Nvidia's Blackwell GPU Platform Poised to Drive Future Growth Amid AI Boom

5 Sources

5 Sources

[1]

Nvidia shares to remain stuck for the rest of the year, says Citi

Citi is expecting Nvidia 's margins to bottom out early next year as its Blackwell platform will take time to fully ramp up. Analyst Atif Malik maintained his buy rating on the artificial intelligence darling. He also kept his $150 price target, which suggests shares can jump 17.4%. This year, Nvidia has soared nearly 158%. "While we are bullish on another strong +40% Y/Y cloud data center capex growth next year, we expect the stock to likely remain range bound through CES Jan before Blackwell driven Y/Y sales and gross margin inflection in the [April quarter]," Malik wrote in a Monday note to clients. "Fundamentally, we believe AI adoption remains in 3rd/4th innings as enterprise AI demand takes off next with AI agents." Malik expects Nvidia's gross margins to be in the low 70s range, or roughly 72%, in the first quarter of next year, with long-term gross margins stabilizing in at a mid-70s percentage with the Blackwell graphics processing unit, or GPU. Nvidia is expected to ramp up Blackwell production in the fourth quarter of this year, with production continuing into fiscal 2026. But long-term, Nvidia has a strong investment case, according to the analyst. He explained that enterprise clients don't want to be tied to a single cloud system. Instead, they will likely prefer to write their applications once with Nvidia's GPUs and have them transferable across clouds. "NVDA's large installed base is a strong pull for developers who aim to have the largest possible adoption of their applications," Malik said. And while Nvidia has already emphasized the return on investment that its products deliver for major consumer internet companies in markets such as social media, e-commerce and search, Malik believes generative AI will continue to create disruptive business models. "We expect to see positive ROI data points next year led by GPU as a service providers," he said.

[2]

Nvidia: What are investors are asking? By Investing.com

Investing.com -- Analysts at Citi have been on the road marketing in Boston and Europe, where they discussed with investors key topics regarding the Nvidia (NASDAQ:NVDA) stock. According to the Wall Street firm, the company's AI adoption "remains in 3rd/4th innings as enterprise AI demand takes off next with AI agents." Analysts expect Nvidia stock to remain range-bound through the CES event in early 2025 before new product launches, such as Blackwell GPUs, drive a sales and margin inflection. Citi notes that a recurring investor concern is Nvidia's gross margin trajectory. The bank predicts that gross margins will bottom out at around 72% in the January quarter, stabilizing in the mid-70s once the Blackwell series ramps up. Another focal point for investors is the competition between Nvidia's GPUs and custom application-specific integrated circuits (ASICs). While ASICs can be advantageous for fixed-function applications, Nvidia GPUs offer versatility. As AI models expand, Nvidia's GPUs, which are capable of handling various applications, will likely see continued demand, analysts said. Moreover, enterprises favor multi-cloud strategies, and GPUs allow applications to run across different cloud platforms without rewriting. Citi also highlights that data center operators prioritize the total cost of ownership (TCO) and return on investment (ROI), areas where Nvidia continues to lead due to its ability to run diverse applications, including AI. "As NVDA runs various applications including AI, the data center operators rely on NVDA to have the hardware to run multiple applications rather than buying accelerators that are limited in their use cases," analysts said in a Monday note. At the same time, investors are also keeping a close eye on Nvidia's vertical integration strategy, which has progressed from chips to entire systems, a response to the slowdown of Moore's Law. As for the Blackwell sales mix, the shift towards the GB200 format from the B100's 8-GPU format is also expected to optimize TCO and ROI, Citi's note states. Looking ahead, investors are optimistic about the long-term ROI, particularly with Nvidia's emphasis on AI across large markets like social media and e-commerce. However, patience will be required as generative AI matures into disruptive business models. "We expect to see positive ROI data points next year led by GPU-as-a-service providers," analysts said. With a Buy rating and a price target of $150, Citi remains bullish on Nvidia, with potential risks stemming from competition in gaming and possible market volatility in the auto and data center segments.

[3]

Citi maintains $150 target on NVIDIA shares, reiterates Buy rating By Investing.com

On Monday, Citi reaffirmed its Buy rating on NVIDIA Corporation (NASDAQ:NVDA) with a consistent price target of $150.00. The firm's outlook is based on a projection of strong year-over-year growth in cloud data center capital expenditures, anticipating over 40% increase next year. Despite this, NVIDIA's stock is expected to stay within a certain range until the Consumer Electronics Show (CES) in January, followed by a sales and gross margin upturn in April, driven by the company's new product, Blackwell. The analyst from Citi highlighted that artificial intelligence (AI) adoption is still in the early to middle phases, with enterprise AI demand set to surge, propelled by AI agents. They forecast a temporary dip in gross margins to approximately 72% in the January quarter, with long-term margins stabilizing in the mid-70s percentage range once Blackwell is fully integrated. The discussion also covered the choice between custom ASICs and GPUs, noting that GPUs are preferred due to their flexibility and adaptability to rapidly evolving AI applications. The analyst pointed out that GPUs, unlike ASICs, allow enterprises to write applications once and use them across multiple clouds, which aligns with the prevalent multi-cloud strategy. NVIDIA's lead in total cost of ownership (TCO) and return on investment (ROI) was emphasized as a key factor for data center operators, who value the ability to run various applications, including AI, on NVIDIA's hardware. As the industry moves towards system-level scaling due to the slowing of Moore's Law, NVIDIA's evolution from chips to systems is seen as a strategic advantage. Finally, Citi expects a shift in NVIDIA's sales mix towards the GB200 format, which offers better TCO and ROI. While the firm recognizes the need for patience as generative AI creates new business models, it anticipates positive ROI data points to emerge next year, particularly from GPU as a service providers. In other recent news, Super Micro Computer (NASDAQ:SMCI) has reported shipping over 100,000 graphics processors (GPUs) each quarter due to the surge in demand for generative artificial intelligence technology. The company also announced the launch of a new suite of liquid cooling products. In addition, JPMorgan (NYSE:JPM) maintained a $155.00 price target on NVIDIA Corporation, expressing confidence in its next-generation Blackwell GPU platform. The firm anticipates substantial revenues from the Blackwell GPUs in its fiscal fourth quarter. OpenAI, known for its ChatGPT, secured $6.6 billion in a recent funding round, reaching a post-money valuation of $157 billion. Major contributors included Microsoft (NASDAQ:MSFT) and Nvidia. However, Apple Inc (NASDAQ:AAPL). exited negotiations to invest in the same funding round. NVIDIA's strong market position, as highlighted in Citi's analysis, is further supported by recent InvestingPro data. The company's market capitalization stands at an impressive $3.18 trillion, reflecting its dominant role in the semiconductor industry. NVIDIA's financial performance has been exceptional, with a staggering revenue growth of 194.69% in the last twelve months as of Q2 2025, aligning with Citi's projections of continued strong growth in cloud data center expenditures. InvestingPro Tips underscore NVIDIA's financial strength. The company boasts impressive gross profit margins, which supports Citi's forecast of long-term margins stabilizing in the mid-70s percentage range. Additionally, NVIDIA has maintained dividend payments for 13 consecutive years, demonstrating its commitment to shareholder returns despite its focus on growth and innovation. The company's P/E ratio of 60.22 might seem high, but it's important to consider this in the context of NVIDIA's rapid growth and market leadership in AI technologies. An InvestingPro Tip notes that NVIDIA is trading at a low P/E ratio relative to its near-term earnings growth, suggesting potential undervaluation despite its recent stock price surge. For investors seeking a deeper understanding of NVIDIA's potential, InvestingPro offers 21 additional tips, providing a comprehensive analysis of the company's financial health and market position.

[4]

JPMorgan maintains $155 target on NVIDIA shares, confident in growth By Investing.com

On Wednesday, JPMorgan (NYSE:JPM) expressed continued confidence in NVIDIA Corporation (NASDAQ:NVDA), maintaining an Overweight rating and a $155.00 price target on the stock. The firm's optimism is anchored in NVIDIA's progress with its next-generation Blackwell GPU platform, which is expected to ship in high volume production in the fourth quarter. The analyst highlighted that early product yield issues have been addressed, and the company anticipates several billion dollars in revenues from the Blackwell GPUs in its fiscal fourth quarter, with a strong ramp into calendar year 2025. NVIDIA has clarified its stance amid recent concerns over changes to its rackscale portfolio, particularly the GB200 dual-rack 36x2 NVL72 solution. The company advised investors not to overemphasize these reports, emphasizing that the Blackwell GPU platform will support over 100 different system configurations. This marks a significant increase from the 19-20 configurations supported by the previous generation Hopper GPU platform. The GB200 36x2 NVL72 platform is expected to be a high volume platform, offering advantages in power density and infrastructure support costs. The company's team is confident about the sustainability of AI and accelerated computing spending beyond 2025. This confidence is based on the scaling of GenAI and foundational models, market penetration of inferencing, and the early development phases of enterprise and sovereign AI initiatives. NVIDIA anticipates that the push towards accelerating existing workloads in traditional CPU-centric datacenter infrastructure will contribute to an estimated $500 billion annual investment in infrastructure. Despite emerging competition from startups and domestic AI solutions in China, NVIDIA's established position in the market is seen as a significant competitive advantage. The company's extensive software ecosystem, developer base, and strong partnerships are viewed as formidable barriers to entry for competitors. NVIDIA's platform supports over 5 million developers worldwide and has the backing of global CSPs, OEMs, and ODMs. Its Enterprise AI software and framework platform, which enables customers to train and deploy proprietary models rapidly, further solidifies NVIDIA's market dominance. In other recent news, OpenAI, the company behind ChatGPT, has secured a significant $6.6 billion in a recent funding round, reaching a post-money valuation of $157 billion. Major contributors to the funding round included Microsoft (NASDAQ:MSFT) and Nvidia, along with returning investors Thrive Capital and Khosla Ventures. This capital boost is expected to fuel OpenAI's future projects and research in artificial intelligence. Meanwhile, Apple (NASDAQ:AAPL) has exited negotiations for investment in OpenAI's funding round. Despite this, other tech giants such as Microsoft and Nvidia remain involved in the funding discussions. The funding round, which has attracted considerable attention, is anticipated to conclude soon. In further developments, Foxconn (SS:601138), the largest contract electronics manufacturer globally, has announced that executives from Nvidia, Google (NASDAQ:GOOGL), and BMW (ETR:BMWG) will be featured speakers at their annual tech day forum. This event serves as a platform for Foxconn to showcase new products and partnerships, with this year's discussions expected to cover topics like artificial intelligence, electric vehicles, and digital health management. Lastly, Micron Technology Inc (NASDAQ:MU). has seen a surge in stock prices following a robust revenue forecast, attributed to growing demand for semiconductors, particularly those used in AI technologies. This positive outlook has also benefited other players in the semiconductor industry, such as Nvidia and Broadcom (NASDAQ:AVGO). NVIDIA's strong market position, as highlighted in JPMorgan's analysis, is further supported by recent financial data and expert insights from InvestingPro. The company's revenue growth is particularly noteworthy, with a staggering 194.69% increase over the last twelve months as of Q2 2025. This aligns with JPMorgan's expectations of significant revenue from the Blackwell GPUs in the coming quarters. InvestingPro Tips indicate that NVIDIA has a perfect Piotroski Score of 9, suggesting strong financial health and performance. This score, combined with the company's impressive gross profit margins of 75.98% in the last twelve months, underscores NVIDIA's operational efficiency and profitability in the highly competitive semiconductor industry. The company's forward-looking prospects are also positive, with InvestingPro reporting that 30 analysts have revised their earnings upwards for the upcoming period. This optimism is reflected in NVIDIA's market capitalization of $2.91 trillion, positioning it as a dominant player in the tech sector. For investors seeking more comprehensive analysis, InvestingPro offers 21 additional tips on NVIDIA, providing a deeper understanding of the company's financial health and market position.

[5]

Nvidia's Blackwell GPU Sets New AI Benchmark With Over 100 System Configurations, Analyst Says - NVIDIA (NASDAQ:NVDA)

JPMorgan analyst emphasizes Nvidia's incumbency in AI markets amid growing competition from start-ups and domestic solutions. As Nvidia Corp NVDA prepares to launch its next-gen Blackwell GPU platform, excitement is building among investors. JPMorgan analyst Harlan Sur has asserted that the company is on track for a spectacular fiscal fourth quarter. Behind The Curtain: Yield Issues? What Yield Issues? "The team characterized the early product yield issues as 'behind the team' post a mask fix on the B200 GPU chip," Sur noted after an insightful investor meeting. As a result, the company is gearing up for a significant shipment volume that will likely bolster its financials. Read Also: Accenture And NVIDIA Team Up To Supercharge Global AI Adoption: Details Noise, Noise, Noise: Stay Focused On Blackwell Despite recent sell-side noise surrounding rackscale portfolio changes, Sur said that investors should not be distracted. "The Blackwell GPU platform [is] supporting over 100 different system configurations," he pointed out, contrasting it with the mere 19-20 options available with the prior generation Hopper GPU platform. This broader configuration flexibility positions Nvidia as a front-runner in the rapidly evolving AI landscape. Future-Proofing: AI Spending To Skyrocket Looking ahead, Nvidia's leadership in AI and accelerated compute spending is expected to sustain growth well into 2025 and beyond. "The team remains confident on the sustainability of XPU infrastructure spending over the next several years," Sur said, citing the exponential scaling of foundational models and AI workloads. A Fortress Of Dominance: Nvidia's Competitive Edge Nvidia's ability to lead in both AI innovation and key global markets reinforces its unmatched position in the tech industry. Sur said, "the two markets where the Nvidia platform / software / ecosystem has strong incumbency is in the enterprise and China markets," highlighting its robust ecosystem of partners. As Nvidia continues to forge ahead, the anticipation for the Blackwell ramp is palpable, and the AI revolution shows no signs of slowing down. With a current share price of $118.93, having risen 147% year to date, investors are likely to keep their eyes on Nvidia as it navigates the burgeoning AI landscape. Read Next: Cramer Says 'Hot Money' Flowing From Nvidia, Apple Into China, Focus On Alibaba 'If You Must' Photo: Shutterstock Market News and Data brought to you by Benzinga APIs

Share

Share

Copy Link

Nvidia's upcoming Blackwell GPU platform is generating excitement among investors and analysts, with expectations of strong revenue growth and market dominance in the AI sector.

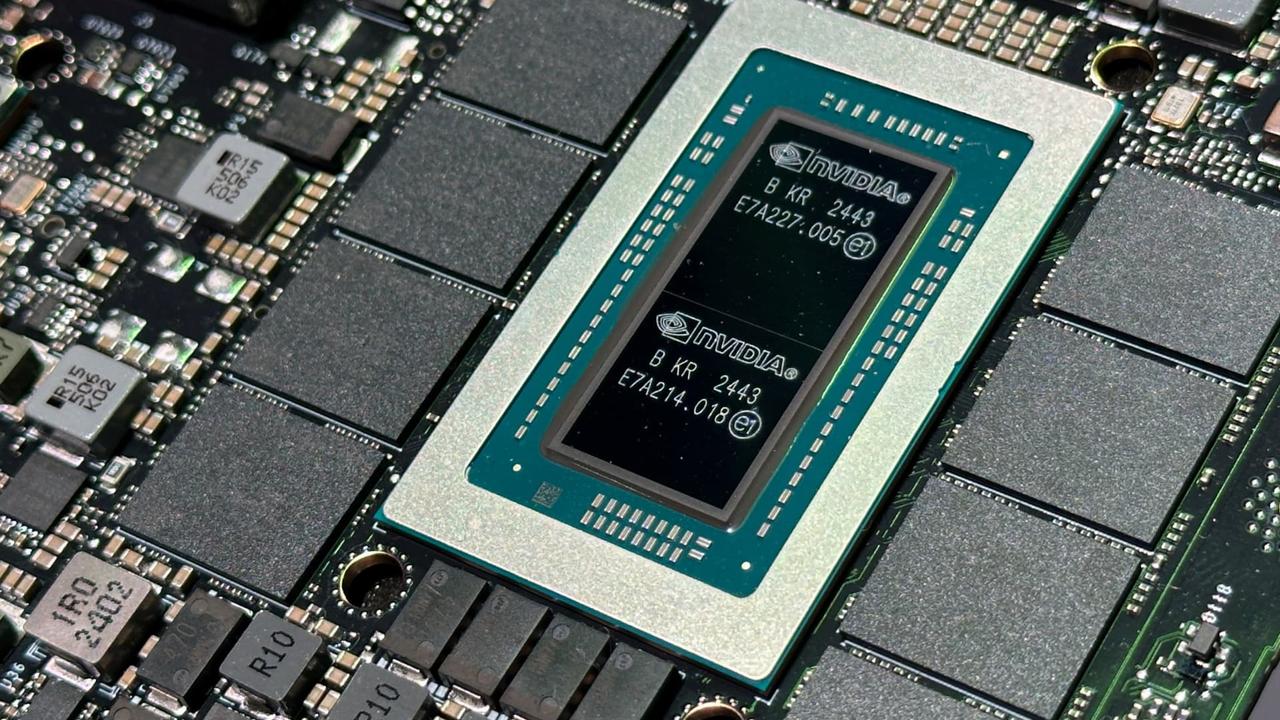

Nvidia's Blackwell GPU Platform Set to Revolutionize AI Computing

Nvidia, the artificial intelligence (AI) darling of the tech industry, is poised for significant growth with the upcoming launch of its next-generation Blackwell GPU platform. Despite recent market fluctuations, analysts remain bullish on Nvidia's long-term prospects in the rapidly evolving AI landscape.

Blackwell Platform: A Game-Changer for AI Computing

JPMorgan analyst Harlan Sur reports that Nvidia has successfully addressed early yield issues with the Blackwell GPU chip, paving the way for high-volume production in the fourth quarter

4

. The Blackwell platform is expected to support over 100 different system configurations, a substantial increase from the 19-20 configurations offered by the previous Hopper GPU platform4

. This flexibility positions Nvidia to cater to a wide range of AI applications and customer needs.Financial Outlook and Market Position

Citi analyst Atif Malik maintains a buy rating on Nvidia with a $150 price target, suggesting a potential 17.4% upside

1

. While Malik expects Nvidia's stock to remain range-bound through early 2025, he anticipates a sales and gross margin inflection driven by the Blackwell platform in the April quarter1

2

.Nvidia's financial performance has been exceptional, with a staggering revenue growth of 194.69% in the last twelve months as of Q2 2025

3

. The company's market capitalization stands at an impressive $3.18 trillion, reflecting its dominant role in the semiconductor industry3

.AI Adoption and Enterprise Demand

Analysts believe that AI adoption is still in its early to middle stages, with enterprise AI demand set to surge

2

. Nvidia's GPUs are preferred over custom ASICs due to their flexibility and adaptability to rapidly evolving AI applications2

. This aligns with the prevalent multi-cloud strategy adopted by enterprises, allowing them to write applications once and use them across multiple cloud platforms2

.Related Stories

Competition and Market Advantages

Despite emerging competition from startups and domestic AI solutions in China, Nvidia's established position in the market is seen as a significant competitive advantage

4

. The company's extensive software ecosystem, developer base of over 5 million worldwide, and strong partnerships with global CSPs, OEMs, and ODMs create formidable barriers to entry for competitors4

.Future Outlook and Industry Impact

Nvidia anticipates that the push towards accelerating existing workloads in traditional CPU-centric datacenter infrastructure will contribute to an estimated $500 billion annual investment in infrastructure

4

. The company's confidence in the sustainability of AI and accelerated computing spending beyond 2025 is based on the scaling of generative AI and foundational models, market penetration of inferencing, and the early development phases of enterprise and sovereign AI initiatives4

.As Nvidia continues to innovate and expand its market presence, the company's impact on the AI industry and broader technology sector is expected to grow. With its strong financial performance, technological advancements, and strategic market positioning, Nvidia remains at the forefront of the AI revolution, shaping the future of computing and artificial intelligence.

References

Summarized by

Navi

[2]

[3]

[4]

Related Stories

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

Meta strikes up to $100 billion AI chips deal with AMD, could acquire 10% stake in chipmaker

Technology

3

Pentagon threatens Anthropic with supply chain risk label over AI safeguards for military use

Policy and Regulation