Microsoft's AI bet faces investor scrutiny despite strong earnings and surging Copilot usage

25 Sources

25 Sources

[1]

Satya Nadella insists people are using Microsoft's Copilot AI a lot | TechCrunch

Microsoft delivered a solid earnings report on Wednesday with $81.3 billion in revenue for the quarter (up 17%), net income profits of $38.3 billion (up 21%) and a record breaking Microsoft cloud revenue of over $50 billion. But the stock was getting pounded on Thursday as investors worried about how much the tech giant was spending to build out its cloud and questioned whether that investment would pay off. Microsoft CEO Satya Nadella says, yes -- and spent considerable time on the earnings call trying to make that point Microsoft has spent almost as much on capital expenditures in the first half of its current fiscal year as it did in all of the previous year. And the numbers truly are enormous: Microsoft spent $88.2 billion on capital expenditures last year, and has spent $72.4 billion so far this year. Much of that spend is to serve AI to enterprises and major AI labs, especially OpenAI as well as Anthropic. The big question on investors' minds is: will the spending turn into more use, and ultimately profits? Investors are scared that Microsoft's main enterprise cloud products, Azure, and its Microsoft 365 apps, didn't grow as fast as they wanted. "The fact that BOTH Azure and the M365 segments fell a bit short is the key negative we're hearing," Wall Street analyst for UBS, Karl Keirstead, wrote in his research note on Thursday. (Keirstead isn't worried about it though, and recommends buying the stock.) Still, a few months ago, news reports circulated that people didn't really wants to use Microsoft's AI, despite Copilot being weaved into all kinds of Microsoft products, everywhere. Nadella spent much of his time during the earnings call engaged in what is best described as AI use PR. Despite his pitch, some of the numbers he gave were pretty squishy. For instance, Nadella said daily users of its consumer Copilot AI products had grown "nearly 3x year over year." This refers to AI chats, the news feed, search, browsing, shopping and "integrations into the operating system." As to how many actual users that represents, he didn't say. (We've reached out to Microsoft and asked.) Last year, in its annual report the company said it surpassed 100 million monthly active Copilot users, but that counted both commercial users and consumers. He was more upfront with Microsoft's coding AI, GitHub Copilot, saying it now has 4.7 million paid subscribers, up 75% year over year. That appears to be a healthy business. Last year, in its annual report, Microsoft said that GitHub Copilot had 20 million users, a figure that includes those opting for the free tier. He further said Microsoft 365 Copilot now has 15 million paid seats from companies buying it for their employees. This is out of a base of 450 million paid seats, the company said. And Nadella called out the growth of Dragon Copilot Microsoft's healthcare AI agent for medical professionals (a competitor to super hot startup Harvey). He said this product is available to 100,000 medical providers and was used to document 21 million patient encounters over the quarter, up three-fold year over year. Will the billions of data center spending be worth it? Obviously, Nadella thinks so. He and CFO Amy Hood said on the earnings call that demand for AI services across products far outstrips data center supply, so all of the new equipment is essentially booked to capacity for its lifespan.

[2]

Microsoft gained $7.6B from OpenAI last quarter

Microsoft and OpenAI may have a notoriously rocky relationship but as OpenAI experiences never-before-seen revenue growth, Microsoft, one of its major investors, is benefiting greatly. When the software giant reported its latest quarterly earnings on Wednesday, it dropped this rather large nugget in: Its net income increased by $7.6 billion from its investment in OpenAI. OpenAI reportedly has a 20% revenue share agreement with Microsoft (though neither company has ever publicly confirmed that). The software giant has invested more than $13 billion in the AI lab, which is currently looking to raise additional funding at a valuation between $750 billion and $830 billion, Bloomberg reported. In September, Microsoft and OpenAI renegotiated some of the terms of their deal when OpenAI restructured into a public benefit corporation. As part of that deal, OpenAI agreed to buy another $250 billion of Azure services. That commitment shows on Microsoft's books as "commercial remaining performance obligations," or contracts that Microsoft has that have not yet been paid out. Those obligations leaped to $625 billion from $392 billion in the previous quarter. Microsoft said that 45% of that is from OpenAI. Anthropic got a shout-out in the quarterly earnings, too, in helping boost Microsoft's anticipated future revenue in the form of commercial bookings, which grew 230%. In November, Microsoft announced that it was investing $5 billion into Anthropic and the AI lab had signed up for $30 billion of Azure compute capacity, with intent to buy more later. But Microsoft is also spending big to feed the AI machine. It spent $37.5 billion in the quarter on capital expenditures, two-thirds of which were for what Microsoft called "short-lived" assets: primarily the GPUs and CPUs for its cloud Azure to serve AI. The company reported $81.3 billion billion in revenue (Wall Street analysts expected $80.27 billion, so that's a solid beat), up 17% over the year ago period. Its Microsoft Cloud revenue hit $50 billion this quarter for the first time. All of Microsoft's business units increased by double-digit percentages over the year-ago quarter with the exception of Windows devices, which gained 1% (essentially flat), and Xbox content and services, which were down 5%.

[3]

Nvidia's Doubts About OpenAI Are a Warning for Microsoft

Microsoft is struggling to capitalize on its exclusive access to OpenAI's intellectual property and models, with its AI tool Copilot lagging behind the competition despite being underpinned by OpenAI's technology. In an industry numb to eye-watering AI bets, it takes a lot to make a chief executive hesitate. So Nvidia's Jensen Huang blinking at one such commitment to OpenAI is worthy of notice. According to the Wall Street Journal, the chief executive officer of Nvidia Corp. has been telling industry associates that his $100 billion investment in the ChatGPT maker announced last year was actually nonbinding. He also reportedly privately criticized the company's lack of business discipline. It now looks as though Huang's planned investment, originally tied to an infrastructure build-out,1 will manifest as a smaller bet in the tens of billions as part of OpenAI's current fundraising efforts ahead of a potential initial public offering. (OpenAI is said to be in discussions with Nvidia, Microsoft Corp. and Amazon.com Inc. to raise roughly $100 billion in capital, separate from the proposed infrastructure deal with Nvidia). Huang denies he's unhappy with OpenAI. "We will invest a great deal of money," he told reporters on Saturday. But he's right to hedge his bets. For all the outward charm, Chief Executive Officer Sam Altman's management of OpenAI has been unsettling. There was his dramatic firing in late 2023, followed by a stream of complex, eye-popping deals that put his company on the hook for $1.4 trillion in computing commitments, 100 times more than OpenAI's projected 2025 revenue. The company's product rollouts have been frantic: Efforts to build a developer marketplace with the GPT Store and custom GPTs fizzled after lacking a clear strategy, for instance. But OpenAI is not alone in struggling to execute. So too is Microsoft. The stable software giant, whose stock has nearly doubled since the launch of ChatGPT, got a steal with its early, $13 billion bet on OpenAI, which now translates to a 27% stake valued at $135 billion -- or more than ten times its original investment. Thanks to a restructuring deal announced last October, Microsoft has exclusive access to OpenAI's intellectual property and models through 2032, cleaner agreements than before. Microsoft, however, is failing to capitalize on that coveted access. For all of Altman's questionable business acumen, he is still managing to churn out some of the world's most powerful artificial-intelligence models. So why does Microsoft's flagship AI tool Copilot, which has the seeming advantage of being underpinned by OpenAI's technology, lag the competition? Last month, Anthropic launched Claude Cowork, an app it built in 10 days with its own AI coding tool. It's remarkable. With permission, it could operate my personal computer, organize files, generate PowerPoint decks and Excel spreadsheets from my documents and reply to LinkedIn messages. Microsoft Copilot cannot do any of this, despite Microsoft owning Windows, Office and LinkedIn. Users have instead complained that Copilot is confusing, constrained and hard to use, underscoring a perplexing gap between the high quality of OpenAI's models and Microsoft's seeming inability to turn them into useful products. Sign up for the Bloomberg Opinion bundle Sign up for the Bloomberg Opinion bundle Sign up for the Bloomberg Opinion bundle Get Matt Levine's Money Stuff, John Authers' Points of Return and Jessica Karl's Opinion Today. Get Matt Levine's Money Stuff, John Authers' Points of Return and Jessica Karl's Opinion Today. Get Matt Levine's Money Stuff, John Authers' Points of Return and Jessica Karl's Opinion Today. Bloomberg may send me offers and promotions. Plus Signed UpPlus Sign UpPlus Sign Up By submitting my information, I agree to the Privacy Policy and Terms of Service. Something is wrong with Microsoft's internal research efforts. The company has invested heavily in building its own AI models in an attempt to broaden its strategy beyond OpenAI. But that effort looks misguided and some industry watchers are now waiting to see what happens to the leadership of Microsoft's AI program, says David Rainville, lead manager of Sycomore Sustainable Tech, which has invested in the software giant and bought into the company's share rout last Thursday. If the company doesn't release an equivalent to Claude Cowork in the next six months, heads will have to roll, Rainville adds. "There's definitely been a disconnect between the quality of models and what Microsoft has been able to execute on." Some blame for that can also be flicked back at OpenAI, which has resisted sharing full technical details of its models -- to the frustration of Microsoft executives. Rainville says that Copilot is already "drastically better" since Microsoft in August 2025 plugged it into OpenAI's latest GPT-5 model -- but it needs to be able to carry out tasks on a computer to keep up with competitors like Anthropic and OpenClaw. The next few years will likely put Microsoft at a crossroads. Should OpenAI's financing efforts falter, it could be absorbed into a larger entity -- perhaps Microsoft. To make the most of that possibility and the access it has today, the software giant should capitalize on its partnership, however tense it may be. Jensen Huang's hesitation should be taken as a warning: Microsoft needs to turn its privileged access into better products. With AI models becoming increasingly commoditized, the race is now about execution, and Microsoft risks being left behind. More from Bloomberg Opinion: * Sam Altman's 'Last Resort' for ChatGPT Looks a Lot Like Facebook: Parmy Olson * Data Centers Can Power More Than AI Chatbots: Lara Williams * Microsoft Has Lost Its AI Sparkle: Dave Lee Want more Bloomberg Opinion? Terminal readers head to OPIN <GO> . Or subscribe to our daily newsletter .

[4]

Microsoft investors sweat cloud giant's OpenAI exposure

All the promises in the world won't pay the GPU bills when the music stops What should have been a banner second quarter for Microsoft was met with tepid apprehension on Wall Street on Wednesday, sending its share price by 6 percent in after-hours trading. It could have been a celebratory quarter, as Redmond saw profits surge 60 percent year over over (YoY) to $38.5 billion on revenues of $81.3 billion. But in question after question, analysts politely pressed CEO Satya Nadella and CFO Amy Hood for assurances that Microsoft's lopsided reliance on AI model makers - and the massive capital expenditures required to serve them - wasn't going to come back to haunt the cloud giant. Of particular concern was the fact that 45 percent of Microsoft's $625 billion backlog was directly attributable to OpenAI. As part of OpenAI's restructuring as a public benefit corporation last fall, Microsoft revealed OpenAI had contracted to purchase an incremental $250 billion in Azure services. In exchange, Redmond would give up the right of first refusal to be OpenAI's compute provider. Hood attempted to assuage investors that the other 55 percent of Microsoft's remaining performance obligations were broad-based and growing at a healthy pace, up 28 percent during the quarter. "The reason we talked about that number is because 55% or roughly $350 billion is related to the breadth of our portfolio, the breadth of customers, across solutions, across Azure, across industries, across geographies," she said. "That is a significant RPO balance, larger than most peers, more diversified than most peers. And frankly, I think we have super high confidence in it." Left out of Hood's analyst commentary, but conspicuously noted in Microsoft's earnings slides, was the fair portion of that growth driven by OpenAI rival Anthropic. As you may recall, back in November, Anthropic committed to purchasing $30 billion of Azure compute capacity from Microsoft with an additional commitment to support the deployment of up to a gigawatt of compute capacity. But the deal didn't come cheap. In exchange, Nvidia and Microsoft agreed to invest half that ($10 billion and $5 billion) respectively back into the AI model dev. In other words, roughly half of Redmond's backlog is tied up in AI startups that haven't yet shown they can turn a profit. To realize those revenues, Microsoft will have to invest heavily in AI infrastructure, and it won't all be its in-house silicon, like the Maia 200 revealed this week. That gigawatt of compute capacity we mentioned earlier is tied specifically to deployments of Nvidia Grace Blackwell and Vera Rubin systems. Speaking with analysts on Wednesday, Hood attempted to dispel Wall Street's jitters over Microsoft's rampant capex spending, which topped $37.5 billion during the quarter. Of that, two-thirds is wrapped up in fast depreciating assets like GPUs and CPUs, which have just six years to generate a profit. "I think it's probably better to think about the Azure guidance that we give as an allocated capacity guide about what we can deliver in Azure revenue," she said. "The majority of the capital that we're spending today and a lot of the GPUs that we're buying are already contracted for most of their useful life." she added when pressed on Microsoft's ability to achieve a meaningful return on investment the chips aged out. "Much of that risk that I think you're pointing to isn't there because they're already sold for the entirety of their useful life." But as any landlord knows, just because someone signs a lease doesn't mean they're good for the rent when the going gets tough. Looking ahead to Q3, Microsoft expects to continue riding the AI wave. The company is forecasting revenues of $80.65 to $81.75 billion, up 15 to 17 percent year-over-year. At the same time, Microsoft doesn't expect to spend quite so lavishly during the third quarter, with capex down compared to Q2, due to "normal variability from cloud infrastructure build outs and the timing of delivery of finance leases," Hood explained. ®

[5]

Satya Nadella argues that Microsoft's AI bet is paying off as Copilot usage nearly triples

Serving tech enthusiasts for over 25 years. TechSpot means tech analysis and advice you can trust. In context: Microsoft reported another strong quarter, with revenue rising 17 percent to $81.3 billion and net income increasing 21 percent to $38.3 billion. The company also reached a symbolic milestone: its cloud business generated more than $50 billion in a single quarter, the highest in its history. Yet despite these headline numbers, the market responded coolly. Shares fell on Thursday as analysts questioned whether the company's escalating spending on AI infrastructure might be stretching resources too far, too fast. The concern stems from Microsoft's capital expenditures, which have soared to near-record levels. The company spent $88.2 billion last fiscal year and $72.4 billion in the first half of the current fiscal year. Most of this spending is aimed at building new data centers and high-performance computing infrastructure to support AI workloads for enterprises and major research partners, including OpenAI and Anthropic. The strategy is clear: saturate the market with capacity before demand peaks. What remains uncertain is how quickly that demand will convert into sustained profits. Wall Street's ambivalence reflects growth in Microsoft's core platforms. Azure, the company's enterprise cloud division, and Microsoft 365, its productivity suite, both posted solid but slightly slower expansion than investors had anticipated. UBS analyst Karl Keirstead described the underperformance as the key factor weighing on sentiment, though he still rated the stock a buy. The slower growth doesn't signal weakness - overall expansion remains strong - but it contrasts with Microsoft's image as the primary beneficiary of the AI boom. During the earnings call, CEO Satya Nadella sought to reframe the narrative, spending considerable time explaining how Microsoft's AI initiatives are driving user engagement. Nadella said adoption of Copilot, Microsoft's flagship consumer AI assistant, has nearly tripled in daily usage compared to a year ago. He did not disclose exact user numbers but highlighted its integration across Microsoft's ecosystem - from search and news feeds to the Windows operating system. The company's last publicly reported figure was 100 million monthly active users across both consumer and business segments. More concrete details were provided for GitHub Copilot, Microsoft's AI coding assistant. The service now has 4.7 million paid subscribers, a 75 percent year-over-year increase. Including free users, GitHub reported a total Copilot user base of 20 million last year, making it one of the most widely adopted developer AI tools to date. Meanwhile, Microsoft 365 Copilot has secured 15 million paid enterprise seats - a fraction of its 450 million total business customers - but a sign that corporate adoption is accelerating. Nadella also highlighted a quieter success story in Microsoft's healthcare division. Dragon Copilot, the company's AI agent for medical professionals, now serves 100,000 providers and processed 21 million patient encounters this quarter, tripling usage from a year ago. The product competes in a rapidly growing space that includes startups such as Harvey and reflects Microsoft's strategy to expand AI into specialized verticals beyond its core enterprise base. Image credit: App Economy Insights Behind these metrics lies the rationale for Microsoft's enormous capital push. Both Nadella and CFO Amy Hood noted that AI demand is already exceeding current data center capacity, leaving new compute infrastructure effectively booked the moment it comes online. The implication is that Microsoft's data center expansion is not speculative spending but a response to existing utilization. That framing may reassure investors, though the numbers suggest that even "booked to capacity" could involve billions in sunk costs before operating margins catch up. For now, Microsoft's results illustrate a company redefining scale in the cloud era. Market skepticism may fade if its data infrastructure gamble translates into consistent AI-driven revenue across its portfolio. But with capital spending already approaching last year's record, and only halfway through the fiscal year, Microsoft is betting heavily that global demand for AI compute will grow faster than even its vast supply capacity.

[6]

Microsoft Has Lost Its AI Sparkle

Who could forget those heady days when Microsoft Corp. Chief Executive Officer Satya Nadella looked like the smartest man in tech? When ChatGPT emerged in late 2022, his decision to back OpenAI put Nadella's company at the forefront of the AI boom. The top AI models would be embedded in its software and available on its cloud platform exclusively. But more recently, the relationship has cooled and with it the perceived value of Nadella's foresight. Microsoft has now invested in Anthropic and looked to incorporate its capabilities into its products. And OpenAI, hungry for computing power, has turned to Oracle Corp., Alphabet Inc.'s Google and Amazon.com Inc. All this AI polyamory has put Microsoft's eggs in a few more baskets, but it has also highlighted that Microsoft's early mover advantage has run its course. The AI sparkle that illuminated a market value that more than doubled has diminished. Since their peak last October, Microsoft shares have fallen by about 11% and, until Wednesday's close, had been flat since the start of 2026. If Wall Street had been hoping that quarterly results would bring a lift, it was left disappointed. Shares fell as much as 8.1% in after-hours trading because capital expenditures came in higher than analysts' already lofty expectations -- $37.5 billion compared with a consensus of $36.2 billion, according to Bloomberg data. A beat on total sales and a profit up by almost a quarter from the period a year earlier -- not including the $7.6 billion impact of its OpenAI investment, now on its balance sheet -- weren't enough to offset that jolt. "One of the core issues that is weighing on investors is capex is growing faster than we expected," Keith Weiss of Morgan Stanley remarked in the earnings call, "and maybe Azure is growing a little bit slower than we expected." In other words: Where's the return on investment? The thorny issue of ROI is stalking all of the top AI players, not just Microsoft. But the pressure has mounted on Nadella because of the shifting narrative of the AI industry. The AI story of 2026 so far is one that says Google, with its Gemini model, is crushing it with consumer use cases and benefiting from the availability and lower cost of its own chips. At the same time, Anthropic's coding capabilities are at the leading edge of redefining software engineering, and its Cowork "agent" is finally the intelligent assistant that AI boosters have been promising (or warning about, depending on your point of view). Indeed, according to reporting from The Information this week, Microsoft's engineers are scratching their heads and wondering how Cowork appears better at controlling Excel and PowerPoint than Microsoft's own AI. Sign up for the Bloomberg Opinion bundle Sign up for the Bloomberg Opinion bundle Sign up for the Bloomberg Opinion bundle Get Matt Levine's Money Stuff, John Authers' Points of Return and Jessica Karl's Opinion Today. Get Matt Levine's Money Stuff, John Authers' Points of Return and Jessica Karl's Opinion Today. Get Matt Levine's Money Stuff, John Authers' Points of Return and Jessica Karl's Opinion Today. Bloomberg may send me offers and promotions. Plus Signed UpPlus Sign UpPlus Sign Up By submitting my information, I agree to the Privacy Policy and Terms of Service. Whatever the reason, with its huge base of enterprise users and ownership of the coding mega-platform GitHub, Microsoft stands accused of letting its advantages dwindle. Then again, some of Microsoft's critics today were Google's critics yesterday. It wasn't so long ago that analysts and commentators were lining up to talk about how OpenAI had overtaken the search giant's in-house AI research shop, DeepMind, and condemned Google's entire business model to the scrap heap. As we know now, Google's floundering was just the lag of a corporate monolith with too many layers of management and too little urgency. The company soon answered the wake-up call and worked to push out its AI tools at something resembling startup speed. Now, Google is the team to beat. That's a useful guide for Microsoft, which must follow its example if it wants to be considered formidable opposition once more. More From Bloomberg Opinion: * Sam Altman and Masayoshi Son Are Dreaming Too Much: Shuli Ren * The AI Bubble Is Getting Closer to Popping: Shannon O'Neil * Anthropic's Next Big AI Hit Could Also Bruise Jobs: Parmy Olson Want more Bloomberg Opinion? Terminal readers head to OPIN <GO>. Or subscribe to our daily newsletter.

[7]

Microsoft's AI Spend Is Starting To Spook Investors

In its second-quarter earnings report on Wednesday, tech giant Microsoft reported $37.5 billion in capital expenditures, exceeding market estimates by more than a billion. The spending was up 66% from a year earlier, and roughly two-thirds of it was primarily spent on GPUs and CPUs, Microsoft executives said in an investor call. A few months ago, a report like this would have sent (and did send) Microsoft stock soaring. But on Wednesday, it had the opposite effect, and the stock went down 7%. As worries over an AI bubble simmer, the market is more desperate than ever to see tangible revenue returns that can reignite belief in the great financial promises of the technology, rather than just another huge spending commitment. But accompanying Microsoft's record spending was slowing cloud growth. Revenue from Microsoft's cloud services grew by 39% this quarter, down from 40% growth in the first quarter. During the investor call, Microsoft CFO Amy Hood attributed this discrepancy between capital expenditure and cloud growth at least partially to Microsoft allocating GPUs and cloud capacity to internal teams as well. Customer demand for cloud is still outpacing supply, Hood said. But even if the slowing cloud growth can be explained away, what also got investors anxious was Microsoft's reliance on AI giant OpenAI. 45% of Microsoft's remaining cloud commitments are solely from OpenAI. Although OpenAI used to be the silver bullet for finance, growing uncertainty over the startup's road to profitability and the risks associated with its ability to pay for towering, ambitious dealmaking has made some start to view any dependence on the AI darling as a potential burden. OpenAI has signed trillions of dollars worth of deals this past year, despite its $20 billion annualized revenue. Lately, the market has started questioning these overcommitments, as concerns over a potential AI bubble mount. If it continues to take too long for AI investments to start translating to actual gains or if somehow it turns out OpenAI cannot pay for its piling commitments, it could lead to a sharp market correction and spell trouble for the U.S. economy, which it seems is currently held up by AI investment.

[8]

Microsoft beats expectations, cloud tops $50B as OpenAI and Anthropic deals reshape its business

Microsoft's big financial bet on artificial intelligence got even bigger in the December quarter, but it also showed continued signs of paying off for its cloud business. The company spent $37.5 billion on capital expenditures during the second quarter of its 2026 fiscal year, up 66% from a year ago, with roughly two-thirds going toward GPUs and other hardware to power its AI and cloud offerings, according to results released Thursday afternoon. Revenue rose 17% to $81.3 billion, topping the $80.3 billion analyst consensus, and adjusted earnings per share jumped 24% to $4.14, well ahead of the $3.85 expected by Wall Street. Azure, Microsoft's cloud computing platform, which is increasingly driven by AI demand, posted revenue growth of 39% in the quarter, or 38% in constant currency. That exceeded the company's previous guidance of 37% growth. The broader Microsoft Cloud business, which also includes commercial Microsoft 365 subscriptions, LinkedIn, and Dynamics 365, topped $50 billion in quarterly revenue for the first time. The results come with an accounting quirk tied to Microsoft's OpenAI investment. Under generally accepted accounting principles, Microsoft recorded a $10 billion gain this quarter ($7.6 billion after-tax) stemming from OpenAI's October recapitalization. That boosted Microsoft's GAAP earnings per share to $5.16, translating into a 60% jump that doesn't really reflect its underlying business. Microsoft's adjusted earnings ($4.14/share) strip out the OpenAI impact for clarity. On the flip side, the company expects to record accounting losses in future quarters as OpenAI spends down its cash. Meanwhile, the company's remaining performance obligations (RPO), a closely watched measure of contracted future revenue, more than doubled to $625 billion. OpenAI accounts for roughly 45% of that backlog, reflecting the AI company's long-term commitments to use Microsoft's Azure cloud infrastructure under their renegotiated partnership. The rest of Microsoft's RPO balance grew 28%, which the company said was aided by a commitment from Anthropic, another leading AI company that has become an Azure customer. Microsoft shares were down 4% in initial after-hours trading.

[9]

'We are pushing the frontier across our entire AI stack': Microsoft's latest results show new cloud and AI returns - but reliance on OpenAI causes concerns

Investors are worried about over reliance on AI model makers, OpenAI and CapEx Microsoft has posted a 17% year-over-year increase in quarterly revenue ($81.3 billion), but despite this success, it seems investors are concerned about bigger things at play than just the company's finances. Share prices actually dropped 6% in after-hours trading, with investors likely worried about Microsoft's heavy reliance on AI model makers and huge capital spending. And despite Microsoft forfeiting its right of first refusal as OpenAI's compute provider, the company is still heavily tied to the ChatGPT maker in more ways than one, which adds to the pressure it faces in gaining investor confidence. In its earnings release, Microsoft admitted that its commercial remaining performance obligation increased 110% to $625 billion. Nearly half (45%) of this is tied to OpenAI after OpenAI set out plans to buy an additional $250 billion in Azure services, with Microsoft CFO Amy Hood stressing the remaining 55% of its backlog is spread across various industries, geographies and customers, and is unrelated to OpenAI. Still, Hood praised Microsoft Cloud's performance, which has now hit the $50 billion mark in quarterly revenue - in other words, the department is now responsible for nearly two-thirds (63%) of the entire company's revenue. "We are only at the beginning phases of AI diffusion and already Microsoft has built an AI business that is larger than some of our biggest franchises," CEO Satya Nadella declared. "We are pushing the frontier across our entire AI stack to drive new value for our customers and partners." During its most recent quarter, Microsoft's CapEx reached $37.5 billion, or nearly half (46%) of its entire revenue, with an estimated two-thirds spend on GPUs and CPUs, Hood explained in the call. Microsoft also implied a continued reliance on Nvidia chips despite in-house efforts with its own Maia hardware. Nvidia shares have plateaued in recent weeks over concerns of an impending AI bubble pop and increased activity by its customers producing their own chips.

[10]

Microsoft shrugs off AI bubble fears again with strong financial results

Company reports second-quarter revenues of $81.27bn but posts slowing growth in key cloud computing business Investor interest in Microsoft's shares may have weakened in recent months, but the company posted strong financial results on Wednesday that yet again demonstrated that the AI boom is roaring on. Microsoft reported earnings for the second quarter of fiscal year that are likely to keep the party going for Wall Street, despite slowing growth in its key cloud computing business. Microsoft reported revenues of $81.27bn against expectations of $80.32bn, and improved from the 12.3% increase it recorded in the same quarter last year. Earnings came in at $4.14 per share against expectations of $3.92. "We are only at the beginning phases of AI diffusion, and already Microsoft has built an AI business that is larger than some of our biggest franchises," said Microsoft CEO Satya Nadella. "We are pushing the frontier across our entire AI stack to drive new value for our customers and partners." Microsoft shares fell 4% in extended trading on Wednesday after the software maker posted slowing cloud growth. Microsoft has been one of the primary beneficiaries of the AI boom, but investor confidence in it has slipped of late. Six months ago, the company hit the vaunted level of a $4tn market capitalization. Three months ago, it beat analysts' revenue expectations by 2.9%, reporting revenues up 18.4% year on year. The four largest AI spenders - Microsoft, Alphabet, Amazon and Meta - are expected to spend $505bn on AI infrastructure this year alone, up from roughly $366bn in 2025. But shares in the company have slumped 11% since as investors' anxieties over the billions being pumped into AI without corresponding returns have increased. Despite those fears, Microsoft has exceeded Wall Street's expectations in every quarter over the past two years. In its last earning report, Microsoft said orders booked by its Azure cloud-computing business, which incorporates AI, "significantly" exceeded capacity. Revenue to that unit was that projected to rise 38% for a year earlier. On Wednesday, Microsoft said Azure revenues grew 39%, compared with 40% growth in the fiscal first quarter. "Microsoft Cloud revenue crossed $50bn this quarter, reflecting the strong demand for our portfolio of services," said Amy Hood, executive vice-president and chief financial officer of Microsoft. "We exceeded expectations across revenue, operating income, and earnings per share." But Microsoft's 365 Copilot AI unit is facing increased competition, including from Anthropic's Claude Cowork, a desktop AI tool meant to act as a more accessible version of Claude Code. In the fashion of circular investment deals now common to the industry, Anthropic is also in an exchange partnership with for compute capacity. Wedbush's Dan Ives said this week he viewed Microsoft "as the clear front-runner on the enterprise hyper-scale AI front despite increasing competition from Amazon and Google". The most recent US productivity report showed strong gains without increased work-hours, suggesting that the gains could be attributed to AI.

[11]

Microsoft Stock Takes Most Massive Single-Day Loss Since Pandemic as Its AI Efforts Flail

Microsoft is taking a pounding in the stock market. On Thursday, the Redmont giant's share price collapsed by nearly 12 percent after it released its latest quarterly results, making it not only its biggest single day slide since March 2020, according to Bloomberg, but also one of the worst drops in the company's history. The Wile E. Coyote-worthy cliff-plunge, which wiped out over $400 billion in valuation, was despite Microsoft actually exceeding some key expectations, including its net income, which rose by 23 percent from the same period the year before to nearly $31 billion. Revenue also increased by 17 percent to $81.3 billion, which is about a billion more than what analysts projected. But Microsoft's AI spending spree has investors second-guessing its direction, and it's striking that the lack of faith was strong enough to precipitate a historic plunge even with respectable financial growth. Overall, its total capital expenditures grew by 66 percent to a record $37.5 billion in Q4, as the company continues to splurge on building AI data centers for its Azure cloud computing business. Azure reported a 38 percent bump in revenue, which is slightly slower than the year before, adding to investor uncertainty over whether the business will be able to reap back the tens of billions spent on its data centers. In December, The Information reported that Azure was struggling to sell the company's autonomous "AI agents" to its business customers, with quotas being slashed by up to 50 percent. Some analysts had predicted the stock drop, citing the uncertainty over Microsoft's AI spending. "Since it is becoming even more evident that Microsoft is not going to garner a strong ROI from their massive AI investment, their shares need to be revalued back down to a level that is more consistent with its historic fair value," Matthew Maley, chief market strategist at Miller Tabak + Co, told Bloomberg before markets opened on Thursday. In the latest earnings, Microsoft boasted it had more than $625 billion in contracts for its cloud business that it still needed to fulfill. Nearly half of that, though -- a colossal $350 billion -- is from OpenAI, raising concerns that it may be putting too many eggs in one basket. It also draws attention to how Microsoft has struggled to make an impact with its own AI products like its Copilot assistant, which was heavily based on OpenAI's tech, and which many enthusiasts perceive as an inferior version of ChatGPT. Microsoft 365 Copilot, the business-focused version of its chatbot integrated into its apps like Word, had 15 million annual users, the company just revealed. "As an investor, when you think about our capex, don't just think about Azure, think about Copilot," CEO Satya Nadella said on a call with analysts, as quoted by the Financial Times. "We don't want to maximize just one business of ours. We want to be able to allocate capacity, while we are supply constrained, that allows us to build the best portfolio."

[12]

Wall Street is losing patience with OpenAI's $1 trillion revenue problem -- and they're taking it out on Microsoft | Fortune

Wall Street's years-long bet on AI is facing a severe test on Thursday, as investors might begin to view OpenAI-and generative AI in general -- not as a catalyst for continuous growth, but as a source of systemic risk for Big Tech. A sharp selloff in tech stocks on Thursday underscored investors' exhaustion with the "spend now, profit later" model that has propelled the AI bull market for three years. Microsoft led the retreat, with its shares plummeting 12% by noon, erasing more than $440 billion in market value, a collapse it hasn't seen since the pandemic. The NASDAQ was down almost 2% at time of writing. The immediate catalyst, it seems, is an intensifying focus on capex. Microsoft revealed that its spending surged 66% to $37.5 billion in the latest quarter, even as growth in its Azure cloud business cooled slightly. Even more concerning to analysts, however, was a new disclosure that approximately 45% of the company's $625 billion in remaining performance obligations (RPO) -- a key measure of future cloud contracts -- is tied directly to OpenAI, the company revealed after reporting earnings Wednesday afternoon. (Microsoft is both a major investor in and a provider of cloud-computing services to OpenAI). "It's the collapse of software and the ascent of hardware and it is staggering," CNBC's Jim Cramer noted on X on Thursday, as the market punished companies that are spending billions on software infrastructure while failing to show immediate returns. It's an "ominous" statistic, Morning Brew founder Austin Rief wrote on X, especially combined with the fact that Meta is planning to spend most of their free cash flow on CapEx. Meta has gotten away from the selloff on a stronger-than-expected revenue forecast, showing a healthy 24% year-over-year revenue growth, driven by online ads. The fact that Wall Street is letting Meta get away with their also massive capex indicates the reason why investors are selling off: they don't trust OpenAI to bring that revenue on their own without massive infusions of outside cash. The sentiment shift is not limited to Redmond. Oracle Corp. has seen its shares halved from their September highs, erasing nearly $463 billion in value. Once a darling of the AI trade, Oracle has also struggled with investor confidence that the massive data centers it is building for OpenAI will get funded eventually. Additionally, the timeline for several projects has reportedly slipped to 2028, creating a gap between the company's heavy debt-funded spending and the arrival of actual revenue. OpenAI has made about $1.4 trillion in commitments to procure both the energy and compute it needs to fuel its operations. But its revenue barely crossed $20 billion in 2025. Investors are increasingly critical of what they describe as "circular" deals involving the industry's biggest players. On Wednesday evening, The Information reported that OpenAI is seeking a fresh $60 billion in funding from heavyweights like Nvidia and Amazon. However, market reaction suggests that more capital isn't going to be a viable substitute for a business model anymore."Maybe Oracle stock got way ahead of fundamentals and now the market's saying, alright, show me, I want to see it," Eric Diton, president of Wealth Alliance, told Yahoo Finance.

[13]

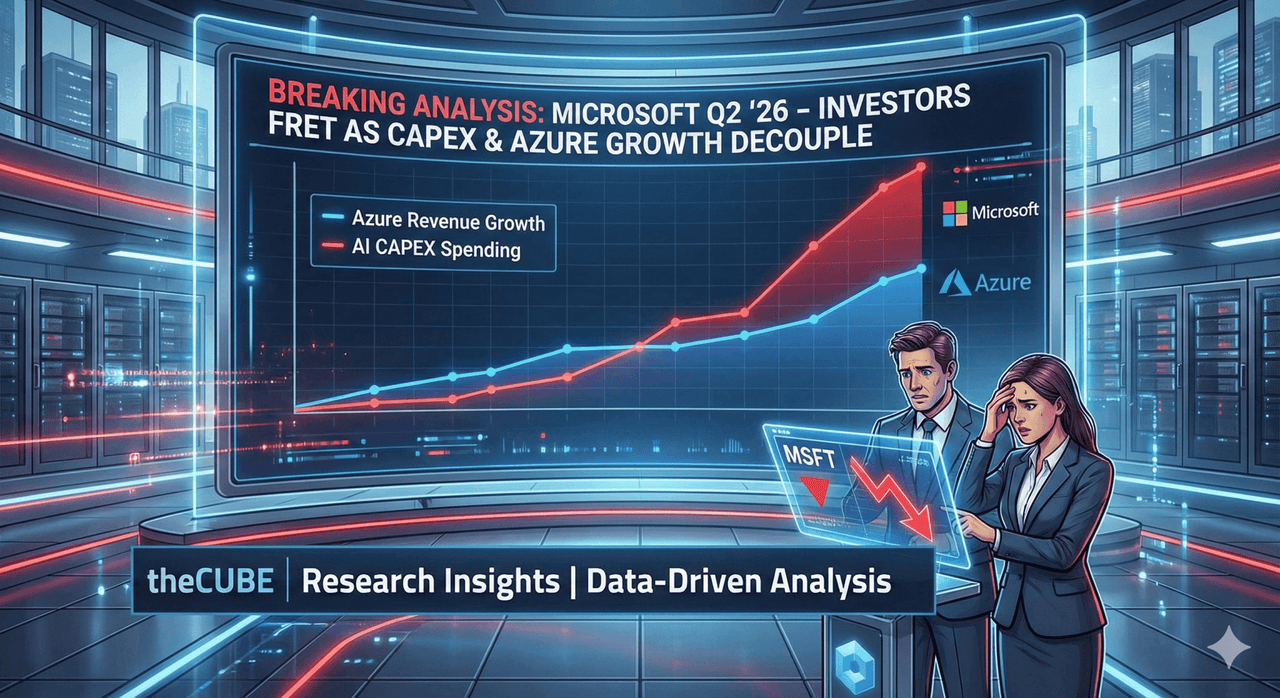

Microsoft investors fret as capital spending and Azure growth decouple - SiliconANGLE

Microsoft investors fret as capital spending and Azure growth decouple Microsoft Corp. last week delivered what looks on paper like a great quarter, with a beat of 1% and 5% on revenue and operating operating profit, respectively. But the two-day reaction from investors tells a different story, with the stock off double digits from its pre-earnings price. Last quarter, increased capital spending was interpreted as a signal for enthusiasm and confidence. But artificial intelligence ambition has turned into AI skepticism. Specifically, Microsoft's capital expenditures came in higher than expected but Azure growth didn't. Without a clean bridge from capital spend to clear cloud return on investment, Azure growth, despite an impressive performance, has become a sticking point. In this Breaking Analysis, we unpack nuggets from Microsoft's second-quarter 2026 earnings print and explain why in our view, the Street's negative reaction misses the bigger picture. The chart below shows Microsoft's stock over the past five trading days. After the earnings announcement on Wednesday, the stock took a hit, falling after the market close. It was down Thursday and kept sliding on Friday. In the top right, you've got a confident Meta Platforms Inc. Chief Executive Zuckerberg and a frowning Microsoft CEO Satya Nadella. Meta crushed its quarter, and the market clearly thinks it's getting a lot of bang for its buck with AI investments. Microsoft? Not so much, according to the market's reaction. The market seems confused, as you can see above the stock was in the green pre-market for a brief period of time, then ended down for the day, with the stock off 11% since the earnings print. The confusion comes from investors' hope that CapEx and Azure growth would move in smooth, lockstep pattern; but that rarely happens and the divergence is not surprising, as we'll explain in more detail below. In our view, Satya Nadella's remarks are best understood as a shift in what Microsoft wants investors to measure. The company's cloud business is enormous - using simple math, it is running at roughly a $200 billion run rate across Azure and the broader software-as-a-service portfolio - but the emphasis is moving toward building token factories and distributing that capability across a expanding edge and distributed cloud estates. Nadella referenced "token factories," and cited the most important metric "tokens per watt per dollar." We believe Microsoft is confirming our premise that AI infrastructure economics are becoming the governing key performance indicator. The winners are the ones that improve performance and throughput while lowering cost, because that is what expands adoption and usage. That is why our analysis naturally connects to Nvidia Corp.'s recent CES disclosures around Vera Rubin - 5X performance, 10X throughput and one-10th the cost per token. In our view, this reinforces the flywheel that we believe drives a 15X demand expansion through Jevons Paradox. This is a key reason Nvidia separates from the broader graphics processing unit pack, even as hyperscalers invest in their own silicon. Microsoft referenced Maia and Cobalt, highlighted work with Advanced Micro Devices Inc., and positioned its silicon program as part of the optimization path. Nadella later cited improvements in tokens per watt per dollar tied to OpenAI Group PBC inference, and we believe that is relevant because access and allocation to the most efficient hardware becomes critical. Nvidia remains the most critical supplier to all AI leaders and Nadella doesn't have the supply he needs to satisfy all his demands. As such, Microsoft must balance GPU allocation between lower margin Azure AI services (for example, OpenAI inference) and first-party AI (for example, M365 and GitHub Copilot). Our expectation is that "tokens per watt per dollar" will continue to show up across the hyperscalers. Google LLC and Amazon Web Services Inc. are running in the same race, and Microsoft's language suggests the industry is converging on a common set of economics-driven metrics that connect CapEx to outcomes. The rub in the quarter is the CapEx and Azure growth diverged. The second major takeaway from the earnings call is the application platform transition. Nadella said a new application platform is being born, and we agree. We believe the shift from on-prem to SaaS changed everything - technical architectures, operating models and pricing. We expect another full-stack shift as AI becomes the dominant interface and execution layer. Seat-based pricing is becoming less aligned with value as tokens and outcomes become the important variable. Consumption models already pulled software in this direction. Outcome-based pricing is the next step as enterprises price to delivered results, with token usage serving as the underlying cost that has to be managed. Finally, Nadella's comments on agentic initiatives give insight to how Microsoft thinks about future software architectures. He describes agentic systems as "macro delegation and micro steering." This is Microsoft's way of separating orchestration from execution. We believe this maps cleanly to an orchestration layer coordinating agents that do focused "worker bee" tasks. The company is investing to refactor its stack around that model, and the resources being applied indicate Microsoft views this as a platform transition, not a set of new features. We believe Nadella is telling the market that Microsoft is building the infrastructure and platform layer for the token economy, with tokens per watt per dollar as the core KPI, Nvidia-driven efficiency improvements will shape unit economics, and an emerging application platform that shifts software monetization toward outcomes as orchestration and agentic execution become the key building blocks. In our view, the most important part of Chief Financial Officer Amy Hood's commentary is the tension between scale performance and the margin and growth tradeoffs created by AI infrastructure. Microsoft is operating at an astounding $325 billion revenue run rate, growing the top line about 15% in constant currency. Earnings growth is also strong at roughly 21% in constant currency. Those are extraordinary results for a $300 billion-plus company. But the market reaction suggests the sentiment has moved from "How strong is Microsoft?" to "How fast does AI infrastructure convert into monetization, and at what margin?" The key issue to consider is margin pressure. Microsoft's historical software economics at scale were defined by near-zero incremental cost. In the CD-ROM era, the marginal cost at volume was essentially the media - literally pennies. Cloud shifted that as SaaS delivery introduced a real cost structure driven by compute, storage and networking cost of goods sold. AI further pressures margins because the economics now include a heavy AI infrastructure layer, with GPUs and central processing units driving cost of goods and capital intensity. This is a structural change that forces investors to rethink what "software margins" mean in an AI-first operating model. CapEx is the real story. Microsoft spent $37.5 billion in CapEx in the quarter. That number dominated the discussion because it shines a light on the conversion cycle from investment to revenue and profit. Azure grew 38% in constant currency, which is strong in absolute terms, but it came in below the 40% expectation many investors had anchored to. The company guided to flattish sequential growth rates for Azure, and that fed the narrative that CapEx and Azure growth are decoupling. The second issue is allocation. Microsoft has to decide how much GPU capacity goes to Azure services versus first-party services and products such as Copilot, including coding use cases. Management said that without the need to balance capacity across Azure and first-party AI, Azure growth would have been 40%. We believe that comment was intended to explain the constraint, but the market interpreted it as a negative signal about the near-term ability to translate CapEx into cloud growth. What the market looked past was Microsoft's guidance that CapEx growth would decline sequentially while Azure growth will maintain its current trajectory. A side point worth noting is how OpenAI flows through the financials. Microsoft's ownership in OpenAI is recognized as equity rather than profit and loss, so the reported impact reflects OpenAI's balance sheet performance. That contributed to a $10 billion gain in GAAP or net results on the income statement, but it does not change the core operating question investors are asking about ongoing monetization and margins. Stepping back, we believe the market is demanding more clarity on the conversion timeline from CapEx spend to Azure revenue and profit specifically. Investors want the relationship between AI infrastructure buildout and revenue growth to feel immediate and in lockstep. In our view, that expectation is unrealistic. Infrastructure buildout takes time, and the monetization path depends on productizing that capacity into APIs, inference services, and application-level intelligence. Microsoft also emphasized model optionality, which aligns with a broader hyperscaler playbook, but optionality does not shorten the time required to deploy capacity, integrate it and drive consumption. We believe the quarter highlighted a an operating reality that Microsoft is delivering exceptional scale growth while absorbing AI infrastructure costs, and the market is focused on how quickly CapEx converts into Azure and application monetization. The demand is there, but the core issue is the pace of deployment, the allocation of scarce GPU capacity, and the timeline investors are willing to tolerate as Microsoft builds its token factories and turns it into durable revenue. The sell-side analysts' main concerns related to the CapEx rising faster while Azure growth is moderating, and investors want better visibility into the ROI path. Keith Weiss of Morgan Stanley pressed that point, focusing on the relationship among capacity buildout, Azure growth and the timeline for returns. The market's reaction suggests this is the central issue, despite the headline revenue and earnings performance. The decoupling between CapEx and Azure growth is a product of prioritization. Microsoft is allocating scarce AI capacity across two competing objectives: 1) Expanding Azure's AI services; and 2) Building out first-party experiences such as Copilot. We believe this tradeoff makes economic sense. Azure carries lower gross margins relative to Microsoft's first-party software products, and first-party AI features are the way Microsoft protects and extends its software franchises. In this context, the allocation decision is a margin optimization as well as a product strategy. This also highlights product quality and execution. Copilot has received mixed reviews from customers. Offerings from AI specialists such as Glean Technologies Inc. are in many ways what Copilot should be delivering. We believe Microsoft well understands the gap. The company has a long history of shipping a rougher 1.0 and improving it through iteration, distribution and sustained investment. We expect Copilot to follow that pattern. The near-term consequence is that the market gets a less predictable story on the CapEx-to-Azure-growth relationship because some of the capacity is being directed toward first-party adoption and learning curves. The second concern is backlog. Analysts pointed to the mismatch between infrastructure depreciation cycles and revenue visibility. Analysts referenced GPU and CPU depreciation cycles that Microsoft uses of roughly six years, while remaining performance obligations or RPOs sit at about 2.5 years. That is an improvement from roughly two years last quarter, but it is still materially shorter than the asset life. This creates a natural investor concerns over how durable the backlog is relative to the capital being deployed. The OpenAI exposure is an additional concern. About 45% of the RPO is tied to OpenAI commitments. Microsoft's response referenced visibility and demand dynamics saying about 25% of backlog is expected to convert within the current fiscal year. Meanwhile the backlog is expected to grow, and demand continues to outstrip supply. We believe management was trying to reinforce confidence in near-term conversion. Investors, however, are focused on what happens beyond the current horizon, especially when depreciation assumptions are longer than the contracted visibility window. Moreover, if and when the bubble bursts, so will demand and with it the backlog. All of that brings the discussion back to Azure growth as the sticking point. The market is willing to fund CapEx if it sees a credible path to sustainable monetization at scale. When Azure growth underwhelms expectations, the ROI debate becomes louder and scrutiny intensifies. Nonetheless, we believe Microsoft is making a rational allocation choice to maximize long-term margin and platform leverage, but the market is demanding better visibility on how CapEx converts into Azure growth and sustainable backlog. Azure growth remains the key factor, and the combination of shorter RPO visibility, meaningful OpenAI exposure and long asset lives keeps ROI and backlog visibility at the center of the conversation. Let's take a look at some external data that validates Microsoft's position. Below we show Microsoft's account-based spending momentum from Enterprise Technology Research data. The market is debating CapEx, Azure growth rates and AI ROI timing. This data helps separate near-term sentiment from what customers are actually planning to do with Microsoft across the portfolio. This chart above uses ETR's proprietary Net Score methodology, which measures spending intention and velocity across roughly 1,700 enterprise accounts, with Microsoft represented in well over 1,000 of them. The stacked bars go back to January 2023 and break the installed base into spend behavior segments. The blue Net Score line is derived by subtracting the reds from the greens. It has been hovering in the mid-40s. In this framework, anything above 40% is considered highly elevated. We believe the key point is Microsoft is sustaining highly elevated spending momentum while operating at a $300 billion-plus scale. That combination is rare and speaks to ubiquity and outstanding execution. The yellow line at the top represents pervasion, or penetration, into the 1,700-account dataset. It sits around the 70% level with minimal variability. We do not view the small dips as meaningful. Microsoft's footprint is extensive and sustainable, and that market presence creates the conditions for platform adoption. We believe Microsoft is increasingly benefiting from data gravity. The company is not just an infrastructure and productivity vendor. It is becoming a data platform player as well. Fabric was referenced as one of Microsoft's fastest-growing products in its history, and in our view it strengthens the gravitational pull by bringing together data and analytics inside Microsoft's ecosystem. When the data and the platform sit in the same footprint, it becomes easier to attach ancillary products and drive adoption of AI-infused experiences, including Copilot for Microsoft 365, GitHub-related offerings and other first-party workloads. Where Microsoft's first-party data products are insufficient, its ecosystem partners such as Databricks Inc., Snowflake Inc. and a spate of other ecosystem partners fill the gaps. We also believe Microsoft's product cycle maturity is relevant here. Early versions are not always great, but the company tends to iterate aggressively, learn from deployment, and eventually get products into a mature state. We've seen that dynamic play out with Power BI, Power Automate and many other products in the portfolio. In our opinion, that trend underpins why spending momentum stays elevated over time, even when the market debates the short-term narrative. It's just easy and convenient to do business with Microsoft. We believe ETR's Net Score and pervasion view reinforces our belief that Microsoft's customer momentum remains exceptionally strong at massive scale, and that the company's expanding data platform installed base increases the pull for AI products, even as investors debate near-term CapEx, Azure growth and the pacing of AI ROI. We believe the cloud leaders continue to lead and the cloud is where most AI services are being consumed. ETR's cloud sector analysis makes that obvious. This chart below plots spending momentum against account overlap across 1,746 enterprise accounts and covers the full cloud computing sector, not just infrastructure as a service and platform as a service. The data suggests the hyperscalers remain in a power position, and the emergence of AI-native infrastructure providers inside the survey shows at where the next layer of cloud demand is forming. The vertical axis is Net Score, ETR's measure of spending momentum. The horizontal axis is overlap, a proxy for penetration across the 1,746 accounts. The red dotted line at 40% is the highly elevated momentum line. Microsoft sits in the upper right, with both high penetration and highly elevated momentum, and AWS is also positioned as a leader separating from the rest of the field. Google Cloud Platform is above the 40% line as well and is tightening the gap on the top two thans to its AI and data chops. All three hyperscalers are operating above the "highly elevated" threshold, which reinforces the idea that enterprise cloud demand remains structurally strong. Below the hyperscalers, the chart shows a mid-pack where providers have meaningful presence on the horizontal axis but less momentum. Oracle Corp. stands out here. It has relatively strong penetration on the horizontal axis, sitting just behind Cloudflare Inc. and Salesforce Inc., which sell higher-volume products. Oracle's presence reflects a different model with fewer, larger deals and higher value and price points. IBM Corp. appears in the same mid-pack cohort. We believe this supports the broader point where cloud adoption continues to outpace on-premises data centers, and even vendors with different go-to-market models retain meaningful footprint as enterprise architectures modernize. We also see evidence that the rich get richer. Microsoft's hybrid and on-prem business grew in the low single digits, roughly 1% to 2%, while its overall cloud business grew in the mid-20s and Azure approached 40% growth. In our view, this persists as enterprises continue reallocating budgets toward cloud services that deliver velocity, elasticity, and increasingly AI infrastructure. One of the more interesting developments is on the far left with CoreWeave Inc. appears in the dataset. Its Net Score is not off the charts, but the fact that it shows up at all is relevant because CoreWeave historically sells heavily into AI specialists and model builders. We believe this is an early indicator that AI infrastructure specialists are expanding their enterprise footprint. We are watching CoreWeave alongside Lambda and Crusoe, which are increasingly central to building and operating the AI infrastructure layer. That AI infrastructure layer has long-term budget implications. We have said repeatedly that information technology spending averages around 4% of revenue as a rule of thumb. We believe that over the next five to seven years, that figure moves toward 10% of revenue or more, driven by AI infrastructure and token-driven services. The directional shift is away from legacy IT stacks and toward token generation and consumption through APIs. In our opinion, the hyperscalers are best positioned to monetize this shift because they own the cloud delivery platform and are building the token factory layer on top of it. We believe the ETR cloud sector view reinforces that hyperscalers remain in an advantageous position, cloud continues to outpace on-prem, and AI-native infrastructure providers are beginning to surface in enterprise datasets as the token economy expands. Over time, token API services become a core driver of productivity and workflow redesign, and the cloud leaders are positioned to capture that shift. Let's step back and look at IaaS and PaaS share over time. The view below isolates the core cloud infrastructure market - it excludes Microsoft 365 and other SaaS products - and shows how AWS, Azure, GCP, Alibaba and Oracle have been performing since 2020. The market is large, still growing quickly, and the share shifts help explain why investors are so sensitive to any hint that AI CapEx is not translating into near-term growth. The top half of the slide shows IaaS and PaaS revenue by provider, with 2025 as an estimate. The "Big 5" expands from roughly $78.4 billion in 2020 to an estimated $274.1 billion in 2025, a 31% year-over-year growth rate for the cohort. Within that growth, the mix is changing: The bottom half shows how those growth rates translate into share shifts from 2024. AWS declines from about 51.3% in 2024 to 46.6% in 2025E, a five-point drop inside this cohort. Azure rises from about 30.2% to 33.7%, a four-point gain. GCP holds roughly 9.8%. Alibaba declines about one point to 5.6%. Oracle rises from roughly 2.2% to 4.3%, a two-point gain. The longer view is the real story. AWS moves from roughly 57.8% share in 2020 to 46.6% in 2025E, while Azure rises from roughly 22.1% to 33.7%. GCP improves through the early years and then holds share as Azure accelerates and the cohort mix changes. Oracle's share gain looks modest relative to its growth rate because the market itself is large and growing fast. We believe this share math helps explain the current market psychology. Valuations are high, CapEx is rising and investors want the ROI timeline to be shorter and more visible. That creates a knee-jerk reaction when growth shows slightly below expectations, even if the market position remains strong. In our view, the underlying cloud market continues to expand, and the share shifts show that the winners keep compounding, even as the leaderboard evolves. We believe the share data reinforces two truths that cloud demand remains strong and is still growing fast, while the market is repricing leadership based on who converts AI-era investment into the next leg of growth. AWS remains the scale leader, Azure continues to take share at a meaningful clip, GCP is increasingly viable and accelerating, and Oracle's growth rate is too large to ignore. Against that backdrop, we believe investors are prone to overreacting to near-term variance because the AI ROI cycle is entering a phase where expectations are high and patience is thin. Longer-term, we believe Microsoft is making the investments that will set it up for massive valuations in the coming decade.

[14]

Microsoft demand backlog doubles to $625 billion thanks to OpenAI, but hefty spending and slower revenue growth spook investors | Fortune

During the earnings call with analysts after market close on Wednesday, chairman and CEO Satya Nadella and chief financial officer Amy Hood were pressed on investor fears over a slowdown in revenue growth for the Azure platform amid soaring capital expenditures -- both signs that the company is struggling to keep up with AI demand. Those two figures combined have given rise to questions about whether Microsoft can build out computing capacity as fast as planned, and if that issue will further limit Azure's growth. Essentially, investors are worried they might be seeing the first blush of a yellow flag. "One of the core issues that is weighing on investors is capex is growing faster than we expected, and maybe Azure is growing a little bit slower than we expected," said Keith Weiss, head of U.S. software research at Morgan Stanley, during the call. "That fundamentally comes down to a concern on the [return on investment], on this capex spend over time." To level-set: Microsoft spent $34.9 billion on capital expenditures in the first quarter of fiscal 2026 alone, with roughly half dedicated to assets including GPUs and CPUs, which are the chips it uses in PCs, servers, and the Azure data centers. In Q2, capex was roughly $37.5 billion, which brought the first half total to $72.4 billion, signaling significant infrastructure spending. In the first quarter, Hood told investors the company was seeing growing demand and a rising RPO balance that meant it would increase its chips spending. Meanwhile, Azure growth flattened out, falling from 40% in the first quarter to 39% in the second. "We continue to see strong demand across workloads, customer segments and geographic regions, and demand continues to exceed available supply," said Hood during the call. The latest earnings figures have investors thinking about capacity constraints, and ROI questions. Hood pushed back on the idea that investors should draw a direct correlation between capital expenditures and Azure's revenue figures. "Sometimes I think it's probably better to think about the Azure guidance that we give as an allocated capacity guide about what we can deliver in Azure revenue," Hood told Weiss in response to his question. "The first thing we're doing is solving for the increased usage and sales and the accelerating pace of the M365 Copilot, as well as GitHub Copilot," she said. Then, Microsoft invests in R&D and product innovation, which are both long-term investments. "You end up with the remainder going toward serving the Azure capacity that continues to grow in terms of demand," said Hood. If Microsoft had allocated all new GPUs from the first and second quarters exclusively to Azure, Hood stated, Azure's growth would have been well above the 39% Microsoft reported. Nadella underscored Hood's point, noting that investors should evaluate performance across the entire AI enterprise. He said investors should "obviously" consider Azure, but shouldn't forget about Microsoft 365 Copilot, Github Copilot, Dragon Copilot, and Security Copilot, all of which incorporate AI. "Acquiring an Azure customer is super important to us, but so is acquiring an M365, or a GitHub or a Dragon Copilot [customer]," said Nadella. He said compute spending also functions as an R&D-like investment. "You've got to think about compute as also R&D, and that's sort of the second element of it," said Nadella. "And so we're using all that, obviously, to optimize for the long term." Still, investors are likely to remain concerned that the ongoing capacity constraints could prevent the tech giant from converting its record RPO backlog, reported in filings in the form of remaining performance obligations (RPO), into revenue growth as fast as Wall Street expects. In addition, investors will be looking next quarter for signs that the infrastructure spending is justified by revenue growth. Despite the investor concerns and the after-hours stock drop, much of the news from the latest earnings report was positive. Microsoft reported second quarter revenue of $81.3 billion, up 17% from $69.6 billion a year ago, leapfrogging past the company's guidance of $79.5 billion to $80.6 billion. Operating income grew 21% to $38.3 billion from $31.7 billion, while diluted earnings per share rose 24% to $4.14 from $3.35. Moreover, the cloud business cracked $50 billion in quarterly revenue for the first time ever, hitting $51.5 billion, growth of 26% year over year. RPO was up 110% year over year to $625 billion, driven in part by a $250 billion commitment from OpenAI that was announced in October. Hood said investors shouldn't worry about the exposure to one of Microsoft's major partners, pointing out that roughly $344 billion of the RPO came from a diverse set of other customers. RPO from that set of customers grew 28% year over year, which Hood said was larger than most of Microsoft's peers. Some "55% or roughly $350 billion is related to the breadth of our portfolio, breadth of customers, across solutions, across Azure, across industries, across geographies," said Hood. "Frankly, I think we have super high confidence in it."

[15]

Microsoft's shock plunge isn't end of AI bubble. But it's a warning

Microsoft's sudden share price plunge is a warning sign that AI confidence in the AI story is starting to be tested, and sentiment can move quickly. What's remarkable about the 10 per cent plunge in Microsoft's share price on Thursday night - the biggest one-day fall since 2020, before anyone had really heard of generative artificial intelligence - is that the December quarter results the company produced just 15 hours earlier were pretty damn impressive. Revenue surged 17 per cent to $US81.3 billion ($115.4 billion) and operating income jumped 21 per cent to $US38.3 million. These are stonking numbers for a three-month period, and they were ahead of analyst expectations.

[16]

Microsoft reports $7.6 billion net income gain from OpenAI investment

Microsoft reported a $7.6 billion increase in net income from its investment in OpenAI during its latest quarterly earnings released on Wednesday. The software company has invested more than $13 billion in the AI lab. OpenAI reportedly operates under a 20% revenue-share agreement with Microsoft, although neither entity has publicly confirmed this arrangement. OpenAI currently seeks additional funding at a valuation ranging from $750 billion to $830 billion, as reported by Bloomberg. In September, OpenAI restructured into a public benefit corporation, prompting Microsoft and OpenAI to renegotiate terms of their partnership. Under the revised agreement, OpenAI committed to purchasing an additional $250 billion in Azure services from Microsoft. This commitment registers on Microsoft's financial statements as "commercial remaining performance obligations," defined as contracts Microsoft holds that remain unpaid. The total value of these obligations rose sharply to $625 billion from $392 billion in the prior quarter. Microsoft specified that 45% of the current obligations derive from OpenAI. The earnings report also referenced Anthropic's role in driving growth, noting a 230% increase in commercial bookings. In November, Microsoft disclosed a $5 billion investment in Anthropic. Separately, Anthropic agreed to $30 billion in Azure compute capacity, expressing intent to acquire more capacity later. Microsoft allocated $37.5 billion to capital expenditures during the quarter. Two-thirds of this amount funded short-lived assets, consisting primarily of GPUs and CPUs deployed in the Azure cloud platform to support AI workloads.

[17]

Satya Nadella Says These 2 Technologies Are 'Pushing the Frontier.' Investors Have Doubts

Microsoft is a significant investor in OpenAI and has business relationships with all of the major players in the artificial intelligence space. So it may not be a surprise that Satya Nadella is betting heavily on two technologies: cloud computing and AI. What is surprising is that investors' faith in Nadella's bet may be starting to wane. As part of Microsoft's fiscal Q2 earnings Wednesday, Nadella doubled down on his enthusiasm for the technology, saying "We are only at the beginning phases of AI diffusion and already Microsoft has built an AI business that is larger than some of our biggest franchises. We are pushing the frontier across our entire AI stack to drive new value for our customers and partners." On paper, that evangelism seems to be justified. Microsoft's earnings beat analyst expectations, coming in at $4.14 (compared to an expected $2.97), while quarterly revenue hit $81.27 billion (above estimates of $80.27 billion), growing 17 percent year over year. Despite the solid beat, however, Microsoft shares quickly tumbled more than 6 percent in after hours trading as investor worries grew. Part of the concern is the company's cloud growth, which is expanding, but not at the same rate it has in recent quarters. Revenue from Azure and other cloud services grew 39 percent, compared with 40 percent growth in the fiscal first quarter. The bigger worry, however, appears to be Microsoft's commercial remaining performance obligation (RPO), which are expected revenues based on customer commitments. That skyrocketed 110 percent this quarter to $625 billion. Last September, a similar spike in RPO sent Oracle shares soaring by more than 40 percent, briefly making founder Larry Ellison the world's richest man. Oracle shares have since fallen well below where they stood before that spike -- for the same reasons that Microsoft shares seemingly moved lower. It comes down, mostly, to OpenAI. Some 45 percent of Microsoft's RPO number is a commitment from OpenAI. That gives Microsoft significant exposure to the AI giant's ability to meet its promises. While OpenAI has been successful in its ongoing fundraising efforts, it has made $1.4 trillion in total commitments over the next eight years. Since the company is still not profitable, that means OpenAI must continue to hunt for investors. (Bloomberg reported last week that OpenAI CEO Sam Altman reportedly recently visited the United Arab Emirates to speak with sovereign wealth funds in the area, hoping to close a new multibillion dollar funding round which is expected to total $50 billion or more.) Beyond concerns that OpenAI might have overpromised future spending, investors took note of Microsoft's 66 percent increase in capital expenditures in the earnings. Investors are starting to wonder when they'll see meaningful returns from that spending and, so far, there aren't any clear answers. Nadella, last October, signaled that spending wasn't likely to slow anytime soon, saying. "Our planet-scale cloud and AI factory, together with Copilots across high value domains, is driving broad diffusion and real-world impact. It's why we continue to increase our investments in AI across both capital and talent to meet the massive opportunity ahead." Investors have largely been with him for that ride. Over the past five days alone, Microsoft's stock gained 7.5 percent (before the earnings were unveiled). A lot of the issue comes down to something Nadella said in his annual LinkedIn letter in late 2024: "trust is earned, not given." Investors have had a lot of trust in Nadella and Microsoft's instincts on the promise of AI and the cloud, but with so much riding on a promise from Altman and heavy expenditures that don't look to be ending anytime soon, they're looking for signs that the trust is still warranted to. The preferred-rate deadline for the 2026 Inc. Best Workplaces awards is this Friday, January 30, at 11:59 p.m. PT. Apply today.

[18]

Microsoft Q2 Earnings: CEO Nadella Defends AI Investments