Nvidia's $5 billion Intel investment already gains $2.5B as AI chip partnership takes shape

3 Sources

3 Sources

[1]

Nvidia invests $5B on Intel bailout, gains $2.5B

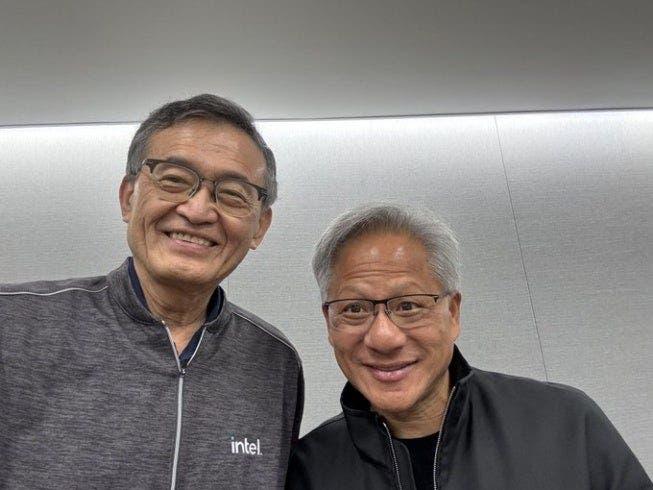

The deal negotiated in September locked Nvidia into a purchase price of $23 per share. Intel shares traded at $36 on Monday Nvidia's $5 billion Intel stock purchase is already worth $7.58 billion, turning the recently approved bailout of its rival into a shrewd financial play. Nvidia had locked in a purchase price of $23.28 per share for Intel when Nvidia CEO Jensen Huang and Intel CEO Lip-Bu Tan struck a deal in September. The deal had been under scrutiny by the U.S. Federal Trade Commission, which was examining whether Nvidia's potential 4 percent ownership stake could run afoul of antitrust laws. However, the FTC gave the deal a greenlight on Dec. 18. The purchase of 214 million shares closed on Dec. 26, according to Intel regulatory filings. Intel shares closed Monday at $36.68. Under the terms of the deal, Nvidia and Intel will jointly develop "multiple generations" of chips for datacenter and PC in a move to capture share across the entire chip customer base from consumer to hyperscale customers. The two companies will work on connecting their chips via the incredibly fast NVLink, which reaches 1.8 TB/s of bandwidth (900 GB/s in each direction) per GPU - about 14x the bandwidth of a PCIe 5.0 x16 slot. In the PC arena, Intel will build Nvidia-custom x86 CPUs that Nvidia will integrate into its AI infrastructure platforms and offer to the market. Intel will also be able to build x86 systems-on-chips (SOCs) that integrate Nvidia RTX GPU chiplets. These new x86 RTX chips will power PCs that contain integrated CPUs and GPUs. The agreement between Intel and Nvidia to develop chips for the data center and for the PC is similar to one that ran afoul of regulators in 2021 when Nvidia attempted to buy UK-based chipmaker Arm outright for $40 billion. At the time, the FTC said such a deal would have given a large chipmaker control over one of its rivals and amounted to the largest semiconductor deal ever attempted. The FTC sued. Nvidia abandoned the deal two months after the lawsuit was filed. Then FTC chairman Lina Khan noted it was a rare out-of-court win for the agency during US Senate testimony. "The proposed merger would have given one of the largest chip companies control over its rivals' designs for competing chips," she told United States Senate Committee on the Judiciary Subcommittee on Antitrust, Competition Policy and Consumer Rights in September 2022. "By doing so, the FTC's complaint alleged that the combined firm would have had the means and incentive to stifle next-generation technologies, including those used to run datacenters and driver-assistance systems in cars." Khan, an appointee of former US President Joe Biden, is no longer with the agency. Nvidia has a long-standing relationship with both Arm and Arm-based SoC designers. Prior to its 72-core Grace CPUs, Nvidia worked with Arm on its Tegra family of chips, which power consoles like Nintendo Switch. And as we previously reported, Nvidia has extended similar support for its NVLink tech to Qualcomm and Fujitsu. ®

[2]

Intel and Nvidia's superchip plans blend CPUs, GPUs, and big money

Serving tech enthusiasts for over 25 years. TechSpot means tech analysis and advice you can trust. Looking ahead: Intel and Nvidia have officially formalized their long-rumored partnership, locking in a $5 billion stock deal that ties the two chipmakers together just as the AI boom reshapes the industry. While the most interesting outcomes remain years away, Nvidia is already sitting on a sizable paper gain. Regulatory filings confirm that Nvidia has acquired roughly 215 million Intel shares at a fixed price of $23.28 per share, a transaction approved by the Federal Trade Commission earlier this month. The deal was first agreed to in September by Nvidia CEO Jensen Huang and Intel CEO Lip-Bu Tan. Intel's stock has climbed sharply since then. Shares closed at $36.68 on Monday and were trading near $38 at the time of writing, pushing the value of Nvidia's stake well above its original $5 billion investment. While those gains remain unrealized, they underscore how quickly market sentiment around Intel has shifted. Source: App Economy Insights Beyond the financial upside, the agreement lays the groundwork for deeper technical collaboration. Intel and Nvidia say they plan to co-develop shared platforms and system-on-chip designs across "multiple generations," targeting both data center infrastructure and consumer PCs. The data center side of the partnership is expected to come first. The companies plan to use NVLink, Nvidia's high-bandwidth interconnect, to enable tighter integration between Nvidia GPUs and Intel's x86 CPUs. The goal is to offer alternatives to existing CPU-GPU pairings that rely on PCI Express, particularly for AI workloads that demand faster data movement. On the consumer side, Intel and Nvidia have signaled interest in SoC-style designs that combine Intel CPUs with Nvidia RTX graphics. If realized, those chips could directly challenge AMD's APUs by offering discrete-class GPU features in more compact and affordable systems. Source: App Economy Insights Another noteworthy aspect of the Intel - Nvidia deal is the regulatory response, or lack thereof. The FTC's approval of the stock deal stands in stark contrast to Nvidia's failed attempt to acquire Arm in 2021, which regulators blocked over competition concerns. At the time, Chairman Lina Khan argued that the merger would hinder market competition and technological progress in data center and automotive markets. The current FTC, influenced by the Trump-era leadership, has taken a very different approach. This time, regulators appear comfortable with a minority stake and a collaborative roadmap rather than outright ownership. For now, the partnership is more promise than product. But with Nvidia deepening its ties to Intel, both financially and technologically, the companies are positioning themselves for a future where CPUs and GPUs are no longer developed in isolation.

[3]

Intel's AI Reset Gets $5 Billion Boost From Nvidia - Intel (NASDAQ:INTC), NVIDIA (NASDAQ:NVDA)

Intel Corporation (NASDAQ:INTC) said Monday it has completed the issuance and sale of more than 214 million shares of common stock to Nvidia Corporation (NASDAQ:NVDA) in a $5 billion private placement. The transaction was finalized on December 26, 2025, following the execution of an agreement previously announced between the companies. Intel issued 214,776,632 shares at $23.28 per share, generating $5.0 billion in gross proceeds. The shares carry a par value of $0.001 per share. The issuance was completed under a Securities Purchase Agreement dated September 15, 2025. Also Read: Intel Eyes $1.6 Billion AI Chip Buy As It Takes On Nvidia's Turf Strategic Reset Under New Leadership The deal lands as Intel pushes through a broader strategic reset under CEO Lip-Bu Tan, who has called 2025 a "defining year" for the company. Intel shares are up about 81% year to date, reflecting investor optimism around a turnaround driven by AI-focused funding and execution improvements. Alongside the Nvidia investment, Intel has also secured a separate $2 billion commitment from SoftBank Group (OTC:SFTBF) (OTC:SFTBY). Tan has cited tighter execution, cultural changes, and renewed customer confidence as key contributors to the rebound. The Nvidia stake strengthens Intel's balance sheet as it works to regain competitiveness in AI chips and advanced manufacturing, even as it navigates ongoing political and regulatory scrutiny. Price Action: Intel shares were down 0.03% at $36.19 during premarket trading on Monday, according to Benzinga Pro data. Nvidia shares were down 1.23%. Read Next: China Sanctions Boeing, Northrop, Anduril Founder Photo by Tada Images via Shutterstock INTCIntel Corp$36.11-0.25%OverviewNVDANVIDIA Corp$188.25-1.20%AAPLApple Inc$272.32-0.39%MSFTMicrosoft Corp$485.80-0.39%SFTBFSoftBank Group Corp$113.835.20%SFTBYSoftBank Group Corp$56.970.37%TSMTaiwan Semiconductor Manufacturing Co Ltd$302.50-0.11%Market News and Data brought to you by Benzinga APIs

Share

Share

Copy Link

Nvidia completed its $5 billion investment in Intel, purchasing 214 million shares at $23.28 each. With Intel stock now trading at $36.68, Nvidia's stake has surged to $7.58 billion. The partnership will jointly develop next-generation chips for data centers and PCs, integrating Nvidia GPUs with Intel CPUs via high-speed NVLink technology.

Nvidia and Intel Finalize Strategic Partnership with Immediate Financial Upside

Nvidia has completed its $5 billion investment in Intel, a deal that has already generated substantial paper gains for the AI chip leader. The transaction, which closed on December 26, saw Nvidia purchase 214 million Intel shares at a locked-in price of $23.28 per share

1

. With Intel stock trading at $36.68 on Monday, Nvidia's stake has ballooned to $7.58 billion, delivering an unrealized gain of approximately $2.5 billion in just three months2

.The agreement was first struck in September by Nvidia CEO Jensen Huang and Intel CEO Lip-Bu Tan, giving Nvidia roughly a 4 percent ownership stake in its rival

1

. The Federal Trade Commission (FTC) approved the deal on December 18 after examining potential antitrust concerns, marking a significant shift from the regulatory environment that blocked Nvidia's attempted $40 billion acquisition of Arm in 20211

.

Source: The Register

Next-Generation Chips for Data Centers and Advanced Computing Solutions

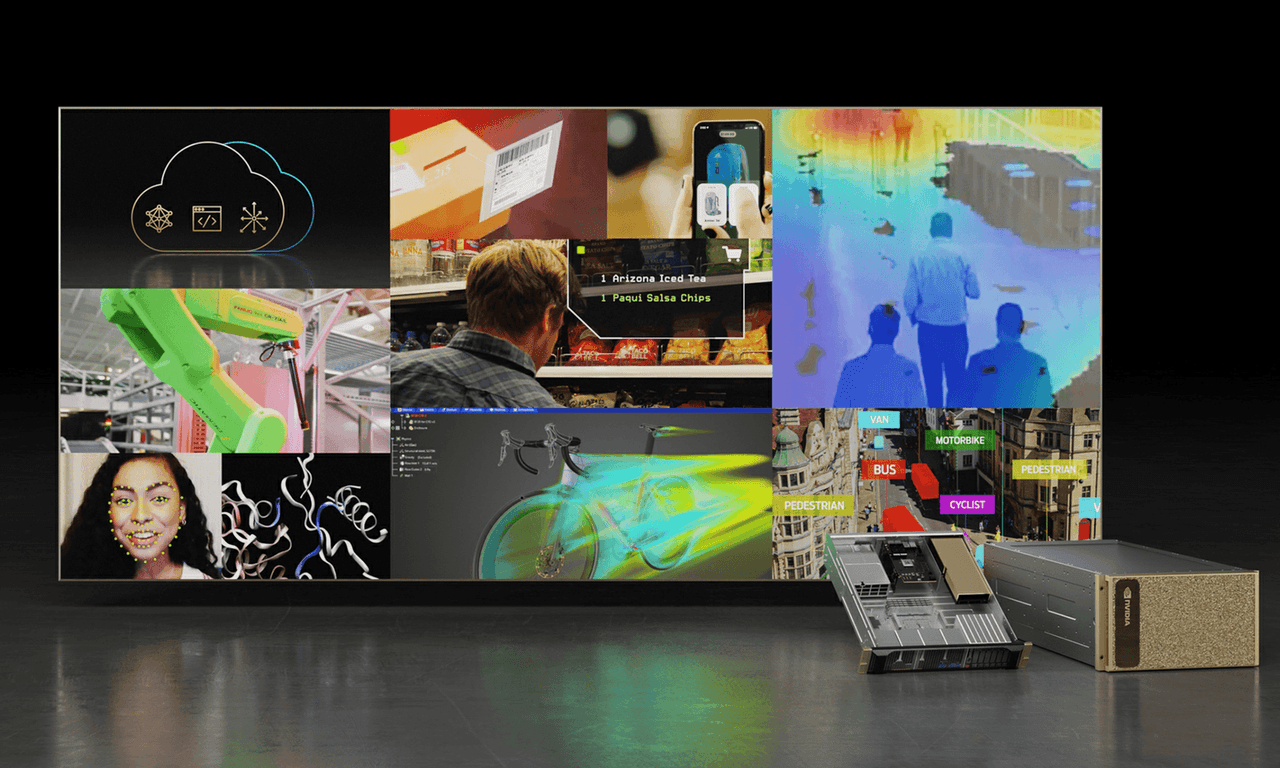

Beyond the financial windfall, Nvidia and Intel plan to co-develop shared platforms across "multiple generations" of chips targeting both data center AI workloads and consumer PCs

1

. The partnership centers on integrating Nvidia GPUs and Intel CPUs using NVLink, Nvidia's high-bandwidth interconnect that delivers 1.8 TB/s of bandwidth per GPU—roughly 14 times faster than PCIe 5.0 x16 slots1

. This tighter integration aims to address AI infrastructure demands where faster data movement between processors has become critical.

Source: TechSpot

For data center applications, the companies will develop x86 CPUs custom-designed by Intel that Nvidia will incorporate into its AI infrastructure platforms and offer to the broader market

1

. The data center side of the collaboration is expected to materialize first, providing alternatives to existing CPU-GPU pairings that rely on slower PCI Express connections2

.System-on-Chip Designs Target Consumer PCs and GPU Chiplets

On the consumer front, Intel will build x86 systems-on-chips (SoC) that integrate Nvidia RTX GPU chiplets, creating new x86 RTX chips designed to power PCs with integrated CPUs and GPUs

1

. If realized, these SoC-style designs could directly challenge AMD's APUs by delivering discrete-class graphics performance in more compact and affordable systems2

. While these consumer products remain years away, the technical roadmap signals both companies' intent to reshape how processors are designed and sold.Related Stories

AI-Driven Turnaround and Regulatory Scrutiny Shift

The $5 billion investment arrives as Intel pursues an AI-driven turnaround under Lip-Bu Tan, who has called 2025 a "defining year" for the company

3

. Intel shares have climbed 81% year-to-date, reflecting investor confidence in execution improvements and renewed focus on AI chips and advanced manufacturing3

. The Nvidia stock purchase helps strengthen Intel's balance sheet alongside a separate $2 billion commitment from SoftBank Group3

.

Source: Benzinga

The FTC's approval marks a notable departure from its 2021 stance when it blocked Nvidia's Arm acquisition over market competition concerns. Then-chairman Lina Khan argued the semiconductor deal would give "one of the largest chip companies control over its rivals' designs," potentially stifling innovation in data centers and automotive systems

1

. The current regulatory approach appears more comfortable with minority stakes and collaborative development rather than outright ownership2

.What This Means for the AI Chip Landscape

For AI developers and enterprise customers, the partnership signals a future where CPUs and GPUs are no longer developed in isolation but engineered from the ground up for seamless integration

2

. The focus on NVLink connectivity and custom x86 CPUs suggests both companies recognize that AI workload performance increasingly depends on how efficiently data moves between different processor types rather than raw compute power alone.The immediate financial success of Nvidia's stock purchase also demonstrates how market sentiment around Intel has shifted dramatically in recent months. What began as a strategic investment to secure manufacturing capacity and technical collaboration has quickly become a lucrative financial play, with Nvidia sitting on billions in paper gains while positioning itself across multiple chip architectures and manufacturing partnerships.

References

Summarized by

Navi

[1]

Related Stories

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology