Intuit Revolutionizes QuickBooks with AI Agents for Enhanced Business Efficiency

4 Sources

4 Sources

[1]

QuickBooks' new AI agents accelerate business efficiency

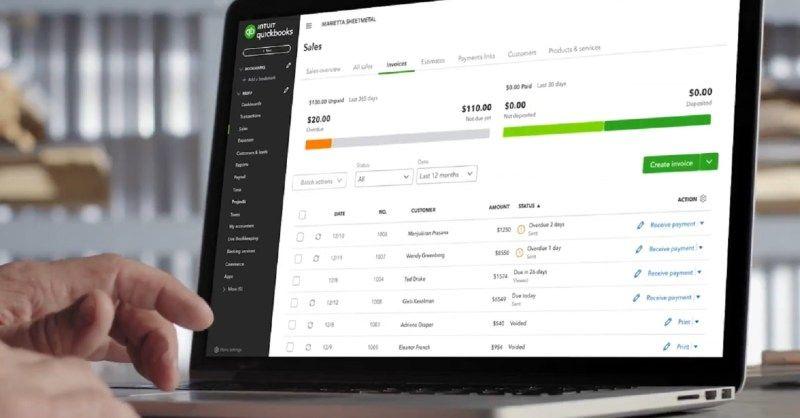

Intuit is reimagining business operations, and its latest upgrade to QuickBooks is a paradigm shift. Starting July 1, U.S. customers will have access to AI agents that are deployed across QuickBooks Online, backed by redesigned web and mobile interfaces. This virtual team will dramatically reduce the time businesses spend on manual tasks, up to 12 hours a month, according to Intuit's internal data. These aren't your general-purpose chatbots. They're vertical-specific, domain-trained tools integrated within QuickBooks ecosystem to handle complex tasks autonomously and proactively. Early results are speaking for themselves: 78% of customers report that Intuit's AI makes running their business easier, while 68% say they now have more time to grow their business instead of being buried in the back office. 90% off at Quickbooks Meet the AI Agents Powering the Future of Work Let's explore the core agents driving this transformation: Payments Agent: boosts cash flow by helping your business get paid up to five days faster. It predicts late payments, automates invoice creation, tracks outstanding balances, and sends reminders, all without you having to lift a finger. Accounting Agent: Say goodbye to spreadsheet sprawl. This agent handles your bookkeeping and categorizes transactions as they happen, minimizing errors and delivering accurate, reconciled books. Finance Agent: Designed for growing and mid-market businesses, the Finance Agent offers deep financial insight through KPI monitoring, scenario planning, and peer benchmarking. It will provide your finance team with actionable, data-driven forecasts to guide long-term strategy. Customer Hub: The centralized command center for CRM gets a serious upgrade with two new agents. First, the Customer Agent automates lead sourcing, email follow-ups, meeting scheduling, and customer tracking. Coming later this year, the Marketing Agent will sync with Mailchimp to automate audience segmentation and campaign execution. A New Interface Built for Business Intelligence All agents are paired with human experts for users who want an extra level of assurance or guidance. You get all of this wrapped in a modern UI built for real-world application. Customizable dashboards, mobile-first responsiveness, and widget-driven layouts bring business metrics and AI outputs front and center so nothing falls through the cracks. Quickbooks is redefining what accounting software can do. These AI agents are built to scale with your business and eliminate the need to constantly switch between tools or dashboards. That's real operational efficiency, not merely hype. Whether you're a solopreneur, a startup, or a scaling enterprise, this new experience in QuickBooks is designed to let you focus on strategy and growth, your team of AI agents will handle the grind. 90% off at Quickbooks

[2]

Meet Your New Virtual QuickBooks Team: Intuit's AI Agents

Give Your Excel Sheets a Visual Makeover With This Simple Hack This article is sponsored by Intuit. Product choices and opinions expressed are from the sponsor and do not reflect the views of MakeUseOf editorial staff. The word "spreadsheet" is enough to send shivers up someone's spine. Say it around a small-business owner and they'll be conjuring up visions of tax write-off confusion, cash-flow woes, delayed invoices, and endless financial busy work that takes them away from their actual business. This is where Intuit QuickBooks shines. The cloud-based financial management software has been a longtime staple in the small- and mid-sized business world, helping everyone from freelancers and bookkeepers to accountants and business owners. QuickBooks has always made financial management easier -- invoicing, payroll, tax prep, expense tracking, and more -- and now it's evolving to meet the latest and greatest tech capabilities that AI has to offer. Intuit QuickBooks' new AI agents are like a virtual workforce -- a team just for you -- that's always at the ready and working behind the scenes to streamline your business and make your life easier. This game-changing, foundational update to the already intuitive and powerful software will help users cut down on busywork and make smarter decisions while allowing their businesses to thrive. "Intuit's AI-driven expert platform is transforming how businesses run and grow with first-of-its-kind agentic AI experiences," says Intuit CEO Sasan Goodarzi. "When our vast amounts of data and AI capabilities are combined with the power of trusted human experts, Intuit's uniquely designed, integrated platform unlocks next-level efficiencies, profitability, and growth for businesses." Inside the New Intuit AI Agent Experience Intuit QuickBooks Intuit QuickBooks is a leading accounting software solution designed to help small businesses and self-employed professionals manage their finances with ease. From tracking income and expenses to generating invoices, running payroll, and preparing taxes, QuickBooks streamlines day-to-day financial tasks. With powerful reporting tools and cloud-based access, it offers real-time insights into your business's financial health -- whether you're at your desk or on the go. See at QuickBooks Expand Collapse The new AI agents debuted in the US on July 1, and so far, 78% of customers say that Intuit's AI has made it easier for them to run their business. The introduction of Inuit's AI agents isn't just an update; it's a holistic platform improvement that offers a completely new level of support. The new QuickBooks experience begins with a fully redesigned and personalized homepage layout, featuring customizable widgets and a business feed showing real-time insights, recommendations, and a summary of the tasks completed by your AI agents. The mobile app has also been redesigned with a modern interface so that you can capitalize on the AI agents and access your business insights wherever you are. The agents, together with trusted human experts, create a powerful virtual team that proactively manages tasks across accounting, payments, financial planning, and customer relationship management. Formerly time-consuming tasks such as categorizing transactions, tracking invoices, and forecasting cash flow can now be delegated to the AI agents while you maintain full control over your data and all decision-making. The AI agents can make recommendations and execute on your behalf, but you're still in the driver's seat when it comes to pulling the trigger on business decisions. Meet the Intuit AI Agent Team It's time to meet the new support team! These are the various specialized AI agents that will help you and your business every step of the way. Payments Agent The Payments Agent is there to keep your payments and invoices on track, ensuring that your business gets paid on time while helping to optimize and grow your cash flow. Inuit's Beta testing found that when compared to businesses sending standard invoice reminders to the same customers, the businesses using the Payments Agent were paid an average of five days faster. The Payments Agent can deliver tailored acceleration strategies that predict late payments, it can automate invoice tracking, plus it creates and sends invoices and reminders -- just more busy work that's taken off your plate. Accounting Agent If you struggle when you're in the weeds with transaction categorization, bookkeeping, and reconciliation, the Accounting Agent will be your new best friend. The Accounting Agent's specialty is improving accuracy and reducing human error, so you end up with cleaner, more accurate books. While you focus on more important aspects of your business, the Accounting Agent can automate bookkeeping and transaction categorization, and assist in reconciliation. Finance Agent The Finance Agent is there to help your company achieve its financial goals. It can help you and your team with financial forecasting, making recommendations that will allow you to make smarter business decisions for the growth of your company. It goes beyond basic reporting by delivering advanced tools for performance tracking, KPI analysis, peer benchmarking, and scenario planning, offering a comprehensive solution for managing the financial health of growing, mid-market businesses. Customer Agent Within the QuickBooks Customer Hub, the Customer Agent is ready to help you manage leads and track customer opportunities and interactions in the sales cycle. This powerful AI agent can automate and streamline the sales and customer relationship management process, including sourcing leads, drafting email responses, suggesting and scheduling meetings, and more. This agent can transform how you track interactions in your sales pipelines while capitalizing on more opportunities. Future Intuit AI Agents Later this year, also within the QuickBooks Customer Hub, the Marketing Agent will be making its debut. This agent will focus on automating audience management and help drive customer acquisition and retention. The Marketing Agent will also assist with campaign execution by integrating with Mailchimp to deliver powerful marketing content. Also coming later this year are two new agents that will be ideal for larger and growing businesses. The Payroll Agent and Project Management Agent will help tackle more complex tasks and boost productivity even further by collecting employee time and attendance data, running payroll at your command, plus managing project quotes, milestones, and budgets. The Bigger Picture and Future of Intuit's AI Agents Intuit's new AI agents represent a monumental shift for QuickBooks, going from a tool and software to a proactive, powerful business partner. They will work in tandem with AI-enabled human experts in QuickBooks Live to deliver a collaborative approach to running your business and providing expert advice. Accountants and business owners are now empowered with more insight, and even more importantly, more time to focus on strategy rather than spreadsheets. The feedback is already rolling in, and business owners are thrilled with the new features that will help take their businesses to the next level. "I need more time to be able to invest back into my business," says business owner Kurtis Graham, founder of COSIGN Enterprises, LLC. "Intuit's AI can help me save several hours a month and drive revenue for my business. That's a win-win for my business." The future of QuickBooks holds even more: additional agents, more connectivity within the Intuit ecosystem of products and services, and integration with third-party apps. A new standard has been set for the power and capabilities of financial management. By combining automation, expert guidance, and smart forecasting, QuickBooks is helping entrepreneurs and finance teams focus less on admin and more on growth. The software tool is now your trusted teammate.

[3]

Intuit Upgrades QuickBooks as Small Businesses Tap AI for Accounting | PYMNTS.com

By completing this form, you agree to receive marketing communications from PYMNTS and to the sharing of your information with our sponsor, if applicable, in accordance with our Privacy Policy and Terms and Conditions. The new enhancements are designed to offer companies the use of artificial intelligence (AI) automation to help eliminate the use of "multiple disconnected tools," Intuit said in a news release Tuesday (July 29). "As businesses grow in size and complexity, we know that they need a financial technology platform that provides deeper customisation, enhanced automation and features to get critical jobs done," Ciarán Quilty, Intuit's senior vice president of international, said in the release. "We're committed to listening to our customers to help businesses and accountants work smarter, not harder, whilst gaining the financial expertise and confidence they need to succeed." Among the updates is "QuickBooks Payments," letting users connect their bank accounts to a "pay now" button on invoices to reduce late payments. In addition, Intuit now offers an AI-powered bank feed, aimed at addressing issues related to categorizing bank transactions, which the company calls "one of the most repetitive and error-prone tasks in accounting." This tool can learn from users' actions and suggest categories based on historical patterns, letting businesses streamline workflows and improve accuracy. These updates come one week after Inuit added AI agents to its Enterprise Suite, which can handle routine accounting tasks and other duties. As PYMNTS wrote soon after that launch, tools like these are helping small medium-sized business (SMB) owners use AI to level the accounting services playing field, offering these smaller operations access to tools that were once solely the domain of large enterprises. "AI will amplify the value of accounting services for SMBs," Ariege Misherghi, senior vice president and general manager of accounts payable, accounts receivable and accountant channel at Bill, said in an interview with PYMNTS. "Once routine tasks like data extraction and invoice processing are automated, accountants will be freed up to focus on higher value advisory work that only humans can provide: applying judgement, guiding SMBs through complex financial decisions and delivering strategic insights," Misherghi added. Lisa Huang, senior vice president of product management at Xero, told PYMNTS that many accounting systems remain manual despite mounting external pressures for the industry. "The accounting and bookkeeping industry is at a turning point," Huang said. "Many professionals are overworked and under-resourced, facing increasing client demand and rising pressure from evolving regulatory and compliance requirements."

[4]

Intuit Launches Intelligent Automations to Simplify Accounting for Businesses

Latest QuickBooks updates bring faster payments and improved financial compliance to businesses and their accountants Intuit Inc. (Nasdaq: INTU), the global financial technology platform that makes Intuit TurboTax, Credit Karma, QuickBooks, and Mailchimp, announced today the launch of a series of new product innovations in Intuit QuickBooks, that deliver a more intelligent and automated accounting experience for businesses and their accountants across international markets. These enhancements reflect Intuit's commitment to continuous innovation -- delivering both everyday efficiencies and breakthrough capabilities that redefine how businesses run and grow, and how accounting is done. They also mark the ongoing evolution of the Intuit platform, offering all-in-one-place business solutions that leverage AI to automate everyday tasks and manage complex workflows, bringing together the data they need, and eliminating the use of multiple disconnected tools. The full suite of innovations can be explored in detail at Intuit's new QuickBooks Launchpad; a central resource supporting users in staying up-to-date with what's new and what's next, in terms of product features and innovations. 1. QuickBooks Payments Late payments remain a significant challenge for businesses, with 73% of UK SMBs impacted by delayed payments, and 31% spending 20-30 hours per month chasing customers. Intuit has introduced a faster, more secure way to enable invoices to be settled*. QuickBooks Payments, now available in beta, allows QuickBooks users to connect their bank account to a pay now button on invoices, so that their customers can complete a direct payment in just a few clicks. Payments are automatically reconciled, keeping books up to date with minimal manual effort. This new functionality is fully integrated with QuickBooks Online and works across all devices, supporting quicker settlement times, and with competitive transaction fees. 2. AI-Powered Bank Feed Categorising bank transactions is one of the most repetitive and error-prone tasks in accounting. Intuit's new AI-powered bank feed in QuickBooks addresses this by learning from users' previous actions and suggesting categories based on historical patterns. Each suggestion is accompanied by a clear explanation, allowing users to review, approve, or amend with confidence -- streamlining workflows and improving accuracy. This enhanced feed offers more accurate categorisation suggestions, allows for inline editing of fields (like category, supplier, class, location, and product/service), and provides payee suggestions with the ability to add new payees directly from the bank feed. This significantly boosts efficiency and provides full transparency on why each suggestion was made, allowing users to maintain control, whilst leveraging AI as much or as little as is needed. 3. Out-of-the-box support for depreciation methods Calculating depreciation on business assets can be complex, particularly for mid-sized businesses managing extensive or ageing asset portfolios. Intuit has streamlined and automated how its customers track the depreciation of fixed assets in QuickBooks Online Advanced, which now supports reducing balance depreciation, expanding its fixed asset capabilities to better meet the needs of finance teams. Previously limited to straight-line depreciation, users can now apply the reducing balance method by entering a rate, with QuickBooks automatically handling the calculations and updating reports. This approach provides a more accurate reflection of asset value over time. By automating this popular depreciation calculation and providing new filtering options of categories in the asset register, Intuit helps customers reduce manual errors, maintain compliance with accounting standards, and supports real-time reporting. 4. Construction Industry Scheme (CIS) enhancements Managing CIS obligations can be complex for contractors and their advisors. QuickBooks Advanced, Plus, Essentials and Simple Start plans now allow users to automatically bulk-send monthly CIS statements to subcontractors directly after filing. This update cuts hours of repetitive work each month, helping users stay organised and audit-ready. To further support compliance, new CIS reminders enable users to schedule email alerts ahead of each month's deadline. Admin users within QuickBooks can set up reminders and receive the alerts via email, making it easier to submit returns on time and avoid late filing penalties. QuickBooks also now supports direct subcontractor verification with HMRC. Users can check subcontractor status within the platform, store Government Gateway credentials securely, and view the date of verification, to help users know when re-verification is due. By reducing manual steps and consolidating key CIS tasks, these features offer a more efficient, compliant way to manage construction industry obligations. Ciarán Quilty, Senior Vice President of International at Intuit said: "As businesses grow in size and complexity, we know that they need a financial technology platform that provides deeper customisation, enhanced automation and features to get critical jobs done. We're committed to listening to our customers to help businesses and accountants work smarter, not harder, whilst gaining the financial expertise and confidence they need to succeed. Driven by direct feedback from our customers, these latest innovations are powerful examples of how we're using AI to simplify financial workflows, improve accuracy, and give our customers more time to focus on what matters most. We're re-imagining our entire connected business platform and I couldn't be more excited about what's coming." Aaron Patrick, ACA, FMAAT, and Head of Accounting at Boffix Ltd said: "I jumped at the chance to switch to the new QuickBooks experience, and the AI-powered bank feed alone has already saved hours of manual review and given my clients greater confidence in their records. As an accountant, I'm especially looking forward to the roll out of the enhancements to CIS. This will help us deliver compliance more quickly and free up time to focus on providing more support for our clients." Disclaimer: This information is intended to outline our general product direction, but represents no obligation and should not be relied on in making a purchasing decision. Additional terms, conditions and fees may apply with certain features and functionality. Eligibility criteria may apply. Product offers, features, and functionality are subject to change without notice. *Based on a 2023 survey commissioned by Intuit QuickBooks of 2,008 small-medium business owners. About Intuit Intuit is the global financial technology platform that powers prosperity for the people and communities we serve. With approximately 100 million customers worldwide using products such as TurboTax, Credit Karma, QuickBooks and Mailchimp, we believe that everyone should have the opportunity to prosper. We never stop working to find new, innovative ways to make that possible. Please visit us at Intuit.com and find us on social for the latest information about Intuit and our products and services. Intuit Limited registered in England (Company No.: 2679414) Registered address and principal place of business: 5th Floor Cardinal Place, 80 Victoria Street, London, SW1E 5JL, England. View source version on businesswire.com: https://www.businesswire.com/news/home/20250729172197/en/

Share

Share

Copy Link

Intuit introduces AI-powered agents to QuickBooks, offering automated solutions for accounting, payments, finance, and customer management, aimed at boosting efficiency for small and medium-sized businesses.

Intuit's AI Revolution in QuickBooks

Intuit, the global financial technology platform behind QuickBooks, has unveiled a groundbreaking update to its accounting software, integrating AI agents to dramatically enhance business efficiency. Launched on July 1 for U.S. customers, this update represents a significant shift in how small and medium-sized businesses manage their finances and operations

1

.AI Agents: The New Virtual Workforce

At the heart of this transformation are specialized AI agents designed to handle complex tasks autonomously and proactively. These agents are not general-purpose chatbots but domain-trained tools integrated within the QuickBooks ecosystem

1

. The key agents include:-

Payments Agent: Boosts cash flow by predicting late payments, automating invoice creation, and sending reminders. Beta testing showed businesses using this agent were paid an average of five days faster

1

2

. -

Accounting Agent: Handles bookkeeping and categorizes transactions in real-time, minimizing errors and delivering accurate, reconciled books

1

3

. -

Finance Agent: Offers deep financial insights through KPI monitoring, scenario planning, and peer benchmarking, providing actionable, data-driven forecasts

1

. -

Customer Agent: Automates lead sourcing, email follow-ups, meeting scheduling, and customer tracking within the QuickBooks Customer Hub

1

2

.

Redesigned Interface and User Experience

Source: Digital Trends

The AI agents are complemented by a fully redesigned and personalized homepage layout featuring customizable widgets and a business feed showing real-time insights and recommendations

2

. The mobile app has also been revamped to provide access to business insights on the go2

.Impact on Business Efficiency

According to Intuit's internal data, these AI-driven improvements can save businesses up to 12 hours a month on manual tasks

1

. Early results are promising, with 78% of customers reporting that Intuit's AI makes running their business easier, and 68% saying they now have more time to focus on growth1

2

.Related Stories

Addressing Key Business Challenges

The new QuickBooks features address several critical challenges faced by small and medium-sized businesses:

-

Late Payments: The Payments Agent helps businesses get paid up to five days faster, addressing cash flow issues

1

2

. -

Bookkeeping Accuracy: The AI-powered bank feed learns from users' actions and suggests categories based on historical patterns, reducing errors in transaction categorization

3

4

. -

Financial Compliance: New features support compliance with accounting standards, including out-of-the-box support for depreciation methods and enhancements to the Construction Industry Scheme (CIS)

4

.

Source: MakeUseOf

The Future of Accounting and Business Management

Source: PYMNTS

Intuit's CEO, Sasan Goodarzi, emphasizes that this AI-driven expert platform is transforming how businesses run and grow

2

. The integration of AI capabilities with vast amounts of data and human expertise creates a unique platform that unlocks next-level efficiencies, profitability, and growth for businesses2

.As the accounting industry faces increasing pressures and demands, these AI-driven solutions offer a way to automate routine tasks, allowing accountants and business owners to focus on higher-value advisory work and strategic decision-making

3

.With these innovations, Intuit is not just updating QuickBooks; it's redefining the role of accounting software in business management and setting a new standard for AI integration in financial technology platforms.

References

Summarized by

Navi

[1]

Related Stories

Intuit Revolutionizes Business Operations with AI Agents in QuickBooks

27 Jun 2025•Technology

Intuit Launches AI Agent Team to Address SMB Growth Challenges Across Global Markets

13 Nov 2025•Business and Economy

Intuit Integrates Generative AI into QuickBooks, Boosting SMB Financial Management

22 Nov 2024•Business and Economy

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

Anthropic takes Pentagon to court over unprecedented supply chain risk designation

Policy and Regulation

3

Meta smart glasses face lawsuit and UK probe after workers watched intimate user footage

Policy and Regulation