Nvidia to Launch Cheaper Blackwell AI Chip for China Amid US Export Restrictions

23 Sources

23 Sources

[1]

Nvidia RTX PRO 6000D (B40) Blackwell GPUs reportedly set to supersede banned H20 accelerators in China

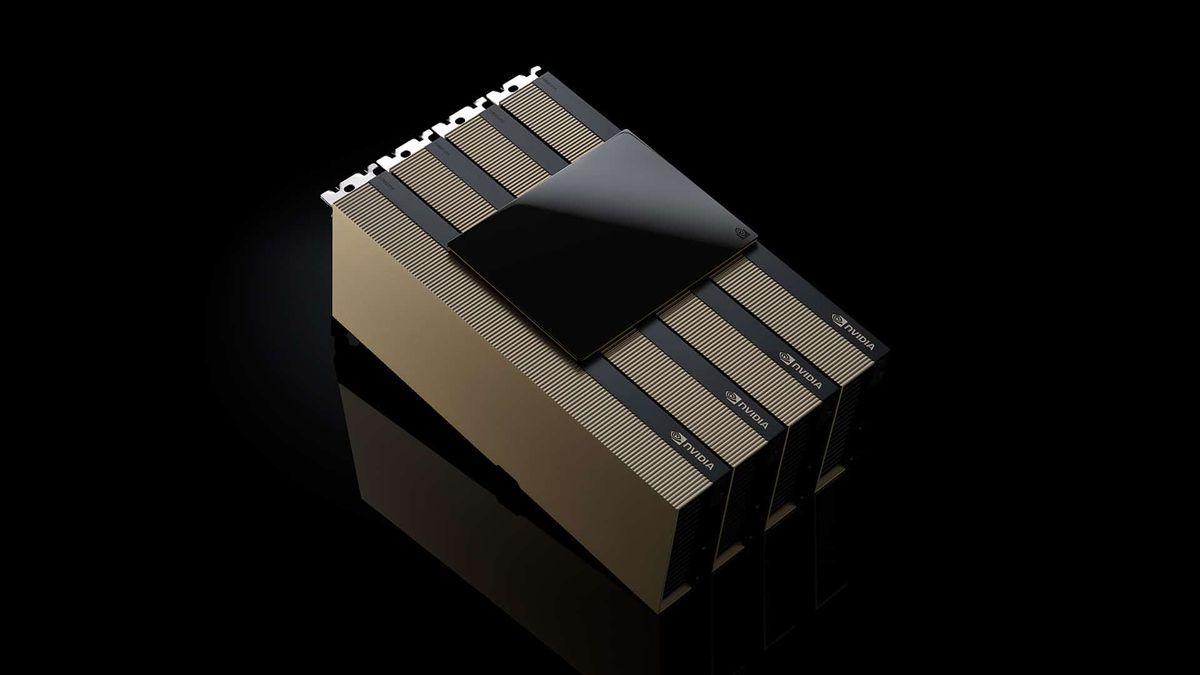

Following the ban of its Hopper H20 accelerations in China, Nvidia is reportedly planning on launching new Blackwell-based solutions at a lower price this year, per Reuters. With mass production anticipated by June, we can expect these solutions to be widely available in the Chinese market by Q3 or Q4. While technical details are still emerging, we can already discern some important details and specifications. Due to stringent U.S. export policies targeting China, the Hopper family has largely been a cat-and-mouse chase between U.S. regulators and Nvidia. Even before their official debut, the flagship H100 and H200 accelerators were already subject to export bans. Nvidia introduced the H800 to circumvent these regulations, which eventually faced a similar fate in October 2023. The cut-down H20 served as Nvidia's primary AI solution for the Chinese market in the interim until its recent ban under the current administration last month, which forced Nvidia to write off $5.5 billion in GPU supply. Reuters reports that Nvidia's follow-up to the H20 will be based on the Blackwell architecture, more specifically, the RTX Pro 6000D. Further clarification by tipster Jukanlosreve at X, citing a report from China's GF Securities, suggests the RTX Pro 6000D will be dubbed B40 (likely a successor to the Ada Lovelace L40). Reuters classifies this as a server-class GPU which uses traditional GDDR7 memory instead of HBM, and notably avoids the use of TSMC's CoWoS packaging technology, likely signaling at its monolithic nature. There are two possibilities based on the available data. This GPU can either be based on datacenter grade GB1XX Blackwell or consumer-grade GB2XX Blackwell silicon. The former is unlikely, as it only features HBM controllers at the silicon level. If the B40 utilizes GB2XX dies, it would be a derivative of the GB202 chip (found in the RTX 5090 and RTX Pro Blackwell 6000) and would lack NVLink support. The report estimates the price of the B40 between $6,500 and $8,000, which is less than the H20 and comparable to Nvidia's global RTX Pro 6000 workstation models. The HGX H20 could be configured in an 8-GPU configuration, but without NVLink, the B40 would likely face challenges in multi-GPU setups. Nvidia's latest RTX Pro Blackwell servers employ up to eight RTX Pro 6000 GPUs, connected via ConnectX-8 SuperNICs with integrated PCIe 6.0 switches, for GPU-to-GPU communication. This setup is likely what we'll see for the B40, with scaling beyond eight GPUs expected to be handled by Nvidia's Spectrum-X networking platform. Since details are scarce, this is just speculation on our part, so please don't read it as gospel.

[2]

Nvidia Plans Cheaper Blackwell AI Chip for China, Reuters Says

Nvidia Corp. plans to launch a new artificial intelligence chip for China with its latest Blackwell architecture at a lower price than the H20 model, Reuters reported on Saturday, citing people familiar with the matter who weren't identified. The company plans mass production of the new graphics processing unit as early as June, according to the report. It's expected to cost between $6,500 and $8,000, whereas the H20 model for China has sold until now for $10,000 to $12,000, two of the people told Reuters.

[3]

Exclusive: Nvidia to launch cheaper Blackwell AI chip for China after US export curbs, sources say

BEIJING/TAIPEI, May 24 (Reuters) - Nvidia (NVDA.O), opens new tab will launch a new artificial intelligence chipset for China at a significantly lower price than its recently restricted H20 model and plans to start mass production as early as June, sources familiar with the matter said. The GPU or graphics processing unit will be part of Nvidia's latest generation Blackwell-architecture AI processors and is expected to be priced between $6,500 and $8,000, well below the $10,000-$12,000 the H20 sold for, according to two of the sources. The lower price reflects its weaker specifications and simpler manufacturing requirements. It will be based on Nvidia's RTX Pro 6000D, a server-class graphics processor and will use conventional GDDR7 memory instead of more advanced high bandwidth memory, the two sources said. They added it would not use Taiwan Semiconductor Manufacturing Co's (2330.TW), opens new tab advanced Chip-on-Wafer-on-Substrate (CoWoS) packaging technology. The new chip's price, specifications and production timing have not previously been reported. The three sources Reuters spoke to for this article declined to be identified as they were not authorised to speak to media. An Nvidia spokesperson said the company was still evaluating its "limited" options. "Until we settle on a new product design and receive approval from the U.S. government, we are effectively foreclosed from China's $50 billion data center market." TSMC declined to comment. MARKET SHARE PLUNGE China remains a huge market for Nvidia, accounting for 13% of its sales in the past financial year. It's the third time that Nvidia has had to tailor a GPU for the world's second-largest economy after restrictions from U.S. authorities who are keen to stymie Chinese technological development. After the U.S. effectively banned the H20 in April, Nvidia initially considered developing a downgraded version of the H20 for China, sources have said, but that plan didn't work out. Nvidia CEO Jensen Huang said last week the company's older Hopper architecture - which the H20 uses - can no longer accommodate further modifications under current U.S. export restrictions. Reuters was unable to determine the product's final name. Chinese brokerage GF Securities said in a note published on Tuesday that the new GPU would likely be called the 6000D or the B40, though it did not disclose pricing or cite sources for the information. According to two of the sources, Nvidia is also developing another Blackwell-architecture chip for China that is set to begin production as early as September. Reuters was not immediately able to confirm specifications of that variant. Nvidia's market share in China has plummeted from 95% before 2022, when U.S. export curbs that impacted its products began, to 50% currently, Huang told reporters in Taipei this week. Its main competitor is Huawei (HWT.UL) which produces the Ascend 910B chip. Huang also warned that if U.S. export curbs continue, more Chinese customers will buy Huawei's chips. The H20 ban forced Nvidia to write off $5.5 billion in inventory and Huang told the Stratechery podcast on Monday that the company also had to walk away from $15 billion in sales. The latest export restrictions introduced new limits on GPU memory bandwidth - a crucial metric measuring data transmission speeds between the main processor and memory chips. This capability is particularly important for AI workloads that require extensive data processing. Investment bank Jefferies estimates that the new regulations cap memory bandwidth at 1.7-1.8 terabytes per second. That compares with the 4 terabytes per second that the H20 is capable of. GF Securities forecast the new GPU will achieve approximately 1.7 terabytes per second using GDDR7 memory technology, just within the export control limits. Reporting by Liam Mo in Beijing and Fanny Potkin in Taipei, additional reporting by Karen Freifeld in New York; Editing by Brenda Goh and Edwina Gibbs Our Standards: The Thomson Reuters Trust Principles., opens new tab Suggested Topics:Disrupted

[4]

Nvidia to launch cheaper Blackwell AI chip for China after U.S. export curbs, sources say

Nvidia will launch a new artificial intelligence chipset for China at a significantly lower price than its recently restricted H20 model and plans to start mass production as early as June, sources familiar with the matter said. The GPU or graphics processing unit will be part of Nvidia's latest generation Blackwell-architecture AI processors and is expected to be priced between $6,500 and $8,000, well below the $10,000-$12,000 the H20 sold for, according to two of the sources. The lower price reflects its weaker specifications and simpler manufacturing requirements. It will be based on Nvidia's RTX Pro 6000D, a server-class graphics processor and will use conventional GDDR7 memory instead of more advanced high bandwidth memory, the two sources said. They added it would not use Taiwan Semiconductor Manufacturing's 2330.TW advanced Chip-on-Wafer-on-Substrate (CoWoS) packaging technology. The new chip's price, specifications and production timing have not previously been reported. The three sources Reuters spoke to for this article declined to be identified as they were not authorized to speak to media. An Nvidia spokesperson said the company was still evaluating its "limited" options. "Until we settle on a new product design and receive approval from the U.S. government, we are effectively foreclosed from China's $50 billion data center market."

[5]

Nvidia plans cheaper, simpler Blackwell AI GPUs for China: Report

The trade war between US and China is hardly showing any sings of slowing down, and tech giants NVIDIA are already bearing the brunt of this war. However, the company is making all possible attempts to circumvent the political turmoil and add stability to their position in the Chinese markets. As per latest reports from Reuters, NVIDIA will launch a new AI chipset for China at lower price points. The chipset will be significantly lower than its restricted H20 model, with mass production rumored to start in as early as June.

[6]

Report: Nvidia racing to develop new, scaled-down Blackwell GPUs for China - SiliconANGLE

Report: Nvidia racing to develop new, scaled-down Blackwell GPUs for China Nvidia Corp. isn't giving up on the Chinese market, and is instead racing to develop a new, lower-powered artificial intelligence chip that will be sold at a cheaper price than the now-restricted H20 model. The new graphics processing unit will be considered as part of Nvidia's latest generation of Blackwell processors, but will be significantly less powerful than the variants destined for western markets. According to Reuters, which first reported the news, it will be priced at around $6,500 to $8,000, well below the $12,000 price tag of the H20 chipset, which is based on an older architecture. In April, Nvidia was slapped with fresh restrictions that prohibited the export of the H20 GPU to China. That chip, based on the company's Hopper architecture, is comparable to the H100 and H200 products that are sold to U.S. companies, but has less bandwidth and slower interconnection speeds. It was designed to meet earlier restrictions on chip exports to China, but Trump administration officials seemingly decided that even the scaled-down H20 was still too powerful to be exported to its biggest rival in the AI industry. The decision came just weeks after it was revealed that DeepSeek Ltd., the startup that developed a foundation model with reasoning capabilities on a par with the best models from OpenAI and other U.S. firms, did so using clusters of H20 chips. The lower price of Nvidia's new chip is said to reflect its lower specifications and simpler manufacturing requirements, Reuters reported, citing three anonymous sources familiar with the company's plans. It will be based on the Nvidia RTX Pro 6000D, which is a server-class Blackwell GPU. It will be equipped with conventional GDDR7 memory, as opposed to the high-bandwidth memory found in other Blackwell chips. It could enter production as early as June, the sources added. The new chip would not be manufactured using Taiwan Semiconductor Manufacturing Co.'s most advanced Chip-on-Wafer-on-Substrate packaging technology, but instead use an older process. A spokesperson for Nvidia declined to comment on the new chip, but said the company was still evaluating its "limited options" with regard to the Chinese market. "Until we settle on a new product design and receive approval from the U.S. government, we are effectively foreclosed from China's $50 billion data center market," the spokesperson said. Despite the sanctions, China remains a key market for Nvidia, accounting for 13% of its annual revenue in its previous financial year. It has been hit with sanctions prohibiting it from selling its most advanced chips to Chinese companies twice before, and each time has responded by creating a scaled-down version of its technology for that market. Nvidia's biggest competitor in the Chinese GPU market is Huawei Technologies Co. Ltd., which produces the Ascend 910B chipset. Nori Chiou, a semiconductor industry analyst at White Oak Capital Partners, told Reuters that Huawei is expected to be able to match the performance of Nvidia's scaled-down chips within the next one-to-two years. However, Nvidia still has one advantage over its rival, due to its chips' ability to integrate AI clusters with the CUDA platform. CUDA is the programming architecture that's used to optimize applications and AI models for Nvidia's GPUs, and its widespread popularity means that developers are keen to stick with it. The export ban implemented in April forced Nvidia to write off more than $5.5 billion in inventory, and the company's chief executive officer Jensen Huang admitted last week that it also walked away from more than $15 billion in sales. According to Huang, Nvidia initially considered developing an even more scaled-down version of the H20 chip in response to the latest restrictions, but soon realized that the older Hopper architecture is unable to accommodate further modifications. The latest restrictions introduced new limits on GPU memory bandwidth, which is a metric that measures how fast data can be sent between the actual processor and the onboard memory system. Higher bandwidth is vital for AI workloads, as they involve processing extensive amounts of data.

[7]

NVIDIA to Launch Cheaper AI Chips for China, Reports Say | AIM

The company could start mass production as early as June, with the chips priced between $6500 and $8000. NVIDIA is set to launch a new AI chip for China at a much lower price than its restricted H20 model, with mass production starting in June, sources familiar with the matter told Reuters. The sources said the GPUs will be part of NVIDIA's most recent generation Blackwell architecture AI processors, priced between $6500 and $8000, much below the H20 model, which sold between $10,000 and $12,000. The lower price reflects its weaker specifications and simpler manufacturing requirements, which can reduce the company's costs through simplified designs. According to the two sources, the upcoming AI chip will be built on NVIDIA's RTX Pro 6000D, a server-grade graphics processor. It will use standard GDDR7 memory rather than the more sophisticated high-bandwidth memory (HBM). They further mentioned that it would not incorporate the advanced Chip-on-Wafer-on-Substrate (CoWoS) packaging technology from Taiwan Semiconductor Manufacturing Co (2330.TW). According to a spokesperson from NVIDIA, the company is still assessing its "limited" options. "Until we settle on a new product design and receive approval from the US government, we are effectively foreclosed from China's $50 billion data centre market," Reuters quoted the source. Reports show that NVIDIA's position in the Chinese market stood at 95% four years ago, but it has significantly dropped to 50% due to the US government's restricted regulations on exporting the company's AI chips to China. This new AI chip leverages NVIDIA's still-existing ground presence in the Chinese AI sector. Export restrictions have resulted in financial setbacks for NVIDIA, including a $5.5 billion write-off and around $15 billion in lost sales. Hence, this approach could be a strategic move to compensate for the losses. Reuters also reported that NVIDIA investors will look for definitive answers on how much US chip curbs on China will cost when the company releases its results on Wednesday, even as a pullback in other regulations is expected to open up new markets.

[8]

NVIDIA RTX Pro 6000D-Derived Blackwell Chip Targeted at China

Nvidia is about to roll out a more wallet-friendly AI chip built on its Blackwell GPU design, specifically for the Chinese market. Production kicks off in June, and the idea is to bring pricing down to about USD 6,500-8,000 -- a significant drop compared to the USD 10,000-12,000 tag on the H20. The cost cut comes from dialing back on some performance specs and making the chip assembly easier. At its heart, this new Blackwell variant leverages the same GPU engine as Nvidia's RTX Pro 6000D but swaps out the pricey high-bandwidth memory for standard GDDR7. That change alone trims manufacturing costs. On top of that, Nvidia has opted not to use the most advanced packaging tech from TSMC, further simplifying production and helping keep the price in check. To meet export rules, memory bandwidth has been limited to 1.8 terabytes per second, instead of the H20's 4 TB/s ceiling. This throttle helps Nvidia comply with US export controls while still delivering a capable AI accelerator. Despite its earlier dominance, Nvidia's foothold in China has eased back under tighter US trade policies. Market share plunged from about 95 percent in 2022 to roughly 50 percent more recently as restrictions took effect. Jensen Huang, Nvidia's CEO, has warned that any additional curbs could push Chinese organizations toward local alternatives -- one likely contender being Huawei's Ascend 910B. To address this challenge, Nvidia isn't stopping at just one budget-oriented chip. A second Blackwell design, expected to hit production in September, is already underway, although Nvidia has kept the specifics under wraps for now. From a technical standpoint, the new Blackwell chip is an exercise in balancing performance and cost. By replacing HBM with GDDR7, Nvidia accepts a drop in peak throughput but gains in manufacturing efficiency and component availability. Standard GDDR7 modules are easier to source and integrate, cutting lead times and simplifying supply-chain management. The decision to cap throughput at 1.8 TB/s further eases the design constraints, allowing Nvidia to bypass the complexity of advanced memory interfaces designed for ultra-high bandwidth. For Chinese AI developers and data-center operators, this chip should hit a sweet spot between performance and affordability. While it won't deliver the highest possible throughput for large-scale model training, it will support a wide range of inference workloads and smaller training tasks at a lower price point. That can be especially valuable for research labs, university computing clusters, and smaller enterprises looking to deploy AI without investing in premium-priced hardware. Looking ahead, Nvidia's dual-chip lineup for China could help stabilize its position in the region's AI hardware market. The two variants -- one launching in June and the other in September -- provide a tiered approach that addresses both mid-range and entry-level segments. Combined with Huang's cautionary statements about trade-restriction fallout, Nvidia's strategy underscores the delicate balance between regulatory compliance and market competitiveness. As US export policies evolve, the effectiveness of these tailored solutions will likely shape Nvidia's long-term standing in China's rapidly growing AI ecosystem. Source: Reuters

[9]

Nvidia plans to make cheaper AI chips for China: Report

Nvidia will reportedly launch a new lower-cost artificial intelligence chip specifically for China, following restrictions on exporting its more expensive model. Nvidia plans to start mass production of the new AI chips in June, which will be part of the firm's latest generation of AI chips, Reuters reported on May 26, citing people familiar with the matter. The company plans to sell it for between $6,500 and $8,000 owing to its lower specifications and simple manufacturing requirements -- cheaper than the some $10,000 to $12,000 Nvidia's recently restricted H20 model sold for. An Nvidia spokesperson told Reuters it was still evaluating the company's limited options. "Until we settle on a new product design and receive approval from the US government, we are effectively foreclosed from China's $50 billion data center market," they said. China is a massive market for the chipmaker, accounting for 13% of its sales in the past financial year. In April, the US government informed Nvidia that export licenses were required for its popular H20 chips. The restrictions specifically mentioned China, and the government cited concern over the risk that the technology "may be used in, or diverted to, a supercomputer in China." According to Nvidia CEO Jensen Huang, its market share in China has plummeted from 95% before 2022, when US export restrictions first impacted its products, to 50% currently. "We will continue to make tremendous efforts to optimize compliant products and continue serving the Chinese market," he said on Taiwanese TV last week. It is the company's third attempt to create China-compliant chips, and the new chip is designed to meet current US bandwidth limits of 1.7 terabytes per second. Related: Anthropic debuts most powerful AI yet amid 'whistleblowing' controversy Nvidia's main rival is Shenzhen-based Huawei, which is testing and preparing to ship a new AI chip called the Ascend 910D. The news comes a couple of days before the firm is due to release its quarterly earnings report, which is due on May 28. The chip manufacturer's stock finished last week down around 3%, breaking a streak of four straight weekly gains. Analysts on average expect Nvidia to report quarterly revenue of $43.4 billion, 66% higher year-over-year, and adjusted net income of $21.3 billion, according to Investopedia. "We see upside ... despite the loss of H20 sales to China," said Oppenheimer analysts.

[10]

NVIDIA's new Blackwell AI GPU for China rumored to be named 6000D or B40, expected to use GDDR7

NVIDIA's new special edition Blackwell AI GPU for China expected to be named 6000D or B40, GDDR7 and not HBM, will support CUDA, could cost around $7000. As an Amazon Associate, we earn from qualifying purchases. TweakTown may also earn commissions from other affiliate partners at no extra cost to you. NVIDIA's new special edition Blackwell AI GPU for China is expected to roll out later this year, and could be named 6000D or B40 according to the latest reports. In a new post on X by insider @Jukanlosreve, we're hearing that the new NVIDIA 6000D or B40 -- whatever it ends up being called -- will be based on Blackwell and not Hopper, with NVIDIA CEO Jensen Huang saying last week that NVIDIA's new AI GPU for China wouldn't be based on Hopper as H20 "can't be modified anymore". NVIDIA's new 6000D or B40 will reportedly shift to GDDR7 instead of HBM, also lining up with previous rumors, with @Jukanlosreve saying that the GDDR7 memory bandwidth will be around 1.7TB/sec, and that the NVLink speed is estimated to be around 550GB/sec per direction, and that it will support CUDA. The insider adds that the "shipment volume is projected to reach up to 1 million units by the end of the year" and that the "price is estimated to be around $7000, and the shipment figure is a projection for reference only". With mass production estimated to start in early July, we should begin to hear more and more concrete details on what NVIDIA is planning for China -- as well as the naming of its new AI GPU whether its the 6000D, B40, or something else entirely.

[11]

Nvidia to launch cheaper Blackwell AI chip for China after US export curbs, sources say

China remains a huge market for Nvidia, accounting for 13% of its sales in the past financial year. It's the third time that Nvidia has had to tailor a GPU for the world's second-largest economy after restrictions from U.S. authorities who are keen to stymie Chinese technological development.Nvidia will launch a new artificial intelligence chipset for China at a significantly lower price than its recently restricted H20 model and plans to start mass production as early as June, sources familiar with the matter said. The GPU or graphics processing unit will be part of Nvidia's latest generation Blackwell-architecture AI processors and is expected to be priced between $6,500 and $8,000, well below the $10,000-$12,000 the H20 sold for, according to two of the sources. The lower price reflects its weaker specifications and simpler manufacturing requirements. It will be based on Nvidia's RTX Pro 6000D, a server-class graphics processor and will use conventional GDDR7 memory instead of more advanced high bandwidth memory, the two sources said. They added it would not use Taiwan Semiconductor Manufacturing Co's advanced Chip-on-Wafer-on-Substrate (CoWoS) packaging technology. The new chip's price, specifications and production timing have not previously been reported. The three sources Reuters spoke to for this article declined to be identified as they were not authorised to speak to media. An Nvidia spokesperson said the company was still evaluating its "limited" options. "Until we settle on a new product design and receive approval from the U.S. government, we are effectively foreclosed from China's $50 billion data center market." TSMC declined to comment. Market share plunge China remains a huge market for Nvidia, accounting for 13% of its sales in the past financial year. It's the third time that Nvidia has had to tailor a GPU for the world's second-largest economy after restrictions from U.S. authorities who are keen to stymie Chinese technological development. After the U.S. effectively banned the H20 in April, Nvidia initially considered developing a downgraded version of the H20 for China, sources have said, but that plan didn't work out. Nvidia CEO Jensen Huang said last week the company's older Hopper architecture - which the H20 uses - can no longer accommodate further modifications under current U.S. export restrictions. Reuters was unable to determine the product's final name. Chinese brokerage GF Securities said in a note published on Tuesday that the new GPU would likely be called the 6000D or the B40, though it did not disclose pricing or cite sources for the information. According to two of the sources, Nvidia is also developing another Blackwell-architecture chip for China that is set to begin production as early as September. Reuters was not immediately able to confirm specifications of that variant. Nvidia's market share in China has plummeted from 95% before 2022, when U.S. export curbs that impacted its products began, to 50% currently, Huang told reporters in Taipei this week. Its main competitor is Huawei which produces the Ascend 910B chip. Huang also warned that if U.S. export curbs continue, more Chinese customers will buy Huawei's chips. The H20 ban forced Nvidia to write off $5.5 billion in inventory and Huang told the Stratechery podcast on Monday that the company also had to walk away from $15 billion in sales. The latest export restrictions introduced new limits on GPU memory bandwidth - a crucial metric measuring data transmission speeds between the main processor and memory chips. This capability is particularly important for AI workloads that require extensive data processing. Investment bank Jefferies estimates that the new regulations cap memory bandwidth at 1.7-1.8 terabytes per second. That compares with the 4 terabytes per second that the H20 is capable of. GF Securities forecast the new GPU will achieve approximately 1.7 terabytes per second using GDDR7 memory technology, just within the export control limits.

[12]

Nvidia to launch cheaper Blackwell AI chip for China after US export curbs

Nvidia will launch a new artificial intelligence chipset for China at a significantly lower price than its recently restricted H20 model and plans to start mass production as early as June, sources familiar with the matter said. The GPU or graphics processing unit will be part of Nvidia's latest generation Blackwell-architecture AI processors and is expected to be priced between $6,500 and $8,000, well below the $10,000-$12,000 the H20 sold for, according to two of the sources. The lower price reflects its weaker specifications and simpler manufacturing requirements. It will be based on Nvidia's RTX Pro 6000D, a server-class graphics processor and will use conventional GDDR7 memory instead of more advanced high bandwidth memory, the two sources said. They added it would not use Taiwan Semiconductor Manufacturing Co's advanced Chip-on-Wafer-on-Substrate (CoWoS) packaging technology. The new chip's price, specifications and production timing have not previously been reported. The three sources Reuters spoke to for this article declined to be identified as they were not authorised to speak to media. An Nvidia spokesperson said the company was still evaluating its "limited" options. "Until we settle on a new product design and receive approval from the U.S. government, we are effectively foreclosed from China's $50 billion data center market." TSMC declined to comment. Market share plunge China remains a huge market for Nvidia, accounting for 13% of its sales in the past financial year. It's the third time that Nvidia has had to tailor a GPU for the world's second-largest economy after restrictions from U.S. authorities who are keen to stymie Chinese technological development. After the U.S. effectively banned the H20 in April, Nvidia initially considered developing a downgraded version of the H20 for China, sources have said, but that plan didn't work out. Nvidia CEO Jensen Huang said last week the company's older Hopper architecture - which the H20 uses - can no longer accommodate further modifications under current U.S. export restrictions. Reuters was unable to determine the product's final name. Chinese brokerage GF Securities said in a note published on Tuesday that the new GPU would likely be called the 6000D or the B40, though it did not disclose pricing or cite sources for the information. According to two of the sources, Nvidia is also developing another Blackwell-architecture chip for China that is set to begin production as early as September. Reuters was not immediately able to confirm specifications of that variant. Nvidia's market share in China has plummeted from 95% before 2022, when U.S. export curbs that impacted its products began, to 50% currently, Huang told reporters in Taipei this week. Its main competitor is Huawei which produces the Ascend 910B chip. Huang also warned that if U.S. export curbs continue, more Chinese customers will buy Huawei's chips. The H20 ban forced Nvidia to write off $5.5 billion in inventory and Huang told the Stratechery podcast on Monday that the company also had to walk away from $15 billion in sales. The latest export restrictions introduced new limits on GPU memory bandwidth - a crucial metric measuring data transmission speeds between the main processor and memory chips. This capability is particularly important for AI workloads that require extensive data processing. Investment bank Jefferies estimates that the new regulations cap memory bandwidth at 1.7-1.8 terabytes per second. That compares with the 4 terabytes per second that the H20 is capable of. GF Securities forecast the new GPU will achieve approximately 1.7 terabytes per second using GDDR7 memory technology, just within the export control limits.

[13]

NVIDIA Could Earn Up To $10 Billion From Its Next "Blackwell" Chip For China This Year, Priced at Just $6,500-$8,000

NVIDIA is set to launch its next chip for the China AI market in the upcoming months, and the price of this chip is expected to be a bargain for clients. Team Green needs to move with its position in China quickly, since not only is the competition from the likes of Huawei ramping up, but with the evolving geopolitical situation, NVIDIA doesn't know what the next move from the Trump administration will be. According to a new report by Reuters, it has been revealed that NVIDIA's next Blackwell chip could be half the price of the H20 AI accelerator, as the key focus with the release would likely be to get the market share back from the likes of Huawei. The chip is expected to enter production as soon as next month, and is said to be available to the Chinese AI markets by July. The price tag NVIDIA will offer does come with a cost, which is a cut-down on specifications. According to what we know, the significant difference will lie in the use of GDDR7 memory instead of HBM, which is done to comply with memory bandwidth restrictions by the US chip policies. Along with this, the Blackwell chip is expected not to use TSMC's CoWoS technology, which means that the performance with this model will be severely lower than what mainstream solutions offer, which means that the gap between Chinese and Western AI performance is only going to increase. NVIDIA's revenue from China has significantly dropped after the initial round of restrictions set by the Biden adminstration. The firm's revenue in China doesn't come from the H20 AI accelerator alone, as the firm was previously said to be selling "millions" of AI GPUs, particularly the H100 and the A100 models. Jensen claims that China is a $50 billion opportunity for NVIDIA, yet US restrictions have held them back to the point where NVIDIA's CEO has revealed that they could be replaced, since market share has dropped to 50%. The low cost of the Blackwell AI chip is likely to lure in customers, since NVIDIA is anticipated to sell over one million units of these chips by the end of the year. However, it is safe to say that with this particular chip, Team Green would no longer be the company offering the highest-end solution to the domestic market, since the Ascend 910C chip from Huawei will outperform it. But, NVIDIA has plans to leverage its software ecosystem, CUDA, which will give the company an edge.

[14]

After Jensen Huang Criticized US Export Curbs, Nvidia Set To Launch Cheaper Blackwell AI Chip For China Amid Market Share Slide: Report - NVIDIA (NASDAQ:NVDA), Taiwan Semiconductor (NYSE:TSM)

Nvidia Corp. NVDA will launch a significantly cheaper artificial intelligence chip for China's market, priced between $6,500 and $8,000, as the company adapts to ongoing U.S. export restrictions that have decimated its Chinese market share. What Happened: The new graphics processing unit, based on Nvidia's latest Blackwell architecture, represents a dramatic price reduction from the company's recently banned H20 model, which sold for $10,000 to $12,000. Mass production could begin as early as June, Reuters reported, citing sources. The lower pricing reflects weaker specifications and simplified manufacturing requirements. The chip will utilize Nvidia's RTX Pro 6000D server-class processor with conventional GDDR7 memory rather than advanced high bandwidth memory. Notably, it will not require Taiwan Semiconductor Manufacturing Co. TSM advanced Chip-on-Wafer-on-Substrate packaging technology. "Until we settle on a new product design and receive approval from the U.S. government, we are effectively foreclosed from China's $50 billion data center market," an Nvidia spokesperson stated, according to the report. See Also: Unprecedented Demand For Nvidia's GB200 Drives Accelerated Production: 'Taiwan Engineers Are Working Incredibly Hard,' Says Expert Why It Matters: China remains critical for Nvidia, accounting for 13% of sales in the past financial year. However, the company's Chinese market share has plummeted from 95% before 2022 to 50% currently, CEO Jensen Huang revealed last week. The H20 ban in April forced Nvidia to write off $5.5 billion in inventory and abandon approximately $15 billion in sales. Get StartedEarn 7.2% -- No Matter What the Fed Does Markets expect rate cuts -- but your earnings don't have to suffer. Lock in 7.2% until 2028 from ten individual bonds. Get Started Nvidia faces intensifying competition from Huawei Technologies' Ascend 910B chip. Semiconductor expert Nori Chiou from White Oak Capital Partners expects domestic Chinese technologies to match downgraded chip performance within one to two years, though Nvidia maintains advantages through its CUDA programming platform integration, the report noted. Price Action: Nvidia stock closed at $131.29 on Friday, down 1.16% for the day. In after-hours trading, the stock dipped slightly to $131.17, marking a further decline of 0.09%. The stock has declined 5.08% year-to-date but remains 15.27% higher compared to the same time last year. According to Benzinga Edge Stock Rankings, Nvidia maintains strong price momentum across short-, medium-, and long-term timeframes. While its momentum score remains solid, the stock ranks poorly on value metrics. More detailed metrics are available here. Image Via Shutterstock Read Next: Trump's Targeting Of Apple Isn't Random -- Analyst Says It's A Calculated Move For Maximum Political Gain Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. NVDANVIDIA Corp$131.17-1.25%Stock Score Locked: Edge Members Only Benzinga Rankings give you vital metrics on any stock - anytime. Unlock RankingsEdge RankingsMomentum82.17Growth98.78Quality93.95Value6.61Price TrendShortMediumLongOverviewTSMTaiwan Semiconductor Manufacturing Co Ltd$191.50-2.39%Market News and Data brought to you by Benzinga APIs

[15]

NVIDIA's Next "China-Focused" Option Will Likely Be The "B40" AI Chip, Shipments Expected to Reach Up to a Million Units By This Year

Details about NVIDIA's next chip for the Chinese AI market have surfaced online, and it seems like Team Green is planning to flood the domestic markets with its customized Blackwell chips. After the recent H20 export restriction by the US, NVIDIA is exploring new options for the Chinese markets, in an attempt to maintain its influence in the region. Team Green's CEO did say in the past that they weren't expected to release a new "cut-down" Hopper chip anytime soon, so the next solution will undoubtedly be based on Blackwell. Now, according to @Jukanlosreve, citing local Chinese sources, NVIDIA's next AI chip for China will feature GDDR7 memory, along with projected shipments of a whopping one million units by the end of 2025, showing that the demand is to stay here. We know that NVIDIA's upcoming chips will ditch HBM entirely to comply with US restrictions, and they will now leverage the GDDR7 technology. The memory bandwidth for the firm's next AI chip is said to be rated around 1.7 TB/s, which is the standard figure similar to what we have seen with the RTX 5090 GPU. Along with this, the chip is expected to leverage CUDA capabilities in order to drive its perf/watt figures, and this is how NVIDIA plans to stay relevant in the Chinese market. Interestingly, despite all the differences, the firm's new "China-specific" Blackwell chip is still better than Huawei's existing solutions since NVIDIA would leverage its superior architectural capabilities and software ecosystem. However, the uncertainty surrounding using NVIDIA products has ultimately forced Chinese firms to opt for in-house options, such as the Ascend chips from Huawei, and it seems like Huawei's is gaining influence in the market, so it will be interesting to see how NVIDIA combats this. NVIDIA is moving fast towards China, and we expect a new solution in the Chinese market as soon as July, which will put the firm back on track. Jensen has been against the US's harsh stance towards China's AI developments, and it seems like Team Green won't leave the Chinese markets neglected anytime soon.

[16]

NVIDIA's Next "China-Specific" Blackwell AI Chip Expected to Be The Cheapest Option From The Company, Priced at Just $6,500-$8,000

NVIDIA is set to launch its next chip for the China AI market in the upcoming months, and the price of this chip is expected to be a bargain for clients. Team Green needs to move with its position in China quickly, since not only is the competition from the likes of Huawei ramping up, but with the evolving geopolitical situation, NVIDIA doesn't know what the next move from the Trump administration will be. According to a new report by Reuters, it has been revealed that NVIDIA's next Blackwell chip could be half the price of the H20 AI accelerator, as the key focus with the release would likely be to get the market share back from the likes of Huawei. The chip is expected to enter production as soon as next month, and is said to be available to the Chinese AI markets by July. The price tag NVIDIA will offer does come with a cost, which is a cut-down on specifications. According to what we know, the significant difference will lie in the use of GDDR7 memory instead of HBM, which is done to comply with memory bandwidth restrictions by the US chip policies. Along with this, the Blackwell chip is expected not to use TSMC's CoWoS technology, which means that the performance with this model will be severely lower than what mainstream solutions offer, which means that the gap between Chinese and Western AI performance is only going to increase. NVIDIA's revenue from China has significantly dropped after the initial round of restrictions set by the Biden adminstration. The firm's revenue in China doesn't come from the H20 AI accelerator alone, as the firm was previously said to be selling "millions" of AI GPUs, particularly the H100 and the A100 models. Jensen claims that China is a $50 billion opportunity for NVIDIA, yet US restrictions have held them back to the point where NVIDIA's CEO has revealed that they could be replaced, since market share has dropped to 50%. The low cost of the Blackwell AI chip is likely to lure in customers, since NVIDIA is anticipated to sell over one million units of these chips by the end of the year. However, it is safe to say that with this particular chip, Team Green would no longer be the company offering the highest-end solution to the domestic market, since the Ascend 910C chip from Huawei will outperform it. But, NVIDIA has plans to leverage its software ecosystem, CUDA, which will give the company an edge.

[17]

Nvidia to launch cheaper Blackwell AI chip for China after U.S. export curbs, sources say

BEIJING/TAIPEI -- Nvidia will launch a new artificial intelligence chipset for China at a significantly lower price than its recently restricted H20 model and plans to start mass production as early as June, sources familiar with the matter said. The GPU or graphics processing unit will be part of Nvidia's latest generation Blackwell-architecture AI processors and is expected to be priced between US$6,500 and US$8,000, well below the US$10,000-US$12,000 the H20 sold for, according to two of the sources. The lower price reflects its weaker specifications and simpler manufacturing requirements. It will be based on Nvidia's RTX Pro 6000D, a server-class graphics processor, and will use conventional GDDR7 memory instead of more advanced high bandwidth memory (HBM), the two sources said. They added it would not use Taiwan Semiconductor Manufacturing Co's 2330.TW advanced Chip-on-Wafer-on-Substrate (CoWoS) packaging technology. The new chip's price, production timing and above details have not previously been reported. The three sources Reuters spoke to for this article declined to be identified as they were not authorized to speak to media. An Nvidia spokesperson said the company was still evaluating its "limited" options. "Until we settle on a new product design and receive approval from the U.S. government, we are effectively foreclosed from China's $50 billion data center market." TSMC declined to comment. China remains a huge market for Nvidia, accounting for 13% of its sales in the past financial year. It's the third time that Nvidia has had to tailor a GPU for the world's second-largest economy after restrictions from U.S. authorities who are keen to stymie Chinese technological development. Nvidia's new GPU, despite its much weaker computing power compared to the H20, is expected to keep the company competitive despite the loss of substantial market share thus far due to export restrictions. Its main rival in China is Huawei which produces the Ascend 910B chip. "Domestic Chinese technologies like Huawei are expected to catch up with the computing performance of downgraded versions within one to two years," said Nori Chiou, an expert in semiconductors and investment director at Singapore-based White Oak Capital Partners. Nvidia's "remaining edge lies primarily in its ability to integrate AI clusters with its CUDA platform," he added. CUDA is the company's programming architecture engineers use to build their AI models and apps on its GPUs. Its broad use and the ecosystem built around it makes developers keen to stick with Nvidia. Nicolas Gaudois, head of Asia technology research at UBS, said, however, that a new GPU with conventional memory would be insufficient for some AI training and inference uses. Nvidia's market share in China has plummeted from 95% before 2022, when U.S. export curbs that impacted its products began, to 50% currently, Nvidia CEO Jensen Huang told reporters in Taipei last week. Huang also warned that if U.S. export curbs continue, more Chinese customers will buy Huawei's chips. According to two of the sources, Nvidia is also developing another Blackwell-architecture chip for China that is set to begin production as early as September. Reuters was not immediately able to learn the specifications of that variant. After the U.S. effectively banned the H20 in April, Nvidia initially considered developing a downgraded version of the H20 for China, sources have said, but that plan didn't work out. Huang has said the company's older Hopper architecture - which the H20 uses - can no longer accommodate further modifications under current U.S. export restrictions. Reuters was unable to determine the final name for the new GPU to be launched as early as June. Chinese brokerage GF Securities said in a note published last week that it would likely be called the 6000D or the B40, though it did not disclose pricing or cite sources for the information. The H20 ban forced Nvidia to write off $5.5 billion in inventory and Huang told the Stratechery podcast last week that the company also had to walk away from $15 billion in sales. The latest export restrictions introduced new limits on GPU memory bandwidth - a crucial metric measuring data transmission speeds between the main processor and memory chips. This capability is particularly important for AI workloads that require extensive data processing. Investment bank Jefferies estimates that the new regulations cap memory bandwidth at 1.7-1.8 terabytes per second. That compares with the 4 terabytes per second that the H20 is capable of. GF Securities forecast the new GPU will achieve approximately 1.7 terabytes per second using GDDR7 memory technology, just within the export control limits.

[18]

Nvidia to launch cheaper Blackwell AI chip for China after US export...

Nvidia will launch a new artificial intelligence chipset for China at a significantly lower price than its recently restricted H20 model and plans to start mass production as early as June, sources familiar with the matter said. The GPU, or graphics processing unit, will be part of Nvidia's latest generation Blackwell-architecture AI processors and is expected to be priced between $6,500 and $8,000, well below the $10,000-$12,000 the H20 sold for, according to two of the sources. The lower price reflects its weaker specifications and simpler manufacturing requirements. It will be based on Nvidia's RTX Pro 6000D, a server-class graphics processor and will use conventional GDDR7 memory instead of more advanced high bandwidth memory, the two sources said. They added it would not use Taiwan Semiconductor Manufacturing Co.'s advanced Chip-on-Wafer-on-Substrate, or CoWoS, packaging technology. The new chip's price, specifications and production timing have not previously been reported. The three sources Reuters spoke to for this article declined to be identified as they were not authorized to speak to media. An Nvidia spokesperson said the company was still evaluating its "limited" options. "Until we settle on a new product design and receive approval from the U.S. government, we are effectively foreclosed from China's $50 billion data center market." TSMC declined to comment. China remains a huge market for Nvidia, accounting for 13% of its sales in the past financial year. It's the third time that Nvidia has had to tailor a GPU for the world's second-largest economy after restrictions from U.S. authorities who are keen to stymie Chinese technological development. After the U.S. effectively banned the H20 in April, Nvidia initially considered developing a downgraded version of the H20 for China, sources have said, but that plan didn't work out. Nvidia CEO Jensen Huang said last week the company's older Hopper architecture - which the H20 uses - can no longer accommodate further modifications under current U.S. export restrictions. Reuters was unable to determine the product's final name. Chinese brokerage GF Securities said in a note published on Tuesday that the new GPU would likely be called the 6000D or the B40, though it did not disclose pricing or cite sources for the information. According to two of the sources, Nvidia is also developing another Blackwell-architecture chip for China that is set to begin production as early as September. Reuters was not immediately able to confirm specifications of that variant. Nvidia's market share in China has plummeted from 95% before 2022, when U.S. export curbs that impacted its products began, to 50% currently, Huang told reporters in Taipei this week. Its main competitor is Huawei HWT.UL which produces the Ascend 910B chip. Huang also warned that if U.S. export curbs continue, more Chinese customers will buy Huawei's chips. The H20 ban forced Nvidia to write off $5.5 billion in inventory and Huang told the Stratechery podcast on Monday that the company also had to walk away from $15 billion in sales. The latest export restrictions introduced new limits on GPU memory bandwidth - a crucial metric measuring data transmission speeds between the main processor and memory chips. This capability is particularly important for AI workloads that require extensive data processing. Investment bank Jefferies estimates that the new regulations cap memory bandwidth at 1.7-1.8 terabytes per second. That compares with the 4 terabytes per second that the H20 is capable of. GF Securities forecast the new GPU will achieve approximately 1.7 terabytes per second using GDDR7 memory technology, just within the export control limits.

[19]

Nvidia to launch lower-priced AI chipset for China - Reuters By Investing.com

Investing.com -- Nvidia (NASDAQ:NVDA) is planning to introduce a new artificial intelligence (AI) chipset in China that will be significantly less expensive than its recently limited H20 model, Reuters reported on Monday. The company aims to start mass production of the new chipset as soon as June, the report added, citing sources familiar with the matter. The graphics processing unit (GPU) will be a part of Nvidia's latest generation Blackwell-architecture AI processors. The expected price range for this new chipset is between $6,500 and $8,000, substantially lower than the $10,000 to $12,000 price point of the H20 model, Reuters added. The reduced price of the new chipset is attributed to its less powerful specifications and simpler manufacturing requirements. According to the report, the new chipset will be based on Nvidia's RTX Pro 6000D, a server-class graphics processor, and will use conventional GDDR7 memory instead of the more advanced high bandwidth memory.

[20]

Nvidia plans to launch cheap Blackwell AI chip in China amid US controls- Reuters By Investing.com

Investing.com-- Nvidia (NASDAQ:NVDA) plans to launch a new artificial intelligence chip in China at a lower price than its recently restricted H20 chip, with production planned to begin by as early as June, Reuters reported over the weekend. The GPU, or graphics processing unit, will be part of Nvidia's current generation Blackwell line of processors, and will be priced between $6,500 and $8,000, lower than the $10,000 to $12,000 Nvidia charged for the H20, Reuters reported, citing two sources familiar with the matter. The proposed chip will have weaker specifications and simpler manufacturing requirements, and will use conventional GDDR7 memory instead of the high bandwidth memory (HBM) used by more advanced AI chips. This is in line with new U.S. restrictions on chip exports to China, which prevent sales of chips with HBM. The new China chip will not use Nvidia supplier TSMC's advanced chip-on-wafer-on-substrate packaging technology, Reuters reported. The push for a new China chip comes as Nvidia struggles against new U.S. export restrictions to remain competitive in the Chinese market. CEO Jensen Huang recently said China remained a valuable market for Nvidia, and could balloon to a $50 billion sales market in the coming years. Nvidia was recently blocked from selling the H20 chip- a lower-spec AI chip it had developed specifically for Chinese markets under Biden-era controls on chip exports to China. But the Donald Trump administration recently introduced tighter controls on tech exports to China, essentially restricting the sale of any AI chips with advanced HMB tech in the country. Nvidia has been steadily losing market share in China since 2022, with Huang stating that it had fallen to 50% from 95% before 2022. Huang had recently also called the U.S. export controls on China a "failure," noting that the controls had only pushed local chipmakers to increase their efforts to develop alternatives to U.S. exports. Nvidia faces stiff competition from China's Huawei, which has made steady advancements in its AI chip development capabilities in recent years with its Ascend line.

[21]

Exclusive-Nvidia to launch cheaper Blackwell AI chip for China after US export curbs, sources say

BEIJING/TAIPEI (Reuters) -Nvidia will launch a new artificial intelligence chipset for China at a significantly lower price than its recently restricted H20 model and plans to start mass production as early as June, sources familiar with the matter said. The GPU or graphics processing unit will be part of Nvidia's latest generation Blackwell-architecture AI processors and is expected to be priced between $6,500 and $8,000, well below the $10,000-$12,000 the H20 sold for, according to two of the sources. The lower price reflects its weaker specifications and simpler manufacturing requirements. It will be based on Nvidia's RTX Pro 6000D, a server-class graphics processor and will use conventional GDDR7 memory instead of more advanced high bandwidth memory, the two sources said. They added it would not use Taiwan Semiconductor Manufacturing Co's advanced Chip-on-Wafer-on-Substrate (CoWoS) packaging technology. The new chip's price, specifications and production timing have not previously been reported. The three sources Reuters spoke to for this article declined to be identified as they were not authorised to speak to media. An Nvidia spokesperson said the company was still evaluating its "limited" options. "Until we settle on a new product design and receive approval from the U.S. government, we are effectively foreclosed from China's $50 billion data center market." China remains a huge market for Nvidia, accounting for 13% of its sales in the past financial year. It's the third time that Nvidia has had to tailor a GPU for the world's second-largest economy after restrictions from U.S. authorities who are keen to stymie Chinese technological development. After the U.S. effectively banned the H20 in April, Nvidia initially considered developing a downgraded version of the H20 for China, sources have said, but that plan didn't work out. Nvidia CEO Jensen Huang said last week the company's older Hopper architecture - which the H20 uses - can no longer accommodate further modifications under current U.S. export restrictions. Reuters was unable to determine the product's final name. Chinese brokerage GF Securities said in a note published on Tuesday that the new GPU would likely be called the 6000D or the B40, though it did not disclose pricing or cite sources for the information. According to two of the sources, Nvidia is also developing another Blackwell-architecture chip for China that is set to begin production as early as September. Reuters was not immediately able to confirm specifications of that variant. Nvidia's market share in China has plummeted from 95% before 2022, when U.S. export curbs that impacted its products began, to 50% currently, Huang told reporters in Taipei this week. Its main competitor is Huawei which produces the Ascend 910B chip. Huang also warned that if U.S. export curbs continue, more Chinese customers will buy Huawei's chips. The H20 ban forced Nvidia to write off $5.5 billion in inventory and Huang told the Stratechery podcast on Monday that the company also had to walk away from $15 billion in sales. The latest export restrictions introduced new limits on GPU memory bandwidth - a crucial metric measuring data transmission speeds between the main processor and memory chips. This capability is particularly important for AI workloads that require extensive data processing. Investment bank Jefferies estimates that the new regulations cap memory bandwidth at 1.7-1.8 terabytes per second. That compares with the 4 terabytes per second that the H20 is capable of. GF Securities forecast the new GPU will achieve approximately 1.7 terabytes per second using GDDR7 memory technology, just within the export control limits. (Reporting by Liam Mo in Beijing and Fanny Potkin in Taipei, additional reporting by Karen Freifeld in New York; Editing by Brenda Goh and Edwina Gibbs)

[22]

Nvidia prepares lighter Blackwell chip for China in response to US restrictions

Nvidia is preparing to launch a new artificial intelligence chip for the Chinese market at a significantly lower price than its previous H20 model, which is now restricted by US sanctions. According to sources close to the matter, mass production will begin in June, with an estimated price tag of between $6,500 and $8,000, compared to $10,000 to $12,000 for the H20. This new GPU is part of Nvidia's latest generation of AI processors, based on the Blackwell architecture. It is said to be derived from the RTX Pro 6000D, a model designed for servers, and to use more conventional GDDR7 memory instead of the more powerful but more strictly controlled HBM (High Bandwidth Memory). Another notable simplification is that the chip will not use TSMC's advanced packaging, known as CoWoS (Chip-on-Wafer-on-Substrate), a key technology in high-end chips. These choices are intended to comply with US restrictions while maintaining a competitive product. China remains a major market for Nvidia, accounting for 13% of its sales in the last fiscal year. But since the first US restrictions on GPU exports in 2022, its market share in the country has fallen from 95% to around 50%, according to CEO Jensen Huang in Taipei last week. He also warned that further restrictions would push more Chinese customers towards Huawei, its main local rival. This new GPU, despite its reduced performance, would allow Nvidia to remain present in the Chinese market while complying with the regulatory limit on memory bandwidth, now capped at around 1.7-1.8 terabytes per second. By comparison, the H20 reached 4 TB/s. At the same time, Nvidia is reportedly working on another version of the Blackwell chip for China, with production set to begin as early as September. No technical details have been released yet. The company had initially planned a downgraded version of the H20, but had to abandon the project due to the limitations of the older Hopper architecture, which was deemed unsuitable for the new US regulations. The new chip, which could be called 6000D or B40 according to a recent note from GF Securities, would be a regulatory-compliant alternative without compromising performance. However, we will have to wait for the technical details to make a comprehensive comparison between Nvidia's new GPU and Huawei's Ascend chip. The ban on the H20 in April forced Nvidia to take a $5.5 billion charge for inventory write-downs. Speaking on the Stratechery podcast, Jensen Huang also revealed that the company had to forego $15 billion in sales. Despite these setbacks, Nvidia retains a crucial competitive advantage: its CUDA software platform, which is essential for AI developers and difficult to replace, even for Chinese players such as Huawei, whose chips such as the Ascend 910B are advancing rapidly. According to analyst Nori Chiou, Nvidia could maintain a one- to two-year lead thanks to its integrated software ecosystem, even if the hardware performance gap narrows.

[23]

Nvidia to launch cheaper AI chip for China: sources

STORY: Nvidia will launch a new and cheaper AI chip for China to avoid U.S. export restrictions. That's according to Reuters sources. They say mass production of the new silicon will begin as early as June. The current H20 chip was effectively banned for sale to China in April. Washington wants to slow the country's development of AI and other technologies. The new product will reportedly use conventional memory, instead of the so-called high-bandwidth memory used by some advanced chips. It's expected to be priced at up to $8,000 per unit - well down on the $10,000-$12,000 for the H20. An Nvidia spokesperson would only say that the company is still evaluating its options. The sources say an earlier plan to produce a downgraded version of the H20 didn't work out. Nvidia boss Jensen Huang says the firm's market share in China has plunged from 95% before export curbs kicked in, to 50% now. He warned that if restrictions stay in place more customers will buy chips from Chinese rival Huawei. On Monday, Huang told the Stratechery podcast that Nvidia had been forced to walk away from $15 billion in sales. It has also written off more than $5 billion in inventory.

Share

Share

Copy Link

Nvidia plans to introduce a new, lower-priced Blackwell-architecture AI chip for the Chinese market, following US export restrictions on its H20 model. The new GPU is expected to begin mass production in June and will be priced between $6,500 and $8,000.

Nvidia's Strategic Move in Response to US Export Restrictions

Nvidia, the leading AI chip manufacturer, is set to launch a new, more affordable artificial intelligence chip for the Chinese market. This move comes in the wake of recent US export restrictions that have significantly impacted Nvidia's operations in China

1

2

3

4

.

Source: CNBC

The New Blackwell-Based GPU

The upcoming GPU will be part of Nvidia's latest generation Blackwell-architecture AI processors. According to sources familiar with the matter, the chip is expected to be priced between $6,500 and $8,000, considerably lower than the recently restricted H20 model, which sold for $10,000 to $12,000

3

4

.Key features of the new chip include:

- Based on Nvidia's RTX Pro 6000D, a server-class graphics processor

- Use of conventional GDDR7 memory instead of more advanced high bandwidth memory

- Avoidance of TSMC's advanced Chip-on-Wafer-on-Substrate (CoWoS) packaging technology

The lower price point reflects the chip's weaker specifications and simpler manufacturing requirements, designed to comply with US export regulations

3

.Production Timeline and Market Impact

Nvidia plans to begin mass production of the new GPU as early as June, with the chip expected to be widely available in the Chinese market by Q3 or Q4 of this year

1

3

. This rapid development and production schedule underscores Nvidia's urgency to maintain its presence in the lucrative Chinese market.The company is also reportedly developing another Blackwell-architecture chip for China, set to begin production as early as September

3

.

Source: TweakTown

Related Stories

Navigating Export Restrictions

The introduction of this new chip is Nvidia's latest attempt to navigate the complex landscape of US export restrictions targeting China. The company has faced a series of challenges, including:

- Export bans on flagship H100 and H200 accelerators

- Introduction and subsequent ban of the H800 model

- Recent ban on the cut-down H20 model, forcing Nvidia to write off $5.5 billion in GPU supply

1

3

The latest export restrictions have introduced new limits on GPU memory bandwidth, a crucial metric for AI workloads. Investment bank Jefferies estimates that the new regulations cap memory bandwidth at 1.7-1.8 terabytes per second, compared to the 4 terabytes per second capability of the H20

3

.Market Share and Competition

Nvidia's market share in China has plummeted from 95% before 2022 to 50% currently, according to CEO Jensen Huang. The company faces increasing competition from Chinese manufacturers, particularly Huawei with its Ascend 910B chip

3

.

Source: Interesting Engineering

An Nvidia spokesperson stated that the company is still evaluating its "limited" options, emphasizing that until a new product design is settled and approved by the US government, Nvidia is "effectively foreclosed from China's $50 billion data center market"

3

4

.As the situation continues to evolve, Nvidia's ability to adapt to regulatory challenges while maintaining its technological edge will be crucial in determining its future success in the Chinese market.

References

Summarized by

Navi

[1]

[3]

[5]

Related Stories

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

Anthropic takes Pentagon to court over unprecedented supply chain risk designation

Policy and Regulation

3

Meta smart glasses face lawsuit and UK probe after workers watched intimate user footage

Policy and Regulation