Nvidia Faces Hurdles in Resuming H20 AI Chip Sales to China Despite Export Ban Lift

5 Sources

5 Sources

[1]

Nvidia's China restart faces production obstacles, The Information reports

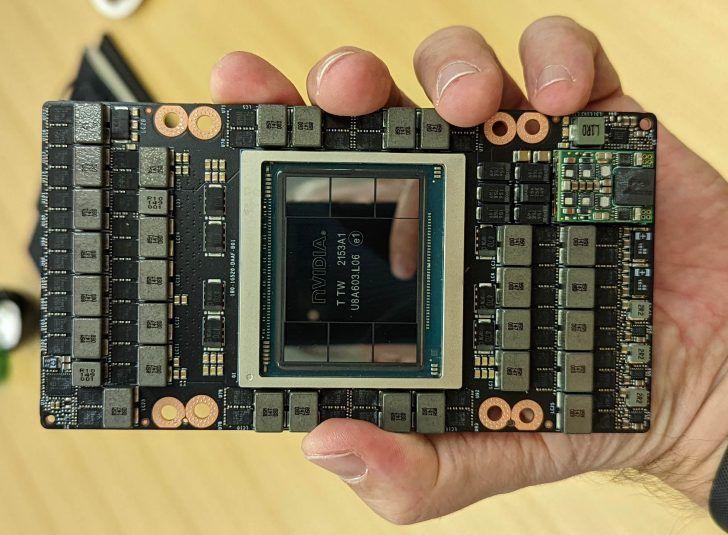

July 19 (Reuters) - Nvidia (NVDA.O), opens new tab has told its Chinese customers it has limited supplies of H20 chips, the most powerful AI chip it had been allowed to sell to China under U.S. export restrictions, and that it doesn't plan to restart production, The Information reported on Saturday. The U.S. government's April ban on sales of the H20 chips forced Nvidia to void customer orders and cancel manufacturing capacity it had booked at Taiwan Semiconductor Manufacturing (2330.TW), opens new tab which makes the chips, the report said, citing two people with knowledge of the matter. Nvidia said this week that it was planning to resume sales of the H20 chips to China. Reporting by Angela Christy in Bengaluru; Editing by Aidan Lewis Our Standards: The Thomson Reuters Trust Principles., opens new tab

[2]

No near-term lifeline from China for Nvidia's H20 chips

Nvidia investors should expect a slow, methodical China recovery and not a near-term sales spike. Earlier this month, the company announced plans to resume sales of H20 chips to China . The less-advanced semiconductors, built on its Hopper architecture, are designed for artificial intelligence computing, but remain compliant with U.S. export restrictions to China. However, a report in The Information suggested Nvidia is facing production delays in restarting H20 shipments to China. The report flags logistical setbacks, but Nvidia has already outlined a similiar timeline , indicating that revenue from these chips will likely be negligible until at least the fourth quarter. Analysts at Morgan Stanley, Piper Sandler, and Rosenblatt cite a mix of hurdles: export licenses are still pending, previous orders were canceled , and Nvidia has little finished inventory. The company's supply chain also takes nine months to ramp. "We would keep near-term expectations in check, given licenses have not yet been issued, and we see questions around available supply of H20 and whether RTX chips (formerly B30/B40) will also be included, but it is a significant positive for 2026 for all AI stocks, including our Top Pick NVDA," Morgan Stanley analyst Charlie Chan wrote in a research note Sunday. NVDA YTD mountain Nvidia shares year to date Nvidia shares have risen 24% year to date, with a nearly 6% gain so far this month. To propel future gains, investor attention is likely to continue shifting toward Nvidia's next-gen Blackwell-based RTX chips, potentially accelerating a move away from the older Hopper line. For now, the path to recovery in China is more about rebuilding momentum than generating near-term upside - with the potential for a more material revenue impact starting next year.

[3]

NVIDIA Won't Restart China H20 AI Chip Production, Says Report

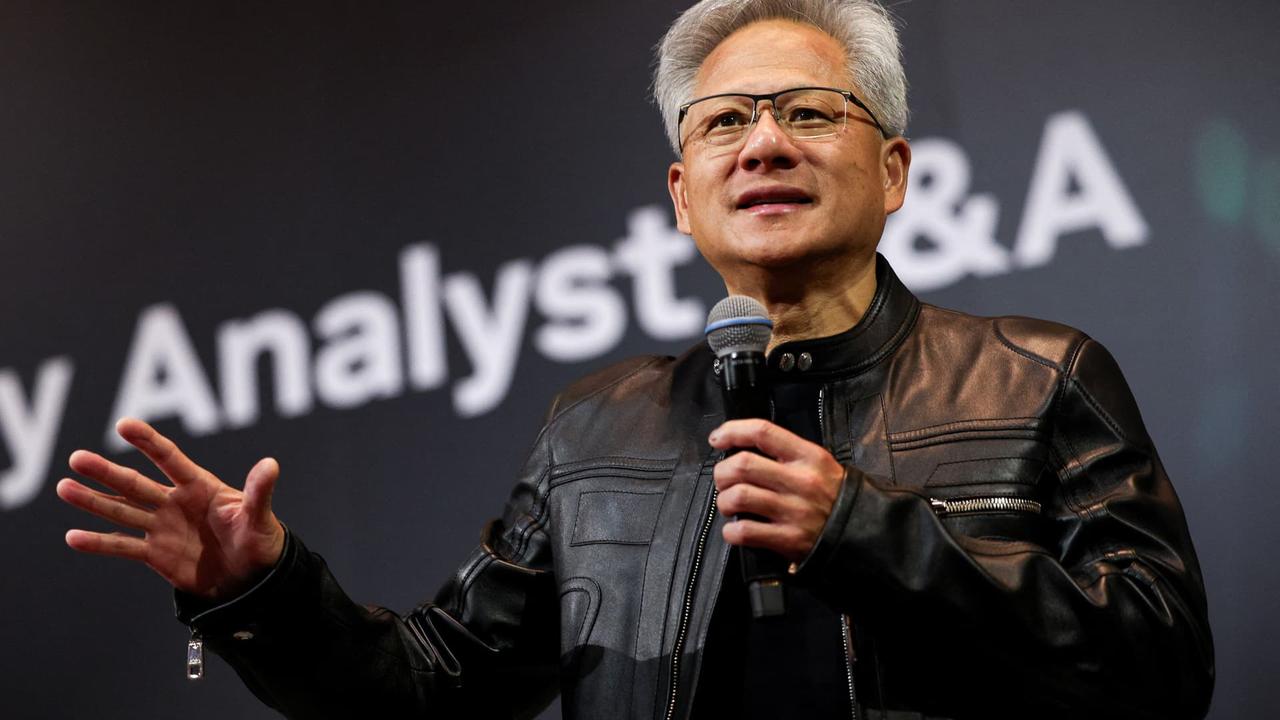

AI chip giant NVIDIA Corporation is finding it difficult to fulfill orders of its China-specific H20 GPU after the Trump administration decided to relax restrictions and grant export control licenses of the chip. While the H20 is NVIDIA's latest AI GPU that is cleared to be sold to Chinese firms, it is still behind the firm's leading-edge products in terms of performance. As a result, most of the firm's production contracts focus on newer or more powerful chips to create constraints, and a new report from The Information suggests that NVIDIA doesn't plan to restart the production of the China-specific GPUs. NVIDIA's announcement that it was expecting the Trump administration to grant licenses for its H20 GPUs came as CEO Jensen Huang was visiting China. The news of H20 sales resuming in China generated reports that NVIDIA might face difficulties in fulfilling all the orders it was receiving in China. Huang was asked about the potential difficulties and responded that NVIDIA might find it harder to recover some of its written-off inventory. "We'll compare what customers would like to buy now vs inventory we have," said the executive and added that "it's probably not 100%, but it's not 0% either." Now, a fresh report from The Information suggests that NVIDIA might not restart its H20 production as the lines dedicated to the China-specific GPU by contract chip manufacturer TSMC have been repurposed for other chips. The firm's existing inventory includes finished H20 chips as well as those that are yet to be packaged. The Information refers to the latter as "wafers in production," but it is unclear which production stage the publication is referring to. The report adds that prior to the Trump administration's decision to require, NVIDIA had been designing an upgrade to the H20 for its Chinese customers. The H20 is a toned-down version of NVIDIA's GPUs that are designed with the Hopper architecture. The firm's latest GPUs are its Blackwell lineup, which are currently shipping to countries and companies that are not subject to US AI GPU restrictions. Market reports have also suggested NVIDIA is developing a Blackwell-specific chip for its Chinese customers. CEO Huang has left the option of selling advanced chips to China open but accepted that the sales will depend on US approval. Today's report also suggests that NVIDIA might be facing memory chip constraints from SK hynix as the Korean memory company has informed NVIDIA that it might find it difficult to supply higher-end memory chips for the newer H20 GPUs that NVIDIA might ship to China. With NVIDIA's earnings now due, the firm has entered its quiet period and cannot comment on market rumors. Investors will eagerly watch the numbers to determine the extent of tailwinds that the firm could generate from resuming sales to China, among other variables, including cost control, at the upcoming results.

[4]

NVIDIA's Partners Struggle to Restart H20 AI Chip Production Amid Crowded Fabs -- What's Next for Jensen and China?

While the news of NVIDIA's H20 AI chip ban getting lifted was a great one for many of us out there, it seems like there are a lot of "unnoticed" complications associated with production. For those unaware, NVIDIA CEO Jensen Huang announced last week that the Trump administration is set to give the "green signal" to sell H20 AI chips to China, and initially, the firm will rely on its inventory to cater to the demand. However, given that China's AI market has been restricted from accessing NVIDIA's chips for so long, the need for high-end chips is certainly there, but according to a report from the Ctee, Team Green and its suppliers are facing production issues, since many of them had adjusted their fabs for other products, after the initial export controls came in. While the markets are anticipating that NVIDIA will see billions being flown into the company's revenue from China, that might not be the case, at least for a few quarters. It is claimed that firms like TSMC are showing reluctance towards restarting production for wafers needed for the H20 AI chip, saying that the demand for other nodes is currently massive, and even if production lines are prepared for NVIDIA's H20 chips, the time for them to enter the market would be pretty far ahead, which means that Team Green cannot capitalize on the demand. It is said that if the AI supply chain doesn't see the inflow of massive orders of the H20 AI chip, restarting production would have complications. According to estimates by various investment firms, NVIDIA is currently anticipating shipping out millions of units of the H20 AI chip, much of which will come from the company's existing inventory. However, in terms of newer units, the market isn't certain for now, however, based on our estimates, here's one way NVIDIA's business in China could pan out in the future. What could happen is that NVIDIA might initially target clearing the H20 inventory to recover the write-offs that happened last quarter and then shift focus to an entirely new solution for the domestic markets. According to reports over the past week, NVIDIA is anticipated to rely on multiple solutions for China's AI market, including the B20 AI chip, RTX PRO 6000D, and the B30 AI chip, all targeting different streams of the market. This way, suppliers could open up newer production lines, and instead of relying on the H20 chip, NVIDIA could try something different. While the future does look optimistic for NVIDIA, it is expected that there will be uncertainty in the company's business in China at least by year-end, since restarting H20 production would be complicated for NVIDIA and its suppliers.

[5]

Nvidia's China restart faces production obstacles, The Information reports

(Reuters) -Nvidia has told its Chinese customers it has limited supplies of H20 chips, the most powerful AI chip it had been allowed to sell to China under U.S. export restrictions, and that it doesn't plan to restart production, The Information reported on Saturday. The U.S. government's April ban on sales of the H20 chips forced Nvidia to void customer orders and cancel manufacturing capacity it had booked at Taiwan Semiconductor Manufacturing which makes the chips, the report said, citing two people with knowledge of the matter. Nvidia said this week that it was planning to resume sales of the H20 chips to China. (Reporting by Angela Christy in Bengaluru; Editing by Aidan Lewis)

Share

Share

Copy Link

Nvidia encounters production obstacles and supply constraints as it attempts to restart sales of H20 AI chips to China following the relaxation of U.S. export restrictions.

Nvidia's Challenges in Resuming H20 AI Chip Sales to China

Nvidia, the AI chip giant, is encountering significant obstacles in its efforts to resume sales of H20 AI chips to China following the relaxation of U.S. export restrictions. Despite the company's recent announcement of plans to restart sales, various factors are complicating the process and potentially delaying substantial revenue impact until 2026

1

2

.

Source: Wccftech

Production and Supply Constraints

According to reports from The Information, Nvidia has informed its Chinese customers that it has limited supplies of H20 chips and does not plan to restart production

1

5

. The company's supply chain was disrupted when the U.S. government imposed a ban on H20 chip sales to China in April, forcing Nvidia to void customer orders and cancel manufacturing capacity it had booked with Taiwan Semiconductor Manufacturing (TSMC)1

5

.Logistical Setbacks and Timeline

While Nvidia CEO Jensen Huang announced the expected granting of export control licenses for H20 chips, the company faces several hurdles in meeting Chinese demand

2

3

:- Export licenses are still pending approval

- Previous orders were canceled, requiring renegotiation

- Nvidia has limited finished inventory

- The company's supply chain typically takes nine months to ramp up production

These factors suggest that revenue from H20 chip sales to China will likely be negligible until at least the fourth quarter of 2025

2

.Related Stories

Production Line Repurposing and Memory Constraints

Source: Wccftech

Reports indicate that TSMC, Nvidia's contract chip manufacturer, has repurposed production lines previously dedicated to H20 chips for other products

3

. This shift in manufacturing priorities creates additional challenges for Nvidia in restarting H20 production.Furthermore, Nvidia may face memory chip constraints from SK hynix, as the Korean memory company has reportedly informed Nvidia of potential difficulties in supplying higher-end memory chips for newer H20 GPUs destined for China

3

.Market Expectations and Future Outlook

Analysts from Morgan Stanley, Piper Sandler, and Rosenblatt suggest keeping near-term expectations in check due to the various challenges Nvidia faces

2

. While the resumption of H20 sales to China is seen as a positive development for AI stocks, including Nvidia, the impact is more likely to be significant in 2026 rather than the immediate future2

.Investor attention may shift towards Nvidia's next-generation Blackwell-based RTX chips, potentially accelerating a move away from the older Hopper line, which includes the H20

2

3

. Reports also suggest that Nvidia is developing a Blackwell-specific chip for its Chinese customers, subject to U.S. approval3

.

Source: CNBC

As Nvidia enters its quiet period ahead of earnings announcements, investors will be closely watching the numbers to gauge the potential tailwinds from resumed sales to China, among other variables

3

4

. The path to recovery in the Chinese market appears to be more about rebuilding momentum than generating immediate upside, with the potential for a more substantial revenue impact starting next year2

.References

Summarized by

Navi

[5]

Related Stories

Nvidia's AI Chip Strategy in China: Navigating Geopolitical Tensions and Domestic Competition

19 Aug 2025•Technology

Nvidia Navigates US-China Tensions with Potential New AI Chip for Chinese Market

22 Aug 2025•Technology

Nvidia's Strategic Moves in China: New GPUs and Export Control Navigation

16 Jul 2025•Technology

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy