Intuit Launches AI Agent Team to Address SMB Growth Challenges Across Global Markets

3 Sources

3 Sources

[1]

Intuit reveals new AI agents in a bid to help SMBs across the world grow and prosper

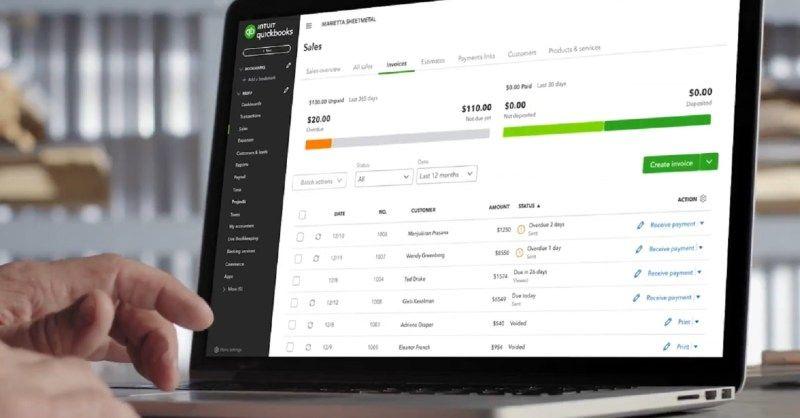

Intuit has announced a host of new AI tools and services for small businesses looking to take their next big leap forward. The accountancy software giant revealed five new AI agents on its Intuit platform, which it says will be able to transform how SMBs work and operate, offering them the chance to prosper and grow. Available now as an all-in-one platform, the agents will cover everything from bookkeeping to customer leads to financial summaries and project management, automating time-consuming tasks and boosting productivity and collaboration across the board. "This is very much the start, not the end - allowing trusted experts like accountants and bookkeepers combined in one place to help small and mid-sized companies run and grow their business, and ultimately solve more of the critical jobs they need to do to run their company, all in one place," Ciaran Quilty, SVP, International, Intuit said at a launch event attended by TechRadar Pro. The launch comes after Intuit revealed new research which found many SMBs say they are being held back by fragmented systems or siloed services, leading to major operational inefficiencies. Surveying 3,600 SMB leaders across the UK, Australia and Canada, the study found these businesses could see up to 58% more revenue growth by closing what it calls the "Growth Gap" on unrealised potential - equivalent to at least £121,272 in annual revenue for smaller firms, and as much as £416,000 for mid-sized firms. Daily operations are causing much of these inefficiencies, with the study finding nearly 40% of UK leaders are nearly always involved in daily operations, and just 5% said they felt confident delegating major decisions, with bosses also losing nearly a full working day each week switching between seven to nine digital systems to keep their business running. The company believes AI can help unlock this business potential, as 80% of SMB leaders say AI can help them delegate more effectively while maintaining control, and 40% saying they already save 5-8 hours per week through automation. "Even though businesses are missing out on growth opportunities, the extent of their AI use makes a clear difference," Quilty added. "Ambition is abundant, but the path to execution remains obstructed by everyday complexity. The challenge isn't ambition itself, but the systems required to turn it into progress. When routine work is automated, time and visibility returns - giving leaders the insights they need, and the confidence to act with conviction."

[2]

Too stretched: Australian businesses and missed growth opportunities

"For businesses with up to 15 to 24 employees, they're spending around $20,000 annually on compliance," Dr Trembath says. "It's a cost-of-doing-business crisis within a cost-of-living crisis -- they're tangled in red tape." The impact is not simply financial. It's cognitive. Decision fatigue and operational overload gradually erode the ability to think strategically. "They can't be innovative or think about growth opportunities if they're in survival mode," she says. The research shows many business owners lose the equivalent of two workdays every month switching between systems and platforms, often juggling six to nine different tools just to complete basic tasks. This leads to what Intuit calls a delegation crisis. Leaders know what needs to happen next but can't step back long enough to delegate effectively. Nearly half of those surveyed admit projects often stall because decisions depend solely on them. "What small and medium businesses need is help transitioning into digital and AI," Dr Trembath says. "They know AI can help, but they don't know how, or which one to use, or how it integrates." She adds: "We'd love to see a small-business-first approach from government." According to The Growth Gap report, increasing execution capacity could lift SMB revenues by 6.7 per cent* annually, representing an additional $35 billion in economic uplift. AI is already proving its value for Australian SMBs, with early adopters saving up to six hours a week* and 80 per cent* of leaders agreeing it can help them delegate more effectively while maintaining control. For Sonal Patel, founder of Shilu's Vegetarian -- a fast-growing vegetarian take-home meal provider -- compliance and paperwork were consuming the time she wanted to spend creating new products. "As a growing business with both an online shop and stockists across Australia, we were constantly battling paperwork and GST compliance," Patel says. "Compliance feels like a never-ending cycle -- it's hard to make time to be creative." After adopting AI features, that changed. "Intuit's new AI agents in QuickBooks are a game-changer," Patel says. "The Accounting Agent handles the daily bookkeeping and categorisation, and the GST AI Agent will ensure we stay compliant without the usual headache." The impact is immediate. "This automation saves us crucial time we can now spend on creating new recipes, not on spreadsheets." "To unlock time and focus for businesses, Intuit is adding a team of five AI agents in QuickBooks that will work together across the Intuit platform to handle repetitive tasks, surface insights, and support collaboration between business owners and their advisors," says Suzy Nicoletti, regional vice president, Intuit APAC. "The problem for Australia SMBs isn't capability, it's capacity," says Suzy Nicoletti, regional vice president, Intuit APAC. "Intuit QuickBooks' virtual team of agents handles repetitive and time-consuming tasks, with AI acting as the 'great rebalancer' for SMBs," she says. "Early AI adopters are already saving up to six hours a week -- nearly a whole work day -- giving leaders the clarity, time and confidence needed to shift their focus from operational grind to strategic vision." Functionality will vary depending on plans. While available in all QuickBooks supported languages, the AI Agent's output will be English-only at launch. Localisation for other languages will roll out gradually thereafter. We recommend you review all outputs carefully.

[3]

Intuit's All-in-One Platform Introduces a Virtual Team of AI Agents to Help UK Businesses Increase Efficiency and Growth

Intuit Inc. (Nasdaq: INTU), the global financial technology platform that makes Intuit TurboTax, Credit Karma, QuickBooks, and Mailchimp, has today announced the global availability of AI agents on Intuit's All-in-One platform, creating a more powerful and automated QuickBooks experience designed to deliver time savings, greater efficiency, insights and value for customers. The company also released a new report which highlights the benefits of AI-driven solutions for business growth. Now available to QuickBooks customers in the United Kingdom, a proactive team of AI agents and trusted human experts deliver an automated experience across essential financial pillars -- including growing and managing customers, accounting, finance, and VAT, all within the Intuit platform. Together this virtual team automates time-consuming tasks, streamlines collaboration and workflows and surfaces insights and recommendations that enable smarter, faster business decisions. Businesses can save up to 12 hours a month* with simplified day-to-day operations across accounting, projects, customer management, and financial analysis. The virtual team of AI agents in QuickBooks will work together across the Intuit platform to handle repetitive tasks, and support collaboration between business owners and their accounting professionals. These include: These new experiences delivered by the new AI agents and trusted experts are accompanied by a completely redesigned and personalised QuickBooks web layout. The homepage is transformed into a striking display of customisable widgets with a powerful business feed that shows real-time intelligent insights, recommendations, and summarises the workflows and tasks completed by the AI agents. Customers can seamlessly collaborate with their trusted experts, connect to additional Intuit products, services, and third-party apps to truly realise the benefits and power of Intuit's All-in-One platform. A new Intuit report launched today, entitled The Growth Gap, reveals why this evolution matters. In the UK, 58% of small and medium-sized business growth potential goes unrealised, held back by inefficiencies and decision fatigue. A stronger ability to execute these opportunities could lift revenues across the UK SMB economy by 7.9% annually, representing an uplift of £121,272 on average per company**. Optimism remains high amongst SMB leaders, yet much of that ambition becomes trapped in daily operational drag. The Growth Gap report reveals that three in four UK SMBs have abandoned new growth generating ideas multiple times in the past year. Held back by inefficiencies, and decision fatigue, UK SMB leaders report losing nearly a full working day (6.6 hours) each week switching between disconnected tools, and 40% say they remain tied up in daily operations, with only 5% feeling confident delegating**. The study defines a Growth Readiness Scorecard, exposing a clear line between firms ready to grow and those struggling to keep pace. 39% of UK firms received high-readiness scores, making them agile, data-driven, and strategically flexible converters of growth. However 27% remain in the low-readiness category, described by Intuit as 'overstretched operators, confident in their ambitions but lacking the capabilities to execute them. They rely on manual processes and individual effort.' The Growth Readiness Scorecard provides a benchmark for SMBs in prioritising what to fix first and what to automate**. Intuit's Growth Gap study found that 80% of UK SMB leaders believe AI could help them delegate more effectively while maintaining oversight. This represents what Intuit calls the AI Dividend: the productivity, focus, and confidence regained when technology automates the tasks that can slow businesses down. Ciarán Quilty, Senior Vice-President for International at Intuit said: "Ambition is abundant, but the path to execution remains obstructed by everyday complexity. The challenge isn't ambition itself, but the systems required to turn it into progress. When routine work is automated, time and visibility returns - giving leaders the insights they need, and the confidence to act with conviction." Leigh Thomas, Vice President EMEA at Intuit, said: "When combined with an overload of apps that don't talk to each other, businesses are finding it increasingly difficult to sustain meaningful growth. We believe inefficiency is the hidden tax on growth and AI is the great rebalancer of that. The Intuit platform recognises the real pressures facing businesses today. With QuickBooks on the Intuit platform, we support businesses in bridging the gap between the opportunities they identify and the ones they are able to seize. By combining trusted human expertise and agentic AI, we streamline how businesses operate day-to-day, giving them the tools, and the time, to scale. Automation where it counts, human where it matters." Harry Pill, Founder of Freshcut Video said: "The Intuit AI agents are really exciting for me, because QuickBooks has got so much of my business data from years and years of work, but I'm not really qualified to make much of it. So the fact that they can bring it all together paints a nice picture for me that I can understand, and I can take those insights forward to make good decisions and hopefully keep growing the business." Aaron Patrick, Head of Accounts at Boffix said: "The Intuit platform marks a genuine reset for how accountants can deliver value. It's cleaner, faster, and more adaptable across every device -- making it easier to train teams, onboard clients, and scale confidently. What excites me most is how Intuit is unlocking true business advisory potential for accountants within QuickBooks. With AI agents now able to automate time sinks, like reconciliations or data clean-up, we can spend more time helping clients understand why their numbers change, not just what the numbers are. The integration across QuickBooks, Mailchimp, and the wider Intuit ecosystem means we can finally connect financial insight with business activity -- redefining what it means to be an accountant in the age of AI." More information can be found on our blog. Disclaimers Functionality will vary depending on plans. While available in all QuickBooks supported languages, the AI Agent's output will be English-only at launch. We recommend you review all outputs carefully. This information is intended to outline our general product direction, but represents no obligation and should not be relied on in making a purchasing decision. Additional terms, conditions and fees may apply with certain features and functionality. Eligibility criteria may apply. Product offers, features, and functionality are subject to change without notice. About Intuit Intuit is the global financial technology platform that powers prosperity for the people and communities we serve. With approximately 100 million customers worldwide using products such as TurboTax, Credit Karma, QuickBooks, and Mailchimp, we believe that everyone should have the opportunity to prosper. We never stop working to find new, innovative ways to make that possible. Please visit us at Intuit.com and find us on social for the latest information about Intuit and our products and services. About the Study This research is conducted in partnership with Dr Chris Brauer, Director of Innovation, Goldsmiths, University of London between September and October 2025. Dr Brauer's research team included Research Director Dr Jennifer Barth and a core group of economists, psychologists, data and social scientists from UK-based research firm Symmetry Insights. They used a mixed method approach to build a model and scorecard of the growth gap. Censuswide surveys of 1200 small and medium business leaders across each of the UK, AUS and Canada (n=3600) were conducted in September 2025.

Share

Share

Copy Link

Intuit introduces five AI agents on its QuickBooks platform to help small and medium businesses overcome operational inefficiencies. New research reveals SMBs could increase revenue by up to 58% by closing their 'Growth Gap' through AI automation.

Intuit Unveils AI Agent Team to Transform SMB Operations

Intuit has announced the global launch of five AI agents integrated into its QuickBooks platform, marking a significant step toward automating small and medium business operations

1

. The financial technology company's new virtual team is designed to handle repetitive tasks across essential business functions, including bookkeeping, customer management, financial analysis, and project coordination3

.

Source: TechRadar

The AI agents work collaboratively across Intuit's platform to automate time-consuming processes and streamline workflows between business owners and their accounting professionals. According to Intuit, businesses can save up to 12 hours monthly through simplified day-to-day operations

3

.The Growth Gap Research Findings

Intuit's launch coincides with new research revealing significant untapped potential in the SMB sector. The company's "Growth Gap" study, surveying 3,600 SMB leaders across the UK, Australia, and Canada, found that businesses could achieve up to 58% more revenue growth by addressing operational inefficiencies

1

.The research indicates that smaller firms could gain at least £121,272 in annual revenue, while mid-sized companies could see increases of up to £416,000 by closing this growth gap . In the UK specifically, 58% of SMB growth potential remains unrealized, with stronger execution capabilities potentially lifting revenues by 7.9% annually

3

.Operational Challenges Hampering Growth

The study reveals that daily operational demands are significantly impacting business leaders' ability to focus on strategic growth. Nearly 40% of UK leaders remain constantly involved in daily operations, with only 5% feeling confident about delegating major decisions

1

.Business owners are losing nearly a full working day each week switching between seven to nine different digital systems, creating what Intuit describes as a "delegation crisis"

1

. This system fragmentation leads to decision fatigue and operational overload, gradually eroding leaders' ability to think strategically2

.

Source: Financial Review

Related Stories

AI Adoption and Early Results

Despite these challenges, early AI adoption is showing promising results. The research found that 80% of SMB leaders believe AI can help them delegate more effectively while maintaining control, with 40% already saving 5-8 hours per week through automation

1

.Sonal Patel, founder of Shilu's Vegetarian, exemplifies these benefits. Her fast-growing vegetarian meal provider was struggling with compliance and paperwork that consumed time needed for product development. After adopting Intuit's AI features, she reported significant time savings: "The Accounting Agent handles the daily bookkeeping and categorisation, and the GST AI Agent will ensure we stay compliant without the usual headache"

2

.Platform Integration and Future Vision

The AI agents are accompanied by a completely redesigned QuickBooks interface featuring customizable widgets and a business feed that displays real-time insights and recommendations

3

. This transformation enables seamless collaboration between business owners and trusted experts while connecting to additional Intuit products and third-party applications.Ciaran Quilty, SVP International at Intuit, emphasized that this launch represents just the beginning: "This is very much the start, not the end - allowing trusted experts like accountants and bookkeepers combined in one place to help small and mid-sized companies run and grow their business"

1

.References

Summarized by

Navi

[2]

Related Stories

Intuit Revolutionizes Business Operations with AI Agents in QuickBooks

27 Jun 2025•Technology

Intuit Revolutionizes QuickBooks with AI Agents for Enhanced Business Efficiency

29 Jul 2025•Business and Economy

Intuit Integrates Generative AI into QuickBooks, Boosting SMB Financial Management

22 Nov 2024•Business and Economy

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

Anthropic takes Pentagon to court over unprecedented supply chain risk designation

Policy and Regulation

3

Meta smart glasses face lawsuit and UK probe after workers watched intimate user footage

Policy and Regulation