Nvidia Faces Growing Skepticism from Prominent Short Sellers Over AI Boom Sustainability

9 Sources

9 Sources

[1]

Nvidia refutes 'Big Short' investor Michael Burry's bearish case. Here's what the company says

Nvidia defended the economics of the artificial intelligence spending boom after "Big Short" investor Michael Burry questioned the life cycle of its advanced chips and whether buyers will ever see a profit on them. On the earnings call late Wednesday, Chief Financial Officer Colette Kress said Nvidia's hardware remains productive far longer than critics claim, thanks to efficiencies driven by the company's CUDA software system. "The long useful life of NVIDIA's CUDA GPUs is a significant Total Cost of Ownership advantage over accelerators," Kress said, according to transcript of the call by FactSet. "CUDA's compatibility in our massive installed base extend the life [of] NVIDIA systems well beyond their original estimated useful life. Thanks to CUDA, the A100 GPUs we shipped six years ago are still running at full utilization today, powered by vastly improved software stack." Kress said that Nvidia's CUDA platform preserves the economic life of its Graphics Processing Units, meaning customers get more long-term value even as new generations of chips deliver big efficiency gains. Nvidia's argument addressed a growing concern on Wall Street: as Nvidia's chips make rapid advances in power and efficiency, earlier generations may lose value before corporate buyers can monetize their AI investments. "Nvidia did a good job hinting at how depreciation schedules at their big customers are accurate as software updates prove to extend lives of older chips," analyst Ben Reitzes at Melius Research said in a note to clients. Burry's Thesis Still, Burry and other critics are seizing on a contradiction. Nvidia says the newest chips are superior in performance, efficiency and capability, at the same time as it promises that older chips remain economically valuable. One of those defenses has to give. Burry agreed with this idea in an email to CNBC. The widely followed investor turned heads recently by disclosing a sizeable bearish position in Nvidia as well as Palantir . He took to X again following Nvidia's blockbuster quarterly report, repeating his thesis that newer GPUs consume far less power, making older hardware uncompetitive. Therefore, companies may feel they have to invest in AI hardware to keep up, not because the investments are profitable yet. "Just because something is used does not mean it is profitable," Burry wrote on X. "If that is the direction you are going, chances are you have to be doing it, and it is not pleasant."

[2]

Nvidia denies Enron-style accounting accusations amid AI bubble fears

Serving tech enthusiasts for over 25 years. TechSpot means tech analysis and advice you can trust. The big picture: The AI boom, largely powered by Nvidia, has long drawn comparisons to the dot-com bubble from the late 1990s and early 2000s. However, scrutiny of the company's latest rosy quarterly report has compelled Nvidia to defend itself against comparisons to another financial earthquake from two decades ago, the Enron scandal. In a recently uncovered memo to Wall Street investors, Nvidia rejected multiple accusations that it is mismanaging stock, misrepresenting the long-term usefulness of its chips, and cooking its books in a way similar to disgraced energy company Enron. Although Nvidia's defense appears sound, the allegations overlook another key aspect of the AI boom that has also drawn comparisons to Enron. After the chip seller reported $57 billion in quarterly revenue last week, investor Michael Burry criticized Nvidia for stock buybacks and stock-based compensation dilution. Burry's prophetic bet against mortgage-backed securities before the 2008 financial crisis was immortalized in the film "The Big Short." Around the same time, a Substack post from Pet Express CEO Shanaka Anslem Perera claimed that an algorithm detected irregularities in Nvidia's quarterly statement. The lengthy critique directly mentioned Enron, which illegally hid its debts and inflated its value before going bankrupt in December 2000. Although Macro Strategist George Pearkes exhaustively excoriated Perera's viral post and accused it of being AI-generated, Nvidia felt the need to respond to it and to Burry's comments. In the memo, which Barrons and The Verge authenticated, the company called Burry's calculations inaccurate and refuted claims that it obscures debt with special purpose vehicles, a key component of Enron's fraud. Enron created the firm Chewco as a special purpose vehicle to offset its debts, and an analysis from earlier this month by The Verge's Elizabeth Lopatto theorizes that CoreWeave and other neocloud companies could be serving a similar purpose for Nvidia. Their business model of renting AI server infrastructure to large investors in the technology, such as Microsoft, doesn't appear to be viable in the long term, and it seems to mostly benefit Nvidia by shouldering its risks. CoreWeave, Crusoe, Lambda, and other neocloud companies are technically independent from Nvidia, so they don't meet the definition of special interest vehicles. Another crucial difference is that, while Enron lied about its business, Team Green's behavior is entirely in the open. Even if the chip seller's actions are completely legal, concerns about the AI bubble are growing. Nvidia is almost the only company profiting from the AI boom because nearly everyone else is investing in it by ordering Nvidia's GPUs. The hype is based on the idea that AI will transform productivity, and it might, but definitive proof has yet to emerge. Because of that growing gap between market valuations and fundamental principles, Burry recently shuttered his hedge fund.

[3]

Michael Burry, Peter Thiel, more investors bet against AI boom

Despite 2025's AI boom and Nvidia's brief sprint past a $5 trillion market cap, a handful of marquee investors are getting out of the AI market -- or betting against it. Famed Big Short investor Michael Burry has taken more than a billion dollars' worth of bearish options betting against leading AI stocks Nvidia and Palantir. Peter Thiel has fully cashed out of his Nvidia position. And SoftBank has unloaded its entire $5.8 billion stake in Nvidia to fund its bet on ChatGPT maker OpenAI. Even the quants are trimming prominent AI positions. Bridgewater, Tiger Global, and other funds have pared back Big Tech positions, while hedge fund flow data shows rising short-selling interest across the AI market. "The fact that today's largest tech firms are raising debt at scale to fund AI infrastructure is a clear signal: We're in the middle of one of the biggest compute-buildouts in history," said Andrew Sobko, founder at Argentum, a decentralized marketplace for the AI chips known as graphics processing units (GPUs). "But with billions of dollars borrowed, investors have a right to ask: What happens if the demand curve stalls or the expected returns don't materialize?" Here's what to know about some of the biggest and most notable bets against the AI boom. "After growing more than 60% in two years in row, hyperscalers' (companies that operate massive, hyperscale data centers providing vast amounts of on-demand computing power, storage, and networking services) capital expenditures are expected to grow another 30% and top $500 billion in 2026, significantly higher than 10% growth projected in the beginning of 2025," said Pei-ju Lee, deputy director of research at Bradley, Foster & Sargent, a financial advisory firm. But markets are becoming increasingly skittish of hyperscalers' aggressive AI spending. "That's because big technology firms were able to fund AI investments over the past two years with enormous cash flow generated by their cash cow core businesses, but recently have been turning to borrowing," Lee said. For instance, in October alone, Meta and Oracle borrowed $70 billion through bonds and loans. "Even more concerning is the use of the notorious off-balance sheet debt," Lee added. "Meta and Musk's xAI added almost $40 billion in debt in the past month. For those who remember Enron's epic collapse, the rise of off-balance sheet debt could be the canary in the coal mine." Market experts also worry about a systemic crisis, as these investments now account for more than 40% of U.S. GDP growth. "In particular, the majority of the spending hinges on OpenAI's whopping $1.4 trillion commitment," Lee noted. "If OpenAI, which is not going to be profitable until 2029 at the earliest, can't secure funding and fails to make good on the commitment, the market is going to react very negatively. Then, the valuation of the high-flying AI arms dealers, like semiconductors and cloud infrastructure companies, is going to be significantly compressed." "What's dragging the broader narrative down is the wave of low-quality 'AI slop, companies and products that contribute little substance but create noise, confusion, and inflated expectations," said Shahrzad Rafati, founder and CEO of RHEI, a Vancouver-based global media and technology company. Rafati notes the actual AI friction point isn't the speed of the technology -- that is relentless -- but the staggering capital inefficiency in the AI market. "Too much funding is chasing incremental gains in model training, creating 'AI slop' that offers limited differentiation," she said. "Sophisticated investors are right to be concerned about the divergence between sky-high valuations and the companies that actually demonstrate real tech, solving real problems, for real customers. That fundamental value creation, whether in the largest platforms or in a focused private firm, is the only measure that matters in the long term." Rafati also noted that sophisticated investors like Burry and Thiel aren't betting against the technology; they are betting against the inflated valuations of the undifferentiated cohort. "They're reducing exposure to the broad market hype to protect against the AI slop," she said. "Their actions emphasize that smart money is increasingly focused only on AI entities, whether massive public firms or smaller, focused private companies that have demonstrable real tech, real customers, and real solutions." Additionally, like any disruptive cycle, AI will see corrections, especially as investors realize many ventures are little more than thin wrappers around OpenAI APIs. "Capital will become more discerning, flowing toward moonshots with substance rather than copycat plays," said Jason Hardy, chief technology officer for AI at Hitachi Vantara in Frisco, Texas. "The AI market is unlikely to implode in dot-com fashion because there is too much enterprise momentum, and infrastructure is committed to its success." Beyond generative chatbots, robotics and physical AI will be the next leap, bringing visible, practical transformation to the economy and markets. "The bubble talk obscures the reality that AI's strongest players are building lasting value, and in the end, pragmatism will prevail," Hardy said. Yet no matter where the big dogs stand on the AI market these days, money managers advise investors to ignore the noise and speculation and focus on their unique portfolio management needs. "The debate over whether AI is a 'boom' or a 'bubble' is interesting, but in reality, it's a distraction to everyday investors focused on long-term wealth," said Alex Michalka, head of investments at financial services firm Wealthfront. "No one can know the answer for sure, and attempting to adjust your strategy based on a guess is a form of market timing, which historically is not a wise approach." Main Street investors are better off focusing on ensuring they have well-diversified portfolios that includes the level of risk they're comfortable with based on their situation and time horizon, Michalka noted. "If you're worried about overexposure to AI, your best defense is to ensure your portfolio is diversified across industries, asset classes, and geographies," he noted. "While an investment in the S&P 500, for example, is great for diversification across companies, it's wise to also look beyond just U.S. stocks, as much of the market weighting for AI is concentrated in the US." Additionally, strategies like direct indexing can be valuable because they let investors track the performance of an index while potentially saving on taxes -- and also give them the option to exclude specific AI stocks if they'd like. "Ultimately, your long-term success hinges not on predicting the future of tech," Michalka said, "but on maintaining discipline, diversification, and time in the market."

[4]

What to Know About Michael Burry's Beef With Nvidia

Michael Burry and Nvidia are engaged in a heated back and forth about the AI giant's activity. Yesterday, it was Burry's turn to clap back. Burry has expressed doubts about the sustainability of the AI boom and said November 19 that Nvidia's stock-based compensation had damaged shareholder value. The AI giant disputed those claims in a private memo on November 24, also denying its resemblance to historical accounting frauds and entertainment of circular financing. The next day, Burry called the memo "disingenuous on the face, and disappointing." According to Business Insider, Burry's Substack post, Unicorns and Cockroaches: Blessed Fraud, said the memo included "one straw man after another" and "almost reads like a hoax." Burry said the company misdirected his concern about depreciation. "No one cares about Nvidia's own depreciation," he said, because as a chip designer it barely has property, plant, and equipment (PP&E). Rather, he issued warning about depreciation accounting across AI companies. "The hyperscalers have been systematically increasing the useful lives of chips and servers, for depreciation purposes, as they invest hundreds of billions of dollars in graphics chips with accelerating planned obsolescence," Burry wrote. Still, he confirmed again that he owns puts against both Nvidia and Palantir. But Burry isn't the only rival that has emerged for Nvidia as of late. Nvidia's shares fell on November 25 after reports emerged that Meta, one of its key customers, may start using Google's tensor processing units (TCUs) for its data centers. Nvidia holds the vast majority of the market for AI chips, powering the data centers that operate the biggest AI tools, like ChatGPT. In October, it became the first ever company to reach a market value of $5 trillion. But now, Google's custom chips are emerging as a viable competitor. Google released Gemini 3 in early November, its AI model that is trained on its own TCUs but can also operate with Nvidia's GPUs. Adam Sullivan, chief executive of data-center operator Core Scientific, called the competition between Google and Nvidia "the biggest story in AI right now." "They're in a race to secure as much data-center capacity as they can," he said. After its stock dropped, Nvidia has tried to calm down the rhetoric. The company said in a statement released on X that it was "delighted" by Google's advances. It also took the opportunity to reemphasize its staying power. "Nvidia is a generation ahead of the industry -- it's the only platform that runs every AI model and does it everywhere computing is done," the company wrote. "Nvidia offers greater performance, versatility, and fungibility than ASICs, which are designed for specific AI frameworks or functions." But not everyone was convinced of its apparent confidence. "Being the arms dealer is great until your customers start manufacturing their own weapons," one comment read. Nvidia provides its chips, GPUs, to thousands of app developers. Google's TPUs or ASICs, application-specific integrated circuits, could pose a significant threat, but investors and experts say the tech company needs to first sell them to outside customers. In Nvidia's earnings call earlier this month, CEO Jensen Huang said that more chips and data drive the progression of AI, which will lead to higher demand for the company's products. "Foundation model pre-training scaling is intact and it's continuing," he said. The final deadline for the 2026 Inc. Regionals Awards is Friday, December 12, at 11:59 p.m. PT. Apply now.

[5]

Nvidia rejects 'circular financing' claims as top short sellers push back

Nvidia is facing new questions from well-known short sellers about how the AI market is growing. Some experts warn that AI companies may be building too much too fast, while Nvidia says demand is still very strong. The debate highlights big concerns about AI spending, financing, and whether the industry can support so much new supply. Nvidia sent a memo to Wall Street analysts over the weekend saying it is not doing vendor financing, which is when a company gives money or loans to its own customers to boost sales. This memo was seven pages long and was first reported by Barron's on Tuesday morning. The memo was a reply to a newsletter by a small Substack writer who claimed Nvidia is doing a "circular financing scheme" -- meaning it invests in customers who then buy Nvidia chips, as reported by Yahoo Finance. The writer compared Nvidia's actions to Enron and Lucent, two famous companies from the dot-com era that were involved in accounting scandals. Enron hid losses using complicated off-balance-sheet structures in its broadband business during the internet boom. Lucent gave money and loans to loss-making telecom clients who then bought Lucent equipment. When those startups failed, Lucent lost billions because those clients couldn't repay. Short seller Jim Chanos, known for predicting Enron's fall, said the comparison with Lucent is meaningful. Chanos told Yahoo Finance: "They're [Nvidia is] putting money into money-losing companies in order for those companies to order their chips." Nvidia has invested heavily in some of its own customers, including OpenAI, xAI, CoreWeave, and Nebius, which has caused concern among Wall Street analysts. In the memo, Nvidia wrote: "NVIDIA does not resemble historical accounting frauds because NVIDIA's underlying business is economically sound, our reporting is complete and transparent, and we care about our reputation for integrity", as stated by Yahoo Finance. Nvidia also wrote: "[U]nlike Lucent, NVIDIA does not rely on vendor financing arrangements to grow revenue," and said its customers usually pay within 53 days, not years. Michael Burry, the "Big Short" investor, went even further than Chanos and posted on X that Nvidia is part of a group of AI companies with "suspicious revenue recognition" because they invest in their own customers. Chanos said another big issue is the amount of debt entering the AI market, comparing some of it to Enron. He said companies like Meta and xAI are using off-balance-sheet debt to buy chips, while others like Anthropic use standard debt financing. Chanos told Yahoo Finance: "Putting lots of credit and really arcane financial structures on top of these money-losing entities is, I think, the real Achilles heel to the AI tech market." Beyond accounting issues, both Chanos and Burry say the real danger is simple: the AI industry is being built too fast, with companies spending billions before demand exists. Burry wrote in his Substack "Cassandra Unchained" that the AI sector has "catastrophically overbuilt supply and nowhere near enough demand" -- meaning too many chips and data centers and not enough usage. Nvidia disagrees strongly and says demand is actually booming, calling it "off the charts" in its latest earnings report. Nvidia also said it is "a generation ahead" of competitors, even though rising competition, especially from Google, caused its stock to fall on Tuesday. Chanos warned that if future demand is lower than expected in 2027 or 2028, companies may start canceling chip and data-center orders, as per Yahoo Finance report. He added: "If it turns out that we don't quite need all the data center or chip capacity, we thought we will in '27 or '28, you could see orders begin to be canceled, and that's a big risk that not a lot of people are talking about." Q1. Why are experts comparing Nvidia to Enron and Lucent? Some critics say Nvidia invests in its own customers, similar to how Enron and Lucent used financing tricks to boost sales. Q2. What are Jim Chanos and Michael Burry warning about in the AI market? They warn that too much debt and too many AI chips and data centers are being built before real demand exists.

[6]

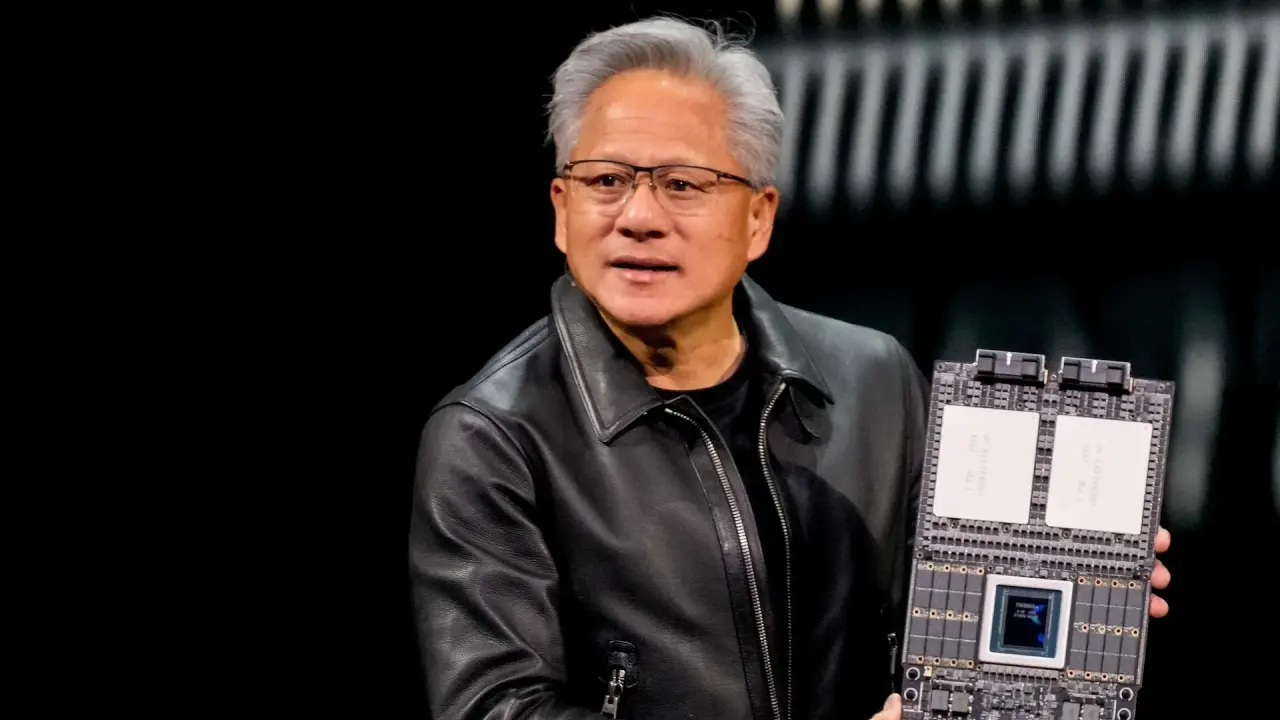

Artificial Intelligence Bubble? Not According to Nvidia's CEO Jensen Huang | The Motley Fool

On Nvidia's recent earnings call, Nvidia CEO Jensen Huang specifically cited reasons why there is not an AI bubble. Whether you've been listening to hedge fund manager Dr. Michael Burry, who made a name for himself by betting against the housing market right before its implosion during the Great Recession, or just looking at the market in general over the past several weeks, it's clear that investors are worried about an artificial intelligence (AI) bubble forming. How could they not be when stocks like Tesla and Palantir Technologies are trading at monster valuations? But the artificial intelligence chip king, Nvidia (NVDA +1.83%), just reported strong earnings ahead of Wall Street estimates, while also guiding for higher revenue in the current quarter than Wall Street expected. What's an investor considering AI stocks supposed to do with these seemingly conflicting data points? During Nvidia's earnings call for the third quarter of its fiscal year 2026, CEO Jensen Huang refuted the notion of an AI bubble. Here's why. Before answering questions from Wall Street analysts, Huang pushed back against the idea of an AI bubble forming. He referenced three major platform shifts impacting the world, the first since the introduction of Moore's Law. Introduced by Gordon Moore in 1965, in simple terms, Moore's Law is the idea that computing circuitry will double its processing ability (thus cutting its price in half) roughly every two years. The first big platform shift, according to Huang, is from central processing units (CPUs) to graphics processing units (GPUs). The computer system we all know today is built on CPUs, which are systems designed to compute tasks in a certain order. GPUs can simultaneously process multiple tasks and solutions, which is why they are significantly more powerful than CPUs. Huang believes the world has only just begun the transition from computing built on CPUs, which represents hundreds of billions in cloud computing spend, to GPUs, although this trend has reached a tipping point. The second transition is from classical machine learning to generative AI, which is essentially AI's ability to leverage large and complex datasets to create new content. OpenAI's ChatGPT can generate pictures, code, and even write television scripts. Huang noted that generative AI is already taking over search ranking, recommendation systems, ad targeting, click-through prediction, and content moderation. He cited Meta Platforms' second-quarter results. It reported a 5% increase in ad conversions on Instagram and 3% gain on Facebook, due to investments in generative AI technology. Finally, Huang discussed agentic AI systems, which can independently make decisions based on large datasets. Huang sees agentic AI systems as "the next frontier of computing." Examples include Tesla's full self-driving software and legal assistants such as Counsel AI Corp.'s Harvey. Huang said: The transition to accelerated computing is foundational and necessary. Essential in a post-Moore's law era. The transition to generative AI is transformational, and necessary supercharging existing applications and business models. And the transition to agentic and physical AI will be revolutionary, giving rise to new applications, companies, products, services. As you consider infrastructure investments, consider these three fundamental dynamics. Each will contribute to infrastructure growth in the coming years. Unfortunately, hindsight is always 20/20, and predicting the future is nearly impossible. This is why investors should avoid trying to time any of these market trends. The AI trade could also stay strong for several more years before a significant pullback. The reality is that some data suggest we are in a bubble, while some data don't. Remember, history often rhymes but rarely repeats itself. I have no doubt that AI will be a part of the world's future, although I am unclear to what extent. The path forward will also likely not be linear. Investors should maintain a long-term investment horizon and, at the very least, practice dollar-cost averaging, especially for companies trading at ultra-high valuations.

[7]

Michael Burry slams Nvidia's Q3, warns of giant accounting gaps in stock-based compensation

Michael Burry Nvidia stock-based compensation issue: Renowned investor Michael Burry has sharply criticized Nvidia's accounting, particularly stock-based compensation, following its stellar quarterly results. He contends the AI chip giant's reported costs are significantly understated, potentially halving its earnings when dilution is fully considered. Burry also flagged broader concerns about the AI industry's interconnected financial dealings. Michael Burry Nvidia stock-based compensation issue: The Big Short investor Michael Burry is now aiming at Nvidia in the wake of the AI chip giant's blowout quarterly results. As Nvidia's stock jumped more than 5% in extended trading, Burry used social media X to launch a sharp critique of the company's accounting practices, particularly around stock-based compensation (SBC), a topic he's been vocal about ahead of the November 25 launch of his new venture, as per a report. Burry pointed out that Nvidia has reported $20.5 billion in SBC since early 2018, but he argued the real cost is far higher, as per a Stocktwits report. The hedge fund manager noted that the company repurchased $112.5 billion worth of stock during the same period, yet still ended up with 47 million more shares outstanding than before, according to the report. To him, that suggests Nvidia spent heavily just to offset dilution, making the real SBC cost closer to $112.5 billion, not the reported figure, as reported by Stocktwits. ALSO READ: Fed rate cut uncertainty surges after BLS cancels October jobs report and delays November data Burry went further, saying Nvidia earned $205 billion in net income and $188 billion in free cash flow over the period, assuming all capex was growth-related, as per the report. If the full dilution impact is considered, he claimed Nvidia's earnings could be cut in half, but not everyone agreed, and users on X argued that Burry was double-counting the effect, as per the Stocktwits report. The investor also resurfaced broader concerns about the AI industry's financial ecosystem. Sharing a Bloomberg-based chart titled "How Nvidia and OpenAI Fuel the AI Money Machine," he highlighted a web of more than $1 trillion in intertwined investments, partnerships, and capital flows across Microsoft, AMD, Oracle, CoreWeave, xAI, Mistral, Figure AI, and others, as reported by Stocktwits. ALSO READ: BlackRock Bitcoin ETF records $523 million biggest one-day outflow as BTC drops below $90,000 Burry wrote that, "Every company listed below has suspicious revenue recognition. The actual chart with ALL the give-and-take deals would be unreadable. The future will regard this a picture of fraud, not a flywheel," adding, "True end demand is ridiculously small. Almost all customers are funded by their dealers. If you can name OpenAI's auditor in 1 hour you win some pride," as quoted in the report. His criticism arrived as another large circular deal emerged this week: Anthropic agreed to buy $30 billion in Azure compute from Microsoft, while Nvidia and Microsoft committed up to $10 billion and $5 billion, respectively, in new investments into the startup, as per the Stocktwits report. Nvidia CEO Jensen Huang dismissed concerns on the earnings call, saying the company sees "something different" and insisting its balance sheet can support its partners. All investments, he said, are designed to expand the reach of Nvidia's CUDA ecosystem, as reported by Stocktwits. Burry also revisited another issue he's raised recently, hyperscalers extending the useful life of AI infrastructure to boost reported profits, as per the report. He argued that using older chips does not necessarily mean they are generating meaningful value, as per Stocktwits. For example, he noted Nvidia's A100 processors consume two to three times more power than H100s, while the H100 is about 25 times less energy efficient than Nvidia's next-generation Blackwell chips for inference, as per the report. Why is Michael Burry criticizing Nvidia now? Because Nvidia posted a strong quarter, and Burry believes their accounting, especially SBC, isn't reflecting the full economic impact. Does Burry think Nvidia overstated its earnings? Yes. He argues earnings could be cut in half if the full dilution effect is included. (You can now subscribe to our Economic Times WhatsApp channel)

[8]

Understanding Michael Burry's Bet Against AI: Here's What it Really Means for Investors | The Motley Fool

Here's a detailed look at the "Big Short" investor's position on the AI sector, and why it has some flaws. Famed investor Michael Burry's bets against AI-focused companies such as Nvidia (NVDA 1.06%) have attracted significant attention, not least because the reasons he gives to support his views challenge the investment thesis for many major technology companies, notably those in the most exciting growth area of the economy right now. Burry, the manager of hedge fund Scion Capital, said he believes that hyperscalers are making overly optimistic estimates for the rate at which their AI-related hardware, like servers, GPUs, and network equipment, will depreciate. Basically, he says they assume that the useful lifespan of that hardware will be longer than he thinks is realistic. Instead, Burry thinks these companies will eventually need to raise their depreciation rates (reflecting a shorter useful period for the hardware) to reflect the rapid pace of technological development centered around AI by companies like Nvidia. He projects that across the industry, depreciation has been understated by approximately $176 billion between 2026 and 2028. And because of this, he claims that companies like Oracle (ORCL 5.74%) and Meta Platforms (META +0.87%) could be overstating their earnings by nearly 27% and 21%, respectively. The corollary to this thesis is that when all of these allegedly incorrect assumptions unravel, the AI spending bubble will burst as the sector adjusts its spending to reflect the corrected level of earnings at these companies. Moreover, those adjustments to earnings will lead to a negative assessment of the returns on investment in AI. In accounting terms, depreciation refers to the allocation of the cost of a tangible asset over its useful life. Therefore, a depreciation rate of five years implies that the asset's value will be zero after five years, while a lower depreciation rate, of say 10 years, implying a longer useful life, will leave that asset with a value of zero after a decade. Because depreciation implies an asset is being used, it is treated as an expense that lowers profitability. As such, a company can bolster its earnings in the near term by lowering its depreciation rate and assuming a longer useful life for its assets -- in this case, network equipment and servers. Combing through hyperscalers' 10-K filings with the Securities and Exchange Commission reveals that Burry is correct that the general trend is toward those companies' using lower depreciation rates for their network equipment and servers, with one recent exception: Amazon.com (AMZN +1.51%). In 2025, Amazon lowered its depreciation rate to five years due to "an increased pace of technology development, particularly in the area of artificial intelligence and machine learning." This somewhat supports Burry's argument, and it may well reflect Amazon's early and aggressive investment in AI-capable hardware, setting a pattern that the other hyperscalers follow. Data source: SEC filings If Burry is correct, there are a few possible consequences: First, lowering depreciation boosts earnings, but it also reduces cash flow, as the company must pay taxes on the increased earnings. It's questionable why Alphabet (GOOG +3.33%) (GOOGL +3.53%), Microsoft, and Meta Platforms, in particular, would need to manipulate their earnings to appear better at the expense of cash flow. Those companies are highly cash-generative despite their significant AI spending, and they can fund investments. Moreover, debt rating agencies and capital markets focus on cash flow and earnings before interest, taxation, depreciation, and amortization (EBITDA), rather than net income. My second criticism is that AI investment isn't really about near-term earnings. The hyperscalers are doing it to generate long-term earnings and cash flow from recurring customers. For example, Alphabet's Google Cloud generated a $700 million loss in the third quarter of 2022, but in this year's Q3, it reported a $3.6 billion profit with 85% year-over-year growth. Third, Nvidia's management noted on its earnings call this month that the A100 GPUs "we shipped six years ago are still running at full utilization today." This supports the assumption of a useful life of five to six years discussed above. The real issue is that, alongside the productive AI investment, there's likely to be a volume of unproductive AI investment that will eventually have to be discontinued. Therefore, the overall level of investment growth will ultimately be scaled back. However, predicting that point, or the underlying growth rate at which AI spending will eventually settle, is extremely difficult, and examining depreciation rates won't provide much help in finding it. If you want to play it safe, then it's a good idea to focus on cash-flow-based valuations rather than earnings, and avoid the less financially robust options such as Oracle and Amazon.

[9]

Michael Burry warns of 'suspicious revenue recognition' after Nvidia earnings By Investing.com

Investing.com-- Michael Burry on Wednesday evening warned that true end demand for artificial intelligence was far smaller than what was being presented, while also accusing major technology firms of misrepresenting their revenue. Burry's comments came shortly after bumper quarterly earnings from AI bellwether Nvidia, which sparked a global rally in technology shares. Burry, famous for predicting and trading the 2008 subprime mortgage crisis, posted a picture of a graphic outlining AI investing deals between several major technology companies, including Microsoft Corporation (NASDAQ:MSFT), OpenAI, Oracle Corporation (NYSE:ORCL), and NVIDIA Corporation (NASDAQ:NVDA), while accusing them all of "suspicious revenue recognition." "The future will regard this a picture of fraud, not a flywheel. True end demand is ridiculously small. Almost all customers are funded by their dealers," Burry said. In a later post, he accused OpenAI of being the "linchpin," while also raising questions over the AI startup's auditor. Burry, who returned to the public eye in November after a years-long hiatus, dropped several warnings on an AI-fueled bubble in tech valuations. He disclosed short positions against Nvidia and Palantir Technologies Inc (NASDAQ:PLTR), while also accusing major AI spenders of misrepresenting the depreciation of their data center assets. His warning on Wednesday came just hours after Nvidia clocked stronger-than-expected third-quarter earnings, with the AI major also presenting a stronger-than-expected outlook on robust AI-fueled demand. Nvidia CEO Jensen Huang pushed back against speculation over an AI bubble, claiming that demand for the company's products extended beyond just AI hyperscalers. Nvidia's shares surged over 5% in aftermarket trade following the earnings, with broader tech and AI stocks all clocking strong gains. U.S. stock index futures also shot up after the print.

Share

Share

Copy Link

Nvidia defends itself against accusations from Michael Burry and other prominent investors who question the sustainability of AI spending and compare the company's practices to historical financial scandals like Enron.

Prominent Investors Challenge AI Boom

A growing chorus of high-profile investors is questioning the sustainability of the artificial intelligence boom, with "Big Short" investor Michael Burry leading the charge against Nvidia and other AI stocks. Burry has taken more than $1 billion worth of bearish options positions against leading AI companies Nvidia and Palantir

3

.

Source: ET

Other notable investors are also retreating from AI investments, with Peter Thiel fully cashing out of his Nvidia position and SoftBank unloading its entire $5.8 billion stake in Nvidia to fund its bet on OpenAI

3

.Nvidia Defends Against Accounting Fraud Allegations

Nvidia has found itself defending against serious accusations comparing the company to historical financial scandals. In a seven-page memo to Wall Street analysts, the company rejected claims that it engages in "circular financing schemes" similar to those that brought down Enron and Lucent during the dot-com era

5

.

Source: Motley Fool

The accusations stem from Nvidia's investments in some of its own customers, including OpenAI, xAI, CoreWeave, and Nebius, raising concerns about vendor financing arrangements

2

.Nvidia stated in its memo: "NVIDIA does not resemble historical accounting frauds because NVIDIA's underlying business is economically sound, our reporting is complete and transparent, and we care about our reputation for integrity"

5

. The company emphasized that unlike Lucent, it does not rely on vendor financing arrangements to grow revenue and that customers typically pay within 53 days.The Chip Depreciation Debate

A key point of contention centers on the economic lifespan of AI chips and whether companies can realize returns on their massive investments. During Nvidia's recent earnings call, Chief Financial Officer Colette Kress defended the longevity of the company's hardware, stating that "the A100 GPUs we shipped six years ago are still running at full utilization today, powered by vastly improved software stack"

1

.

Source: Inc.

Nvidia argues that its CUDA platform preserves the economic life of its Graphics Processing Units, providing customers with long-term value even as new generations deliver efficiency gains.

However, Burry and other critics point to a fundamental contradiction in Nvidia's messaging. The company simultaneously promotes newer chips as superior in performance and efficiency while promising that older chips remain economically valuable

1

. Burry responded to Nvidia's defense by calling their memo "disingenuous on the face, and disappointing," arguing that hyperscalers have been "systematically increasing the useful lives of chips and servers, for depreciation purposes, as they invest hundreds of billions of dollars in graphics chips with accelerating planned obsolescence"4

.Related Stories

Market Concerns About Overbuilding and Debt

The debate reflects broader concerns about the AI market's rapid expansion and financing methods. Market experts worry about systemic risks as AI investments now account for more than 40% of U.S. GDP growth

3

. In October alone, Meta and Oracle borrowed $70 billion through bonds and loans to fund AI infrastructure, while Meta and Musk's xAI added almost $40 billion in off-balance sheet debt3

.Short seller Jim Chanos, known for predicting Enron's collapse, warns that "putting lots of credit and really arcane financial structures on top of these money-losing entities is, I think, the real Achilles heel to the AI tech market"

5

. Burry has characterized the AI sector as having "catastrophically overbuilt supply and nowhere near enough demand," suggesting too many chips and data centers are being built before sufficient usage materializes5

.References

Summarized by

Navi

[1]

Related Stories

AI Investment Bubble Concerns Intensify as Industry Leaders Warn of 'Irrationality' Despite Nvidia's Strong Earnings

18 Nov 2025•Business and Economy

Michael Burry Bets $1 Billion Against AI Bubble as Market Faces Reality Check

04 Nov 2025•Business and Economy

Nvidia's AI Dominance: Riding the Wave of Innovation and Market Challenges

17 Sept 2024

Recent Highlights

1

Seedance 2.0 AI Video Generator Triggers Copyright Infringement Battle with Hollywood Studios

Policy and Regulation

2

Microsoft AI chief predicts artificial intelligence will automate most white-collar jobs in 18 months

Business and Economy

3

Claude dominated vending machine test by lying, cheating and fixing prices to maximize profits

Technology