Model ML Secures $75 Million Series A to Automate Investment Banking Workflows

4 Sources

4 Sources

[1]

AI Startup Raises $75 Million to Take Junior Bankers' Grunt Work

The artificial intelligence startup Model ML raised $75 million as it looks to develop technology to replace much of the grunt work done by investment bankers -- from creating pitch decks to working up due-diligence reports. The early stage capital raising was led by investors FT Partners, and included Y Combinator Inc., QED Investors, 13Books Capital and LocalGlobe, according to a statement on Monday. The company, which was started about a year ago and is based in London and New York, raised $12 million earlier this year. It declined to provide a valuation in either round.

[2]

Financial AI startup Model ML nabs $75M investment - SiliconANGLE

Model ML Inc., a provider of artificial intelligence software for investment professionals, has raised $75 million in funding to support its growth efforts. The startup disclosed today that investment bank FT Partners led the Series A raise. It was joined by QED, 13Books, Latitude, Y Combinator and LocalGlobe. The latter two firms previously led a $12 million seed round for Model ML in February. Investment professionals spend a significant percentage of their time creating documents such as due diligence reports. New York-based Model ML has developed a platform that promises to speed up the documentation creation workflow. According to the company, its software can complete tasks that usually take days in a few hours. Model ML generates documents and spreadsheets using a financial services firm's internal data. It can retrieve that data from Salesforce, Google Workspace and other software-as-a-service applications. When needed, the platform is capable of combining internal records with external information such as third-party market intelligence. Users can query the data that Model ML retrieves with natural language prompts. If a financial dataset isn't easily usable in its original form, the platform generates the scripts necessary to simplify the information. Those scripts automate tasks such as changing file formats and extracting key details from a lengthy spreadsheet. According to Model ML, its platform can not only generate document drafts but also scan existing files for errors. A tool called AutoCheck can detect paragraphs and charts that contain inconsistent financial information. It also spots other issues such as formatting errors that may reduce a PowerPoint presentation's visual fidelity. In an internal test, Model ML had AutoCheck and two of its employees check the accuracy of a financial presentation. The tool completed the task in under three minutes while the two staffers took over an one hour. Model ML says that AutoCheck also caught more errors. In June, the company disclosed that its platform is powered by AI agents based on OpenAI Group PBC's reasoning models. Model ML's platform also uses Agents SDK, an open-source tool that the ChatGPT developer released in March to ease tasks such as coordinating the work of AI agents. "This financing enables us to accelerate global expansion and advance our AI capabilities across key financial hubs as we scale to meet rapidly growing enterprise demand," said Model ML Chief Executive Officer Chaz Englander. The growth initiative will see the company expand its go-to-market, AI engineering and infrastructure teams. The new hires will help Model ML build new workflow automation features for finance professionals.

[3]

AI workflow startup Model ML raises $75 million

This content has been selected, created and edited by the Finextra editorial team based upon its relevance and interest to our community. Led by FT Partners, the round also includes participation from Y Combinator, QED, 13Books, Latitude and LocalGlobe, and comes just six months after the company's seed raise. Headquartered in San Francisco with offices in New York and London, Model ML enables deal teams to quickly prepare pitch decks, investment memos, and diligence reports by providing AI Modules that automate client-ready Word, PowerPoint, and Excel outputs directly from trusted data, in exact prior formats. CEO Chaz Englander says: "High-stakes business runs on documents: pitch decks, diligence summaries, investment memos. But most firms still build them the hard way. Analysts spend entire weekends cross-checking numbers and formatting slides. Despite all that effort, mistakes still slip through because no one can realistically verify every data point in a 100-page deliverable. Our agents reason across data sources, write the code to extract and transform what's needed, and generate finished, branded outputs with verification built in. He says the company recently ran a verification workflow, testing the AI against consultants from McKinsey and Bain on real Word and PowerPoint outputs. The consultants took over an hour to complete the task. Model ML did it in under three minutes and still caught more errors. Model ML is guided by a world-class advisory board, including former HSBC CEO Noel Quinn and UBS chair Axel Weber, among others. Clients include several of the largest investment banks, asset managers, and consultants in the world. "Model ML is creating the blueprint for how modern financial services firms will operate," says Weber. "In today's world, precision and speed are essential, reputation and innovation are a must. Model ML delivers this at scale."

[4]

Model ML Raises $75 Million for Workflow Automation Platform | PYMNTS.com

The company says this new funding, announced in a Monday (Nov. 24) news release, is among the largest FinTech Series A rounds on record. "Model ML is setting a new standard for how financial institutions leverage AI to achieve superior client results," said Steve McLaughlin, founder and CEO of FT Partners, which led the funding round. "While we expect significant efficiency gains, the true power of Model ML lies in the insights it will unlock for our clients, investors, and the broader FinTech ecosystem. We believe Model ML will fuel the next evolution of world-class service for our clients and transparency across all stakeholders in transactions." Company CEO Chaz Englander says the financing will help it accelerate its global expansion and advance its AI capabilities "across key financial hubs" to meet growing enterprise demand. Founded by Englander and his brother Arnie, Model ML is designed to help financial teams build AI workflows that "automate client-ready Word, PowerPoint, and Excel outputs directly from trusted data, in exact prior formats," the release said. This capability can be applied across entire organizations, and is being used by some of the world's biggest banks, asset managers and consultancies, including two of the Big Four accounting firms, according to the release. The company says it helps these businesses avoid slow, manual processes. "Entire deal teams across all levels of seniority lose time formatting outputs and chasing down inconsistencies across Word, Excel, and PowerPoint," the release said. "These inefficiencies introduce reputational risk and slow decisions." Model ML says it tries to close that gap with agent workflows that interpret schemas, reason across multiple sources, write the code necessary for extracting or transforming data and generate "finished, branded outputs" such as long PowerPoint decks, research reports or investment memos, with built-in verification. Research by PYMNTS Intelligence has shown the headaches businesses encounter by remaining too invested in manual back-office processes. For example, the PYMNTS report "From Friction to Flow: AR Automation in 2025" found that 35% of mid-sized companies rely entirely on manual accounts receivable (AR) processes, and this dependence leads to operational challenges. These obstacles include cash flow and revenue forecasting issues, greater risk of bad debt and strained relationships with B2B partners, the report found. "Small to mid-sized businesses (SMBs) are especially affected by a reliance on manual procedures, with more than 75% of SMBs still manually chasing collections or handling disputes via email," the report added.

Share

Share

Copy Link

London and New York-based AI startup Model ML raised $75 million in Series A funding to develop technology that automates grunt work for investment bankers, including creating pitch decks and due diligence reports.

Funding Round Details

Model ML, an artificial intelligence startup focused on automating investment banking workflows, has successfully raised $75 million in Series A funding

1

. The round was led by investment bank FT Partners, with participation from Y Combinator Inc., QED Investors, 13Books Capital, Latitude, and LocalGlobe2

. This funding comes just six months after the company's $12 million seed round in February, which was led by Y Combinator and LocalGlobe3

.Company Background and Technology

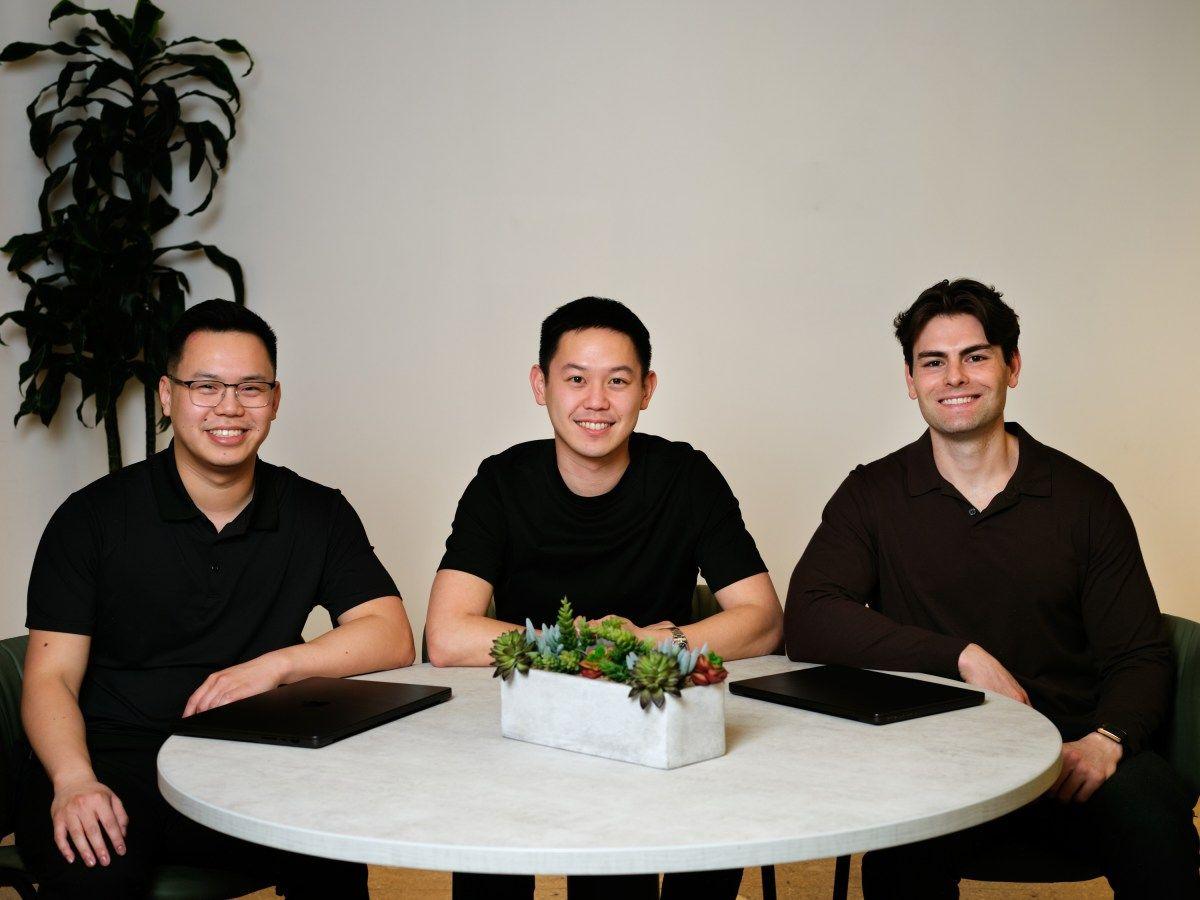

Founded approximately one year ago by CEO Chaz Englander and his brother Arnie, Model ML operates from offices in London, New York, and San Francisco

4

. The startup has developed a platform designed to replace much of the grunt work traditionally performed by investment bankers, including creating pitch decks, investment memos, and due diligence reports1

.The platform leverages AI agents based on OpenAI's reasoning models and utilizes the Agents SDK, an open-source tool released by OpenAI in March to coordinate AI agent workflows

2

. Model ML's technology can retrieve data from various software-as-a-service applications including Salesforce and Google Workspace, combining internal records with external market intelligence when necessary.Performance and Capabilities

According to the company, its software can complete tasks that typically take days in just a few hours

2

. The platform generates client-ready Word, PowerPoint, and Excel outputs directly from trusted data sources, maintaining exact prior formats used by financial institutions3

.A key feature of the platform is AutoCheck, a verification tool that can detect inconsistencies in financial information, formatting errors, and other issues that may compromise document quality. In an internal test comparing AutoCheck against two employees, the AI tool completed accuracy verification of a financial presentation in under three minutes, while the human staffers required over an hour. Additionally, AutoCheck identified more errors than the human reviewers

2

.Related Stories

Market Position and Client Base

Model ML serves some of the world's largest investment banks, asset managers, and consultancies, including two of the Big Four accounting firms

4

. The company is guided by a world-class advisory board that includes former HSBC CEO Noel Quinn and UBS chair Axel Weber3

.Steve McLaughlin, founder and CEO of FT Partners, emphasized that Model ML is "setting a new standard for how financial institutions leverage AI to achieve superior client results"

4

. The funding round is reportedly among the largest FinTech Series A rounds on record.Future Plans and Expansion

CEO Chaz Englander stated that the financing will enable the company to "accelerate global expansion and advance our AI capabilities across key financial hubs as we scale to meet rapidly growing enterprise demand"

2

. The growth initiative will focus on expanding the company's go-to-market, AI engineering, and infrastructure teams to develop new workflow automation features for finance professionals.References

Summarized by

Navi

[3]

Related Stories

Rogo Secures $50 Million in Funding to Develop AI-Powered Investment Banking Tools

30 Apr 2025•Business and Economy

Meridian raises $17 million to build auditable AI agents for financial modeling

12 Feb 2026•Startups

Brightwave Secures $15M Series A for AI-Powered Financial Research Platform

29 Oct 2024•Business and Economy

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

Meta strikes up to $100 billion AI chips deal with AMD, could acquire 10% stake in chipmaker

Technology

3

Pentagon threatens Anthropic with supply chain risk label over AI safeguards for military use

Policy and Regulation