Nvidia Briefly Overtakes Apple as World's Most Valuable Company Amid AI Boom

11 Sources

11 Sources

[1]

Nvidia briefly overtakes Apple as world's most valuable company amid soaring AI demand

In a nutshell: Nvidia briefly managed to dethrone Apple as the world's most valuable company. With demand for the chipmaker's AI silicon showing no signs of letting up anytime soon, Team Green is poised to cement itself as the new king of the market cap before long. On Friday, Nvidia's market cap soared to $3.53 trillion during trading, nudging just past Apple's $3.52 trillion valuation. While Apple's shares ended the day up a modest 0.4 percent, Nvidia closed 0.8 percent higher with a $3.47 trillion market cap - just slightly lower than the Cupertino powerhouse. The movement displaced Microsoft from its second-place seat, which it has held since it accomplished a similar feat in January. The Redmond titan finished Friday's trading at a $3.18 trillion valuation, up 0.8 percent. Its quick trip to the top marks the second time Nvidia has sat above its rivals. In June, the chipmaker briefly claimed the crown before being overtaken again by the tech titans Microsoft and Apple. The three companies have been running neck-and-neck all year, with AI becoming increasingly crucial in each firm's portfolio. Once known primarily as a supplier of graphics processors for gaming rigs, Nvidia has transformed into the heavyweight champion of AI chipmaking. Its processors power data-hungry AI models from Microsoft, Google, Meta, and others and have little competition. Overall, Nvidia's stock has surged a whopping 190 percent this year, propelling CEO Jensen Huang into the ranks of the world's wealthiest individuals. One of the most recent spikes was driven by blowout earnings - up 36 percent year over year - reported by TSMC, the world's top contract chipmaker, fueled by an appetite for its AI chips. Another boost came from a $6.6 billion funding round for OpenAI earlier this month, which buoyed optimism about data center demand. In contrast, Apple has faced dull demand for its smartphone lineup. Flagship iPhone sales dipped 0.3 percent in China last quarter, while rival Huawei's phone sales surged by 42 percent. The diverging fortunes highlight how AI has reshuffled the deck. Investors continue to rally around companies facilitating the AI revolution while being skeptical about the long-term growth of more mature consumer hardware businesses. Thanks to tech stocks in general, the overall stock market has seen a banner year, as optimism around AI, expectations of considerably lower US interest rates, and a solid start to the earnings season have propelled the S&P 500 to new highs.

[2]

Nvidia overtakes Apple as world's most valuable company

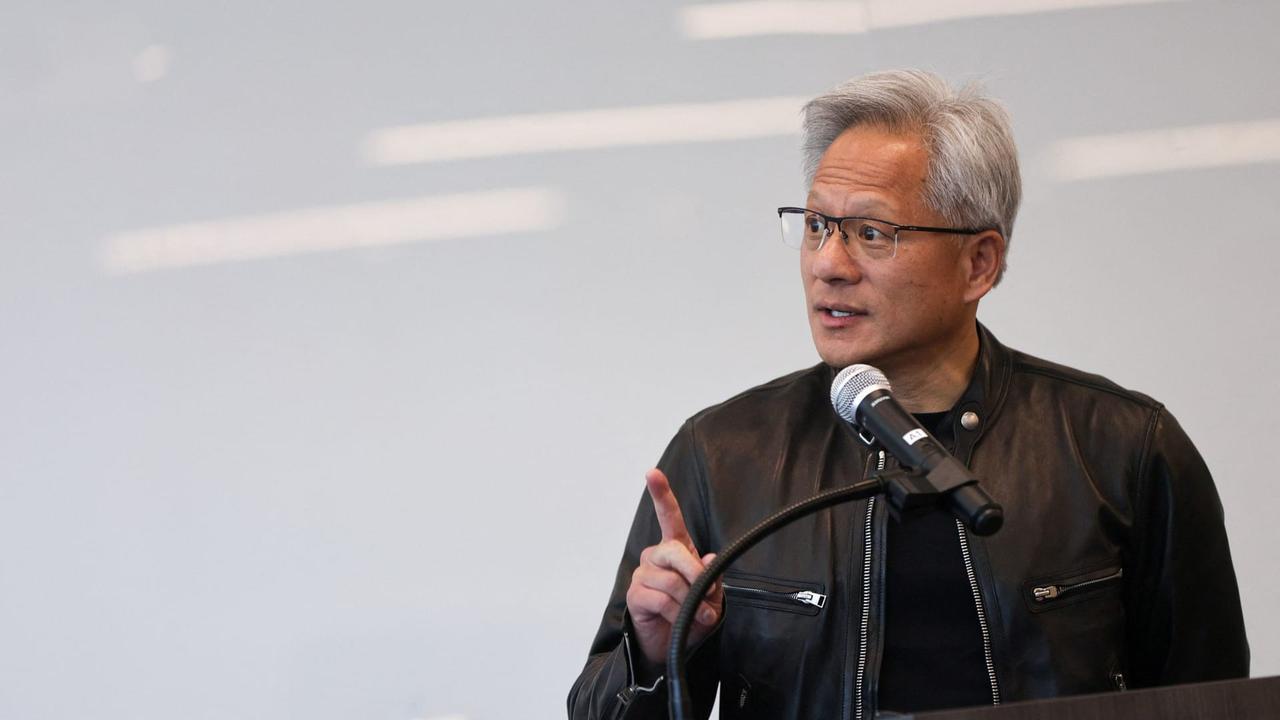

NVIDIA founder, president and CEO Jensen Huang on Sept. 27 in Washington, D.C.Chip Somodevilla / Getty Images file Nvidia dethroned Apple as the world's most valuable company on Friday following a record-setting rally in the stock, powered by insatiable demand for its specialized artificial intelligence chips. Nvidia's stock market value briefly touched $3.53 trillion, slightly above Apple's $3.52 trillion, LSEG data showed. Nvidia ended the day up 0.8%, with a market value of $3.47 trillion, while Apple's shares rose 0.4%, valuing the iPhone maker at $3.52 trillion. In June, Nvidia briefly became the world's most valuable company before it was overtaken by Microsoft and Apple. The tech trio's market capitalizations have been neck-and-neck for several months. Microsoft's market value stood at $3.18 trillion, with its stock up 0.8%. The Silicon Valley chipmaker is the dominant supplier of processors used in AI computing, and the company has become the biggest winner in a race between Microsoft, Alphabet, Meta Platforms and other heavyweights to dominate the emerging technology. Known since the 1990s as a designer of processors for videogames, Nvidia's stock has risen about 18% so far in October, with a string of gains coming after OpenAI, the company behind ChatGPT, announced a funding round of $6.6 billion. Nvidia and other semiconductor stocks got a lift on Friday after data storage maker Western Digital reported quarterly profit that beat analysts' estimates, buoying optimism about data center demand. "More companies are now embracing artificial intelligence in their everyday tasks and demand remains strong for Nvidia chips," said Russ Mould, investment director at AJ Bell. "It is certainly in a sweet spot and so long as we avoid a big economic downturn in the United States, there is a feeling that companies will continue to invest heavily in AI capabilities, creating a healthy tailwind for Nvidia." Nvidia's shares hit a record high on Tuesday, building on a rally from last week when TSMC, the world's largest contract chipmaker, posted a forecast-beating 54% jump in quarterly profit driven by soaring demand for chips used in AI. Meanwhile, Apple is struggling with tepid demand for its smartphones. iPhone sales in China slipped 0.3% in the third quarter, while sales of phones made by rival Huawei surged 42%. With Apple set to report its quarterly results on Thursday, analysts on average see its revenue climbing 5.55% year over year to $94.5 billion, LSEG data showed. That compares with analysts' projections for Nvidia of nearly 82% revenue growth to $32.9 billion. Shares of Nvidia, Apple and Microsoft have an outsized influence on the richly valued technology sector as well as the broader U.S. stock market, with the trio accounting for about a fifth of the S&P 500 index's weight. Optimism about the prospects for AI, expectations that the Federal Reserve will considerably bring down U.S. interest rates, and most recently, an upbeat start to the earnings season, helped lift the benchmark S&P 500 to an all-time high last week. Nvidia's massive gains have helped boost the stock's appeal for option traders and the company's options are among the most traded on any given day in recent months, according to data from options analytics provider Trade Alert. The stock has surged nearly 190% so far this year as the boom in generative AI led to a series of blowout forecasts from Nvidia. "The question is whether the revenue stream will last for a long time and will be driven by the emotion of investors rather than by any ability to prove or disprove the thesis that AI is overdone," said Rick Meckler, partner at Cherry Lane Investments, a family investment office in New Vernon, New Jersey. "I think Nvidia knows that near term, their numbers are likely to be quite remarkable."

[3]

Nvidia overtakes Apple as world's most valuable company

Nvidia has surpassed Apple to become the world's most valuable company. This shift is due to the high demand for Nvidia's supercomputing AI chips. Nvidia's stock soared and its market capitalization briefly reached $3.53 trillion, compared to Apple's $3.52 trillion. The company's gains are also bolstered by strong demand from AI companies like OpenAI.Nvidia dethroned Apple as the world's most valuable company on Friday, following a record-setting rally in the stock powered by an insatiable demand for its new supercomputing AI chips. Nvidia's stock market value briefly touched $3.53 trillion, while that of Apple was $3.52 trillion, according to data from LSEG. In June, Nvidia briefly became the world's most valuable company, before it was overtaken by Microsoft and Apple. The tech trio's market capitalizations have been neck-and-neck for several months. Microsoft's market value stood at $3.20 trillion. Nvidia's stock has risen about 18% so far in October, with a string of gains coming after OpenAI, the company behind ChatGPT, announced a funding round of $6.6 billion. Nvidia provides chips used to train so-called foundation models such as OpenAI's GPT-4. "More companies are now embracing artificial intelligence in their everyday tasks and demand remains strong for Nvidia chips," said Russ Mould, investment director at AJ Bell. "It is certainly in a sweet spot and so long as we avoid a big economic downturn in the United States, there is a feeling that companies will continue to invest heavily in AI capabilities, creating a healthy tailwind for Nvidia." Nvidia's shares hit a record high on Tuesday, building on a rally from last week when TSMC, the world's largest contract chipmaker, posted a forecast-beating 54% jump in quarterly profit driven by soaring demand for chips used in AI. The next big test will be when Nvidia reports third-quarter results in November. Nvidia in August forecast third-quarter revenue of $32.5 billion, plus or minus 2%, compared with the current average analyst expectation of $32.90 billion, according to data compiled by LSEG. Morgan Stanley analyst Joseph Moore said in a note dated Oct. 10 that he remains "very bullish" about the company longer term, but the recent rally "raises the bar for earnings somewhat". After a meeting with Nvidia's CEO Jensen Huang, Moore noted the ramp up in production of its next-generation Blackwell chips appeared to be "quite strong" and are booked out for 12 months. The stock came under pressure in August after Nvidia confirmed reports that the production of Blackwell chips was delayed until the fourth quarter. Shares of Nvidia, Apple and Microsoft have an outsized influence on the richly valued technology sector as well as the broader U.S. stock market, with the trio accounting for about a fifth of the S&P 500 index's weightage. Frenzy around the prospects of AI, expectations that the U.S. Federal Reserve will considerably bring down interest rates, and most recently, an upbeat start to the earnings season, have pushed the benchmark S&P 500 to an all-time high last week. Nvidia's massive gains have helped boost the stock's appeal for option traders and the company's options are among the most traded on any given day in recent months, according to data from options analytics provider Trade Alert. The stock has surged nearly 190% so far this year as a boom in generative AI prompted the company to issue a series of blowout forecasts. "The question is whether the revenue stream will last for a long time and will be driven by the emotion of investors rather than by any ability to prove or disprove the thesis that AI is overdone," said Rick Meckler, partner at Cherry Lane Investments, a family investment office in New Vernon, New Jersey. "I think Nvidia knows that near term, their numbers are likely to be quite remarkable."

[4]

Nvidia overtakes Apple as world's most valuable company

(Reuters) - Nvidia dethroned Apple as the world's most valuable company on Friday, following a record-setting rally in the stock powered by an insatiable demand for its new supercomputing AI chips. Nvidia's stock market value briefly touched $3.53 trillion, while that of Apple was $3.52 trillion, according to data from LSEG. In June, Nvidia briefly became the world's most valuable company, before it was overtaken by Microsoft and Apple. The tech trio's market capitalizations have been neck-and-neck for several months. Microsoft's market value stood at $3.20 trillion. Nvidia's stock has risen about 18% so far in October, with a string of gains coming after OpenAI, the company behind ChatGPT, announced a funding round of $6.6 billion. Nvidia provides chips used to train so-called foundation models such as OpenAI's GPT-4. "More companies are now embracing artificial intelligence in their everyday tasks and demand remains strong for Nvidia chips," said Russ Mould, investment director at AJ Bell. "It is certainly in a sweet spot and so long as we avoid a big economic downturn in the United States, there is a feeling that companies will continue to invest heavily in AI capabilities, creating a healthy tailwind for Nvidia." Nvidia's shares hit a record high on Tuesday, building on a rally from last week when TSMC, the world's largest contract chipmaker, posted a forecast-beating 54% jump in quarterly profit driven by soaring demand for chips used in AI. The next big test will be when Nvidia reports third-quarter results in November. Nvidia in August forecast third-quarter revenue of $32.5 billion, plus or minus 2%, compared with the current average analyst expectation of $32.90 billion, according to data compiled by LSEG. Morgan Stanley analyst Joseph Moore said in a note dated Oct. 10 that he remains "very bullish" about the company longer term, but the recent rally "raises the bar for earnings somewhat". After a meeting with Nvidia's CEO Jensen Huang, Moore noted the ramp up in production of its next-generation Blackwell chips appeared to be "quite strong" and are booked out for 12 months. The stock came under pressure in August after Nvidia confirmed reports that the production of Blackwell chips was delayed until the fourth quarter. Shares of Nvidia, Apple and Microsoft have an outsized influence on the richly valued technology sector as well as the broader U.S. stock market, with the trio accounting for about a fifth of the S&P 500 index's weightage. Frenzy around the prospects of AI, expectations that the U.S. Federal Reserve will considerably bring down interest rates, and most recently, an upbeat start to the earnings season, have pushed the benchmark S&P 500 to an all-time high last week. Nvidia's massive gains have helped boost the stock's appeal for option traders and the company's options are among the most traded on any given day in recent months, according to data from options analytics provider Trade Alert. The stock has surged nearly 190% so far this year as a boom in generative AI prompted the company to issue a series of blowout forecasts. "The question is whether the revenue stream will last for a long time and will be driven by the emotion of investors rather than by any ability to prove or disprove the thesis that AI is overdone," said Rick Meckler, partner at Cherry Lane Investments, a family investment office in New Vernon, New Jersey. "I think Nvidia knows that near term, their numbers are likely to be quite remarkable." (Reporting by Noel Randewich in San Francisco, Sruthi Shankar in Bengaluru, Saqib Ahmed in New York and Paolo Laudani in Gdansk; Editing by Shounak Dasgupta)

[5]

Nvidia overtakes Apple as world's most valuable company with $3.5T...

Nvidia dethroned Apple as the world's most valuable company on Friday, following a record-setting rally in the stock powered by an insatiable demand for its new supercomputing AI chips. Nvidia's stock market value briefly touched $3.53 trillion, while that of Apple was $3.52 trillion, according to data from LSEG. In June, Nvidia briefly became the world's most valuable company, before it was overtaken by Microsoft and Apple. The tech trio's market capitalizations have been neck-and-neck for several months. Microsoft's market value stood at $3.20 trillion. Nvidia's stock has risen about 18% so far in October, with a string of gains coming after OpenAI, the company behind ChatGPT, announced a funding round of $6.6 billion. Nvidia provides chips used to train so-called foundation models such as OpenAI's GPT-4. "More companies are now embracing artificial intelligence in their everyday tasks and demand remains strong for Nvidia chips," said Russ Mould, investment director at AJ Bell. "It is certainly in a sweet spot and so long as we avoid a big economic downturn in the United States, there is a feeling that companies will continue to invest heavily in AI capabilities, creating a healthy tailwind for Nvidia." Nvidia's shares hit a record high on Tuesday, building on a rally from last week when TSMC, the world's largest contract chipmaker, posted a forecast-beating 54% jump in quarterly profit driven by soaring demand for chips used in AI. The next big test will be when Nvidia reports third-quarter results in November. Nvidia in August forecast third-quarter revenue of $32.5 billion, plus or minus 2%, compared with the current average analyst expectation of $32.90 billion, according to data compiled by LSEG. Morgan Stanley analyst Joseph Moore said in a note dated Oct. 10 that he remains "very bullish" about the company longer term, but the recent rally "raises the bar for earnings somewhat." After a meeting with Nvidia's CEO Jensen Huang, Moore noted the ramp up in production of its next-generation Blackwell chips appeared to be "quite strong" and are booked out for 12 months. The stock came under pressure in August after Nvidia confirmed reports that the production of Blackwell chips was delayed until the fourth quarter. Shares of Nvidia, Apple and Microsoft have an outsized influence on the richly valued technology sector as well as the broader US stock market, with the trio accounting for about a fifth of the S&P 500 index's weightage. Frenzy around the prospects of AI, expectations that the Federal Reserve will considerably bring down interest rates, and most recently, an upbeat start to the earnings season, have pushed the benchmark S&P 500 to an all-time high last week. Nvidia's massive gains have helped boost the stock's appeal for option traders and the company's options are among the most traded on any given day in recent months, according to data from options analytics provider Trade Alert. The stock has surged nearly 190% so far this year as a boom in generative AI prompted the company to issue a series of blowout forecasts. "The question is whether the revenue stream will last for a long time and will be driven by the emotion of investors rather than by any ability to prove or disprove the thesis that AI is overdone," said Rick Meckler, partner at Cherry Lane Investments, a family investment office in New Vernon, NJ. "I think Nvidia knows that near term, their numbers are likely to be quite remarkable."

[6]

Nvidia has just dethroned Apple in its domain: no one is worth more than them - Softonic

Nvidia's shares reached an all-time high on Tuesday, capitalizing on last week's rally Nvidia dethroned Apple on Friday as the most valuable company in the world following a record rise in its shares. Nvidia is the fastest-growing company in the tech world over the last two years thanks to AI. Nvidia's market value briefly touched $3.53 billion, slightly above Apple's $3.52 billion, according to LSEG data. Nvidia ended the day with an increase of 0.8%, with a market value, while Apple's shares rose by 0.4%. And that's where the overtaking occurred. In June, Nvidia briefly became the most valuable company in the world before being surpassed by Microsoft and Apple. The stock market capitalizations of the tech trio have been on par for several months. The Silicon Valley chip manufacturer is the dominant supplier of processors used in AI computing, and the company has become the biggest winner in a race among Microsoft, Alphabet, Meta Platforms, and other heavyweights to dominate the emerging technology. Known since the 1990s as a processor designer for video games, Nvidia's shares have risen by about 18% so far in October, with a series of gains occurring after OpenAI, the company behind ChatGPT, announced a $6.6 billion funding round. Nvidia and other semiconductor stocks rose on Friday after the data storage manufacturer Western Digital announced quarterly earnings that exceeded analysts' estimates, boosting optimism about data center demand. Nvidia's shares reached an all-time high on Tuesday, capitalizing on last week's rally, when TSMC, the world's largest contract chip manufacturer, reported a 54% increase in its quarterly profit, driven by the rising demand for chips used in AI. In comparison, analysts' forecasts for Nvidia point to a revenue growth of nearly 82%, reaching $32.9 billion. The shares of Nvidia, Apple, and Microsoft have an outsized influence on the high-value tech sector, as well as on the U.S. stock market in general, as the trio accounts for approximately one-fifth of the weighting of the S&P 500 index.

[7]

NVIDIA briefly dethrones Apple to become the world's most valuable company

AI-Assisted TLDR: On October 25, 2024, NVIDIA briefly surpassed Apple to become the world's most valuable company with a market cap of $3.53 trillion, before closing at $3.47 trillion. This marks the second time NVIDIA has overtaken Apple and Microsoft, driven by its leadership in AI hardware and chip design.* Generated from the content by Kosta Andreadis below. On Friday, October 25, 2024, NVIDIA briefly overtook Apple to become the world's most valuable company with an eye-watering market cap of $3.53 trillion. This put NVIDIA's valuation higher than Apple's $3.52 for a moment, closing the day at $3.47 trillion in second place ahead of Microsoft. This market marks the second time NVIDIA has taken the crown from its tech giant rivals Apple and Microsoft, reaching this height in June 2024. Even though it feels like we're only starting to get used to talking about NVIDIA in the same light as companies like Apple, Microsoft, Google, and Meta, with everyone laser-focused on generative AI, this remarkable result makes sense. NVIDIA, the clear leader in AI hardware software and chip design, has hardware and technology in almost every data center and system currently working with AI models, from significant endeavors from companies like OpenAI to workstations sitting on a desk running desktop RTX hardware in the office of a small startup somewhere. "More companies are now embracing artificial intelligence in their everyday tasks, and demand remains strong for NVIDIA chips," said Russ Mould, investment director at AJ Bell. "It is certainly in a sweet spot, and so long as we avoid a big economic downturn in the United States, there is a feeling that companies will continue to invest heavily in AI capabilities, creating a healthy tailwind for NVIDIA." Naturally, with a meteoric rise that has seen NVIDIA's stock surge by almost 190% this year, there is uncertainty. Companies like Microsoft, AMD, Intel, and many others are developing their own AI accelerators, not to mention that some believe there's simply too much attention (and money) being placed on generative AI. For now, NVIDIA shows no sign of slowing down. The demand for its next-gen Blackwell AI hardware is unprecedented, with AI GPUs like the B100, B200, and GB200 Superchip set to become the company's most successful product launches - yes, even more popular than the iconic GeForce GTX 1080 Ti. Jokes aside, NVIDIA is still a leader in consumer graphics and gaming hardware - where it's expected to unveil its next-gen Blackwell-powered gaming GeForce RTX gaming GPUs at CES 2025.

[8]

NVIDIA Overtakes Apple: Analysing the Shift in Market Value

The positive investor sentiment surrounding Nvidia reflects expectations for continued innovation and expansion into new industries. Nvidia's focus on high-growth areas like data centres, cloud computing, and AI research ensures a diversified revenue stream, contributing to its resilience in an ever-evolving tech market. As AI adoption accelerates across industries, Nvidia's role in shaping this transformation appears secure. Nvidia's commitment to advancing AI capabilities and its ability to support complex workloads position it to capitalize on emerging trends in automation, machine learning, and deep learning. From cloud computing and automotive AI to healthcare innovations, Nvidia's technology will remain foundational in diverse sectors. Nvidia's strategic approach, spanning both hardware and software, strengthens its position as a preferred AI partner, allowing businesses to develop and deploy AI solutions effectively. The company's expansion into cloud partnerships, software frameworks, and AI research solidifies its status as a leader in the AI era. Looking forward, Nvidia's focus on continuous improvement and adaptability will likely reinforce its position as a cornerstone of AI innovation. Nvidia's rise to become the world's most valuable company marks a pivotal moment in the technology sector. The company's leadership in AI hardware, combined with its robust software ecosystem, has fuelled unprecedented demand across industries. Nvidia's GPUs remain essential to AI advancement, and its influence in data centres, cloud computing, and automotive sectors underscores its relevance in today's AI-driven economy. With a strategic approach to innovation and market diversification, Nvidia is positioned to maintain its dominance in the rapidly evolving technology landscape.

[9]

Nvidia overtakes Apple as world's most valuable company

Oct 25 (Reuters) - Nvidia (NVDA.O), opens new tab dethroned Apple (AAPL.O), opens new tab as the world's most valuable company on Friday, following a record-setting rally in the stock powered by an insatiable demand for its new supercomputing AI chips. Nvidia's stock market value briefly touched $3.53 trillion, while that of Apple was $3.52 trillion, according to data from LSEG. In June, Nvidia briefly became the world's most valuable company, before it was overtaken by Microsoft (MSFT.O), opens new tab and Apple. The tech trio's market capitalizations have been neck-and-neck for several months. Microsoft's market value stood at $3.20 trillion. Advertisement · Scroll to continue Nvidia's stock has risen about 18% so far in October, with a string of gains coming after OpenAI, the company behind ChatGPT, announced a funding round of $6.6 billion. Nvidia provides chips used to train so-called foundation models such as OpenAI's GPT-4. "More companies are now embracing artificial intelligence in their everyday tasks and demand remains strong for Nvidia chips," said Russ Mould, investment director at AJ Bell. Advertisement · Scroll to continue "It is certainly in a sweet spot and so long as we avoid a big economic downturn in the United States, there is a feeling that companies will continue to invest heavily in AI capabilities, creating a healthy tailwind for Nvidia." Nvidia's shares hit a record high on Tuesday, building on a rally from last week when TSMC (2330.TW), opens new tab, the world's largest contract chipmaker, posted a forecast-beating 54% jump in quarterly profit driven by soaring demand for chips used in AI. The next big test will be when Nvidia reports third-quarter results in November. Nvidia in August forecast third-quarter revenue of $32.5 billion, plus or minus 2%, compared with the current average analyst expectation of $32.90 billion, according to data compiled by LSEG. Morgan Stanley analyst Joseph Moore said in a note dated Oct. 10 that he remains "very bullish" about the company longer term, but the recent rally "raises the bar for earnings somewhat". After a meeting with Nvidia's CEO Jensen Huang, Moore noted the ramp up in production of its next-generation Blackwell chips appeared to be "quite strong" and are booked out for 12 months. The stock came under pressure in August after Nvidia confirmed reports that the production of Blackwell chips was delayed until the fourth quarter. Shares of Nvidia, Apple and Microsoft have an outsized influence on the richly valued technology sector as well as the broader U.S. stock market, with the trio accounting for about a fifth of the S&P 500 index's (.SPX), opens new tab weightage. Frenzy around the prospects of AI, expectations that the U.S. Federal Reserve will considerably bring down interest rates, and most recently, an upbeat start to the earnings season, have pushed the benchmark S&P 500 to an all-time high last week. Nvidia's massive gains have helped boost the stock's appeal for option traders and the company's options are among the most traded on any given day in recent months, according to data from options analytics provider Trade Alert. The stock has surged nearly 190% so far this year as a boom in generative AI prompted the company to issue a series of blowout forecasts. "The question is whether the revenue stream will last for a long time and will be driven by the emotion of investors rather than by any ability to prove or disprove the thesis that AI is overdone," said Rick Meckler, partner at Cherry Lane Investments, a family investment office in New Vernon, New Jersey. "I think Nvidia knows that near term, their numbers are likely to be quite remarkable." Reporting by Noel Randewich in San Francisco, Sruthi Shankar in Bengaluru, Saqib Ahmed in New York and Paolo Laudani in Gdansk; Editing by Shounak Dasgupta Our Standards: The Thomson Reuters Trust Principles., opens new tab Noel Randewich Thomson Reuters San Francisco correspondent covering the stock market with a focus on Big Tech, semiconductors and other Silicon Valley companies

[10]

Nvidia Overtakes Apple As World's Most Valuable Company, Again - NVIDIA (NASDAQ:NVDA)

AI supercomputing chips fuel Nvidia's stock surge, hinting at the future of tech dominance. Nvidia Corp NVDA once again surpassed Apple Inc AAPL Friday to become the world's most valuable company. What Happened: On Friday, Nvidia's market value briefly reached $3.53 trillion, edging past Apple's $3.52 trillion, Reuters reported. This shift in leadership comes as a result of the record-breaking surge in Nvidia's stock driven by the soaring demand for its new artificial intelligence supercomputing chips. "More companies are now embracing artificial intelligence in their everyday tasks and demand remains strong for Nvidia chips," Russ Mould, investment director at AJ Bell, told Reuters. Nvidia's shares have climbed nearly 18% in October following OpenAI's news of a $6.6 billion funding round. OpenAI, known for creating ChatGPT, relies on Nvidia's chips to train large-scale models like GPT-4, positioning Nvidia to capitalize on the growing demand for advanced AI infrastructure. See Also: Nvidia Chases Growth in India: AI Partnerships With Reliance, Infosys, Wipro, Expanding into Robotics And Key Industries Why It Matters: Nvidia's rise to the top is a testament to the growing influence of AI and the increasing demand for AI chips. In June, the company surpassed Microsoft and Apple to become the most valuable public company in the world. Read Next: Elon Musk Says Tesla, SpaceX Manufactured In Costly California Just Because He Lived There Even As Rivals Photo: Shutterstock. This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Market News and Data brought to you by Benzinga APIs

[11]

Nvidia's market value surges due to AI prominence rather than GPUs

Nvidia, the Californian tech company known for its PC GPUs, has seen a surge in market value, briefly overtaking Apple as the world's most valuable company. And the reason isn't video games. It's AI. On Friday last week Nvidia's stock market value reached $3.53 trillion, overtaking Apple's $3.52tn, as reported by Reuters based on LSEG data. At the end of that day, Apple remained on top at $3.52tn, but at $3.47tn Nvidia saw an overall market value increase of 0.8 percent. LSEG data shows Nvidia, Apple and Microsoft are in a three horse race as the world's most valuable companies. Nvidia briefly hit the top spot back in June, but was overtaken by both Microsoft and Apple shortly after. By comparison on Friday, Microsoft's market value was $3.18 trillion. The reason for Nvidia's increased market value is it's become the dominant supplier of processors used in AI computing, which requires huge amounts of processing power. Additionally, earlier this month, Nvidia unveiled a new AI model that reportedly outperforms the likes of Chat GPT maker OpenAI (thanks VentureBeat). It marks a shift for the company as it enhances its AI capabilities alongside its typical GPU offering. "More companies are now embracing artificial intelligence in their everyday tasks and demand remains strong for Nvidia chips," Russ Mould, investment director at AJ Bell, told Reuters. "It is certainly in a sweet spot and so long as we avoid a big economic downturn in the United States, there is a feeling that companies will continue to invest heavily in AI capabilities, creating a healthy tailwind for Nvidia." It seems graphics processing and AI could go hand in hand, too. Last month, Nvidia boss Jensen Huang discussed how AI could be used to advance graphical capabilities. "We can't do computer graphics anymore without artificial intelligence," he said. "We compute one pixel, we infer the other 32. I mean, it's incredible. And so we hallucinate, if you will, the other 32, and it looks temporally stable, it looks photorealistic, and the image quality is incredible, the performance is incredible." Nvidia will be supplying parts for Nintendo's forthcoming Switch 2 console, as Digital Foundry explored last year. The company's next round of top of the range graphics cards are also expected to be announced soon.

Share

Share

Copy Link

Nvidia's market value surged to $3.53 trillion, briefly surpassing Apple's $3.52 trillion, driven by soaring demand for AI chips. This milestone highlights the growing importance of AI in the tech industry and Nvidia's dominant position in the market.

Nvidia's Market Dominance

Nvidia, the Silicon Valley chipmaker, briefly overtook Apple as the world's most valuable company on Friday, with its market capitalization reaching $3.53 trillion compared to Apple's $3.52 trillion

1

2

. This milestone marks a significant shift in the tech industry, highlighting the growing importance of artificial intelligence (AI) and Nvidia's dominant position in the market for specialized AI chips.AI-Driven Growth

The company's remarkable ascent is primarily attributed to the surging demand for its AI-focused products. Nvidia's stock has risen approximately 18% in October alone, with its value increasing by nearly 190% year-to-date

3

. This growth has been fueled by several factors:- OpenAI's recent $6.6 billion funding round, which boosted optimism about data center demand

1

. - Strong performance from TSMC, the world's largest contract chipmaker, which reported a 54% jump in quarterly profit driven by AI chip demand

4

. - Increasing adoption of AI technologies across various industries, creating a sustained demand for Nvidia's products

2

.

Competitive Landscape

While Nvidia has taken the lead, the competition among tech giants remains fierce. Microsoft, with a market value of $3.18 trillion, is closely trailing

1

. Apple, despite being temporarily overtaken, continues to hold a strong position but faces challenges in its smartphone business, particularly in the Chinese market2

.Related Stories

Future Outlook and Challenges

Nvidia's future prospects appear promising, with analysts remaining bullish about the company's long-term potential. However, some challenges and considerations include:

- The upcoming third-quarter results in November, which will be a crucial test for the company

5

. - Production ramp-up of next-generation Blackwell chips, which are reportedly booked out for 12 months

4

. - Questions about the sustainability of the AI-driven revenue stream and potential market saturation

3

.

Market Impact

The rise of Nvidia and the AI sector has had a broader impact on the stock market:

- Nvidia, Apple, and Microsoft now account for about a fifth of the S&P 500 index's weight

4

. - The overall stock market has seen a banner year, with the S&P 500 reaching new highs

1

. - Nvidia's stock has become increasingly popular among options traders

5

.

As the AI revolution continues to reshape the tech landscape, Nvidia's position at the forefront of this transformation underscores the critical role of specialized hardware in driving innovation and economic value in the AI era.

References

Summarized by

Navi

[4]

Related Stories

Nvidia's AI Chip Demand Propels It to Record Highs, Challenging Apple's Market Cap Crown

10 Oct 2024•Business and Economy

Nvidia Surpasses Apple as World's Most Valuable Company, Riding AI Wave

05 Nov 2024•Business and Economy

Nvidia Reclaims World's Most Valuable Company Title, Driven by AI Boom

30 May 2025•Business and Economy

Recent Highlights

1

OpenAI secures $110 billion funding round from Amazon, Nvidia, and SoftBank at $730B valuation

Business and Economy

2

Anthropic stands firm against Pentagon's demand for unrestricted military AI access

Policy and Regulation

3

Pentagon Clashes With AI Firms Over Autonomous Weapons and Mass Surveillance Red Lines

Policy and Regulation