Intuit Integrates Generative AI into QuickBooks, Boosting SMB Financial Management

2 Sources

2 Sources

[1]

Intuit Adds Generative AI-Powered Financial Assistant to QuickBooks | PYMNTS.com

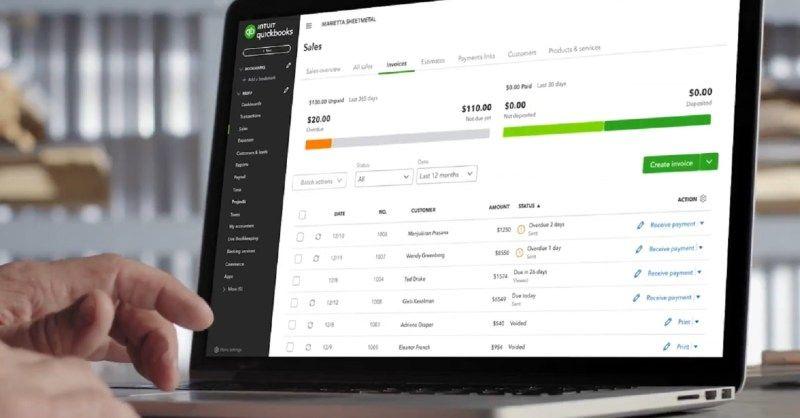

The new Intuit Assist for QuickBooks is designed to help small and medium-sized businesses (SMBs) by generating estimates, invoices, bills and payment reminders and delivering personalized recommendations, the company said in a Wednesday (Nov. 20) press release. "With Intuit Assist, customers can leverage connected tools and services to manage and keep a business growing," Dave Talach, senior vice president, product, Intuit QuickBooks, said in the release. "It's a game changer that empowers business owners to work like they have a larger team behind them, with a holistic view of their business." Intuit Assist delivers a new Business Feed on the QuickBooks home page that displays a dynamic view of the user's business and highlights work the AI assistant has done that is ready for the user to review, according to the release. The AI assistant can generate estimate, invoices or bills based on information in emails, electronic documents or photos of handwritten notes; draft personalized reminders when it detects past due invoices; extract details from receipts and auto-populate them in QuickBooks; and match invoices paid or bills paid to the corresponding bank transaction, the release said. For customers who are new to QuickBooks, Intuit Assist can streamline setup by showing them how to connect with a live human expert who can walk them through the process, per the release. An Intuit Assist for QuickBooks beta customer said in the release that the AI assistant helps her save time on administrative tasks. "When I started using QuickBooks Online, I loved how it automatically generated reports for me and helped me track my goals and growth, but the addition of Intuit Assist has truly made an impact on the time and effort I have to spend completing manual tasks like creating estimates and invoices," Kim Cross, owner of Zhi Bath & Body, said in the release. Intuit said in September that it would introduce agentic AI capabilities in December and continue rolling them out through 2025, adding them across its platforms and products.

[2]

Intuit Sees AI Driving Big Changes for Small Businesses | PYMNTS.com

All artificial intelligence (AI) systems are software, but not all software is AI. At least, not yet. Embracing the AI-ification of everything was the theme of accounting and tax software provider Intuit Inc.'s Q1 2025 earnings call on Thursday (Nov. 21), where executives highlighted the success of the company's AI-driven strategy. "We've had a strong start to the year as we demonstrate the power of Intuit's AI-driven expert platform strategy. By delivering 'done-for-you' experiences, enabled by AI with access to AI-powered human experts, we continue to fuel the success of consumers and businesses," said Sasan Goodarzi, Intuit's chief executive officer. "Our innovation and the proof points we're observing continue to bolster our confidence in our strategy." On Wednesday (Nov. 20), Intuit added a generative AI-powered financial assistant to QuickBooks designed to help small- to medium-sized businesses (SMBs) by generating estimates, invoices, bills and payment reminders and delivering personalized recommendations. In addition to its QuickBooks software, Intuit is the parent company of TurboTax, Credit Karma and Mailchimp. The company said in September that it would introduce agentic AI capabilities this coming December and continue rolling them out through 2025, adding them across its platforms and products. PYMNTS Intelligence finds that, among those who have tried AI, 96% of SMBs believe it to be an effective tool. Read also: Big Tech's AI Tools Are Helping Democratize Growth for Small Businesses Intuit, a household name in the world of financial software, has grown from its roots in personal finance to become a multifaceted provider of tools for small businesses, consumers and self-employed individuals. Intuit's latest financial results revealed revenue growth across various segments, particularly in Global Business Solutions and Credit Karma. Overall revenue increased by 10% year-over-year to $3.3 billion. "We delivered strong first quarter fiscal 2025 results across the company driven by our Global Business Solutions Group and Credit Karma," said Sandeep Aujla, Intuit's chief financial officer. "We are confident in delivering double-digit revenue growth and margin expansion this year, and we are reiterating our full year guidance for fiscal 2025." QuickBooks Online Accounting revenue grew 21% in the quarter, driven by customer growth, higher effective prices and mix-shift; while the whole of the Global Business Solutions Group revenue grew to $2.5 billion, up 9%, and Online Ecosystem revenue increased to $1.9 billion, up 20%. Credit Karma revenue grew 29% to $524 million, fueled by growth in personal loans, auto insurance and credit cards. Despite some declines in other areas, including Consumer Group revenue -- which declined 6% to $176 million, primarily due to lapping the extended tax filing deadline for California filers in the prior year -- Intuit expressed confidence in its AI-driven strategy and future performance. Read more: Intuit Rolls Out Product Suite for Mid-Market Businesses Intuit reiterated its full-year guidance for fiscal 2025, expecting double-digit revenue growth and margin expansion. The company projects revenue to be between $18.160 billion and $18.347 billion, representing a growth of 12% to 13%. The demand for intuitive, cloud-based financial software is in part being driven by the growing complexity for businesses of managing financial data spread across multiple enterprise applications. Traditional tools like spreadsheets, once the backbone of accounting operations, are increasingly falling short in meeting the needs of today's finance teams, particularly the understaffed ones of small businesses. Still, the company's shares fell Thursday by around 8%, as of reporting, in extended trading after giving a sales and profit outlook that was shy of estimates. And as the company seeks to sustain its trajectory of growth, it faces a delicate balancing act: navigating intensifying competition, addressing regulatory scrutiny and maintaining innovation in an evolving economic landscape. For example, PYMNTS covered that Intuit and H&R Block saw their stocks drop 5% and 8%, respectively, on Tuesday (Nov. 19) after a media report that the incoming Trump administration is considering a free tax-filing app.

Share

Share

Copy Link

Intuit has introduced a generative AI-powered financial assistant to QuickBooks, aiming to streamline financial management for small and medium-sized businesses. The company reports strong Q1 2025 results, highlighting the success of its AI-driven strategy across its platforms.

Intuit Launches AI-Powered Financial Assistant for QuickBooks

Intuit, the financial software giant, has taken a significant leap in artificial intelligence integration by introducing Intuit Assist, a generative AI-powered financial assistant, to its QuickBooks platform. This move aims to revolutionize financial management for small and medium-sized businesses (SMBs)

1

.Key Features of Intuit Assist

The new AI assistant offers a range of functionalities designed to streamline business operations:

- Automated document generation: Creates estimates, invoices, and bills based on information from emails, electronic documents, or photos of handwritten notes.

- Smart reminders: Drafts personalized reminders for past due invoices.

- Receipt processing: Extracts details from receipts and auto-populates them in QuickBooks.

- Transaction matching: Matches paid invoices or bills to corresponding bank transactions.

- Business Feed: Displays a dynamic view of the user's business on the QuickBooks home page, highlighting AI-completed tasks

1

.

Intuit's AI Strategy and Financial Performance

Intuit's commitment to AI extends beyond QuickBooks. The company plans to introduce agentic AI capabilities across its platforms, including TurboTax, Credit Karma, and Mailchimp, starting December 2024 through 2025

2

.In its Q1 2025 earnings call, Intuit reported strong financial results:

- Overall revenue increased by 10% year-over-year to $3.3 billion.

- QuickBooks Online Accounting revenue grew 21%.

- Global Business Solutions Group revenue rose to $2.5 billion, up 9%.

- Credit Karma revenue grew 29% to $524 million

2

.

Related Stories

Impact on Small Businesses

The integration of AI into financial software is particularly significant for SMBs. PYMNTS Intelligence reports that 96% of SMBs who have tried AI believe it to be an effective tool

2

. This aligns with Intuit's strategy to provide "done-for-you" experiences enabled by AI, potentially allowing small businesses to operate with the efficiency of larger organizations.Challenges and Future Outlook

Despite the positive developments, Intuit faces challenges:

- Intensifying competition in the financial software market.

- Regulatory scrutiny, particularly in the tax preparation sector.

- The need for continuous innovation in a rapidly evolving economic landscape.

Intuit remains confident in its AI-driven strategy, projecting revenue between $18.160 billion and $18.347 billion for fiscal 2025, representing a growth of 12% to 13%

2

. However, the company's stock experienced a decline following its earnings report, indicating that market expectations and competitive pressures continue to shape its trajectory in the AI-driven financial software landscape.References

Summarized by

Navi

Related Stories

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

Anthropic takes Pentagon to court over unprecedented supply chain risk designation

Policy and Regulation

3

Meta smart glasses face lawsuit and UK probe after workers watched intimate user footage

Policy and Regulation