Mistral AI acquires Koyeb in first deal to accelerate its cloud infrastructure push

5 Sources

5 Sources

[1]

Mistral AI buys Koyeb in first acquisition to back its cloud ambitions | TechCrunch

Mistral AI, the French company last valued at $13.8 billion, has made its first acquisition. The OpenAI competitor has agreed to buy Koyeb, a Paris-based startup that simplifies AI app deployment at scale and manages the infrastructure behind it. Mistral has been primarily known for developing large language models (LLMs), but this deal confirms its ambitions to position itself as a full-stack player. In June 2025, it had announced Mistral Compute, an AI cloud infrastructure offering which it now hopes Koyeb will accelerate. Founded in 2020 by three former employees of French cloud provider Scaleway, Koyeb aimed to help developers process data without worrying about server infrastructure -- a concept known as serverless. This approach gained relevance as AI grew more demanding, also inspiring the recent launch of Koyeb Sandboxes, which provide isolated environments to deploy AI agents. Before the acquisition, Koyeb's platform already helped users deploy models from Mistral and others. In a blog post, Koyeb said its platform will continue operating. But its team and technology will now also help Mistral deploy models directly on clients' own hardware (on premises), optimize its use of GPUs, and help scale AI inference -- the process of running a trained AI model to generate responses -- according to a press release from Mistral. As part of the deal, Koyeb's 13 employees and its three co-founders, Yann Léger, Edouard Bonlieu, and Bastien Chatelard (pictured in 2020), are set to join the engineering team of Mistral, overseen by CTO and co-founder Timothée Lacroix. Under his leadership, Koyeb expects its platform to transition into a "core component" of Mistral Compute over the coming months. "Koyeb's product and expertise will accelerate our development on the Compute front, and contribute to building a true AI cloud," Lacroix wrote in a statement. Mistral has been ramping up its cloud ambitions. Just a few days ago, the company announced a $1.4 billion investment in data centers in Sweden amid growing demand for alternatives to U.S. infrastructure. Koyeb had raised $8.6 million to date, including a $1.6 million pre-seed round in 2020, followed in 2023 by a $7 million seed round led by Paris-based VC firm Serena, whose principal Floriane de Maupeou celebrated the acquisition. For the firm, this combination will play a key role "in building the foundations of sovereign AI infrastructure in Europe," she told TechCrunch. In part thanks to these geopolitical tailwinds, but also due to its focus on helping enterprises unlock value from AI, Mistral recently passed the milestone of $400 million in annual recurring revenue. Koyeb, too, will be focused on enterprise clients going forward, and new users will no longer be able to sign up for its Starter tier. Mistral didn't disclose financial terms of the deal, and it is unknown whether other acquisitions are in the works. But speaking at Stockholm's Techarena conference last week, CEO Arthur Mensch said Mistral is hiring for infrastructure and other roles, pitching the company to prospective employees as an organization that is "headquartered in Europe, that is doing frontier research in Europe."

[2]

France's AI company Mistral buys cloud service startup Koyeb

PARIS, Feb 17 (Reuters) - French artificial intelligence company Mistral AI said on Tuesday it had agreed to buy cloud computing service startup Koyeb based near Paris for an undisclosed amount. "With this first acquisition, Mistral AI takes a significant step forward in its mission to build a full-stack AI champion and advance cutting-edge AI infrastructure," Mistral said in a statement. Koyeb, which is registered in Paris commune Boulogne-Billancourt, provides cloud services without servers. Its 13 employees and three co-founders will join Mistral's team. Mistral, which was valued at $11.7 billion in September after chipmaking equipment supplier ASML (ASML.AS), opens new tab became a shareholder, is considered Europe's largest AI company. Last week, the company announced a 1.2 billion euro ($1.42 billion) investment in new data centres in Sweden as part of an effort to keep its technology and cloud servers in Europe, unlike its main competitors such as U.S.-based Open AI. ($1 = 0.8455 euros) Reporting by Inti Landauro, Editing by Charlotte Van Campenhout Our Standards: The Thomson Reuters Trust Principles., opens new tab

[3]

Mistral AI buys cloud startup Koyeb

When European tech observers talk about AI ambition, the narrative often splits neatly in two: models and infrastructure. On one side are the clever bits of code that can write, reason, and generate text or images. On the other is the gritty reality of making those bits run reliably, at scale, and in production. Today, Mistral AI made a move that bridges that divide. The Paris-based AI upstart confirmed its first acquisition by agreeing to buy Koyeb, another French venture focused on serverless cloud infrastructure for AI workloads. The deal, terms were not disclosed, marks a clear signal: Mistral wants to own not just cutting-edge AI models, but also the infrastructure that delivers them to developers and enterprises. Mistral has built momentum over the past two years with large language models that have put it in close competition with U.S. players. But for all the excitement around models, real-world adoption hinges on how those models are deployed and scaled. Koyeb's technology is built for exactly that: a serverless platform that lets developers run AI apps without managing the underlying infrastructure. Think of it as giving Mistral not only the engine but also the transmission, the parts that take raw computational power and make it usable on demand. That's a critical piece when companies want to ship AI solutions without hiring a team of DevOps experts. This acquisition dovetails with a wider strategy playing out in Europe: build an AI stack that doesn't depend on U.S. hyperscalers. Mistral recently announced a €1.2 billion investment in data centers in Sweden and has been vocal about offering a homegrown alternative to cloud services from AWS, Microsoft, and Google. By folding Koyeb's team and platform into what they call Mistral Compute, the company is laying claim to a more complex AI offering - from model training to deployment and inference. In other words, it's less about selling APIs and more about owning the full AI experience. Koyeb's roots are in serverless computing, scalable, managed infrastructure that lets developers forget about servers and focus on code. Its platform supports AI tasks across CPUs, GPUs, and specialized accelerators, with features like autoscaling and isolated environments for complex applications. The founders and all 13 team members are joining Mistral's engineering ranks, where they'll shift focus toward embedding their technology into the Mistral Compute platform. For existing users of Koyeb's services, the transition is designed to be smooth, with the platform continuing to operate as usual while integrating deeper over time. In a market still heavily dominated by U.S. cloud providers, owning more of the AI value chain is both a business move and a geopolitical statement. This deal isn't just about snapping up a smaller startup; it's about signalling a shift in how European AI companies conceive of competition and capability. One of the early questions about the future of AI wasn't whether Europe could produce models that compete with those from Silicon Valley, it was whether it could build the platforms and systems those models truly depend on. With the Koyeb acquisition, Mistral is making a direct answer to that question.

[4]

Mistral AI acquires AI infrastructure startup Koyeb - SiliconANGLE

Mistral AI SAS today announced that it has acquired Koyeb SAS, a startup with a cloud platform built to run artificial intelligence workloads. The deal's financial terms were not disclosed. Paris-based Mistral develops an eponymous series of open-source large language models. It also has several paid offerings, including a cloud platform called Mistral Compute. The company received a 11.7 billion-euro valuation last September after raising a 1.7 billion-euro round led by ASML Holding NV. Koyeb, for its part, raised $7 million in 2023 from a consortium that included Samsung Next and other prominent backers. Its namesake cloud platform enables developers to run AI workloads without having to maintain the underlying hardware. The company says that deploying an application on its infrastructure takes a few minutes. From there, an autoscaling feature automatically adjusts the amount of hardware allocated to the application as demand changes. If traffic goes down to zero, Koyeb deactivates the workload until it's needed again. Completely shutting down idle applications is often technically challenging for developers. One of the main reasons is that restarting an inactive workload can be fairly time-consuming, which creates delays for users. According to Koyeb, its platform addresses the challenge with mechanisms that enable it to relaunch workloads in under 200 milliseconds. The company runs customer workloads in instances that each feature up to eight graphics processing units. Those instances are spread across 10 data centers located in different parts of the world. If one of the facilities goes offline, Koyeb can reroute traffic to another site. One of the latest additions to the platform's feature set is a capability called Koyeb Sandboxes. It creates isolated environments in which AI agents can run without creating cybersecurity risks. According to Koyeb, the capability enables applications to launch up to thousands of agents per day for tasks such as generating code. Mistral will use the company's technology to enhance a similar sandboxing feature it provides to users of its code generation models. Koyeb will also help improve Mistral Compute, a cloud platform designed to run AI models. The platform is powered by water-cooled servers equipped with Nvidia Corp. graphics cards. Alongside infrastructure, it provides access to software tools that ease tasks such as managing AI workloads' encryption keys.

[5]

Mistral AI Acquires Platform Tech to Expand and Speed up its AI Offerings Across Europe

French AI startup Mistral, which was recently valued at $13.8 billion and could be seen as a laggard in the frenetic race amongst its peers, made its first acquisition in the form of Koyeb, a startup that simplifies app deployment at scale while also managing the infrastructure. In a blog post, Koyeb says it will bring its platform, technology, and team to accelerate Mistral Compute offering. Compute is designed to provide leading teams across the globe the same state-of-the-art infrastructure Mistral AI uses to build, run, and scale frontier models and AI software. Looks like this is another warning shot from Europe across American Big Tech's bows. It is interesting that just recently Mistral AI CEO Arthur Mensch told CNBC that so long as enterprises have the "right infrastructure in place" they're able to connect their data to AI systems to create applications to run certain parts of work. This is the first acquisition made by Mistral, which has till date made the headlines as developers of large language models (LLMs). Does it mean that the company is joining the big league of players that position themselves as full-stack players? Of course, getting Koyeb on board does make sense as the French AI startup can use it to speed-up Mistral Compute adoption. Launched last June, Mistral Compute is described by the company as a "European-hosted AI cloud that unites high-performance GPU capacity, turnkey orchestration, and advanced model-building tools in one fully integrated platform for developing and running cutting-edge AI." With Koyeb in its fold, Mistral AI can now hope to scale up fast and in the process take on American AI power. It is quite obvious that Mistral does not want external factors such as the mad rush playing out in the AI circular deals playing out in the United States. Slow-and-steady seems to be their motto, a very French thing to do, given how Airbus industrie has done in the past to beat American Boeing at its own game. Mistral AI, which was founded in 2023 and can be termed as the last-off-the blocks among the AI startups that kicked off post the ChatGPT preview in November 2022, has toed the Anthropic line by focusing on helping enterprises gain value from AI. The company recently achieved the crucial milestone of $400 million in annual recurring revenues. As for Koyeb, the company was founded in 2020 by three former employees of French cloud provider Scaleway in 2020. Their aim was to help developers process data without bothering too much about server infrastructure, an idea that gained value as AI demand for processing power increased exponentially. The company came out with Koyeb Sandboxes that provide isolated environments to deploy AI agents. The company helped enterprises deploy models from Mistral and other AI providers. Per the acquisition deal, while Koyeb's platform would remain operational, its team and technology will be used to support Mistral deploy its models directly on client premises, optimise the GPUs and help scale AI inference. What exactly does the deal bring forth? In a blog post, Koyeb says the rise of Gen AI and agentic workloads redefined cloud infrastructure as it increased scale and bought new requirements. Koyeb provides serverless GPUs, specialised accelerators and CPU workloads with capabilities to increase efficiency, enable new use-cases and control costs from sub-second scale-to-zero and autoscaling to sandboxes for agents. Today, Koyeb operates a purpose-built serverless platform for teams to run AI applications, from APIs and agents on CPU to high-performance inference on GPUs, with no ops, servers, or infrastructure management, the blog said. As part of the deal, Koyeb's 13-member team and its three co-founders Yann Leger, Edouard Bonlieu and Bastien Chatelard would join Mistral. Mistral CTO and co-founder Timothée Lacroix noted in a statement that "Koyeb's product and expertise will accelerate our development on the Compute front, and contribute to building a true AI cloud." Koyeb had raised $8.6 million till date and this acquisition is likely to play a major role in building the foundations of sovereign AI infrastructure in Europe. On its part, Mistral AI too has ramped up its cloud plans in recent times with the company recently announcing a $1.4 billion investment across datacentres in Sweden. With growing demand from across Europe for alternatives to the US infrastructure suppliers, this could just be the deal that the company required to shift gears and hit the expressway to expansion. Looks like Mistral and Arthur Mensch do mean business. In the same chat with CNBC, he said his company works closely with customers to ensure that they have a fully custom applications to run a workflow, to run a procurement workflow, or to run supply chain workflows, for instance, in a way where I would say five years ago, you would actually need a vertical SaaS."

Share

Share

Copy Link

Mistral AI, valued at $13.8 billion, has acquired Paris-based Koyeb to strengthen its position as a full-stack AI provider. The deal brings serverless deployment technology and 13 engineers to accelerate Mistral Compute, the company's AI cloud infrastructure platform launched in June 2025. This marks Europe's push to build sovereign AI infrastructure independent of U.S. hyperscalers.

Mistral AI Makes Strategic Move Into Full-Stack Territory

Mistral AI has completed its first acquisition, agreeing to buy Koyeb, a Paris-based startup specializing in app deployment and infrastructure management for AI workloads

1

2

. The deal, with undisclosed financial terms, signals a decisive shift for the French company valued at $13.8 billion1

. While Mistral AI has built its reputation developing large language models that compete with OpenAI, this acquisition confirms its ambition to position itself as a full-stack AI provider capable of owning the entire AI experience from model development to deployment3

.

Source: The Next Web

Koyeb's platform addresses a critical gap in the AI infrastructure landscape. Founded in 2020 by three former Scaleway employees—Yann Léger, Edouard Bonlieu, and Bastien Chatelard—the startup built a serverless platform that lets developers run AI workloads without managing underlying hardware

1

. The company raised $8.6 million to date, including a $7 million seed round in 2023 led by Paris-based VC firm Serena1

4

.

Source: TechCrunch

Accelerating Mistral Compute With Proven Technology

The acquisition directly supports Mistral Compute, the AI cloud infrastructure offering launched in June 2025

1

. Koyeb's technology will help Mistral AI deploy models directly on clients' own hardware through on-premises deployment, optimize GPUs usage, and improve scaling AI inference—the process of running trained AI models to generate responses1

. All 13 employees and three co-founders will join Mistral's engineering team under CTO and co-founder Timothée Lacroix, who stated that "Koyeb's product and expertise will accelerate our development on the Compute front, and contribute to building a true AI cloud"1

5

.Koyeb brings battle-tested capabilities to the table. The platform enables application deployment in minutes with autoscaling features that automatically adjust hardware allocation as demand changes

4

. When traffic drops to zero, the system deactivates workloads until needed, then relaunch them in under 200 milliseconds4

. The company operates across 10 data centers globally, running customer AI workloads in instances featuring up to eight GPUs each4

.Building Sovereign AI Infrastructure in Europe

This move fits within a broader European strategy to establish sovereign AI infrastructure independent of U.S. hyperscalers like AWS, Microsoft, and Google

3

. Just days before announcing the Koyeb acquisition, Mistral AI revealed a $1.4 billion investment in data centers in Sweden, responding to growing demand for alternatives to U.S. infrastructure1

5

. Floriane de Maupeou, principal at Serena, told TechCrunch this combination will play a key role "in building the foundations of sovereign AI infrastructure in Europe".The geopolitical implications extend beyond simple market competition. CEO Arthur Mensch, speaking at Stockholm's Techarena conference, positioned Mistral AI as an organization "headquartered in Europe, that is doing frontier research in Europe" while actively hiring for infrastructure roles

1

. The company recently passed $400 million in annual recurring revenue, driven partly by these geopolitical tailwinds and its focus on helping enterprises unlock value from AI1

5

.Related Stories

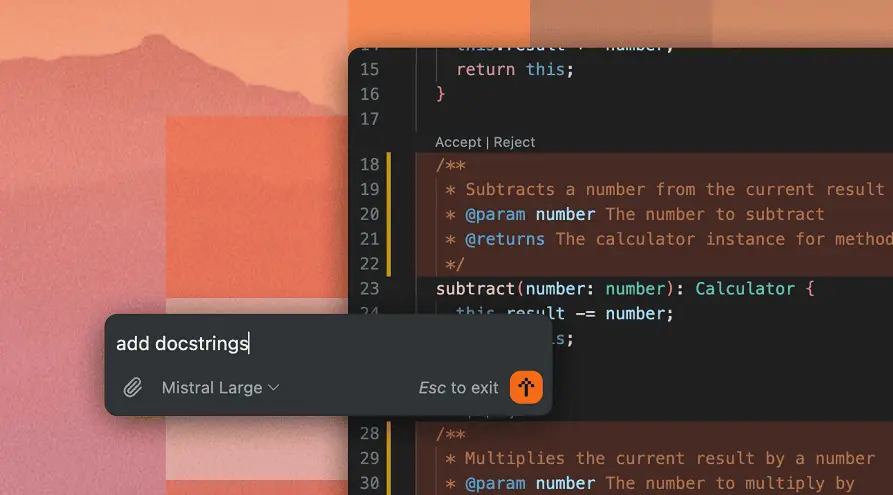

Advanced Capabilities for AI Agents and Code Generation

Koyeb recently launched Koyeb Sandboxes, which provide isolated environments where AI agents can operate without creating cybersecurity risks

4

. This sandboxing capability enables applications to launch up to thousands of agents per day for tasks including code generation4

. Mistral AI will integrate this technology to enhance similar features it provides to users of its code generation models4

.

Source: SiliconANGLE

The platform's existing user base already deployed models from Mistral AI and other providers

1

. While Koyeb's cloud platform will continue operating, the company is shifting focus toward enterprise clients and has closed new signups for its Starter tier1

. Over the coming months, Koyeb expects its platform to transition into a "core component" of Mistral Compute1

. This integration positions Mistral AI to compete not just on model quality but on the complete infrastructure stack that enterprises need to deploy AI at scale, marking a strategic evolution from pure model development to comprehensive cloud services.References

Summarized by

Navi

[3]

Related Stories

Mistral AI Launches European AI Cloud and Advanced Reasoning Models to Challenge US Tech Giants

12 Jun 2025•Technology

Mistral AI commits $1.4 billion to build data centers in Sweden, marking Europe's AI autonomy push

11 Feb 2026•Business and Economy

Mistral AI: Europe's AI Powerhouse Nears $14 Billion Valuation in Latest Funding Round

04 Sept 2025•Startups

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Microsoft AI chief predicts artificial intelligence will automate most white-collar jobs in 18 months

Business and Economy

3

Anthropic and Pentagon clash over AI safeguards as $200 million contract hangs in balance

Policy and Regulation