within that complexity rather than demanding simplification. The fastest AI ROI will come from solutions that understand and enhance existing business processes rather than replacing them.

[2]

Intuit Adds Agentic AI to Its Enterprise Suite | PYMNTS.com

By completing this form, you agree to receive marketing communications from PYMNTS and to the sharing of your information with our sponsor, if applicable, in accordance with our Privacy Policy and Terms and Conditions. The agents are part of a larger expansion of the product that includes new automation and financial management capabilities for mid-market companies, according to a Tuesday (July 22) press release. "Mid-market companies are turning to Intuit Enterprise Suite to reduce the cost and complexity of growing their business," Ashley Still, executive vice president, Intuit Mid-Market, said in the release. "This release further streamlines multi-entity financial management and gives customers proactive business intelligence. Through the power of AI, we're giving businesses access to more accurate data, faster, so they can make more informed decisions and focus on driving growth." The company's AI agents can automate "tedious, day-to-day financial, accounting and payments tasks," the release said. The offerings include a finance agent that provides reporting and scenario planning, and an account agent that automates bookkeeping and transaction categorization, among others. The product launch comes as AI agents are being turned "into autonomous software workers capable of making decisions, executing tasks and collaborating in ways that were once the exclusive domain of humans," according to the PYMNTS Intelligence report "Payments Execs Say AI Agents Give Payments an Autonomous Overhaul." "We now actually think of agents as one of the boxes in our org chart," i2c CEO and founder Amir Wain told PYMNTS last month. "It's not about being fancy," he added. "It's about being effective." However, with more autonomy comes more responsibility. As AI agents become more powerful, the risks around them increase. "You've got to treat these AI agents as non-human actors with unique identities in your system," Kathryn McCall, chief legal and compliance officer at Trustly, told PYMNTS last month. "You need audit logs, human-readable reasoning and forensic replay. Can your agent initiate invoice creation but not approve disbursement without human review? What's the scope? What are they allowed to do and what are they not allowed to do?" Forward-thinking companies are building in guardrails like explainability, human oversight and ethical fail-safes to prevent costly missteps and ensure accountability.

[3]

Intuit Launches New Agentic AI Experiences and Financial Management Capabilities for Intuit Enterprise Suite to Drive Mid-Market Business Growth

Intuit Inc. announced significant updates to Intuit Enterprise Suite, the all-in-one solution designed to help mid-market businesses scale with the addition of new proactive AI agents, enhanced automation, business intelligence, and financial management capabilities that increase productivity and profitability. These enhancements deliver an integrated solution built for enterprise-level operations, all in one place on the Intuit platform. Introduced last September, Intuit Enterprise Suite is transforming how more complex, mid-market businesses grow, eliminating the need for companies to juggle multiple applications to manage their operations. Intuit Enterprise Suite provides businesses with a configurable, AI-powered solution that includes ERP-level multi-entity and multi-dimensional financial management capabilities, business intelligence and reporting, payments and bill pay, project profitability, payroll, HR, and marketing, in one connected, scalable, cloud-based product. Introducing Intuit AI Agents: Streamlining Operations and Optimizing Cash Flow: Intuit's new AI agents act as intelligent business partners, transforming how companies manage their finances by delivering done-for-you experiences through the automation of tedious, day-to-day financial, accounting, and payments tasks. The result: 78% of customers say Intuit's AI makes it easier for them to run their business; and 68% state it allows them to spend more time growing their business. Finance Agent: Provides robust reporting, KPI analysis, and scenario planning and forecasting based on performance and peer benchmarking, helping finance teams make smart decisions to achieve financial goals. Accounting Agent: Automates bookkeeping and transaction categorization, and assists in reconciliation, delivering cleaner, more accurate books. Project Management Agent: Automates projects from start to finish, creating estimates, setting up project details, plans, and tasks, and suggesting profitability targets. It also builds project summaries and provides insights and recommendations to improve profitability for future projects. Payments Agent: Optimizes and grows cash flow by getting businesses paid an average of 5 days faster by automating and streamlining payment collections with tailored acceleration strategies that predict late payments, automate invoice tracking, and create and send invoices and reminders. Improved Multi-Entity Financial Management: Holistic Views for Better Decision Making: Intuit Enterprise Suite now delivers ERP-level operations with new and enhanced features that help more complex businesses better manage their multiple entities, users, and locations with real-time visibility, all in one place.

Share

Share

Copy Link

Intuit has launched new AI agents and enhanced capabilities for its Enterprise Suite, designed to streamline operations and boost productivity for mid-market businesses, potentially saving organizations up to 20 hours per month.

Intuit's AI Innovation for Mid-Market Businesses

Intuit, the company behind popular business services like QuickBooks and TurboTax, has announced a significant expansion of its Enterprise Suite with the introduction of agentic AI experiences. This move is aimed at addressing the unique challenges faced by mid-market businesses, which Intuit defines as companies generating between $2 million and $100 million in annual revenue

1

.

Source: PYMNTS

The Mid-Market Technology Paradox

Mid-market companies often find themselves in a technological limbo, having outgrown small business tools but lacking the resources for full-scale enterprise solutions. These organizations typically juggle 25 or more disconnected software tools, creating a fragmented operational environment

1

. Intuit's new AI agents are designed to bridge this gap, offering intelligent automation without the need for expensive platform consolidation.AI Agents: The Core of the Innovation

The expanded Enterprise Suite introduces four key AI agents:

- Finance Agent: Generates monthly performance summaries, potentially saving finance teams up to 17-20 hours per month

1

. - Accounting Agent: Automates bookkeeping, transaction categorization, and assists in reconciliation

3

. - Project Management Agent: Automates project lifecycle management, from estimates to profitability analysis

3

. - Payments Agent: Optimizes cash flow by predicting late payments and automating invoice tracking, helping businesses get paid an average of 5 days faster

3

.

Source: VentureBeat

These agents are built on Intuit's AI platform, GenOS, which incorporates large language models (LLMs), prompt optimization, and a data cognition layer

1

.Addressing Mid-Market Specific Needs

Unlike solutions for small businesses or large enterprises, Intuit's mid-market AI is designed to function across multi-entity business structures while integrating with existing workflows. For instance, the Finance Agent creates consolidated monthly summaries that understand entity relationships and identify performance variances across different parts of the organization

1

.Implementation and User Experience

Intuit emphasizes the importance of seamless implementation and user experience. The AI capabilities are integrated into the Enterprise Suite, rather than existing as external tools. This integration extends to the initial setup process, where AI assists in creating multi-entity structures and charts of accounts

1

.Related Stories

Impact and Adoption

Early results show promising adoption rates:

- 78% of customers report that Intuit's AI makes it easier to run their business

- 68% state it allows them to spend more time on business growth

3

Ashley Still, Executive Vice President and General Manager of Mid-Market at Intuit, emphasizes that these AI agents are designed to complement human intelligence, not replace it. "It's not about replacing humans, but making them more productive and enabling better decision-making," she stated

1

.The Broader Context of AI in Business

The introduction of these AI agents aligns with a broader trend in the business world. As noted by i2c CEO Amir Wain, some companies are beginning to think of AI agents as part of their organizational structure

2

. However, this increased autonomy also raises important questions about responsibility and risk management.Conclusion

Intuit's introduction of agentic AI to its Enterprise Suite represents a significant step in addressing the unique needs of mid-market businesses. By offering intelligent automation across fragmented, multi-entity business structures, Intuit aims to increase productivity and profitability for this crucial market segment.

References

Summarized by

Navi

[1]

Related Stories

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

Anthropic takes Pentagon to court over unprecedented supply chain risk designation

Policy and Regulation

3

Meta smart glasses face lawsuit and UK probe after workers watched intimate user footage

Policy and Regulation