Meta acquires Manus for $2 billion, adding revenue-generating AI agents to its platforms

42 Sources

42 Sources

[1]

Meta just bought Manus, an AI startup everyone has been talking about | TechCrunch

Meta Platforms is acquiring Manus, a Singapore-based AI startup that's become the talk of Silicon Valley since it materialized this spring with a demo video so slick it went instantly viral. The clip showed an AI agent that could do things like screen job candidates, plan vacations, and analyze stock portfolios. Manus claimed at the time that it outperformed OpenAI's Deep Research. By April, just weeks after launch, the early-stage firm Benchmark led a $75 million funding round that assigned Manus a post-money valuation of $500 million. General partner Chetan Puttagunta joined the board. Some other big-name backers had already invested in Manus at that point, including Tencent, ZhenFund, and HSG (formerly known as Sequoia China). Though Bloomberg raised questions when Manus started charging $39 or $199 a month for access to its AI models (the outlet noted the pricing seemed "somewhat aggressive . . . for a membership service still in a testing phase,") the company recently announced it had since signed up millions of users and crossed $100 million in annual recurring revenue. That's when Meta started negotiating with Manus, according to the WSJ, which says Meta is paying $2 billion -- the same valuation Manus was seeking for its next funding round. For Zuckerberg, who has staked Meta's future on AI, Manus represents something new: an AI product that's actually making money (investors have grown increasingly twitchy about Meta's $60 billion infrastructure spending spree). Meta says it'll keep Manus running independently while weaving its agents into Facebook, Instagram, and WhatsApp, where Meta's own chatbot, Meta AI, is already available to users. There is one wrinkle, however, which is that Manus, which launched eight months ago, has Chinese founders who founded parent company Butterfly Effect in Beijing in 2022 before decamping to Singapore in the middle of this year. Whether that raises flags in Washington remains to be seen, but Senator John Cornyn already dragged Benchmark for its investment in the company, asking back in May on X who thought it was "a good idea for American investors to subsidize our biggest adversary in AI, only to have the CCP use that technology to challenge us economically and militarily? Not me." Cornyn, a Texas Republican and senior member of the Senate Intelligence Committee, has long been one of Congress's most vocal hawks on China and technology competition, but he's hardly alone. Being tough on China has become one of the genuinely bipartisan issues in Congress. Unsurprisingly, Meta has already told Nikkei Asia that after the acquisition, Manus won't have any ties to Chinese investors and will no longer operate in China. "There will be no continuing Chinese ownership interests in Manus AI following the transaction, and Manus AI will discontinue its services and operations in China," a Meta spokesperson told the outlet.

[2]

Everything Meta could do with its new $2 billion AI agent

Meta has acquired Singapore-based startup Manus.Manus went viral in March as the first general AI agent.The deal could help Meta to gain a competitive edge. Meta announced on Monday that it's acquiring Manus, the China-founded startup that went viral earlier this year with the release of what was promoted as the first truly useful AI agent. The deal, which The Wall Street Journal reported was valued at over $2 billion, marks Meta's latest effort to push to the forefront of the AI race. "Manus's exceptional talent will join Meta's team to deliver general-purpose agents across our consumer and business products, including in Meta AI," Meta wrote in its announcement. "We're excited to welcome the Manus team and help improve the lives of billions of people and millions of businesses with their technology." Also: What are AI agents? How to access a team of personalized assistants Despite its vast supply of capital and computing resources -- it's currently ranked as the sixth most valuable company in the world -- Meta was something of a late bloomer when it comes to consumer-facing AI. The acquisition of Manus, however, could help it to deploy more practically useful AI systems to its already expansive user base, and close the gap separating it from industry-leading AI labs like OpenAI, Anthropic, and Google DeepMind. Launched in March with financial backing from the Chinese firm Beijing Butterfly Effect Technology, Manus made waves across the tech world for its ability to handle complex tasks with less human oversight and prompting than are required by more traditional chatbots, such as ChatGPT. (Manus moved its headquarters from Beijing to Singapore in June to sidestep the US government's export controls of high-value GPUs to China.) Leading tech developers in the US soon followed suit by releasing their own agents, like OpenAI's Operator, which were broadly marketed as a form of AI that would be genuinely useful to individual users and businesses: able to not only respond to prompts but also browse the web, fill out forms, analyze financial data, generate reports, and handle other tasks. Also: Why AI agents failed to take over in 2025 - it's 'a story as old as time,' says Deloitte The acquisition of Manus could allow Meta to build and launch its own agents across Instagram, Facebook, Messenger, and WhatsApp. A Meta spokesperson did not immediately respond to a question about whether the company plans to give its Meta AI assistant an agentic upgrade following the acquisition. But Meta isn't just integrating Manus's technology into its products: The Singapore-based startup will also continue to operate and sell its own service, according to Monday's announcement, meaning that a separate revenue stream from millions of additional users will flow into Meta's coffers, further fueling its AI ambitions, including its goal of being the first to build "superintelligence." Meta changed its name from Facebook in October 2021 to signal its transition from a primarily social media-oriented brand to one focused on building the so-called "metaverse," a virtual world that, according to CEO Mark Zuckerberg, would be the future of commerce and socialization. However, that dream fizzled as virtual reality headset sales lagged and metaverse platforms, such as Meta's Horizon Worlds, became virtual ghost towns. Following the release of ChatGPT a little over three years ago and the ensuing fervor throughout the tech industry for all things generative AI, Zuckerberg did an about-face, declaring 2023 his company's "Year of Efficiency," and making AI research and development one of its top priorities. Also: As Meta fades in open-source AI, Nvidia senses its chance to lead Meta has invested heavily since then in its Llama family of open-sourced large language models, and also in embedding its Meta AI assistant across its family of apps. It has also been aggressively pushing to attract and acquire top talent. In June, Meta invested a reported sum of $14.3 billion in the data-labeling company Scale AI, and appointed the company's CEO, the 28-year-old Alexandr Wang, as its new chief AI officer. The company announced a partnership with Midjourney a couple of months later, with an eye toward integrating the latter company's generative AI tools across Meta's family of apps.

[3]

Zuck buys Chinese AI company Manus

Meta will acquire made-in-China AI outfit Manus and harness its "general agent" technology across its products. Manus debuted in March 2025 and immediately pitched itself as a leap beyond generative AI chatbots, which it characterizes as best suited to summarizing information and answering questions. The outfit promotes its own services as enabling "wide research and context-aware reasoning to produce actionable results in the format you need." To illustrate that promise, Manus offers a scenario in which users ask its tech to select the best candidate for an job by evaluating job applications stored in a .ZIP file. Manus can open that archive, read the files it contains, evaluate them according to user-defined criteria, then produce a document that ranks candidates by suitability for the role. The service does that in its own "computer" - a cloud-hosted VM - that Manus says "operates as a multi-agent system powered by several distinct models." Manus was created by a Chinese company called Butterfly Effect, which also operates an entity in Hong Kong an recently moved its headquarters to Singapore. The outfit recently claimed to have $100 million annual recurring revenue just eight months after launch. Meta's announcement of the deal states: "Manus is already serving the daily needs of millions of users and businesses worldwide" and reveals the made-in-China company's staff will join the social networking giant. The value of the deal was not disclosed. Manus hailed its acquisition as "validation of our pioneering work with General AI Agents." "Our solution is driving value for millions of users worldwide today. With time, we hope to expand this subscription to the millions of businesses and billions of people on Meta's platforms," Manus's post states, before adding a canned quote from CEO Xiao Hong who said joining the Zuckosphere represents a chance to "build on a stronger, more sustainable foundation without changing how Manus works or how decisions are made." "We're excited about what the future holds with Meta and Manus working together and we will continue to iterate the product and serve users that have defined Manus from the beginning." Meta boss-for-life Mark Zuckerberg wants to build a "superintelligence" service, which he defines as software "that knows us deeply, understands our goals, and can help us achieve them." In pursuit of that goal, Meta has committed to at least $70 billion of capital expenditure in 2025 and expects to spend more next year, much of it going towards building datacenters to host AI workloads. While the company credits AI with helping it to improve advertising revenue, Meta does not currently offer a paid AI service but is reportedly testing a subscription product called "Meta AI+". Manus seems a good fit for that offering, and perhaps also a step towards superintelligence. The deal is the fifth AI-related acquisition Meta has made in 2025, following its purchases of AI startups PlayAI and WaveForms, accelerator developer Rivos, and wearable device developer Limitless. The social networking giant has also dangled eight-figure compensation packages to lure top AI talent to the company. ®

[4]

Meta to acquire Chinese startup Manus to boost advanced AI features

Dec 29 (Reuters) - Meta (META.O), opens new tab said on Monday it would acquire Chinese artificial intelligence startup Manus, as the technology giant accelerates efforts to integrate advanced AI across its platforms. Tech giants such as Meta have been ramping up AI investments through strategic acquisitions and talent hires as they navigate fierce industry competition. Earlier this year, the Facebook-owner invested in Scale AI in a deal valuing the data-labeling startup at $29 billion and bringing in its 28-year-old CEO, Alexandr Wang. Financial terms of its deal with Manus were not released. Singapore-based Manus makes general-purpose AI agent, which can operate as a digital employee, executing tasks such as research and automation independently and with minimal prompts. Meta will operate and sell the Manus service, as well as integrate it into its consumer and business products, including in Meta AI, the company said. Earlier this year, Manus launched its AI agent, claiming that its performance surpasses that of OpenAI's AI agent, DeepResearch. The company, part of Beijing Butterfly Effect Technology Ltd Co, has marketed its product by completing dozens of tasks for users on X for free. Reporting by Harshita Mary Varghese in Bengaluru; Editing by Shilpi Majumdar Our Standards: The Thomson Reuters Trust Principles., opens new tab

[5]

Meta buys startup Manus in latest move to advance its artificial intelligence efforts

DETROIT (AP) -- Meta is buying artificial intelligence startup Manus, as the owner of Facebook and Instagram continues an aggressive push to amp-up AI offerings across its platforms. The California tech giant declined to disclose financial details of the acquisition. But The Wall Street Journal reported that Meta closed the deal at more than $2 billion. Manus, a Singapore-based platform with some Chinese roots, launched its first "general-purpose" AI agent earlier this year. The platform offers paid subscriptions for customers to use this technology for research, coding and other tasks. "Manus is already serving the daily needs of millions of users and businesses worldwide," Meta said in a Monday announcement, adding that it plans to scale this service -- as Manus will "deliver general-purpose agents across our consumer and business products, including in Meta AI." Xiao Hong, CEO of Manus, added that joining Meta will allow the platform to "build on a stronger, more sustainable foundation without changing how Manus works or how decisions are made." Manus confirmed that it would continue to sell and operate subscriptions through its own app and website. The platform has grown rapidly over the past year. Earlier this month, Manus announced that it had crossed the $100 million mark in annual recurring revenue, just eight months after launching. Some of Manus' initial financial backers reportedly included China's Tencent Holdings, ZhenFund and HSG. And the company that first launched the platform -- Butterfly Effect, which also operates under the Monica. Im name -- was founded in China before moving to Singapore. A Meta spokesperson confirmed on Tuesday that there would be "no continuing Chinese ownership interests in Manus AI" following its transaction, and that the platform would also discontinue its services and operations in China. Manus reiterated that it would continue to operate in Singapore, where most of its employees are based. Meta CEO Mark Zuckerberg has been pushing to revive its commercial AI efforts as the company faces tough competition from rivals such as Google and OpenAI, maker of ChatGPT. In June, the company made a $14.3 billion investment in AI data company Scale and recruited its CEO Alexandr Wang to help lead a team developing "superintelligence" at the tech giant.

[6]

Meta buys startup known for its AI task automation agents

Meta has acquired an AI startup called Manus -- known for its custom research and website-building agents -- in a deal valued at more than $2 billion, according toThe Wall Street Journal. It's reportedly one of the largest acquisitions yet involving a startup nurtured in China's AI ecosystem. Manus arrived in March 2025, shortly after another Chinese AI startup, DeepSeek appeared on the scene. The company (called Butterfly Effect at the time) originally described it as "the first general AI agent" to perform complex tasks autonomously, rather than just generating ideas. It draws from several third-party models, particularly Anthropic's Claude 3.5 Sonnet and versions of Alibaba's Qwen. Manus is designed to automate certain tasks, like market research, coding, sales data analysis and website cloning and creation. (However, one skeptic called it "a product devilishly optimized for influencers, which is why it exploded so much.") The company claims that Manu is "already serving the daily needs of millions of users and businesses" and has an annualized average revenue of more than $100 million only eight months after launch. Manus laid off most of its Beijing employees this summer before moving its headquarters to Singapore in an effort to expand globally.The company was reportedly seeking a funding round that would have valued it at $2 billion when it was approached by Meta. "Joining Meta allows us to build on a stronger, more sustainable foundation without changing how Manus works or how decisions are made," said Manus CEO Xiao Hong in a company news release.

[7]

Meta acquires intelligent agent firm Manus, capping year of aggressive AI moves

The logo of Meta is seen at the Viva Technology conference dedicated to innovation and startups at Porte de Versailles exhibition center in Paris, France, on June 11, 2025. Meta Platforms said Tuesday that it has acquired Manus, a Singapore-based developer of general-purpose AI agents, as the tech giant continues its massive investments into artificial intelligence. Manus, founded in China before relocating to Singapore, launched its first general AI agent earlier this year, which can execute complex tasks such as market research, coding, and data analysis. The company claimed it had achieved an annualized average revenue of more than $100 million just eight months after launch, while its revenue run rate exceeded $125 million. Meta said in a statement that its acquisition was aimed at accelerating AI innovation for businesses and integrating advanced automation into its consumer and enterprise products, including its Meta AI assistant. "Manus is already serving the daily needs of millions of users and businesses worldwide ... We plan to scale this service to many more businesses," Meta said. According to the firms, Manus will continue operating its subscription service without disruption. Further terms of the acquisition were not disclosed. Manus began as a product of Chinese start-up Butterfly Effect, also known as Monica.Im, before growing into a separate entity. It emerged as a notable AI player earlier this year after claiming its chatbot offered superior performance to OpenAI's DeepResearch. The company raised $75 million in a Series B funding round led by U.S. venture firm Benchmark in April, and is backed by Tencent and private equity firm HongShan Capital Group (HSG), formerly known as Sequoia, according to data from market research firm Tracxn. The start-up reportedly laid off most of its staff in Beijing in July before moving its headquarters to Singapore in June as it looked towards global expansion. "Joining Meta allows us to build on a stronger, more sustainable foundation without changing how Manus works or how decisions are made," Xiao Hong, CEO of Manus, said in a company release. The firm also announced a strategic partnership with Alibaba's Qwen AI team in March, highlighting its existing ties to Chinese tech companies.

[8]

Meta makes $2 billion bet on agentic AI with Manus acquisition

Serving tech enthusiasts for over 25 years. TechSpot means tech analysis and advice you can trust. What just happened? Meta Platforms has agreed to buy Singapore-based artificial intelligence startup Manus in a deal valued at more than $2 billion, according to people familiar with the matter. The acquisition marks one of the largest purchases by a US tech giant of an AI product from Asia. Manus gained international attention earlier this year when it unveiled an AI agent capable of generating detailed research reports and building customized websites. The system drew on models from both US and Chinese developers, including Anthropic and Alibaba, and was designed to handle multifaceted requests from paying users. The company's rapid ascent and hybrid technology base made it an attractive target for Meta as it sought to strengthen its AI tool portfolio. The deal would bring Manus's co-founder and CEO, Xiao Hong - known as Red - into Meta's executive structure, where she will report to Chief Operating Officer Javier Olivan, people familiar with the arrangement told The Wall Street Journal. In announcing the deal, Meta said it plans to "scale this service to many more businesses" while keeping the Manus platform operational and integrating it with Meta's broader social media ecosystem. For Meta, the acquisition signals a more aggressive play in the expanding market for AI agents. Microsoft's Copilot and similar assistants from OpenAI and Google have established early leads in the space, putting pressure on Meta to close the gap. Manus launched in March 2025 and drew millions of users within months, offering subscription plans for access to its research, coding, and analysis tools. In December, the company disclosed that its annual recurring revenue had surpassed $100 million - an extraordinary milestone just eight months after launch. Around the same time, Meta began talks about an acquisition, according to people familiar with the timeline. Earlier funding rounds had already set the company apart in Asia's competitive AI market. Manus raised $75 million in April in a round led by Benchmark, whose general partner, Chetan Puttagunta, later joined the company's board. That investment valued the startup at about $500 million and brought in additional backers, including HSG, ZhenFund, and Tencent. The parent company, Butterfly Effect, was founded in 2022, with offices in Beijing and Wuhan, and relocated its headquarters to Singapore after the Benchmark investment. Most of Manus's research and engineering talent remained in China, though the firm positioned itself globally to access American-developed AI models unavailable in the Chinese market. "Joining Meta allows us to build on a stronger, more sustainable foundation without changing how Manus works or how decisions are made," Xiao said in a statement announcing the deal. Meta's acquisition comes as the company channels billions into AI research and infrastructure to rival Microsoft, Google, and OpenAI. Chief Executive Mark Zuckerberg has spent much of the year recruiting top AI scientists and executives with multimillion-dollar contracts following delays in rolling out Meta's next-generation AI model. The company has also diversified its AI investments, taking a 49% stake in Scale AI at a $29 billion valuation, a move that brought Scale founder Alexandr Wang into Meta as its chief AI officer. Meta's AI systems already underpin much of its consumer-facing platforms, from Instagram recommendations to WhatsApp chat assistants. The company has also integrated machine learning deeply into its advertising business, bolstering profits even as it rolls out largely free, open-source AI models. Image credit: South China Morning Post

[9]

Meta buys Chinese-founded AI agent start-up Manus

Barton Crockett, analyst at Rosenblatt Securities, told Reuters it was a "natural fit" for Meta, which extended into boss Mark Zuckerberg's "vision of personal AI" using agents. Based in Singapore after relocating from China, Manus has sought to set itself apart from rival AI developers with what it claims can be a "truly autonomous" agent. Unlike many chatbots which need to be repeatedly asked for things before a user can get their desired response, Manus says its service can plan, execute and complete tasks independently in accordance with instructions. It forms part of the company's mission to "extend human reach" with general-purpose agents that can aid, rather than replace, human work. The company said its acquisition by Meta was "validation" of its efforts. "Joining Meta allows us to build on a stronger, more sustainable foundation without changing how Manus works or how decisions are made," said Xiao Hong, its chief executive and one of its Chinese founders, in a blog post. "We're excited about what the future holds with Meta and Manus working together and we will continue to iterate the product and serve users that have defined Manus from the beginning." Meta said as part of its deal it would continue to operate and sell Manus' AI service. It marks yet another high-profile move by the Silicon Valley tech giant to cement its presence in the sector through deals with rising start-ups. In June the company spent $14bn to buy 49% of Scale AI and secured its boss to take a lead role in Meta's development of the tech. This came amid a wider increase in spending by Zuckerberg on the company's AI strategy, as well as reportedly luring talent from rivals like OpenAI.

[10]

Meta Buys AI Agent Startup for $2 Billion, Says It Will Cut All Ties With China

Meta did it again. The social media giant just bought another AI startup. This time, it’s the Singapore-based AI agent company Manus. Meta is buying the AI company in a deal worth more than $2 billion, according to the Wall Street Journal. It’s the latest move in Meta’s increasingly aggressive push into AI. The company already has plans to invest billions into AI infrastructure. Additionally, Meta has snapped up or invested in AI startups like Scale AI and Limitless, a sign that its in-house efforts may not be moving fast enough. However, there’s one hitch with today’s deal. Manus’s roots in China could raise eyebrows in Washington, as the U.S. and China remain locked in an AI arms race. Manus made a splash when it debuted this spring as a general AI agent that could handle a wide range of tasks, including deep research, vacation planning, coding, and stock analysis. Earlier this month, Manus announced that it had reached $100 million in annual recurring revenue just eight months after launching. “Joining Meta allows us to build on a stronger, more sustainable foundation without changing how Manus works or how decisions are made,†Manus CEO Xiao Hong said in a statement. Meta said in its own announcement that it plans to continue operating Manus as its own service, while also integrating it into its own products. The startup was founded by its parent company, Butterfly Effect, which previously held offices in Beijing and Wuhan. Shortly after launching Manus, the company moved its headquarters to Singapore. Manus's Chinese ties have already drawn scrutiny. Earlier this year, Silicon Valley venture capital firm Benchmark faced backlash from U.S. lawmakers after investing in Manus. “Who thinks it is a good idea for American investors to subsidize our biggest adversary in AI, only to have the CCP use that technology to challenge us economically and militarily? Not me,†Sen. John Cornyn wrote in a post on X at the time. In what appears to be an effort to get ahead of similar accusations, Meta said that after the deal closes, Manus will be required to sever all remaining ties with China. “There will be no continuing Chinese ownership interests in Manus AI following the transaction, and Manus AI will discontinue its services and operations in China,†a Meta spokesperson told Nikkei Asia. Meta did not immediately respond to Gizmodo's request for comment. According to Nikkei, Manus has laid off most of its Chinese employees and now has 105 staffers based in Singapore, Tokyo, and San Francisco.

[11]

Meta is reportedly buying Manus -- here's what it could mean for how you use AI every day

2026 could be the year Meta AI proves it can keep up with OpenAI and Google IIt's already looking like 2026 could be the year Meta AI finally levels up. According to The Wall Street Journal, Meta is in the process of acquiring Manus, an AI startup best known for building autonomous, "agentic" systems. Manus is an AI in a league of its own because it can take action and delivers finished work with minimal back-and-forth chatting. On the surface, this acquisition looks like another big-ticket AI deal in an already crowded space. But for everyday users, it could quietly change how Meta AI works across Facebook, Instagram, WhatsApp and whatever comes next. There's a very good chance you may have not heard of Manus. It's not one of the more common chatbots like ChatGPT, Gemini or Claude. It surfaced about a year ago as competition to Deepseek and has been quietly building traction. But while most people are used to AI as a conversational tool, Manus stands out as an autonomous worker. Instead of responding step by step, agentic systems are designed to: Think less "help me write an outline" and more "research this topic, draft a summary, pull sources and format it for me." If Meta integrates that kind of capability into Meta AI, it moves the assistant from being reactive to proactive, which is a meaningfut shift towards the future of AI. If you use Meta AI today, you've probably noticed it's helpful but limited. It answers questions, generates images and assists with basic tasks, but it still feels like a chatbot. Agentic AI could change that in a few key ways: For consumers, this is the difference between talking to AI and delegating to it. Meta has been vocal about its AI ambitions, but it's also playing catch-up in some areas. With Google's Gemini 3.0 currently at the top of the leaderboards, the purchase of Manus could instantly accelerate Meta's push forward. Agentic AI is a space where companies like OpenAI and Google are already investing heavily. Instead of building everything in-house, Meta would be buying a team and a system already designed around autonomous execution. It's also a signal that Meta isn't just focused on flashy AI features -- it's aiming for utility. And utility is what actually keeps people using AI tools long-term. For users, the real story won't be the acquisition itself -- it'll be what ships. WIthin the upcoming months, I'll be watching how Meta integrates agentic features directly into Meta AI, or keeps them separate. I'll also be curious to see if this shows up first in productivity-style tools, or consumer apps like WhatsApp and Instagram. And perhaps most importantly, how much autonomy will users actually trust AI with? This deal reinforces a clear trend: AI is moving beyond conversation and toward action. For everyday users, that could mean fewer prompts, less micromanagement and AI that finally feels like a true assistant. Whether Meta can deliver on that promise is the question -- and one we'll be watching closely.

[12]

Meta buys Manus for $2 billion to power high-stakes AI agent race

The acquisition accelerates Meta's pivot from chatbot tools to task-completing AI across its platforms Meta has acquired AI startup Manus, known for its semi-autonomous AI agents, in a deal reportedly valued at more than $2 billion, according to The Wall Street Journal. It's one of the largest AI acquisitions to date. More importantly, it underscores Meta's plan to shift from creating foundational models like Llama to providing full-service AI agents capable of completing complex tasks for individuals and businesses. Meta said it plans to make the AI agent platform part of its Meta AI assistant and enterprise offerings. Manus agents can perform complex analytics and long-term research and planning, along with the more usual conversations and image generation. It can also go out to the web and carry out tasks for users, which is why it's named Manus, Latin for hand. "We will continue to operate and sell the Manus service, as well as integrate it into our products," Meta said in a statement. "Manus is already serving the daily needs of millions of users and businesses worldwide. It launched its first General AI Agent earlier this year and has already served more than 147T tokens and created more than 80M virtual computers. We plan to scale this service to many more businesses." The reported valuation aligns with where Manus had been headed before Meta intervened. The company had been raising new funds at a $2 billion valuation when Meta approached with an offer. With over $125 million in revenue run rate just eight months after launch, Manus had proven not only its technical capabilities but also its commercial appeal. But this isn't just a story of a high-value tech buyout. It marks a directional turn for Meta, one that deepens its commitment to building AI that does more than chat. In fact, Manus was not simply another chatbot; it was one of the first widely available agentic systems able to autonomously perform multi-step, goal-oriented tasks using a blend of reasoning, memory, and tool use. Users could, for instance, hand Manus a research objective or a programming task and watch it coordinate a solution end-to-end. That's a radically different product category than LLMs trained solely to predict the next word. Meta wants to build AI that acts. That's also the reason Meta invested $14.3 billion in Scale AI earlier this year. But a working autonomous AI platform is several steps beyond. The company's pricing model, a mix of free and premium subscriptions, helped it grow rapidly, especially among developers, analysts, and SMEs looking to automate workflows without hiring engineers. And while Meta has been pouring money into building out its own LLMs, developing effective agentic behavior remains a highly specific engineering and design challenge. Tools like planning, memory, tool-use, and recursive reasoning can't simply be bolted onto a large model, and Manus has already solved many of these problems. "Joining Meta allows us to build on a stronger, more sustainable foundation without changing how Manus works or how decisions are made," Manus CEO Xiao Hong said in a statement. "We're excited about what the future holds with Meta and Manus working together, and we will continue to iterate the product and serve users that have defined Manus from the beginning." Meta is racing to build up AI agents among fierce competition. Google's Gemini is actively developing agentic features, while OpenAI's ChatGPT has introduced tools to perform tasks online and provide more assistance that adapts to context. But Manus promises to make it easy to integrate its services into other platforms. That earned it interest from companies like Microsoft, which tested Manus integration in Windows 11. With Meta owning the whole thing, what happens next is just as much a question of strategy as it is technology. Manus's origins add a layer of complexity. Initially developed under the Chinese AI startup Butterfly Effect before spinning off, concerns over data security likely contributed to its relocation from Beijing to Singapore this year and the layoffs of most of its Chinese workforce. Meta's acquisition even comes with an explicit condition that "there will be no continuing Chinese ownership interests," according to the companies. Meta has had to walk a fine line in the global AI race as it skirts regulatory scrutiny. Manus lets it jump ahead in product development, but will probably come with at least some probing questions about who owns the data used to run Manus. In 2026, no major American tech company can afford to look like it has Chinese influence, just ask TikTok. Then there's the hardware angle. Meta's Reality Labs division doesn't bring in much cash, but Meta still sees a future of smart glasses and agentic AI assistants that interact with the physical world. Manus could provide the cognitive layer for those ambitions. The acquisition makes it clear that Meta sees 2026 as the time when AI chatbots will become AI agents. With Manus powering its AI platforms, Meta plans to be the tool of first resort when it comes to AI engaging with the real world.

[13]

Meta's deal with Manus AI could be worth $2.5 billion

Why it matters: AI has reset startup exit valuations, driven by unprecedented revenue growth. Catch up quick: Manus AI was valued at only $500 million when it raised $75 million in Series B funding this past May, led by Benchmark. * The deal was controversial given Manus AI's roots in China, although the company was headquartered in Singapore and its 100 or so China employees relocated shortly thereafter. What it does: Manus AI has developed a general AI agent that it claims can complete various real-world tasks, going well beyond chatbot or workflow functions. * Tasks include market research, coding, data analysis and resume screening. * The company claims it reached over $100 million in annual recurring revenue within months of launch. The intrigue: Manus is sold on a subscription basis to companies, marking Meta's first significant foray into AI for the enterprise. * The deal has the potential to put Meta on more equal footing in the agentic AI race with competitors Salesforce, Google, Microsoft and OpenAI. What we're watching: Meta has faced repeated scandals, fines, and criticism for data practices.

[14]

Meta acquires Manus: what it means for your enterprise AI agent strategy

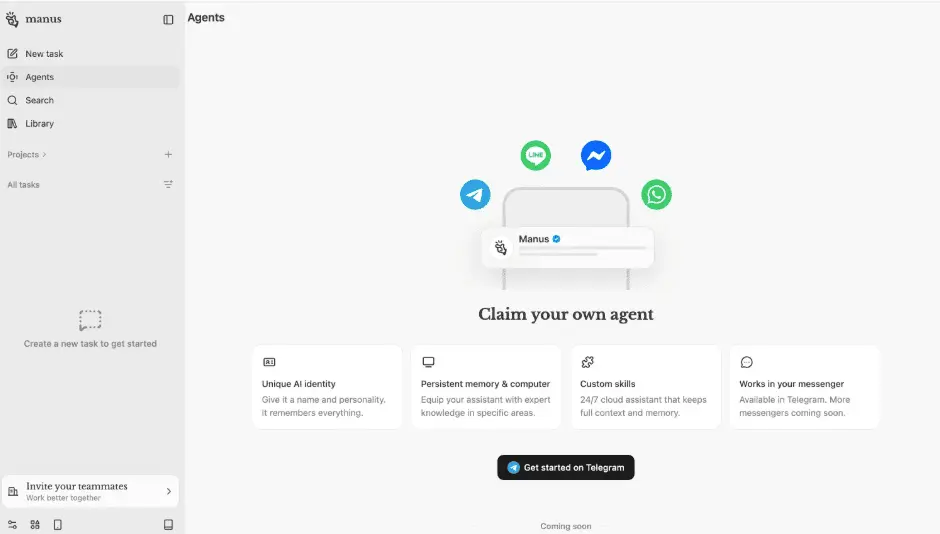

Facebook and Instagram parent company Meta's agreement to acquire Manus for more than $2 billion -- announced last night by both companies and reported in The Wall Street Journal -- marks one of the clearest signals yet that large tech platforms are no longer just competing on model quality, but on who controls the execution layer of AI-powered work. Manus, a Singapore-based startup founded by Chinese entrepreneurs that debuted earlier this year, has built a general-purpose AI agent designed to autonomously carry out multi-step tasks such as research, analysis, coding, planning, and content generation. The company will continue operating from Singapore and selling its subscription product while its team and technology are integrated into Meta's broader AI organization. Manus co-founder and CEO Xiao Hong, who goes by "Red," is expected to report to Meta COO Javier Olivan. The deal arrives as Meta accelerates its AI investments to compete with Google, Microsoft, and OpenAI -- and as the industry's focus shifts from conversational demos to systems that can reliably produce artifacts, complete workflows, and operate with minimal supervision. Manus as an execution layer, not a chat interface Manus has consistently positioned itself less as an assistant and more as an execution engine. Rather than answering isolated prompts, its agent is designed to plan tasks, invoke tools, iterate on intermediate outputs, and deliver finished work. It gained 2 million users on its waitlist alone after unveiling itself in spring 2025. At that time, Manus outperformed OpenAI's Deep Research agent (powered then by the o3 model) and other state-of-the-art systems on the GAIA benchmark, which evaluates how well AI agents complete real-world, multi-step tasks, by more than 10% in some cases. And in the acquisition announcement last night, Manus said its system has processed more than 147 trillion tokens and created over 80 million virtual computers, metrics that suggest sustained, production-level usage rather than limited experimentation. Meta, meanwhile, said Manus can independently execute complex tasks such as market research, coding, and data analysis, and confirmed it will continue operating and selling the Manus service while integrating it into Meta AI and other products. For enterprises, this distinction matters. Many early "agent" systems fail not because the underlying models can't reason, but because execution breaks down: tools fail silently, intermediate steps drift, or long-running tasks can't be resumed or audited. Manus's core value proposition is that it manages those failure modes. What Manus users were actually doing with the agent Evidence of that execution-first positioning shows up clearly in Manus's own community. In the official Manus Discord server, a "Use Case Channel" post shared by a community member named Yesly on March 6, 2025 catalogued real examples of how users were already deploying the agent. Those use cases went far beyond casual prompting. They included: * Generating long-form research reports, such as a detailed analysis of climate change impacts on Earth and human society over the next century * Producing data-driven visual artifacts, including an NBA scoring efficiency four-quadrant chart based on player statistics * Conducting product and market research, such as comparing every MacBook model across Apple's history * Planning and synthesizing complex, multi-country travel itineraries, complete with budget estimates, accommodations, and a generated travel handbook * Tackling technical and academic tasks, including summarizing high-temperature superconductivity research, proposing PhD research directions, and outlining simulation-based approaches to room-temperature superconductors * Drafting structured proposals, such as designs for a solar-powered, self-sufficient home with defined geographic coordinates and engineering constraints Each example was shared as a replayable Manus session, reinforcing that the system wasn't just generating text, but orchestrating multi-step work to produce finished outputs. This pattern matters because it shows Manus operating in the messy middle ground where enterprise AI often stalls: tasks that are too complex for a single prompt, but too open-ended for rigid automation. Manus's recent updates The pace at which Manus shipped updates was also impressive, which likely added to its momentum with users and as a ripe acquisition target for Meta. In October, the company released Manus 1.5, an update aimed squarely at where early agent systems tended to break down: long, brittle tasks that lost context or stalled halfway through. Manus re-architected its core agent engine and saw immediate gains. The company said average task completion times dropped from roughly 15 minutes earlier in the year to under four minutes, nearly a fourfold speedup. The system dynamically allocated more reasoning time and compute to harder problems instead of treating every task the same. Manus also expanded the agent's context windows, enabling it to track longer conversations and more intricate workflows without dropping key details. Together, those changes reduced outright task failures and improved output quality for research-heavy, analytical, and multi-step jobs that previously required frequent human intervention. In December, Manus built on that foundation with version 1.6, extending those execution gains into more autonomous, creative, and platform-spanning work. The release introduced a higher-performance agent tuned to complete more tasks successfully in a single pass, along with new support for mobile application development, not just web-based projects. Users could describe a mobile app and have the agent handle the end-to-end build process, expanding Manus's reach beyond the browser. At the same time, the agent carried creative objectives across an entire production arc -- from research and ideation to drafting, visual creation, revision, and final delivery -- within one continuous session. That included generating and editing images through a visual interface, assembling presentations and reports, and building full-stack web applications the agent could launch, test, and fix on its own. Taken together, the updates reinforced Manus's positioning not as a prompt-driven assistant, but as an execution system designed to stay with a job, adapt when things broke, and reliably deliver finished work across analytical, creative, web, and mobile workflows. Application-layer traction over proprietary models Notably, Manus does not train its own frontier model. Reporting on the deal says it relies on third-party AI models from providers including Anthropic and Alibaba, focusing its differentiation on orchestration, reliability, and execution. That hasn't prevented commercial traction. Yuchen Jin, co-founder and chief technology officer (CTO) of AI cloud GPU-as-a-service provider Hyperbolic Labs, highlighted this dynamic in a public post discussing the acquisition. Jin noted that Manus by its own admission reached roughly $100 million in annual recurring revenue just eight months after launch, despite having no proprietary large language model (LLM) of its own, relying on the aforementioned providers. "People keep assuming a small update from OpenAI or Google will wipe out a lot of AI startups," Jin wrote. "But in reality, the AI application layer should be where most of the opportunity is." A similar interpretation came from Dev Shah, lead developer relations at Resemble AI, who argued that Meta didn't acquire a model company so much as an "environment company" and that "intelligence cannot exist in isolation." His point? Agentic capability emerges from how models are coupled with tools, memory, and execution environments -- a new concept he described as "Situated Agency." From that perspective, Manus's achievement was not training a proprietary foundation model, but engineering an execution layer that allows models like Claude to browse the web, write and run code, manipulate files, and complete multi-step workflows autonomously. Shah suggested this may align more closely with Meta's long-term strategy: rather than winning the race for state-of-the-art models, Meta could focus on owning the agentic infrastructure -- the orchestration, context engineering, and interfaces -- and swap in whichever model performs best over time. If that thesis holds, the Manus acquisition signals a shift toward treating foundation models as interchangeable inputs, while the execution environment becomes the primary source of durable value. These perspectives help explain Meta's move. Rather than buying another model team, it is acquiring a system that has already proven it can package existing models into a product users will pay for -- and keep using. What this means for your enterprise AI strategy For enterprise technical decision-makers, the Manus acquisition is less a vendor endorsement and more a strategic signal. First, it reinforces that orchestration layers -- systems that manage planning, tools, retries, memory, and monitoring -- are becoming as important as the models themselves. Enterprises building internal AI capabilities may want to invest more heavily in agent infrastructure that sits above models and can survive rapid shifts in the underlying model ecosystem. In that sense, building an internal agent layer is not speculative or redundant. It is exactly the class of software that large platforms now view as strategically valuable -- whether as acquisition targets or as internal accelerators. A video recorded ahead of this announcement by VentureBeat founder and CEO Matt Marshall and Red Dragon co-founder Witteveen delves deeper into this subject. Watch it free below or on YouTube. Second, the deal does not automatically mean enterprises should rush to standardize on Manus itself. Meta's history with enterprise products gives reason for caution. Tools like Workplace by Facebook gained early adoption but ultimately failed to become deeply embedded enterprise platforms, in part due to shifting internal priorities and inconsistent long-term investment. That history suggests a measured approach. Enterprises evaluating Manus today may want to treat it as a pilot or adjunct tool, not a foundational dependency, until Meta's integration strategy becomes clearer. Key questions include whether Manus remains product-led rather than ad- or data-driven, how governance and compliance evolve under Meta, and whether the roadmap continues to prioritize execution reliability over surface-level integration. Finally, the acquisition sharpens a broader choice facing enterprises: whether to wait for vendors to define the agent layer, or to build and control it themselves. Manus's trajectory suggests that the real leverage in AI increasingly lives not in who owns the smartest model, but in who owns the systems that turn reasoning into completed work. In that light, Meta's acquisition is less about Manus alone -- and more about where the next durable layer of the AI stack is taking shape. Why this deal matters beyond Meta From the perspective of some of us here at VentureBeat, the Manus acquisition is best read as confirmation of where value is consolidating in the AI stack (and Meta's enterprise AI agent ambitions, though the latter is far less assured.) The defining signal is not that Manus built novel models, but that it demonstrated how quickly well-designed agents can be turned into revenue-generating products by focusing on execution, speed, and concrete outcomes. That shift -- from debating what frontier models can do to measuring what agents actually deliver -- increasingly frames how AI progress is evaluated. The deal also sharpens an important distinction for enterprise readers: this is not primarily about adopting a Meta-backed product, but about recognizing that agent orchestration has become strategically material. Manus succeeded by targeting tractable, real-world tasks and shipping agents that worked end to end, even if those use cases skewed more consumer-oriented. The broader implication is that enterprises can apply the same approach in their own domains, building agent systems where they already possess data, expertise, and operational leverage. At the same time, we're cautious about reading this as a direct enterprise buying signal. Meta's history suggests that long-term enterprise trust is difficult to earn without sustained focus and specialized go-to-market muscle. Where the acquisition may make more immediate sense is on the consumer and small-business side of Meta's own ecosystem, particularly within products already designed to manage commerce, content, and customer interaction at scale. Manus's agentic capabilities map cleanly onto surfaces like Meta Business Suite, where small businesses already juggle content calendars, inboxes, ads, analytics, and monetization tools across Facebook and Instagram. An execution-oriented agent could plausibly automate or coordinate many of those tasks end to end, from drafting and scheduling posts to responding to messages, optimizing ads, or assembling performance reports. Manus's "Design View" feature, which launched publicly just a week prior to the Meta acquisition announcement and allows users to generate new imagery with editable discrete components using natural language, would seem to be tailor-made for a social network ad creation experience: Beyond creators and small businesses, those agents could plausibly extend to everyday users navigating Instagram or Facebook for shopping, discovery, or personal expression. An execution-oriented agent could assist regular users with tasks such as browsing and comparing products, managing purchases, assembling wish lists, or coordinating returns, while also helping them create and edit posts, reels, or stories for friends and family -- not as professional content, but as casual, social, and entertainment-driven output. That framing aligns closely with Meta's historical strengths. The company has been most successful when AI capabilities are tightly integrated into high-frequency consumer workflows rather than positioned as standalone enterprise software. A Manus-powered agent that helps users do things -- shop, create, plan, or manage interactions inside Meta's apps -- would fit naturally into Instagram and Facebook's evolution toward more agentic experiences. In that scenario, Manus functions less as an enterprise brand and more as an invisible execution layer, powering AI assistants that operate natively within Meta's consumer ecosystem, where scale, engagement, and commerce already converge. As a result, the acquisition's clearest relevance is not whether enterprises should standardize on Manus, but that investments in internal agent frameworks, orchestration layers, and governance now appear increasingly well-justified -- because that is precisely the layer large platforms are now willing to pay for.

[15]

Meta claims 'no continuing Chinese ownership interests in Manus AI' after reported $2 billion deal to shore up in AI agent race | Fortune

Meta is buying artificial intelligence startup Manus, as the owner of Facebook and Instagram continues an aggressive push to amp up AI offerings across its platforms. The California tech giant declined to disclose financial details of the acquisition. But The Wall Street Journal reported that Meta closed the deal at more than $2 billion. Manus, a Singapore-based platform with some Chinese roots, launched its first "general-purpose" AI agent earlier this year. The platform offers paid subscriptions for customers to use this technology for research, coding and other tasks. "Manus is already serving the daily needs of millions of users and businesses worldwide," Meta said in a Monday announcement, adding that it plans to scale this service -- as Manus will "deliver general-purpose agents across our consumer and business products, including in Meta AI." Xiao Hong, CEO of Manus, added that joining Meta will allow the platform to "build on a stronger, more sustainable foundation without changing how Manus works or how decisions are made." Manus confirmed that it would continue to sell and operate subscriptions through its own app and website. The platform has grown rapidly over the past year. Earlier this month, Manus announced that it had crossed the $100 million mark in annual recurring revenue, just eight months after launching. Some of Manus' initial financial backers reportedly included China's Tencent Holdings, ZhenFund and HSG. And the company that first launched the platform -- Butterfly Effect, which also operates under the name monica.im, which was founded in China before moving to Singapore. A Meta spokesperson confirmed on Tuesday that there would be "no continuing Chinese ownership interests in Manus AI" following its transaction, and that the platform would also discontinue its services and operations in China. Manus reiterated that it would continue to operate in Singapore, where most of its employees are based. Meta CEO Mark Zuckerberg has been pushing to revive its commercial AI efforts as the company faces tough competition from rivals such as Google and OpenAI, maker of ChatGPT. In June, the company made a $14.3 billion investment in AI data company Scale and recruited its CEO Alexandr Wang to help lead a team developing "superintelligence" at the tech giant.

[16]

Meta wants AI agents in your day-to-day, starting with Manus

The plan is to scale Manus inside consumer and business tools, including Meta AI. Meta has acquired Manus, a Singapore-based startup behind a general-purpose autonomous agent it plans to fold into its products. Meta Manus AI agents are being framed as the next step beyond chat, software that can carry work through to completion. Meta and Manus say the agent can independently handle tasks like market research, coding, and data analysis. The expectation is, you keep working where you already are, and the agent takes on more of the busywork that normally eats a day. Recommended Videos If you already use Manus, the companies are stressing continuity. The subscription service will keep running through the current app and website, and Manus will continue operating from Singapore. Manus is built to execute Manus is described as an execution layer that can take a goal, move through the steps, and deliver an output without constant back-and-forth. To back that up, Manus points to scale metrics. It says the agent has processed more than 147 trillion tokens and powered the creation of over 80 million virtual computers in a few months. Meta says it will keep operating the Manus service while it works on integrations across its consumer and business products, including Meta AI. Why Meta wants agents everywhere Meta is positioning the acquisition as an accelerator for business AI, and a way to bake automation into products people already use. That matters because it suggests agents will not stay locked inside a standalone tool, Meta says it wants them inside its broader ecosystem. The deal terms are still thin in public. CNBC reports the Wall Street Journal pegged the acquisition at more than $2 billion, and CNBC also reports Manus claimed an annualized average revenue above $100 million eight months after launch, with a run rate over $125 million. Those figures help explain why Meta would buy, not just partner. What businesses should watch next The near term looks like a two-track plan, keep the existing subscription steady while Meta starts weaving the agent into more surfaces. The practical questions for businesses are where it appears first and what data and tools it can access. If you run a team, start by listing the workflows you would actually trust an agent to execute end to end, like recurring research, first-pass analysis, or internal coding tasks. Then watch for updates around admin controls, pricing tiers, and data handling language as Meta scales Manus to more businesses.

[17]

Meta to acquire AI startup Manus in deal valued at over $2 billion

The acquisition comes as Mark Zuckerberg intensifies Meta's push to compete with rivals such as Google and OpenAI. Meta has agreed to buy artificial intelligence startup Manus, doubling down on its aggressive bid to supercharge AI across Facebook, Instagram and its wider product portfolio. The California tech giant declined to reveal the exact financial terms of the deal, but The Wall Street Journal reported that the acquisition is valued at more than $2 billion (€1.7 billion). Manus, a Singapore-based platform with some Chinese roots, launched its first "general-purpose" AI agent earlier this year, positioning itself as a versatile tool for everything from research to coding. The platform operates on a paid subscription model, offering users access to its AI-powered services. "Manus is already serving the daily needs of millions of users and businesses worldwide," Meta said in a Monday announcement, adding that it plans to scale the service - with Manus set to "deliver general-purpose agents across our consumer and business products, including in Meta AI." Xiao Hong, the CEO of Manus, said the move would allow the company to "build on a stronger, more sustainable foundation without changing how Manus works or how decisions are made." Manus confirmed it would continue selling and operating subscriptions through its own app and website. The startup's rise has been rapid. Earlier this month, Manus revealed it had surpassed $100 million in annual recurring revenue - just eight months after launch. Some of Manus' early backers reportedly included China's Tencent Holdings, ZhenFund and HSG. The platform was initially developed by Butterfly Effect - also known as monica.im - a company founded in China before relocating to Singapore. A Meta spokesperson confirmed on Tuesday that there would be "no continuing Chinese ownership interests in Manus AI" following the transaction, and that the company would wind down its services and operations in China. The deal is the latest in a series of high-profile moves by the Silicon Valley group to strengthen its foothold in the AI sector by snapping up fast-growing start-ups. In June, Meta spent $14 billion (€11.9 billion) to acquire a 49% stake in Scale AI.

[18]

Manus-Meta Deal May Come Under Scrutiny From Beijing: Report | AIM

Manus, now headquartered in Singapore, was founded in China. It raised $75 million in 2025 before moving its base. Meta's recent acquisition of Singapore-based AI startup Manus could attract scrutiny from Chinese regulators over potential violations of technology export controls, according to the South China Morning Post. The report cited Cui Fan, the deputy general secretary and director of research at the China Society for WTO Studies. Fan said regulators would focus on whether any technology restricted or prohibited under Chinese law was transferred overseas without approval. He pointed to China's Regulations on Technology Import and Export Administration, under which authorities may assess when, how, and what technologies were moved abroad by Manus' onshore entities, including both individuals and companies. The concern arises because Manus, now headquartered in Singapore, was founded in China in 2022. The company was established by a China-based team and raised $75 million in a Series B round in April 2025, led by US venture firm Benchmark, valuing it at about $500 million. The funding drew scrutiny from US regulators due to executive orders limiting American investment in Chinese AI companies, prompting a Treasury Department review. After the round, Manus shifted its headquarters to Singapore and scaled back its China operations. This included layoffs in mainland China, shutting down local operations, cancelling plans for a China-specific product, and ending technical collaboration discussions with Alibaba. However, despite attempts to distance itself from China, regulatory exposure may persist. Fan also noted that there has been no confirmation that Manus' core team members have renounced Chinese nationality or that they are no longer subject to Chinese jurisdiction. He added that Manus' mainland-registered parent company, Butterfly Effect, remains with the founding team, and that the firm's early research and development was conducted in China. Other experts quoted in the report said AI agents are likely to be classified as "important information technology products and services" under Chinese regulations, which could bring the Meta-Manus deal within the scope of China's national security review of foreign investment. The situation echoes the regulatory dynamics seen in the long-running TikTok saga. In that case, Beijing asserted jurisdiction over core technologies developed in China, particularly recommendation algorithms, even as parent company ByteDance sought to ring-fence or divest overseas operations.

[19]

Meta just bought one of the fastest-growing AI startups you've probably never heard of

In a year defined by companies pouring shocking sums of money into AI, one more deal squeaked in just before 2026. Meta just made a play on Manus, the buzzy Singapore-based company with Chinese roots that turned heads earlier this year when it showed its AI agents executing complex tasks, like hunting for real estate and sorting through resumes. The deal is sure to turn heads too. Manus and its parent company Butterfly Effect are now based in Singapore but were founded in China - a country with a fraught relationship to the U.S tech industry - and maintain operations there. Facebook's parent company will reportedly pay more than $2 billion to acquire the startup, which it hopes will bolster its own lagging AI capabilities. In a crowded field of soaring chipmakers, nimble startups laser focused on AI, and ancient tech giants like Microsoft making themselves freshly relevant with big AI bets, Meta is far from leading the pack - a fact the company seems well aware of.

[20]

Meta Platforms buys Manus to bolster its agentic AI skillset - SiliconANGLE

Meta Platforms buys Manus to bolster its agentic AI skillset Meta Platforms Inc. is pushing into autonomous artificial intelligence agents with the acquisition of Singapore-based Manus, which made headlines when it first emerged earlier this year for its ability to perform tasks using a web browser without human supervision. Manus shot to fame in March, just weeks after China's DeepSeek Ltd. shocked the world with its low-cost alternative to OpenAI Group PBC's ChatGPT. It was one of the first AI agents to be made widely available to everyday users through a subscription service, and it made a huge splash on social media for its ability to perform complicated tasks such as creating resumes, writing software applications and designing and building websites. It also demonstrated impressive research capabilities. In one video posted on X, a user asked Manus to find them a suitable two-bedroom apartment in their desired location and it immediately set about generating a comprehensive list of available real estate, complete with evaluations of local crime rates and commute times to different parts of the city. Manus was one of the first in a wave of AI agents that have taken the enterprise world by storm this year, and nowadays they're pretty common as everyone has jumped onto the bandwagon in an effort to fulfill the promise of AI work automation. For instance, coding agents like CodeGPT, GitHub Copilot, Replit and Jules have transformed software development, while companies such as Salesforce Inc. and ServiceNow Inc. have launched fleets of AI agents designed to automate work across industry verticals. Manus is much more of a general-purpose agent, and although the headlines have since died down, it has reportedly built on its initial success after raising $75 million in funding in April. In a brief blog post announcing today's acquisition, Meta said Manus has processed more than 147 trillion tokens this year and created over 80 million virtual computers while serving "millions of users and businesses" globally. The startup, which was initially based in China before moving to Singapore in the summer, says it reached $100 million in annually recurring revenue just eight months after its launch, making it the first startup anywhere to achieve this milestone in such a rapid timeframe. Most of its revenue stems from paid subscribers. In its announcement, Meta said it will continue to operate and sell the Manus agent as a separate offering for the time being, while also integrating its technology into its own ecosystem, including its Meta AI platform. That could expand the reach of Manus's technology to billions of users globally. "Joining Meta allows us to build on a stronger, more sustainable foundation without changing how Manus works or how decisions are made," said Manus Chief Executive Xiao Hong. The deal suggests Meta is getting more serious about the need to build a viable business around its massive, multibillion dollar investments in AI infrastructure. AI has become the top priority of Meta founder and CEO Mark Zuckerberg, surpassing his ambitions for the metaverse, but the social media giant has struggled recently, with its Llama family of large language models perceived to have fallen behind rivals such as OpenAI's GPT-5 and Google LLC's Gemini 3. Zuckerberg responded by forming a dedicated AI research division called Meta Superintelligence Labs that's focused on building more advanced models and AI agents. The unit is led by Alexandr Wang, the founder of data labelling startup Scale AI Inc. Meta paid $14 billion to acquire a 49% stake in Scale AI earlier this year in what was effectively an "acquihire" for Wang's services.

[21]

Mark Zuckerberg's Meta is dropping over $2 billion for an AI startup -- a rare example of a U.S. tech giant buying a platform founded in China | Fortune

Manus, in case you're unfamiliar, builds so‑called AI "agents" that can carry out complex digital tasks for consumers and businesses. The idea here is that Manus will essentially fold its technology into Meta's products, including the Meta AI assistant that runs across Facebook, Instagram, and WhatsApp. The deal marks one of the first major instances of a key player in U.S. tech buying a startup founded in China, making it somewhat of a litmus test for cross-border deals of this kind -- especially in the AI space. Manus launched just three years ago, in 2022. It started as a project from Butterfly Effect, a.k.a. Monica.im, a startup that was based in Beijing before it moved its headquarters to Singapore earlier this year as it looks to expand globally. Manus' AI agent, notably, can screen résumés, plan trips, analyze stock portfolios, and handle other multi‑step jobs with minimal human input, positioning it as a kind of virtual colleague rather than a simple chatbot. Manus has seen explosive growth in its brief life so far. Just a little over a week ago, Manus released a blog post claiming it had reached $100 million in annualized recurring revenue and achieved a $125 million run rate, thanks largely to subscriptions and power users. The company also says Microsoft tested Manus on Windows 11 PCs this year to help users build websites and other content from their local files. For Meta, the Manus deal is the latest in a series of multibillion‑dollar bets aimed at turning heavy infrastructure spending on AI chips and data centers into commercially viable products. Founder and CEO Mark Zuckerberg has called AI the company's top priority: Meta continues to invest heavily in its Llama family of open‑source language models, and made a large strategic investment in Scale AI earlier this year, even bringing on the startup's 28-year-old billionaire founder Alexandr Wang to lead Meta's broader AI efforts. The acquisition also untangles Manus's ownership ties to China. While the startup has received backing from Chinese investors from the likes of Tencent, ZhenFund, and HSG (formerly Sequoia China), a Meta spokesperson told Nikkei Asia "there will be no continuing Chinese ownership interests in Manus AI following the transaction, and Manus AI will discontinue its services and operations in China." A Meta spokesperson did not immediately respond to Fortune's request for comment. Of course, this move to disentangle Manus from China should help Meta avoid the eye and ire of U.S. politicians and regulators. John Cornyn, the 73-year-old Republican senator from Texas, slammed U.S. VC firm Benchmark Capital back in May for joining a $75 million funding round for Manus, asking and answering a hypothetical question on X, "Who thinks it is a good idea for American investors to subsidize our biggest adversary in AI, only to have the CCP use that technology to challenge us economically and militarily? Not me." Manus's founder and CEO, Xiao Hong, framed the sale as a way to scale the technology globally. "The era of AI that not only talks but also acts, creates, and delivers is just beginning," he said on social media, according to Al Jazeera. "Now, we have the opportunity to build it at a scale we could never have envisioned." Meta has said it will keep the Manus service running while integrating the team of roughly 100 employees into its broader AI organization.

[22]

Meta buys startup Manus in latest move to advance its artificial intelligence efforts

DETROIT (AP) -- Meta is buying artificial intelligence startup Manus, as the owner of Facebook and Instagram continues an aggressive push to amp up AI offerings across its platforms. The California tech giant declined to disclose financial details of the acquisition. But The Wall Street Journal reported that Meta closed the deal at more than $2 billion. Manus, a Singapore-based platform with some Chinese roots, launched its first "general-purpose" AI agent earlier this year. The platform offers paid subscriptions for customers to use this technology for research, coding and other tasks. "Manus is already serving the daily needs of millions of users and businesses worldwide," Meta said in a Monday announcement, adding that it plans to scale this service -- as Manus will "deliver general-purpose agents across our consumer and business products, including in Meta AI." Xiao Hong, CEO of Manus, added that joining Meta will allow the platform to "build on a stronger, more sustainable foundation without changing how Manus works or how decisions are made." Manus confirmed that it would continue to sell and operate subscriptions through its own app and website. The platform has grown rapidly over the past year. Earlier this month, Manus announced that it had crossed the $100 million mark in annual recurring revenue, just eight months after launching. Some of Manus' initial financial backers reportedly included China's Tencent Holdings, ZhenFund and HSG. And the company that first launched the platform -- Butterfly Effect, which also operates under the name monica.im, which was founded in China before moving to Singapore. A Meta spokesperson confirmed on Tuesday that there would be "no continuing Chinese ownership interests in Manus AI" following its transaction, and that the platform would also discontinue its services and operations in China. Manus reiterated that it would continue to operate in Singapore, where most of its employees are based. Meta CEO Mark Zuckerberg has been pushing to revive its commercial AI efforts as the company faces tough competition from rivals such as Google and OpenAI, maker of ChatGPT. In June, the company made a $14.3 billion investment in AI data company Scale and recruited its CEO Alexandr Wang to help lead a team developing "superintelligence" at the tech giant.

[23]

Meta buys startup Manus in latest move to advance its artificial intelligence efforts

DETROIT -- Meta is buying artificial intelligence startup Manus, as the owner of Facebook and Instagram continues an aggressive push to amp up AI offerings across its platforms. The California tech giant declined to disclose financial details of the acquisition. But The Wall Street Journal reported that Meta closed the deal at more than $2 billion. Manus, a Singapore-based platform with some Chinese roots, launched its first "general-purpose" AI agent earlier this year. The platform offers paid subscriptions for customers to use this technology for research, coding and other tasks. "Manus is already serving the daily needs of millions of users and businesses worldwide," Meta said in a Monday announcement, adding that it plans to scale this service -- as Manus will "deliver general-purpose agents across our consumer and business products, including in Meta AI." Xiao Hong, CEO of Manus, added that joining Meta will allow the platform to "build on a stronger, more sustainable foundation without changing how Manus works or how decisions are made." Manus confirmed that it would continue to sell and operate subscriptions through its own app and website. The platform has grown rapidly over the past year. Earlier this month, Manus announced that it had crossed the $100 million mark in annual recurring revenue, just eight months after launching. Some of Manus' initial financial backers reportedly included China's Tencent Holdings, ZhenFund and HSG. And the company that first launched the platform -- Butterfly Effect, which also operates under the name monica.im, which was founded in China before moving to Singapore. A Meta spokesperson confirmed on Tuesday that there would be "no continuing Chinese ownership interests in Manus AI" following its transaction, and that the platform would also discontinue its services and operations in China. Manus reiterated that it would continue to operate in Singapore, where most of its employees are based. Meta CEO Mark Zuckerberg has been pushing to revive its commercial AI efforts as the company faces tough competition from rivals such as Google and OpenAI, maker of ChatGPT. In June, the company made a $14.3 billion investment in AI data company Scale and recruited its CEO Alexandr Wang to help lead a team developing "superintelligence" at the tech giant.

[24]

Meta buys fast growing AI firm Manus in 2 billion dollar deal

Meta Platforms is acquiring Manus, a Singapore-based AI startup, for $2 billion. The Wall Street Journal reported the deal matches the valuation Manus sought for its next funding round after the startup's rapid user growth and revenue milestones. Manus emerged in spring with a demo video that gained viral attention. The video demonstrated an AI agent capable of screening job candidates, planning vacations, and analyzing stock portfolios. The startup positioned this technology as superior to OpenAI's Deep Research. Within weeks of its launch, by April, Benchmark led a $75 million funding round for the early-stage firm. This round established a post-money valuation of $500 million. Benchmark general partner Chetan Puttagunta joined the Manus board as part of the investment. Prior to this round, Manus had secured $10 million from investors including Tencent, ZhenFund, and HSG, formerly known as Sequoia China. Chinese media outlets reported these backers' involvement in the earlier financing. Manus introduced pricing at $39 or $199 per month for access to its AI models. Bloomberg described this as "somewhat aggressive ... for a membership service still in a testing phase." The company later reported signing up millions of users. It also achieved over $100 million in annual recurring revenue. These developments prompted Meta to enter negotiations with Manus. Meta plans to maintain Manus as an independent operation. At the same time, it will integrate Manus's AI agents into Facebook, Instagram, and WhatsApp. This complements Meta's existing Meta AI chatbot available to users on those platforms.

[25]

Meta buys startup Manus in latest move to advance its artificial intelligence efforts

DETROIT (AP) -- Meta is buying artificial intelligence startup Manus, as the owner of Facebook and Instagram continues an aggressive push to amp-up AI offerings across its platforms. The California tech giant declined to disclose financial details of the acquisition. But The Wall Street Journal reported that Meta closed the deal at more than $2 billion. Manus, a Singapore-based platform with some Chinese roots, launched its first "general-purpose" AI agent earlier this year. The platform offers paid subscriptions for customers to use this technology for research, coding and other tasks. "Manus is already serving the daily needs of millions of users and businesses worldwide," Meta said in a Monday announcement, adding that it plans to scale this service -- as Manus will "deliver general-purpose agents across our consumer and business products, including in Meta AI." Xiao Hong, CEO of Manus, added that joining Meta will allow the platform to "build on a stronger, more sustainable foundation without changing how Manus works or how decisions are made." Manus confirmed that it would continue to sell and operate subscriptions through its own app and website. The platform has grown rapidly over the past year. Earlier this month, Manus announced that it had crossed the $100 million mark in annual recurring revenue, just eight months after launching. Some of Manus' initial financial backers reportedly included China's Tencent Holdings, ZhenFund and HSG. And the company that first launched the platform -- Butterfly Effect, which also operates under the Monica. Im name -- was founded in China before moving to Singapore. A Meta spokesperson confirmed on Tuesday that there would be "no continuing Chinese ownership interests in Manus AI" following its transaction, and that the platform would also discontinue its services and operations in China. Manus reiterated that it would continue to operate in Singapore, where most of its employees are based. Meta CEO Mark Zuckerberg has been pushing to revive its commercial AI efforts as the company faces tough competition from rivals such as Google and OpenAI, maker of ChatGPT. In June, the company made a $14.3 billion investment in AI data company Scale and recruited its CEO Alexandr Wang to help lead a team developing "superintelligence" at the tech giant.

[26]

Manus Skips $2 Billion Funding to Join Meta: Report