Meta's $70B AI gamble hits turbulence as Zuckerberg faces internal revolt and strategy shift

6 Sources

6 Sources

[1]

Inside Mark Zuckerberg's turbulent bet on AI

This summer, Mark Zuckerberg was struggling to poach a top artificial intelligence researcher from rival OpenAI when he heard his target had fallen sick. On top of the offer of a stratospheric salary, the billionaire tech titan added a personal flourish: the hand delivery of some homemade soup. Bespoke touches from one of the world's richest men are just one element of the gloves-off, all-consuming bet that Zuckerberg has made this year on turning his social media platform from AI laggard to leader. In a headlong rush to develop what he dubs "personal superintelligence" and compete with OpenAI and Google, Zuckerberg is pumping billions of dollars into building out the infrastructure that could help him pull off his ambitions while luring talent with gargantuan compensation packages. To smooth the path to dominance and avoid red tape, Zuckerberg has also publicly courted Donald Trump, lavishing the US president with praise and softening content moderation rules to appease Maga fears about censorship. If successful, the AI push could supercharge Meta's already lucrative business, and restore the coveted status of "tech visionary" to Zuckerberg, after his attempt to create an avatar-filled virtual metaverse fell flat and received pushback from Wall Street. But the strategy has also created corporate whiplash inside the Silicon Valley company, as employees have faced a rapid succession of lay-offs, restructurings and executive reshuffles in one of the most turbulent periods in its 20-year existence. Investors are also increasingly skittish. Meta's 2025 capital expenditures are expected to hit at least $70bn, up from $39bn the previous year, and the company has started undertaking complex financial manoeuvrings to help pay for the cost of new data centres and chips, tapping corporate bond markets and private creditors. At its October earnings, the Big Tech chief announced plans for even more spending on AI next year that could top $100bn -- but failed to provide much clarity on how exactly the technology would be integrated into Meta's existing social media empire and monetised. Meta's shares dropped more than 10 per cent, wiping more than $208bn from its valuation. 2026 could be the year Zuckerberg's AI vision starts to become reality -- or shatters under pressure. Meta's freshly hatched elite research lab is aiming to release a new AI model in the first quarter of next year, according to four people familiar with the matter. The model, codenamed Avocado internally, will be built from scratch, rather than an iteration on its Llama large language models, which underperformed this year relative to peers. The company, which declined to comment for this article, is aiming for Avocado to have performance on a level with Google's Gemini 2.5 upon release, and with Gemini 3 by the summer, according to one person familiar with the matter. Gemini 2.5 was released in March this year, while Gemini 3 was rolled out in November to wide acclaim and is considered to have leapfrogged OpenAI's ChatGPT. Either way, Avocado will need to be highly competitive with the flurry of recent model releases from Google, OpenAI and Anthropic -- or fresh hires from Zuckerberg's Great Talent Heist could flee. "Mark Zuckerberg likes to play high-stakes poker. Other people like doing it in Las Vegas. He likes doing it with his company," says one former Meta executive who worked closely with him. "Mark has a keen sense of when the market is changing and moving quickly to catch up. Here, he is buying momentum," the person adds. "I would be wary of betting against his ability to deploy his resources to be successful. Will he 'win'? I'm not sure. But he will not lose." Zuckerberg's declaration last year that he wanted to become an AI leader very rapidly fell short of expectations. In April 2025, the social platform released Llama 4, the latest iteration of its open source large language model, which also powers its Meta AI chatbot, to much fanfare. But the model performed worse than those by rivals such as OpenAI and Google on jobs including coding tasks and complex problem solving. The company was also accused of trying to game the leader boards -- where models are compared and benchmarked by third parties -- by submitting a customised version to the ranking. The flop was a humiliating blow to Zuckerberg's plans to centre Meta's future around generative AI. In conversations with multiple current and former staff, as well as industry insiders, some blame the quality of Meta's training data, and say the teams did not apply rigorous testing methods. Others cited cultural and organisational issues: competing research cliques divided on decision-making, research and product teams not aligning, or a lack of key AI leadership. Tijmen Blankevoort, an AI researcher who left Meta this summer, described the company in a memo at the time as having a "wavering vision that was tough for team members to enthusiastically rally behind" and "instability in team assignments, leading to experience not building up and crystallising over time". Another Meta insider says: "Our tools and products became fragmented because so many teams were rooting for their own products that no one was really thinking about how they worked together." Seeking to regain ground, Zuckerberg -- whose reputation for fixating on chosen projects is so well-established that executives call it the "Eye of Sauron" -- escalated his ambition. The overarching goal, Zuckerberg said in a memo in July, was now to pursue so-called "personal superintelligence", or AI that surpasses human intelligence, that can "fit in people's pockets". In particular, he indicated that he would direct development of the technology towards "relationships and culture and creativity and having fun and enjoying life" as much as improving productivity and other "grand problems". In interviews and podcasts, he also pointed to research showing that the average American has fewer than three real friends but wishes they had five times that number. The answer, Zuckerberg posited, was for Meta to offer AI that will be a companion, as well as a secretary, personal shopper or ghostwriter. In the longer term, he plans to fully embed the AI technology within futuristic Meta smart glasses that have an augmented reality display and will allow wearers to interact seamlessly with the world around them. While Meta has already developed simpler Ray-Ban smart glasses alongside other more sophisticated AI glasses prototypes, he hopes future upgrades might one day replace Apple iPhones and Google's Android as the computing platform of choice. To deliver on his new dream, Zuckerberg has taken a two-pronged approach. Firstly, he conducted a hiring blitzkrieg on prime talent in the AI community. Hundreds of potential candidates from rival labs at OpenAI, Anthropic, Apple, Google and Microsoft were targeted over the summer for roles in a new VIP AI team with huge pay packages and sign-on bonuses worth $100mn. The strategy marked a decisive shift away from relying largely on what insiders call "Friends of Zuckerberg" (or FoZ) -- longtime lieutenants at the company from its early start-up days -- to bringing in a new wave of hungry AI native leaders. To steer the entire AI effort, renamed Meta Superintelligence Lab, Zuckerberg in June hired 28-year-old billionaire entrepreneur Alexandr Wang, who founded data labelling start-up Scale AI. Wang is also heading up Meta's secretive TBD Lab, focused on developing new frontier AI models. Tasked with integrating those models into Meta's product is Nat Friedman, a popular Silicon Valley investor and former head of coding site GitHub. Meta spent $14bn for a 49 per cent stake in Wang's Scale and a 49 per cent stake in Friedman's investment group NFDG. A new design studio focused on integrating AI within hardware such as smart glasses will be headed by Alan Dye, a top Apple design executive. The company has also shifted towards a buy-over-build strategy -- scooping up several smaller AI start-ups in areas such as wearables, agreeing partnerships to license technology such as Midjourney's video AI and using rivals' models internally to boost their own work. While some insiders have welcomed a new energy closer to Elon Musk's "hardcore" work ethic, cracks have begun to emerge at an executive level. Tensions have been bubbling between Wang and Zuckerberg, according to four people familiar with the matter. Wang has told associates he finds Zuckerberg's micromanagement of the company's AI work suffocating, several of the people say. Internally, some staff question whether Wang is out of his depth, given his lack of experience managing teams in a large corporation but also his expertise in AI data services rather than as an AI researcher pushing technical breakthroughs. Friedman is also under increasing pressure from Zuckerberg to move faster on delivering AI products. Some in his team were frustrated by what they felt was the rushed release of Vibes, Meta's feed of AI-generated videos, rolled out at breakneck speed in order to beat the release of OpenAI's similar Sora. "Meta is in a tough spot as a newcomer. Few folks get hired into leadership and it's such a tenure-driven place," says one former insider who left recently. "When you're a friend of Zuck you have more room for error." At the same time, the company recently laid off 600 workers from its AI team, casting the cuts as designed to speed up decision-making processes. "The thing they are really trying to change is agility -- being quick to market, having the ability to read the market signs in terms of how the market is changing rapidly," says Arun Chandrasekaran, an AI analyst at Gartner. For the remaining old guard, 2025 has been a year of adjustment. As the new vision and leadership have crystallised, some top names have left, including some so-called Friends of Zuck. Among them, in recent weeks, Meta's longtime chief legal officer Jennifer Newstead was poached by arch-rival Apple, while chief revenue officer John Hegeman announced he too was leaving to launch a start-up. Meanwhile, storied chief AI scientist and Turing Award winner Yann LeCun is departing to launch a new AI initiative. He had taken exception at having to report to Wang, according to two people familiar with the matter, while his longer-term research was hit hard by the recent cuts. Some newer hires also did not stay the course: Meta's head of business AI Clara Shih, poached from Salesforce, has left within a year of starting. Alongside the hiring bonanza, Zuckerberg has opened up a fire hose of cash to build huge data centres powered by costly chips, escalating AI infrastructure spending. Investors have punished Meta for the spree. Its shares fell sharply by around 17 per cent in November over concerns about its dwindling free cash flow, which analysts project could fall from about $54bn to $20bn this year. "We're going to get to a point at the end of next year where if they are to sustain a similar level of capex spending, it's going to eat up all your free cash flows or you've got to bring on a lot more debt," says Uday Cheruvu, portfolio manager and analyst at asset manager Harding Loevner, which invests in Meta. Meta has become bolder and more experimental in its financing. In late October, the company raised $30bn in one of the largest corporate bond offerings in US history to finance its infrastructure ambitions. It also raised a further $27bn in debt from private credit markets in late 2025 -- the largest private debt deal on record -- to build the colossal multi-gigawatt Hyperion data centre hub in Louisiana. In order to keep the loans off its balance sheet, the deal was achieved via a special purpose vehicle that is 80 per cent owned by investment group Blue Owl Capital. The SPV will build and own Hyperion, which will be leased and operated by Meta, whose rent will fund the interest payments on the debt. By keeping the debt off its books, Meta can preserve its high credit rating. But investors have been wary in past tech hype cycles about off-balance sheet financing and are likely to have questions about Meta's guarantees to the SPV should the AI boom start to collapse. Those close to the company say they will have hedged carefully against such eventualities. "Clearly, [chief financial officer] Susan Li and the team recognise this risk and have worked hard to insulate the company from the fiscal carnage if it turns out there's wild overcapacity in data centres," the former Meta executive says. Meta's shares jumped as much as 7 per cent when it emerged this month that the company was shifting budget away from the metaverse teams towards its AI wearables. For Zuckerberg's part, he has argued that the real danger is in not being aggressive enough. "If we end up misspending a couple of hundred billion dollars, I think that that is going to be very unfortunate obviously. But actually I think the risk is higher on the other side," he said recently in an interview on the Access podcast. "If you build too slowly . . . then you are just out of position on what I think is going to be the most important technology that enables the most new product and innovation and value creation in history." Going forward, investors will be closely watching how Meta's new Avocado model lands. The TBD group has been wielding rival models as part of the training process for Avocado, using a process known as distillation to transfer knowledge and predictions from those models to their own model, according to one person familiar with the matter and first reported by Bloomberg. In particular, Meta is using Google's Gemma, OpenAI's gpt-oss and Qwen, a model from the Chinese tech giant Alibaba Group Holding Ltd, despite Zuckerberg previously raising concerns that Chinese models might be censored by Beijing and arguing that America must win the AI race against China. There has also been debate about whether Meta's new model will be open source, or a closed proprietary model, meaning that consumers will have to pay to access it, with Wang pushing for the latter. Others argue that Meta must show how data from its user chatbot conversations can be fed into its advertising-targeting machine, even if Zuckerberg himself is reluctant to speak on the commercial aspect. "Mark needs to find a new version of [former chief operating officer] Sheryl Sandberg who can connect the dots for advertisers on why Meta's AI products can combine with advertising and targeting," says Katie Harbath, global affairs officer at Duco Experts and a former Meta public policy director. "It's not cool and sexy [but] if they want to buy themselves some runway . . . it's the lowest hanging fruit." At the same time, Zuckerberg will also need the trust of users, lawmakers and regulators, and to reassure them that his products will not leak their private information or harm their kids. In August, leaked Meta policy guidelines revealed that the platform expressly allowed its chatbots to have "sensual" and "romantic" chats with children -- revelations that have prompted public outcry around the world, and from US politicians on both sides of the aisle. Insiders say that Friedman in particular has been prioritising safety. But David Evan Harris, a lecturer at University of California, Berkeley, and a former research manager in responsible AI at Meta, says that the decision on the policy guidelines revealed in August "will go down in history as one of the most unconscionable decisions ever made about AI". "We see these big investments in hiring technology people, but I think that one of the biggest ways that the [race can be won] is on AI trust," he adds. Insiders are bracing for more tumult ahead. "The more Mark is not seen at the same level as [OpenAI chief Sam] Altman or others, the more paranoid he's going to get," says Harbath. "And the quicker the pivots are going to get."

[2]

Meta's next AI model, 'Avocado,' signals shift to closed development

Meta is reportedly developing a new AI model, code-named "Avocado," slated for release in the spring of 2026. Unlike its popular Llama series, which embraced an open-source approach, Avocado is expected to adopt a closed-source model. During its training, the project reportedly drew on multiple models developed by competitors, including Alibaba's Qwen, Google's Gemma, and OpenAI's proprietary systems. Bloomberg reported that while it remains unclear which specific Qwen model was used, the news has already drawn attention in China, where Qwen had long sought to catch up to Llama. The situation now appears reversed, with Qwen serving as a reference point for Llama's successor. According to the South China Morning Post, historically, Chinese companies have leveraged Llama to build their own AI models, sometimes sparking controversy. For instance, in 2023-2024, AI startup 01.AI, founded by Kai-Fu Lee, faced criticism for not fully disclosing the use of Llama in its training process. Interest in Chinese open-source models surged in early 2025 with the breakout success of DeepSeek. Both DeepSeek and Qwen have become leading examples of China's rapid AI innovation, accelerating model development and adoption. In November, Alibaba's Qwen3-based app, Qwen Chat, entered public testing and surpassed 10 million downloads within a week, outpacing the initial launches of ChatGPT and DeepSeek. Alibaba aims to position Qianwen as "the gateway to AI-powered daily life," signaling a shift from its traditional enterprise focus toward consumer applications. While Chinese developers continue to embrace open-source models, Meta's Avocado project marks a clear pivot toward closed-source development. CEO Mark Zuckerberg has invested heavily in building Meta's AI engineering teams and is personally monitoring the project's progress, underscoring the company's high stakes in the next generation of AI.

[3]

Inside Meta's pivot from open-source to moneymaking AI model

Meta Platforms Inc.'s Mark Zuckerberg, months into building one of the priciest teams in technology history, is getting personally involved in day-to-day work and pivoting the company's focus to an artificial intelligence model it can make money off of. One new model, code-named Avocado, is expected to debut sometime next spring, and may be launched as a "closed" model -- one that can be tightly controlled and that Meta can sell access to, according to people familiar with the matter, who declined to speak publicly about internal plans. The move, which aligns with what rivals Google and OpenAI do with their models, would mark the biggest departure to date from the open-source strategy Meta has touted for years. Open-source models allow outside developers and researchers to review and build upon the code. Meta's new Chief AI Officer Alexandr Wang is an advocate of closed models, according to the people. Meta's strategy shifted dramatically earlier this year after the company released Llama 4, an open-source model that disappointed Silicon Valley and Zuckerberg, Meta's chief executive officer. He sidelined some of the people who worked on that project and personally recruited top AI researchers and leaders, in some cases offering them hundreds of millions of dollars in multiyear pay packages, and some, like Wang, who came in through a $14.3 billion investment deal. Now, Zuckerberg spends much of his time and energy working closely with those new hires, in a group called TBD Lab. The TBD group is using several third-party models as part of the training process for Avocado, distilling from rival models including Google's Gemma, OpenAI's gpt-oss and Qwen, a model from the Chinese tech giant Alibaba Group Holding Ltd., the people said. Training the new model on Chinese technology signals a shift in tone for Zuckerberg, who raised concerns on Joe Rogan's podcast in January that Chinese models could be shaped by state censorship. Zuckerberg has since repeatedly advocated for U.S. government support for American tech companies seeking to dominate the global AI race before China can, and said his open-source strategy was part of leading that mission. But Llama and other U.S. efforts have fallen behind. "China is well ahead -- way ahead on open-source," Nvidia Corp. CEO Jensen Huang said earlier this month. A spokesperson for Meta declined to comment. Zuckerberg has long maintained that giving the public access to emerging tools and technologies, particularly in AI, strengthens Meta's products and encourages wider adoption. He's likened Meta's open-source approach for AI to Google's Android operating system for smartphones. While Meta already builds some closed models for internal use, and Zuckerberg has teased the idea of developing other closed models in the past, several iterations of Meta's current flagship AI model, Llama, are open-source. On an earnings call with investors in late July, Zuckerberg hinted that the company would pursue both open and closed models moving forward. AI has become Meta's top priority, commanding the bulk of spending and attention from executives as Meta races against rivals to become the first company to achieve AI models that can surpass human-level capabilities. Zuckerberg has pledged to spend $600 billion on U.S. infrastructure projects over the next three years, most of them AI-related. He's also redistributing some of Meta's investments internally, planning meaningful cuts to its virtual reality and metaverse efforts in favor of putting that spending into AI glasses and other related hardware, people familiar with the matter have said. Still, Meta's AI spending has become the focus of Wall Street investors, who recently balked at Zuckerberg's pledge to continue investing heavily into 2026. While Meta maintains that its AI investments already pay off by making the company's advertising business stronger, and Zuckerberg has argued for the need to quickly "front-load" capacity, others have worried that its expensive bet on building data centers and acquiring other infrastructure may not contribute to profit for years, if at all. After Bloomberg reported that Meta was considering steep cuts to its metaverse efforts, the stock jumped on optimism for more disciplined spending. If Meta is to deliver something industry-leading next year, it will depend heavily on Wang, the 28-year-old wunderkind who joined the company after its deal with his startup, Scale AI. Zuckerberg has positioned himself as a mentor to Wang, according to people familiar with their relationship, entrusting him with arguably the company's most important and expensive product endeavor. While Wang isn't considered a technical AI researcher, he knows the industry through relationships he built at Scale and has impressed his new colleagues with his ability to get things done quickly and offer a big-picture vision, the people said. Yet Wang has at times been frustrated by what he sees as micromanagement, according to people familiar with the matter. Zuckerberg has a long history of getting intensely hands-on with the company's most important products. Members of the TBD Lab group have been situated around the CEO's desk at Meta's Menlo Park, Calif., headquarters so it's easier for Zuckerberg to check in on their progress, the people said. Meanwhile, Meta has de-prioritized its open-source strategy. Some Meta employees were directed by leadership to stop talking publicly about open-source and Llama products after the Llama 4 launch while the company recalibrated whether those efforts still made sense moving forward, according to people familiar with the moves. Yann LeCun, known as one of the godfathers of AI, recently left the company after years leading Meta's long-term AI research group, in part because of frustrations that he couldn't get enough resources, Bloomberg News reported. Prior to his departure, some employees had been encouraged to keep LeCun, who was a big proponent of open-source technology, out of the spotlight, including at public speaking events, the people said. Meta no longer saw him as emblematic of the company's AI strategy, and couldn't trust that he'd stay on message, they added. The model after Llama 4 had the internal code name Behemoth -- but Zuckerberg was disappointed in its direction and scrapped it in pursuit of something new, the people said. Since then, pressure on the new team has ratcheted up, thanks in large part to Meta's exorbitant spending to build what Zuckerberg has called "the most elite and talent-dense team in the industry." Roughly six months into Meta's AI pivot, the team has been mostly heads-down without much to show publicly, yet. The news that has trickled out has skewed negative. Some new hires from Meta Superintelligence Labs have departed within weeks of arriving. In October, Meta eliminated 600 jobs from its AI unit, with deep cuts to its more academically focused unit, FAIR. LeCun left the company a month later, intent on doing his research elsewhere. The most high-profile product to come out of MSL has also received mixed reviews. To get ahead of OpenAI's release of Sora 2, a video-generation tool, Meta rushed out its own product called Vibes using technology that it licensed from AI startup Midjourney Inc. While Meta insiders insist that Vibes is performing well in terms of usage, Sora's launch just one week later quickly overshadowed Vibes in the press and online. Success could also depend on Zuckerberg's ability to sell his vision to users, regulators and investors. The group's stated goal is to achieve "superintelligence," which broadly refers to AI systems capable of completing tasks better than humans. But the term has also left people confused and concerned both inside and outside the company. This summer, Meta leadership tasked data-focused employees with conducting market research on how the term would land with policymakers in the U.S. and abroad. Working with external consultants, they found that "superintelligence" triggered fears of AI's unchecked power, particularly in Europe, where regulators have already come after Meta's AI offerings, the people said. In the U.S., some high-profile AI academics and other technologists, including Apple Inc. co-founder Steve Wozniak and Virgin Atlantic Airways Ltd.'s Richard Branson, have gone so far as to encourage a ban on developing "superintelligence" until more is done to prove it can be built safely.

[4]

Meta's 'Highest-Paid' Employee Is Reportedly Unhappy With Zuckerberg - ProShares S&P 500 Dynamic Buffer ETF (BATS:FB)

Meta Platforms Inc.'s (NASDAQ:FB) AI whizz Alexandr Wang is reportedly feeling 'suffocated' under the micromanagement of CEO Mark Zuckerberg. What Happened: Wang, the brains behind Scale AI, became part of Meta earlier this year when the social media giant acquired a 49% stake in his startup for over $14 billion. Wang has allegedly communicated to his colleagues that Zuckerberg's stringent control over the AI project is impeding its advancement, reports The Financial Times. This news surfaces amidst a period of internal discord at Meta, characterized by layoffs, high-level departures, and hasty AI deployments. The company's much-anticipated AI model, Llama 4, failed to live up to the hype, fueling further dissatisfaction. Despite these hurdles, Zuckerberg remains committed to AI investment, with Wang at the helm of the enigmatic TBD Lab, tasked with creating a novel flagship AI model, codenamed "Avocado". However, there has been some skepticism within Meta regarding Wang's capability to oversee large research teams, considering his expertise lies in AI data services rather than pioneering AI models. Also Read: Harvard Expert Says Zuckerberg Is Derailing Facebook: 'I Think The Wealth Went To His Head' The pressure is also mounting on former GitHub CEO Nat Friedman, who was recruited to incorporate AI models into Meta's offerings. The urgency to deliver has led to premature product launches. Amid these leadership challenges, several high-ranking executives have exited Meta, and the company has dismissed 600 employees from its AI divisions. Meta's AI capital expenditures are projected to hit a minimum of $70 billion this year. Meta has contested certain elements of the report, asserting that public leaderboards can be misleading and that recent policy issues were based on examples that were "erroneous and inconsistent" with its guidelines. Why It Matters: The reported dissatisfaction of Wang, a key player in Meta's AI initiative, could potentially impact the company's ambitious AI projects. The internal strife and high-level departures may further destabilize the company's AI efforts. Additionally, the criticisms of rushed product releases and the failure of the Llama 4 model underscore the challenges Meta faces in its pursuit of AI dominance. Read Next Mark Zuckerberg Names 'Facemash', Not 'Facebook', As His Most Significant Harvard Achievement FBProShares S&P 500 Dynamic Buffer ETF$42.290.39%Overview This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Market News and Data brought to you by Benzinga APIs

[5]

Meta's billionaire AI star Alexandr Wang thinks boss Mark...

Meta paid billions to bring billionaire AI prodigy Alexandr Wang on board -- but the tech wunderkind now privately believes CEO Mark Zuckerberg's micromanagement of the company's AI push is "suffocating," according to a bombshell report. Wang, the 28-year-old founder of Scale AI who joined Meta earlier this year after the company shelled out more than $14 billion for a 49% stake in his startup, was installed as the public face of Zuckerberg's AI reboot. But behind the scenes, Wang has complained to associates that Zuckerberg's tight grip on the effort is stifling progress, the Financial Times reported, citing multiple people familiar with the situation. Wang's unhappiness is just the latest manifestation of the internal upheaval engulfing Meta, which has been beset by repeated layoffs, senior executive exits, rushed AI rollouts and eye-popping spending that has shaken morale and fueled investor anxiety. One major sign of trouble that reared its head earlier this year was the botched rollout of Meta's highly anticipated AI model, Llama 4. Despite ambitious expectations, Llama 4 lagged behind rivals on key benchmarks such as coding and complex reasoning. Meta was also accused of trying to game AI leaderboards by submitting a customized version for rankings. Inside Meta, the setback was seen as a humiliating blow to Zuckerberg's pledge to turn the company into an AI powerhouse within a short period of time. Current and former employees blamed weak training data, insufficient testing and deep organizational dysfunction. "Our tools and products became fragmented because so many teams were rooting for their own products that no one was really thinking about how they worked together," one Meta insider told the FT. Rather than slow down, Zuckerberg doubled down -- launching a hiring blitz across Silicon Valley, dangling compensation packages worth up to $100 million and pouring tens of billions of dollars into AI infrastructure. Wang, who was widely viewed as key to this strategy, also heads the secretive TBD Lab, which is tasked with building a new flagship AI model codenamed "Avocado." But some Meta employees have privately questioned whether Wang is out of his depth managing massive research teams at a company of Meta's scale, according to FT. These employees noted that his background is in AI data services rather than developing frontier AI models. Tensions have also surfaced between Zuckerberg and Nat Friedman, the former GitHub CEO brought in to integrate AI models into Meta's products. Friedman has faced mounting pressure to deliver quickly, frustrating members of his team who felt products were rushed out the door to beat competitors. One example cited by the FT was the rapid rollout of "Vibes," Meta's AI-generated video feed, which insiders said was pushed out at breakneck speed to stay ahead of OpenAI's Sora. As leadership strains intensified, top executives began heading for the exits. Meta's longtime chief legal officer Jennifer Newstead was recently poached by Apple. John Hegeman, the company's chief revenue officer, announced he was leaving to launch a startup. Storied chief AI scientist Yann LeCun, a Turing Award winner, is also departing to start a new AI initiative after reportedly objecting to reporting to Wang and seeing his research priorities slashed. Other high-profile hires didn't last either. Clara Shih, recruited from Salesforce to lead business AI, left within a year. Even as senior talent walked out the door, Meta laid off 600 workers from its AI teams, framing the cuts as a way to speed decision-making. All of it is unfolding against a backdrop of staggering spending. Meta's AI capital expenditures are expected to hit at least $70 billion this year, with Zuckerberg signaling costs could top $100 billion annually. Investors have recoiled. Meta shares plunged sharply in November amid fears that free cash flow could collapse as spending spirals. Meta disputed aspects of the FT report, saying it routinely experiments with different AI model variants and arguing that public leaderboards can be misleading and "easily gameable." The company also pointed to prior statements disputing characterizations of internal upheaval and said recent chatbot policy concerns were based on examples that were "erroneous and inconsistent" with its rules.

[6]

Meta's top AI executive calls Zuckerberg's management suffocating, here is why

Recent departures of senior executives, including Yann LeCun and Jennifer Newstead, reflect growing unease within Meta's AI hierarchy. It's no lie that Meta has been spending billions of dollars to build its aspirational AI team. But the new report suggests that the company seems to be going through early turbulence, with signs of internal strain emerging around its high-profile AI leadership overhaul. Back in June, the Facebook parent agreed to acquire a 49 per cent stake in AI startup Scale AI in a deal valued at $14.8 billion, bringing its young founder and chief Alexandr Wang, into the company to lead a newly created 'superintelligence' division. Wang was elevated as the public face of CEO Mark Zuckerberg's AI reset, a move fuelled by aggressive hiring and nine-figure pay packages aimed at luring top talent away from competitors. However, according to a Financial Times report, tensions between Wang and Zuckerberg have begun to emerge, with concerns that the company's tightly controlled management style is slowing progress at a time when Meta is under pressure to deliver breakthroughs. According to the report, Wang has privately expressed frustration with what he perceives as excessive oversight of Meta's AI efforts, implying that decision-making has become constrained. People familiar with the situation told the newspaper that senior-level disagreements have been simmering for some time, pointing to a growing schism between Meta leadership and the AI chief. Also read: Meta plans new image and video AI model codenamed Mango, targets 2026 release: Report The report added that some employees have questioned Wang's background, pointing out that his expertise is in AI data services rather than core research, and that he has limited experience leading teams on the scale of a global technology company. These doubts have reportedly added to the anxiety surrounding Meta's AI reorganisation. This comes after Meta recently revealed a restructured hierarchy. Meta abandoned its previous frontier model and has since divided its AI operations into several units, focusing on research, advanced systems, products and infrastructure. In recent weeks, Meta's chief legal officer Jennifer Newstead, has joined Apple, chief revenue officer John Hegeman has announced plans to leave to start a new company, and long-time chief AI scientist Yann LeCun is reportedly leaving to pursue a separate AI initiative.

Share

Share

Copy Link

Mark Zuckerberg is betting Meta's future on AI with at least $70 billion in capital expenditures this year, but the strategy has triggered internal chaos. The company's pivot from open-source to closed AI models, led by new hire Alexandr Wang, faces mounting challenges as executives depart and the highly anticipated Avocado model becomes a test of Zuckerberg's vision.

Meta Pivots Strategy After Llama 4 Disappointment

Mark Zuckerberg is orchestrating one of the most aggressive transformations in Meta's 20-year history, pumping at least $70 billion in capital expenditures into AI infrastructure this year as the company races to compete with OpenAI and Google

1

. The strategic shift follows the disappointing April 2025 release of Llama 4, Meta's open-source AI model that underperformed rivals on coding tasks and complex problem solving1

. The setback prompted Zuckerberg to pursue what he calls "personal superintelligence" through a dramatic overhaul that includes recruiting top AI talent with compensation packages reaching hundreds of millions of dollars3

.

Source: FT

Meta is now developing a new AI model code-named Avocado, expected to debut in spring 2026, marking the company's biggest departure from its open-source strategy

2

. Unlike previous Llama iterations, Avocado will adopt a closed-source approach that Meta can tightly control and monetize, aligning with strategies used by rivals Google and OpenAI3

. The model aims to achieve performance comparable to Google's Gemini 2.5 upon release and Gemini 3 by summer, according to sources familiar with the matter1

.

Source: Benzinga

Training Data Draws on Chinese Technology

The Avocado project is using several third-party models as part of its training process, including Google's Gemma, OpenAI's gpt-oss, and Qwen from Chinese tech giant Alibaba

3

. This reliance on Chinese technology represents a notable shift for Zuckerberg, who raised concerns on Joe Rogan's podcast in January about Chinese models potentially being shaped by state censorship3

. The situation reflects how Chinese open-source models like Qwen have gained ground, with Nvidia CEO Jensen Huang stating that "China is well ahead -- way ahead on open-source"3

.Historically, Chinese companies leveraged Llama to build their own AI models, but the dynamic now appears reversed, with Qwen serving as a reference point for Llama's successor

2

. Alibaba's Qwen3-based app surpassed 10 million downloads within a week of public testing in November, outpacing initial launches of ChatGPT and DeepSeek2

.Alexandr Wang Faces Zuckerberg Micromanagement

At the center of Meta's AI reboot is Alexandr Wang, the 28-year-old founder of Scale AI who joined Meta after the company acquired a 49% stake in his startup for over $14 billion

4

. Wang now heads the secretive TBD Lab tasked with building Avocado, but sources say he has privately complained to associates that Zuckerberg micromanagement is "suffocating" progress5

. Zuckerberg has positioned himself as a mentor to Wang and spends much of his time working closely with the new hires in TBD Lab3

.

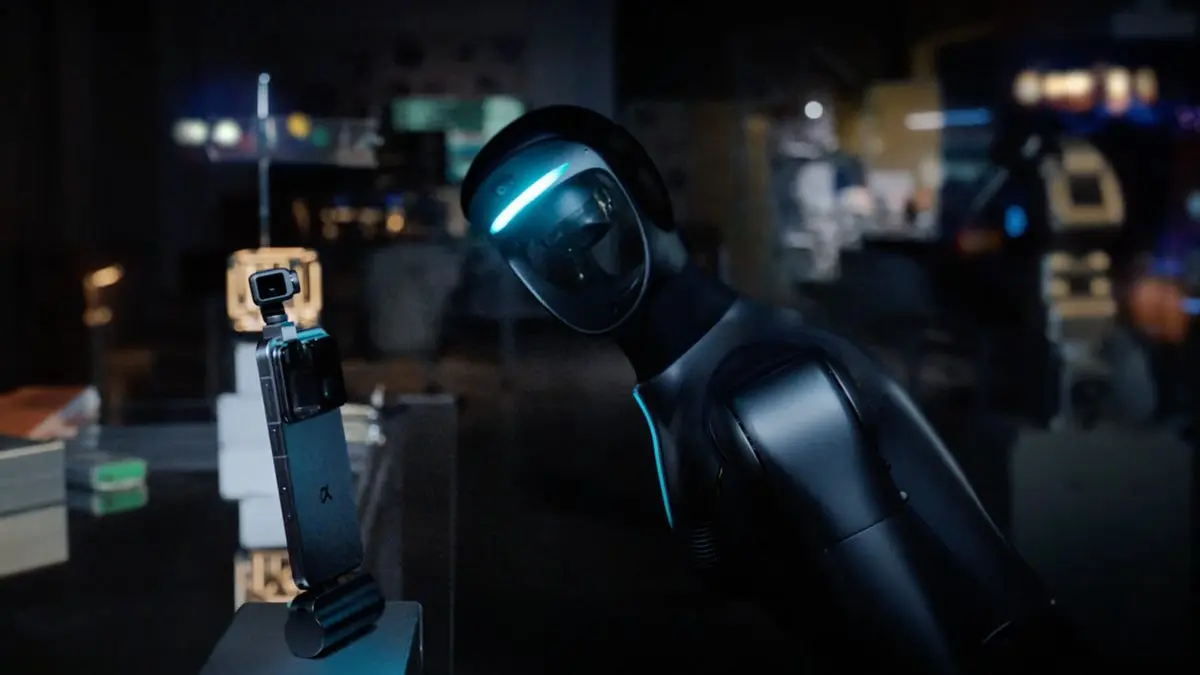

Source: New York Post

Some Meta employees have questioned whether Wang is equipped to manage massive research teams at the company's scale, noting his background is in AI data services rather than developing frontier AI models

5

. Wang is an advocate of closed models, influencing Meta's strategic shift away from open-source AI3

.Related Stories

Executive Departures Signal Internal Turmoil

Meta has experienced a wave of executive departures as the AI push creates corporate upheaval. Longtime chief legal officer Jennifer Newstead was recruited by Apple, while chief revenue officer John Hegeman announced plans to launch a startup

5

. Yann LeCun, the company's storied chief AI scientist and Turing Award winner, is departing to start a new AI initiative after reportedly objecting to reporting to Wang and seeing his research priorities slashed5

.The company has also laid off 600 employees from its AI divisions, framing the cuts as necessary to speed decision-making

5

. Former GitHub CEO Nat Friedman, brought in to integrate AI models into Meta's products, has faced mounting pressure to deliver quickly, frustrating team members who felt products were rushed out to beat competitors5

.Investor Concerns Mount Over Spending

Investor concerns have intensified as Zuckerberg signals AI spending could top $100 billion annually, up from $39 billion the previous year

1

. At Meta's October earnings, the company failed to provide clarity on how AI technology would be integrated into its social media empire and monetized, triggering a stock drop of more than 10 percent that wiped over $208 billion from its valuation1

. The company has undertaken complex financial maneuvering to pay for new data centers and chips, tapping corporate bond markets and private creditors1

.Zuckerberg has pledged to spend $600 billion on U.S. infrastructure projects over the next three years, most AI-related, while redistributing investments away from virtual reality and metaverse efforts toward AI glasses and related hardware

3

. The year 2026 could determine whether Zuckerberg's vision becomes reality or shatters under pressure, with Avocado's performance critical to retaining the AI talent recruited through what insiders call the "Great Talent Heist"1

.References

Summarized by

Navi

[3]

[5]

Related Stories

Meta's AI Talent Exodus: Turmoil at Superintelligence Lab Amid Aggressive Hiring and Restructuring

27 Aug 2025•Technology

Meta's AI Talent Hunt Sparks Internal Tensions and High-Profile Departures

10 Sept 2025•Business and Economy

Meta's $100M Talent Poaching Attempts Fail to Lure OpenAI's Top Researchers

18 Jun 2025•Business and Economy

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology

3

ChatGPT cracks decades-old gluon amplitude puzzle, marking AI's first major theoretical physics win

Science and Research