Nvidia Propels Nasdaq to Record High Amid Inflation Concerns and Bank Earnings

12 Sources

12 Sources

[1]

Nvidia powers Nasdaq to fresh record, as inflation and earnings data weigh elsewhere

July 15 (Reuters) - The Nasdaq Composite (.IXIC), opens new tab advanced to its latest record high on Tuesday, powered by a jump in heavyweight Nvidia's shares, while the other Wall Street benchmarks were sluggish as traders digested a key inflation report and a flurry of bank earnings. Should gains on the Nasdaq hold, it would be the fourth session in five that the technology-heavy index has posted a record close, and the eighth time since June 27. Markets have been buoyant in recent weeks. Investor concerns that the U.S. economy would be tarnished by President Donald Trump's policies, including major tariff announcements, have started to abate, allowing Wall Street to move higher. This week was expected to be a significant test of that improving sentiment, with the start of second-quarter earnings season and inflation reports that were forecast to reflect sellers starting to pass on higher tariff-related costs. The first of these reports showed U.S. consumer prices posted their biggest jump in five months in June, hinting that tariffs may be starting to heat up inflation. Still, underlying inflation stayed moderate, offering some reassurance despite the headline spike. "The CPI report came in a little better than expected, but it's backwards-looking, so the market is still concerned that there will be inflationary pressures building because of tariffs," said Chris Zaccarelli, chief investment officer at Northlight Asset Management. He added the news could be used by some investors to take profits after the recent good run, which would explain declines on both the S&P 500 (.SPX), opens new tab and the Dow Jones Industrial Average (.DJI), opens new tab. At 1:52 p.m. EDT, the Nasdaq Composite (.IXIC), opens new tab had gained 122.51 points, or 0.59%, to 20,762.84. However, the Dow Jones Industrial Average (.DJI), opens new tab fell 336.57 points or 0.76% to 44,123.08, and the S&P 500 (.SPX), opens new tab lost 5.93 points or 0.09% to 6,262.63. The Nasdaq's increase came primarily from artificial intelligence-chip leader Nvidia (NVDA.O), opens new tab, which rose 4% after unveiling plans to resume sales of its H20 AI chip to China. The news buoyed other chipmakers, with Advanced Micro Devices (AMD.O), opens new tab and Super Micro Computer (SMCI.O), opens new tab rising more than 6.7% each. The semiconductor index (.SOX), opens new tab also advanced 1.5%, to its highest point in a year, while the S&P technology index (.SPLRCT), opens new tab climbed by the same percentage to hit a record high. Meanwhile, Wall Street opened the second-quarter earnings season on a somber note, with banking stocks whipsawing in volatile trade. JPMorgan Chase (JPM.N), opens new tab slipped 0.7% despite raising its 2025 net interest income outlook, while Wells Fargo (WFC.N), opens new tab fell 6.3% even as its profit rose on reduced loan-loss reserves. BlackRock (BLK.N), opens new tab notched a new milestone, managing a record $12.53 trillion in assets amid optimism over trade deals and rate cuts, yet its shares slid 5.5%. The KBW Bank Index (.BKX), opens new tab sank to a two-week low, down 1.1%. Bucking the trend, Citigroup (C.N), opens new tab climbed 3.4% after its traders delivered a windfall that boosted second-quarter profit. Northlight's Zaccarelli said the differing share performance was less about Tuesday's broadly positive numbers and more a reflection of how they matched up with investors' existing expectations for each bank. In other news, at least four Fed officials including Board Governor Michael Barr were scheduled to speak on Tuesday, potentially offering fresh clues on the central bank's next steps. Hopes for a July rate cut have all but vanished, and bets on a September move dipped to 55% from 60% after the latest inflation data, according to CME FedWatch. Reporting by David French in New York; Additional reporting by Pranav Kashyap and Nikhil Sharma in Bengaluru; Editing by Pooja Desai, Maju Samuel and Matthew Lewis Our Standards: The Thomson Reuters Trust Principles., opens new tab

[2]

Nvidia makes history with $4 trillion market cap while markets brush off tariff worries

The S&P 500 rose 0.6%. The tech-heavy Nasdaq climbed 0.9%. While the Dow Jones ticked up 218 points, good for a 0.5% increase, after taking the worst of the two-day slump. Traders seemed to ignore this latest round of tariff news -- a stark contrast to their reaction in April when President Donald Trump's initial burst of tariff policies caused a broad market sell off that hit equities, the U.S. dollar, and the bond market. When tariffs returned to the forefront right before the July 4th holiday last week, investors had already braced themselves. Markets dipped a little but stayed largely in the range of their recent highs. Wednesday, July 9 marked the deadline for a 90-day pause on tariffs. However, Trump has since extended the deadline to Aug. 1. On Wednesday, the President sent "tariff letters" to seven new countries including the Philippines, Moldova, and Brunei. Asian markets were mostly down on the news of renewed tariff policies. Shangai's SSE Composite dipped 0.13%. Stocks in Hong Kong dropped 1.06% during the session. The ASX 200 and the NIFTY 50 slipped 0.61% and 0.18% respectively. A rare bright spot was the Nikkei which is up 0.33% on the day. Back in the U.S., stock market darling and semiconductor juggernaut Nvidia became the first company with a $4 trillion valuation. Shares rose 1.8% on Wednesday hitting a share price of $162.86. Nvidia became the poster child for the AI market rally that led the S&P 500 to back-to-back years of more than 20% growth. The company's shares shot up as soon as markets closed. Investors were eager to scoop up shares after shares fell slightly over the past week. After that initial exuberance, the price tailed off into before plateauing around 11a.m. Shares remained stable throughout the rest of the session. Nvidia beat other legendary tech giants in Apple and Microsoft to the $4 trillion mark. Since the start of the year Nvidia's stock is up 17%. Though that is a relatively calm year for the chipmaker, which has seen its stock rise 1,453% over the last five years.

[3]

Nasdaq ends at another record high on Nvidia's China chip cheer

Nasdaq achieved a record close, driven by Nvidia's stock surge. Other Wall Street indices faced declines. A key inflation report and bank earnings announcements occurred. Consumer prices saw a significant increase. Banking stocks experienced volatility. JPMorgan Chase's outlook improved. Wells Fargo's profit increased. BlackRock reached a new milestone. Citigroup's traders boosted profit. The Nasdaq Composite posted its latest record finish on Tuesday, supported by a jump in shares of heavyweight Nvidia, but the other Wall Street benchmarks dropped as a key inflation report and a flurry of bank earnings failed to excite investors. It was the fourth session in five that the technology-heavy Nasdaq index has posted a record close, and the eighth time since June 27. Artificial-intelligence chip leader Nvidia was the primary factor behind the Nasdaq's increase, gaining 4% after it unveiled plans to resume sales of its H20 AI chip to China. The news buoyed other chipmakers, with Advanced Micro Devices and Super Micro Computer both gaining more than 6.4%. The semiconductor index also advanced 1.3% to its highest point in a year, while the S&P technology index climbed by the same percentage to hit a record high. Rob Swanke, senior investment research analyst at Commonwealth Financial Network, said the Nvidia news meant that some investors, who had moved into other stocks due to technology's high valuations, were rotating back. "I would probably say it's a one-day pop," he added, noting that investors would be waiting for sales to be reflected in its earnings. The Nasdaq Composite gained 37.47 points, or 0.18%, to finish at 20,677.80. The Dow Jones Industrial Average fell 436.36 points, or 0.98%, to 44,023.29, and the S&P 500 lost 24.80 points, or 0.40%, to 6,243.76. Markets have been buoyant in recent weeks. Investor concerns that the U.S. economy would be tarnished by President Donald Trump's policies, including major tariff announcements, have started to abate, allowing Wall Street to move higher. This week was expected to be a significant test of that improving sentiment, with the start of second-quarter earnings season and inflation reports that were forecast to reflect sellers starting to pass on higher tariff-related costs. The first of these reports showed U.S. consumer prices posted their biggest jump in five months in June, hinting that tariffs may be starting to heat up inflation. Still, underlying inflation stayed moderate, offering some reassurance despite the headline spike. "The picture from inflation this morning, coming in a little bit higher than expected but pretty much in line, gives you some sense that the tariffs are starting to flow through into the economy," said Commonwealth's Swanke. "We'll get more concrete news, as we go through earnings, to see how companies are delivering the impact of higher tariffs." On the first day of second-quarter earnings season, banking stocks whipsawed in volatile trade. JPMorgan Chase slipped 0.7% despite raising its 2025 net interest income outlook, while Wells Fargo fell 5.5% even as its profit rose on reduced loan-loss reserves. BlackRock notched a new milestone for assets under management, yet its shares slid 5.9%. Bucking the trend, Citigroup climbed 3.7% to its highest finish since the global financial crisis, after its traders delivered a windfall that boosted second-quarter profit. The number of shares changing hands on U.S. exchanges on Tuesday was 16.82 billion, compared with the 17.55 billion average for the last 20 trading days.

[4]

S&P 500, Nasdaq poised to climb after inflation data; focus on bank earnings

(Reuters) - The Nasdaq and the S&P 500 were poised for a higher open on Tuesday after fresh inflation data, while banking heavyweights kicked off the second-quarter earnings season. A Labor Department report showed U.S. consumer prices rose as expected on a monthly basis in June. Annually, the prices rose 2.7%, compared with an estimated 2.6% rise. The core figure, which excludes volatile food and energy components, rose 0.2% on a monthly basis and 2.9% from a year earlier, but the gains were below estimates. "There's little evidence that some of the tariff inflation is beginning to creep in," said Peter Cardillo, chief market economist at Spartan Capital Securities. "So, (the) bottom line (is), the tariff inflationary aspect still needs to be monitored." The odds of a July rate cut have almost become nil, while markets are still pricing in a roughly 60% chance of a move in September, according to CME FedWatch. At 8:42 a.m. ET, S&P 500 E-minis were up 23.75 points, or 0.38%, while the Dow E-minis were down 29 points, or 0.06%. Nasdaq 100 futures also rose 0.61%, powered by a jump in Nvidia after the chip designer announced plans to restart sales of its H20 AI chip to China. The company's shares were up 5% in premarket trading. The news also lifted other chipmakers, with Advanced Micro Devices rising 5.3%, while Marvell Technology and U.S.-listed shares of TSM rose 2.1% each. Wall Street kick-started another earnings season with major financial institutions reporting results. JPMorgan Chase's shares slipped 0.3%, even as the company lifted its net interest income forecast for 2025. Wells Fargo's profit rose in the second quarter as it set aside less money to shield for potential bad loans. However, its shares fell 3.6%. Meanwhile, BlackRock's assets under management touched a new high, hitting $12.53 trillion in the second quarter on prospects of trade deals and interest-rate cuts in the United States. Its shares were down 2.8%. Citigroup's profit jumped in the second quarter as its traders brought in a windfall from turbulent markets. The lender's shares rose 1%. Despite President Donald Trump's renewed tariff threats - this time aimed at Russia - markets largely brushed off the rhetoric, focusing instead on a breakthrough from negotiations with U.S. trade partners. Hopes were buoyed after Trump signaled willingness to talk, following his weekend warning of 30% tariffs on the European Union and Mexico from August 1. On Monday, all three indexes closed higher, with the Nasdaq finishing at a record high. Later in the day, at least four Fed officials, including Board Governor Michael Barr, are scheduled to speak, potentially offering fresh clues on the central bank's next steps. Among other movers, Trade Desk surged 12.7% after the software firm was set to join the benchmark S&P 500 index. (Reporting by Pranav Kashyap and Nikhil Sharma in Bengaluru; Editing by Maju Samuel and Shinjini Ganguli)

[5]

S&P 500, Nasdaq touch record highs as Nvidia jumps; data, bank results in focus

(Reuters) - The Nasdaq and the S&P 500 crept up to new record highs on Tuesday on the back of gains in Nvidia, while investors assessed a largely in-line inflation report and bank results that kicked off the second-quarter earnings season. A Labor Department report showed U.S. consumer prices rose as expected on a monthly basis in June. Annually, the prices rose 2.7%, compared with an estimated 2.6% rise. The core figure, which excludes volatile food and energy components, rose 0.2% on a monthly basis and 2.9% from a year earlier, but the gains were below estimates. "There's little evidence that some of the tariff inflation is beginning to creep in," said Peter Cardillo, chief market economist at Spartan Capital Securities. "So, (the) bottom line (is), the tariff inflationary aspect still needs to be monitored." The odds of a July rate cut have almost become nil, while markets pricing for a reduction in September lowered slightly to around 56%, according to CME FedWatch. At 09:51 a.m. ET, the S&P 500 gained 15.68 points, or 0.25%, to 6,284.24, and the Nasdaq Composite rose 142.25 points, or 0.69%, to 20,782.58. The Dow Jones Industrial Average fell 101.39 points, or 0.24%, to 44,353.40. The Nasdaq and the S&P 500 were boosted by AI-chip leader Nvidia, which surged 5% after unveiling plans to resume sales of its H20 AI chip to China. Other chipmakers also advanced, with Advanced Micro Devices surging 8% and Super Micro Computer rising 5%. The Philadelphia Semiconductor Index was up 2.1%. Wall Street kicked off second-quarter earnings with big banks in the spotlight. JPMorgan Chase slipped 1% despite boosting its 2025 net interest income outlook, while Wells Fargo shares tumbled 5%, even as its quarterly profit climbed on lower loan-loss reserves. Meanwhile, BlackRock set a new record with $12.53 trillion in assets under management amid hopes for trade deals and interest-rate cuts, but its shares dropped 6.2%. The KBW Bank index hit a two-week low and was last down 1.1%. Citigroup rose 1% after the lender's profit jumped in the second quarter as its traders brought in a windfall from turbulent markets. Despite President Donald Trump's renewed tariff threats - this time aimed at Russia - markets largely brushed off the rhetoric, focusing instead on a breakthrough from negotiations with U.S. trade partners. Hopes were buoyed after Trump signaled a willingness to talk following his weekend warning of 30% tariffs on the European Union and Mexico from August 1. At least four Fed officials including Board Governor Michael Barr are scheduled to speak later in the day, potentially offering fresh clues on the central bank's next steps. Among other movers, Trade Desk surged 11.4% after the software firm was set to join the benchmark S&P 500 index. Declining issues outnumbered advancers by a 1.09-to-1 ratio on the NYSE and by a 1.08-to-1 ratio on the Nasdaq. The S&P 500 posted 19 new 52-week highs and two new lows, while the Nasdaq Composite recorded 53 new highs and 27 new lows. (Reporting by Pranav Kashyap and Nikhil Sharma in Bengaluru; Editing by Maju Samuel, Shinjini Ganguli and Pooja Desai)

[6]

Nvidia powers Nasdaq to record high; S&P 500 lags as data, earnings parsed

(Reuters) -The Nasdaq cruised to a fresh record high on Tuesday, powered by a jump in Nvidia, while the S&P 500 hovered below its peak, as investors digested an inflation report and a flurry of major bank earnings. U.S. consumer prices posted their biggest jump in five months in June, hinting that tariffs may be starting to heat up inflation. Still, underlying inflation stayed moderate, offering some reassurance despite the headline spike. Hopes for a July rate cut have all but vanished, and bets on a September move dipped to 55% from 60% after the latest data, according to CME FedWatch. "It's (CPI data) perfectly in line with expecting the Fed to kind of re-engage on rate cuts at its September meeting," said Ross Mayfield, investment strategist at Baird. At 11:33 a.m. ET, the S&P 500 gained 0.71 points, or 0.01%, to 6,269.27, and the Nasdaq Composite rose 136.40 points, or 0.66%, to 20,776.73. The Dow Jones Industrial Average fell 251.28 points, or 0.57%, to 44,208.37. The Nasdaq was boosted by AI-chip leader Nvidia, which rose 4.4% after unveiling plans to resume sales of its H20 AI chip to China. Other chipmakers also advanced, with Advanced Micro Devices and Super Micro Computer rising more than 6% each. The technology sector rose 1.7% to hit a record high. Meanwhile, Wall Street opened the second-quarter earnings season on a somber note, with banking stocks whipsawing in volatile trade. JPMorgan Chase slipped 0.4% despite raising its 2025 net interest income outlook, while Wells Fargo fell 5% even as its profit rose on reduced loan-loss reserves. BlackRock notched a new milestone, managing a record $12.53 trillion in assets amid optimism over trade deals and rate cuts, yet its shares slid 5.4%. The KBW Bank Index sank to a two-week low, down 1.1%. Bucking the trend, Citigroup climbed 3% after its traders delivered a windfall that boosted second-quarter profits. Mayfield, referring to the banks' results, said "there must have been a higher bar to clear, but most of the reporters so far have beaten estimates, which is what you want to see." Despite President Donald Trump's renewed tariff threats - this time aimed at Russia - markets largely brushed off the rhetoric, focusing instead on a breakthrough from negotiations with U.S. trade partners. Hopes were buoyed after Trump signaled a willingness to talk following his weekend warning of 30% tariffs on the European Union and Mexico from August 1. At least four Fed officials including Board Governor Michael Barr are scheduled to speak later in the day, potentially offering fresh clues on the central bank's next steps. Nine of the 11 S&P 500 sectors were trading in the red. Among other movers, Trade Desk surged 9.7% after the software firm was set to join the benchmark S&P 500 index. Declining issues outnumbered advancers by a 2.65-to-1 ratio on the NYSE and by a 2.06-to-1 ratio on the Nasdaq. The S&P 500 posted 21 new 52-week highs and eight new lows, while the Nasdaq Composite recorded 64 new highs and 46 new lows. (Reporting by Pranav Kashyap and Nikhil Sharma in Bengaluru; Editing by Shinjini Ganguli, Pooja Desai and Maju Samuel)

[7]

Nvidia powers Nasdaq to fresh record, as inflation and earnings data weigh elsewhere

(Reuters) -The Nasdaq Composite advanced to its latest record high on Tuesday, powered by a jump in heavyweight Nvidia's shares, while the other Wall Street benchmarks were sluggish as traders digested a key inflation report and a flurry of bank earnings. Should gains on the Nasdaq hold, it would be the fourth session in five that the technology-heavy index has posted a record close, and the eighth time since June 27. Markets have been buoyant in recent weeks. Investor concerns that the U.S. economy would be tarnished by President Donald Trump's policies, including major tariff announcements, have started to abate, allowing Wall Street to move higher. This week was expected to be a significant test of that improving sentiment, with the start of second-quarter earnings season and inflation reports that were forecast to reflect sellers starting to pass on higher tariff-related costs. The first of these reports showed U.S. consumer prices posted their biggest jump in five months in June, hinting that tariffs may be starting to heat up inflation. Still, underlying inflation stayed moderate, offering some reassurance despite the headline spike. "The CPI report came in a little better than expected, but it's backwards-looking, so the market is still concerned that there will be inflationary pressures building because of tariffs," said Chris Zaccarelli, chief investment officer at Northlight Asset Management. He added the news could be used by some investors to take profits after the recent good run, which would explain declines on both the S&P 500 and the Dow Jones Industrial Average. At 1:52 p.m. EDT, the Nasdaq Composite had gained 122.51 points, or 0.59%, to 20,762.84. However, the Dow Jones Industrial Average fell 336.57 points or 0.76% to 44,123.08, and the S&P 500 lost 5.93 points or 0.09% to 6,262.63. The Nasdaq's increase came primarily from artificial intelligence-chip leader Nvidia, which rose 4% after unveiling plans to resume sales of its H20 AI chip to China. The news buoyed other chipmakers, with Advanced Micro Devices and Super Micro Computer rising more than 6.7% each. The semiconductor index also advanced 1.5%, to its highest point in a year, while the S&P technology index climbed by the same percentage to hit a record high. Meanwhile, Wall Street opened the second-quarter earnings season on a somber note, with banking stocks whipsawing in volatile trade. JPMorgan Chase slipped 0.7% despite raising its 2025 net interest income outlook, while Wells Fargo fell 6.3% even as its profit rose on reduced loan-loss reserves. BlackRock notched a new milestone, managing a record $12.53 trillion in assets amid optimism over trade deals and rate cuts, yet its shares slid 5.5%. The KBW Bank Index sank to a two-week low, down 1.1%. Bucking the trend, Citigroup climbed 3.4% after its traders delivered a windfall that boosted second-quarter profit. Northlight's Zaccarelli said the differing share performance was less about Tuesday's broadly positive numbers and more a reflection of how they matched up with investors' existing expectations for each bank. In other news, at least four Fed officials including Board Governor Michael Barr were scheduled to speak on Tuesday, potentially offering fresh clues on the central bank's next steps. Hopes for a July rate cut have all but vanished, and bets on a September move dipped to 55% from 60% after the latest inflation data, according to CME FedWatch. (Reporting by David French in New York; Additional reporting by Pranav Kashyap and Nikhil Sharma in Bengaluru; Editing by Pooja Desai, Maju Samuel and Matthew Lewis)

[8]

Wall Street digests Fed minutes with tariffs in focus, Nvidia hits $4 trillion valuation

(Reuters) -The S&P 500 extended gains slightly on Wednesday following the release of minutes from the last Federal Reserve meeting, after Nvidia briefly reached a $4 trillion valuation and as investors awaited more details on President Donald Trump's trade policy. The minutes showed narrow support for an interest rate cut later this month, with only "a couple" of Fed officials at its June 17-18 meeting saying they felt rates could fall in July. Most policymakers continued to worry about the expected inflationary pressure from Trump's import taxes. Nvidia was last up 1.7% after it became the world's first company to hit a $4 trillion market value Wednesday morning, solidifying its position as one of Wall Street's most favored stocks to tap in the ongoing surge in demand for artificial intelligence technologies. The S&P 500's other main boosts came from megacap companies including Microsoft Corp and Amazon.com. "There's definitely a megacaps bias ... to some extent it's a flight to safety but not what you would traditionally think of as a safety trade," said Kevin Gordon, senior investment strategist at Charles Schwab. "From a trade standpoint it's not like you're getting much clarity." At 2:14 p.m. ET, the Dow Jones Industrial Average rose 164.00 points, or 0.37%, to 44,404.76, the S&P 500 gained 28.01 points, or 0.45%, at 6,253.53 and the Nasdaq Composite climbed 157.20 points, or 0.77%, to 20,575.90. Nine of the 11 S&P 500's major industry sectors were advancing, with utilities and communication services leading gainers, while defensive consumer staples was the biggest decliner. Trump on Wednesday issued letters to seven countries, calling for tariffs of 30% on Algeria, Iraq, Libya and Sri Lanka, 25% on Brunei and Moldova, and 20% on the Philippines. The European Union has said it could reach an outline trade agreement with the U.S. in the coming days. On Tuesday, Trump had ramped up his trade offensive with the announcement of a 50% tariff on copper and a vow to slap long-threatened levies on semiconductors and pharmaceuticals. On Monday, Trump hit 14 trading partners with a fresh wave of tariff warnings, including Japan and South Korea. While Wall Street indexes had fallen on trade jitters on Monday, they have steadied since then, with analysts noting that investors have become used to Trump's pattern of saber-rattling on tariffs. And with the deadline for the latest tariffs pushed to August 1, many are betting that negotiations will defuse the trade war. "The tariff issue continues to be this sort of seesaw and because of that back-and-forth, it obviously has given investors a bit of a calm," said Philip Blancato, chief market strategist at Osaic Wealth. Meanwhile, after last week's record closes for the S&P 500 and the Nasdaq - buoyed by a surprisingly robust jobs report -investors are turning their attention to Thursday's initial jobless claims for the next pulse check on the labor market. Among individual stocks, AES Corp jumped 18.7% after Bloomberg reported that the power provider was exploring options, including a sale. Boeing advanced 4.1% as Susquehanna raised its price target after the planemaker reported on Tuesday that its airplane deliveries in June increased 27% on a yearly basis. UnitedHealth Group slipped 1.7% after the Wall Street Journal reported that the U.S. Department of Justice was investigating how the health insurer deployed doctors and nurses to gather diagnoses that increased its Medicare payments. Advancing issues outnumbered decliners by a 1.97-to-1 ratio on the NYSE where there were 205 new highs and 30 new lows on the NYSE. On the Nasdaq, 2,747 stocks rose and 1,656 fell as advancers outnumbered decliners by a 1.66-to-1 ratio. The S&P 500 posted 17 new 52-week highs and six new lows while the Nasdaq Composite recorded 64 new highs and 42 new lows. (Reporting by Sinéad Carew, Pranav Kashyap in Bengaluru; Editing by Saumyadeb Chakrabarty, Maju Samuel and Richard Chang)

[9]

S&P 500, Nasdaq post record closes, Nvidia closing valuation $4 trillion

NEW YORK (Reuters) -The S&P 500 and Nasdaq registered record closing highs on Thursday, and Nvidia's market value closed above $4 trillion for the first time, while the Brazilian real recovered some losses following U.S. President Donald Trump's announcement of a 50% tariff on the country's goods. Also helping Wall Street, shares of Delta Air Lines jumped 12% after it forecast third-quarter and full-year profits above analysts' estimates. Other travel stocks also rose, including United Airlines, which ended 14.3% higher, and Hertz Global, up 11.8%. Shares of Nvidia ended up 0.75% at $164.10, giving the chipmaker a market value of $4.004 trillion, thanks to surging demand for artificial-intelligence. The move solidified its position as one of Wall Street's most-favored stocks. Trump confirmed a 50% tariff would be imposed on copper, and said it would start August 1. The Brazilian real recovered some losses that followed the tariff news. Late on Wednesday, the currency's volatility gauges surged to their highest levels since late April. The dollar was last down 0.8% against the real . Brazilian stocks were down 0.5%. Brazilian President Luiz Inácio Lula da Silva vowed retaliation against unilateral tariff hikes. Some traders said U.S. consumers could see sharp price increases for coffee and orange juice if Trump sticks to the Brazil tariffs. Reactions in the broader market to Trump's latest tariff moves have been less severe than in April, possibly reflecting expectations that ongoing negotiations between Washington and trade partners could yield agreements. Investors are gearing up for second-quarter earnings, looking for signs of an impact from Trump's trade war launched on April 2. Bruce Zaro, managing director at Granite Wealth Management in Plymouth, Massachusetts, said the market appears to be in a holding pattern ahead of reports from S&P 500 companies. JPMorgan Chase is due to release results Tuesday, essentially kicking off the reporting period. "There's been great skepticism with all of the analysts that follow the S&P 500, how they've been reducing their estimates at large, based on the tariffs and uncertainty around that," he said. "But we think, when all is said and done, those growth companies, and specifically tech companies, are going to come through with fabulous earnings. So I think the market is in a waiting period." The Dow Jones Industrial Average rose 192.34 points, or 0.43%, to 44,650.64, the S&P 500 rose 17.20 points, or 0.27%, to 6,280.46 and the Nasdaq Composite rose 19.33 points, or 0.09%, to 20,630.67. MSCI's gauge of stocks across the globe rose 1.92 points, or 0.21%, to 926.22. The pan-European STOXX 600 index rose 0.54%. Bitcoin rallied to another all-time high. The world's largest cryptocurrency was last up 2.56% to $113,609.36. Investors also digested upbeat quarterly results from TSMC, which showed strong demand for the world's largest contract chipmaker's products, fueled by surging interest in AI applications. The dollar index, which measures the greenback against a basket of currencies, rose 0.23% to 97.61. Benchmark 10-year U.S. Treasury yields edged higher after U.S. data showed jobless claims unexpectedly fell last week and as investors focused on how tariffs will impact inflation. The yield on benchmark U.S. 10-year notes was last up 0.4 basis points on the day at 4.346%. Oil prices fell as investors weighed potential effects of Trump's tariffs on growth. Brent crude futures settled at $68.64 a barrel, down $1.55, or 2.21%. U.S. West Texas Intermediate crude finished at $66.57 a barrel, down by $1.81, or 2.65%. Spot gold rose 0.3% to $3,323.39 an ounce. (Reporting by Caroline Valetkevitch; additional reporting by Rae Wee, Johann M Cherian and Marc Jones; Editing by Jamie Freed, Bernadette Baum, Tomasz Janowski, Jane Merriman, Cynthia Osterman and David Gregorio)

[10]

Nasdaq, S&P 500 futures gain ground with earnings, inflation in spotlight

(Reuters) -Futures tracking the Nasdaq and the S&P 500 edged higher on Tuesday as investors geared up for earnings from major Wall Street lenders as well as inflation data that could sway expectations around how soon the Federal Reserve will cut interest rates. At 5:32 a.m. ET, Dow E-minis were down 44 points, or 0.1%, and S&P 500 E-minis were up 22 points, or 0.35%. Nasdaq 100 futures rose 0.59% to record highs, powered by an uptick in Nvidia after the chip designer announced plans to restart sales of its H20 AI chip to China. The company's shares were up 5.2% in premarket trading. The news also lifted other chipmakers, with Advanced Micro Devices rising 3.6%, Marvell Technology up 2.7% and U.S.-listed shares of TSM gaining 2.5%. Meanwhile, the earnings season is about to kick off with banking giants JPMorgan Chase, Wells Fargo, and Citigroup set to report their quarterly results before the opening bell. Major U.S. banks are expected to report stronger profits, driven by buoyant trading and a modest rebound in investment banking. Despite President Donald Trump's renewed tariff threats - this time aimed at Russia - markets largely brushed off the rhetoric, focusing instead on a breakthrough from negotiations with U.S. trade partners. Hopes were buoyed after Trump signaled willingness to talk, following his weekend warning of 30% tariffs on the European Union and Mexico starting August 1. On Monday, all three indexes closed higher, with the Nasdaq finishing at record-high. All eyes are on the June consumer price report, due at 8:30 a.m. ET, as investors watch for any signs that tariffs are fueling inflation. Economists surveyed by Reuters expect headline inflation accelerated to 2.7% last month on a year-over-year basis, up from 2.4% in May, while core inflation is forecast to tick up to 3% from 2.8%. Elias Haddad, senior markets strategist at Brown Brothers Harriman, noted that the effect of tariffs on inflation has been muted, but stuck to the view that "higher U.S. levies is a downside risk to U.S. growth and upside risk to inflation." The odds of a July rate cut have faded, while markets are pricing in a roughly 60% chance of a move in September, according to CME FedWatch. Later in the day, at least four Fed officials, including Board Governor Michael Barr, are scheduled to speak, potentially offering fresh clues on the central bank's next steps. Among other movers, Trade Desk surged 15.1% after the software firm was set to join the benchmark S&P 500 index. (Reporting by Pranav Kashyap in Bengaluru; Editing by Maju Samuel)

[11]

Nasdaq ends at another record high on Nvidia's China chip cheer

(Reuters) -The Nasdaq Composite posted its latest record finish on Tuesday, supported by a jump in shares of heavyweight Nvidia, but the other Wall Street benchmarks dropped as a key inflation report and a flurry of bank earnings failed to excite investors. It was the fourth session in five that the technology-heavy Nasdaq index has posted a record close, and the eighth time since June 27. Artificial-intelligence chip leader Nvidia was the primary factor behind the Nasdaq's increase, gaining 4% after it unveiled plans to resume sales of its H20 AI chip to China. The news buoyed other chipmakers, with Advanced Micro Devices and Super Micro Computer both gaining more than 6.4%. The semiconductor index also advanced 1.3% to its highest point in a year, while the S&P technology index climbed by the same percentage to hit a record high. Rob Swanke, senior investment research analyst at Commonwealth Financial Network, said the Nvidia news meant that some investors, who had moved into other stocks due to technology's high valuations, were rotating back. "I would probably say it's a one-day pop," he added, noting that investors would be waiting for sales to be reflected in its earnings. The Nasdaq Composite gained 37.47 points, or 0.18%, to finish at 20,677.80. The Dow Jones Industrial Average fell 436.36 points, or 0.98%, to 44,023.29, and the S&P 500 lost 24.80 points, or 0.40%, to 6,243.76. Markets have been buoyant in recent weeks. Investor concerns that the U.S. economy would be tarnished by President Donald Trump's policies, including major tariff announcements, have started to abate, allowing Wall Street to move higher. This week was expected to be a significant test of that improving sentiment, with the start of second-quarter earnings season and inflation reports that were forecast to reflect sellers starting to pass on higher tariff-related costs. The first of these reports showed U.S. consumer prices posted their biggest jump in five months in June, hinting that tariffs may be starting to heat up inflation. Still, underlying inflation stayed moderate, offering some reassurance despite the headline spike. "The picture from inflation this morning, coming in a little bit higher than expected but pretty much in line, gives you some sense that the tariffs are starting to flow through into the economy," said Commonwealth's Swanke. "We'll get more concrete news, as we go through earnings, to see how companies are delivering the impact of higher tariffs." On the first day of second-quarter earnings season, banking stocks whipsawed in volatile trade. JPMorgan Chase slipped 0.7% despite raising its 2025 net interest income outlook, while Wells Fargo fell 5.5% even as its profit rose on reduced loan-loss reserves. BlackRock notched a new milestone for assets under management, yet its shares slid 5.9%. Bucking the trend, Citigroup climbed 3.7% to its highest finish since the global financial crisis, after its traders delivered a windfall that boosted second-quarter profit. The number of shares changing hands on U.S. exchanges on Tuesday was 16.82 billion, compared with the 17.55 billion average for the last 20 trading days. (Reporting by David French in New York; Additional reporting by Pranav Kashyap and Nikhil Sharma in Bengaluru; Editing by Pooja Desai, Maju Samuel and Matthew Lewis)

[12]

Nasdaq posts latest record close on Nvidia's China chip cheer

(Reuters) -The Nasdaq Composite posted its latest record finish on Tuesday, supported by a jump in shares of heavyweight Nvidia, but the other Wall Street benchmarks ended lower as a key inflation report and a flurry of bank earnings failed to excite investors. It was the fourth session in five that the technology-heavy Nasdaq index has posted a record close, and the eighth time since June 27. Artificial intelligence-chip leader Nvidia was the primary factor behind the Nasdaq's increase, gaining after it unveiled plans to resume sales of its H20 AI chip to China. The news buoyed other chipmakers, including Advanced Micro Devices and Super Micro Computer, while both the semiconductor index and the S&P technology index also increased. Rob Swanke, senior investment research analyst at Commonwealth Financial Network, said the Nvidia news meant that some investors, who had moved into other stocks due to technology's high valuations, were rotating back. "I would probably say it's a one-day pop," he added, noting that investors would be waiting for sales to be reflected in its earnings. According to preliminary data, the S&P 500 lost 25.68 points, or 0.40%, to end at 6,243.67 points, while the Nasdaq Composite gained 37.47 points, or 0.18%, to 20,677.80. The Dow Jones Industrial Average fell 437.07 points, or 0.98%, to 44,022.58. Markets have been buoyant in recent weeks. Investor concerns that the U.S. economy would be tarnished by President Donald Trump's policies, including major tariff announcements, have started to abate, allowing Wall Street to move higher. This week was expected to be a significant test of that improving sentiment, with the start of second-quarter earnings season and inflation reports that were forecast to reflect sellers starting to pass on higher tariff-related costs. The first of these reports showed U.S. consumer prices posted their biggest jump in five months in June, hinting that tariffs may be starting to heat up inflation. Still, underlying inflation stayed moderate, offering some reassurance despite the headline spike. Meanwhile, Wall Street opened the second-quarter earnings season on a somber note, with banking stocks whipsawing in volatile trade. JPMorgan Chase slipped despite raising its 2025 net interest income outlook, while Wells Fargo fell even as its profit rose on reduced loan-loss reserves. BlackRock notched a new milestone for assets under management, yet its shares slid. Bucking the trend, Citigroup climbed after its traders delivered a windfall that boosted second-quarter profit. (Reporting by David French in New York; Additional reporting by Pranav Kashyap and Nikhil Sharma in Bengaluru; Editing by Pooja Desai, Maju Samuel and Matthew Lewis)

Share

Share

Copy Link

Nvidia's plan to resume AI chip sales to China drives tech stocks, pushing Nasdaq to a new record. Meanwhile, inflation data and mixed bank earnings create market volatility.

Nvidia Drives Nasdaq to New Heights

The Nasdaq Composite reached a fresh record high on Tuesday, primarily driven by a surge in Nvidia's stock price. The tech giant's shares jumped 4% after announcing plans to resume sales of its H20 AI chip to China

1

. This news not only boosted Nvidia but also lifted other chipmakers, with Advanced Micro Devices and Super Micro Computer both gaining over 6.4%3

.

Source: Market Screener

The semiconductor index advanced 1.3% to its highest point in a year, while the S&P technology index climbed by the same percentage to hit a record high

3

. This marks the fourth session in five that the Nasdaq has posted a record close, and the eighth time since June 271

.Inflation Data and Market Response

A key inflation report released on Tuesday showed U.S. consumer prices posted their biggest jump in five months in June. The Labor Department report indicated that prices rose 2.7% annually, slightly higher than the estimated 2.6%

4

. However, core inflation, which excludes volatile food and energy components, remained moderate1

.The inflation data had a mixed impact on market sentiment. While it hinted at potential inflationary pressures due to tariffs, the underlying inflation stayed moderate, offering some reassurance to investors

1

. The odds of a July rate cut have almost disappeared, while the probability of a September rate cut dipped to around 56% following the inflation report5

.Bank Earnings and Market Volatility

The second-quarter earnings season kicked off with major financial institutions reporting mixed results. JPMorgan Chase slipped 0.7% despite raising its 2025 net interest income outlook

1

. Wells Fargo fell 5.5% even as its profit rose on reduced loan-loss reserves3

. BlackRock reached a new milestone with $12.53 trillion in assets under management, yet its shares declined by 5.9%3

.Citigroup, however, bucked the trend with a 3.7% climb to its highest finish since the global financial crisis, after its traders delivered a windfall that boosted second-quarter profit

3

. The KBW Bank Index sank to a two-week low, down 1.1%1

.Related Stories

Market Sentiment and Global Trade

Despite recent volatility, markets have been generally buoyant in recent weeks. Investor concerns about the U.S. economy being tarnished by President Donald Trump's policies, including major tariff announcements, have started to abate

1

. This improving sentiment has allowed Wall Street to move higher.However, new tariff threats have emerged, with President Trump sending "tariff letters" to seven new countries, including the Philippines, Moldova, and Brunei

2

. Despite these developments, markets have largely brushed off the rhetoric, focusing instead on potential breakthroughs in negotiations with U.S. trade partners5

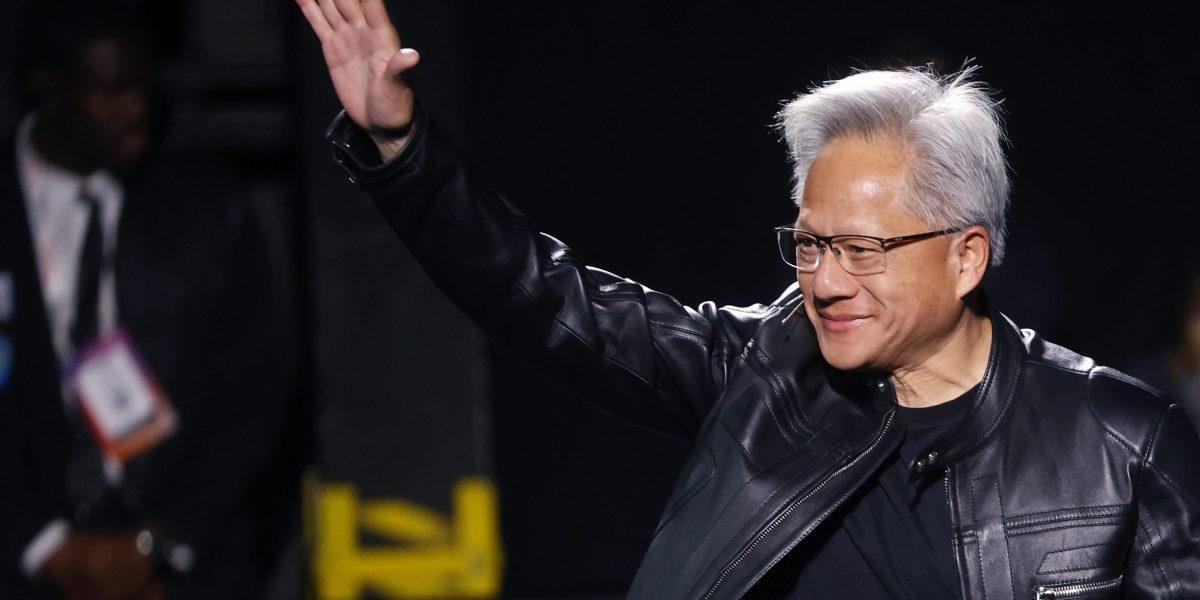

.Nvidia's Milestone

Source: Fortune

In a historic moment for the tech industry, Nvidia became the first company to reach a $4 trillion market capitalization. The company's shares rose 1.8% on Wednesday, hitting a share price of $162.86

2

. This milestone cements Nvidia's position as the poster child for the AI market rally that has led the S&P 500 to back-to-back years of more than 20% growth2

.As markets continue to navigate through earnings season, inflation concerns, and global trade tensions, all eyes remain on tech giants like Nvidia and the potential impact of AI on various sectors of the economy.

References

Summarized by

Navi

[4]

Related Stories

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

Anthropic takes Pentagon to court over unprecedented supply chain risk designation

Policy and Regulation

3

Meta smart glasses face lawsuit and UK probe after workers watched intimate user footage

Policy and Regulation