Nvidia's Next-Gen AI Chip for China: Geopolitical Tensions and Market Demand

15 Sources

15 Sources

[1]

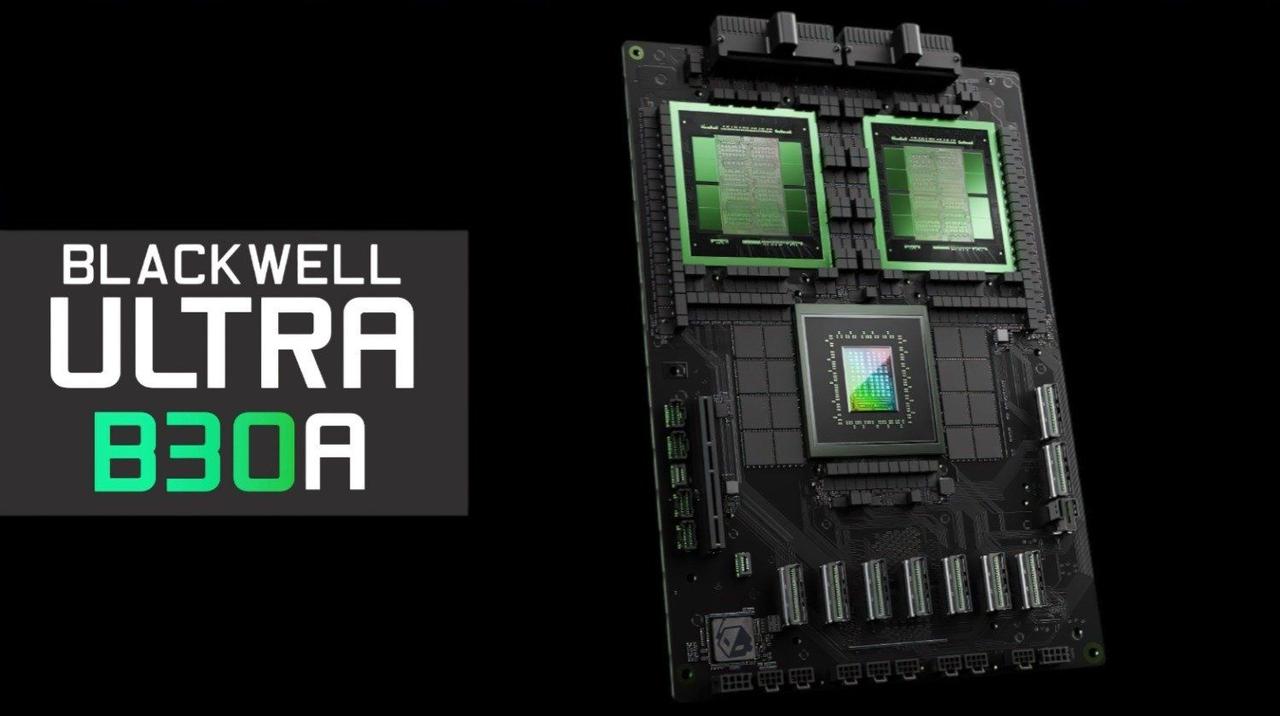

Nvidia's next-gen AI chip could double the price of H20 if China export is approved -- Chinese firms still consider Nvidia's B30A a good deal

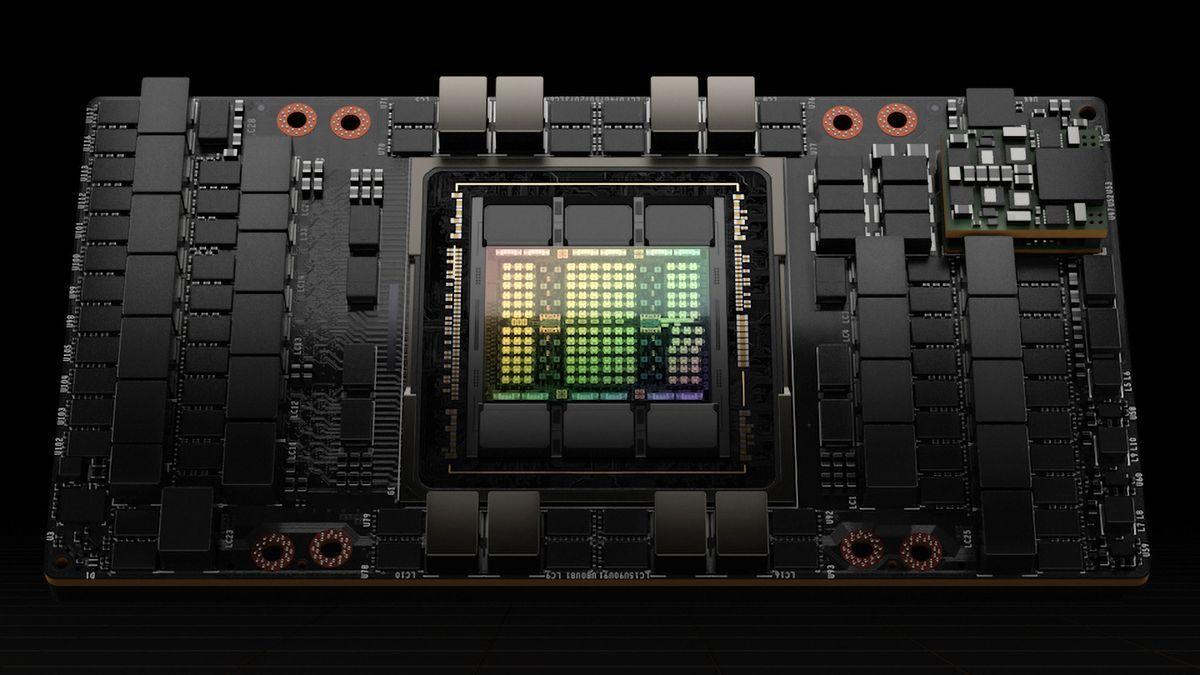

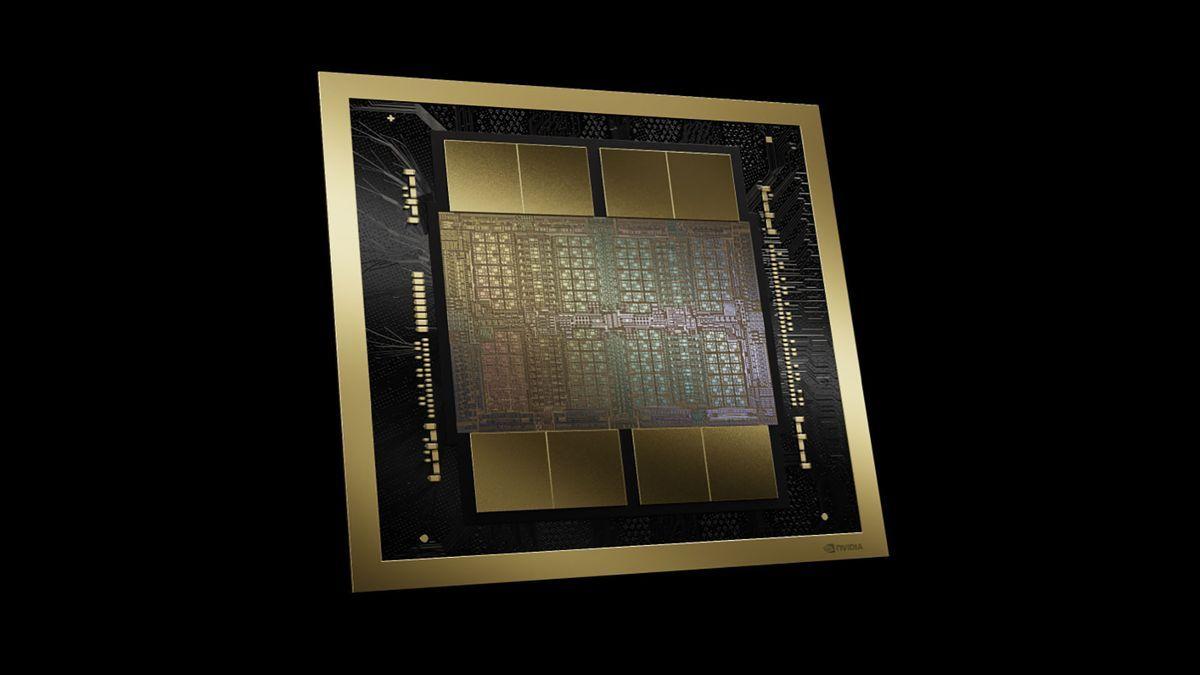

The Nvidia B30A, which the company is developing as its next-generation replacement for the China-market H20 AI chip, is expected to cost double the price of the earlier model. Reuters reports that the H20 currently sells between $10,000 and $12,000, meaning the B30A will likely be priced from $20,000 to $25,000. Despite this massive increase, many Chinese companies, like TikTok owner ByteDance, are keen on getting their hands on Nvidia's latest chips, with some sources saying that these chips are considered great deals. It's estimated that the B30A will be six times more powerful than the H20, despite being a watered-down version of the full-fat B300 AI chip. Nvidia has reportedly already developed the B30A, but it's still waiting for approval from the U.S. government to proceed with the marketing and sale of the Blackwell-based GPU. In the meantime, many Chinese tech firms are still buying H20 chips despite Beijing's guidance to stop buying them. U.S. President Donald Trump has previously banned the sales of H20 chips, resulting in a $5.5-billion write-off for Nvidia. However, he reversed course in mid-July 2025, allowing the company to resume deliveries to Chinese customers. But instead of a blanket provision allowing it to sell the H20 to anyone, the U.S. instead started issuing export licenses to Nvidia, allowing it to ship its products. Because of this, there's currently a massive license backlog at the U.S. Department of Commerce -- the worst it has experienced in 30 years -- turning the H20 taps into a trickle. The White House is also still ironing out the 15% deal that AMD and Nvidia signed, so that the companies can market their products to China. We've also seen reports that Nvidia is asking its suppliers to wind down H20-related production, with the company only telling Tom's Hardware, "We constantly manage our supply chain to address market conditions." So, with all these delays, red tape, and rumors, many of Nvidia's Chinese customers are getting apprehensive and want assurance that their H20 orders are delivered. This shows that there is still massive demand for these powerful chips, thus turning it into a massive geopolitical tool to be wielded on the negotiating table by both the East and the West.

[2]

Trump, Nvidia talks to allow advanced AI chip sales in China will take time, CEO says

WASHINGTON, Aug 28 (Reuters) - Discussions with the White House to allow American AI chip company Nvidia (NVDA.O), opens new tab to sell a less advanced version of its next-generation advanced GPU chip to China will take time, Nvidia CEO Jensen Huang said on Thursday. When asked about White House talks on Blackwell chip sales to China in a Fox Business News interview, Huang said the discussions had started. "The conversation will take a while, but ... President Trump understands that having the world build AI on the American tech stack helps America win the AI race." Earlier this month, Trump suggested he might allow Nvidia to sell a scaled-down version of the chip in China, noting that it would be 30-50% less capable than the regular version. That comes despite deep-seated fears in Washington that China could harness U.S. artificial intelligence capabilities to supercharge its military. China hawks fear allowing even stripped-down Blackwell chip sales to China could open the door to Beijing securing more advanced computing power from the U.S., even as the two countries battle for technology supremacy. Reuters in May reported that Nvidia was preparing a new chip for China that was a variant of its most recent state-of-the-art AI Blackwell chips at a significantly lower cost. Reporting by Jasper Ward and Alexandra Alper, Editing by Franklin Paul, Rod Nickel Our Standards: The Thomson Reuters Trust Principles., opens new tab

[3]

Trump, Nvidia talks to allow advanced AI chip sales in China will take time, CEO say

WASHINGTON, Aug 28 (Reuters) - Discussions with the White House to allow American AI chip giant Nvidia (NVDA.O), opens new tabvto sell a less advanced version of its next generation Blackwell chip to China "wil take a while," Nvidia CEO Jensen Huang said on Thursday. When asked about WHite House talks on Blackwell chip sales to China in a Fox Business News interview, Huang said, "I started to have the conversation with them. I think that the conversation will take a while, but, but President Trump understands that having the world built AI on American tech stack helps America win the AI race." Reporting by Jasper Ward and Alexandra Alper, Editing by Franklin Paul Our Standards: The Thomson Reuters Trust Principles., opens new tab

[4]

Exclusive: Chinese firms still want Nvidia chips despite government pressure not to buy, sources say

Sept 4 (Reuters) - Alibaba (9988.HK), opens new tab, ByteDance and other Chinese tech firms remain keen on Nvidia's (NVDA.O), opens new tab artificial intelligence chips despite regulators in Beijing strongly discouraging them from such purchases, four people with knowledge of procurement discussions said. They want reassurance that their orders of Nvidia's H20 model, which the U.S. firm in July regained permission to sell in China, are being processed, and are closely monitoring Nvidia's plans for a more powerful chip, tentatively named the B30A and which is based on its Blackwell architecture, two of the people said. The B30A - if approved for sale by Washington - is likely to cost about double the H20, which currently sells for between $10,000 and $12,000, those two people said. Chinese tech firms perceive the potential B30A pricing, reported by Reuters for the first time, as a good deal, they added. One said the B30A promises to be up to six times more powerful than the H20. Both chips are downgraded versions of models sold outside China, developed specifically to comply with U.S. export restrictions. All sources for this article were not authorised to speak to media and declined to be identified. The extent to which China, which generated 13% of Nvidia's revenue in the past financial year, can have access to cutting-edge AI chips is one of the biggest flashpoints in the U.S.-Sino war for tech supremacy. On one hand, the U.S. has retreated from its previous position of more severe restrictions on Nvidia sales of advanced chips to China. Nvidia and other critics of the controls say it is better if Chinese firms continue to use its chips - which work with Nvidia's software tools - so that developers do not completely switch over to offerings from rivals like Huawei (HWT.UL). U.S. President Donald Trump has also struck a deal with Nvidia for it to give the U.S. government 15% of its H20 revenue. At the same time, China is keen for its tech industry to wean itself off U.S. chips. Chinese authorities have summoned companies, including Tencent (0700.HK), opens new tab and ByteDance, over their purchases of the H20, asking them to explain their reasons and expressing concerns over information risks, sources said last month. They have, however, not been ordered to cease purchases of Nvidia products. LIMITED DOMESTIC CHIP SUPPLY Despite that pressure, demand for Nvidia chips remains strong in China due to constrained supplies of products from domestic rivals such as Huawei and Cambricon (688256.SS), opens new tab, the four sources said. Another three sources who are involved in engineering operations at Chinese tech firms also said Nvidia's chips perform better than domestic products. Alibaba, ByteDance and Tencent did not reply to Reuters requests for comment. Huawei and Cambricon also did not respond to Reuters queries. Asked about its position versus rivals in China, Nvidia said in a statement that the "competition has undeniably arrived." It declined further comment. Lack of clarity about Nvidia's prospects in China led the U.S. firm in late August to issue a tepid quarterly sales forecast that excluded potential revenue from the world's second-biggest economy. The company, the most valuable in the world, has seen its stock lose 6% since then. During its earnings call, Nvidia executives said the company had received some export licenses for H20 but had yet to commence shipping because it was sorting out some issues related to the deal to give the U.S. government a portion of its China sales. Nvidia CEO Jensen Huang has also assured Chinese customers not to worry about the H20's availability and has told suppliers that demand remains strong, two of the sources said. Reuters reported in July that Nvidia has an inventory of 600,000-700,000 H20 chips and had asked TSMC to produce more. Sources have also said Nvidia is hoping to deliver samples of the B30A to Chinese clients for testing as early as September. Huang estimates that the China market could be worth $50 billion to Nvidia if it were able to offer competitive products. Reporting by Fanny Potkin, Liam Mo and Brenda Goh; Editing by Miyoung Kim and Edwina Gibbs Our Standards: The Thomson Reuters Trust Principles., opens new tab

[5]

Nvidia CEO Jensen Huang says talks with Trump to allow chips into China will take time

China may not want to buy Nvidia chips over supposed security risks and US comments Nvidia CEO Jensen Huang said that discussions with the US Government on allowing scaled-down Blackwell GPU sales to China have started, but it could take time to reach a deal. According to Reuters reporting, Trump indicated that Nvidia could sell a less powerful version of Blackwell to China that's 30-50% less capable than the regular version. However, the White House fears that even stripped-down AI chips could support China's military and technological strength, hence the delays that Nvidia is facing with regards to a decision. Huang estimates that China represents a $50 billion opportunity for Nvidia, potentially growing 50% annually if access to sell chips in the country is allowed. For a company with $46.7 billion in quarterly revenue, that's a considerable opportunity. Nvidia had already made the H20 AI chip for China to meet Biden-era export restrictions, but that got banned over security concerns when Trump came to power. Sales of the H20 in China are still on pause, but at an expense to Nvidia which is losing out on billions in sales. In the meantime, China has been promoting the use of domestic chips to plug the gap left by stalled Nvidia sales. The country has also reportedly been asking local firms to avoid Nvidia's chips, citing security risks. China's reluctance to buy Nvidia chips could be heightened further following comments from US Commerce Secretary Howard Lutnick, who said the plan is to make China addicted to American tech. On the flip side, Huang argues that enabling American companies to sell AI chips in China helps the US set the standards and win the global race. Nvidia recently posted a 56% year-on-year rise in quarterly revenue, noting a lack of H20 sales in China and a $180 million release of previously reserved H20 inventory from around $650 million in unrestricted H20 sales. Huang commended Blackwell's performance gains, adding that Blackwell Ultra production "is ramping at full speed."

[6]

Tech firms in China are reportedly still patiently waiting to buy Nvidia's AI chips, even though the Chinese government would prefer they didn't

If you're aware of what Nvidia's H20 chips are, there's a good chance you're sick of hearing about Nvidia's H20 chips. Well, sorry to be the bearer of bad news, but we aren't done yet, as some Chinese firms are reportedly still waiting on their preorders. As reported by Reuters, and citing "four people with knowledge of procurement discussions", Chinese firms like ByteDance (the owner of TikTok and Pico) are waiting on Nvidia's AI chips. They reportedly ordered them after the US government allowed the sale of the chip in China back in July. The H20 chip is effectively a downgraded version of the top-of-the-line H100 GPU, which is mostly used to power AI workloads within beastly servers. Reuters notes that, according to those it spoke to, these same Chinese firms are keeping a close eye on Nvidia in the hopes of procuring its next AI chip, code-named B301. This is reportedly being developed on Blackwell architecture (the same architecture in the RTX 50-series). Also according to Reuters, three sources have stated that Nvidia's chips are currently performing better than domestic alternatives. This same report claims that Nvidia had somewhere between 600,000 to 700,000 H20 chips and has asked TSMC to step up production in July. However, that doesn't paint the full picture. Here's a very quick timeline of the Nvidia H20 chip in recent months: China's distrust of H20 chips seemed in part linked to the fact that some US politicians were arguing to add backdoors into Nvidia's tech. Nvidia did state 'There is no such thing as a good secret backdoor' and denied such a technology being in its devices, but the Chinese government does appear to want to step up its own production. Given how unpredictable America's stance on tariffs has been over the last few months, it wouldn't be unreasonable for those outside of the US to feel like they may not be able to fully rely on production from within the States. AI is a new frontier for all countries right now, and they're all competing to win the AI arms race.

[7]

Chinese companies prepared to pay $24,000 for NVIDIA's next-gen China-specific B30A AI GPU

TL;DR: Chinese tech giants like Alibaba and ByteDance are eager to secure NVIDIA's China-specific B30A AI GPUs, priced at $24,000 each, due to superior software integration and performance. Despite US export restrictions and government mandates favoring domestic chips, NVIDIA's AI GPUs remain highly preferred across China's AI industry. Chinese tech companies are willing to pay $24,000 for each of NVIDIA's new China-specific B30A AI GPUs, and are eager to have their H20 AI GPU orders processed ASAP. In a new report from Reuters, the outlet reports that its sources said Chinese tech companies like Alibaba and TikTok parent company ByteDance are eager to have their H20 AI GPU orders processed, and are willing to pay $24,000 for NVIDIA's next-gen China-specific B30A AI GPU. Chinese AI developers in all sizes with small and medium-sized businesses continue to prefer NVIDIA AI GPU offerings as they provide better software integration and performance in chip clusters, even in the midst of the Chinese government aggressively pushing local companies to rely on domestic AI chips, going as far as mandating government clusters to feature at least 50% domestic AI chips. The US government has been putting further restrictions on AI chips made by NVIDIA and AMD from entering China, but NVIDIA AI hardware is widely preferred. Reuters reports from four different sources that not only are China's big tech companies like Alibaba and ByteDance continuing to prefer NVIDIA AI GPUs, they're also keeping a close eye on the license approval status of H20 AI GPUs. NVIDIA's upcoming China-specific B30 AI GPU is compliant with US regulations, with the new B30A being faster than the H20, but much slower than higher-end AI GPU offerings like the B200 and upcoming B300 "Blackwell Ultra" AI GPU. B30A has a single-chip design compared to dual chiplet-based designs like the B200 and B300.

[8]

Trump, Nvidia talks to allow advanced AI chip sales in China will take time, CEO says - The Economic Times

When asked about White House talks on Blackwell chip sales to China in a Fox Business Network interview with "The Claman Countdown," Huang said the discussions had started.Discussions with the White House to allow American AI chip company Nvidia to sell a less advanced version of its next-generation advanced GPU chip to China will take time, Nvidia CEO Jensen Huang said on Thursday. When asked about White House talks on Blackwell chip sales to China in a Fox Business Network interview with "The Claman Countdown," Huang said the discussions had started. "The conversation will take a while, but ... President Trump understands that having the world build AI on the American tech stack helps America win the AI race." Earlier this month, Trump suggested he might allow Nvidia to sell a scaled-down version of the chip in China, noting that it would be 30-50% less capable than the regular version. That comes despite deep-seated fears in Washington that China could harness U.S. artificial intelligence capabilities to supercharge its military. China hawks fear allowing even stripped-down Blackwell chip sales to China could open the door to Beijing securing more advanced computing power from the U.S., even as the two countries battle for technology supremacy. Reuters in May reported that Nvidia was preparing a new chip for China that was a variant of its most recent state-of-the-art AI Blackwell chips at a significantly lower cost. Nvidia's exclusion of potential China sales from the forecast for the current quarter underscored the uncertainty caused by Chinese-U.S. trade tensions, despite Nvidia striking a deal with President Donald Trump for export licenses in exchange for 15% of China sales of its H20 AI chips. Huang said the company does not yet have H20 orders from China. Asked if he would be forced to say yes if Trump demanded 15% of Blackwell chip sales to China, Huang suggested he was open to it. "I don't know that it's 'forced to say yes,' but ultimately, it's in the best interest of the world, of our country, for us to be able to sell in China," Huang said. "So whatever it takes to get it approved for us to be able to sell in China is fine with us." He estimated the AI market in China is worth $50 billion to Nvidia. "My hope is that we'll be able to go back and address a significant part of that $50 billion," Huang said.

[9]

NVIDIA's Planned Latest China AI GPU Will Sell Like Hot Cakes Even With A $24,000 Price Tag, Says Report

This is not investment advice. The author has no position in any of the stocks mentioned. Wccftech.com has a disclosure and ethics policy. NVIDIA's AI GPUs continue to be popular among Chinese firms despite government efforts to reduce reliance on foreign products, suggests a report on Reuters, which builds on similar claims made earlier by brokerage firms. Two sources quoted by the publication reveal that Chinese big tech firms Alibaba and ByteDance are eager to have their H20 AI GPU orders processed and are willing to pay as much as $24,000 for NVIDIA's next-generation B30A China-specific AI GPUs. Today's report from Reuters follows coverage by brokerages, which revealed that small and medium-sized Chinese AI developers continued to prefer NVIDIA's AI GPUs as they offered better software integration and performance in chip clusters. The local preference for NVIDIA's chips comes despite the fact that the Chinese government has aggressively started to push local firms to rely on domestic chips and gone as far as to mandate government clusters to accommodate at least 50% domestic AI chips. US restrictions on NVIDIA and AMD AI GPU sales to China, which were lifted in August, have also seen growing interest in domestic chip firms. One such firm Cambricon saw its revenue grow 43 times annually in the first half of 2025 amidst soaring valuation due to few domestic alternatives apart from Huawei. However, even as domestic Chinese AI chip firms benefit from the growing interest in local chips, NVIDIA's products are still the most widely preferred. Reuters, quoting four sources, reveals that not only are Chinese big tech firms such as ByteDance and Alibaba continuing to prefer NVIDIA's AI chips, but they are also closely watching the license approval status of the H20 GPUs. Additionally, the Chinese AI software firms continue to be enthusiastic about future NVIDIA AI GPUs. After NVIDIA's latest earnings report led to mute share price action over missed data center revenue guidance, CEO Jensen Huang confirmed to Fox Business that he was confident in being able to secure US approval for new China-specific chips designed with the Blackwell architecture. Huang's sentiments appeared to be aimed at assuaging investors questioning NVIDIA's China revenue, and according to Reuters, participants in the demand side of the equation are equally, if not more, enthusiastic. They are willing to pay anywhere between double the $10,000 to $12,000 of the current-generation H20 AI GPU as they believe the chip, called the B30A, can offer as much as six times the performance punch over its predecessor. The report also comes as NVIDIA and AMD wind down their supply chain operations for the China-specific AI GPUs. AMD's CFO, Jean Hu, outlined yesterday at a conference that her firm had stopped starting new wafer production for the firm's China-specific MI300 AI GPU. AMD's vice president of investor relations, Matthew Ramsay added that "getting visibility in the short term as to what" the license approval situation will be for the China chips was a key factor behind deciding whether to invest more in the Chinese AI chips.

[10]

What's Going On With Nvidia Stock Thursday? - NVIDIA (NASDAQ:NVDA)

Alibaba Group BABA, ByteDance, and other major Chinese technology firms are continuing to seek out Nvidia's NVDA artificial intelligence chips despite Beijing's growing pressure to adopt domestic alternatives. The companies are pressing for confirmation that their orders of Nvidia's H20 processors, reapproved for sale in China in July, are being filled. At the same time, they are closely monitoring the development of a next-generation Blackwell-based chip, tentatively called the B30A, according to Reuters. Also Read: Beijing Asks Alibaba, ByteDance Why They Need Nvidia H20 Chips Instead Of Local Alternatives If cleared by Washington, the B30A is expected to cost nearly twice as much as the H20's $10,000-$12,000 price tag and could be up to six times more powerful. Chinese regulators have questioned leading internet firms, including Tencent TCEHY and ByteDance, over their H20 purchases but have stopped short of banning them. Domestic offerings from Huawei and Cambricon remain in short supply, and executives told Reuters that Nvidia's chips still far exceed the performance of local alternatives. To secure the resumption of H20 sales, Nvidia agreed to remit 15% of its China chip revenue to the U.S. government. Even so, analysts at Bernstein expect the company's market share in China to decline to 55% this year from 66% in 2024. Nvidia has already absorbed a $4.5 billion first-quarter charge tied to excess H20 inventory and related commitments, following $4.6 billion in sales of the chip during the same period. Chinese giants including Alibaba, ByteDance, and Tencent were reported to have stockpiled as many as one million H20 units before fresh sanctions, representing more than $16 billion in quarterly orders. Since 2025, Nvidia has logged $18 billion in H20 orders, with $17 billion of that tied to China, equal to 13% of its fiscal 2024 revenue. Investor sentiment around Nvidia remains robust. Shares have climbed more than 27% this year, fueled by surging demand for its data center business and AI-focused GPUs. Bank of America analyst Vivek Arya projects Nvidia could generate an additional $6-$10 billion in China sales from August through January if shipments proceed, citing an incremental 300,000 H20 units ordered from Taiwan Semiconductor Manufacturing Co. TSM. He noted, however, that as much as $3-$4 billion of this revenue may be delayed until early next year because of supply chain ramp-up issues. Nvidia CEO Jensen Huang has sought to reassure Chinese customers about product availability, emphasizing that China could represent a $50 billion opportunity for Nvidia if it continues to deliver competitive offerings. Price Actions: At last check Thursday, NVDA stock is trading higher by 0.60% to $171.64 premarket. BABA stock is down 2.24%. Read Next: Nvidia Prepares New China-Specific AI Chip To Defend Market Share Image via Shutterstock NVDANVIDIA Corp$171.710.64%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum88.29Growth97.79Quality93.20Value7.79Price TrendShortMediumLongOverviewBABAAlibaba Group Holding Ltd$133.32-2.29%TCEHYTencent Holdings Ltd$76.77-0.40%TSMTaiwan Semiconductor Manufacturing Co Ltd$232.210.35%Market News and Data brought to you by Benzinga APIs

[11]

Alibaba, ByteDance Defy Beijing Warnings As Chinese Tech Titans Race To Secure Nvidia's $12,000 H20 Chips, Eye Next-Gen B30A At Double The Price - NVIDIA (NASDAQ:NVDA)

Chinese tech giants are pushing ahead with Nvidia Corp. NVDA purchases even as regulators in Beijing caution them against heavy reliance on U.S. chips. Chinese Firms Stockpile Nvidia's $12,000 H20 Despite Beijing Pressure Alibaba Group Holding Ltd BABA, ByteDance and other leading firms are pressing suppliers to confirm deliveries of Nvidia's H20 processors, according to Reuters. currently priced between $10,000 and $12,000, while monitoring the possible rollout of the B30A, a next-generation chip built on the Blackwell architecture, according to people familiar with procurement discussions. B30A Could Be Six Times Faster And Twice As Expensive As H20 If Washington approves the B30A, it could be up to six times more powerful than the H20, though its cost is expected to be nearly double, according to a report by Reuters. Chinese tech companies consider the potential performance boost to outweigh the higher price, seeing it as a worthwhile investment for maintaining AI competitiveness. Nvidia CEO Jensen Huang has privately reassured Chinese customers that H20 shipments are secure, despite ongoing negotiations with the U.S. government over a deal requiring Nvidia to hand over 15% of China-related sales. "Competition has undeniably arrived," Nvidia said in a statement, without elaborating on rivals such as Huawei and Cambricon. See More: Alibaba Chair Says AI Total Addressable Market Is $10 Trillion, Expects Benefits Via Its Cloud Business China Flags Security Concerns Over Nvidia H20 Chips Amid US-China Tech Tensions In August, China signaled strong opposition to any U.S. proposals to embed tracking technology in high-end chips, sending a clear warning to Nvidia executives without issuing a formal ban. This comes as Washington considers legislation requiring location-tracking in AI chips to prevent them from reaching rival states. Nvidia's H20 AI chips are under scrutiny in China, with state media and regulators highlighting potential security risks, including backdoor vulnerabilities that could allow remote access. Social media accounts linked to CCTV criticized the chips for being unsafe and environmentally unfriendly, raising further doubts among Chinese consumers. Price Action: Nvidia's stock fell 0.094% to close at $170.62 on Wednesday, then gained 0.70% in premarket trading on Thursday, according to Benzinga Pro. Read Next: Palantir Soars, Markets Sputter, But These ETFs Are Still Gaining Ground Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Photo courtesy: Chung-Hao-Lee / Shutterstock NVDANVIDIA Corp$171.650.60%Stock Score Locked: Edge Members Only Benzinga Rankings give you vital metrics on any stock - anytime. Unlock RankingsEdge RankingsMomentum88.29Growth97.79Quality93.20Value7.79Price TrendShortMediumLongOverviewBABAAlibaba Group Holding Ltd$133.44-2.21%Market News and Data brought to you by Benzinga APIs

[12]

Chinese firms still want Nvidia chips despite government pressure not to buy, Reuters sources say

Alibaba, ByteDance and other Chinese tech firms remain keen on Nvidia's artificial intelligence chips despite regulators in Beijing strongly discouraging them from such purchases, four people with knowledge of procurement discussions said. They want reassurance that their orders of Nvidia's H20 model, which the U.S. firm in July regained permission to sell in China, are being processed, and are closely monitoring Nvidia's plans for a more powerful chip, tentatively named the B30A and which is based on its Blackwell architecture, two of the people said. The B30A - if approved for sale by Washington - is likely to cost about double the H20, which currently sells for between US$10,000 and $12,000, those two people said. Chinese tech firms perceive the potential B30A pricing, reported by Reuters for the first time, as a good deal, they added. One said the B30A promises to be up to six times more powerful than the H20. Both chips are downgraded versions of models sold outside China, developed specifically to comply with U.S. export restrictions. All sources for this article were not authorized to speak to media and declined to be identified. The extent to which China, which generated 13% of Nvidia's revenue in the past financial year, can have access to cutting-edge AI chips is one of the biggest flashpoints in the U.S.-Sino war for tech supremacy. On one hand, the U.S. has retreated from its previous position of more severe restrictions on Nvidia sales of advanced chips to China. Nvidia and other critics of the controls say it is better if Chinese firms continue to use its chips - which work with Nvidia's software tools - so that developers do not completely switch over to offerings from rivals like Huawei. U.S. President Donald Trump has also struck a deal with Nvidia for it to give the U.S. government 15 per cent of its H20 revenue. At the same time, China is keen for its tech industry to wean itself off U.S. chips. Chinese authorities have summoned companies, including Tencent and ByteDance, over their purchases of the H20, asking them to explain their reasons and expressing concerns over information risks, sources said last month. They have, however, not been ordered to cease purchases of Nvidia products. Despite that pressure, demand for Nvidia chips remains strong in China due to constrained supplies of products from domestic rivals such as Huawei and Cambricon, the four sources said. Another three sources who are involved in engineering operations at Chinese tech firms also said Nvidia's chips perform better than domestic products. Alibaba, ByteDance and Tencent did not reply to Reuters requests for comment. Huawei and Cambricon also did not respond to Reuters queries. Asked about its position versus rivals in China, Nvidia said in a statement that the "competition has undeniably arrived." It declined further comment. Lack of clarity about Nvidia's prospects in China led the U.S. firm in late August to issue a tepid quarterly sales forecast that excluded potential revenue from the world's second-biggest economy. The company, the most valuable in the world, has seen its stock lose 6% since then. During its earnings call, Nvidia executives said the company had received some export licenses for H20 but had yet to commence shipping because it was sorting out some issues related to the deal to give the U.S. government a portion of its China sales. Nvidia CEO Jensen Huang has also assured Chinese customers not to worry about the H20's availability and has told suppliers that demand remains strong, two of the sources said. Reuters reported in July that Nvidia has an inventory of 600,000-700,000 H20 chips and had asked TSMC to produce more. Sources have also said Nvidia is hoping to deliver samples of the B30A to Chinese clients for testing as early as September. Huang estimates that the China market could be worth US$50 billion to Nvidia if it were able to offer competitive products.

[13]

Trump, Nvidia talks to allow advanced AI chip sales in China will take time, CEO say

WASHINGTON (Reuters) -Discussions with the White House to allow American AI chip giant Nvidiavto sell a less advanced version of its next generation Blackwell chip to China "wil take a while," Nvidia CEO Jensen Huang said on Thursday. When asked about WHite House talks on Blackwell chip sales to China in a Fox Business News interview, Huang said, "I started to have the conversation with them. I think that the conversation will take a while, but, but President Trump understands that having the world built AI on American tech stack helps America win the AI race." (Reporting by Jasper Ward and Alexandra Alper, Editing by Franklin Paul)

[14]

Trump, Nvidia talks to allow advanced AI chip sales in China will take time, CEO says

NVIDIA Corporation is the world leader in the design, development, and marketing of programmable graphics processors. The group also develops associated software. Net sales break down by family of products as follows: - computing and networking solutions (77.8%): data center platforms and infrastructure, Ethernet interconnect solutions, high-performance computing solutions, platforms and solutions for autonomous and intelligent vehicles, solutions for enterprise artificial intelligence infrastructure, crypto-currency mining processors, embedded computer boards for robotics, teaching, learning and artificial intelligence development, etc.; - graphics processors (22.2%): for PCs, game consoles, video game streaming platforms, workstations, etc. (GeForce, NVIDIA RTX, Quadro brands, etc.). The group also offers laptops, desktops, gaming computers, computer peripherals (monitors, mice, joysticks, remote controls, etc.), software for visual and virtual computing, platforms for automotive infotainment systems and cloud collaboration platforms. Net sales break down by industry between data storage (78%), gaming (17.1%), professional visualization (2.5%), automotive (1.8%) and other (0.6%). Net sales are distributed geographically as follows: the United States (44.3%), Taiwan (22%), China (16.9%) and other (16.8%).

[15]

Exclusive-Chinese firms still want Nvidia chips despite government pressure not to buy, sources say

(Reuters) -Alibaba, ByteDance and other Chinese tech firms remain keen on Nvidia's artificial intelligence chips despite regulators in Beijing strongly discouraging them from such purchases, four people with knowledge of procurement discussions said. They want reassurance that their orders of Nvidia's H20 model, which the U.S. firm in July regained permission to sell in China, are being processed, and are closely monitoring Nvidia's plans for a more powerful chip, tentatively named the B30A and which is based on its Blackwell architecture, two of the people said. The B30A - if approved for sale by Washington - is likely to cost about double the H20, which currently sells for between $10,000 and $12,000, those two people said. Chinese tech firms perceive the potential B30A pricing, reported by Reuters for the first time, as a good deal, they added. One said the B30A promises to be up to six times more powerful than the H20. Both chips are downgraded versions of models sold outside China, developed specifically to comply with U.S. export restrictions. All sources for this article were not authorised to speak to media and declined to be identified. The extent to which China, which generated 13% of Nvidia's revenue in the past financial year, can have access to cutting-edge AI chips is one of the biggest flashpoints in the U.S.-Sino war for tech supremacy. On one hand, the U.S. has retreated from its previous position of more severe restrictions on Nvidia sales of advanced chips to China. Nvidia and other critics of the controls say it is better if Chinese firms continue to use its chips - which work with Nvidia's software tools - so that developers do not completely switch over to offerings from rivals like Huawei. U.S. President Donald Trump has also struck a deal with Nvidia for it to give the U.S. government 15% of its H20 revenue. At the same time, China is keen for its tech industry to wean itself off U.S. chips. Chinese authorities have summoned companies, including Tencent and ByteDance, over their purchases of the H20, asking them to explain their reasons and expressing concerns over information risks, sources said last month. They have, however, not been ordered to cease purchases of Nvidia products. LIMITED DOMESTIC CHIP SUPPLY Despite that pressure, demand for Nvidia chips remains strong in China due to constrained supplies of products from domestic rivals such as Huawei and Cambricon, the four sources said. Another three sources who are involved in engineering operations at Chinese tech firms also said Nvidia's chips perform better than domestic products. Alibaba, ByteDance and Tencent did not reply to Reuters requests for comment. Huawei and Cambricon also did not respond to Reuters queries. Asked about its position versus rivals in China, Nvidia said in a statement that the "competition has undeniably arrived." It declined further comment. Lack of clarity about Nvidia's prospects in China led the U.S. firm in late August to issue a tepid quarterly sales forecast that excluded potential revenue from the world's second-biggest economy. The company, the most valuable in the world, has seen its stock lose 6% since then. During its earnings call, Nvidia executives said the company had received some export licenses for H20 but had yet to commence shipping because it was sorting out some issues related to the deal to give the U.S. government a portion of its China sales. Nvidia CEO Jensen Huang has also assured Chinese customers not to worry about the H20's availability and has told suppliers that demand remains strong, two of the sources said. Reuters reported in July that Nvidia has an inventory of 600,000-700,000 H20 chips and had asked TSMC to produce more. Sources have also said Nvidia is hoping to deliver samples of the B30A to Chinese clients for testing as early as September. Huang estimates that the China market could be worth $50 billion to Nvidia if it were able to offer competitive products. (Reporting by Fanny Potkin, Liam Mo and Brenda Goh; Editing by Miyoung Kim and Edwina Gibbs)

Share

Share

Copy Link

Nvidia's plans for a new AI chip for the Chinese market face geopolitical challenges and regulatory hurdles, while Chinese tech firms remain eager for advanced AI hardware despite government pressure.

Nvidia's Next-Generation AI Chip for China

Nvidia is developing a new AI chip, tentatively named B30A, as a replacement for its China-market H20 model. The B30A is expected to be significantly more powerful and expensive than its predecessor, with sources indicating it could be priced between $20,000 and $25,000, roughly double the cost of the H20

1

. Despite the price increase, many Chinese companies, including ByteDance (TikTok's owner), are eager to acquire Nvidia's latest chips, considering them a good value4

.

Source: TweakTown

Geopolitical Tensions and Regulatory Hurdles

The development and potential sale of the B30A chip to China are complicated by ongoing geopolitical tensions between the United States and China. Nvidia CEO Jensen Huang has stated that discussions with the White House regarding the sale of a less advanced version of the next-generation Blackwell chip to China will "take a while"

2

. President Trump has suggested allowing Nvidia to sell a scaled-down version of the chip in China, which would be 30-50% less capable than the regular version3

.

Source: ET

Chinese Market Demand and Government Pressure

Despite pressure from Chinese regulators discouraging the purchase of Nvidia chips, major Chinese tech firms such as Alibaba and ByteDance remain interested in acquiring these advanced AI processors. These companies are seeking reassurance that their orders for the H20 model, which Nvidia recently regained permission to sell in China, are being processed

4

.Domestic Alternatives and Market Competition

The Chinese government has been promoting the use of domestic chips to reduce reliance on US technology. However, sources indicate that demand for Nvidia chips remains strong due to limited supplies of products from domestic rivals like Huawei and Cambricon. Engineering experts at Chinese tech firms also report that Nvidia's chips outperform domestic products

4

.Related Stories

Nvidia's Market Strategy and Challenges

Nvidia faces a complex situation in balancing its business interests with regulatory compliance. The company has developed the H20 and potential B30A chips as downgraded versions of models sold outside China to comply with US export restrictions. Nvidia CEO Jensen Huang argues that allowing American companies to sell AI chips in China helps the US set standards and win the global AI race

5

.

Source: Benzinga

Financial Implications and Future Outlook

The Chinese market represents a significant opportunity for Nvidia, with Huang estimating its potential value at $50 billion. However, ongoing regulatory challenges have led to uncertainty, causing Nvidia to issue a cautious quarterly sales forecast that excluded potential revenue from China

4

. As negotiations continue and the geopolitical landscape evolves, the future of Nvidia's advanced AI chip sales in China remains uncertain, with implications for both the company's growth and the broader AI technology market.References

Summarized by

Navi

[1]

[4]

Related Stories

Chinese Tech Giants Invest $16 Billion in NVIDIA's H20 AI GPUs Amid US Export Restrictions

03 Apr 2025•Business and Economy

Chinese Tech Giants Pivot to Homegrown AI Chips Amid US Export Controls

30 May 2025•Technology

Nvidia prepares to ship up to 80,000 H200 AI chips to China as political hurdles loom

22 Dec 2025•Policy and Regulation

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

Anthropic takes Pentagon to court over unprecedented supply chain risk designation

Policy and Regulation

3

Meta smart glasses face lawsuit and UK probe after workers watched intimate user footage

Policy and Regulation