Nvidia Faces Intensifying AI Chip Competition as Citi Lowers Price Target

3 Sources

3 Sources

[1]

Nvidia gets a price target cut from Citi as competition in AI arena grows

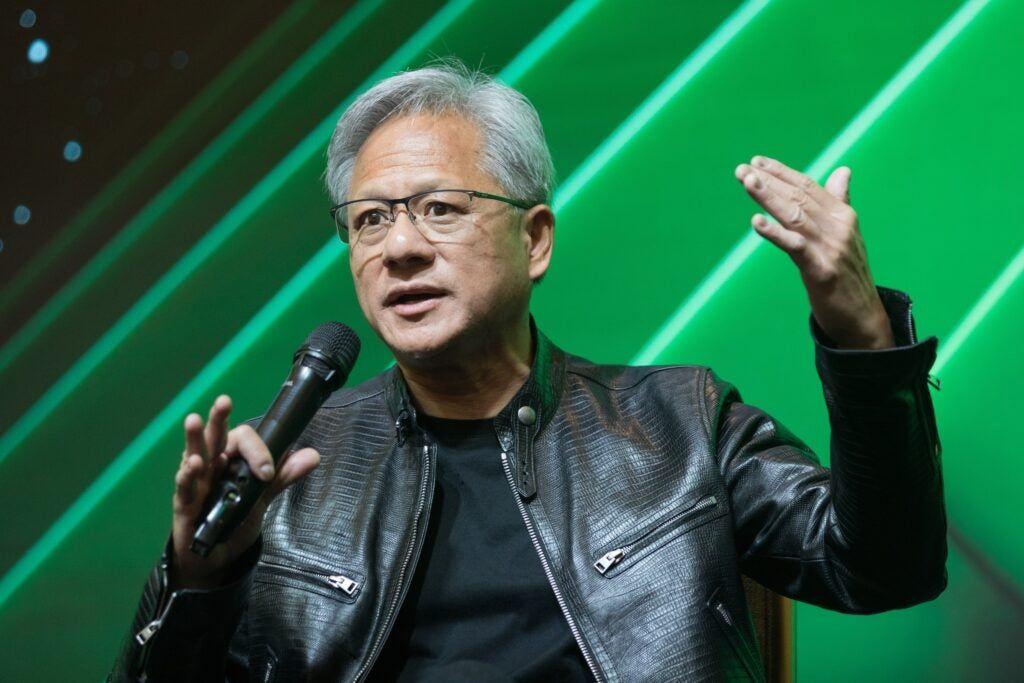

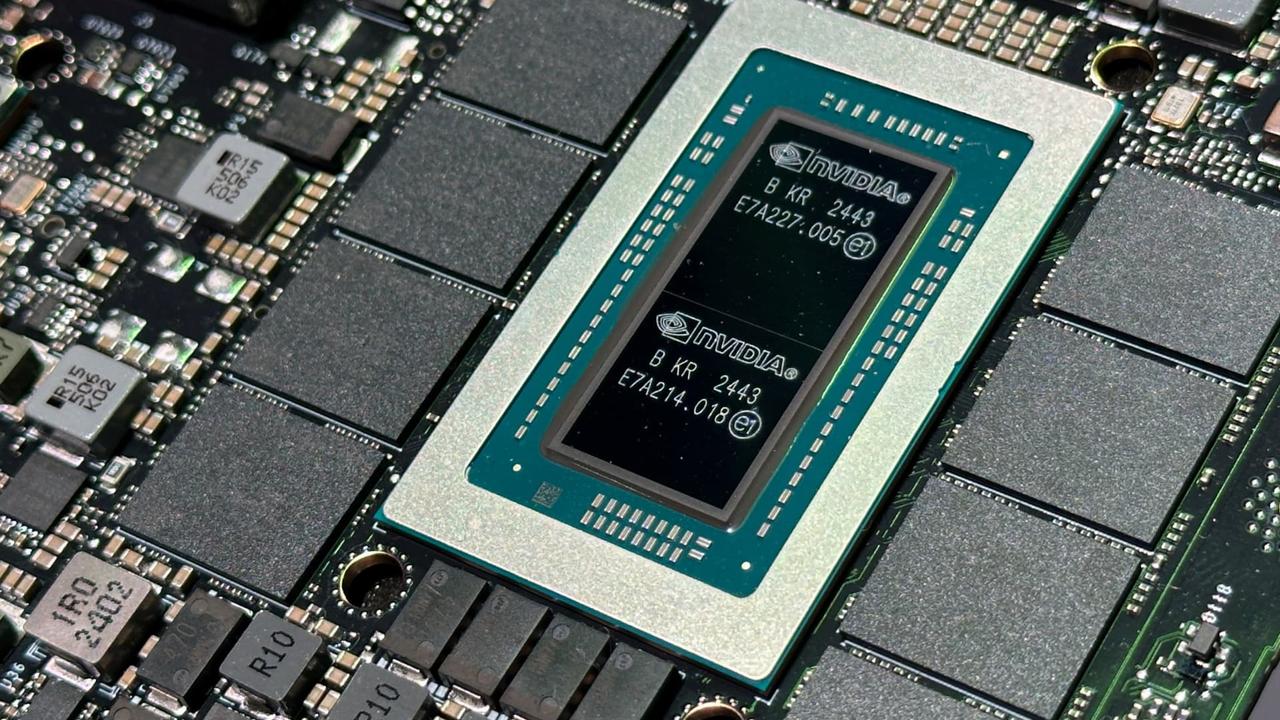

Nvidia's moat is under threat by other artificial intelligence chipmakers, according to Citi. Analyst Atif Malik kept his buy rating on Nvidia but trimmed his price target by $10 to $210. His new target suggests that shares of the tech giant, which are up 24.4% this year, could see 19.7% additional upside from Friday's close. Malik's lower target comes after Broadcom's quarterly results last week reflected strong year-over-year growth. The company also announced a $10 billion order of custom AI chips, which the company calls XPUs, from a fourth mystery customer. On the back of these results, Malik said he expects Nvidia to report roughly 4% lower 2026 GPU sales than previously estimated. He said growing competition from Broadcom could be fueled by Google's increasingly competitive tensor processing units, or TPUs, that are a growing threat to sales of Nvidia's Graphics Processing Units. NVDA 1Y mountain Nvidia stock performance over the past year. "We previously expected the AI XPU chip sales to outpace GPU sales in 2026 and view Broadcom's comments of faster XPU adoption likely driven by Google's shift in indirectly competing with Nvidia to offer compute capacity to its rivals like Meta, Open AI, and Oracle, a risk we flagged recently," Malik wrote in a Monday note to clients. "We estimate ~$12B GPU sales impact to Nvidia's 2026 sales from the above deals." The next key event for Nvidia is CEO Jensen Huang's GTC keynote speech scheduled for Oct. 28. Shares of Nvidia have slid about 8.6% over the past month after the company's data center revenue grew slightly less than expected in the second quarter. Concerns are also growing about Nvidia's clientele, as top two customers made up 39% of its total revenue in its July quarter. Malik noted that his calendar year 2025 and 2026 estimates on Nvidia are still slightly above the consensus, driven by growth in spending tied to neoclouds and sovereign AI , the latter referring to deals involving specific nations producing and controlling its own AI infrastructure. His estimates do not include China, which he said could be a source of upside if Nvidia resumes GPU shipments to the country.

[2]

What happened? Analyst slashes Nvidia stock target despite year-to-date gains

Nvidia stock price target 2025: Nvidia, despite its AI chip dominance, faces Wall Street concerns as Citi lowers its stock target due to rising competition and missed data center revenue expectations. Broadcom's growing XPU market share, fueled by custom AI chip orders, poses a significant challenge. While China sales could offer an upside, Citi trims its 2026 GPU sales forecast by $12 billion. Nvidia stock price target 2025: After Nvidia's being one of the top stock performers of 2024 due to the AI boom, the chipmaker had a rough start this year, including tariff uncertainty, the US tightening export restrictions on advanced chips, and a broader market uncertainty around tech valuations. While some of its pressures have eased, like Nvidia signed a deal with the US government to start its sales in China for a fee of 15% of the sales. But even after continued dominance in the AI chip market, Nvidia is facing renewed pressure from Wall Street. ALSO READ: Broadcom Q3 earnings beat expectations driven by AI revenue - can its custom chips challenge Nvidia? Citi analyst Atif Malik has lowered his price target on the AI chipmaker's stock from $210 to $200, citing rising competition, and this comes after the firm missed revenue expectations in a critical business segment, as per a report. The downgrade comes even though Nvidia shares remain up 25% year to date, following a massive 171% surge in 2024 driven by the explosive demand for generative AI technologies like ChatGPT, as per The Street. ALSO READ: Apple iPhone 17 & iPhone Air Accessories: Clear and silicone cases in multiple colors, crossbody strap, MagSafe battery and more! Nvidia reported its Q2 earnings on August 27, showing revenue of $46.74 billion, beating Wall Street estimates. Profits also came in strong at $1.05 per share, ahead of expectations. But investors were less enthusiastic about one key detail: for the second quarter in a row, Nvidia's data center revenue, its most crucial growth driver, missed expectations, according to The Street. That miss appears to have left a mark. Since the earnings report, Nvidia's stock has dropped more than 7%, reported The Street. ALSO READ: After firing thousands, Oracle's Larry Ellison could overtake Musk as the richest person today as stock skyrockets In his Monday note, Malik pointed to growing pressure from custom AI chip solutions, especially Broadcom's next-generation XPUs, which recently secured a massive $10 billion order, according to the report. He said that while Nvidia's GPUs still command more than 85% of AI compute sales, the emerging XPU market is growing faster and could outpace GPU growth by 2026, as per The Street. Malik wrote, "While GPUs will continue to dominate the AI compute market with an 85%+ sales share, we believe the XPU market accelerates year-over-year into 2026," as quoted in the report. The analyst forecasted that XPU sales will grow 53% in 2026, compared to 34% growth for GPUs, which would be driven largely by adoption from Google, Meta, and Amazon, as reported by The Street. ALSO READ: Kamala Harris blasts Joe Biden, her former boss - calls his solo reelection decision reckless in new book As a result, Citi now estimates around $12 billion less in GPU sales for 2026 than it had previously modeled, including a $2 billion reduction from Meta, according to the report. That implies about a 5% hit to its prior $232 billion forecast for 2026 merchant GPU sales, as reported by The Street. He added that, "Importantly, our estimates do not include China, which could be a source of upside if and when Nvidia restarts GPU shipments to China," as quoted by The Street. Why did Citi lower its price target on Nvidia stock? Due to missed data center revenue expectations and rising competition from custom chipmakers like Broadcom. How much did Nvidia's stock fall after the earnings report? Shares dropped more than 7% since the August 27 earnings release.

[3]

Analyst Slashes Nvidia Price Target Amid Broadcom's Recent Gains, Warns Lower GPU Sales In 2026 - Alphabet (NASDAQ:GOOG), Broadcom (NASDAQ:AVGO)

Nvidia Corporation NVDA has seen its price target slashed by Citi due to increasing competition in the artificial intelligence (AI) chip market. Citi Downgrades Nvidia to $210 Amid Rising Chip Competition Citi analyst Atif Malik has downgraded Nvidia's stock from $220 to $210, citing the rise of rival AI chipmakers, CNBC reported. This new target still suggests a 19.7% upside from the current share price. Check out the current price of NVDA stock here. Malik's decision was influenced by the recent strong performance of Broadcom Inc. AVGO, a major player in the AI chip market. The company's Q3 results showed significant growth, and they secured a $10 billion order for custom AI chips from an undisclosed client. Malik predicts that Nvidia's 2026 GPU sales will be about 4% lower than previously estimated due to increasing competition from Broadcom, particularly from Google's TPUs. He also noted that Nvidia's top two clients accounted for 39% of its total revenue in the July quarter, raising concerns about the company's customer base. "We estimate ~$12B GPU sales impact to Nvidia's 2026 sales from the above deals," stated the analyst note. Malik stated that they had previously expected AI XPU chip sales to outpace GPU sales in 2026 and viewed Broadcom's comments on faster XPU adoption -- likely driven by Google's shift in indirectly competing with Nvidia to provide compute capacity to rivals such as Meta, OpenAI, and Oracle -- as a risk they had recently flagged. See Also: Bitcoin To Hold $110,000 Through September, Analyst Says -- What About Ethereum, XRP, AVAX? - Benzinga Broadcom Emerges As A Key Rival To Nvidia In AI Chips The AI chip market has been heating up, with Broadcom emerging as a formidable competitor to Nvidia. Broadcom's collaboration with Google GOOG (GOOGL) on the Ironwood TPU project is expected to generate over $15 billion in revenue, solidifying Broadcom's position in the AI acceleration game. Moreover, Nvidia's grip on the AI ecosystem has been further challenged by OpenAI's $10 billion deal with Broadcom to co-design and mass-produce its own AI chips. This move signals a significant shift away from Nvidia's AI hardware dominance and has the potential to reshape the AI hardware landscape. Despite these challenges, major Chinese technology firms continue to seek out Nvidia's AI chips. This demand, despite Beijing's pressure to adopt domestic alternatives, could be a potential source of upside for Nvidia if GPU shipments to China resume. Nvidia's next major event is CEO Jensen Huang's GTC keynote, set for October 28. Benzinga Edge Stock Rankings shows that Nvidia had a strong price trend over the medium and long term, and a weak trend over the short term. Check the detailed report here to assess the other ratings. READ NEXT: Eightco Chair Dan Ives Calls Sam Altman's World Project The 'Intersection Of AI And Crypto,' Compares It To Nvidia, Palantir Image via Shutterstock Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. AVGOBroadcom Inc$350.261.33%Stock Score Locked: Edge Members Only Benzinga Rankings give you vital metrics on any stock - anytime. Unlock RankingsEdge RankingsMomentum94.99Growth34.63Quality89.85Value5.83Price TrendShortMediumLongOverviewGOOGAlphabet Inc$233.85-0.13%NVDANVIDIA Corp$169.700.83%Market News and Data brought to you by Benzinga APIs

Share

Share

Copy Link

Citi analyst cuts Nvidia's price target due to growing competition in the AI chip market, particularly from Broadcom and Google. The move highlights potential shifts in the AI hardware landscape and raises questions about Nvidia's future market dominance.

Nvidia's Market Position Under Pressure

Nvidia, the dominant force in AI chip manufacturing, is facing increased scrutiny from Wall Street as competition in the artificial intelligence arena intensifies. Citi analyst Atif Malik has lowered Nvidia's price target from $220 to $210, signaling growing concerns about the company's market position

1

3

.

Source: ET

Rising Competition from Broadcom and Google

The price target cut comes in the wake of Broadcom's strong quarterly results and a significant $10 billion order for custom AI chips from an undisclosed customer. This development, coupled with Google's increasingly competitive tensor processing units (TPUs), poses a substantial threat to Nvidia's Graphics Processing Units (GPUs) sales

1

.Malik predicts that Nvidia's 2026 GPU sales could be approximately 4% lower than previously estimated due to this growing competition. He anticipates that AI XPU (accelerated processing unit) chip sales may outpace GPU sales by 2026, driven by adoption from major tech players like Google, Meta, and Amazon

2

.Impact on Nvidia's Future Sales

The analyst estimates a significant $12 billion reduction in Nvidia's 2026 GPU sales compared to previous projections. This includes a $2 billion reduction from Meta alone, implying about a 5% hit to the prior $232 billion forecast for 2026 merchant GPU sales

2

.Related Stories

Nvidia's Recent Performance and Challenges

Despite the price target cut, Nvidia's stock has shown resilience, with shares up 24.4% year-to-date. However, the company has faced challenges, including missed expectations in data center revenue for two consecutive quarters. Concerns are also growing about Nvidia's client concentration, with its top two customers accounting for 39% of total revenue in the July quarter

1

2

.Potential Upside and Future Outlook

While the competitive landscape is evolving, Nvidia still maintains a dominant position, commanding over 85% of AI compute sales. The company's future performance may also benefit from potential GPU shipments to China, which could provide an upside if resumed

1

3

.Investors and industry watchers are now looking forward to CEO Jensen Huang's GTC keynote speech scheduled for October 28, which may provide further insights into Nvidia's strategy to maintain its market leadership in the face of growing competition

1

.

Source: Benzinga

References

Summarized by

Navi

Related Stories

Nvidia's Stock Soars as Citi Raises Price Target, Citing Expanding AI and Sovereign AI Opportunities

08 Jul 2025•Business and Economy

Nvidia's Blackwell GPU Platform Poised to Drive Future Growth Amid AI Boom

03 Oct 2024•Technology

NVIDIA Faces Setback as Citi Cuts Estimates Amid AI Chip Delay Reports

05 Aug 2024

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy